Analysts’ Viewpoint on Market Scenario

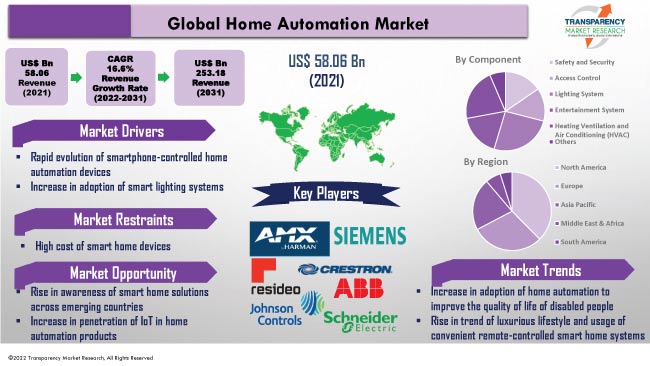

Rise in demand and popularity of smart home heating, cooling, and air quality systems to provide reliable, effective, climate control in the home is one of the key factors influencing global home automation market expansion. Growing technical developments in sensor-based controls contribute to more secure and comfortable homes.

Adoption of home automation systems is fueled by the increase in usage of Internet of Things (IoT) for smart home applications such as lighting; room control; audio & video control; and security & entry control. Moreover, major companies in the market are focusing on expansion of their operations around the globe in order to increase their consumer base and maintain competitiveness in the market.

According to latest market trends, large firms would have a strong hold on the market, and market consolidation (mergers and acquisitions) and new product development would both increase.

The automatic control of electronic devices at home is known as home automation. These devices can be managed remotely owing to their Internet connectivity. Individual devices can trigger one another due to home automation, eliminating the need for manual controls. Internet of Things (IoT) enabled devices, such as security systems and cameras, in home automation can also result in increased safety.

The global home automation market is estimated to advance at a significant growth rate during the forecast period due to various functions offered by home automation such as fire and carbon monoxide monitoring, remote lighting control, thermostat control, alarm systems, real-time text and email alerts, and digital personal assistant integration. Smart home technology typically saves users around half an hour per day, or 182.5 hours annually and more than a week. Consequently, home automation companies are spending heavily on new technologies that which enable voice control over home automation, with the aid of Alexa, Google Assistant, and Siri.

Rise in popularity of smart home integration devices, voice-controlled home automation systems, and home lighting automation systems is also expected to boost the global home automation market during the forecast period.

The smart home market is becoming increasingly attractive due to the rapid developments of smartphone-controlled applications. Alarm.com, a U.S.-based technology company, conducted a survey of 1000 homes in the U.S. The survey found that while the large range of devices on the market perplexed 59% of respondents, nearly 48% of participants were enthusiastic about smart-home solutions.

Participants in the survey placed a high priority on the security that smart homes would offer; and comfort, energy savings, etc., come next to security. Therefore, key players operating in the home automation are engaged in the development of innovative products to gain a competitive edge. For instance, in June 2022, Hogar Controls India Pvt. Ltd. launched a new range of digital door locks, smart touch panels, controllers, and smart curtain motors in the Indian market.

Its Wi-Fi-enabled Smart Touch Panels comprise various product variants under the Prima and Prima+ series. These touch panels are compatible with any smartphone and voice-controlled via Amazon Alexa or Google Assistant on supported devices. Hence, increase in use of smartphones to remotely control lighting equipment, air conditioning, laundry systems, heating, and audio/video system has propelled the adoption of smart home systems.

Smart lighting is a cutting-edge technique of indoor lighting. Smart LED bulbs are integrated with software that connects to an app, smart home assistant, or other smart accessories, eliminating the need for conventional wall switches and automate lights or control them remotely. Each smart bulb and LED-integrated fixture can be wirelessly controlled with a phone, tablet, or a smart assistant such as Google Assistant or Amazon Alexa; this feature enables the rapid adoption of smart lights.

