For a product to keep its integrity intact, it is important to provide them with all-important barrier properties such as moisture, gas, and aroma. High barrier films play a major role in providing products with required properties, and helps in extending the shelf life of the product. It also helps to make the structure recyclable with all layers relating to the same family of polymers. Moreover, high barrier films have an impermeable co-extruded & resilient structure. It is solvent-free and usually does not react with packaged food.

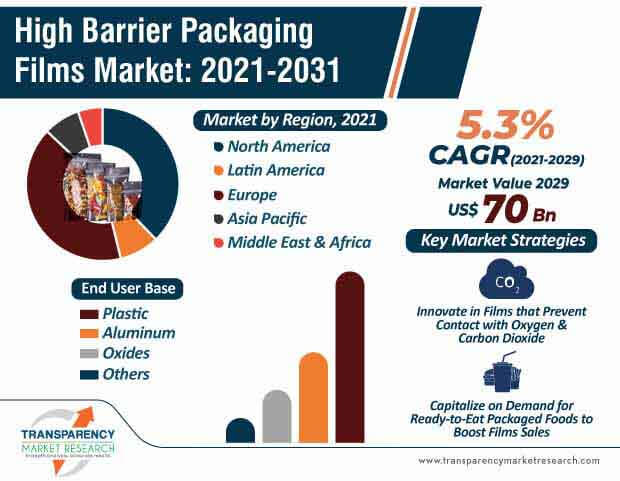

The high barrier packaging films help prevent contact with oxygen, carbon dioxide, or moisture while restricting the effect of mineral oil and UV light. This powerful barrier, created using functional materials, also holds the qualities of food such as color, taste, texture, aroma, and flavor. Moreover, currently, the world is witnessing increased popularity of ready-to-eat food, influencing consumer shift toward packaged products. Hectic work-life balance and increasing workload are also contributing to the rising demand for packaged foods by working professionals. Thus, with the growing demand for packaged food, the global high barrier packaging films market is expected to rise during the forecast period.

As the COVID-19 outbreak has spread and its humanitarian impact has grown, businesses that help provide for primary needs, such as getting food and required supplies safely to consumers, are increasingly affected. With food packaging being the high barrier packaging films market’s largest area of activity, the multi-billion worldwide industry is on the front lines. The coronavirus pandemic has already led to some of the sharpest drops in modern times in demand for certain types of packaging films, while stimulating growth for others such as high barrier packaging for eCommerce shipments that are rising as lifelines in this new world. Such changes are presenting many businesses with a new set of challenges.

The spread of COVID-19 pandemic has been limited in several countries and serious efforts are being made to eradicate the virus globally. With the restoration of the supply chain and logistics, raw materials would be available, restoring the manufacturing industry. Businesses across all industries are likely to increase their production capacity to flatten the demand curve, which can prove significant for the high barrier packaging films market post COVID-19. Moreover, the increasing growth in consumption of food and pharmaceutical packaging products is most likely to overcome the present restraints in the demand.

People across the world have become more health-conscious with the rising prevalence of harmful viruses and bacteria. The trend of living a healthy lifestyle and increasing preference for safe and hygienic products have boosted the pharmaceutical and medical sectors. These sectors, being major end users, are anticipating an increased demand in the global high barrier packaging films market. The high barrier packaging films in medical sectors are mostly used to protect medicines against oxygen, water, light, moisture, chemical, bacteria, and germs, and protect medical products. The films are resilient, strong against tear, and puncture-resistant, which can be essential while packaging and transportation. In addition, the medicine visibility is higher while using barrier packaging films for packing. Furthermore, high barrier films shield the medicinal products against environmental impacts, safeguard the quality, and improve the shelf life of the products.

The global high barrier packaging films are witnessing higher demand from the food & beverage industry. The food segment presently holds the highest market value share among all end users. Moreover, increased consumption and demand for processed and ready-to-eat packaged foods in Asia Pacific is likely to drive the high barrier packaging films market in the region during the forecast period.

The high barrier packaging films market is expected to cross US$ 26.6 Bn by 2029, at a CAGR of 6% during the forecast period.

Analysts’ Viewpoint

The high barrier packaging films help maintain rich flavors and aromas by forming a tightly sealed barrier system. Thus, high barrier films for food packaging are set for sturdy growth outpacing the general trends of food packaging. However, the plastic used in packaging such as polyethylene and polypropylene is hard to recycle and causes environmental concerns. This is expected to hamper the growth of the high barrier packaging films market. Nevertheless, developments and studies to replace non-recyclable plastics with biodegradable resources are most likely to overcome the restraints of the market. Moreover, the growing requirement and development of digital printing are contributing toward the progress of the global high barrier packaging films market.

