Pork is the most consumed meat across the world and the trend is set to continue in the near future due to the increase in its demand. According to estimates, at present, there are around one billion pigs in the world. Over the past few decades, the hog production and pork market has evolved in several ways, particularly in regions such as Latin America and Asia Pacific. Pork production systems have gradually transformed from forest-based to pasture-based, and most recently into specifically designed buildings. At present, the hog production and pork market is witnessing significant developments in its production, owing to the mounting pressure and demand for sustainable production techniques.

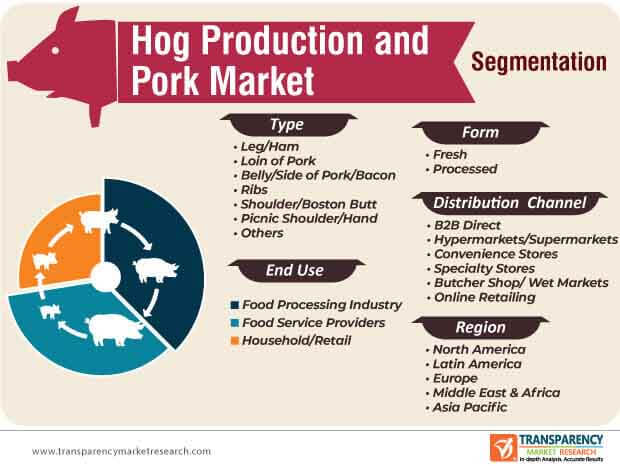

With exponential growth in global human population, the demand for hog production and pork meat has witnessed significant growth. Additionally, a significant increase in the disposable income of consumers, coupled with the economic development of various countries of Asia Pacific and Latin America, is expected to positively impact the consumption of pork worldwide. As per the current trends, existing industrialized pork production facilities could pave the way for enhanced and larger production facilities in the near future. The newer production facilities are heading toward a more sustainable production approach. Growing demand for hog and pork meat, adoption of sustainable production methods, and a substantial rise in disposable income are expected to drive the growth of the hog production and pork market during the forecast period (2019-2027). As a result of these factors, the hog production and pork market is projected to reach a market value of ~US$ 464 Bn by the end of 2027.

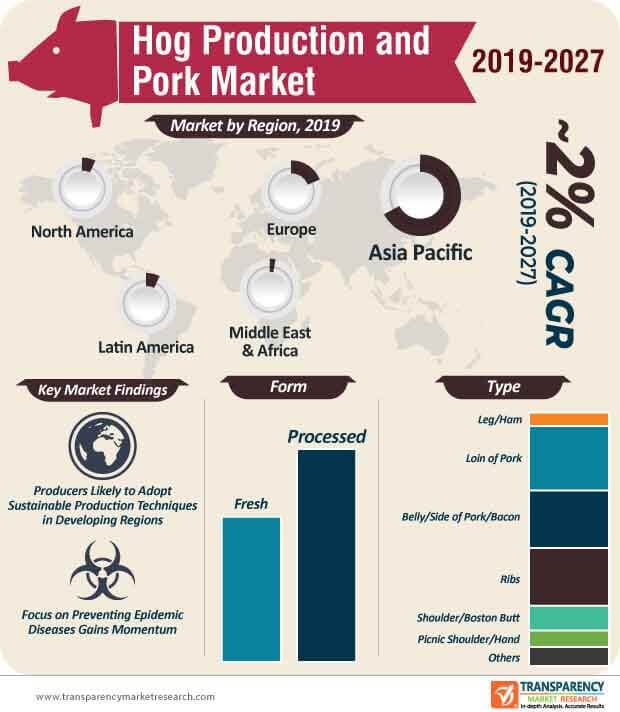

For several years, North America and Europe have been the early adopters of advanced production and farming methods pertaining to hogs and pigs. While industrialized production systems are extensively being adopted in developed regions, production systems across the Asia Pacific are heading in a similar direction. Despite leading the way, in terms of technology and production capabilities, North America and Europe accounted for a combined share of ~27% of the hog production and pork market in 2018. However, with the Asia Pacific hog production and pork market valuing ~US$ 257 Bn in 2018, the region held a market share of ~66%. The region is likely to remain the most prominent consumer and producer of pork meat during the forecast period.

