Analysts’ Viewpoint on Hot Sauce Market Scenario

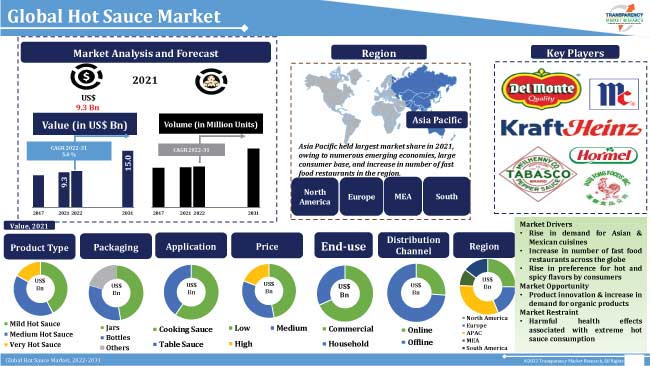

Increase in number of fast food restaurants and quick service restaurants; and rise in adoption of Asian and Mexican cuisines across the world are projected to drive the global hot sauce market during the forecast period. Asia Pacific countries are anticipated to be the growth frontiers for the hot sauce market. Consumers in countries such as China and India consider hot sauce to be an ideal accompaniment for a meal, as it is perceived to be flavorful and low in calories. Rise in demand for organic products is encouraging key suppliers to increase their R&D activities in development of new products with organic materials and sustainable packaging. Manufacturers should tap into incremental opportunities by using natural ingredients in hot sauce to broaden their revenue streams.

Hot sauce is made from chili peppers and other ingredients such as vinegar, salt, vegetables, garlic, and fruits, which is why it is known as sweet and spicy sauce. Hot sauce is also known as hot pepper sauce, as it can be made by combining red tomato puree and chili pepper paste. Hot sauce is widely used to add complementary or contrasting flavors to a variety of cuisines. It has a spicy flavor and is used in many Asian, African, and other cuisines. The scope for the hot sauce market appears positive, since even the blandest meal can be changed into something special with a few drops of hot sauce. Hot sauce companies are now focusing on local farm produce; and striving to use natural ingredients in making hot sauce.

Surge in Asian immigrants in various countries of the world such as the U.S. and Canada is driving the popularity of Asian cuisine. Many Asian restaurants have come up to serve the growing Chinese and Japanese immigrant communities in the U.S. These immigrants have introduced westerners to traditional Asian food. Growth in population of Asian immigrants has augmented the number of Asian businesses. Thus, rise in demand for Asian cuisine is driving the market for hot sauce. The number of Asian fast food restaurants has grown more than 500% globally over the last decade. This is the highest growth rate in any category of fast food restaurants in the world. Rise in demand for Asian as well as Mexican cuisines among people across the globe is a key factor propelling the global hot sauce market. Millennials, Gen X, and Gen Y are the first to try different dishes and share their experiences by rating restaurants. Word-of-mouth advertising is also driving the demand for Asian and Mexican cuisines. Most dishes in Asia and Mexico use red hot sauce or fermented hot sauce as well as tabasco pepper sauce as key ingredient to enhance the taste and flavor.

Millennial and graying baby boomers prefer new and varied experiences. They feel that flavorful hot sauce enhances their dulled sense of taste. According to a recent Instacart survey conducted online by The Harris Poll among over 2,000 U.S. adults, 74% of Americans eat hot sauce with their food, and nearly half said they typically dash hot sauce on their food once a week or more often. According to Food Institute analysis of IRI data, supermarket sales for hot or Cajun sauce category rose by approximately 5%, or US$ 800 Mn, in 2021. Instacart also found that customers from the U.S. purchased around 450,000 gallons of hot sauce from supermarkets between December 2020 and November 2021. Growth in popularity and consumer inclination toward hot and spicy flavors for their meals is driving the market for habanero pepper sauce and jalapeno sauce. Tony Simmons, CEO of McIlhenny, remarked, "People are becoming more experimental with their food. They are more willing to try new flavors and new spices. The use of condiments and flavor enhancers to make their food taste better is what has driven the whole demand analysis of hot sauce industry to be one of the very few parts of the consumer packaged goods industry that has seen reasonable growth."

