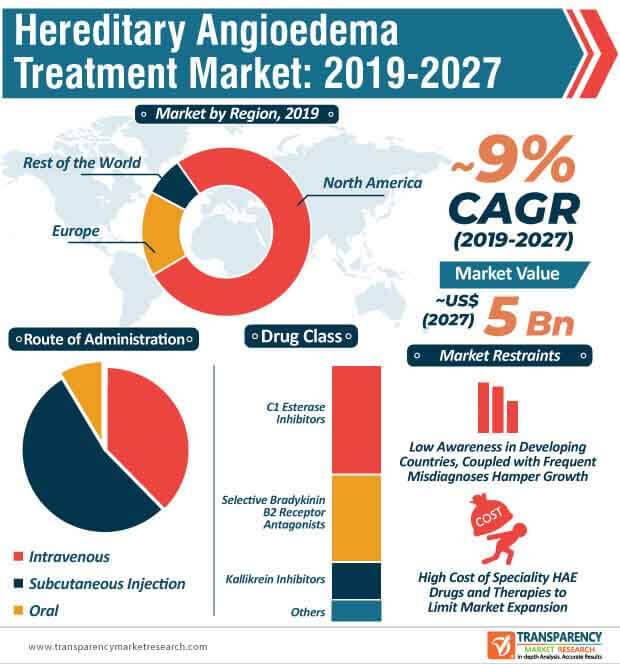

The prevalence of rare diseases has surged in recent years, as the tracking of their incidence has improved around the world in the past few decades. This is particularly significant for genetic diseases, as standardized screenings and tests are few, as such, making it hard to determine how many people are affected by them. Hereditary angioedema, also known as HAE, has been in the spotlight, as government and non-government organizations around the world work to raise public awareness to increase diagnosis and improve treatment. According to a report by Transparency Market Research on the global hereditary angioedema treatment market, in 2018, the treatment for HAE was sought mainly in North America, making it the largest regional market, accounting for over three-fourth of the global market share. This can be attributed not only to enhanced data tracking, but also better healthcare infrastructure, which has led to the better availability of specialty HAE products in the region.

Although the North America market is expected to grow at a healthy pace over the forecast years, it is expected to yield market share of ~4% to Europe and the Rest of the World, as public awareness about the disease rises in other parts of the world, shaping the further evolution of the hereditary angioedema treatment market.

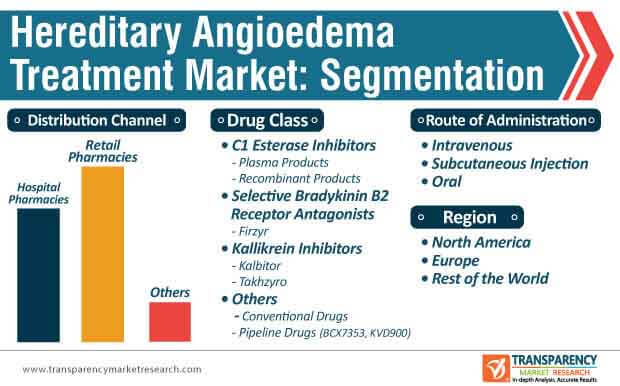

The intravenous route of medicine administration has been the method of choice for drugs used in the treatment of hereditary angioedema. This can be attributed to the fact that, conventional prophylactic drugs have traditionally been administered intravenously, and this method has occupied a significant share of the global hereditary angioedema treatment market in the last few years. However, with the development of drugs that can be administered orally and by subcutaneous injection, intravenous drugs are expected to lose popularity in the foreseeable future.

The phenomenal growth of subcutaneous injections as a mode of drug administration can be attributed to the demand for ease-of-usage for patients, which has had an instrumental impact on the growth of this segment. Where in 2018 subcutaneous injections accounted for close to half of the total market, by the end of the forecast period in 2027, this segment is anticipated to grow to occupy ~65% of the share.