The Asia Pacific region is expected to be the largest regional market for hog production and pork, primarily due to high production output and consumption in China. The hog production and pork market in China was valued at ~US$ 213 Bn in 2018, and the trend is projected to continue during the forecast period. Focus on refurbishing breeding farms and epidemic prevention, and favorable government policies are some of the leading factors driving the expansion of the hog production and pork market in China. Due to rising investments and support from governments, several players operating in the hog production and pork market in Asia Pacific are focusing on enhancing their production capacity, increasing the size of their farms, and developing a stable production and supply chain.

The growing prevalence of African Swine Fever (ASF) across different regions of the world could hinder the growth of the hog production and pork market in the near future. Furthermore, reports suggest that the number of such cases has increased at a rapid pace in developing countries of Asia Pacific, including Cambodia, Vietnam, and Laos. Lack of vaccines and treatment to address ASF is compelling stakeholders in the hog production and pork market to improve their feed production techniques. Moreover, rise in the number of ASF cases could potentially affect the global hog and pork market, which could lead to significant financial losses of participants of the hog production and pork market landscape. Pig health diagnostics will continue to remain a major challenge for hog and pork meat producers, especially in Asia Pacific.

Analysts’ Viewpoint

The hog production and pork market is expected to expand at a CAGR of ~2% during the forecast period. China is a major producer and consumer, in terms of port meat consumption as well as production. This factor is anticipated to drive the hog production and pork market during the forecast period. Moreover, favorable government policies and efforts to improve the quality of the products are some of the major factors that will propel the hog production and pork market growth in Asia Pacific. Additionally, key players in the hog production and pork market landscape should focus on modernizing their production facilities and preventing epidemic diseases such as the ASF.

Hog Production and Pork Market: Overview

Hog Production and Pork Market Frontrunners

Hog Production and Pork Market: Trends

Hog Production and Pork Market: Strategies

Target Region for Hog Production and Pork Market

Hog Production and Pork Market: Key Players

Hog Production and Pork Market is projected to reach US$ 464 Bn by the end of 2027

Hog Production and Pork Market is expected to grow at a CAGR of 2% during 2019-2027

Rising demand for organic food products is anticipated to be a major contributor to the growth of the hog production and pork market

Asia Pacific is more attractive region for vendors in the Hog Production and Pork Market

Key vendors in the Hog Production and Pork Market are JBS S.A, Smithfield Foods, Inc., Triumph Foods, LLC, Seaboard Corporation, etc

1. Global Hog Production and Pork Market - Executive Summary

1.1. Summary of Key Findings

1.2. Opportunity Assessment

1.3. Global Hog Production and Pork Market Introduction

2. Global Hog Production and Pork Market Overview

2.1. Global Hog Production and Pork Market Taxonomy

2.2. Global Hog Production and Pork Market Definition

2.3. Global Hog Production and Pork Market Size (US$ Mn & Volume) and Forecast, 2013-2027

2.3.1. Global Hog Production and Pork Market Y-o-Y Growth

2.4. Global Hog Production and Pork Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.4.4. Trends

2.5. Production Outlook, 2017-18

2.5.1. Hog Trade Analysis (Key Importers and Exporters)

2.5.2. Cost of Hog Production

2.5.3. Per-Capita Consumption of Meat

2.6. Forecast Factors

2.7. Regulatory Framework

2.7.1. World Food Regulatory Bodies

2.7.2. Key Regulations

2.7.3. Label Claims: Overview

2.7.4. Global Food Certification: Certification Process Snapshot

2.8. Value Chain Analysis and Operating Margins

2.9. Consumer Sentiment Analysis

2.10. Pricing Analysis, by Region and Form, 2019

3. Global Hog Production and Pork Market Analysis and Forecast 2013-2027

3.1. Global Hog Production and Pork Market Size and Forecast By Type, 2013-2027

3.1.1. Leg/Ham Market Size and Forecast, 2013-2027

3.1.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.1.2. Market Share Comparison, By Region