The ability of smart lighting systems to connect with other devices, including cameras, audio equipment, thermostats, and home assistants, fuels the demand for smart lights. Nearly 20% of global electricity usage and 6% of CO2 emissions are consumed by lighting. According to The International Energy Agency lighting accounts for around 3% of the world's oil demand. Global energy usage for lighting would increase by about 60% by 2030 if prompt action has not been taken. Smart lighting offers greater energy efficiency as compared to traditional lighting. This factor is expected to drive the global market.

In terms of component, the global home automation market has been segmented into safety and security, access control, lighting system, entertainment system, Heating Ventilation and Air Conditioning (HVAC), and others. The Heating Ventilation and Air Conditioning (HVAC) segment has been further divided into actuators; sensors and transducers; thermostats; ducted split systems; humidifiers; UV air purifiers; and others. Among these, the thermostat is one of the significant technologies in the market and the segment is projected to grow at a rapid pace during the forecast period.

Thermostat assists customers in saving roughly 23% of HVAC energy consumption by controlling the temperature through customizable scheduling, remote access, and geofencing. Users of smart thermostats can reduce energy and financial costs while maintaining indoor comfort. Spotify and Bluetooth streaming, hands-free calling, and intercom functions are all available on modern thermostats.

In terms of technology, the global home automation market has been classified into wired and wireless. The wireless segment is anticipated to dominate the market during the forecast period. The wireless segment has been further categorized into ZigBee, Wi-Fi, Bluetooth, and others. Among the segments, ZigBee accounted for a significant share of the market in 2021, and it is expected to grow at the highest CAGR during the forecast period.

Zigbee is low-cost wireless communication technology that consumes less power. The IEEE's 802.15.4 personal-area network standard is the foundation of Zigbee. For some applications, such as low-powered devices that don't require a lot of bandwidth, such as smart home sensors, Zigbee is often regarded as an alternative to Wi-Fi and Bluetooth. There is no communication barrier while using Zigbee because two devices, even if different companies manufacture them, can communicate using the same language. Thus, Zigbee is the key element in the smart home automation system.

North America held the highest share, approximately 37.8% of the global home automation market in 2021. It is expected to dominate the global market during the forecast period due to the presence of key market players, technological advancements, and countries, such as the U.S. and Canada offering ample and lucrative opportunities for manufacturers on a long-term basis in the region.

Home automation has gained popularity in North America in the last decade. In the U.S., about half of millennials already own smart gadgets. The majority of homes in the U.S. are starting to adopt smart speakers with assistants. More than a 1/4th of broadband-enabled homes, currently, utilize smart speakers with helpful assistants. Additionally, the search by voice capability is currently used at least once per month by about 35% of people in the U.S. Thus, the market in North America is being driven by the rise in demand for sustainable home energy management systems, improved home security levels, and the growing integration of smart devices & standalone voice assistants in homes.

The market in Europe and Asia Pacific is also growing significantly due to rapid adoption of smart home automation devices or home automation kits across various countries in these regions. Home automation products and solutions are widely used in China, India, and South Korea, as a result of increased middle-class disposable income and preference for luxurious lifestyles.

Middle East & Africa is a larger market for home automation as compared to South America; moreover, the market in Middle East & Africa is estimated to grow at a rapid pace as compared to the market in South America.

The global home automation market is consolidated, with the presence of large-scale vendors that control majority of the share. Several companies are investing significantly in comprehensive research and development, and new product development.

Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. HARMAN, SAMSUNG, Crestron Electronics, Inc., Siemens AG, Lutron Electronics Co., Inc, ABB Ltd., Johnson Controls International, Honeywell International Inc., Snap One, LLC, Schneider Electric SE, Savant Systems, Inc, Legrand SA, and Nice North America LLC are prominent players operating in the global market.