In recent years, there has been an impressive amount of research being done for the development of drugs for hereditary angioedema treatment. This has included not just drugs to control the symptoms of the illness, but also prophylactic treatment for HAE attacks. There are currently several drugs that are in various stages of approval for the long-term prophylactic treatment of HAE in children and adults. For instance, in May 2019, BioCryst Pharmaceuticals announced that its drug - BCX7353, for the prevention of (HAE) attacks, has achieved its primary endpoint for both dose levels.

Frequent Misdiagnosis of HAE to Negatively Impact Market

As with all rare genetic diseases, because the incidence of hereditary angioedema is lower in comparison to other illnesses, it is often overlooked and misdiagnosed as a different disease. The alarming rate of misdiagnosis of hereditary angioedema, globally, as common allergies, appendicitis, and Irritable Bowel Syndrome, has led to a delay in effective treatment, which has had a significant negative impact on the growth of the global hereditary angioedema treatment market.

Also restraining the growth of the market is the prohibitively high cost of the drugs used for hereditary angioedema treatment. Even as drug companies are working to introduce newer and better drugs for hereditary angioedema treatment, for both, acute attack and prophylactic treatments, cost management continues to remain an obstacle in the growth trajectory of the market.

Hereditary Angioedema Treatment Market: Analysts’ Overview

The global hereditary angioedema treatment market is set to grow at a healthy pace during the forecast period, due to the gradually increasing awareness and diagnoses of rare genetic diseases, and product innovation for their treatment. According to analysts at Transparency Market Research, as newer and better classes of drugs are being made for a spectrum of symptoms and severity, players targeting their R&D toward the prophylactic treatment of hereditary angioedema attacks are likely to maximize their gains in the near future.

Subcutaneous injections are growing in popularity due to patient convenience and ease, being aided by the launch of innovative new products that employ this route of administration. Players in the market taking advantage of this preference in the development of medication for HAE are likely to gain a competitive edge in the hereditary angioedema treatment market.

The regional market in North America is expected to expand robustly, due to the large number of reported cases, coupled with a well-established healthcare infrastructure. The future is set to be lucrative for manufacturers focusing on ameliorating their product offerings to include personalized and speciality drugs for the treatment of hereditary angioedema.

Global Hereditary Angioedema Treatment Market and Report Description

Hereditary Angioedema Treatment Market: Drivers

Hereditary Angioedema Treatment Market: Notable Trends

Hereditary Angioedema Treatment Market: Segment Analysis

Global Hereditary Angioedema Treatment Market: Major Players

Hereditary angioedema treatment market to Reach a value of ~US$ 5 Bn by 2027

Hereditary angioedema treatment market is projected to expand at a CAGR of ~9% from 2019 to 2027

Hereditary angioedema treatment market is driven by increase in awareness about hereditary angioedema and novel pipeline drugs

The subcutaneous injection segment dominated the global market, and the trend is likely to continue during the forecast period

Key players in the global hereditary angioedema treatment market are Shire plc (Takeda Pharmaceutical Company Limited), CSL Limited, and Pharming Group NV

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hereditary Angioedema Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hereditary Angioedema Treatment Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Pipeline Analysis