3.1.1.3. Y-o-Y growth Comparison, By Region

3.1.2. Loin of Pork Market Size and Forecast, 2013-2027

3.1.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.2.2. Market Share Comparison, By Region

3.1.2.3. Y-o-Y growth Comparison, By Region

3.1.3. Belly/ Side of Pork/ Bacon Market Size and Forecast, 2013-2027

3.1.3.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.3.2. Market Share Comparison, By Region

3.1.3.3. Y-o-Y growth Comparison, By Region

3.1.4. Ribs Market Size and Forecast, 2013-2027

3.1.4.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.4.2. Market Share Comparison, By Region

3.1.4.3. Y-o-Y growth Comparison, By Region

3.1.5. Shoulders/ Boston Butt Market Size and Forecast, 2013-2027

3.1.5.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.5.2. Market Share Comparison, By Region

3.1.5.3. Y-o-Y growth Comparison, By Region

3.1.6. Picnic Shoulder/ Hand Market Size and Forecast, 2013-2027

3.1.6.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.6.2. Market Share Comparison, By Region

3.1.6.3. Y-o-Y growth Comparison, By Region

3.1.7. Others Market Size and Forecast, 2013-2027

3.1.7.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.7.2. Market Share Comparison, By Region

3.1.7.3. Y-o-Y growth Comparison, By Region

3.2. Global Hog Production and Pork Market Size and Forecast By Form, 2013-2027

3.2.1. Fresh Market Size and Forecast, 2013-2027

3.2.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.1.2. Market Share Comparison, By Region

3.2.1.3. Y-o-Y growth Comparison, By Region

3.2.2. Processed Market Size and Forecast, 2013-2027

3.2.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.2.2. Market Share Comparison, By Region

3.2.2.3. Y-o-Y growth Comparison, By Region

3.3. Global Hog Production and Pork Market Size and Forecast By End-Use, 2013-2027

3.3.1. Food Processing Industry Market Size and Forecast, 2013-2027

3.3.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.3.1.2. Market Share Comparison, By Region

3.3.1.3. Y-o-Y growth Comparison, By Region

3.3.2. Food Service Provider Market Size and Forecast, 2013-2027

3.3.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.3.2.2. Market Share Comparison, By Region

3.3.2.3. Market Share Comparison, By Region

3.3.3. Household/Retail Market Size and Forecast, 2013-2027

3.3.3.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.3.3.2. Market Share Comparison, By Region

3.3.3.3. Market Share Comparison, By Region

3.4. Global Hog Production and Pork Market Size and Forecast By Distribution Channel, 2013-2027

3.4.1. B2B/Direct Market Size and Forecast, 2013-2027

3.4.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.1.2. Market Share Comparison, By Region

3.4.1.3. Y-o-Y growth Comparison, By Region

3.4.2. Hypermarket/Supermarket Market Size and Forecast, 2013-2027

3.4.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.2.2. Market Share Comparison, By Region

3.4.2.3. Y-o-Y growth Comparison, By Region

3.4.3. Convenience Stores Market Size and Forecast, 2013-2027

3.4.3.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.3.2. Market Share Comparison, By Region

3.4.3.3. Y-o-Y growth Comparison, By Region

3.4.4. Specialty Stores Market Size and Forecast, 2013-2027

3.4.4.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.4.2. Market Share Comparison, By Region

3.4.4.3. Y-o-Y growth Comparison, By Region

3.4.5. Butcher’s Shop/ Wet Markets Market Size and Forecast, 2013-2027

3.4.5.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.5.2. Market Share Comparison, By Region

3.4.5.3. Y-o-Y growth Comparison, By Region

3.4.6. Online Retailing Market Size and Forecast, 2013-2027

3.4.6.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.4.6.2. Market Share Comparison, By Region

