Analysts’ Viewpoint on Household Cleaners Market Scenario

The global household cleaners market is highly fragmented in nature and few key global players hold large market share. North America and Asian Pacific are the most mature markets for household cleaners. The market in North America is growing due to increasing demand for organic products in the household cleaners’ category. Consumers are favoring organic products over chemical products for health and cleaning purposes. The global household cleaners market players are investing into R&D and innovations to cater to the needs of end users and increase their consumer base. Key vendors in the household cleaners market are focusing on high-growth applications such as bathroom cleaners, kitchen cleaners, and floor cleaners, among others, to keep their businesses growing.

The demand for household cleaning products has risen significantly all over the world, owing to growing consumer concerns about sanitation and well-being. Consumers have been engaging in enhanced cleaning practices to protect themselves from fatal illnesses.

Chemicals used to clean houses are known as household cleaners. The growing rate of urbanization and lifestyle changes, driven by increased income levels and improved sanitation practices is expected to support the growth of the global household cleaners market in the upcoming years. Surface cleaners are an ever-growing market, due to rising hygiene awareness and customers' adoption of a healthier lifestyle. Smart drop technology, designed specifically to take care of special areas, can now be used to clean stainless steel, glass, wood, and mirrors. Liquid cleaners, consisting of solid repellent particles suspended in a thick liquid matrix, now come in many formats, including pump-action bottles, triggers, and aerosol cans. Currently, consumers are also eyeing environment-friendly toilet care products that are natural and with pleasant scents. Clorox Professional Product Company, for instance, sells a toilet bowl cleaner called 'Green Works Natural Toilet Bowl Cleaner’.

Global household cleaners represent a growing segment driven by improved domestic spending and consumers' emphasis on cleaner living lifestyle. Solid fluid soluble solvents are now available in a variety of formats such as detergents, aerosol cans, and pump-filled bottles. Market players are also introducing new ways to clean toilets. The key manufacturer Clorox Professional Product Company offers a 'Green Toilet Container' made from natural ingredients. In a study conducted by the CDC throughout the U.S., during the COVID-19 pandemic, one-quarter of participants reported one or another problem related to the use of cleaning products and disinfectants; the problem was related to skin, eye, nose, and nasal itching, headache, nausea, and respiratory distress. This has led to an increase in demand for organic cleaning products without the risks involved.

Household cleaning products are widely used to maintain cleanliness, for regular cleaning, and for pest control. Increased focus on maintaining good hygiene can be attributed to the fact that a lack of hygiene may lead to diseases such as Buruli ulcers and diarrhea. There is a growing trend in both developing and developed countries to buy hygiene products and home care products. In addition, there is increasing use of household cleaners for commercial use where textile filters and over-the-top deodorizers have provided significant impetus to the household cleaners market.

According to the data released by the World Health Organization, in 2015, poor sanitation resulted in the deaths of 280,000 people due to diarrhoea worldwide. Unsanitary habitats cause various diseases, leading to the need for appropriate cleaning solutions that help keep spaces clean and free of harmful bacteria such as cyanobacteria, staphylococcaceae, and acid bacteria. These factors are expected to propel the demand for household cleaners during the forecast period.

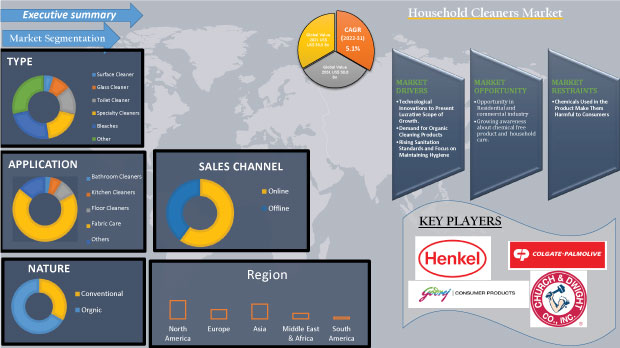

Chemicals used in indoor household cleaners can be toxic and may lead to various side effects, which cause allergies or other skin-related problems, thus hindering the growth of the household cleaners market. Moreover, the high diversity of household cleaning products is expected to hinder the growth of the market. Besides, lack of awareness and poor infrastructure in less developed countries in Asia and Africa poses a serious challenge to industry players and limits the continued growth of the household cleaning products market. Several substitute products that are easily available and comparatively cheap can pose a threat to the growth of the household cleaners market worldwide.

