Analysts’ Viewpoint on Market Scenario

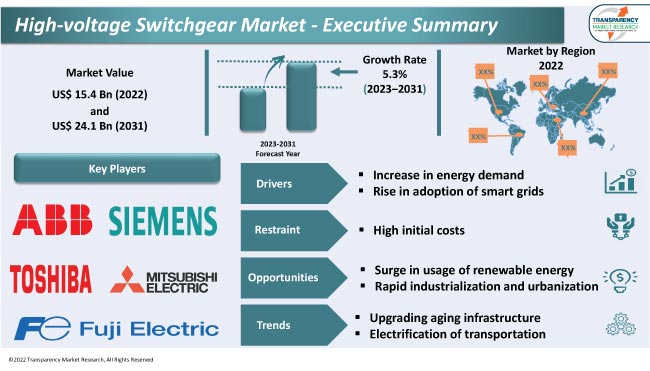

Increase in energy demand and rise in adoption of smart grids are projected to augment the high-voltage switchgear market size during the forecast period. High-voltage switchgear is primarily used to manage and regulate the flow of electrical power in substations, power generation facilities, and transmission and distribution networks.

Surge in usage of renewable energy and rapid industrialization and urbanization are likely to offer lucrative opportunities to vendors in the global high-voltage switchgear industry. However, high initial costs are estimated to limit the high-voltage switchgear market growth in the next few years. Thus, manufacturers are focusing on innovation in design and engineering to offer more compact, efficient, and affordable high-voltage electrical gear solutions.

High-voltage switchgear plays a crucial role in electrical power systems, helping to control and protect the flow of electricity at high-voltage levels. The implementation of smart grid technologies requires advanced switchgear that can handle two-way communication and data exchange. This, in turn, is fueling demand for high-voltage switching equipment with integrated communication capabilities.

Circuit breakers, switches, relays, and busbars are various types of high-voltage switchgear. There are various advantages of high-voltage switchgear. High-voltage switchgear includes protective devices such as circuit breakers and relays that can quickly detect and interrupt electrical faults. Many modern high-voltage circuit breakers are equipped with remote monitoring and control capabilities.

Rapid urbanization and industrialization is boosting electricity consumption, thereby leading to surge in need for HV electrical switchgear to handle higher voltages and currents. Moreover, modernization and expansion of electrical grids are also driving the installation of new high-voltage switchgear. These initiatives ensure the efficient transmission and distribution of electricity across long distances.

Utilities are investing in advanced high-voltage switchgear, with features such as self-healing capabilities and enhanced protection systems, to enhance grid reliability and resilience. Regulatory requirements and safety standards play a significant role in fueling the high-voltage switchgear market revenue. Updates and changes to these regulations can necessitate the replacement or upgrading of existing switchgear.

Rise in energy demand worldwide is prompting the expansion and upgrade of electrical grids to accommodate the surge in load. High-voltage switchgear is essential in this process as it allows for efficient transmission and distribution of electricity at higher voltages, thereby reducing energy losses during transport. It enables the distribution of electricity to various end-users while maintaining grid stability and reliability. Thus, growth in energy demand is propelling the high-voltage switchgear market value.

Surge in energy demand is often associated with increase in industrial and commercial activities. Industries and businesses rely on high-voltage switchgear to ensure a consistent and uninterrupted power supply for their operations. Maintaining grid resilience becomes crucial in regions with high energy demand. Such regions rely on high-voltage switchgear to enhance grid resilience. High-voltage switchgear offers advanced protection mechanisms against faults and overloads.

Smart grids are modernized electrical grids that incorporate digital communication and control technologies. Utilities and governments worldwide are investing significantly in grid modernization, which is driving demand for high-voltage switchgear that can integrate seamlessly with smart grid systems.

Smart grids are becoming more interconnected and data-driven, thereby propelling the need for cybersecurity measures. High-voltage switchgear with embedded security features helps protect critical grid infrastructure. High-voltage switchgear within a smart grid can also contribute to energy efficiency by minimizing losses during transmission and distribution. It enables the grid to operate at higher voltages, reducing energy wastage.

Surge in demand for smart grids is boosting the need for advanced high-voltage switchgear with communication, automation, and monitoring capabilities. These capabilities are essential for enhancing grid efficiency, reliability, and resilience in an increasingly digital and interconnected energy landscape.

According to the latest high-voltage switchgear market trends, the gas-insulated insulation type segment held 37.8% share in 2022. The segment is projected to maintain the status quo and grow at a CAGR of 5.7% during the forecast period.