3.4.6.3. Y-o-Y growth Comparison, By Region

4. North America Hog Production and Pork Market Size and Forecast, 2013-2027

4.1. Revenue (US$ Mn) & Volume Comparison, By Country

4.2. Revenue (US$ Mn) & Volume Comparison, By Type

4.3. Revenue (US$ Mn) & Volume Comparison, By Form

4.4. Revenue (US$ Mn) & Volume Comparison, By End-Use

4.5. Revenue (US$ Mn) & Volume Comparison, By Distribution Channel

5. Latin America Hog Production and Pork Market Size and Forecast, 2013-2027

5.1. Revenue (US$ Mn) & Volume Comparison, By Country

5.2. Revenue (US$ Mn) & Volume Comparison, By Type

5.3. Revenue (US$ Mn) & Volume Comparison, By Form

5.4. Revenue (US$ Mn) & Volume Comparison, By End-Use

5.5. Revenue (US$ Mn) & Volume Comparison, By Distribution Channel

6. Europe Hog Production and Pork Market Size and Forecast, 2013-2027

6.1. Revenue (US$ Mn) & Volume Comparison, By Country

6.2. Revenue (US$ Mn) & Volume Comparison, By Type

6.3. Revenue (US$ Mn) & Volume Comparison, By Form

6.4. Revenue (US$ Mn) & Volume Comparison, By End-Use

6.5. Revenue (US$ Mn) & Volume Comparison, By Distribution Channel

7. Asia Pacific Hog Production and Pork Market Size and Forecast, 2013-2027

7.1. Revenue (US$ Mn) & Volume Comparison, By Country

7.2. Revenue (US$ Mn) & Volume Comparison, By Type

7.3. Revenue (US$ Mn) & Volume Comparison, By Form

7.4. Revenue (US$ Mn) & Volume Comparison, By End-Use

7.5. Revenue (US$ Mn) & Volume Comparison, By Distribution Channel

8. MEA Hog Production and Pork Market Size and Forecast, 2013-2027

8.1. Revenue (US$ Mn) & Volume Comparison, By Country

8.2. Revenue (US$ Mn) & Volume Comparison, By Type

8.3. Revenue (US$ Mn) & Volume Comparison, By Form

8.4. Revenue (US$ Mn) & Volume Comparison, By End-Use

8.5. Revenue (US$ Mn) & Volume Comparison, By Distribution Channel

9. Global Hog Production and Pork Market Company Share Analysis, Competitive Dashboard, and Company Profile

9.1. Company Share Analysis

9.2. Competitive Dashboard

9.3. Company Profile

9.3.1. JBS S.A.

9.3.1.1. Overview

9.3.1.2. Product Portfolio

9.3.1.3. Production Footprint

9.3.1.4. Sales Footprint

9.3.1.5. Strategies Overview

9.3.1.6. SWOT Analysis

9.3.1.7. Financial Analysis

9.3.2. Smithfield Foods, Inc.

9.3.2.1. Overview

9.3.2.2. Product Portfolio

9.3.2.3. Production Footprint

9.3.2.4. Sales Footprint

9.3.2.5. Strategies Overview

9.3.2.6. SWOT Analysis

9.3.2.7. Financial Analysis

9.3.3. Triumph Foods, LLC

9.3.3.1. Overview

9.3.3.2. Product Portfolio

9.3.3.3. Production Footprint

9.3.3.4. Sales Footprint

9.3.3.5. Strategies Overview

9.3.3.6. SWOT Analysis

9.3.3.7. Financial Analysis

9.3.4. Seaboard Corporation

9.3.4.1. Overview

9.3.4.2. Product Portfolio

9.3.4.3. Production Footprint

9.3.4.4. Sales Footprint

9.3.4.5. Strategies Overview

9.3.4.6. SWOT Analysis

9.3.4.7. Financial Analysis

9.3.5. The Maschhoffs, LLC

9.3.5.1. Overview

9.3.5.2. Product Portfolio

9.3.5.3. Production Footprint

9.3.5.4. Sales Footprint

9.3.5.5. Strategies Overview

9.3.5.6. SWOT Analysis

9.3.5.7. Financial Analysis

9.3.6. Wan Chau International Limited

9.3.6.1. Overview

9.3.6.2. Product Portfolio

9.3.6.3. Production Footprint

