Analysts’ Viewpoint on Hexane Market Scenario

Demand for hexane is majorly, i.e. nearly 50%, for oil extraction applications. Rise in demand for hexane in the edible oil industry for use in oil extraction is primarily due to its significant benefits and increased need for a high-efficiency solvent. The global edible oil industry, particularly in countries such as India, Brazil, China, and Indonesia, has been witnessing significant investments, including FDIs, for the last few years. This is likely to create opportunities for the global hexane market in the near future. Key local and global players operating in these countries are planning to become price competitive in order to maintain their hexane market share. Increased emphasis on continuous improvements in production processes by investing resources in technological advancements is expected to create lucrative opportunities for manufacturers of hexane in the next few years. Companies can invest in the launch of innovative products, such as polymer-grade hexane, for use in industrial applications to boost sales of their products. This is likely to drive the demand for hexane in these applications during the forecast period.

Hexane, also known as n-hexane or hexyl hydride, is an aliphatic hydrocarbon derived from fractional distillation of crude oil/natural gas. It contains mixture of hydrocarbons with six carbon atoms, similar to cyclohexane. Hexane has several key applications and it is used as an essential oil thinner, chemical intermediate, and cleaning agent, Hexane is also utilized as a solvent in rubber polymerization to manufacture synthetic rubber. It is used to manufacture binder, coating, paint, and off-set oil.

Hexane solvent is used in the extraction of edible oil from seeds and vegetable crops such as soybean, groundnut, corn, palm, and rapeseed. Hexane removes unwanted taste from oil and helps obtain higher yield. Hexane is increasingly being employed in the healthcare and pharmaceutical industry for use as a liquid in the manufacturing of tablet molds, which in turn is anticipated to propel the hexane market size.

Hexane is largely used for extraction of edible oils from vegetables and seeds such as mustard seed, cottonseed, rape seed, flax, groundnut, soybean, corn germ, safflower seed, and palm. It helps extract the maximum possible quantity of oil and removes unwanted odor and taste from oil. It is recyclable and it can be reused after oil extraction. Food-grade hexane is employed in oil extraction, due to its efficiency and safety. It has a low boiling point and it retains its liquid state in cold climates. It extracts oil from vegetables and seeds, without disturbing their nutrient content.

According to the OECD–FAO Agricultural Outlook 2019–2028, the per capita vegetable oil consumption is rising at a rate of 3.1% p.a., and it would reach up to 15 kilograms per capita by 2028.

Growth of population, rise in disposable income, and improvement in standards of living are key drivers of the demand for edible oil in growing economies such as China, Brazil, and India. Rise in number of retail outlets and expansion of the food processing sector are also driving the demand for edible oil across the globe. This, in turn, is projected to drive the production of edible oil across the world and consequently, propel the demand for hexane in the oil extraction process and drive the global hexane market during the forecast period.

As a solvent, hexane is used in paints and coatings for the dissolving of pigments, additives, and binders. Solvents control paint viscosity and enhance film quality. Solvents dissolve or disperse different components such as binders, additives, pigments, and extenders used in the formulation of paints and coatings. They also help speed up the curing and drying process and therefore, the demand for solvents is increasing in the global paints & coatings industry.

Paints and coatings is an integral part of the global building & construction industry. Thus, increase in residential construction activities is augmenting the paints & coatings industry across the globe. Rising demand for printing inks, paints, and coatings is expected to drive the demand for solvents in the near future. This, in turn, is projected to drive the global hexane market during the forecast period.

Hexane is also employed in adhesives as a solvent to improve their efficiency at low temperatures, thereby maintaining their evaporation rate and achieving better performance. Moreover, wetting of surface is a crucial property of an adhesive, which is achieved by dispersing or dissolving polymers in a suitable solvent. Adhesives are used in various industries including the automotive industry for bonding, sealing, and gasketing of parts. They provide structural strength to the vehicle body, thereby preventing it from collapsing.

Rising industrialization across the globe is expected to drive the demand for adhesives during the forecast period. Thus, increasing demand for adhesives is likely to drive the global solvents industry in the next few years. This, in turn, is projected to drive the demand for hexane worldwide during the forecast period.

