Analysts’ Viewpoint

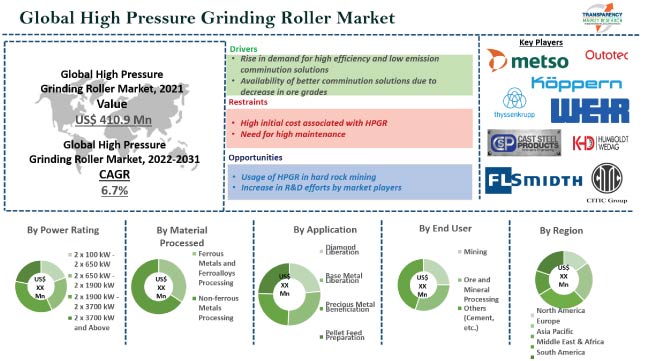

The high pressure grinding roller (HPGR) market is estimated to grow in the near future, owing to the increase in mining, ore, and mineral processing activities across the globe. Rise in demand for high efficiency and low emission comminution solutions is projected to contribute to the market progress during the forecast period.

HPGRs have undergone successful implementations and pilot demonstrations on extremely tough ores, with the introduction of wear abatement technology and significant design improvements. Development of metal carbide studs and tiles specifically designed to produce an autogenous wear layer in the equipment is a key factor increasing the market demand for HPGRs in hard rock applications. Prominent companies are focusing on R&D to accelerate the roll out of new high pressure grinding components to create lucrative opportunities in the worldwide market.

High pressure roller grinding machine is used for size reduction of rocks and ores. High pressure grinding roller is based on advanced energy-efficient comminution technology. It is a fragmentation equipment used in sectors such as briquetting, cement, diamond, iron, and mineral processing.

High pressure grinding rollers are available in different sizes based on application and processing need. HPGR plays a vital role in the mining industry owing to its improved design and proven operational availability for some of the toughest and hardest ores. Rise in demand for HPGR grinding equipment in various end-use applications is expected to boost the global high pressure grinding roller market share during the forecast period.

Comminution, or the process of grinding and crushing, is the most energy-intensive operation in mining. According to the Coalition for Eco-Efficient Comminution (CEEC), the grinding and crushing process consumes 53.0% of all energy utilized at the mining site. It accounts for more than 10.0% of the total mining cost. Existing mineral processing facilities are running at less than ideal levels of energy efficiency. This exposes them to higher expenses associated with excessive energy consumption and carbon limits, i.e. the quantity of carbon emitted into the environment. Thus, the mining sector needs to adopt comminution equipment that is more energy efficient.

Mining activities progressively migrate to remote places upon the depletion of commonly accessible mineral deposits. Demand for improved energy efficiency and throughput rates increases owing to the limited access of remote areas to crucial inputs such as electricity, labor, and infrastructure.

Rise in global energy costs is also putting pressure on mining businesses to minimize the usage of energy in order to stay competitive. Energy efficiency of crushing and grinding operations is a key issue in cement and mineral processing sectors, since these use more than half of the total energy needed in the mining process. Thus, growth in demand for energy-efficient comminution solutions is projected to drive the market for HPGR in the near future.

The average grade of ores is decreasing across the world owing to the exhaustion of high-grade ore bodies. Thus, the value generated by obtaining the desired mineral after the mining process is decreasing despite the increase in comminution activities. This has led to a rise in the operating cost of comminution. At the same time, the cost of commodities and minerals has not increased in the same proportion. This is exerting intense pressure on mining companies.

The output of the crushing and grinding process has become finer in order to help better extraction due to the decrease in proportion of the desired mineral in the mined ore. This trend is being observed across the globe.

In terms of material processed, the non-ferrous metals processing segment is anticipated to dominate the global market during the forecast period. Non-ferrous metals include precious metals such as gold and silver and base metals such as copper, which need an optimum extraction index. The ores develop micro-cracks due to high pressure exerted in HPGR; thus, leaching fluids cause higher liberation of precious metals. Furthermore, gold particles do not get flattened in HPGR owing to their working environment.