Hot sauce is likely to worsen acid reflux, IBS, peptic ulcers, and gastritis. Consumption of hot sauce in large amounts may also cause digestive issues including heartburn, diarrhea, nausea, vomiting, and stomach cramps. These harmful effects on the human body are hampering the global hot sauce market.

Hot sauce contains sodium. According to the American Heart Association, consumption of sodium should not exceed 2,300 mg a day. The ideal limit is less than 1,500 mg per day for most adults, especially those with high blood pressure.

In terms of product type, the mild hot sauce segment dominated the global hot sauce market with around 42% share in 2021. Consumers across the world prefer hot sauce in their favorite meals to enhance the flavor. They believe that hot sauce is an ideal condiment for any meal due to its benefits such as versatility, flavor, and low calories. Hot sauce comes in numerous variations in terms of heat. However, consumption of extremely hot sauce can have a negative impact on health. Therefore, the very hot sauce segment accounts for lower share of the global hot sauce market.

In terms of application, the global hot sauce market has been bifurcated into cooking sauce and table sauce. Cooking sauce increases the market value of hot sauce. The segment dominated the global hot sauce market with more than 60% share in 2021. The cooking sauce segment is expected to maintain its leading position in the market during the forecast period. The impact of commercial use and packaging of bottles is driving the cooking sauce market. However, the table sauce segment is expected to grow at a faster CAGR during the forecast period due to the rise in number of quick service restaurants across the globe. Cooking sauce can make dishes more hot and spicy, as peppers or chilies are spread easily while cooking. They release capsaicin into the dish. The spiciness is then spread out throughout the dish, giving the sensation of an overall spicier meal. Rise in demand and popularity of spicy food in several regions is projected to fuel the cooking sauce segment during the forecast period.

Asia Pacific is the fastest-growing market for hot sauce. The region accounted for about 32% share of the global hot sauce market in 2021. This can be ascribed to the presence of various emerging economies, large consumer base, and increase in number of fast food restaurants in the region. Rise in popularity of hot sauce in countries such as China and India is creating growth opportunities for manufacturers in the region. Thailand and Vietnam have been using hot sauce and mayonnaise sauce since a very long time. Almost every dish in these countries contains hot sauce, as the population consumes hot and spicy food as part of their daily meals. Hence, the mayonnaise sauce market and the hot sauce market are anticipated to witness promising growth opportunities in the next few years. The market for hot sauce in North America is also growing due to the rise in adoption of Asian and Mexican cuisines.

The global hot sauce market is fragmented, with the presence of large-scale manufacturers and local players that control majority of the share. Expansion of product portfolios and mergers and acquisitions are key strategies adopted by prominent players. McIlhenny Company, Hormel Foods Corporation, McCormick & Company Incorporated, Baumer Foods, Inc., TW Garner Food Company, Conagra Brands, Inc., The Kraft Heinz Company, Del Monte Pacific Ltd., Kikkoman Sales USA, Inc., and Huy Fong Foods, Inc. are the prominent companies operating in the global hot sauce market.

Each of these players has been profiled in the global hot sauce market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 9.3 Bn |

|

Market Forecast Value in 2031 |

US$ 15.0 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The hot sauce market stood at US$ 9.3 Bn in 2021.

The hot sauce market is estimated to grow at a CAGR of 5.0% during 2022-2031.

Rise in demand for Asian and Mexican cuisines; increase in number of fast food restaurants across the globe; and growth in popularity and consumer inclination toward hot and spicy flavors.