North America is a leading market for household cleaners worldwide. Large markets such as the U.S. and Canada have key manufacturers and witness extensive adoption of new technologies, which have a significant impact on the household cleaners market. The growing access to washing machines and dishwashers has increased the demand for new fluids and gels in households. This feature is closely related to the increase in revenue and the rise in consumer awareness. In addition, demand for organic cleaning products is expected to grow rapidly in the region. According to the Organic Trade Association, by 2020, revenue from the sale of organic food and non-food products in the U.S. were significantly high. Therefore, a rising demand for organic products is expected to provide growth opportunities in the household cleaners market in the region.

Asia Pacific is estimated to be the most prominent and growing market for household cleaners during the forecast period. Demand for powder type and cleaner bars is very high in this region due to multitude of households and cheap cost of powder detergents. Washing clothes and dishes by hand is a common practice in the region. Hand washing is carried out effectively using a bar soap and powdered detergents. In addition, the growing demand for home improvement products is expected to propel the demand for household cleaners in the near future.

Detailed profiles of providers of the household cleaners market have been given in the report to evaluate their financials, key product offerings, recent developments, and strategies. The majority of the firms is spending significant amounts on comprehensive research and development, primarily to develop environment-friendly products. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by prominent players.

Key players profiled in the household cleaners report include Henkel AG & Company KGaA (Germany), Colgate Palmolive (U.S.), Unilever (U.K.), Procter & Gamble (U.S.), Reckitt Benckiser Group plc (U.K.), Church & Dwight Co. Inc. (U.S.), Godrej Consumer Products (India), SC Johnson & Son, Inc. (U.S.), Kao Corporation (Japan), The Clorox Company (U.S.), and Seventh Generation (U.S.).

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 33.5 Bn |

|

Market Forecast Value in 2031 |

US$ 58.8 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Mn for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, technology analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market size of the household cleaners market was more than US$ 33.5 Bn

The household cleaners market is expected to cross US$ 58.8 Bn

Technological innovations to present lucrative scope of growth Demand for organic cleaning products Rising sanitation standards and focus on maintaining hygiene

Household cleaners market is expected to grow at a CAGR of 5.1%

The North America region is more lucrative in the household cleaners market

Henkel AG & Company KGaA (Germany), Colgate Palmolive (U.S.), Unilever (U.K.), Procter & Gamble (U.S.), Reckitt Benckiser Group plc (U.K.), Church & Dwight Co. Inc. (U.S.), Godrej Consumer Products (India), SC Johnson & Son, Inc. (U.S.), Kao Corporation (Japan), The Clorox Company (U.S.), and Seventh Generation (U.S.)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Cleaning Products Market Overview

5.4. Industry SWOT Analysis

5.5. Raw Material Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Global Household Cleaners Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projections (US$ Mn)

5.9.2. Market Revenue Projections (Million Units)

6. Global Household Cleaners Market Analysis and Forecast, By Type

6.1. Global Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

6.1.1. Surface Cleaner

6.1.2. Glass Cleaner

6.1.3. Toilet Cleaner

6.1.4. Specialty Cleaners

6.1.5. Bleaches

6.1.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

6.2. Incremental Opportunity, By Type

7. Global Household Cleaners Market Analysis and Forecast, By Nature

7.1. Global Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

7.1.1. Conventional

7.1.2. Organic

7.2. Incremental Opportunity, By Nature

8. Global Household Cleaners Market Analysis and Forecast, By Application

8.1. Global Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

8.1.1. Bathroom Cleaners

8.1.2. Kitchen Cleaners

8.1.3. Floor Cleaners

8.1.4. Fabric Care

8.1.5. Others (appliances, furniture, etc.)

8.2. Incremental Opportunity, By Application

9. Global Household Cleaners Market Analysis and Forecast, by Distribution Channel

9.1. Global Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 – 2031

9.1.1. Online

9.1.1.1. E-commerce Website any Website

9.1.2. Offline

9.1.2.1. Retail Based Stores

9.1.2.2. Hypermarket & Departmental Stores

9.2. Global Incremental Opportunity, by Distribution Channel

10. Global Household Cleaners Market Analysis and Forecast, by Region

10.1. Global Household Cleaners Market (US$ Mn and Million Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. India Incremental Opportunity, by Region

