Analyst Viewpoint

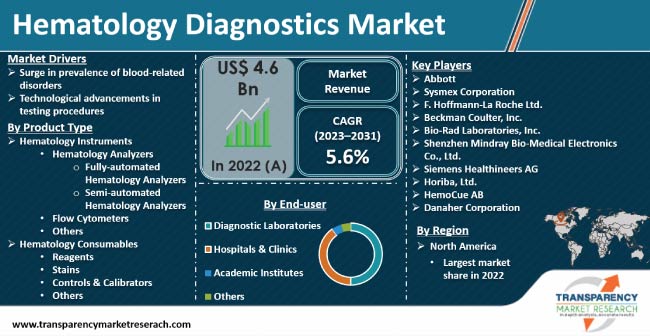

Surge in prevalence of blood-related disorders and technological advancements in testing procedures are propelling the hematology diagnostics market size. Fully automated laboratory hematology analyzers are gaining traction among end-users as they offer streamlined workflows, increased efficiency, and enhanced accuracy in blood analysis.

Governments in various countries are investing in the development of healthcare infrastructure, thereby offering lucrative hematology diagnostics market opportunities to vendors. Comprehensive and user-friendly platforms along with advanced hematology diagnostic tests are gaining popularity among end-users. Vendors are addressing the varied demands of healthcare professionals, fostering long-term relationships, and establishing a strong market position.

Hematology is defined as the diagnostic classification of blood cells and the subsequent identification of blood-forming organ and blood disease abnormalities. The numbers of WBC, RBC, and platelets are all computed. The study of hematologic diseases involves disease monitoring, prognosis, diagnosis, and screening.

Hematology testing devices have made significant strides in their evolution, progressing from diagnosing and monitoring illnesses to conducting blood cell examinations and counts. Automation has further advanced to detect microscopic cell populations in order to diagnose rare blood illnesses. The use of automation has led to a decline in the need for labor and the availability of faster results.

Automation of the hematological assessment procedure has been achieved through various technological approaches, including electrical impedance, flow cytometry, and fluorescence flow, enabling more efficient and accurate blood cell analysis. The convergence of these technologies has increased test yield and productivity in the global hematology diagnostics industry. The number of tests performed or test volume is predicted to increase due to technological advancements in disease detection. This, in turn, is propelling the hematology diagnostics market progress.

Rise in awareness regarding blood-related disorders is boosting demand for specialized hematology lab services. According to the Leukemia & Lymphoma Society, in the U.S., one person is diagnosed with blood cancer every three minutes. Over 173,000 people in the country were expected to be diagnosed with leukemia, lymphoma, or myeloma by 2022. Leukemia, lymphoma, and myeloma were projected to account for more than 10.2% of the 1.7 million new cancer cases diagnosed In the U.S. in 2022. Over 1.3 million people in the country are estimated to have leukemia, lymphoma, or myeloma, or to be in remission.

Rise in cases of various blood disorders, such as anemia, thalassemia, and hemophilia, is augmenting the hematology diagnostics market value. According to National Institutes of Health (NIH), anemia affects around 29% of women and 38% of pregnant women each year. Furthermore, hematologic tests can now identify diabetes, hypotension, and hypoglycemia, all of which are marked by elevated blood glucose levels. This makes them increasingly popular in diabetic-heavy countries.

The blood transferrin receptor test, which was developed recently, allows for more accurate blood analysis for the determination of iron levels in the patient population. Serum ferritin, a 480 kDa multisubunit protein, represents the body's iron storage pool. A drop in serum ferritin level frequently indicates that iron stores have been exhausted. Iron deficiency anemia has become easily distinguishable from chronic disease anemia using serum transferrin receptor testing. Upon comparison to earlier diagnostic approaches, this technology has made hematology diagnostics more accessible and economical.

A newly discovered strain of human herpesvirus has been outlined to play a crucial role in myeloma, a cancer of the cell plasma. Additional thrombotic risk factors have also been identified, leading to more accurate diagnoses. Factor V and prothrombin gene mutations, and hyperhomocysteinaemia are all classified as crucial risk factors. Modern DNA probe arrays can also potentially allow rapid automated detection of mutations. Antisense therapy, ribozyme technology, and other cutting-edge hematology diagnostic techniques have also been developed in the market. Such developments are expected to spur the hematology diagnostics market growth in the near future.

According to the latest hematology diagnostics market forecast, North America is expected to hold largest share from 2023 to 2031. High prevalence of blood-related diseases is fueling the market dynamics of the region. According to The Centers for Disease Control and Prevention (CDC), Sickle Cell Disease (SCD) affects approximately 100,000 people in the U.S. SCD occurs among about 1 out of every 365 Black or African-American births.