9.3.6.4. Sales Footprint

9.3.6.5. Strategies Overview

9.3.6.6. SWOT Analysis

9.3.6.7. Financial Analysis

9.3.7. Iowa Select Farms

9.3.7.1. Overview

9.3.7.2. Product Portfolio

9.3.7.3. Production Footprint

9.3.7.4. Sales Footprint

9.3.7.5. Strategies Overview

9.3.7.6. SWOT Analysis

9.3.7.7. Financial Analysis

9.3.8. China Yurun Food Group Limited

9.3.8.1. Overview

9.3.8.2. Product Portfolio

9.3.8.3. Production Footprint

9.3.8.4. Sales Footprint

9.3.8.5. Strategies Overview

9.3.8.6. SWOT Analysis

9.3.8.7. Financial Analysis

9.3.9. Charoen Pokphand Group

9.3.9.1. Overview

9.3.9.2. Product Portfolio

9.3.9.3. Production Footprint

9.3.9.4. Sales Footprint

9.3.9.5. Strategies Overview

9.3.9.6. SWOT Analysis

9.3.9.7. Financial Analysis

10. Disclaimer and Contact information

List of Tables

TABLE 1: Global Hog Production and Pork Market Value (US$ Mn) & Volume, 2013-2018

TABLE 2: Global Hog Production and Pork Market Value (US$ Mn) & Volume, 2019-2027

TABLE 3: Global Hog Production and Pork Market Value (US$ Mn) & Volume and Y-o-Y, 2018-2027

TABLE 4: Global Leg/Ham Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 5: Global Leg/Ham Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 6: Global Leg/Ham Segment Market Share, By Region 2013-2018

TABLE 7: Global Leg/Ham Segment Market Share, By Region 2019-2027

TABLE 8: Global Leg/Ham Segment Y-o-Y, By Region 2018-2027

TABLE 9: Global Loin of Pork Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 10: Global Loin of Pork Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 11: Global Loin of Pork Segment Market Share, By Region 2013-2018

TABLE 12: Global Loin of Pork Segment Market Share, By Region 2019-2027

TABLE 13: Global Loin of Pork Segment Y-o-Y, By Region 2018-2027

TABLE 14: Global Belly/ Side of Pork/ Bacon Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 15: Global Belly/ Side of Pork/ Bacon Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 16: Global Belly/ Side of Pork/ Bacon Segment Market Share, By Region 2013-2018

TABLE 17: Global Belly/ Side of Pork/ Bacon Segment Market Share, By Region 2019-2027

TABLE 18: Global Belly/ Side of Pork/ Bacon Segment Y-o-Y, By Region 2018-2027

TABLE 19: Global Ribs Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 20: Global Ribs Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 21: Global Ribs Segment Market Share, By Region 2013-2018

TABLE 22: Global Ribs Segment Market Share, By Region 2019-2027

TABLE 23: Global Ribs Segment Y-o-Y, By Region 2018-2027

TABLE 24: Global Shoulders/ Boston Butt Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 25: Global Shoulders/ Boston Butt Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 26: Global Shoulders/ Boston Butt Segment Market Share, By Region 2013-2018

TABLE 27: Global Shoulders/ Boston Butt Segment Market Share, By Region 2019-2027

TABLE 28: Global Shoulders/ Boston Butt Segment Y-o-Y, By Region 2018-2027

TABLE 29: Global Picnic Shoulder/ Hand Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 30: Global Picnic Shoulder/ Hand Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 31: Global Picnic Shoulder/ Hand Segment Market Share, By Region 2013-2018