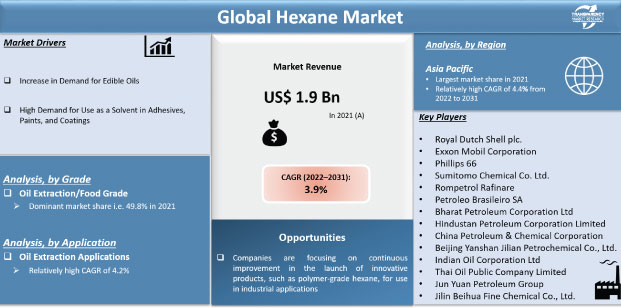

In terms of grade, the global hexane market has been bifurcated into oil extraction/food grade, pharmaceutical grade and industrial grade. The oil extraction/food grade segment accounted for about 50% market share in 2021. It is expected to maintain its dominance during the forecast period.

The industrial segment also accounted for considerable market share in 2021. Hexane is primarily employed in the extraction of edible oil from oilseeds and vegetables. According to our hexane market demand analysis, an increase in consumption of edible oil across the world is expected to drive the demand for hexane during the forecast period. Hexane exhibits excellent functional properties during the oil extraction process. Thus, oil extraction is anticipated to remain a highly attractive grade segment of the global hexane market during the forecast period.

In terms of volume, Asia Pacific held a notable share of 49.0% of the global hexane market in 2021. High consumption of oil extraction/food grade hexane in China, India, and countries in ASEAN is driving the demand for hexane in the region. Rise in demand for industrial solvents for the manufacture of industrial cleaning chemicals and degreasing agents in developing economies is anticipated to augment the demand for hexane in Asia Pacific during the forecast period. This, in turn, is projected to make Asia Pacific a highly attractive region of the global hexane market during the forecast period.

The market in North America and Europe is also expected to expand at a moderate pace during the forecast period. Countries in North America are among the key producers of hexane and its derivatives. Oil extraction, industrial cleaning & degreasing, stain remover products, and pharmaceuticals are expected to be the prominent applications of the hexane market in North America in the near future.

The global hexane market is consolidated with a small number of large-scale vendors controlling the majority of the market share. A majority of the firms are spending a significant amount on comprehensive research and development, primarily to develop environment-friendly products. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Royal Dutch Shell plc., Exxon Mobil Corporation, Phillips 66, Sumitomo Chemical Co. Ltd., Rompetrol Rafinare, Petroleo Brasileiro SA, Bharat Petroleum Corporation Ltd, Hindustan Petroleum Corporation Limited, China Petroleum & Chemical Corporation, Indian Oil Corporation Ltd, Thai Oil Public Company Limited, Jun Yuan Petroleum Group, Beijing Yanshan Jilian Petrochemical Co., Ltd., Jilin Beihua Fine Chemical Co., Ltd., and Liaoning Yufeng Chemical Co., Ltd are the prominent entities operating in the market.

Each of these players has been profiled in the Hexane market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.9 Bn |

|

Market Forecast Value in 2031 |

US$ 2.9 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The hexane market stood at US$ 1.9 Bn in 2021

The hexane market is expected to grow at a CAGR of 3.9% from 2022 to 2031

Increased demand from edible oil industry and high demand for use as a solvent in adhesives, paints, and coatings

Oil extraction was the largest application segment and held 49.8% share in 2021

Asia Pacific was the most lucrative region in the hexane market in 2021

Royal Dutch Shell plc., Exxon Mobil Corporation, Phillips 66, Sumitomo Chemical Co. Ltd., Rompetrol Rafinare, Petroleo Brasileiro SA, Bharat Petroleum Corporation Ltd, Hindustan Petroleum Corporation Limited, China Petroleum & Chemical Corporation, and Indian Oil Corporation Ltd.