5.2. Orphan Drug Exclusivity Scenario

5.3. Key Merger & Acquisitions

5.4. Disease Overview

5.5. Disease Prevalence-Global and Key Countries

6. Global Hereditary Angioedema Treatment Market Analysis and Forecast, by Drug Class, 2017–2027

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017–2027

6.3.1. C1 Esterase Inhibitor

6.3.1.1. Plasma Products

6.3.1.1.1. Berinert

6.3.1.1.2. Cinryze

6.3.1.1.3. Haegarda

6.3.1.2. Recombinant Products

6.3.1.2.1. Ruconest

6.3.2. Selective Bradykinin B2 Receptor Antagonist

6.3.2.1. Firazyr

6.3.3. Kallikrein Inhibitor

6.3.3.1. Kalbitor

6.3.3.2. Takhzyro

6.3.4. Others

6.3.4.1. Conventional Drugs

6.3.4.2. Pipeline Drugs

6.4. Market Attractiveness By Drug Class

7. Global Hereditary Angioedema Treatment Market Analysis and Forecasts, by Route of Administration, 2017–2027

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2027

7.3.1. Intravenous

7.3.2. Subcutaneous Injection

7.3.3. Oral

7.4. Market Attractiveness, by Route of Administration

8. Global Hereditary Angioedema Treatment Market Analysis and Forecasts, by Distribution Channel, 2017–2027

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2027

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Others

8.4. Market Attractiveness, by Distribution Channel

9. Global Hereditary Angioedema Treatment Market Analysis and Forecasts, by Region, 2017–2027

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Rest of the World

9.3. Market Attractiveness, by Country/Region

10. North America Hereditary Angioedema Treatment Market Analysis and Forecast, 2017–2027

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2027

10.2.1. C1 Esterase Inhibitor

10.2.1.1. Plasma Products

10.2.1.1.1. Berinert

10.2.1.1.2. Cinryze

10.2.1.1.3. Haegarda

10.2.1.2. Recombinant Products

10.2.1.2.1. Ruconest

10.2.2. Selective Bradykinin B2 Receptor Antagonist

10.2.2.1. Firazyr

10.2.3. Kallikrein Inhibitor

10.2.3.1. Kalbitor

10.2.3.2. Takhzyro

10.2.4. Others

10.2.4.1. Conventional Drugs

10.2.4.2. Pipeline Drugs

10.3. Market Value Forecast, by Route of Administration, 2017–2027

10.3.1. Intravenous

10.3.2. Subcutaneous Injection

10.3.3. Oral

10.4. Market Value Forecast, by Distribution Channel, 2017–2027

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Hereditary Angioedema Treatment Market Analysis and Forecast, 2017–2027

11.1. .Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2027

11.2.1. C1 Esterase Inhibitor

11.2.1.1. Plasma Products

11.2.1.1.1. Berinert

11.2.1.1.2. Cinryze

11.2.1.1.3. Haegarda

11.2.1.2. Recombinant Products

11.2.1.2.1. Ruconest

11.2.2. Selective Bradykinin B2 Receptor Antagonist

11.2.2.1. Firazyr

11.2.3. Kallikrein Inhibitor

11.2.3.1. Kalbitor

11.2.3.2. Takhzyro

11.2.4. Others

11.2.4.1. Conventional Drugs

11.2.4.2. Pipeline Drugs

11.3. Market Value Forecast, by Route of Administration, 2017–2027

11.3.1. Intravenous

11.3.2. Subcutaneous Injection

11.3.3. Oral

11.4. Market Value Forecast, by Distribution Channel, 2017–2027

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Rest of the World Hereditary Angioedema Treatment Market Analysis and Forecast, 2017–2027

