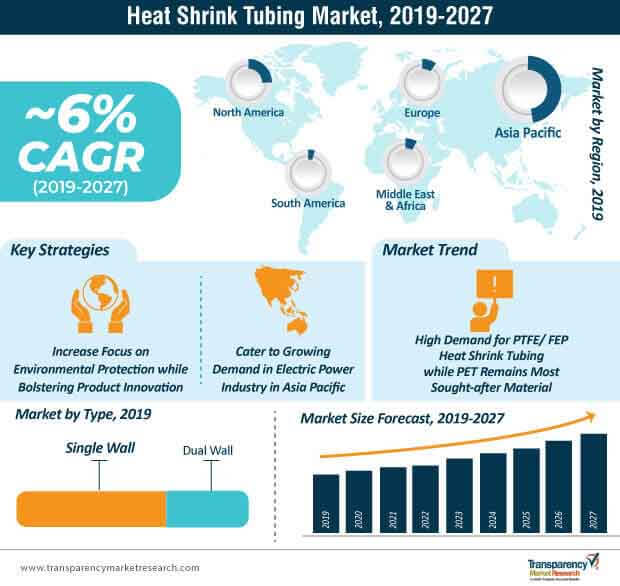

The wide-ranging applications of heat shrink tubes in versatile industrial landscapes, such as aerospace, electrical & electronics, and construction, have been bolstering their demand since the past five years. After surpassing the US$ 1.5 billion mark in 2018, the heat shrink tubing market has entered a new era of technological innovations in catheters with multiple capabilities. In addition, the adoption of advanced technologies such as peelable heat shrink tubing (PHST), to improve catheter performance in heat shrink tubes, is opening up new horizons of innovation in this market.

One of the most popular and recent examples includes the Junkosha’s 2.5:1 PHST solution, which has been touted to have the best shrink ratio. Pioneered by Japanese Conglomerate – Junkosha – with its subsidiaries in the U.S., China, and the U.K., this unique trend will allow manufacturers and key market players the ability to lower their costs in the medical industry, thus boosting the growth of heat shrink tubing market within this sector.

Additionally, catheter manufacturers can avail of baseline materials that are more cost-effective, thus enhancing their revenue margins. This paves the way for a plethora of re-investment opportunities in the coming years, especially at a time when capital cost is a critical metric for various industrial areas. Furthermore, investments in such innovations could additionally boost revenues, boosting the heat shrink tubing market to reach ~US$ 2.7 billion by 2027.

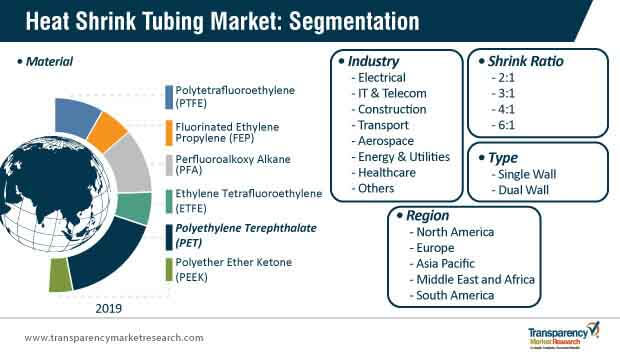

Though the demand for Polytetrafluoroethylene (PTFE) and Fluorinated Ethylene Propylene (FEP) is growing rapidly in the heat shrink tubing market, Polyethylene Terephthalate (PET) is likely to continue to remain the sought-after choice for manufacturing, owing to its superior mechanical properties, including high temperature resistance capacity, and high resistance to UV light, chemicals, and solvents.

In 2018, PET accounted for ~one-third revenue share of the heat shrink tubing market, and its growing adoption in the electrical & electronics industry, due to its high dielectric strength, will continue to foster its sales in the heat shrink tubing market. The ever-expanding range of the applications of PET heat shrink tubes is expected to support the growth of the market, creating new sales opportunities for manufacturers.