TABLE 32: Global Picnic Shoulder/ Hand Segment Market Share, By Region 2019-2027

TABLE 33: Global Picnic Shoulder/ Hand Segment Y-o-Y, By Region 2018-2027

TABLE 34: Global Others Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 35: Global Others Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 36: Global Others Segment Market Share, By Region 2013-2018

TABLE 37: Global Others Segment Market Share, By Region 2019-2027

TABLE 38: Global Others Segment Y-o-Y, By Region 2018-2027

TABLE 39: Global Fresh Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 40: Global Fresh Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 41: Global Fresh Segment Market Share, By Region 2013-2018

TABLE 42: Global Fresh Segment Market Share, By Region 2019-2027

TABLE 43: Global Fresh Segment Y-o-Y, By Region 2018-2027

TABLE 44: Global Processed Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 45: Global Processed Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 46: Global Processed Segment Market Share, By Region 2013-2018

TABLE 47: Global Processed Segment Market Share, By Region 2019-2027

TABLE 48: Global Processed Segment Y-o-Y, By Region 2018-2027

TABLE 49: Global Food Processing Industry Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 50: Global Food Processing Industry Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 51: Global Food Processing Industry Segment Market Share, By Region 2013-2018

TABLE 52: Global Food Processing Industry Segment Market Share, By Region 2019-2027

TABLE 53: Global Food Processing Industry Segment Y-o-Y, By Region 2018-2027

TABLE 54: Global Food Service Provider Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 55: Global Food Service Provider Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 56: Global Food Service Provider Segment Market Share, By Region 2013-2018

TABLE 57: Global Food Service Provider Segment Market Share, By Region 2019-2027

TABLE 58: Global Food Service Provider Segment Y-o-Y, By Region 2018-2027

TABLE 59: Global Household/Retail Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 60: Global Household/Retail Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 61: Global Household/Retail Segment Market Share, By Region 2013-2018

TABLE 62: Global Household/Retail Segment Market Share, By Region 2019-2027

TABLE 63: Global Household/Retail Segment Y-o-Y, By Region 2018-2027

TABLE 64: Global B2B/Direct Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 65: Global B2B/Direct Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 66: Global B2B/Direct Segment Market Share, By Region 2013-2018

TABLE 67: Global B2B/Direct Segment Market Share, By Region 2019-2027

TABLE 68: Global B2B/Direct Segment Y-o-Y, By Region 2018-2027

TABLE 69: Global Hypermarket/Supermarket Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 70: Global Hypermarket/Supermarket Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 71: Global Hypermarket/Supermarket Segment Market Share, By Region 2013-2018

TABLE 72: Global Hypermarket/Supermarket Segment Market Share, By Region 2019-2027

TABLE 73: Global Hypermarket/Supermarket Segment Y-o-Y, By Region 2018-2027

TABLE 74: Global Convenience Stores Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 75: Global Convenience Stores Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 76: Global Convenience Stores Segment Market Share, By Region 2013-2018

TABLE 77: Global Convenience Stores Segment Market Share, By Region 2019-2027

TABLE 78: Global Convenience Stores Segment Y-o-Y, By Region 2018-2027

TABLE 79: Global Specialty Stores Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 80: Global Specialty Stores Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 81: Global Specialty Stores Segment Market Share, By Region 2013-2018

TABLE 82: Global Specialty Stores Segment Market Share, By Region 2019-2027

TABLE 83: Global Specialty Stores Segment Y-o-Y, By Region 2018-2027

TABLE 84: Global Butcher’s Shop/ Wet Markets Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 85: Global Butcher’s Shop/ Wet Markets Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 86: Global Butcher’s Shop/ Wet Markets Segment Market Share, By Region 2013-2018

TABLE 87: Global Butcher’s Shop/ Wet Markets Segment Market Share, By Region 2019-2027

TABLE 88: Global Butcher’s Shop/ Wet Markets Segment Y-o-Y, By Region 2018-2027

TABLE 89: Global Online Retailing Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 90: Global Online Retailing Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 91: Global Online Retailing Segment Market Share, By Region 2013-2018

