Analysts’ Viewpoint

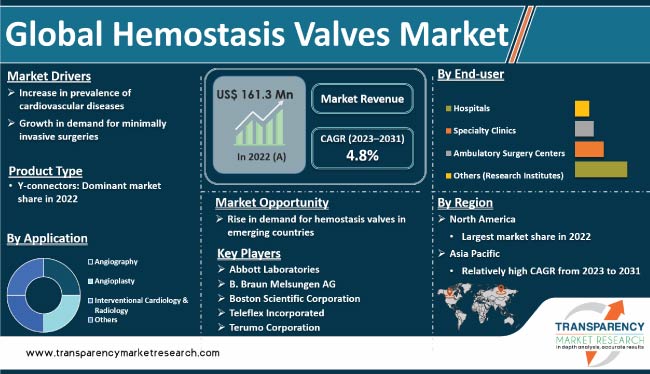

Rise in prevalence of cardiovascular diseases and increase in demand for minimally invasive surgeries are key factors fueling hemostasis valves market growth. Growth in geriatric population, technological advancements in hemostasis valves, and increase in healthcare investment are some of the factors creating value-grab hemostasis valves business opportunities. Demand for hemostasis valves is increasing in emerging countries due to the rise in disposable income of consumers that has led to an increase in access to medical treatments.

Key manufacturers are focusing on developing new products with improved performance characteristics. This is anticipated to positively impact market statistics. However, high cost of hemostasis valves, lack of skilled professionals to perform surgical procedures, and enactment of stringent government regulations are likely to hamper market dynamics during the forecast period.

Hemostasis valves are medical devices that are used to control the flow of blood during medical procedures. They help prevent excessive bleeding and ensure that the patient is not exposed to any potential risks associated with uncontrolled bleeding. Hemostasis valves are used in a variety of medical procedures, including cardiac catheterization, endoscopy, and vascular surgery.

Hemostasis valves are typically made of a combination of metal and plastic components. Metal components are usually made of stainless steel or titanium, while plastic components are made of polycarbonate or polyethylene. Metal components are designed to provide a secure seal between the valve and the patient's body, while plastic components are designed to offer a smooth and comfortable fit.

Hemostasis valves are available in various sizes and shapes, depending upon the type of the procedure performed. Butterfly, ball, and diaphragm valves are the common types of hemostasis valves. Each type of valve has its own advantages and disadvantages.

Hemostasis valves are commonly used in cardiovascular surgeries, where they help prevent blood loss and reduce the risk of complications. Increase in prevalence of cardiovascular diseases is one of the key drivers of the global market.

Cardiovascular diseases (CVDs) are a group of disorders that affect the heart and blood vessels. According to the World Health Organization (WHO), CVDs are responsible for approximately 17.9 million deaths each year, making them the leading cause of death globally.

The prevalence of CVDs is expected to increase in the next few years due to factors such as aging population, sedentary lifestyle, unhealthy diet, and rise in cases of obesity. This is estimated to drive the demand for cardiovascular surgeries around the world.

Hemostasis valves play a critical role in these surgeries by helping surgeons control bleeding and minimize complications. Additionally, technological advancements in hemostasis valves help reduce procedure time and improve patient outcomes.

Minimally invasive surgeries (MIS) refer to surgical procedures that involve smaller incisions. These surgeries have become increasingly popular in recent years due to their benefits over traditional surgeries. These benefits include reduced pain, shorter hospital stays, faster recovery times, and lower healthcare costs.

Hemostasis valve is an essential component of minimally invasive surgeries, as it helps control bleeding during these procedures. Hence, increase in adoption of MIS is fueling the demand for hemostasis valves. Additionally, technological advancements have made it easier than ever before to perform minimally invasive surgeries using hemostasis valves. For instance, some newer models of hemostasis valves feature smaller incision sizes and improved sealing mechanisms that make them more effective at controlling bleeding during surgeries.