The mild hot sauce segment held 42% share of the global hot sauce market in 2021.

Asia Pacific held the largest share of the global hot sauce market in 2021 and is expected to dominate the market during the forecast period.

McIlhenny Company, Hormel Foods Corporation, McCormick & Company Incorporated, Baumer Foods, Inc., TW Garner Food Company, Conagra Brands, Inc., The Kraft Heinz Company, Del Monte Pacific Ltd., Kikkoman Sales USA, Inc., and Huy Fong Foods, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Sauce Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Covid-19 Impact Analysis

5.8. Global Hot Sauce Market Analysis, 2017 - 2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Million Units)

6. Global Hot Sauce Market Analysis and Forecast, By Product Type

6.1. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

6.1.1. Mild Hot Sauce

6.1.2. Medium Hot Sauce

6.1.3. Very Hot Sauce

6.2. Incremental Opportunity, By Product Type

7. Global Hot Sauce Market Analysis and Forecast, By Packaging

7.1. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

7.1.1. Jars

7.1.2. Bottles

7.1.3. Others

7.2. Incremental Opportunity, By Packaging

8. Global Hot Sauce Market Analysis and Forecast, By Application

8.1. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

8.1.1. Cooking Sauce

8.1.2. Table Sauce

8.2. Incremental Opportunity, By Application

9. Global Hot Sauce Market Analysis and Forecast, By Price

9.1. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, By Price

10. Global Hot Sauce Market Analysis and Forecast, By End-use

10.1. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

10.1.1. Commercial

10.1.2. Household

10.2. Incremental Opportunity, By End-use

11. Global Hot Sauce Market Analysis and Forecast, By Distribution Channel

11.1. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. E-commerce Websites

11.1.1.2. Company-owned Websites

11.1.2. Offline

11.1.2.1. Supermarkets/Hypermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Others

11.2. Incremental Opportunity, By Distribution Channel

12. Global Hot Sauce Market Analysis and Forecast, By Region

12.1. Hot Sauce Market (US$ Mn and Million Units), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Hot Sauce Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Demographic Overview

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.5. Key Trend Analysis

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

13.7.1. Mild Hot Sauce

13.7.2. Medium Hot Sauce

13.7.3. Very Hot Sauce

13.8. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

13.8.1. Jars

13.8.2. Bottles

13.8.3. Others

13.9. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

13.9.1. Cooking Sauce

13.9.2. Table Sauce

13.10. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

13.10.1. Low

13.10.2. Medium

13.10.3. High

13.11. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

13.11.1. Commercial

13.11.2. Household

13.12. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

13.12.1. Online

13.12.1.1. E-commerce Websites

13.12.1.2. Company-owned Websites

13.12.2. Offline

13.12.2.1. Supermarkets/Hypermarkets

13.12.2.2. Specialty Stores

13.12.2.3. Others

13.13. Hot sauce Market (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

13.13.1. U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Hot Sauce Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Demographic Overview

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.5. Key Trend Analysis

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

14.7.1. Mild Hot Sauce

14.7.2. Medium Hot Sauce

14.7.3. Very Hot Sauce

14.8. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

14.8.1. Jars

14.8.2. Bottles

14.8.3. Others

14.9. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

14.9.1. Cooking Sauce

14.9.2. Table Sauce

14.10. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

14.10.1. Low

14.10.2. Medium

14.10.3. High

14.11. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

14.11.1. Commercial

14.11.2. Household

14.12. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.1.1. E-commerce Websites

14.12.1.2. Company-owned Websites

14.12.2. Offline

14.12.2.1. Supermarkets/Hypermarkets

14.12.2.2. Specialty Stores

14.12.2.3. Others

14.13. Hot sauce Market (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

14.13.1. U.K.

14.13.2. Germany

14.13.3. France

14.13.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Hot Sauce Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Demographic Overview