The industry in Asia Pacific is projected to grow at the fastest rate during the forecast period. Hemoglobinopathies are the most common genetic disorders among people living in Southeast Asia. In Eastern Asia, alfa and beta thalassemia cases are rather common. Thus, rise in cases of hemoglobinopathies is driving the market statistics in Asia Pacific.

Major hematology diagnostics companies are embracing automation and advanced technologies, such as artificial intelligence and machine learning, to improve the efficiency and accuracy of hematological diagnostics. They are also collaborating with healthcare institutions, research organizations, and industry stakeholders to increase their hematology diagnostics market share.

Abbott, Sysmex Corporation, F. Hoffmann-La Roche Ltd., Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Siemens Healthineers AG, Horiba, Ltd., HemoCue AB, and Danaher Corporation are key entities operating in this market.

Each of these players has been profiled in the hematology diagnostics market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.6 Bn |

| Market Forecast Value in 2031 | US$ 7.6 Bn |

| Growth Rate (CAGR) | 5.6% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentatio |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 4.6 Bn in 2022

It is projected to grow at a CAGR of 5.6% from 2023 to 2031

Surge in prevalence of blood-related disorders and technological advancements in testing procedures

The diagnostic laboratories end-user segment held largest share in 2022

North America held largest share in 2022

Abbott, Sysmex Corporation, F. Hoffmann-La Roche Ltd., Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Siemens Healthineers AG, Horiba, Ltd., HemoCue AB, and Danaher Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hematology Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hematology Diagnostics Market Analysis and Forecast, 2023–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Hematology Diagnostics Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2023–2031

6.3.1. Hematology Instruments

6.3.1.1. Hematology Analyzers

6.3.1.1.1. Fully-automated Hematology Analyzers

6.3.1.1.2. Semi-automated Hematology Analyzers

6.3.1.2. Flow Cytometers

6.3.1.3. Others

6.3.2. Hematology Consumables

6.3.2.1. Reagents

6.3.2.2. Stains

6.3.2.3. Controls & Calibrators

6.3.2.4. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Hematology Diagnostics Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2023–2031

7.3.1. Diagnostic Laboratories

7.3.2. Hospitals & Clinics

7.3.3. Academic Institutes

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Hematology Diagnostics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Hematology Diagnostics Market Analysis and Forecast

9.1. Introduction

9.2. Key Findings

9.3. Market Value Forecast, by Product Type, 2023–2031

9.3.1. Hematology Instruments

9.3.1.1. Hematology Analyzers

9.3.1.1.1. Fully-automated Hematology Analyzers

9.3.1.1.2. Semi-automated Hematology Analyzers

9.3.1.2. Flow Cytometers

9.3.1.3. Others

9.3.2. Hematology Consumables

9.3.2.1. Reagents

9.3.2.2. Stains

9.3.2.3. Controls & Calibrators

9.3.2.4. Others

9.4. Market Value Forecast, by End-user, 2023–2031

9.4.1. Diagnostic Laboratories

9.4.2. Hospitals & Clinics

9.4.3. Academic Institutes

9.5. Market Value Forecast, by Country, 2023–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By End-user

9.6.3. By Country

10. Europe Hematology Diagnostics Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product Type, 2023–2031

10.3.1. Hematology Instruments

10.3.1.1. Hematology Analyzers

10.3.1.1.1. Fully-automated Hematology Analyzers

10.3.1.1.2. Semi-automated Hematology Analyzers

10.3.1.2. Flow Cytometers

10.3.1.3. Others

10.3.2. Hematology Consumables

10.3.2.1. Reagents

10.3.2.2. Stains

10.3.2.3. Controls & Calibrators

10.3.2.4. Others

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Diagnostic Laboratories

10.4.2. Hospitals & Clinics

10.4.3. Academic Institutes

10.4.4. Others

10.5. Market Value Forecast, by Country/Sub-region, 2023–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Asia Pacific Hematology Diagnostics Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product Type, 2023–2031

11.3.1. Hematology Instruments

11.3.1.1. Hematology Analyzers

11.3.1.1.1. Fully-automated Hematology Analyzers

11.3.1.1.2. Semi-automated Hematology Analyzers

11.3.1.2. Flow Cytometers

11.3.1.3. Others

11.3.2. Hematology Consumables

11.3.2.1. Reagents

11.3.2.2. Stains

11.3.2.3. Controls & Calibrators

11.3.2.4. Others

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Diagnostic Laboratories

11.4.2. Hospitals & Clinics

11.4.3. Academic Institutes

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. Latin America Hematology Diagnostics Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product Type, 2023–2031

