Analysts’ Viewpoint on Hotels Market Scenario

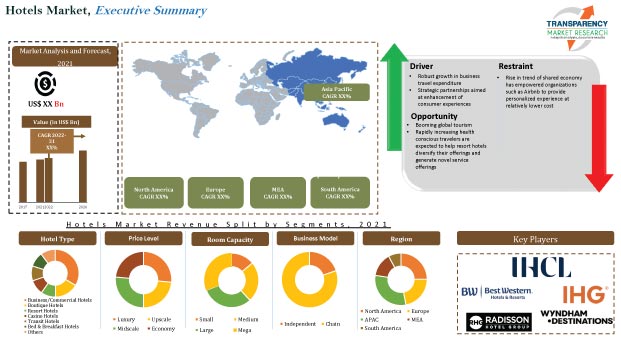

The global hotels market is primarily driven by the large presence of key players in the market. According to the World Travel & Tourism Council (WTTC), more than 170 players operate in the global hotels market. Rise in millennial population, increase in disposable income, and growth in awareness about travel-related news are the prominent factors boosting the number of travel trips across the globe. Increase in penetration of smartphones, particularly in Asia Pacific, is also driving the market. Key players in the market are carrying out comprehensive R&D activities, primarily to provide improved facilities to their customers.

The hotel industry grew significantly in terms of occupancy and revenue in 2021. Hoteliers routinely analyze the market and are in search of the next opportunity that could potentially revolutionize the hospitality industry in order to stay ahead of the competition and continue on the upward trajectory. Rise in purchasing power of consumers across the globe, developing economies, and digitization are fueling the travel and tourism industry. This is expected to create lucrative opportunities for players operating in the global hotels market during the forecast period.

Improving economies, ever-expanding middle-class population, rapid advancements in the technology sector, and increasing population of the millennial workforce have significantly boosted the frequency of business travel. Additionally, growth in corporate profits and globalized business sector have substantially increased the spending capacity of corporates on business travel. This rise in business travel expenditure is expected to contribute to the growth of the global hotels market.

As per GBTA (Global Business Travel Association), global business travel activity has started its rebound from the sharp downturn brought about by the COVID-19 pandemic. Global expenditures are expected to have rebounded by 14% to US$ 754 Bn in 2021, after declining by 53.8% in 2020. A year-over-year surge of 38% is expected in 2022, despite recovery setbacks in 2021, as recovery and pent-up demand increase rapidly, bringing global business travel spending back to over US$ 1 Trn.

Millennials throughout the globe have high expectations from the hotel industry. This generation aspires for a personalized experience and is also willing to pay a premium for it. Such consumer trends are encouraging hotel companies to partner with several other industries to enhance the overall customer experience. Some of the key industries that are enabling hoteliers to upgrade their services include information technology, luxury fashion brands, and entertainment. These partnerships allow hotel companies to leverage their room rents, which subsequently increases the ADR (Average Daily Rent) value, thus fueling the global hotels market.

Growth in global consumer spending capability has dynamically transformed the customer preference for hotels. Majority of the traveling population nowadays opts for chain hotels over independent hotels. Therefore, some of the major hotel chains across the globe have stepped up by enhancing their services and implementing a variety of strategies in order to gain more traction in the global hotels market. In recent years, health and wellness resorts have received substantial attention, encouraging hotel chains across the world to include alternative medicine services and high-end spas, knowing that certain travelers are willing to spend a premium to access these services.

Asia Pacific is the largest hotels market, followed by North America and Europe, across the globe. Asia Pacific has the largest middle-class population in the world. Growth in population, especially among the millennials, across emerging economies such as China and India, rise in disposable income, and increase in number of travelers are the factors driving the market in Asia Pacific.

The hotels market in North America and Europe is mature. Leisure travel spending holds a major share of the market in North America compared to business travel spending. Similarly, domestic travel spending holds a prominent market share compared to international travel spending. Business hotels and casinos are the most popular in North America and hold the largest market share. Leisure travel spending and domestic travel spending hold a major share of the market in Europe. The market in Middle East & Africa (MEA) and South America is growing. This trend is expected to continue during the forecast period.

The global hotels market is consolidated, with a few large-scale vendors controlling a majority of the share. Most of the firms are investing significantly in comprehensive R&D activities, primarily to provide luxurious facilities to their customers. Expansion of hotel chains and mergers & acquisitions are the key strategies adopted by market players. Marriott International, Accor, Hyatt Hotels, Hilton Worldwide, InterContinental Hotels Group, Best Western Hotels, Choice Hotels International, Inc., Wyndham Destinations, and Radisson Hotel Group are the prominent players operating in this market.