1. Executive Summary

1.1. Global Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition

2.2. Market Taxonomy

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation Trends

4. Key Success Factors

4.1. Product Adoption Analysis

4.2. Product USPs / Features

5. Global High Barrier Packaging Films Market Demand Analysis 2012–2020 and Forecast, 2021–2029

5.1. Historical Market Volume (000’ Tonnes) Analysis, 2012–2020

5.2. Current and Future Market Volume (000’ Tonnes) Projections, 2021–2029

5.3. Y-o-Y Growth Trend Analysis

6. Global High Barrier Packaging Films Market - Pricing Analysis

6.1. Pricing Analysis

7. Global High Barrier Packaging Films Demand (Value in US$ Mn) Analysis 2012–2020 and Forecast, 2021–2029

7.1. Historical Market Value (US$ Mn) Analysis, 2012–2020

7.2. Current and Future Market Value (US$ Mn) Projections, 2021–2029

7.2.1.1. Y-o-Y Growth Trend Analysis

7.2.1.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Global Packaging Market Outlook

8.2. Macro-Economic Factors

8.2.1. GDP Growth

8.2.2. Population Growth

8.2.3. Covid-19 Impact

8.2.4. Per Capita Consumption

8.3. Forecast Factors - Relevance & Impact

8.3.1. Packaging Market Growth

8.3.2. Food and Beverage Market Growth

8.3.3. Pharmaceutical Market Growth

8.3.4. Flexible Packaging Market Growth

8.3.5. Segmental Revenue by Key Players

8.3.6. Retail Industrial Growth

8.3.7. E-Commerce Market Growth

8.3.8. Per Capita Consumption

8.4. Value Chain Analysis

8.4.1. Key Participants

8.4.1.1. Raw Material Suppliers

8.4.1.2. High Barrier Packaging Films Manufacturers

8.4.1.3. Distributors

8.4.1.4. End Users

8.4.2. Profitability Margin

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

9. Impact of COVID-19

9.1. Current Statistics and Probable Future Impact

9.2. Impact of COVID-19 on High Barrier Packaging Films Market

10. Global High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029, by High Barrier Films Type

10.1. Introduction

10.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis, by High Barrier Films Type, 2012–2020

10.3. Current and Future Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis and Forecast, by High Barrier Films Type, 2021–2029

10.3.1. Metallized Films

10.3.2. Clear Films

10.3.3. Organic Coating Films

10.3.4. Inorganic Oxide Coating Films

10.4. Market Attractiveness Analysis, By High Barrier Films Type

11. Global High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029, by Material Type

11.1. Introduction

11.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis, by Material Type, 2012–2020

11.3. Current and Future Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis and Forecast, by Material Type, 2021–2029

11.3.1. Plastic

11.3.1.1. Polyethylene (PE)

11.3.1.2. Polypropylene (PP)

11.3.1.3. Ethylene Vinyl Alcohol (EVOH)

11.3.1.4. Polyethylene Terephthalate (PET)

11.3.1.5. Polyvinylidene Chloride (PVDC)

11.3.1.6. Polyamide (Nylon)

11.3.1.7. Polyethylene Naphthalate (PEN)

11.3.1.8. Others (LCD, PS, PVC, PLA, PA)

11.3.2. Aluminum

11.3.3. Oxides

11.3.3.1. Aluminum Oxide

11.3.3.2. Silicon Oxide

11.3.4. Others

11.4. Market Attractiveness Analysis, By Material Type

12. Global High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029, by End User Base

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis, by End User Base, 2012–2020

12.3. Current and Future Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis and Forecast, by End User Base, 2021–2029

12.3.1. Food

12.3.1.1. Meat, Seafood and Poultry

12.3.1.2. Baby Food

12.3.1.3. Snacks

12.3.1.4. Bakery and Confectionery

12.3.1.5. Pet Food

12.3.1.6. Dairy Food

12.3.1.7. Ready to Eat Meals

12.3.1.8. Other Food

12.3.2. Beverages

12.3.2.1. Alcoholic Beverages

12.3.2.2. Non Alcoholic Beverages

12.3.3. Pharmaceuticals

12.3.4. Electronic Devices

12.3.5. Medical Devices

12.3.6. Agriculture

12.3.7. Chemicals

12.3.8. Others

12.4. Market Attractiveness Analysis, By End User Base

13. Global High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029, by Packaging Type

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis, by Packaging Type, 2012–2020