Each of these players has been profiled in the global home automation market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 58.06 Bn |

|

Market Forecast Value in 2031 |

US$ 253.18 Bn |

|

Growth Rate (CAGR) |

16.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 58.06 Bn in 2021

The global market is expected to advance at a CAGR of 16.6% by 2031

The global market is projected to reach US$ 253.18 Bn in 2031

HARMAN, SAMSUNG, Crestron Electronics, Inc., Siemens AG, Lutron Electronics Co., Inc, ABB Ltd., Johnson Controls International, Honeywell International Inc., Snap One, LLC, Schneider Electric SE, Savant Systems, Inc, Legrand SA, and Nice North America LLC

In 2021, the US held approximately 28.1% share of the global home automation market

Based on component, the heating ventilation and air conditioning (HVAC) segment held around 21.4% share of the global home automation market in 2021

Rise in adoption of home automation to improve the quality of life of disabled people; rise in trend of luxurious lifestyles, usage of convenient remote-controlled smart home systems, and increased awareness about home security in developed and developing countries spur the implementation of smart home security systems

North America is a more lucrative region in the global home automation market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Home Automation Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Building and Construction Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Home Automation Market Analysis, by Component

5.1. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

5.1.1. Safety and Security

5.1.1.1. Hardware

5.1.1.1.1. Security Cameras

5.1.1.1.2. Monitors

5.1.1.1.3. Fire Extinguishers

5.1.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

5.1.1.2. Software

5.1.1.3. Services

5.1.2. Access Control

5.1.2.1. Biometric Access Control

5.1.2.1.1. Facial Recognition

5.1.2.1.2. Iris Recognition

5.1.2.1.3. Fingerprint Recognition

5.1.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

5.1.2.2. Non Biometric Access Control

5.1.3. Lighting System

5.1.3.1. Drivers & Ballasts

5.1.3.2. Relays

5.1.3.3. Sensors

5.1.3.4. Dimmers

5.1.3.5. Switches

5.1.3.6. Others (Accessories)

5.1.4. Entertainment System

5.1.4.1. Home Theater Systems

5.1.4.2. Audio Video Control Systems

5.1.4.3. Others

5.1.5. Heating Ventilation and Air Conditioning (HVAC)

5.1.5.1. Actuators

5.1.5.2. Sensors and Transducers

5.1.5.3. Thermostats

5.1.5.4. Ducted Split Systems

5.1.5.5. Humidifiers

5.1.5.6. UV Air Purifiers

5.1.5.7. Others (Energy Meter, Control Valve, etc.)

5.1.6. Others (Smoke Detector, Smart Plugs, etc.)

5.2. Market Attractiveness Analysis, by Component

6. Home Automation Market Analysis, by Technology

6.1. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Wired

6.1.1.1. Power Line Communication (PLC)

6.1.1.2. Ethernet

6.1.1.3. Fiber Optics

6.1.2. Wireless

6.1.2.1. ZigBee

6.1.2.2. Wi-Fi

6.1.2.3. Bluetooth

6.1.2.4. Others

6.2. Market Attractiveness Analysis, by Technology

7. Home Automation Market Analysis, by Type

7.1. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

7.1.1. Luxury

7.1.2. Mainstream

7.1.3. DIY

7.1.4. Managed

7.2. Market Attractiveness Analysis, by Type

8. Home Automation Market Analysis and Forecast, by Region

8.1. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Home Automation Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

