Analysts’ Viewpoint

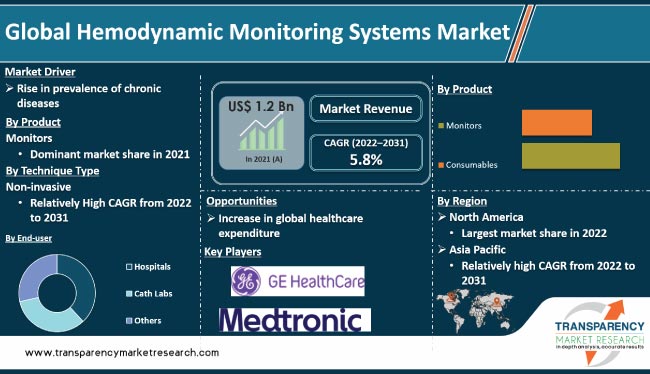

The global hemodynamic monitoring systems market is driven by the increase in demand for advanced monitoring systems, rise in prevalence of chronic diseases, aging population, surge in healthcare expenditure, and growth in awareness about the benefits of hemodynamic monitoring.

Technological advancements in hemodynamic monitoring devices are likely to present significant opportunities for the market. Manufacturers are focusing on developing wireless, non-invasive monitoring systems and the integration of artificial intelligence and machine learning technology in these systems.

The COVID-19 pandemic has accelerated the adoption of telemedicine and remote monitoring. This is expected to drive hemodynamic monitoring system market growth in the next few years. However, high cost of hemodynamic monitoring devices and lack of skilled personnel to operate these devices are likely to restrain market development.

Hemodynamic monitoring systems are medical devices used to measure and monitor various physiological parameters related to the circulatory system such as blood pressure, heart rate, and blood flow. These systems can include invasive and non-invasive methods. They can be used in both inpatient and outpatient settings. Hemodynamic monitoring systems are commonly used in different clinical settings, including critical care, anesthesia, cardiac surgeries, pregnancy, and chronic diseases.

The global hemodynamic monitoring market is driven by the increase in the incidence of chronic diseases, the aging population, and technological advancements in monitoring devices. A rise in awareness about the benefits of hemodynamic monitoring in preventing and managing chronic diseases is anticipated to drive market growth.

The rise in the prevalence of chronic diseases such as cardiovascular disease, hypertension, and diabetes is driving hemodynamic monitoring system market demand, as these devices are used to monitor and manage these conditions.

According to World Health Organization, Global Burden Disease Study 2019, each year, 41 million people succumb to chronic diseases, accounting for 74% of all deaths globally. Of these, cardiovascular diseases cause around 18 million deaths, while chronic respiratory diseases account for nearly 4 million deaths annually.

An increase in the usage of hemodynamic monitoring for chronic diseases is driving the market, as these systems enable continuous monitoring of a patient's cardiovascular status and provide valuable information for the management of chronic diseases such as heart failure and sepsis.

Technological advancements in hemodynamic monitoring systems have led to the development of more advanced, accurate, and non-invasive monitoring devices. In turn, this has improved patient outcomes and efficiency in the healthcare industry.

Non-invasive hemodynamic monitoring devices use sensors placed on the patient's skin to measure blood flow and pressure. These devices have made monitoring safer and more comfortable for patients. It has also reduced the risk of infection.

Integration of artificial intelligence and machine learning algorithms in hemodynamic monitoring systems can analyze data in real time and provide early warning signs of potential complications, enabling healthcare providers to intervene quickly and prevent serious issues. These factors are expected to bolster the global hemodynamic monitoring systems market in the next few years.

An increase in healthcare expenditure attributed to government funding, private insurance, and out-of-pocket expenses, especially in emerging economies, is expected to drive the market.

Emerging markets present hemodynamic monitoring system market opportunities due to the growth in the middle class, increase in healthcare spending, and the large population suffering from chronic diseases. Government initiatives to improve healthcare infrastructure and increase access to healthcare contribute to the growth of the market.

The rise in healthcare expenditure also affects research & development in the field of hemodynamic monitoring systems and leads to the development of more advanced, accurate, and non-invasive monitoring devices, thus augmenting the demand for these systems.

In terms of product, the monitor's segment dominated the global market in 2021. This can be ascribed to the surge in the usage of invasive and non-invasive monitoring systems in hospitals and critical care settings. Monitors provide real-time, accurate, and continuous data on a patient's hemodynamic status, which enables timely and effective treatment.