Each of these players has been profiled in global hotels market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 628.4 Bn |

|

Market Forecast Value in 2031 |

US$ 1.27 Trn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn/US$ Trn for Value |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The hotels market stood at US$ 628.4 Bn in 2021

The hotels market is estimated to register a CAGR of 8.1% during the forecast period

Robust growth in business travel expenditure

The business/commercial hotels segment accounts for 43% share of the hotels market

Asia Pacific is more attractive for vendors in the hotels market

Marriott International, Accor, Hyatt Hotels, Hilton Worldwide, InterContinental Hotels Group, Best Western Hotels, Choice Hotels International, Inc., Wyndham Destinations, Radisson Hotel Group, etc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Overall Travel & Tourism Market

5.4. Key Trend Analysis

5.4.1. Supplier Side

5.4.2. Demand Side

5.5. Industry SWOT Analysis

5.6. Technology Overview

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Analysis

5.9. COVID-19 Impact Analysis

5.10. Global Hotels Market Analysis and Forecast, 2017- 2031

5.10.1. Market Value Projections (US$ Bn)

6. Global Hotels Market Analysis and Forecast, by Hotel Type

6.1. Global Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

6.1.1. Business/Commercial Hotels

6.1.2. Boutique Hotels

6.1.3. Resort Hotels

6.1.4. Casino Hotels

6.1.5. Transit Hotels

6.1.6. Bed & Breakfast Hotels

6.1.7. Others

6.2. Incremental Opportunity, by Hotel Type

7. Global Hotels Market Analysis and Forecast, by Business Model

7.1. Global Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

7.1.1. Independent

7.1.2. Chain

7.2. Incremental Opportunity, by Business Model

8. Global Hotels Market Analysis and Forecast, by Room Capacity

8.1. Global Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

8.1.1. Small

8.1.2. Medium

8.1.3. Large

8.1.4. Mega

8.2. Incremental Opportunity, by Room Capacity

9. Global Hotels Market Analysis and Forecast, by Price Level

9.1. Global Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

9.1.1. Luxury

9.1.2. Upscale

9.1.3. Midscale

9.1.4. Economy

9.2. Incremental Opportunity, by Price Level

9.3. Hotels Market Size (US$ Bn) by Booking Mode, 2017- 2031

9.3.1. Online

9.3.2. Offline

10. Global Hotels Market Analysis and Forecast, by Region

10.1. Global Hotels Market Size (US$ Bn), by Region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Hotels Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Demographic Overview