Gas-insulated high-voltage switchgear is known for its high reliability and performance. It provides excellent electrical insulation properties and can interrupt fault currents effectively, reducing the risk of outages and downtime in critical applications. Gas-insulated high-voltage switchgear offers advanced protection features, including fast fault clearance and isolation capabilities. This enhances grid resilience by minimizing the impact of faults and disturbances.

According to the latest high-voltage switchgear market analysis, the power transmission application segment accounted for 35.2% share in 2022. The segment is estimated to maintain the status quo and grow at a CAGR of 5.8% during the forecast period.

Growth of the segment can be ascribed to increase in electricity consumption and rise in integration of renewable energy. Surge in investment in grid expansion and modernization, growth in concerns regarding energy security, and electrification of various sectors, are also boosting adoption of high-voltage switchgear in power transmission.

According to the latest high-voltage switchgear market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. The region accounted for 39.4% share in 2022. Rapid urbanization and the subsequent investment in infrastructure development are fueling the market dynamics of the region.

Cities rely on high-voltage switchgear for electricity distribution. Thus, many countries in Asia Pacific are investing significantly in grid modernization to improve grid reliability and efficiency. This, in turn, is projected to boost market statistics in the region in the next few years. China and India are major markets for high-voltage switchgear due to rapid industrialization in these countries.

The industry in North America accounted for 30.1% share in 2022. Rise in renewable energy generation, particularly in the U.S. and Canada, is propelling market progress in the region. High-voltage switchgear is essential for connecting renewable energy sources, such as wind farms and solar installations, to the existing grid.

The global industry is consolidated, with the presence of a limited number of high-voltage switchgear manufacturers. Most companies are focusing on the development of compact and efficient equipment as industries are seeking to upgrade their infrastructure. They are adopting various growth strategies, such as collaborations, partnerships, and M&As to increase their high-voltage switchgear market share.

ABB Ltd., Bharat Heavy Electricals Limited, Crompton Greaves Limited, Eaton Corporation, Fuji Electric Co., Ltd., General Electric, Hitachi Energy Ltd., Hyosung Corporation, Mitsubishi Electric Corporation, Siemens AG, and Toshiba Corporation are key entities operating in this industry.

Each of these players has been profiled in the high-voltage switchgear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 15.4 Bn |

| Market Forecast Value in 2031 | US$ 24.1 Bn |

| Growth Rate (CAGR) | 5.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value and Billion Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 15.4 Bn in 2022

It is expected to be 5.3% from 2023 to 2031

Increase in energy demand and rise in adoption of smart grids

The gas-insulated segment accounted for major share of 37.8% in 2022

Asia Pacific is projected to record the highest demand during the forecast period

China accounted for US$ 2.4 Bn in 2022

ABB Ltd., Bharat Heavy Electricals Limited, Crompton Greaves Limited, Eaton Corporation, Fuji Electric Co., Ltd., General Electric, Hitachi Energy Ltd., Hyosung Corporation, Mitsubishi Electric Corporation, Siemens AG, and Toshiba Corporation

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global High-voltage Switchgear Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Switchgear Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global High-voltage Switchgear Market Analysis, By Component

5.1. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

5.1.1. Circuit Breaker

5.1.2. Switch

5.1.3. Relay

5.1.4. Busbar

5.1.5. Others (Indicator Light, Knife, etc.)

5.2. Market Attractiveness Analysis, By Component

6. Global High-voltage Switchgear Market Analysis, By Insulation Type

6.1. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

6.1.1. Gas-insulated

6.1.2. Oil-insulated

6.1.3. Air-insulated

6.2. Market Attractiveness Analysis, By Insulation Type

7. Global High-voltage Switchgear Market Analysis, By Application

7.1. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

7.1.1. Power Generation

7.1.2. Power Transmission

7.1.3. Power Distribution

7.1.4. Industrial

7.2. Market Attractiveness Analysis, By Application

8. Global High-voltage Switchgear Market Analysis and Forecast, By Region

8.1. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America High-voltage Switchgear Market Analysis and Forecast