13.3. Current and Future Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis and Forecast, by Packaging Type, 2021–2029

13.3.1. Pouches

13.3.2. Bags

13.3.3. Lids

13.3.4. Shrink Films

13.3.5. Laminated Tubes

13.3.6. Others

13.4. Market Attractiveness Analysis, By Packaging Type

14. Global High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029, by Region

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis, by Region, 2012–2020

14.3. Current and Future Market Size (US$ Mn) and Volume (000’ Tonnes) Analysis and Forecast, by Region, 2021–2029

14.3.1. North America

14.3.2. Latin America

14.3.3. Europe

14.3.4. Asia Pacific

14.3.5. Middle East & Africa

14.4. Market Attractiveness Analysis, By Region

15. North America High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029

15.1. Introduction

15.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Trend Analysis by Market Taxonomy, 2012–2020

15.3. Market Size (US$ Mn) and Volume (000’ Tonnes) Forecast by Market Taxonomy, 2021–2029

15.3.1. By Country

15.3.1.1. US

15.3.1.2. Canada

15.3.2. By High Barrier Films Type

15.3.3. By Material Type

15.3.4. By End User Base

15.3.5. By Packaging Type

15.4. Market Attractiveness Analysis

15.4.1. By Country

15.4.2. By High Barrier Films Type

15.4.3. By Material Type

15.4.4. By End User Base

15.4.5. By Packaging Type

16. Latin America High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029

16.1. Introduction

16.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Trend Analysis by Market Taxonomy, 2012–2020

16.3. Market Size (US$ Mn) and Volume (000’ Tonnes) Forecast By Market Taxonomy, 2021–2029

16.3.1. By Country

16.3.1.1. Mexico

16.3.1.2. Argentina

16.3.1.3. Brazil

16.3.1.4. Rest of Latin America

16.3.2. By High Barrier Films Type

16.3.3. By Material Type

16.3.4. By End User Base

16.3.5. By Packaging Type

16.4. Market Attractiveness Analysis

16.4.1. By Country

16.4.2. By High Barrier Films Type

16.4.3. By Material Type

16.4.4. By End User Base

16.4.5. By Packaging Type

17. Europe High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029

17.1. Introduction

17.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Trend Analysis by Market Taxonomy, 2012–2020

17.3. Market Size (US$ Mn) and Volume (000’ Tonnes) Forecast By Market Taxonomy, 2021–2029

17.3.1. By Country

17.3.1.1. Germany

17.3.1.2. Spain

17.3.1.3. Italy

17.3.1.4. France

17.3.1.5. U.K

17.3.1.6. BENELUX

17.3.1.7. Nordic

17.3.1.8. Russia

17.3.1.9. Poland

17.3.1.10. Rest of Europe

17.3.2. By High Barrier Films Type

17.3.3. By Material Type

17.3.4. By End User Base

17.3.5. By Packaging Type

17.4. Market Attractiveness Analysis

17.4.1. By Country

17.4.2. By High Barrier Films Type

17.4.3. By Material Type

17.4.4. By End User Base

17.4.5. By Packaging Type

18. Asia Pacific High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029

18.1. Introduction

18.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Trend Analysis by Market Taxonomy, 2012–2020