The development of advanced monitoring technologies, such as wireless and remote monitoring systems, has increased the ease of use and accessibility of hemodynamic monitors. The rise in the adoption of these technologies in developed and developing countries is propelling the monitors segment.

The consumables segment is anticipated to account for a significant hemodynamic monitoring systems market share due to the need for frequent replacement of components such as sensors, catheters, and transducers. The high cost of these components and the need for regular replacement are drives the consumables segment. Additionally, a surge in the number of surgeries and procedures requiring hemodynamic monitoring is bolstering the demand for consumable products in the market.

Based on technique type, the non-invasive segment accounted for the largest share of the global hemodynamic monitoring systems market in 2021. The segment is projected to expand at a high CAGR during the forecast period. These devices are less risky and more comfortable for patients. They reduce the risk of infection and other complications associated with invasive methods.

Technological advancements in non-invasive monitoring systems are also driving the segment, as these systems are now more accurate, reliable, and portable. The increase in the adoption of wireless and remote monitoring technologies has made non-invasive hemodynamic monitoring systems more accessible and convenient to use.

North America is anticipated to dominate the global market from 2022 to 2031. This can be ascribed to a large aging population, a high prevalence of chronic diseases such as hypertension and diabetes, and an increase in the number of surgeries and procedures that require hemodynamic monitoring. Additionally, the presence of well-established healthcare infrastructure and the availability of reimbursement for these systems contribute to market expansion in North America.

Major factors driving the hemodynamic monitoring systems market growth in Asia Pacific are a surge in the incidence of chronic diseases, a rapidly increasing geriatric population, and a rise in the adoption of advanced technologies in healthcare. Expanding healthcare infrastructure and an increase in government support for the development of healthcare systems are expected to propel market progress in the near future. Furthermore, economic growth in countries, such as China and India, is likely to lead to an increase in healthcare spending. In turn, this is expected to accelerate market development in the Asia Pacific.

This report provides profiles of leading players operating in the global hemodynamic monitoring business. These include Koninklijke Philips N.V., ICU Medical, Medtronic, GE HealthCare, Edwards Lifesciences Corporation, Baxter, Biocare Medical, LLC., Uscom, NOGA MEDICAL, Comen, Creative Industry, Dräger, EMTEL Śliwa sp.k., General Meditech, Masimo, Mars Medical Products, UTAS Co., and Vytech.

An increase in mergers & acquisitions, strategic collaborations, and new product launches is expected to drive the global market during the forecast period.

The market report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 1.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 2.2 Bn |

|

Growth Rate (CAGR) 2022-2031 |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.2 Bn in 2021

It is projected to reach more than US$ 2.2 Bn by 2031

The CAGR is anticipated to be 5.8% from 2022 to 2031

The monitors segment accounted for the largest share of more than 50.0% in 2021

North America is expected to account for the leading share during the forecast period

Koninklijke Philips N.V., ICU Medical, Medtronic, GE HealthCare, Edwards Lifesciences Corporation, Baxter, Biocare Medical, LLC, Masimo, Uscom, NOGA MEDICAL, Comen, Creative Industry, Dräger, EMTEL Śliwa sp.k., General Meditech, Mars Medical Products, UTAS Co., and Vytech

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hemodynamic Monitoring Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hemodynamic Monitoring Systems Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Technological Advancements

5.4. Key product/brand Analysis

5.5. Pricing Analysis

5.6. COVID-19 Pandemic Impact on Industry

6. Global Hemodynamic Monitoring Systems Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Monitors

6.3.2. Consumables

6.3.2.1. Pressure Tubing

6.3.2.2. Flush Device

6.3.2.3. Transducers

6.3.2.4. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Hemodynamic Monitoring Systems Market Analysis and Forecast, by Technique Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Technique Type, 2017–2031

7.3.1. Invasive

7.3.2. Non-invasive

7.4. Market Attractiveness Analysis, by Technique Type

8. Global Hemodynamic Monitoring Systems Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Cath Labs

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Hemodynamic Monitoring Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Hemodynamic Monitoring Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Monitors

10.2.2. Consumables

10.2.2.1. Pressure Tubing

10.2.2.2. Flush Device

10.2.2.3. Transducers

10.2.2.4. Others

10.3. Market Value Forecast, by Technique Type, 2017–2031

10.3.1. Invasive

10.3.2. Non-invasive

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Cath Labs

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Technique Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Hemodynamic Monitoring Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Monitors