9.1. Market Snapshot

9.2. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

9.2.1. Circuit Breaker

9.2.2. Switch

9.2.3. Relay

9.2.4. Busbar

9.2.5. Others (Indicator Light, Knife, etc.)

9.3. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

9.3.1. Gas-insulated

9.3.2. Oil-insulated

9.3.3. Air-insulated

9.4. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Power Generation

9.4.2. Power Transmission

9.4.3. Power Distribution

9.4.4. Industrial

9.5. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Component

9.6.2. By Insulation Type

9.6.3. By Application

9.6.4. By Country/Sub-region

10. Europe High-voltage Switchgear Market Analysis and Forecast

10.1. Market Snapshot

10.2. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

10.2.1. Circuit Breaker

10.2.2. Switch

10.2.3. Relay

10.2.4. Busbar

10.2.5. Others (Indicator Light, Knife, etc.)

10.3. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

10.3.1. Gas-insulated

10.3.2. Oil-insulated

10.3.3. Air-insulated

10.4. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Power Generation

10.4.2. Power Transmission

10.4.3. Power Distribution

10.4.4. Industrial

10.5. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Insulation Type

10.6.3. By Application

10.6.4. By Country/Sub-region

11. Asia Pacific High-voltage Switchgear Market Analysis and Forecast

11.1. Market Snapshot

11.2. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

11.2.1. Circuit Breaker

11.2.2. Switch

11.2.3. Relay

11.2.4. Busbar

11.2.5. Others (Indicator Light, Knife, etc.)

11.3. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

11.3.1. Gas-insulated

11.3.2. Oil-insulated

11.3.3. Air-insulated

11.4. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Power Generation

11.4.2. Power Transmission

11.4.3. Power Distribution

11.4.4. Industrial

11.5. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Insulation Type

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Middle East & Africa High-voltage Switchgear Market Analysis and Forecast

12.1. Market Snapshot

12.2. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

12.2.1. Circuit Breaker

12.2.2. Switch

12.2.3. Relay

12.2.4. Busbar

12.2.5. Others (Indicator Light, Knife, etc.)

12.3. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

12.3.1. Gas-insulated

12.3.2. Oil-insulated

12.3.3. Air-insulated

12.4. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Power Generation

12.4.2. Power Transmission

12.4.3. Power Distribution

12.4.4. Industrial

12.5. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Insulation Type

12.6.3. By Application

12.6.4. By Country/Sub-region

13. South America High-voltage Switchgear Market Analysis and Forecast

13.1. Market Snapshot

13.2. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Component, 2017-2031

13.2.1. Circuit Breaker

13.2.2. Switch

13.2.3. Relay

13.2.4. Busbar

13.2.5. Others (Indicator Light, Knife, etc.)

13.3. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Insulation Type, 2017-2031

13.3.1. Gas-insulated

13.3.2. Oil-insulated

13.3.3. Air-insulated

13.4. High-voltage Switchgear Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Power Generation

13.4.2. Power Transmission

13.4.3. Power Distribution

13.4.4. Industrial

13.5. High-voltage Switchgear Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Insulation Type

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global High-voltage Switchgear Market Competition Matrix - a Dashboard View

14.1.1. Global High-voltage Switchgear Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Bharat Heavy Electricals Limited

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Crompton Greaves Limited

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Eaton Corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Fuji Electric Co., Ltd.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. General Electric

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Hitachi Energy Ltd.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Hyosung Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Mitsubishi Electric Corporation

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Siemens AG

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Toshiba Corporation

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Other Key Players

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 2: Global High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 3: Global High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 4: Global High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 5: Global High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 6: Global High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 7: North America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 8: North America High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 9: North America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 10: North America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 11: North America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 12: North America High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Europe High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 14: Europe High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 15: Europe High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 16: Europe High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 17: Europe High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: Europe High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 20: Asia Pacific High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 21: Asia Pacific High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 22: Asia Pacific High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 23: Asia Pacific High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Asia Pacific High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East & Africa High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 26: Middle East & Africa High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 27: Middle East & Africa High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 28: Middle East & Africa High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 29: Middle East & Africa High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 30: Middle East & Africa High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 31: South America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 32: South America High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Component, 2017-2031

Table 33: South America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Insulation Type, 2017-2031

Table 34: South America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 35: South America High-voltage Switchgear Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 36: South America High-voltage Switchgear Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global High-voltage Switchgear Market

Figure 02: Porter Five Forces Analysis - Global High-voltage Switchgear Market

Figure 03: Technology Road Map - Global High-voltage Switchgear Market

Figure 04: Global High-voltage Switchgear Market, Value (US$ Bn), 2017-2031

Figure 05: Global High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 06: Global High-voltage Switchgear Market Projections by Component, Value (US$ Bn), 2017-2031