HPGRs provide scope for increased availability, throughput optimization, lesser power requirement and less wearability in the processing of non-ferrous metals. Hence, HPGR is the preferred choice in the grinding process of non-ferrous metals, as it offers better recovery value in addition to technological benefits.

Based on application, the high pressure grinding roller market segmentation entails diamond liberation, base metal liberation, precious metal beneficiation, and pellet feed preparation. The base metal liberation segment is expected to account for the highest market share during the forecast period.

Base metals such as copper, zinc, lead, and nickel are widely used in various industrial and commercial applications. These ores develop micro-cracks on their surface due to the high pressure exerted in HPGRs. Such micro-cracks help liberate locked minerals prior to gravity concentration, classification, and floatation processes. Thus, demand for HPGR is high in base metal mining due to its efficiency and productivity.

Precious metal beneficiation is estimated to be the fastest-growing market segment during the forecast period, led by the increase in usage of HPGR in gold and silver mining. Demand for gold has always been high due to its emotional, cultural, and financial value. HPGRs provide more efficiency and recovery value in gold treatment; therefore, they are expected to increasingly gain preference in precious metal beneficiation in the next few years.

Asia Pacific recorded significant market progress in 2021. Market growth in the region can be ascribed to the rise in demand for minerals in emerging economies such as China and India.

The high pressure grinding roller market in South America is slated to grow at a considerable pace during the forecast period due to the increase in number of large-sized iron and copper mining projects in the region.

North America is also expected to witness substantial market expansion in the near future. Growth of the mining industry and surge in gold and copper mining activities are likely to augment the North America high pressure grinding roller market share during the forecast period. However, of late, the mining industry in the region has been facing challenges due to stringent environmental regulations and high operating costs. Slowdown in new investments is also hampering market development in North America.

The global high pressure grinding roller market is consolidated, with a few large-scale high pressure grinding roller suppliers controlling majority of the share. High pressure grinding roller manufacturers are focusing on introducing new products such as high-pressure hydraulic tools and rubber roller grinding machines.

Most of the firms are investing significantly in comprehensive research and development activities, primarily to develop innovative products. Expansion of product portfolios and mergers and acquisitions are the strategies adopted by key players. CITIC Heavy Industries Co. Ltd., FLSmidth, KHD Humboldt Wedag International AG, Metso Oyj, Cast Steel Products, The Weir Group PLC, Thyssenkrupp, Koppern Group, Outotec, and TAKRAF GmbH are the prominent market entities.

Key players have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 410.9 Mn |

|

Market Forecast Value in 2031 |

US$ 759.5 Mn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry size stood at US$ 410.9 Mn in 2021.

Itis estimated to grow at a CAGR of 6.7% during 2022 to 2031.

It is likely to be valued US$ 759.5 Mn by 2031.

The non-ferrous metals processing segment is expected to hold major share during the forecast period.

Asia Pacific is projected to hold the highest CAGR during the forecast period.

Rise in demand for high efficiency and low emission comminution solutions, and availability of better comminution solutions due to decrease in ore grades.

CITIC Heavy Industries Co. Ltd., FLSmidth, KHD Humboldt Wedag International AG, Metso Oyj, Cast Steel Products, The Weir Group PLC, Thyssenkrupp, Koppern Group, Outotec, and TAKRAF GmbH.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Mining Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Overview

5.9. Standards and Regulations

5.10. Global High Pressure Grinding Roller Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global High Pressure Grinding Roller Market Analysis and Forecast, By Power Rating

6.1. Global High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, 2017 - 2031

6.1.1. 2 x 100 kW - 2 x 650 kW

6.1.2. 2 x 650 kW - 2 x 1900 kW

6.1.3. 2 x 1900 kW - 2 x 3700 kW

6.1.4. 2 x 3700 kW and Above

6.2. Incremental Opportunity, By Power Rating

7. Global High Pressure Grinding Roller Market Analysis and Forecast, By Material Processed

7.1. Global High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

7.1.1. Ferrous Metals and Ferroalloys Processing

7.1.2. Non-ferrous Metals Processing

7.2. Incremental Opportunity, By Material Processed

8. Global High Pressure Grinding Roller Market Analysis and Forecast, By Application

8.1. Global High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Diamond Liberation

8.1.2. Base Metal Liberation

8.1.3. Precious Metal Beneficiation

8.1.4. Pellet Feed Preparation

8.2. Incremental Opportunity, By Application

9. Global High Pressure Grinding Roller Market Analysis and Forecast, By End User

9.1. Global High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

9.1.1. Mining

9.1.2. Ore and Mineral Processing

9.1.3. Others (Cement, etc.)

9.2. Incremental Opportunity, By End User

10. Global High Pressure Grinding Roller Market Analysis and Forecast, by Region

10.1. Global High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America High Pressure Grinding Roller Market Analysis and Forecast