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2027

12.2.1. C1 Esterase Inhibitor

12.2.1.1. Plasma Products

12.2.1.1.1. Berinert

12.2.1.1.2. Cinryze

12.2.1.1.3. Haegarda

12.2.1.2. Recombinant Products

12.2.1.2.1. Ruconest

12.2.2. Selective Bradykinin B2 Receptor Antagonist

12.2.2.1. Firazyr

12.2.3. Kallikrein Inhibitor

12.2.3.1. Kalbitor

12.2.3.2. Takhzyro

12.2.4. Others

12.2.4.1. Conventional Drugs

12.2.4.2. Pipeline Drugs

12.3. Market Value Forecast, by Route of Administration, 2017–2027

12.3.1. Intravenous

12.3.2. Subcutaneous Injection

12.3.3. Oral

12.4. Market Value Forecast, by Distribution Channel, 2017–2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Others

12.5. Market Attractiveness Analysis

12.5.1. By Drug Class

12.5.2. By Route of Administration

12.5.3. By Distribution Channel

13. Competitive Landscape

13.1. Market Player - Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis, by Company, 2018

13.3. Company Profiles

13.3.1. Shire plc (Takeda Pharmaceutical Company Limited)

13.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.1.2. Company Financials

13.3.1.3. Growth Strategies

13.3.1.4. SWOT Analysis

13.3.2. CSL Limited

13.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.2.2. Company Financials

13.3.2.3. Growth Strategies

13.3.2.4. SWOT Analysis

13.3.3. Pharming Group N.V.

13.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.3.2. Company Financials

13.3.3.3. Growth Strategies

13.3.3.4. SWOT Analysis

13.3.4. Ionis Pharmaceuticals, Inc.

13.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.4.2. Company Financials

13.3.4.3. Growth Strategies

13.3.4.4. SWOT Analysis

13.3.5. BioCryst Pharmaceuticals, Inc.

13.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.5.2. Company Financials

13.3.5.3. Growth Strategies

13.3.5.4. SWOT Analysis

13.3.6. KalVista Pharmaceuticals Ltd.

13.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.6.2. Company Financials

13.3.6.3. Growth Strategies

13.3.6.4. SWOT Analysis

13.3.7. Attune Pharmaceuticals

13.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.7.2. Company Financials

13.3.7.3. Growth Strategies

13.3.7.4. SWOT Analysis

List of Tables

Table 01: Pipeline Analysis, by Phase III

Table 02: Pipeline Analysis, by Phase II and Phase I

Table 03: Pipeline Analysis, by Preclinical Trial

Table 04: Orphan Drug Exclusivity

Table 05: Key Mergers & Acquisition in the Hereditary Angioedema Treatment Market

Table 06: Disease Overview by Type of HAE

Table 07: Reported and Estimated Cases of HAE, by Country

Table 08: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 09: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by C1 Esterase Inhibitor, 2017–2027

Table 10: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Plasma Products, 2017–2027

Table 11: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Kallikrein Inhibitor, 2017–2027

Table 12: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Others, 2017–2027

Table 13: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 14: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 15: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 16: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 17: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 18: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by C1 Esterase Inhibitor, 2017–2027

Table 19: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Plasma Products, 2017–2027

Table 20: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Kallikrein Inhibitor, 2017–2027

Table 21: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Others, 2017–2027

Table 22: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 23: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 24: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 25: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 26: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by C1 Esterase Inhibitor, 2017–2027

Table 27: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Plasma Products, 2017–2027

Table 28: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Kallikrein Inhibitor, 2017–2027

Table 29: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Others, 2017–2027

Table 30: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 31: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 32: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 33: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by C1 Esterase Inhibitor, 2017–2027

Table 34: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Plasma Products, 2017–2027

Table 35: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Kallikrein Inhibitor, 2017–2027

Table 36: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Others, 2017–2027

Table 37: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 38: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Hereditary Angioedema Treatment Market Value Share, by Drug Class, 2018

Figure 04: Global Hereditary Angioedema Treatment Market Value Share, by Route of Administration, 2018

Figure 05: Global Hereditary Angioedema Treatment Market Value Share, by Distribution Channel, 2018

Figure 06: Global Hereditary Angioedema Treatment Market Value Share, by Route of Administration, 2018

Figure 07: Global Hereditary Angioedema Treatment Market - Key Drivers and Restraints

Figure 08: Global Hereditary Angioedema Treatment Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 09: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by C1 Esterase Inhibitor, 2017–2027

Figure 10: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Selective Bradykinin B2 Receptor Antagonist, 2017–2027

Figure 11: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Kallikrein Inhibitor, 2017–2027

Figure 12: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 13: Global Hereditary Angioedema Treatment Market Attractiveness, by Drug Class, 2019–2027