11. North America Household Cleaners Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Demographic Overview

11.4. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

11.4.1. Surface Cleaner

11.4.2. Glass Cleaner

11.4.3. Toilet Cleaner

11.4.4. Specialty Cleaners

11.4.5. Bleaches

11.4.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

11.5. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

11.5.1. Conventional

11.5.2. Organic

11.6. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

11.6.1. Bathroom cleaners

11.6.2. Kitchen cleaners

11.6.3. Floor cleaners

11.6.4. Fabric care

11.6.5. Others (appliances, furniture, etc.)

11.7. Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 - 2031

11.7.1. Online

11.7.1.1. E-commerce Website

11.7.1.2. Company Owned Website

11.7.2. Offline

11.7.2.1. Retail Based Stores

11.7.2.2. Hypermarket & Departmental Stores

11.8. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Incremental Opportunity Analysis

12. Europe Household Cleaners Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Demographic Overview

12.4. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

12.4.1. Surface Cleaner

12.4.2. Glass Cleaner

12.4.3. Toilet Cleaner

12.4.4. Specialty Cleaners

12.4.5. Bleaches

12.4.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

12.5. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

12.5.1. Conventional

12.5.2. Organic

12.6. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

12.6.1. Bathroom cleaners

12.6.2. Kitchen cleaners

12.6.3. Floor cleaners

12.6.4. Fabric care

12.6.5. Others (appliances, furniture, etc.)

12.7. Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 - 2031

12.7.1. Online

12.7.1.1. E-commerce Website

12.7.1.2. Company Owned Website

12.7.2. Offline

12.7.2.1. Retail Based Stores

12.7.2.2. Hypermarket & Departmental Stores

12.8. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Asia Pacific Household Cleaners Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Demographic Overview

13.4. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

13.4.1. Surface Cleaner

13.4.2. Glass Cleaner

13.4.3. Toilet Cleaner

13.4.4. Specialty Cleaners

13.4.5. Bleaches

13.4.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

13.5. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

13.5.1. Conventional

13.5.2. Organic

13.6. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

13.6.1. Bathroom cleaners

13.6.2. Kitchen cleaners

13.6.3. Floor cleaners

13.6.4. Fabric care

13.6.5. Others (appliances, furniture, etc.)

13.7. Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 - 2031

13.7.1. Online

13.7.1.1. E-commerce Website

13.7.1.2. Company Owned Website

13.7.2. Offline

13.7.2.1. Retail Based Stores

13.7.2.2. Hypermarket & Departmental Stores

13.8. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & Africa Household Cleaners Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Demographic Overview

14.4. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

14.4.1. Surface Cleaner

14.4.2. Glass Cleaner

14.4.3. Toilet Cleaner

14.4.4. Specialty Cleaners

14.4.5. Bleaches

14.4.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

14.5. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

14.5.1. Conventional

14.5.2. Organic

14.6. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

14.6.1. Bathroom cleaners

14.6.2. Kitchen cleaners

14.6.3. Floor cleaners

14.6.4. Fabric care

14.6.5. Others (appliances, furniture, etc.)

14.7. Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 - 2031

14.7.1. Online

14.7.1.1. E-commerce Website

14.7.1.2. Company Owned Website

14.7.2. Offline

14.7.2.1. Retail Based Stores

14.7.2.2. Hypermarket & Departmental Stores

14.8. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Incremental Opportunity Analysis