11.2.2. Consumables

11.2.2.1. Pressure Tubing

11.2.2.2. Flush Device

11.2.2.3. Transducers

11.2.2.4. Others

11.3. Market Value Forecast, by Technique Type, 2017–2031

11.3.1. Invasive

11.3.2. Non-invasive

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Cath Labs

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Technique Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Hemodynamic Monitoring Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Monitors

12.2.2. Consumables

12.2.2.1. Pressure Tubing

12.2.2.2. Flush Device

12.2.2.3. Transducers

12.2.2.4. Others

12.3. Market Value Forecast, by Technique Type, 2017–2031

12.3.1. Invasive

12.3.2. Non-invasive

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Cath Labs

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Technique Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Hemodynamic Monitoring Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Monitors

13.2.2. Consumables

13.2.2.1. Pressure Tubing

13.2.2.2. Flush Device

13.2.2.3. Transducers

13.2.2.4. Others

13.3. Market Value Forecast, by Technique Type, 2017–2031

13.3.1. Invasive

13.3.2. Non-invasive

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Cath Labs

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Technique Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Hemodynamic Monitoring Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Monitors

14.2.2. Consumables

14.2.2.1. Pressure Tubing

14.2.2.2. Flush Device

14.2.2.3. Transducers

14.2.2.4. Others

14.3. Market Value Forecast, by Technique Type, 2017–2031

14.3.1. Invasive

14.3.2. Non-invasive

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Cath Labs

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Technique Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Koninklijke Philips N.V.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. ICU Medical

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Medtronic

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. GE HealthCare

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Edwards Lifesciences Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Baxter

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Biocare Medical, LLC.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Uscom

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. NOGA MEDICAL

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Type Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Comen

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Type Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Creative Industry

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Type Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Dräger

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Type Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. EMTEL Śliwa sp.k.

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Type Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. General Meditech

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Type Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

15.3.15. Mars Medical Products

15.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.15.2. Product Type Portfolio

15.3.15.3. Financial Overview

15.3.15.4. SWOT Analysis

15.3.15.5. Strategic Overview

15.3.16. UTAS Co.

15.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.16.2. Product Type Portfolio

15.3.16.3. Financial Overview

15.3.16.4. SWOT Analysis

15.3.16.5. Strategic Overview

15.3.17. Vytech

15.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.17.2. Product Type Portfolio

15.3.17.3. Financial Overview

15.3.17.4. SWOT Analysis

15.3.18. Masimo

15.3.18.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.18.2. Product Type Portfolio

15.3.18.3. Financial Overview

15.3.18.4. SWOT Analysis

15.3.18.5. Strategic Overview

List of Tables

Table 01: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 03: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 04: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 08: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 09: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 11: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 13: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 14: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 17: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 18: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 19: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 23: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 24: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Consumables, 2017–2031

Table 28: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Technique Type, 2017–2031

Table 29: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 03: Global Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 04: Global Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 05: Global Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 06: Global Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 07: Global Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 08: Global Hemodynamic Monitoring Systems Market Value Share Analysis, by Region, 2021 and 2031

Figure 09: Global Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Region, 2022–2031

Figure 10: North America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 12: North America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 13: North America Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 14: North America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 15: North America Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: North America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: North America Hemodynamic Monitoring Systems Market Value Share Analysis, by Country, 2021 and 2031

Figure 18: North America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: Europe Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 21: Europe Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 22: Europe Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 23: Europe Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 24: Europe Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 25: Europe Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 26: Europe Hemodynamic Monitoring Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Asia Pacific Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 30: Asia Pacific Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 31: Asia Pacific Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 32: Asia Pacific Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 33: Asia Pacific Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Asia Pacific Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Hemodynamic Monitoring Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 39: Latin America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 40: Latin America Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 41: Latin America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 42: Latin America Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Latin America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Latin America Hemodynamic Monitoring Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Middle East & Africa Hemodynamic Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Hemodynamic Monitoring Systems Market Value Share Analysis, by Product, 2021 and 2031

Figure 48: Middle East & Africa Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Product, 2022–2031

Figure 49: Middle East & Africa Hemodynamic Monitoring Systems Market Value Share Analysis, by Technique Type, 2021 and 2031

Figure 50: Middle East & Africa Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Technique Type, 2022–2031

Figure 51: Middle East & Africa Hemodynamic Monitoring Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Middle East & Africa Hemodynamic Monitoring Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Middle East & Africa Hemodynamic Monitoring Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Hemodynamic Monitoring Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Global Hemodynamic Monitoring Systems Market Share Analysis, by Company, 2021