In the coming years, the utilization of heat shrink tubes in electrical and IT & telecom industries will reach new heights. Massive innovations are being spearheaded in this sector towards the security of telecommunication and data centers. Cable assemblies can be dressed with heat shrink tubing, giving IT and telecom engineers options for the routing and management of complex cable systems. A rise in the demand for sealing and insulation for the protection of wires in telecommunication connectors will continue to drive the industry.

In 2018, Asia Pacific held nearly half the revenue share of the heat shrink tubing market, with most emerging manufacturers and key industry leaders in the region heavily banking on the need for protecting outdated and aging electrical infrastructure with heat shrink tubes. The need for heat shrink tubing kits in this region is not only directed towards enhanced protection and insulation, but also reflects in the demand for relief against strains and environmental sealing. The heightened demand for heat shrink tubing will further be compounded in Asia Pacific, as the consumption of electricity in this region is high due to its developing economy.

Technological developments are propelling the introduction of insulation materials for the protection of superior cable wires in high voltage electrical infrastructure, thus creating growth opportunities for the heat shrink tubing market. Asia Pacific is seeing innovations in thick wall, flame retardant, low voltage, and halogen-free heat shrink tubing solutions, which will continue to drive the heat shrink tubing industry.

Developed economies such as North America continue to receive a barrage of regulatory enforcement directives in the heat shrink tubing market. The Nuclear Regulatory Commission has formulated stringent instructions regarding the proper usage of heat shrink tubes used in nuclear power reactor facilities. The improper installation of heat shrink tubes over electric splices and terminations could pose a nuclear radiation risk. The strict enforcement of such guidelines could deter key market players from making massive investments in heat shrink tubing, especially in the nuclear power industry.

The cold shrink tubing market competes with the heat shrink tubing market, and this could restrain its growth. Cold shrink tubing has greater UV resistance, making it a more appealing substitute in some industrial sectors. In cold shrink tubing, no hot work or direct flame is required to install components. Hot work permits and stringent regulations are not required, and the reliability of cold shrink tubing is guaranteed due to less complicated techniques. This leads to massive time and cost savings, making it a more preferred substitute for key manufacturers, thus restraining the growth of the heat shrink tubing market.

TE Connectivity Ltd, a Swiss conglomerate, is one of the leading players in the landscape of heat shrink tubing. With an impressive revenue of US$ 134 billion in 2018, strategies behind its stupendous growth mainly revolved around massive funding for research & development activities, and garnering intellectual property rights and patents in the manufacture of electrical and electronic products using heat shrink tubing. Having proprietary rights and being able to track infringements have given it an edge over its competitors, paving the way for its undisputed growth in the heat shrink tubing market.

Pexco LLC is another prominent market player - a specialty plastics extruder using the heat shrink tubing technology. As a part of its strategic growth plan, it recently acquired American Extruded Plastics (AEP) and American Injection Molding (AIM). Pexco acquired AEP as it had expanded into injection molding. The usage of heat shrink tubing in molded plastics has not only added to its core competencies but has also broadened Pexco’s global standing and value proposition by allowing it to provide customized solutions to its clients. These new acquisitions will also flourish under Pexco, which bodes well for its expansion in the market of heat shrink tubing.

In the same breath, Shawcor Ltd, a Canadian giant, is following the same merger and acquisition strategy with companies, which complements it and adds to its revenue base. Furthermore, it is also making large-scale investments to increase profitability. Thus, it can be seen that, key industrial leaders are using acquisitions, mergers, and strategic collaborations to access knowledge, expertise, and capital, which is propelling their growth in the heat shrink tubing industry.

Analysts’ Perspective

A comprehensive view of the heat shrink tubing market has led our analysts to conclude that, the market is growing at a moderately-fast rate, with Asia Pacific being the leading market for heat shrink tubing uses and applications. The rising usage of heat shrink tubing in diverse fields such as healthcare, electrical, transport, and construction, and their usage in the aerospace & defence industries, is spurring its demand. The impact of the heat shrink tubing market will remain high in developing economies in the Asia Pacific region, where electricity consumption is high and large-scale infrastructural projects are being undertaken to revamp outdated electrical supply facilities. The demand for heat shrink tubing is also seen in applications that require a high degree of environmental protection from corrosive elements, abrasion, and extreme temperatures.