18.3. Market Size (US$ Mn) and Volume (000’ Tonnes) Forecast By Market Taxonomy, 2021–2029

18.3.1. By Country

18.3.1.1. China

18.3.1.2. India

18.3.1.3. Japan

18.3.1.4. ASEAN

18.3.1.5. Australia and New Zealand

18.3.1.6. Rest of APAC

18.3.2. By High Barrier Films Type

18.3.3. By Material Type

18.3.4. By End User Base

18.3.5. By Packaging Type

18.4. Market Attractiveness Analysis

18.4.1. By Country

18.4.2. By High Barrier Films Type

18.4.3. By Material Type

18.4.4. By End User Base

18.4.5. By Packaging Type

19. Middle East & Africa High Barrier Packaging Films Market Analysis 2012–2020 and Forecast 2021–2029

19.1. Introduction

19.2. Historical Market Size (US$ Mn) and Volume (000’ Tonnes) Trend Analysis by Market Taxonomy, 2012–2020

19.3. Market Size (US$ Mn) and Volume (000’ Tonnes) Forecast By Market Taxonomy, 2021–2029

19.3.1. By Country

19.3.1.1. GCC

19.3.1.2. North Africa

19.3.1.3. South Africa

19.3.1.4. Rest of Middle East & Africa

19.3.2. By High Barrier Films Type

19.3.3. By Material Type

19.3.4. By End User Base

19.3.5. By Packaging Type

19.4. Market Attractiveness Analysis

19.4.1. By Country

19.4.2. By High Barrier Films Type

19.4.3. By Material Type

19.4.4. By End User Base

19.4.5. By Packaging Type

20. Market Structure Analysis

20.1. Market Analysis, by Tier of High Barrier Packaging Films Companies

20.2. Market Share Analysis of Top Players

20.3. Market Presence Analysis

20.3.1. Product foot print by Players

20.3.2. Channel Foot Print by Players

21. Competition Analysis

21.1. Competition Dashboard

21.2. Competition Benchmarking

21.3. Competition Deep Dive

21.3.1. Amcor Plc

21.3.1.1. Product Portfolio

21.3.1.2. Profitability by Market Segments

21.3.1.3. Sales Footprint

21.3.1.4. Strategy Overview

21.3.1.4.1. Marketing Strategy

21.3.1.4.2. Product Strategy

21.3.1.4.3. Channel Strategy

21.3.2. Sealed Air Corp

21.3.2.1. Product Portfolio

21.3.2.2. Profitability by Market Segments

21.3.2.3. Sales Footprint

21.3.2.4. Strategy Overview

21.3.2.4.1. Marketing Strategy

21.3.2.4.2. Product Strategy

21.3.2.4.3. Channel Strategy

21.3.3. Glenroy, Inc.

21.3.3.1. Product Portfolio

21.3.3.2. Profitability by Market Segments

21.3.3.3. Sales Footprint

21.3.3.4. Strategy Overview

21.3.3.4.1. Marketing Strategy

21.3.3.4.2. Product Strategy

21.3.3.4.3. Channel Strategy

21.3.4. Winpak Ltd.

21.3.4.1. Product Portfolio

21.3.4.2. Profitability by Market Segments

21.3.4.3. Sales Footprint

21.3.4.4. Strategy Overview

21.3.4.4.1. Marketing Strategy

21.3.4.4.2. Product Strategy

21.3.4.4.3. Channel Strategy

21.3.5. Mondi Plc

21.3.5.1. Product Portfolio

21.3.5.2. Profitability by Market Segments

21.3.5.3. Sales Footprint

21.3.5.4. Strategy Overview

21.3.5.4.1. Marketing Strategy

21.3.5.4.2. Product Strategy

21.3.5.4.3. Channel Strategy

21.3.6. Toray Plastics (America) Inc.

21.3.6.1. Product Portfolio

21.3.6.2. Profitability by Market Segments

21.3.6.3. Sales Footprint

21.3.6.4. Strategy Overview

21.3.6.4.1. Marketing Strategy

21.3.6.4.2. Product Strategy

21.3.6.4.3. Channel Strategy

21.3.7. Berry Global, Inc.

21.3.7.1. Product Portfolio

21.3.7.2. Profitability by Market Segments

21.3.7.3. Sales Footprint

21.3.7.4. Strategy Overview

21.3.7.4.1. Marketing Strategy

21.3.7.4.2. Product Strategy

21.3.7.4.3. Channel Strategy

21.3.8. Schur Flexible GmnH

21.3.8.1. Product Portfolio

21.3.8.2. Profitability by Market Segments

21.3.8.3. Sales Footprint

21.3.8.4. Strategy Overview

21.3.8.4.1. Marketing Strategy

21.3.8.4.2. Product Strategy

21.3.8.4.3. Channel Strategy

21.3.9. Huhtamaki Oyj

21.3.9.1. Product Portfolio

21.3.9.2. Profitability by Market Segments

21.3.9.3. Sales Footprint

21.3.9.4. Strategy Overview

21.3.9.4.1. Marketing Strategy

21.3.9.4.2. Product Strategy

21.3.9.4.3. Channel Strategy

21.3.10. Jindal Poly Films Ltd.

21.3.10.1. Product Portfolio

21.3.10.2. Profitability by Market Segments

21.3.10.3. Sales Footprint

21.3.10.4. Strategy Overview

21.3.10.4.1. Marketing Strategy

21.3.10.4.2. Product Strategy

21.3.10.4.3. Channel Strategy

21.3.11. Uflex Ltd.

21.3.11.1. Product Portfolio

21.3.11.2. Profitability by Market Segments

21.3.11.3. Sales Footprint

21.3.11.4. Strategy Overview

21.3.11.4.1. Marketing Strategy

21.3.11.4.2. Product Strategy

21.3.11.4.3. Channel Strategy

21.3.12. Cosmo Films Ltd.

21.3.12.1. Product Portfolio

21.3.12.2. Profitability by Market Segments

21.3.12.3. Sales Footprint

21.3.12.4. Strategy Overview

21.3.12.4.1. Marketing Strategy

21.3.12.4.2. Product Strategy