15.3. Brand Analysis

15.4. Consumer Buying Behavior Analysis

15.5. Key Trend Analysis

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

15.7.1. Mild Hot Sauce

15.7.2. Medium Hot Sauce

15.7.3. Very Hot Sauce

15.8. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

15.8.1. Jars

15.8.2. Bottles

15.8.3. Others

15.9. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

15.9.1. Cooking Sauce

15.9.2. Table Sauce

15.10. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

15.10.1. Low

15.10.2. Medium

15.10.3. High

15.11. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

15.11.1. Commercial

15.11.2. Household

15.12. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.1.1. E-commerce Websites

15.12.1.2. Company-owned Websites

15.12.2. Offline

15.12.2.1. Supermarkets/Hypermarkets

15.12.2.2. Specialty Stores

15.12.2.3. Others

15.13. Hot sauce Market (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Hot Sauce Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Demographic Overview

16.3. Brand Analysis

16.4. Consumer Buying Behavior Analysis

16.5. Key Trend Analysis

16.6. Price Trend Analysis

16.6.1. Weighted Average Selling Price (US$)

16.7. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

16.7.1. Mild Hot Sauce

16.7.2. Medium Hot Sauce

16.7.3. Very Hot Sauce

16.8. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

16.8.1. Jars

16.8.2. Bottles

16.8.3. Others

16.9. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

16.9.1. Cooking Sauce

16.9.2. Table Sauce

16.10. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

16.10.1. Low

16.10.2. Medium

16.10.3. High

16.11. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

16.11.1. Commercial

16.11.2. Household

16.12. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

16.12.1. Online

16.12.1.1. E-commerce Websites

16.12.1.2. Company-owned Websites

16.12.2. Offline

16.12.2.1. Supermarkets/Hypermarkets

16.12.2.2. Specialty Stores

16.12.2.3. Others

16.13. Hot sauce Market (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America Hot Sauce Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Demographic Overview

17.3. Brand Analysis

17.4. Consumer Buying Behavior Analysis

17.5. Key Trend Analysis

17.6. Price Trend Analysis

17.6.1. Weighted Average Selling Price (US$)

17.7. Hot Sauce Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

17.7.1. Mild Hot Sauce

17.7.2. Medium Hot Sauce

17.7.3. Very Hot Sauce

17.8. Hot Sauce Market Size (US$ Mn and Million Units), By Packaging, 2017 - 2031

17.8.1. Jars

17.8.2. Bottles

17.8.3. Others

17.9. Hot Sauce Market Size (US$ Mn and Million Units), By Application, 2017 - 2031

17.9.1. Cooking Sauce

17.9.2. Table Sauce

17.10. Hot Sauce Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

17.10.1. Low

17.10.2. Medium

17.10.3. High

17.11. Hot Sauce Market Size (US$ Mn and Million Units), By End-use, 2017 - 2031

17.11.1. Commercial

17.11.2. Household

17.12. Hot Sauce Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.1.1. E-commerce Websites

17.12.1.2. Company-owned Websites

17.12.2. Offline

17.12.2.1. Supermarkets/Hypermarkets

17.12.2.2. Specialty Stores

17.12.2.3. Others

17.13. Hot sauce Market (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Share Analysis-2021 (%)

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/ Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

18.3.1. Baumer Foods, Inc.

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Financial/ Revenue (Segmental Revenue)

18.3.1.4. Strategy & Business Overview

18.3.1.5. Sales Channel Analysis

18.3.1.6. Product Portfolio & Pricing

18.3.2. Conagra Brands, Inc.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Financial/ Revenue (Segmental Revenue)

18.3.2.4. Strategy & Business Overview

18.3.2.5. Sales Channel Analysis

18.3.2.6. Product Portfolio & Pricing

18.3.3. Del Monte Pacific Ltd.

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Financial/ Revenue (Segmental Revenue)