Technological breakthroughs such as the automation of heat shrink tubing manufacturing processes could provide timely succour as a cost-effective and time-saving strategy, thereby increasing the profit margins of market players. Companies with investment capabilities, and merger and acquisition strategies, will gather momentum and profitability in the heat shrink tubing market. Leading players who are leveraging technology will continue to grow exponentially and have a vast market revenue share. However, tight regulations, stringent usage policies, and the attractiveness of substitutes such as cold shrink tubing could restrain the growth of the market.

Heat Shrink Tubing Market in Brief

Heat Shrink Tubing Market: Definition

Asia Pacific Heat Shrink Tubing Market – Snapshot

Key Challenges Faced by Heat Shrink Tubing Market Players

Heat Shrink Tubing Market - Company Profiles

The total volume of revenues within the global Heat Shrink Tubing market is projected to cross US$ 2.7 billion by 2027.

The Heat Shrink Tubing market revenue is projected to register a CAGR of 6% during the forecast period 2018 - 2026.

Heat Shrink Tubing market is projected to be driven by increasing investments in infrastructure and growing demand for energy, also the increasing need for the repair & maintenance of existing networks is also driving the heat shrink tubing market.

Companies such as Shawcor Ltd., Changyuan Group Ltd., Panduit Corp., Pexco LLC, Techflex, Inc., Zeus Industrial Products, Inc., Taiwan Yun Lin Electronic Co Ltd. are the leaders in Heat Shrink Tubing industry.

Asia Pacific is expected to see the highest opportunity addition in the heat shrink tubing market, where the increasing demand for electrical products and services is a factor driving the heat shrink tubing market.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Heat Shrink Tubing Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Ecosystem Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Regulations and Policies

4.5. Global Heat Shrink Tubing Market Analysis and Forecast, 2017 - 2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2013-2018

4.5.1.2. Forecast Trends, 2019-2027

4.5.2. Pricing Analysis

4.6. Market Opportunity Assessment– By Region (Global/ North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Type

4.6.2. By Material

4.6.3. By Industry

4.7. Competitive Scenario and Trends

4.7.1. Heat Shrink Tubing Market Concentration Rate

4.7.1.1. List of Emerging, Prominent and Leading Players

4.7.2. Mergers & Acquisitions, Expansions

4.8. Market Outlook

5. Global Heat Shrink Tubing Market Analysis and Forecast, by Type

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

5.3.1. Single Wall

5.3.2. Dual Wall

6. Global Heat Shrink Tubing Market Analysis and Forecast, by Material

6.1. Overview

6.2. Key Segment Analysis

6.3. Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

6.3.1. Polytetrafluoroethylene (PTFE)

6.3.2. Fluorinated ethylene propylene (FPE)

6.3.3. Perfluoroalkoxy alkane (PFA)

6.3.4. Ethylene Tetrafluoroethylene (ETFE)

6.3.5. Polyethylene Terephthalate (PET)

6.3.6. Polyether Ether Ketone (PEEK)

7. Global Heat Shrink Tubing Market Analysis and Forecast, by Shrink Ratio

7.1. Overview

7.2. Key Segment Analysis

7.3. Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

7.3.1. 2:1

7.3.2. 3:1

7.3.3. 4:1

7.3.4. 6:1

8. Global Heat Shrink Tubing Market Analysis and Forecast, by Industry

8.1. Overview

8.2. Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

8.2.1. Electrical

8.2.1.1. Electrical Equipment Manufacturing

8.2.1.2. Electrical construction & Repair

8.2.2. IT & Telecom

8.2.3. Construction

8.2.3.1. Residential

8.2.3.2. Commercial

8.2.4. Transport

8.2.4.1. Railway

8.2.4.2. Trucks, Bus & Off Road

8.2.5. Aerospace

8.2.6. Energy & Utilities

8.2.7. Healthcare

8.2.8. Others (Data Center, Automotive, Oil & Gas)

9. Global Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.1. Key Findings

9.2. Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Heat Shrink Tubing Market Analysis and Forecast