Figure 14: Global Hereditary Angioedema Treatment Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 15: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Intravenous, 2017–2027

Figure 16: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Subcutaneous Injection, 2017–2027

Figure 17: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Oral, 2017–2027

Figure 18: Global Hereditary Angioedema Treatment Market Attractiveness, by Route of Administration, 2019–2027

Figure 19: Global Hereditary Angioedema Treatment Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 20: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 21: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 22: Global Hereditary Angioedema Treatment Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 23: Global Hereditary Angioedema Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 24: Global Hereditary Angioedema Treatment Market Value Share Analysis, by Region, 2018 and 2027

Figure 25: Global Hereditary Angioedema Treatment Market Attractiveness Analysis, by Region, 2019–2027

Figure 26: North America Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, 2019–2027

Figure 27: North America Hereditary Angioedema Treatment Market Value Share, by Country, 2018 and 2027

Figure 28: North America Hereditary Angioedema Treatment Market Attractiveness, by Country, 2019–2027

Figure 29: North America Hereditary Angioedema Treatment Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 30: North America Hereditary Angioedema Treatment Market Attractiveness, by Drug Class, 2019–2027

Figure 31: North America Hereditary Angioedema Treatment Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 32: North America Hereditary Angioedema Treatment Market Attractiveness, by Route of Administration, 2019–2027

Figure 33: North America Hereditary Angioedema Treatment Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 34: North America Hereditary Angioedema Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 35: Europe Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, 2019–2027

Figure 36: Europe Hereditary Angioedema Treatment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 37: Europe Hereditary Angioedema Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 38: Europe Hereditary Angioedema Treatment Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 39: Europe Hereditary Angioedema Treatment Market Attractiveness, by Drug Class, 2019–2027

Figure 40: Europe Hereditary Angioedema Treatment Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 41: Europe Hereditary Angioedema Treatment Market Attractiveness, by Route of Administration, 2019–2027

Figure 42: Europe Hereditary Angioedema Treatment Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 43: Europe Hereditary Angioedema Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 44: Rest of the World Hereditary Angioedema Treatment Market Value (US$ Mn) Forecast, 2019–2027

Figure 45: Rest of the World Hereditary Angioedema Treatment Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 46: Rest of the World Hereditary Angioedema Treatment Market Attractiveness, by Drug Class, 2019–2027

Figure 47: Rest of the World Hereditary Angioedema Treatment Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 48: Rest of the World Hereditary Angioedema Treatment Market Attractiveness, by Route of Administration, 2019–2027

Figure 49: Rest of the World Hereditary Angioedema Treatment Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 50: Rest of the World Hereditary Angioedema Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 51: Global Hereditary Angioedema Treatment Market Share Analysis, by Company (2018)

Figure 52: Shire plc, Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 53: Shire plc, Breakdown of Net Sales (%), by Geography, 2017

Figure 54: Shire plc, Breakdown of Net Sales (%), by Therapeutic areas, 2017

Figure 55: Shire plc, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 56: CSL Behring, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 57: CSL Behring, Breakdown of Net Sales (%), by Geography, 2018

Figure 58: CSL Behring, Breakdown of Net Sales (%), by Product Division/Therapy, 2018

Figure 59: CSL Limited, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 60: Pharming Group NV, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 61: Pharming Group NV, Breakdown of Net Sales (%), by Geography, 2018

Figure 62: Pharming Group NV, Region-wise Breakdown of Net Sales (%), by Ruconest, 2018

Figure 63: Pharming Group NV, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 64: Ionis Pharmaceuticals, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 65: Ionis Pharmaceuticals, Inc., Breakdown of Net Sales (%), by Business Segment, 2018

Figure 66: Ionis Pharmaceuticals, Inc., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 67: BioCryst Pharmaceuticals, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 68: BioCryst Pharmaceuticals, Inc., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 69: KalVista Pharmaceuticals Ltd., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 70: KalVista Pharmaceuticals Ltd., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018