9.3.1. Safety and Security

9.3.1.1. Hardware

9.3.1.1.1. Security Cameras

9.3.1.1.2. Monitors

9.3.1.1.3. Fire Extinguishers

9.3.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

9.3.1.2. Software

9.3.1.3. Services

9.3.2. Access Control

9.3.2.1. Biometric Access Control

9.3.2.1.1. Facial Recognition

9.3.2.1.2. Iris Recognition

9.3.2.1.3. Fingerprint Recognition

9.3.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

9.3.2.2. Non Biometric Access Control

9.3.3. Lighting System

9.3.3.1. Drivers & Ballasts

9.3.3.2. Relays

9.3.3.3. Sensors

9.3.3.4. Dimmers

9.3.3.5. Switches

9.3.3.6. Others (Accessories)

9.3.4. Entertainment System

9.3.4.1. Home Theater Systems

9.3.4.2. Audio Video Control Systems

9.3.4.3. Others

9.3.5. Heating Ventilation and Air Conditioning (HVAC)

9.3.5.1. Actuators

9.3.5.2. Sensors and Transducers

9.3.5.3. Thermostats

9.3.5.4. Ducted Split Systems

9.3.5.5. Humidifiers

9.3.5.6. UV Air Purifiers

9.3.5.7. Others (Energy Meter, Control Valve, etc.)

9.3.6. Others (Smoke Detector, Smart Plugs, etc.)

9.4. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

9.4.1. Wired

9.4.1.1. Power Line Communication (PLC)

9.4.1.2. Ethernet

9.4.1.3. Fiber Optics

9.4.2. Wireless

9.4.2.1. ZigBee

9.4.2.2. Wi-Fi

9.4.2.3. Bluetooth

9.4.2.4. Others

9.5. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

9.5.1. Luxury

9.5.2. Mainstream

9.5.3. DIY

9.5.4. Managed

9.6. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of America

9.7. Market Attractiveness Analysis

9.7.1. By Component

9.7.2. By Technology

9.7.3. By Type

9.7.4. By Country and Sub-region

10. Europe Home Automation Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

10.3.1. Safety and Security

10.3.1.1. Hardware

10.3.1.1.1. Security Cameras

10.3.1.1.2. Monitors

10.3.1.1.3. Fire Extinguishers

10.3.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

10.3.1.2. Software

10.3.1.3. Services

10.3.2. Access Control

10.3.2.1. Biometric Access Control

10.3.2.1.1. Facial Recognition

10.3.2.1.2. Iris Recognition

10.3.2.1.3. Fingerprint Recognition

10.3.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

10.3.2.2. Non Biometric Access Control

10.3.3. Lighting System

10.3.3.1. Drivers & Ballasts

10.3.3.2. Relays

10.3.3.3. Sensors

10.3.3.4. Dimmers

10.3.3.5. Switches

10.3.3.6. Others (Accessories)

10.3.4. Entertainment System

10.3.4.1. Home Theater Systems

10.3.4.2. Audio Video Control Systems

10.3.4.3. Others

10.3.5. Heating Ventilation and Air Conditioning (HVAC)

10.3.5.1. Actuators

10.3.5.2. Sensors and Transducers

10.3.5.3. Thermostats

10.3.5.4. Ducted Split Systems

10.3.5.5. Humidifiers

10.3.5.6. UV Air Purifiers

10.3.5.7. Others (Energy Meter, Control Valve, etc.)

10.3.6. Others (Smoke Detector, Smart Plugs, etc.)

10.4. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

10.4.1. Wired

10.4.1.1. Power Line Communication (PLC)

10.4.1.2. Ethernet

10.4.1.3. Fiber Optics

10.4.2. Wireless

10.4.2.1. ZigBee

10.4.2.2. Wi-Fi

10.4.2.3. Bluetooth

10.4.2.4. Others

10.5. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

10.5.1. Luxury

10.5.2. Mainstream

10.5.3. DIY

10.5.4. Managed

10.6. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Component

10.7.2. By Technology

10.7.3. By Type

10.7.4. By Country and Sub-region

11. Asia Pacific Home Automation Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

11.3.1. Safety and Security

11.3.1.1. Hardware

11.3.1.1.1. Security Cameras

11.3.1.1.2. Monitors

11.3.1.1.3. Fire Extinguishers

11.3.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

11.3.1.2. Software

11.3.1.3. Services

11.3.2. Access Control

11.3.2.1. Biometric Access Control

11.3.2.1.1. Facial Recognition

11.3.2.1.2. Iris Recognition

11.3.2.1.3. Fingerprint Recognition

11.3.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

11.3.2.2. Non Biometric Access Control

11.3.3. Lighting System

11.3.3.1. Drivers & Ballasts

11.3.3.2. Relays

11.3.3.3. Sensors

11.3.3.4. Dimmers

11.3.3.5. Switches

11.3.3.6. Others (Accessories)

11.3.4. Entertainment System

11.3.4.1. Home Theater Systems

11.3.4.2. Audio Video Control Systems

11.3.4.3. Others