10.1. Key Findings

10.2. Impact Analysis of Drivers and Restraints

10.3. North America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

10.3.1. Single Wall

10.3.2. Dual Wall

10.4. North America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

10.4.1. Polytetrafluoroethylene (PTFE)

10.4.2. Fluorinated ethylene propylene (FPE)

10.4.3. Perfluoroalkoxy alkane (PFA)

10.4.4. Ethylene Tetrafluoroethylene (ETFE)

10.4.5. Polyethylene Terephthalate (PET)

10.4.6. Polyether Ether Ketone (PEEK)

10.5. North America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

10.5.1. 2:1

10.5.2. 3:1

10.5.3. 4:1

10.5.4. 6:1

10.6. North America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

10.6.1. Electrical

10.6.1.1. Electrical Equipment Manufacturing

10.6.1.2. Electrical construction & Repair

10.6.2. IT & Telecom

10.6.3. Construction

10.6.3.1. Residential

10.6.3.2. Commercial

10.6.4. Transport

10.6.4.1. Railway

10.6.4.2. Trucks, Bus & Off Road

10.6.5. Aerospace

10.6.6. Energy & Utilities

10.6.7. Healthcare

10.6.8. Others (Data Center, Automotive, Oil & Gas)

10.7. North America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

11. Europe Heat Shrink Tubing Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers and Restraints

11.3. Europe Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

11.3.1. Single Wall

11.3.2. Dual Wall

11.4. Europe Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

11.4.1. Polytetrafluoroethylene (PTFE)

11.4.2. Fluorinated ethylene propylene (FPE)

11.4.3. Perfluoroalkoxy alkane (PFA)

11.4.4. Ethylene Tetrafluoroethylene (ETFE)

11.4.5. Polyethylene Terephthalate (PET)

11.4.6. Polyether Ether Ketone (PEEK)

11.5. Europe Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

11.5.1. 2:1

11.5.2. 3:1

11.5.3. 4:1

11.5.4. 6:1

11.6. Europe Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

11.6.1. Electrical

11.6.1.1. Electrical Equipment Manufacturing

11.6.1.2. Electrical construction & Repair

11.6.2. IT & Telecom

11.6.3. Construction

11.6.3.1. Residential

11.6.3.2. Commercial

11.6.4. Transport

11.6.4.1. Railway

11.6.4.2. Trucks, Bus & Off Road

11.6.5. Aerospace

11.6.6. Energy & Utilities

11.6.7. Healthcare

11.6.8. Others (Data Center, Automotive, Oil & Gas)

11.7. Europe Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Rest of Europe

12. Asia Pacific Heat Shrink Tubing Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Asia Pacific Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