1. Executive Summary

1.1. Hexane Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Hexane Market Production Outlook

5. Hexane Price Trend Analysis, 2020–2031

5.1. By Grade

5.2. By Region

6. Global Hexane Market Analysis and Forecast, by Grade, 2020–2031

6.1. Introduction and Definitions

6.2. Global Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

6.2.1. Oil Extraction/Food Grade

6.2.2. Pharmaceutical Grade

6.2.3. Industrial Grade

6.3. Global Hexane Market Attractiveness, by Grade

7. Global Hexane Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Oil Extraction

7.2.2. Industrial Cleaning and Degreasing

7.2.3. Polymerization

7.2.4. Pharmaceutical

7.2.5. Others

7.3. Global Hexane Market Attractiveness, by Application

8. Global Hexane Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Hexane Market Attractiveness, by Region

9. North America Hexane Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.3. North America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.2. U.S. Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Canada Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.4. Canada Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Hexane Market Attractiveness Analysis

10. Europe Hexane Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.3. Europe Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

10.4.1. Germany Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.2. Germany Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. France Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.4. France Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. U.K. Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.6. U.K. Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.7. Italy Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.8. Italy Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.9. Spain Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.10. Spain Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.11. Russia & CIS Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.12. Russia & CIS Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.13. Rest of Europe Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.14. Rest of Europe Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Hexane Market Attractiveness Analysis

11. Asia Pacific Hexane Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.3. Asia Pacific Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.4.1. China Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.2. China Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. Japan Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.4. Japan Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. India Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.6. India Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.7. ASEAN Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.8. ASEAN Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.9. Rest of Asia Pacific Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.10. Rest of Asia Pacific Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Hexane Market Attractiveness Analysis

12. Latin America Hexane Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.3. Latin America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.4.1. Brazil Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.2. Brazil Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.3. Mexico Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.4. Mexico Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.5. Rest of Latin America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.6. Rest of Latin America Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Hexane Market Attractiveness Analysis

13. Middle East & Africa Hexane Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.3. Middle East & Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.4.1. South Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.2. South Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.3. GCC Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.4. GCC Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.5. Rest of Middle East & Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.6. Rest of Middle East & Africa Hexane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Hexane Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Hexane Company Market Share Analysis, 2021

14.2. Competition Matrix

14.3. Market Footprint Analysis

14.3.1. By Grade

14.3.2. By Application

14.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.4.1. Royal Dutch Shell plc.