11.4. Consumer Buying Behaviour

11.5. Key Trends Analysis

11.5.1. Supply side

11.5.2. Demand Side

11.6. Price Trend Analysis

11.6.1. Weighted Average Selling Price (US$)

11.7. Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

11.7.1. Business/Commercial Hotels

11.7.2. Boutique Hotels

11.7.3. Resort Hotels

11.7.4. Casino Hotels

11.7.5. Transit Hotels

11.7.6. Bed & Breakfast Hotels

11.7.7. Others

11.8. Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

11.8.1. Independent

11.8.2. Chain

11.9. Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

11.9.1. Small

11.9.2. Medium

11.9.3. Large

11.9.4. Mega

11.10. Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

11.10.1. Luxury

11.10.2. Upscale

11.10.3. Midscale

11.10.4. Economy

11.11. Hotels Market Size (US$ Bn), by Booking Mode, 2017- 2031

11.11.1. Online

11.11.2. Offline

11.12. Hotels Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

11.12.1. U.S.

11.12.2. Canada

11.12.3. Rest of North America

11.13. Incremental Opportunity Analysis

12. Europe Hotels Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Demographic Overview

12.4. Consumer Buying Behaviour

12.5. Key Trends Analysis

12.5.1. Supply side

12.5.2. Demand Side

12.6. Price Trend Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

12.7.1. Business/Commercial Hotels

12.7.2. Boutique Hotels

12.7.3. Resort Hotels

12.7.4. Casino Hotels

12.7.5. Transit Hotels

12.7.6. Bed & Breakfast Hotels

12.7.7. Others

12.8. Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

12.8.1. Independent

12.8.2. Chain

12.9. Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

12.9.1. Small

12.9.2. Medium

12.9.3. Large

12.9.4. Mega

12.10. Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

12.10.1. Luxury

12.10.2. Upscale

12.10.3. Midscale

12.10.4. Economy

12.11. Hotels Market Size (US$ Bn), by Booking Mode, 2017- 2031

12.11.1. Online

12.11.2. Offline

12.12. Hotels Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

12.12.1. U.K.

12.12.2. Germany

12.12.3. France

12.12.4. Rest of Europe

12.13. Incremental Opportunity Analysis

13. Asia Pacific Hotels Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Demographic Overview

13.4. Consumer Buying Behaviour

13.5. Key Trends Analysis

13.5.1. Supply side

13.5.2. Demand Side

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

13.7.1. Business/Commercial Hotels

13.7.2. Boutique Hotels

13.7.3. Resort Hotels

13.7.4. Casino Hotels

13.7.5. Transit Hotels

13.7.6. Bed & Breakfast Hotels

13.7.7. Others

13.8. Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

13.8.1. Independent

13.8.2. Chain

13.9. Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

13.9.1. Small

13.9.2. Medium

13.9.3. Large

13.9.4. Mega

13.10. Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

13.10.1. Luxury

13.10.2. Upscale

13.10.3. Midscale

13.10.4. Economy

13.11. Hotels Market Size (US$ Bn) by Booking Mode, 2017- 2031

13.11.1. Online

13.11.2. Offline

13.12. Hotels Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

13.12.1. China

13.12.2. India

13.12.3. Japan

13.12.4. Rest of Asia Pacific

13.13. Incremental Opportunity Analysis

14. Middle East & Africa Hotels Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Demographic Overview

14.4. Consumer Buying Behaviour

14.5. Key Trends Analysis

14.5.1. Supply side

14.5.2. Demand Side

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

14.7.1. Business/Commercial Hotels

14.7.2. Boutique Hotels

14.7.3. Resort Hotels

14.7.4. Casino Hotels

14.7.5. Transit Hotels

14.7.6. Bed & Breakfast Hotels

14.7.7. Others

14.8. Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

14.8.1. Independent

14.8.2. Chain

14.9. Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

14.9.1. Small

14.9.2. Medium

14.9.3. Large

14.9.4. Mega

14.10. Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

14.10.1. Luxury

14.10.2. Upscale

14.10.3. Midscale

14.10.4. Economy

14.11. Hotels Market Size (US$ Bn), by Booking Mode, 2017- 2031

14.11.1. Online

14.11.2. Offline

14.12. Hotels Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

14.12.1. GCC

14.12.2. South Africa

14.12.3. Rest of Middle East & Africa

14.13. Incremental Opportunity Analysis

15. South America Hotels Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Demographic Overview

15.4. Consumer Buying Behaviour

15.5. Key Trends Analysis

15.5.1. Supply side

15.5.2. Demand Side

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Hotels Market Size (US$ Bn), by Hotel Type, 2017- 2031

15.7.1. Business/Commercial Hotels

15.7.2. Boutique Hotels

15.7.3. Resort Hotels

15.7.4. Casino Hotels

15.7.5. Transit Hotels

15.7.6. Bed & Breakfast Hotels

15.7.7. Others

15.8. Hotels Market Size (US$ Bn), by Business Model, 2017- 2031

15.8.1. Independent

15.8.2. Chain

15.9. Hotels Market Size (US$ Bn), by Room Capacity, 2017- 2031

15.9.1. Small

15.9.2. Medium

15.9.3. Large

15.9.4. Mega

15.10. Hotels Market Size (US$ Bn), by Price Level, 2017- 2031

15.10.1. Luxury

15.10.2. Upscale

15.10.3. Midscale

15.10.4. Economy

15.11. Hotels Market Size (US$ Bn), by Booking Mode, 2017- 2031

15.11.1. Online

15.11.2. Offline

15.12. Hotels Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

15.12.1. Brazil

15.12.2. Rest of South America

15.13. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2021)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. Accor

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. Marriott international

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Hyatt hotels

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Hilton Worldwide

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. InterContinental Hotels Group

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Best Western Hotels

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. Choice Hotels International, Inc.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. Wyndham Destinations

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. Radisson Hotel Group

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. Indian Hotels Company Limited

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Hotel Type

17.1.2. Business Model

17.1.3. Room Capacity

17.1.4. Price Level

17.1.5. Booking Mode

17.1.6. Geography

17.2. Understanding the Buying Process of Customers

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 2: Global Hotels Market, By Business Model US$ Bn, 2017-2031

Table 3: Global Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 4: Global Hotels Market, By Price Level US$ Bn, 2017-2031

Table 5: Global Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 6: Global Hotels Market, By Region US$ Bn, 2017-2031

Table 7: North America Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 8: North America Hotels Market, By Business Model US$ Bn, 2017-2031

Table 9: North America Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 10: North America Hotels Market, By Price Level US$ Bn, 2017-2031

Table 11: North America Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 12: North America Hotels Market, By Country US$ Bn, 2017-2031

Table 13: Europe Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 14: Europe Hotels Market, By Business Model US$ Bn, 2017-2031

Table 15: Europe Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 16: Europe Hotels Market, By Price Level US$ Bn, 2017-2031

Table 17: Europe Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 18: Europe Hotels Market, By Country US$ Bn, 2017-2031

Table 19: Asia Pacific Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 20: Asia Pacific Hotels Market, By Business Model US$ Bn, 2017-2031