12.3.1. Hematology Instruments

12.3.1.1. Hematology Analyzers

12.3.1.1.1. Fully-automated Hematology Analyzers

12.3.1.1.2. Semi-automated Hematology Analyzers

12.3.1.2. Flow Cytometers

12.3.1.3. Others

12.3.2. Hematology Consumables

12.3.2.1. Reagents

12.3.2.2. Stains

12.3.2.3. Controls & Calibrators

12.3.2.4. Others

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Diagnostic Laboratories

12.4.2. Hospitals & Clinics

12.4.3. Academic Institutes

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Middle East & Africa Hematology Diagnostics Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product Type, 2023–2031

13.3.1. Hematology Instruments

13.3.1.1. Hematology Analyzers

13.3.1.1.1. Fully-automated Hematology Analyzers

13.3.1.1.2. Semi-automated Hematology Analyzers

13.3.1.2. Flow Cytometers

13.3.1.3. Others

13.3.2. Hematology Consumables

13.3.2.1. Reagents

13.3.2.2. Stains

13.3.2.3. Controls & Calibrators

13.3.2.4. Others

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Diagnostic Laboratories

13.4.2. Hospitals & Clinics

13.4.3. Academic Institutes

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By End-user

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Abbott

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. Sysmex Corporation

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. F. Hoffmann-La Roche Ltd.

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. Beckman Coulter, Inc.

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Bio-Rad Laboratories, Inc.

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Overview

14.3.6.5. Strategic Overview

14.3.7. Siemens Healthineers AG

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Overview

14.3.7.5. Strategic Overview

14.3.8. Horiba, Ltd.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Financial Overview

14.3.8.5. Strategic Overview

14.3.9. HemoCue AB

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Financial Overview

14.3.9.5. Strategic Overview

14.3.10. Danaher Corporation

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Financial Overview

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 02: Global Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 03: Global Hematology Diagnostics Market Size (US$ Mn) Forecast, by Region, 2023–2031

Table 04: North America Hematology Diagnostics Market Size (US$ Mn) Forecast, by Country, 2023–2031

Table 05: North America Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 06: North America Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 07: Europe Hematology Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 8: Europe Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 9: Europe Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 10: Asia Pacific Hematology Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 11: Asia Pacific Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 12: Asia Pacific Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Latin America Hematology Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Latin America Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 15: Latin America Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Middle East & Africa Hematology Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Middle East & Africa Hematology Diagnostics Market Size (US$ Mn) Forecast, by Product Type, 2023–2031

Table 18: Middle East & Africa Hematology Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Hematology Diagnostics Market Size (US$ Mn) and Distribution (%), by Region, 2023 and 2031

Figure 02: Global Hematology Diagnostics Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Hematology Diagnostics Market Value Share, by Product Type, 2022

Figure 04: Global Hematology Diagnostics Market Revenue (US$ Mn), by End-user, 2022

Figure 05: Global Hematology Diagnostics Market Value Share, by End-user, 2022

Figure 06: Global Hematology Diagnostics Market Value Share, by Region, 2022

Figure 07: Global Hematology Diagnostics Market Value (US$ Mn) Forecast, 2023–2031

Figure 8: Global Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 9: Global Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 10: Global Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 11: Global Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022-2031

Figure 12: Global Hematology Diagnostics Market Value Share Analysis, by Region, 2023 and 2031

Figure 13: Global Hematology Diagnostics Market Attractiveness Analysis, by Region, 2022-2031

Figure 14: North America Hematology Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 15: North America Hematology Diagnostics Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Hematology Diagnostics Market Value Share Analysis, by Country, 2023 and 2031

Figure 17: North America Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 18: North America Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 19: North America Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 20: North America Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 21: Europe Hematology Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 22: Europe Hematology Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 23: Europe Hematology Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 24: Europe Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 25: Europe Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 26: Europe Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 27: Europe Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 28: Asia Pacific Hematology Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 29: Asia Pacific Hematology Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Asia Pacific Hematology Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 31: Asia Pacific Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 32: Asia Pacific Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 33: Asia Pacific Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 34: Asia Pacific Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Latin America Hematology Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 36: Latin America Hematology Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Hematology Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 38: Latin America Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 39: Latin America Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 40: Latin America Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 41: Latin America Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 42: Middle East & Africa Hematology Diagnostics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 43: Middle East & Africa Hematology Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Middle East & Africa Hematology Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 45: Middle East & Africa Hematology Diagnostics Market Value Share Analysis, by Product Type, 2023 and 2031

Figure 46: Middle East & Africa Hematology Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 47: Middle East & Africa Hematology Diagnostics Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 48: Middle East & Africa Hematology Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031