11.1. Regional Snapshot

11.2. COVID 19 Impact Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Key Supplier Analysis

11.6. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

11.6.1. 2 x 100 kW - 2 x 650 kW

11.6.2. 2 x 650 kW - 2 x 1900 kW

11.6.3. 2 x 1900 kW - 2 x 3700 kW

11.6.4. 2 x 3700 kW and Above

11.7. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

11.7.1. Ferrous Metals and Ferroalloys Processing

11.7.2. Non-ferrous Metals Processing

11.8. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

11.8.1. Diamond Liberation

11.8.2. Base Metal Liberation

11.8.3. Precious Metal Beneficiation

11.8.4. Pellet Feed Preparation

11.9. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

11.9.1. Mining

11.9.2. Ore and Mineral Processing

11.9.3. Others (Cement, etc.)

11.10. High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

11.10.1. The U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe High Pressure Grinding Roller Market Analysis and Forecast

12.1. Regional Snapshot

12.2. COVID 19 Impact Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Key Supplier Analysis

12.6. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

12.6.1. 2 x 100 kW - 2 x 650 kW

12.6.2. 2 x 650 kW - 2 x 1900 kW

12.6.3. 2 x 1900 kW - 2 x 3700 kW

12.6.4. 2 x 3700 kW and Above

12.7. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

12.7.1. Ferrous Metals and Ferroalloys Processing

12.7.2. Non-ferrous Metals Processing

12.8. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

12.8.1. Diamond Liberation

12.8.2. Base Metal Liberation

12.8.3. Precious Metal Beneficiation

12.8.4. Pellet Feed Preparation

12.9. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

12.9.1. Mining

12.9.2. Ore and Mineral Processing

12.9.3. Others (Cement, etc.)

12.10. High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific High Pressure Grinding Roller Market Analysis and Forecast

13.1. Regional Snapshot

13.2. COVID 19 Impact Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supply Side

13.5. Key Supplier Analysis

13.6. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

13.6.1. 2 x 100 kW - 2 x 650 kW

13.6.2. 2 x 650 kW - 2 x 1900 kW

13.6.3. 2 x 1900 kW - 2 x 3700 kW

13.6.4. 2 x 3700 kW and Above

13.7. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

13.7.1. Ferrous Metals and Ferroalloys Processing

13.7.2. Non-ferrous Metals Processing

13.8. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

13.8.1. Diamond Liberation

13.8.2. Base Metal Liberation

13.8.3. Precious Metal Beneficiation

13.8.4. Pellet Feed Preparation

13.9. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

13.9.1. Mining

13.9.2. Ore and Mineral Processing

13.9.3. Others (Cement, etc.)

13.10. High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa High Pressure Grinding Roller Market Analysis and Forecast

14.1. Regional Snapshot

14.2. COVID 19 Impact Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supply Side

14.5. Key Supplier Analysis

14.6. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

14.6.1. 2 x 100 kW - 2 x 650 kW

14.6.2. 2 x 650 kW - 2 x 1900 kW

14.6.3. 2 x 1900 kW - 2 x 3700 kW

14.6.4. 2 x 3700 kW and Above

14.7. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

14.7.1. Ferrous Metals and Ferroalloys Processing

14.7.2. Non-ferrous Metals Processing

14.8. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

14.8.1. Diamond Liberation

14.8.2. Base Metal Liberation

14.8.3. Precious Metal Beneficiation

14.8.4. Pellet Feed Preparation

14.9. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

14.9.1. Mining

14.9.2. Ore and Mineral Processing

14.9.3. Others (Cement, etc.)

14.10. High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America High Pressure Grinding Roller Market Analysis and Forecast