11.3.5. Heating Ventilation and Air Conditioning (HVAC)

11.3.5.1. Actuators

11.3.5.2. Sensors and Transducers

11.3.5.3. Thermostats

11.3.5.4. Ducted Split Systems

11.3.5.5. Humidifiers

11.3.5.6. UV Air Purifiers

11.3.5.7. Others (Energy Meter, Control Valve, etc.)

11.3.6. Others (Smoke Detector, Smart Plugs, etc.)

11.4. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

11.4.1. Wired

11.4.1.1. Power Line Communication (PLC)

11.4.1.2. Ethernet

11.4.1.3. Fiber Optics

11.4.2. Wireless

11.4.2.1. ZigBee

11.4.2.2. Wi-Fi

11.4.2.3. Bluetooth

11.4.2.4. Others

11.5. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

11.5.1. Luxury

11.5.2. Mainstream

11.5.3. DIY

11.5.4. Managed

11.6. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Technology

11.7.3. By Type

11.7.4. By Country and Sub-region

12. Middle East & Africa Home Automation Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

12.3.1. Safety and Security

12.3.1.1. Hardware

12.3.1.1.1. Security Cameras

12.3.1.1.2. Monitors

12.3.1.1.3. Fire Extinguishers

12.3.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

12.3.1.2. Software

12.3.1.3. Services

12.3.2. Access Control

12.3.2.1. Biometric Access Control

12.3.2.1.1. Facial Recognition

12.3.2.1.2. Iris Recognition

12.3.2.1.3. Fingerprint Recognition

12.3.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

12.3.2.2. Non Biometric Access Control

12.3.3. Lighting System

12.3.3.1. Drivers & Ballasts

12.3.3.2. Relays

12.3.3.3. Sensors

12.3.3.4. Dimmers

12.3.3.5. Switches

12.3.3.6. Others (Accessories)

12.3.4. Entertainment System

12.3.4.1. Home Theater Systems

12.3.4.2. Audio Video Control Systems

12.3.4.3. Others

12.3.5. Heating Ventilation and Air Conditioning (HVAC)

12.3.5.1. Actuators

12.3.5.2. Sensors and Transducers

12.3.5.3. Thermostats

12.3.5.4. Ducted Split Systems

12.3.5.5. Humidifiers

12.3.5.6. UV Air Purifiers

12.3.5.7. Others (Energy Meter, Control Valve, etc.)

12.3.6. Others (Smoke Detector, Smart Plugs, etc.)

12.4. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

12.4.1. Wired

12.4.1.1. Power Line Communication (PLC)

12.4.1.2. Ethernet

12.4.1.3. Fiber Optics

12.4.2. Wireless

12.4.2.1. ZigBee

12.4.2.2. Wi-Fi

12.4.2.3. Bluetooth

12.4.2.4. Others

12.5. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

12.5.1. Luxury

12.5.2. Mainstream

12.5.3. DIY

12.5.4. Managed

12.6. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Technology

12.7.3. By Type

12.7.4. By Country and Sub-region

13. South America Home Automation Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

13.3.1. Safety and Security

13.3.1.1. Hardware

13.3.1.1.1. Security Cameras

13.3.1.1.2. Monitors

13.3.1.1.3. Fire Extinguishers

13.3.1.1.4. Others (Doorbells, Water Leak & Freeze Detector, etc.)

13.3.1.2. Software

13.3.1.3. Services

13.3.2. Access Control

13.3.2.1. Biometric Access Control

13.3.2.1.1. Facial Recognition

13.3.2.1.2. Iris Recognition

13.3.2.1.3. Fingerprint Recognition

13.3.2.1.4. Others (Hand Geometry Biometrics, Retina Pattern, etc.)

13.3.2.2. Non Biometric Access Control

13.3.3. Lighting System

13.3.3.1. Drivers & Ballasts

13.3.3.2. Relays

13.3.3.3. Sensors

13.3.3.4. Dimmers

13.3.3.5. Switches

13.3.3.6. Others (Accessories)

13.3.4. Entertainment System

13.3.4.1. Home Theater Systems

13.3.4.2. Audio Video Control Systems

13.3.4.3. Others

13.3.5. Heating Ventilation and Air Conditioning (HVAC)

13.3.5.1. Actuators

13.3.5.2. Sensors and Transducers

13.3.5.3. Thermostats

13.3.5.4. Ducted Split Systems

13.3.5.5. Humidifiers

13.3.5.6. UV Air Purifiers

13.3.5.7. Others (Energy Meter, Control Valve, etc.)

13.3.6. Others (Smoke Detector, Smart Plugs, etc.)

13.4. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

13.4.1. Wired

13.4.1.1. Power Line Communication (PLC)

13.4.1.2. Ethernet

13.4.1.3. Fiber Optics

13.4.2. Wireless

13.4.2.1. ZigBee

13.4.2.2. Wi-Fi

13.4.2.3. Bluetooth

13.4.2.4. Others

13.5. Home Automation Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

13.5.1. Luxury

13.5.2. Mainstream

13.5.3. DIY

13.5.4. Managed

13.6. Home Automation Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Technology