21.3.12.4.3. Channel Strategy

21.3.13. Bischof & Klein SE & Co. KG

21.3.13.1. Product Portfolio

21.3.13.2. Profitability by Market Segments

21.3.13.3. Sales Footprint

21.3.13.4. Strategy Overview

21.3.13.4.1. Marketing Strategy

21.3.13.4.2. Product Strategy

21.3.13.4.3. Channel Strategy

21.3.14. ProAmpac Intermediate, Inc.

21.3.14.1. Product Portfolio

21.3.14.2. Profitability by Market Segments

21.3.14.3. Sales Footprint

21.3.14.4. Strategy Overview

21.3.14.4.1. Marketing Strategy

21.3.14.4.2. Product Strategy

21.3.14.4.3. Channel Strategy

21.3.15. Plastissimo Film Co., Ltd.

21.3.15.1. Product Portfolio

21.3.15.2. Profitability by Market Segments

21.3.15.3. Sales Footprint

21.3.15.4. Strategy Overview

21.3.15.4.1. Marketing Strategy

21.3.15.4.2. Product Strategy

21.3.15.4.3. Channel Strategy

21.3.16. Celplast Metallized Products Ltd.

21.3.16.1. Product Portfolio

21.3.16.2. Profitability by Market Segments

21.3.16.3. Sales Footprint

21.3.16.4. Strategy Overview

21.3.16.4.1. Marketing Strategy

21.3.16.4.2. Product Strategy

21.3.16.4.3. Channel Strategy

21.3.17. Dummore Corporation

21.3.17.1. Product Portfolio

21.3.17.2. Profitability by Market Segments

21.3.17.3. Sales Footprint

21.3.17.4. Strategy Overview

21.3.17.4.1. Marketing Strategy

21.3.17.4.2. Product Strategy

21.3.17.4.3. Channel Strategy

21.3.18. Polyplex Corporation Limited

21.3.18.1. Product Portfolio

21.3.18.2. Profitability by Market Segments

21.3.18.3. Sales Footprint

21.3.18.4. Strategy Overview

21.3.18.4.1. Marketing Strategy

21.3.18.4.2. Product Strategy

21.3.18.4.3. Channel Strategy

21.3.19. Shrinath Rotopack Pvt Ltd

21.3.19.1. Product Portfolio

21.3.19.2. Profitability by Market Segments

21.3.19.3. Sales Footprint

21.3.19.4. Strategy Overview

21.3.19.4.1. Marketing Strategy

21.3.19.4.2. Product Strategy

21.3.19.4.3. Channel Strategy

21.3.20. ACG Worldwide Private Limited

21.3.20.1. Product Portfolio

21.3.20.2. Profitability by Market Segments

21.3.20.3. Sales Footprint

21.3.20.4. Strategy Overview

21.3.20.4.1. Marketing Strategy

21.3.20.4.2. Product Strategy

21.3.20.4.3. Channel Strategy

*The above list is indicative in nature and is subject to change during the course of research

22. Assumptions and Acronyms Used

23. Research Methodology

List of Tables

Table 01: Global High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 02: Global High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 03: Global High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 04: Global High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 05: Global High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 06: Global High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 07: Global High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 08: Global High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 09: Global High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 10: Global High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

Table 11: North America High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H) - 2029(F)

Table 12: North America High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 13: North America High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 14: North America High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 15: North America High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 16: North America High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 17: North America High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 18: North America High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 19: North America High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 20: North America High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

Table 21: Latin America High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 22: Latin America High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 23: Latin America High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 24: Latin America High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 25: Latin America High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 26: Latin America High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 27: Latin America High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 28: Latin America High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 29: Latin America High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 30: Latin America High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