15.1. Regional Snapshot

15.2. COVID 19 Impact Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supply Side

15.5. Key Supplier Analysis

15.6. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

15.6.1. 2 x 100 kW - 2 x 650 kW

15.6.2. 2 x 650 kW - 2 x 1900 kW

15.6.3. 2 x 1900 kW - 2 x 3700 kW

15.6.4. 2 x 3700 kW and Above

15.7. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Material Processed, 2017 - 2031

15.7.1. Ferrous Metals and Ferroalloys Processing

15.7.2. Non-ferrous Metals Processing

15.8. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

15.8.1. Diamond Liberation

15.8.2. Base Metal Liberation

15.8.3. Precious Metal Beneficiation

15.8.4. Pellet Feed Preparation

15.9. High Pressure Grinding Roller Market (US$ Mn and Thousand Units) Forecast, By End User, 2017 - 2031

15.9.1. Mining

15.9.2. Ore and Mineral Processing

15.9.3. Others (Cement, etc.)

15.10. High Pressure Grinding Roller Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2020)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. CITIC Heavy Industries Co. Ltd.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. FLSmidth

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. KHD Humboldt Wedag International AG

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Metso Oyj

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Cast Steel Products

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. The Weir Group PLC

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Thyssenkrupp

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Koppern Group

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Outotec

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. TAKRAF GmbH.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Power Rating

17.1.2. Material Processed

17.1.3. Application

17.1.4. End User

17.1.5. Region

17.2. Understanding the Procurement Process of the Customers

18. Prevailing Market Risks

List of Table

Table 1: Global High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 2: Global High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 3: Global High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 4: Global High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 5: Global High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 6: Global High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 7: Global High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 8: Global High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 9: Global High Pressure Grinding Roller Market Value, by Region, US$ Mn, 2017-2031

Table 10: Global High Pressure Grinding Roller Market Volume, by Region, Thousand Units, 2017-2031

Table 11: North America High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 12: North America High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 13: North America High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 14: North America High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 15: North America High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 16: North America High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 17: North America High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 18: North America High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 19: North America High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Table 20: North America High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Table 21: Europe High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 22: Europe High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 23: Europe High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 24: Europe High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 25: Europe High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 26: Europe High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 27: Europe High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 28: Europe High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 29: Europe High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Table 30: Europe High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Table 31: Asia Pacific High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 32: Asia Pacific High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 33: Asia Pacific High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 34: Asia Pacific High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 35: Asia Pacific High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 36: Asia Pacific High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 37: Asia Pacific High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 40: Asia Pacific High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 41: Asia Pacific High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Table 42: Asia Pacific High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Table 43: MEA High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 44: MEA High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 45: MEA High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 46: MEA High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 47: MEA High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 48: MEA High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 49: MEA High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 50: MEA High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 51: MEA High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Table 52: MEA High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Table 53: South America High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Table 54: South America High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Table 55: South America High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Table 56: South America High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Table 57: South America High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Table 58: South America High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Table 59: South America High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Table 60: South America High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Table 61: South America High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Table 62: South America High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

List of Figures

Figure 1: Global High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 2: Global High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 3: Global High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 4: Global High Pressure Grinding Roller Market Value, by Region, US$ Mn, 2017-2031

Figure 5: Global High Pressure Grinding Roller Market Volume, by Region, Thousand Units, 2017-2031

Figure 6: Global High Pressure Grinding Roller Market Incremental Opportunity, by Region,2021-2031

Figure 7: North America High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Figure 8: North America High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Figure 9: North America High Pressure Grinding Roller Market Incremental Opportunity, by Power Rating, 2021-2031

Figure 10: North America High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Figure 11: North America High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Figure 12: North America High Pressure Grinding Roller Market Incremental Opportunity, by Material Processed, 2021-2031

Figure 13: North America High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Figure 14: North America High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Figure 15: North America High Pressure Grinding Roller Market Incremental Opportunity, by Application, 2021-2031

Figure 16: North America High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 17: North America High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 18: North America High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 19: North America High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Figure 20: North America High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Figure 21: North America High Pressure Grinding Roller Market Incremental Opportunity, by Country, 2021-2031