15. South America Household Cleaners Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Demographic Overview

15.4. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

15.4.1. Surface Cleaner

15.4.2. Glass Cleaner

15.4.3. Toilet Cleaner

15.4.4. Specialty Cleaners

15.4.5. Bleaches

15.4.6. Other (Laundry Detergents, Dishwashing Detergents, etc.)

15.5. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Nature, 2017 - 2031

15.5.1. Conventional

15.5.2. Organic

15.6. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Application, 2017 - 2031

15.6.1. Bathroom cleaners

15.6.2. Kitchen cleaners

15.6.3. Floor cleaners

15.6.4. Fabric care

15.6.5. Others (appliances, furniture, etc.)

15.7. Household Cleaners Market (US$ Mn and Million Units), by Distribution Channel, 2017 - 2031

15.7.1. Online

15.7.1.1. E-commerce Website

15.7.1.2. Company Owned Website

15.7.2. Offline

15.7.2.1. Retail Based Stores

15.7.2.2. Hypermarket & Departmental Stores

15.8. Household Cleaners Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), (2020)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Reckitt Benckiser Group plc

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Procter & Gamble Company

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Kao Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Bombril S.A.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Unilever

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Colgate-Palmolive

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Henkel AG & Co.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. S. C. Johnson & Son, Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Church & Dwight Co., Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. The Clorox Company

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Nature

17.1.3. By Application

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Understanding the Procurement Process of Customers

17.3. Preferred Sales & Marketing Strategy

17.4. Prevailing Market Risks

List of Tables

Table 1: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 2: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 3: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 4: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 5: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 6: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 7: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 8: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 9: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Region

Table 10: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Region

Table 11: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 12: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 13: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 14: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 15: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 16: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 17: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 18: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 19: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Table 20: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Table 21: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 22: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 23: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 24: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 25: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 26: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 27: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 28: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 29: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Table 30: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Table 31: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 32: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 33: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 34: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 35: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 36: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 37: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 38: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 39: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Table 40: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Table 41: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 42: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 43: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 44: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 45: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 46: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 47: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 48: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 49: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Table 50: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Table 51: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 52: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Table 53: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Table 54: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Table 55: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Table 56: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Table 57: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Table 58: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Table 59: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Table 60: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

List of Figures

Figure 1: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 2: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 3: Global Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 4: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 5: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 6: Global Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 7: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 8: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 9: Global Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 10: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 11: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 12: Global Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 13: Global Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Region

Figure 14: Global Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Region

Figure 15: Global Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Region

Figure 16: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 17: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 18: North America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 19: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 20: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 21: North America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 22: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 23: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 24: North America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 25: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 26: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 27: North America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 28: North America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Figure 29: North America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Figure 30: North America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Country

Figure 31: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 32: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 33: Europe Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 34: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 35: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 36: Europe Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 37: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 38: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 39: Europe Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 40: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 41: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 42: Europe Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 43: Europe Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Figure 44: Europe Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Figure 45: Europe Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Country

Figure 46: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 47: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 48: Asia Pacific Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 49: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 50: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 51: Asia Pacific Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 52: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 53: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 54: Asia Pacific Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 55: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 56: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 57: Asia Pacific Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 58: Asia Pacific Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Figure 59: Asia Pacific Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Figure 60: Asia Pacific Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Country

Figure 61: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 62: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 63: Middle East & Africa Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 64: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 65: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 66: Middle East & Africa Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 67: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 68: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 69: Middle East & Africa Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 70: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 71: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 72: Middle East & Africa Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 73: Middle East & Africa Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Figure 74: Middle East & Africa Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Figure 75: Middle East & Africa Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Country

Figure 76: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 77: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 78: South America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Type

Figure 79: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Nature

Figure 80: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Nature

Figure 81: South America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Nature

Figure 82: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Application

Figure 83: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Application

Figure 84: South America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Application

Figure 85: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Distribution Channel

Figure 86: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Distribution Channel

Figure 87: South America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Distribution Channel

Figure 88: South America Household Cleaners Market Value (US$ Mn) Forecast, 2017-2031, by Country

Figure 89: South America Household Cleaners Market Volume (Million Units) Forecast, 2017-2031, by Country

Figure 90: South America Household Cleaners Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 by Country