18.3.3.4. Strategy & Business Overview

18.3.3.5. Sales Channel Analysis

18.3.3.6. Product Portfolio & Pricing

18.3.4. Hormel Foods Corporation

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Financial/ Revenue (Segmental Revenue)

18.3.4.4. Strategy & Business Overview

18.3.4.5. Sales Channel Analysis

18.3.4.6. Product Portfolio & Pricing

18.3.5. Huy Fong Foods, Inc.

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Financial/ Revenue (Segmental Revenue)

18.3.5.4. Strategy & Business Overview

18.3.5.5. Sales Channel Analysis

18.3.5.6. Product Portfolio & Pricing

18.3.6. Kikkoman Sales USA, Inc.

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Financial/ Revenue (Segmental Revenue)

18.3.6.4. Strategy & Business Overview

18.3.6.5. Sales Channel Analysis

18.3.6.6. Product Portfolio & Pricing

18.3.7. McCormick & Company, Incorporated

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Financial/ Revenue (Segmental Revenue)

18.3.7.4. Strategy & Business Overview

18.3.7.5. Sales Channel Analysis

18.3.7.6. Product Portfolio & Pricing

18.3.8. McIlhenny Company

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Financial/ Revenue (Segmental Revenue)

18.3.8.4. Strategy & Business Overview

18.3.8.5. Sales Channel Analysis

18.3.8.6. Product Portfolio & Pricing

18.3.9. The Kraft Heinz Company

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Financial/ Revenue (Segmental Revenue)

18.3.9.4. Strategy & Business Overview

18.3.9.5. Sales Channel Analysis

18.3.9.6. Product Portfolio & Pricing

18.3.10. TW Garner Food Company

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Financial/ Revenue (Segmental Revenue)

18.3.10.4. Strategy & Business Overview

18.3.10.5. Sales Channel Analysis

18.3.10.6. Product Portfolio & Pricing

19. Key Takeaway

19.1. Identification of Potential Market Spaces

19.1.1. Product Type

19.1.2. Packaging

19.1.3. Application

19.1.4. Price

19.1.5. End-use

19.1.6. Distribution Channel

List of Tables

Table 1: Global Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 2: Global Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 3: Global Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 4: Global Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 5: Global Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 6: Global Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 7: Global Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 8: Global Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 9: Global Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 10: Global Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 11: Global Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 12: Global Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 13: Global Hot Sauce Market Volume (Million Units), by Region, 2017 - 2031

Table 14: Global Hot Sauce Market Value (US$ Mn), by Region, 2017 - 2031

Table 15: North America Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 16: North America Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 17: North America Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 18: North America Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 19: North America Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 20: North America Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 21: North America Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 22: North America Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 23: North America Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 24: North America Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 25: North America Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 26: North America Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 27: North America Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Table 28: North America Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Table 29: Europe Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 30: Europe Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 31: Europe Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 32: Europe Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 33: Europe Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 34: Europe Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 35: Europe Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 36: Europe Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 37: Europe Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 38: Europe Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 39: Europe Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 40: Europe Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 41: Europe Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Table 42: Europe Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Table 43: Asia Pacific Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 44: Asia Pacific Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 45: Asia Pacific Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 46: Asia Pacific Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 47: Asia Pacific Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 48: Asia Pacific Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 49: Asia Pacific Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 50: Asia Pacific Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 51: Asia Pacific Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 52: Asia Pacific Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 53: Asia Pacific Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 54: Asia Pacific Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 55: Asia Pacific Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Table 56: Asia Pacific Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Table 57: Middle East & Africa Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 58: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 59: Middle East & Africa Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 60: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 61: Middle East & Africa Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 62: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 63: Middle East & Africa Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 64: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 65: Middle East & Africa Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 66: Middle East & Africa Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 67: Middle East & Africa Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 68: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 69: Middle East & Africa Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Table 70: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Table 71: South America Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Table 72: South America Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Table 73: South America Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Table 74: South America Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Table 75: South America Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Table 76: South America Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Table 77: South America Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Table 78: South America Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Table 79: South America Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Table 80: South America Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Table 81: South America Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Table 82: South America Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 83: South America Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Table 84: South America Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