Figure 07: Global High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 08: Global High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 09: Global High-voltage Switchgear Market Projections by Insulation Type, Value (US$ Bn), 2017-2031

Figure 10: Global High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 11: Global High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 12: Global High-voltage Switchgear Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 13: Global High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 14: Global High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global High-voltage Switchgear Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 16: Global High-voltage Switchgear Market, Incremental Opportunity, by Region, 2023-2031

Figure 17: Global High-voltage Switchgear Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America High-voltage Switchgear Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 19: North America High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 20: North America High-voltage Switchgear Market Projections by Component Value (US$ Bn), 2017-2031

Figure 21: North America High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 22: North America High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 23: North America High-voltage Switchgear Market Projections by Insulation Type (US$ Bn), 2017-2031

Figure 24: North America High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 25: North America High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 26: North America High-voltage Switchgear Market Projections by Application Value (US$ Bn), 2017-2031

Figure 27: North America High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 28: North America High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 29: North America High-voltage Switchgear Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 30: North America High-voltage Switchgear Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 31: North America High-voltage Switchgear Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 32: Europe High-voltage Switchgear Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 33: Europe High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 34: Europe High-voltage Switchgear Market Projections by Component Value (US$ Bn), 2017-2031

Figure 35: Europe High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 36: Europe High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 37: Europe High-voltage Switchgear Market Projections by Insulation Type, Value (US$ Bn), 2017-2031

Figure 38: Europe High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 39: Europe High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 40: Europe High-voltage Switchgear Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 41: Europe High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 42: Europe High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 43: Europe High-voltage Switchgear Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 44: Europe High-voltage Switchgear Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 45: Europe High-voltage Switchgear Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific High-voltage Switchgear Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 47: Asia Pacific High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 48: Asia Pacific High-voltage Switchgear Market Projections by Component Value (US$ Bn), 2017-2031

Figure 49: Asia Pacific High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 50: Asia Pacific High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 51: Asia Pacific High-voltage Switchgear Market Projections by Insulation Type, Value (US$ Bn), 2017-2031

Figure 52: Asia Pacific High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 53: Asia Pacific High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 54: Asia Pacific High-voltage Switchgear Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 55: Asia Pacific High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 56: Asia Pacific High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 57: Asia Pacific High-voltage Switchgear Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 58: Asia Pacific High-voltage Switchgear Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 59: Asia Pacific High-voltage Switchgear Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa High-voltage Switchgear Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 61: Middle East & Africa High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 62: Middle East & Africa High-voltage Switchgear Market Projections by Component Value (US$ Bn), 2017-2031

Figure 63: Middle East & Africa High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 64: Middle East & Africa High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 65: Middle East & Africa High-voltage Switchgear Market Projections by Insulation Type, Value (US$ Bn), 2017-2031

Figure 66: Middle East & Africa High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 67: Middle East & Africa High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 68: Middle East & Africa High-voltage Switchgear Market Projections by Application Value (US$ Bn), 2017-2031

Figure 69: Middle East & Africa High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 70: Middle East & Africa High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 71: Middle East & Africa High-voltage Switchgear Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 72: Middle East & Africa High-voltage Switchgear Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 73: Middle East & Africa High-voltage Switchgear Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America High-voltage Switchgear Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 75: South America High-voltage Switchgear Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 76: South America High-voltage Switchgear Market Projections by Component Value (US$ Bn), 2017-2031

Figure 77: South America High-voltage Switchgear Market, Incremental Opportunity, by Component, 2023-2031

Figure 78: South America High-voltage Switchgear Market Share Analysis, by Component, 2023 and 2031

Figure 79: South America High-voltage Switchgear Market Projections by Insulation Type, Value (US$ Bn), 2017-2031

Figure 80: South America High-voltage Switchgear Market, Incremental Opportunity, by Insulation Type, 2023-2031

Figure 81: South America High-voltage Switchgear Market Share Analysis, by Insulation Type, 2023 and 2031

Figure 82: South America High-voltage Switchgear Market Projections by Application Value (US$ Bn), 2017-2031

Figure 83: South America High-voltage Switchgear Market, Incremental Opportunity, by Application, 2023-2031

Figure 84: South America High-voltage Switchgear Market Share Analysis, by Application, 2023 and 2031

Figure 85: South America High-voltage Switchgear Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 86: South America High-voltage Switchgear Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 87: South America High-voltage Switchgear Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global High-voltage Switchgear Market Competition

Figure 89: Global High-voltage Switchgear Market Company Share Analysis