According to the latest hemostasis valves market trends, the Y-connectors product type segment dominated the global landscape in 2022. It is projected to maintain its dominance during the forecast period. Hemostasis valve y-connectors are increasingly used in various medical procedures.

Y-connectors provide a secure seal during catheterization procedures. This ensures that there is no blood loss or air embolism during and after the process. Additionally, these hemostasis valve y-connectors are easy to use and require minimal training for healthcare professionals.

Y-connectors are also compatible with different types of catheters. Development of more advanced catheterization techniques is projected to drive the need for hemostasis valves that can accommodate these new devices. Furthermore, technological advancements in hemostasis valves have led to improved designs that offer better performance and reduced risk of infection. For instance, some y-connector models are equipped with antimicrobial coatings that prevent bacterial colonization on their surfaces.

Based on application, the angioplasty segment is projected to account for the largest market share during the forecast period, owing to the increase in prevalence of cardiovascular diseases across the globe.

Around 4 million angioplasties were performed globally in 2019. This number is expected to reach 5 million by 2024. This is anticipated to bolster the demand for hemostasis valves that can be used during angioplasty procedures.

According to the latest hemostasis valves market forecast report, the hospitals end-user segment is likely to dominate the global landscape in the near future. Rise in number of surgeries is driving the hospitals segment.

According to the American College of Surgeons, the number of surgeries performed in the U.S. increased from 48.3 million in 2017 to 49.3 million in 2018. This indicates the rise in demand for hemostasis valves in hospitals.

Increase in collaborations between hospitals and medical device companies is also fueling the segment. In April 2020, Medtronic and the University of Michigan Health System announced a collaboration to develop new medical devices and treatments. Such collaborations are expected to fuel market development in the next few years.

According to the latest hemostasis valves market research report, North America accounted for major industry share in 2022. It is anticipated to dominate the market during the forecast period. North America is the largest market for hemostasis valves, primarily led by the presence of a large number of manufacturers and increase in demand for minimally invasive surgeries in the region.

Presence of large patient population, availability of advanced healthcare infrastructure, and increase in incidence of cardiovascular diseases are also expected to drive the hemostasis valves market demand in North America in the near future.

Asia Pacific is projected to be the fastest-growing region in the near future owing to the rise in prevalence of cardiovascular diseases. Increase in demand for minimally invasive surgeries and rise in healthcare expenditure are also augmenting the hemostasis valves market value in the region.

The hemostasis valves market size in Asia Pacific is anticipated to increase during the forecast period, owing to the presence of a large population, increase in government initiatives to promote healthcare, and growth in awareness about the benefits of these valves.

The hemostasis valves market report includes vital information about key stakeholders. Companies are focusing on adopting innovative strategies, including new product launches, mergers, acquisitions, and partnerships, to strengthen their hemostasis valves market share.

Abbott Laboratories, B. Braun Melsungen AG, Boston Scientific Corporation, Teleflex Incorporated, Terumo Corporation, Merit Medical Systems, Inc., Freudenberg Medical, LLC, Argon Medical Devices, Qosina Corp., and DeRoyal Industries are the prominent companies in hemostasis valves market.

Key players have been profiled in the hemostasis valves market analysis report based on parameters such as business strategies, company overview, recent developments, product portfolio, financial overview, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 161.3 Mn |

|

Market Forecast Value in 2031 |

More than US$ 245.6 Mn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 161.3 Mn in 2022

It is projected to reach more than US$ 245.6 Mn by 2031

The CAGR is anticipated to be 4.8% from 2023 to 2031

Increase in prevalence of cardiovascular diseases and rise in demand for minimally invasive surgeries

The Y-connectors product type segment held major share in 2022

North America constituted the largest share in 2022

Abbott Laboratories, B. Braun Melsungen AG, Boston Scientific Corporation, Teleflex Incorporated, Terumo Corporation, Merit Medical Systems, Inc., Freudenberg Medical, LLC, Argon Medical Devices, Qosina Corp., and DeRoyal Industries