List of Figures

Figure 1: Global Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 2: Global Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 3: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 4: Global Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 5: Global Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 6: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 7: Global Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 8: Global Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 9: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 10: Global Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 11: Global Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 12: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 13: Global Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 14: Global Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 15: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 16: Global Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 17: Global Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 18: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 19: Global Hot Sauce Market Volume (Million Units), by Region, 2017 - 2031

Figure 20: Global Hot Sauce Market Value (US$ Mn), by Region, 2017 - 2031

Figure 21: Global Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2022 - 2031

Figure 22: North America Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 23: North America Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 24: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 25: North America Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 26: North America Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 27: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 28: North America Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 29: North America Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 30: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 31: North America Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 32: North America Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 33: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 34: North America Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 35: North America Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 36: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 37: North America Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 38: North America Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 39: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 40: North America Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Figure 41: North America Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Figure 42: North America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 43: Europe Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 44: Europe Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 45: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 46: Europe Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 47: Europe Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 48: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 49: Europe Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 50: Europe Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 51: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 52: Europe Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 53: Europe Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 54: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 55: Europe Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 56: Europe Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 57: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 58: Europe Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 59: Europe Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 60: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 61: Europe Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Figure 62: Europe Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Figure 63: Europe Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 64: Asia Pacific Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 65: Asia Pacific Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 66: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 67: Asia Pacific Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 68: Asia Pacific Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 69: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 70: Asia Pacific Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 71: Asia Pacific Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 72: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 73: Asia Pacific Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 74: Asia Pacific Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 75: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 76: Asia Pacific Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 77: Asia Pacific Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 78: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 79: Asia Pacific Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 80: Asia Pacific Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 81: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 82: Asia Pacific Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Figure 83: Asia Pacific Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Figure 84: Asia Pacific Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 85: Middle East & Africa Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 86: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 87: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 88: Middle East & Africa Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 89: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 90: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 91: Middle East & Africa Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 92: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 93: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 94: Middle East & Africa Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 95: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 96: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 97: Middle East & Africa Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 98: Middle East & Africa Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 99: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 100: Middle East & Africa Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 101: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 102: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 103: Middle East & Africa Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Figure 104: Middle East & Africa Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Figure 105: Middle East & Africa Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 106: South America Hot Sauce Market Volume (Million Units), by Product Type, 2017 - 2031

Figure 107: South America Hot Sauce Market Value (US$ Mn), by Product Type, 2017 - 2031

Figure 108: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2022 - 2031

Figure 109: South America Hot Sauce Market Volume (Million Units), by Packaging, 2017 - 2031

Figure 110: South America Hot Sauce Market Value (US$ Mn), by Packaging, 2017 - 2031

Figure 111: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Packaging, 2022 - 2031

Figure 112: South America Hot Sauce Market Volume (Million Units), by Application, 2017 - 2031

Figure 113: South America Hot Sauce Market Value (US$ Mn), by Application, 2017 - 2031

Figure 114: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2022 - 2031

Figure 115: South America Hot Sauce Market Volume (Million Units), by Price, 2017 - 2031

Figure 116: South America Hot Sauce Market Value (US$ Mn), by Price, 2017 - 2031

Figure 117: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2022 - 2031

Figure 118: South America Hot Sauce Market Volume (Million Units), by End-Use, 2017 - 2031

Figure 119: South America Hot Sauce Market Value (US$ Mn), by End-Use, 2017 - 2031

Figure 120: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by End-Use, 2022 - 2031

Figure 121: South America Hot Sauce Market Volume (Million Units), by Distribution Channel, 2017 - 2031

Figure 122: South America Hot Sauce Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 123: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2022 - 2031

Figure 124: South America Hot Sauce Market Volume (Million Units), by Country, 2017 - 2031

Figure 125: South America Hot Sauce Market Value (US$ Mn), by Country, 2017 - 2031

Figure 126: South America Hot Sauce Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031