Table 31: Europe High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 32: Europe High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 33: Europe High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 34: Europe High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 35: Europe High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 36: Europe High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 37: Europe High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 38: Europe High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 39: Europe High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 40: Europe High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

Table 41: Asia Pacific High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 42: Asia Pacific High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 43: Asia Pacific High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 44: Asia Pacific High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 45: Asia Pacific High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 46: Asia Pacific High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 47: Asia Pacific High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 48: Asia Pacific High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 49: Asia Pacific High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 50: Asia Pacific High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

Table 51: Middle East & Africa High Barrier Packaging Films Volume (000’ Tonnes), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 52: Middle East & Africa High Barrier Packaging Films Volume (US$ Mn), by High Barrier Packaging Films Type, 2012(H)-2029(F)

Table 53: Middle East & Africa High Barrier Packaging Films Volume (000’ Tonnes), by Material Type, 2012(H)-2029(F)

Table 54: Middle East & Africa High Barrier Packaging Films Volume (US$ Mn), by Material Type, 2012(H)-2029(F)

Table 55: Middle East & Africa High Barrier Packaging Films Volume (000’ Tonnes), by End User Base, 2012(H)-2029(F)

Table 56: Middle East & Africa High Barrier Packaging Films Volume (US$ Mn), by End User Base, 2012(H)-2029(F)

Table 57: Middle East & Africa High Barrier Packaging Films Volume (000’ Tonnes), by Packaging Type, 2012(H)-2029(F)

Table 58: Middle East & Africa High Barrier Packaging Films Volume (US$ Mn), by Packaging Type, 2012(H)-2029(F)

Table 59: Middle East & Africa High Barrier Packaging Films Volume (000’ Tonnes), by Region, 2012(H)-2029(F)

Table 60: Middle East & Africa High Barrier Packaging Films Volume (US$ Mn), by Region, 2012(H)-2029(F)

List of Figures

Figure 01: Global High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 02: Global High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 03: Global High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 04: Global High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 05: Global High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 06: Global High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 07: Global High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 08: Global High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 09: Global High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 10: Global High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)

Figure 11: North America High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 12: North America High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 13: North America High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 14: North America High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 15: North America High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 16: North America High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 17: North America High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 18: North America High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 19: North America High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 20: North America High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)

Figure 21: Latin America High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 22: Latin America High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 23: Latin America High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 24: Latin America High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 25: Latin America High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 26: Latin America High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 27: Latin America High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 28: Latin America High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 29: Latin America High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 30: Latin America High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)

Figure 31: Europe High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 32: Europe High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 33: Europe High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 34: Europe High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 35: Europe High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 36: Europe High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 37: Europe High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 38: Europe High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 39: Europe High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 40: Europe High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)

Figure 41: Asia Pacific High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 42: Asia Pacific High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 43: Asia Pacific High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 44: Asia Pacific High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 45: Asia Pacific High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 46: Asia Pacific High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 47: Asia Pacific High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 48: Asia Pacific High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 49: Asia Pacific High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 50: Asia Pacific High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)

Figure 51: Middle East & Africa High Barrier Packaging Films Market Attractiveness Index, by High Barrier Films Type, 2021(E)-2029(F)

Figure 52: Middle East & Africa High Barrier Packaging Films Market Share Analysis, by High Barrier Films Type, 2021(E) & 2029(F)

Figure 53: Middle East & Africa High Barrier Packaging Films Market Attractiveness Index, by Material Type, 2021(E)-2029(F)

Figure 54: Middle East & Africa High Barrier Packaging Films Market Share Analysis, by Material Type, 2021(E) & 2029(F)

Figure 55: Middle East & Africa High Barrier Packaging Films Market Attractiveness Index, by End User Base, 2021(E)-2029(F)

Figure 56: Middle East & Africa High Barrier Packaging Films Market Share Analysis, by End User Base, 2021(E) & 2029(F)

Figure 57: Middle East & Africa High Barrier Packaging Films Market Attractiveness Index, by Packaging Type, 2021(E)-2029(F)

Figure 58: Middle East & Africa High Barrier Packaging Films Market Share Analysis, by Packaging Type, 2021(E) & 2029(F)

Figure 59: Middle East & Africa High Barrier Packaging Films Market Attractiveness Index, by Region, 2021(E)-2029(F)

Figure 60: Middle East & Africa High Barrier Packaging Films Market Share Analysis, by Region, 2021(E) & 2029(F)