TABLE 92: Global Online Retailing Segment Market Share, By Region 2019-2027

TABLE 93: Global Online Retailing Segment Y-o-Y, By Region 2018-2027

TABLE 94: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 95: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 96: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2013-2018

TABLE 97: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2019-2027

TABLE 98: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2013-2018

TABLE 99: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2019-2027

TABLE 100: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2013-2018

TABLE 101: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2019-2027

TABLE 102: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2013-2018

TABLE 103: North America Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2027

TABLE 104: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 105: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 106: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2013-2018

TABLE 107: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2019-2027

TABLE 108: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2013-2018

TABLE 109: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2019-2027

TABLE 110: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2013-2018

TABLE 111: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2019-2027

TABLE 112: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2013-2018

TABLE 113: Latin America Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2027

TABLE 114: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 115: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 116: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2013-2018

TABLE 117: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2019-2027

TABLE 118: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2013-2018

TABLE 119: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2019-2027

TABLE 120: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2013-2018

TABLE 121: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2019-2027

TABLE 122: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2013-2018

TABLE 123: Europe Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2027

TABLE 124: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 125: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 126: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2013-2018

TABLE 127: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2019-2027

TABLE 128: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2013-2018

TABLE 129: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2019-2027

TABLE 130: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2013-2018

TABLE 131: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2019-2027

TABLE 132: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2013-2018

TABLE 133: Asia Pacific Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2027

TABLE 134: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 135: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 136: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2013-2018

TABLE 137: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Type 2019-2027

TABLE 138: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2013-2018

TABLE 139: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Form 2019-2027

TABLE 140: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2013-2018

TABLE 141: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By End-Use 2019-2027

TABLE 142: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2013-2018

TABLE 143: MEA Hog Production and Pork Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2027

List of Figures

FIG. 1: Global Hog Production and Pork Market Value (US$ Mn), 2013-2018

FIG. 2: Global Hog Production and Pork Market Value (US$ Mn) Forecast, 2019-2027

FIG. 3: Global Hog Production and Pork Market Value (US$ Mn) and Y-o-Y, 2018-2027

FIG. 4: Global Leg/Ham Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 5: Global Leg/Ham Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 6: Global Leg/Ham Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 7: Global Loin of Pork Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 8: Global Loin of Pork Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 9: Global Loin of Pork Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 10: Global Belly/ Side of Pork/ Bacon Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 11: Global Belly/ Side of Pork/ Bacon Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 12: Global Belly/ Side of Pork/ Bacon Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 13: Global Ribs Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 14: Global Ribs Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 15: Global Ribs Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 16: Global Shoulders/ Boston Butt Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 17: Global Shoulders/ Boston Butt Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 18: Global Shoulders/ Boston Butt Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 19: Global Picnic Shoulder/ Hand Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 20: Global Picnic Shoulder/ Hand Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 21: Global Picnic Shoulder/ Hand Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 22: Global Others Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 23: Global Others Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 24: Global Others Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 25: Global Fresh Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 26: Global Fresh Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 27: Global Fresh Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 28: Global Processed Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 29: Global Processed Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 30: Global Processed Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 31: Global Food Processing Industry Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 32: Global Food Processing Industry Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 33: Global Food Processing Industry Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 34: Global Food Service Provider Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 35: Global Food Service Provider Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 36: Global Food Service Provider Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 37: Global Household/Retail Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 38: Global Household/Retail Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 39: Global Household/Retail Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 40: Global B2B/Direct Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 41: Global B2B/Direct Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 42: Global B2B/Direct Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 43: Global Hypermarket/Supermarket Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 44: Global Hypermarket/Supermarket Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 45: Global Hypermarket/Supermarket Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 46: Global Convenience Stores Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 47: Global Convenience Stores Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 48: Global Convenience Stores Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 49: Global Specialty Stores Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 50: Global Specialty Stores Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 51: Global Specialty Stores Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 52: Global Butcher’s Shop/ Wet Markets Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 53: Global Butcher’s Shop/ Wet Markets Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 54: Global Butcher’s Shop/ Wet Markets Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 55: Global Online Retailing Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 56: Global Online Retailing Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 57: Global Online Retailing Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 58: North America Hog Production and Pork Market Value (US$ Mn), By Country 2013-2018