14.4.1.1. Company Description

14.4.1.2. Business Overview

14.4.1.3. Financial Details

14.4.1.4. Strategic Overview

14.4.2. Exxon Mobil Corporation

14.4.2.1. Company Description

14.4.2.2. Business Overview

14.4.2.3. Financial Details

14.4.2.4. Strategic Overview

14.4.3. Phillips 66

14.4.3.1. Company Description

14.4.3.2. Business Overview

14.4.4. Sumitomo Chemical Co. Ltd.

14.4.4.1. Company Description

14.4.4.2. Business Overview

14.4.5. Rompetrol Rafinare

14.4.5.1. Company Description

14.4.5.2. Business Overview

14.4.6. Petroleo Brasileiro SA

14.4.6.1. Company Description

14.4.6.2. Business Overview

14.4.7. Bharat Petroleum Corporation Ltd

14.4.7.1. Company Description

14.4.7.2. Business Overview

14.4.8. Hindustan Petroleum Corporation Limited

14.4.8.1. Company Description

14.4.8.2. Business Overview

14.4.9. China Petroleum & Chemical Corporation

14.4.9.1. Company Description

14.4.9.2. Business Overview

14.4.10. Indian Oil Corporation Ltd

14.4.10.1. Company Description

14.4.10.2. Business Overview

14.4.11. Thai Oil Public Company Limited

14.4.11.1. Company Description

14.4.11.2. Business Overview

14.4.12. Jun Yuan Petroleum Group

14.4.12.1. Company Description

14.4.12.2. Business Overview

14.4.13. Beijing Yanshan Jilian Petrochemical Co., Ltd.

14.4.13.1. Company Description

14.4.13.2. Business Overview

14.4.14. Jilin Beihua Fine Chemical Co., Ltd.

14.4.14.1. Company Description

14.4.14.2. Business Overview

14.4.15. Liaoning Yufeng Chemical Co., Ltd

14.4.15.1. Company Description

14.4.15.2. Business Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 2: Global Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 3: Global Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 4: Global Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Global Hexane Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 6: Global Hexane Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 8: North America Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 9: North America Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 10: North America Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: North America Hexane Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 12: North America Hexane Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 14: U.S. Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 15: U.S. Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 18: Canada Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 19: Canada Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: Canada Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 22: Europe Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 23: Europe Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: Europe Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Europe Hexane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Hexane Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 28: Germany Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Germany Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Germany Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 32: U.K. Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 33: U.K. Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 34: U.K. Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: France Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 36: France Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 37: France Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: France Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Italy Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 40: Italy Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 41: Italy Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Italy Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Spain Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 44: Spain Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 45: Spain Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Spain Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Russia & CIS Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 48: Russia & CIS Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 49: Russia & CIS Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Rest of Europe Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 52: Rest of Europe Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 53: Rest of Europe Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Europe Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 56: Asia Pacific Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 57: Asia Pacific Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 58: Asia Pacific Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 59: Asia Pacific Hexane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Hexane Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 62: China Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 63: China Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 64: China Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Japan Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 66: Japan Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 67: Japan Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 68: Japan Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 69: India Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 70: India Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 71: India Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 72: India Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: ASEAN Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 74: ASEAN Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 75: ASEAN Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 76: ASEAN Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 77: Rest of Asia Pacific Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 78: Rest of Asia Pacific Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 79: Rest of Asia Pacific Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 80: Rest of Asia Pacific Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 81: Latin America Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 82: Latin America Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 83: Latin America Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: Latin America Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Latin America Hexane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Latin America Hexane Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: Brazil Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 88: Brazil Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 99: Brazil Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 100: Brazil Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 101: Mexico Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 102: Mexico Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 103: Mexico Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 104: Mexico Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 105: Rest of Latin America Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 106: Rest of Latin America Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 107: Rest of Latin America Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 108: Rest of Latin America Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 109: Middle East & Africa Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 110: Middle East & Africa Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 111: Middle East & Africa Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 112: Middle East & Africa Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Middle East & Africa Hexane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 114: Middle East & Africa Hexane Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 115: GCC Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 116: GCC Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 117: GCC Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 118: GCC Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: South Africa Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 120: South Africa Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 121: South Africa Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 122: South Africa Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 123: Rest of Middle East & Africa Hexane Market Volume (Kilo Tons) Forecast, by Grade, 2020–2031

Table 124: Rest of Middle East & Africa Hexane Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 125: Rest of Middle East & Africa Hexane Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 126: Rest of Middle East & Africa Hexane Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Hexane Price Trend, by Application, 2020–2031 (US$/Ton)

Figure 2: Global Hexane Price Trend, by Region, 2020–2031 (US$/Ton)

Figure 3: Global Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 4: Global Hexane Market Attractiveness, by Grade

Figure 5: Global Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 6: Global Hexane Market Attractiveness, by Application

Figure 7: Global Hexane Market Volume Share, by Region, 2021, 2025, and 2031

Figure 8: Global Hexane Market Attractiveness, by Region

Figure 9: North America Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 10: North America Hexane Market Attractiveness, by Grade

Figure 11: North America Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 12: North America Hexane Market Attractiveness, by Application

Figure 13: North America Hexane Market Volume Share, by Country, 2021, 2025, and 2031

Figure 14: North America Hexane Market Attractiveness, by Country

Figure 15: Europe Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 16: Europe Hexane Market Attractiveness, by Grade

Figure 17: Europe Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 18: Europe Hexane Market Attractiveness, by Application

Figure 19: Europe Hexane Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 20: Europe Hexane Market Attractiveness, by Country and Sub-region

Figure 21: Asia Pacific Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 22: Asia Pacific Hexane Market Attractiveness, by Grade

Figure 23: Asia Pacific Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 24: Asia Pacific Hexane Market Attractiveness, by Application

Figure 25: Asia Pacific Hexane Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 26: Asia Pacific Hexane Market Attractiveness, by Country and Sub-region

Figure 27: Latin America Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 28: Latin America Hexane Market Attractiveness, by Grade

Figure 29: Latin America Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 30: Latin America Hexane Market Attractiveness, by Application

Figure 31: Latin America Hexane Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 32: Latin America Hexane Market Attractiveness, by Country and Sub-region

Figure 33: Middle East & Africa Hexane Market Volume Share, by Grade, 2021, 2025, and 2031

Figure 34: Middle East & Africa Hexane Market Attractiveness, by Grade

Figure 35: Middle East & Africa Hexane Market Volume Share, by Application, 2021, 2025, and 2031

Figure 36: Middle East & Africa Hexane Market Attractiveness, by Application

Figure 37: Middle East & Africa Hexane Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 38: Middle East & Africa Hexane Market Attractiveness, by Country and Sub-region

Figure 39: Global Hexane Market Share Analysis, by Company, 2020