13.7.3. By Type

13.7.4. By Country and Sub-region

14. Competition Assessment

14.1. Global Home Automation Market Competition Matrix - a Dashboard View

14.1.1. Global Home Automation Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Crestron Electronics, Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. HARMAN

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Honeywell International Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Johnson Controls International

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Legrand SA

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Lutron Electronics Co., Inc

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Nice North America LLC

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. SAMSUNG

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Savant Systems, Inc

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Schneider Electric SE

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Siemens AG

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Snap One, LLC

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Component

16.1.2. By Technology

16.1.3. By Type

16.1.4. By Region

List of Tables

Table 01: Global Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 02: Global Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 03: Global Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 04: Global Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 05: Global Home Automation Market Size & Forecast, by Region, Value (US$ Bn), 2017–2031

Table 06: Global Home Automation Market Size & Forecast, by Region, Volume (Million Units), 2017–2031

Table 07: North America Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 08: North America Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 09: North America Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 10: North America Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 11: North America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Table 12: North America Home Automation Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017–2031

Table 13: Europe Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 14: Europe Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 15: Europe Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 16: Europe Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 17: Europe Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Table 18: Europe Home Automation Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017–2031

Table 19: Asia Pacific Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 20: Asia Pacific Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 21: Asia Pacific Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 22: Asia Pacific Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 23: Asia Pacific Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Table 24: Asia Pacific Home Automation Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017–2031

Table 25: Middle East & Africa Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 26: Middle East & Africa Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 27: Middle East & Africa Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 28: Middle East & Africa Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 29: Middle East & Africa Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Table 30: Middle East & Africa Home Automation Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017–2031

Table 31: South America Home Automation Market Size & Forecast, by Component, Value (US$ Bn), 2017–2031

Table 32: South America Home Automation Market Size & Forecast, by Component, Volume (Million Units), 2017–2031

Table 33: South America Home Automation Market Size & Forecast, by Technology, Value (US$ Bn), 2017–2031

Table 34: South America Home Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017–2031

Table 35: South America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Table 36: South America Home Automation Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017–2031

List of Figures

Figure 01: Global Home Automation Price Trend Analysis (Average Price, US$)