FIG. 59: North America Hog Production and Pork Market Value (US$ Mn), By Country 2019-2027

FIG. 60: North America Hog Production and Pork Market Value (US$ Mn), By Type 2013-2018

FIG. 61: North America Hog Production and Pork Market Value (US$ Mn), By Type 2019-2027

FIG. 62: North America Hog Production and Pork Market Value (US$ Mn), By Form 2013-2018

FIG. 63: North America Hog Production and Pork Market Value (US$ Mn), By Form 2019-2027

FIG. 64: North America Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 65: North America Hog Production and Pork Market Value (US$ Mn), By End-Use 2019-2027

FIG. 66: North America Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2013-2018

FIG. 67: North America Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2019-2027

FIG. 68: Latin America Hog Production and Pork Market Value (US$ Mn), By Country 2013-2018

FIG. 69: Latin America Hog Production and Pork Market Value (US$ Mn), By Country 2019-2027

FIG. 70: Latin America Hog Production and Pork Market Value (US$ Mn), By Type 2013-2018

FIG. 71: Latin America Hog Production and Pork Market Value (US$ Mn), By Type 2019-2027

FIG. 72: Latin America Hog Production and Pork Market Value (US$ Mn), By Form 2013-2018

FIG. 73: Latin America Hog Production and Pork Market Value (US$ Mn), By Form 2019-2027

FIG. 74: Latin America Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 75: Latin America Hog Production and Pork Market Value (US$ Mn), By End-Use 2019-2027

FIG. 76: Latin America Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2013-2018

FIG. 77: Latin America Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2019-2027

FIG. 78: Europe Hog Production and Pork Market Value (US$ Mn), By Country 2013-2018

FIG. 79: Europe Hog Production and Pork Market Value (US$ Mn), By Country 2019-2027

FIG. 80: Europe Hog Production and Pork Market Value (US$ Mn), By Type 2013-2018

FIG. 81: Europe Hog Production and Pork Market Value (US$ Mn), By Type 2019-2027

FIG. 82: Europe Hog Production and Pork Market Value (US$ Mn), By Form 2013-2018

FIG. 83: Europe Hog Production and Pork Market Value (US$ Mn), By Form 2019-2027

FIG. 84: Europe Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 85: Europe Hog Production and Pork Market Value (US$ Mn), By End-Use 2019-2027

FIG. 86: Europe Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2013-2018

FIG. 87: Europe Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2019-2027

FIG. 88: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Country 2013-2018

FIG. 89: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Country 2019-2027

FIG. 90: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Type 2013-2018

FIG. 91: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Type 2019-2027

FIG. 92: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 93: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Form 2019-2027

FIG. 94: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 95: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By End-Use 2019-2027

FIG. 96: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2013-2018

FIG. 97: Asia Pacific Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2019-2027

FIG. 98: MEA Hog Production and Pork Market Value (US$ Mn), By Country 2013-2018

FIG. 99: MEA Hog Production and Pork Market Value (US$ Mn), By Country 2019-2027

FIG. 100: MEA Hog Production and Pork Market Value (US$ Mn), By Type 2013-2018

FIG. 101: MEA Hog Production and Pork Market Value (US$ Mn), By Type 2019-2027

FIG. 102: MEA Hog Production and Pork Market Value (US$ Mn), By Form 2013-2018

FIG. 103: MEA Hog Production and Pork Market Value (US$ Mn), By Form 2019-2027

FIG. 104: MEA Hog Production and Pork Market Value (US$ Mn), By End-Use 2013-2018

FIG. 105: MEA Hog Production and Pork Market Value (US$ Mn), By End-Use 2019-2027

FIG. 106: MEA Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2013-2018

FIG. 107: MEA Hog Production and Pork Market Value (US$ Mn), By Distribution Channel 2019-2027