Table 21: Asia Pacific Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 22: Asia Pacific Hotels Market, By Price Level US$ Bn, 2017-2031

Table 23: Asia Pacific Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 24: Asia Pacific Hotels Market, By Country US$ Bn, 2017-2031

Table 25: Middle East & Africa Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 26: Middle East & Africa Hotels Market, By Business Model US$ Bn, 2017-2031

Table 27: Middle East & Africa Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 28: Middle East & Africa Hotels Market, By Price Level US$ Bn, 2017-2031

Table 29: Middle East & Africa Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 30: Middle East & Africa Hotels Market, By Country US$ Bn, 2017-2031

Table 31: South America Hotels Market, By Hotel Type US$ Bn, 2017-2031

Table 32: South America Hotels Market, By Business Model US$ Bn, 2017-2031

Table 33: South America Hotels Market, By Room Capacity US$ Bn, 2017-2031

Table 34: South America Hotels Market, By Price Level US$ Bn, 2017-2031

Table 35: South America Hotels Market, By Booking Mode US$ Bn, 2017-2031

Table 36: South America Hotels Market, By Country US$ Bn, 2017-2031

List of Figures

Figure 1: Global Hotels Market, By Hotel Type US$ Bn, 2017-2031

Figure 2: Global Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 3: Global Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 4: Global Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 5: Global Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 6: Global Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 7: Global Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 8: Global Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 9: Global Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 10: Global Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 11: Global Hotels Market, By Region US$ Bn, 2017-2031

Figure 12: Global Hotels Market, Incremental Opportunity, By Region US$ Bn, 2017-2031

Figure 13: North America Hotels Market, By Hotel Type US$ Bn, 2017-2031

Figure 14: North America Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 15: North America Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 16: North America Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 17: North America Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 18: North America Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 19: North America Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 20: North America Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 21: North America Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 22: North America Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 23: North America Hotels Market, By Country US$ Bn, 2017-2031

Figure 24: North America Hotels Market, Incremental Opportunity, By Country US$ Bn, 2017-2031

Figure 25: Europe Hotels Market, By Hotel Type US$ Bn, 2017-2031

Figure 26: Europe Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 27: Europe Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 28: Europe Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 29: Europe Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 30: Europe Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 31: Europe Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 32: Europe Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 33: Europe Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 34: Europe Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 35: Europe Hotels Market, By Country US$ Bn, 2017-2031

Figure 36: Europe Hotels Market, Incremental Opportunity, By Region US$ Bn, 2017-2031

Figure 37: Asia Pacific Hotels Market, By Hotel Type US$ Bn, 2017-2031

Figure 38: Asia Pacific Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 39: Asia Pacific Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 40: Asia Pacific Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 41: Asia Pacific Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 42: Asia Pacific Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 43: Asia Pacific Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 44: Asia Pacific Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 45: Asia Pacific Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 46: Asia Pacific Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 47: Asia Pacific Hotels Market, By Country US$ Bn, 2017-2031

Figure 48: Asia Pacific Hotels Market, Incremental Opportunity, By Country US$ Bn, 2017-2031

Figure 49: Middle East & Africa Hotels Market, By Hotel Type US$ Bn, 2017-2032

Figure 50: Middle East & Africa Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 51: Middle East & Africa Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 52: Middle East & Africa Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 53: Middle East & Africa Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 54: Middle East & Africa Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 55: Middle East & Africa Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 56: Middle East & Africa Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 57: Middle East & Africa Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 58: Middle East & Africa Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 59: Middle East & Africa Hotels Market, By Country US$ Bn, 2017-2031

Figure 60: Middle East & Africa Hotels Market, Incremental Opportunity, By Country US$ Bn, 2017-2031

Figure 61: South America Hotels Market, By Hotel Type US$ Bn, 2017-2031

Figure 62: South America Hotels Market, Incremental Opportunity, By Hotel Type, US$ Bn, 2017-2031

Figure 63: South America Hotels Market, By Business Model US$ Bn, 2017-2031

Figure 64: South America Hotels Market, Incremental Opportunity, By Business Model, US$ Bn, 2017-2031

Figure 65: South America Hotels Market, By Room Capacity US$ Bn, 2017-2031

Figure 66: South America Hotels Market, Incremental Opportunity, By Room Capacity US$ Bn, 2017-2031

Figure 67: South America Hotels Market, By Price Level US$ Bn, 2017-2031

Figure 68: South America Hotels Market, Incremental Opportunity, By Price Level US$ Bn, 2017-2031

Figure 69: South America Hotels Market, By Booking Mode US$ Bn, 2017-2031

Figure 70: South America Hotels Market, Incremental Opportunity, By Booking Mode US$ Bn, 2017-2031

Figure 71: South America Hotels Market, By Country US$ Bn, 2017-2031

Figure 72: South America Hotels Market, Incremental Opportunity, By Country US$ Bn, 2017-2031