Figure 22: Europe High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Figure 23: Europe High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Figure 24: Europe High Pressure Grinding Roller Market Incremental Opportunity, by Power Rating, 2021-2031

Figure 25: Europe High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Figure 26: Europe High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Figure 27: Europe High Pressure Grinding Roller Market Incremental Opportunity, by Material Processed, 2021-2031

Figure 28: Europe High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Figure 29: Europe High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Figure 30: Europe High Pressure Grinding Roller Market Incremental Opportunity, by Application, 2021-2031

Figure 31: Europe High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 32: Europe High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 33: Europe High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 34: Europe High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Figure 35: Europe High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Figure 36: Europe High Pressure Grinding Roller Market Incremental Opportunity, by Country, 2021-2031

Figure 37: Asia Pacific High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Figure 38: Asia Pacific High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Figure 39: Asia Pacific High Pressure Grinding Roller Market Incremental Opportunity, by Power Rating, 2021-2031

Figure 40: Asia Pacific High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Figure 41: Asia Pacific High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Figure 42: Asia Pacific High Pressure Grinding Roller Market Incremental Opportunity, by Material Processed, 2021-2031

Figure 43: Asia Pacific High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Figure 44: Asia Pacific High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Figure 45: Asia Pacific High Pressure Grinding Roller Market Incremental Opportunity, by Application, 2021-2031

Figure 46: Asia Pacific High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 47: Asia Pacific High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 48: Asia Pacific High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 49: Asia Pacific High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Figure 50: Asia Pacific High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Figure 51: Asia Pacific High Pressure Grinding Roller Market Incremental Opportunity, by Country, 2021-2031

Figure 52: MEA High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Figure 53: MEA High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Figure 54: MEA High Pressure Grinding Roller Market Incremental Opportunity, by Power Rating, 2021-2031

Figure 55: MEA High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Figure 56: MEA High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Figure 57: MEA High Pressure Grinding Roller Market Incremental Opportunity, by Material Processed, 2021-2031

Figure 58: MEA High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Figure 59: MEA High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Figure 60: MEA High Pressure Grinding Roller Market Incremental Opportunity, by Application, 2021-2031

Figure 61: MEA High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 62: MEA High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 63: MEA High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 64: MEA High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Figure 65: MEA High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Figure 66: MEA High Pressure Grinding Roller Market Incremental Opportunity, by Country, 2021-2031

Figure 67: South America High Pressure Grinding Roller Market Value, by Power Rating, US$ Mn, 2017-2031

Figure 68: South America High Pressure Grinding Roller Market Volume, by Power Rating, Thousand Units, 2017-2031

Figure 69: South America High Pressure Grinding Roller Market Incremental Opportunity, by Power Rating, 2021-2031

Figure 70: South America High Pressure Grinding Roller Market Value, by Material Processed, US$ Mn, 2017-2031

Figure 71: South America High Pressure Grinding Roller Market Volume, by Material Processed, Thousand Units, 2017-2031

Figure 72: South America High Pressure Grinding Roller Market Incremental Opportunity, by Material Processed, 2021-2031

Figure 73: South America High Pressure Grinding Roller Market Value, by Application, US$ Mn, 2017-2031

Figure 74: South America High Pressure Grinding Roller Market Volume, by Application, Thousand Units, 2017-2031

Figure 75: South America High Pressure Grinding Roller Market Incremental Opportunity, by Application, 2021-2031

Figure 76: South America High Pressure Grinding Roller Market Value, by End User, US$ Mn, 2017-2031

Figure 77: South America High Pressure Grinding Roller Market Volume, by End User, Thousand Units, 2017-2031

Figure 78: South America High Pressure Grinding Roller Market Incremental Opportunity, by End User, 2021-2031

Figure 79: South America High Pressure Grinding Roller Market Value, by Country, US$ Mn, 2017-2031

Figure 80: South America High Pressure Grinding Roller Market Volume, by Country, Thousand Units, 2017-2031

Figure 81: South America High Pressure Grinding Roller Market Incremental Opportunity, by Country, 2021-2031