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hemostasis Valves Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hemostasis Valves Market Analysis and Forecast, 2017 - 2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Incidence and Prevalence

5.3. Regilatory Approval

5.4. COVID-19 Impact Analysis

6. Global Hemostasis Valves Market Analysis and Forecast, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2017 - 2031

6.3.1. Y-connectors

6.3.2. Double Valves

6.3.3. One-handed

6.3.4. Others

6.4. Market Attractiveness By Product Type

7. Global Hemostasis Valves Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2017 - 2031

7.3.1. Angiography

7.3.2. Angioplasty

7.3.3. Interventional Cardiology & Radiology

7.3.4. Others

7.4. Market Attractiveness By Application

8. Global Hemostasis Valves Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Ambulatory Surgery Centers

8.3.4. Others (Research Institutes)

8.4. Market Attractiveness By End-user

9. Global Hemostasis Valves Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Hemostasis Valves Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2017 - 2031

10.2.1. Y-connectors

10.2.2. Double Valves

10.2.3. One-handed

10.2.4. Others

10.3. Market Value Forecast By Application, 2017 - 2031

10.3.1. Angiography

10.3.2. Angioplasty

10.3.3. Interventional Cardiology & Radiology

10.3.4. Others

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Ambulatory Surgery Centers

10.4.4. Others (Research Institutes)

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Hemostasis Valves Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2017 - 2031

11.2.1. Y-connectors

11.2.2. Double Valves

11.2.3. One-handed

11.2.4. Others

11.3. Market Value Forecast By Application, 2017 - 2031

11.3.1. Angiography

11.3.2. Angioplasty

11.3.3. Interventional Cardiology & Radiology

11.3.4. Others

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Ambulatory Surgery Centers

11.4.4. Others (Research Institutes)

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Hemostasis Valves Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2017 - 2031

12.2.1. Y-connectors

12.2.2. Double Valves

12.2.3. One-handed

12.2.4. Others

12.3. Market Value Forecast By Application, 2017 - 2031

12.3.1. Angiography

12.3.2. Angioplasty

12.3.3. Interventional Cardiology & Radiology

12.3.4. Others

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Ambulatory Surgery Centers

12.4.4. Others (Research Institutes)

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country

13. Latin America Hemostasis Valves Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2017 - 2031

13.2.1. Y-connectors

13.2.2. Double Valves

13.2.3. One-handed

13.2.4. Others

13.3. Market Value Forecast By Application, 2017 - 2031

13.3.1. Angiography

13.3.2. Angioplasty

13.3.3. Interventional Cardiology & Radiology

13.3.4. Others

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Ambulatory Surgery Centers

13.4.4. Others (Research Institutes)

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Hemostasis Valves Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2017 - 2031

14.2.1. Y-connectors

14.2.2. Double Valves

14.2.3. One-handed

14.2.4. Others

14.3. Market Value Forecast By Application, 2017 - 2031

14.3.1. Angiography

14.3.2. Angioplasty

14.3.3. Interventional Cardiology & Radiology

14.3.4. Others

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Specialty Clinics

14.4.3. Ambulatory Surgery Centers

14.4.4. Others (Research Institutes)

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis by Company (2022)

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Test Product Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. B. Braun Melsungen AG

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Test Product Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Boston Scientific Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Test Product Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Teleflex Incorporated

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Test Product Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Terumo Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Test Product Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Merit Medical Systems, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Test Product Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Freudenberg Medical, LLC

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Test Product Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Argon Medical Devices

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Test Product Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Qosina Corp.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Test Product Type Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. DeRoyal Industries

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Test Product Type Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 1: Global Overview of Hemostasis Valves