Figure 02: Global Home Automation Market, Value (US$ Bn), 2017–2031

Figure 03: Global Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 04: Global Home Automation Market, Volume (Million Units), 2017–2031

Figure 05: Global Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 06: Global Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 07: Global Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 08: Global Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 09: Global Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 10: Global Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 11: Global Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 12: Global Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 13: Global Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 14: Global Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 15: Global Home Automation Market Size & Forecast, by Region, Value (US$ Bn), 2017–2031

Figure 16: Global Home Automation Market Attractiveness, by Region, Value (US$ Bn), 2022–2031

Figure 17: Global Home Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022–2031

Figure 18: North America Home Automation Market, Value (US$ Bn), 2017–2031

Figure 19: North America Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 20: North America Home Automation Market, Volume (Million Units), 2017–2031

Figure 21: North America Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 22: North America Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 23: North America Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 24: North America Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 25: North America Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 26: North America Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 27: North America Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 28: North America Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 29: North America Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 30: North America Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 31: North America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Figure 32: North America Home Automation Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 33: North America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 34: Europe Home Automation Market, Value (US$ Bn), 2017–2031

Figure 35: Europe Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 36: Europe Home Automation Market, Volume (Million Units), 2017–2031

Figure 37: Europe Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 38: Europe Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 39: Europe Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 40: Europe Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 41: Europe Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 42: Europe Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 43: Europe Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 44: Europe Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 45: Europe Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 46: Europe Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 47: Europe Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Figure 48: Europe Home Automation Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 49: Europe Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 50: Asia Pacific Home Automation Market, Value (US$ Bn), 2017–2031

Figure 51: Asia Pacific Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 52: Asia Pacific Home Automation Market, Volume (Million Units), 2017–2031

Figure 53: Asia Pacific Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 54: Asia Pacific Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 55: Asia Pacific Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 56: Asia Pacific Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 57: Asia Pacific Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 58: Asia Pacific Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 59: Asia Pacific Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 60: Asia Pacific Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 61: Asia Pacific Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 62: Asia Pacific Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 63: Asia Pacific Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Figure 64: Asia Pacific Home Automation Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 65: Asia Pacific Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 66: Middle East & Africa Home Automation Market, Value (US$ Bn), 2017–2031

Figure 67: Middle East & Africa Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 68: Middle East & Africa Home Automation Market, Volume (Million Units), 2017–2031

Figure 69: Middle East & Africa Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 70: Middle East & Africa Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 71: Middle East & Africa Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 72: Middle East & Africa Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 73: Middle East & Africa Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 74: Middle East & Africa Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 75: Middle East & Africa Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 76: Middle East & Africa Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 77: Middle East & Africa Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 78: Middle East & Africa Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 79: Middle East & Africa Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Figure 80: Middle East & Africa Home Automation Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 81: Middle East & Africa Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 82: South America Home Automation Market, Value (US$ Bn), 2017–2031

Figure 83: South America Home Automation Market, Y-O-Y Value (US$ Bn), 2017–2031

Figure 84: South America Home Automation Market, Volume (Million Units), 2017–2031

Figure 85: South America Home Automation Market, Y-O-Y Volume (Million Units), 2017–2031

Figure 86: South America Home Automation Market Projections, by Component, Value (US$ Bn), 2017–2031

Figure 87: South America Home Automation Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022–2031

Figure 88: South America Home Automation Market Share, by Component, Value (US$ Bn), 2022–2031

Figure 89: South America Home Automation Market Projections, by Technology, Value (US$ Bn), 2017–2031

Figure 90: South America Home Automation Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022–2031

Figure 91: South America Home Automation Market Share, by Technology, Value (US$ Bn), 2022–2031

Figure 92: South America Home Automation Market Projections, by Type, Value (US$ Bn), 2017–2031

Figure 93: South America Home Automation Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022–2031

Figure 94: South America Home Automation Market Share, by Type, Value (US$ Bn), 2022–2031

Figure 95: South America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017–2031

Figure 96: South America Home Automation Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022–2031

Figure 97: South America Home Automation Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2022–2031