Table 2: Regional Overview of Hemostasis Valves

Table 3: North America Overview of Hemostasis Valves

Table 4: Asia Pacific Overview of Hemostasis Valves

Table 5: Global Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 6: Global Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: Global Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 8: Global Hemostasis Valves Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 9: North America Hemostasis Valves Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 10: North America Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 11: North America Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 12: North America Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Europe Hemostasis Valves Revenue (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Europe Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 15: Europe Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 16: Europe Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 17: Asia Pacific Hemostasis Valves Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 18: Asia Pacific Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 19: Asia Pacific Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 20: Asia Pacific Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 21: Latin America Hemostasis Valves Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Latin America Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 23: Latin America Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 24: Latin America Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 25: Middle East & Africa Hemostasis Valves Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 26: Middle East & Africa Hemostasis Valves Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 27: Middle East & Africa Hemostasis Valves Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 28: Middle East & Africa Hemostasis Valves Market Value (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Hemostasis Valves Market

Figure 02: Global Hemostasis Valves Market Size (US$ Mn) Forecast, 2017–2031

Figure 03: Market Value Share, by Product Type (2022)

Figure 04: Market Value Share, By Application (2022)

Figure 05: Market Value Share, by End-user (2022)

Figure 06: Market Value Share, by Region (2022)

Figure 07: Global Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 08 Global Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 09: Global Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 10: Global Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 11: Global Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 12: Global Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 13: Global Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 14: Global Hemostasis Valves Market Value Share, by Region, 2023–2031

Figure 15: Global Hemostasis Valves Market Attractiveness, by Region, 2023–2031

Figure 16: North America Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 17: North America Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 18: North America Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 19: North America Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 20: North America Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 21: North America Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 22: North America Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 23: North America Hemostasis Valves Market Value Share, by Country, 2023–2031

Figure 24: North America Hemostasis Valves Market Attractiveness, by Country, 2023–2031

Figure 25: Europe Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 26: Europe Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 27: Europe Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 28: Europe Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 29: Europe Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 30: Europe Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 31: Europe Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 32: Europe Hemostasis Valves Market Value Share, by Country/Sub-Region, 2022–2031

Figure 33: Europe Hemostasis Valves Market Attractiveness, by Country/Sub-Region, 2023–2031

Figure 34: Asia Pacific Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 35: Asia Pacific Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 36: Asia Pacific Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 37: Asia Pacific Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 38: Asia Pacific Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 39: Asia Pacific Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 40: Asia Pacific Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 41: Asia Pacific Hemostasis Valves Market Value Share, by Country/Sub-Region, 2022–2031

Figure 42: Asia Pacific Hemostasis Valves Market Attractiveness, by Country/Sub-Region, 2023–2031

Figure 43: Latin America Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 44: Latin America Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 45: Latin America Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 46: Latin America Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 47: Latin America Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 48: Latin America Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 49: Latin America Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 50: Latin America Hemostasis Valves Market Value Share, by Country/Sub-Region, 2022–2031

Figure 51: Latin America Hemostasis Valves Market Attractiveness, by Country/Sub-Region, 2023–2031

Figure 52: Middle East & Africa Hemostasis Valves Market Value Share, by Product Type, 2022 and 2031

Figure 53: Middle East & Africa Hemostasis Valves Market Attractiveness, by Product Type, 2023–2031

Figure 54: Middle East & Africa Hemostasis Valves Market Value Share, By Application, 2022 and 2031

Figure 55: Middle East & Africa Hemostasis Valves Market Attractiveness, By Application, 2023–2031

Figure 56: Middle East & Africa Hemostasis Valves Market Value Share, by End-user, 2022 and 2031

Figure 57: Middle East & Africa Hemostasis Valves Market Attractiveness, by End-user, 2023–2031

Figure 58: Middle East & Africa Hemostasis Valves Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 59: Middle East & Africa Hemostasis Valves Market Value Share, by Country/Sub-Region, 2022–2031

Figure 60: Middle East & Africa Hemostasis Valves Market Attractiveness, by Country/Sub-Region, 2023–2031

Figure 61: Global Hemostasis Valves Market Share Analysis, by Company, 2022 (Estimated)

Figure 62: Global Hemostasis Valves Market Performance, by Company, 2022

Figure 63: Competition Matrix