12.3.1. Single Wall

12.3.2. Dual Wall

12.4. Asia Pacific Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

12.4.1. Polytetrafluoroethylene (PTFE)

12.4.2. Fluorinated ethylene propylene (FPE)

12.4.3. Perfluoroalkoxy alkane (PFA)

12.4.4. Ethylene Tetrafluoroethylene (ETFE)

12.4.5. Polyethylene Terephthalate (PET)

12.4.6. Polyether Ether Ketone (PEEK)

12.5. Asia Pacific Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

12.5.1. 2:1

12.5.2. 3:1

12.5.3. 4:1

12.5.4. 6:1

12.6. Asia Pacific Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

12.6.1. Electrical

12.6.1.1. Electrical Equipment Manufacturing

12.6.1.2. Electrical construction & Repair

12.6.2. IT & Telecom

12.6.3. Construction

12.6.3.1. Residential

12.6.3.2. Commercial

12.6.4. Transport

12.6.4.1. Railway

12.6.4.2. Trucks, Bus & Off Road

12.6.5. Aerospace

12.6.6. Energy & Utilities

12.6.7. Healthcare

12.6.8. Others (Data Center, Automotive, Oil & Gas)

12.7. Asia Pacific Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. Rest of Asia Pacific

13. Middle East & Africa (MEA) Heat Shrink Tubing Market Analysis and Forecast

13.1. Key Findings

13.2. Impact Analysis of Drivers and Restraints

13.3. Middle East and Africa (MEA) Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

13.3.1. Single Wall

13.3.2. Dual Wall

13.4. Middle East and Africa (MEA) Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

13.4.1. Polytetrafluoroethylene (PTFE)

13.4.2. Fluorinated ethylene propylene (FPE)

13.4.3. Perfluoroalkoxy alkane (PFA)

13.4.4. Ethylene Tetrafluoroethylene (ETFE)

13.4.5. Polyethylene Terephthalate (PET)

13.4.6. Polyether Ether Ketone (PEEK)

13.5. Middle East and Africa (MEA) Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

13.5.1. 2:1

13.5.2. 3:1

13.5.3. 4:1

13.5.4. 6:1

13.6. Middle East and Africa (MEA) Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

13.6.1. Electrical

13.6.1.1. Electrical Equipment Manufacturing

13.6.1.2. Electrical construction & Repair

13.6.2. IT & Telecom

13.6.3. Construction

13.6.3.1. Residential

13.6.3.2. Commercial

13.6.4. Transport

13.6.4.1. Railway

13.6.4.2. Trucks, Bus & Off Road

13.6.5. Aerospace

13.6.6. Energy & Utilities

13.6.7. Healthcare

13.6.8. Others (Data Center, Automotive, Oil & Gas)

13.7. Middle East and Africa (MEA) Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of MEA

14. South America Heat Shrink Tubing Market Analysis and Forecast

14.1. Key Findings

14.2. Impact Analysis of Drivers and Restraints

14.3. South America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Type, 2017 – 2027

14.3.1. Single Wall

14.3.2. Dual Wall

14.4. South America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Material, 2017 – 2027

14.4.1. Polytetrafluoroethylene (PTFE)

14.4.2. Fluorinated ethylene propylene (FPE)

14.4.3. Perfluoroalkoxy alkane (PFA)

14.4.4. Ethylene Tetrafluoroethylene (ETFE)

14.4.5. Polyethylene Terephthalate (PET)

14.4.6. Polyether Ether Ketone (PEEK)

14.5. South America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Shrink Ratio, 2017 – 2027

14.5.1. 2:1

14.5.2. 3:1

14.5.3. 4:1

14.5.4. 6:1

14.6. South America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Industry, 2017 – 2027

14.6.1. Electrical

14.6.1.1. Electrical Equipment Manufacturing

14.6.1.2. Electrical construction & Repair

14.6.2. IT & Telecom

14.6.3. Construction

14.6.3.1. Residential

14.6.3.2. Commercial

14.6.4. Transport

14.6.4.1. Railway

14.6.4.2. Trucks, Bus & Off Road

14.6.5. Aerospace

14.6.6. Energy & Utilities

14.6.7. Healthcare

14.6.8. Others (Data Center, Automotive, Oil & Gas)

14.7. South America Heat Shrink Tubing Market Size (US$ Mn) Forecast, by Country & Sub-region , 2017 - 2027

14.7.1. Brazil

14.7.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Positioning of Key Players (2018)

15.3. Regional Presence (Intensity Map)

16. Company Profiles

16.1. 3M Company

16.1.1. Business Overview

16.1.2. Sales Area/ Geographical Presence

16.1.3. Key Competitors

16.1.4. Revenue

16.1.5. Strategy

16.2. Changyuan Group, Ltd.

16.2.1. Business Overview

16.2.2. Sales Area/ Geographical Presence

16.2.3. Key Competitors

16.2.4. Revenue

16.2.5. Strategy

16.3. HellermannTyton

16.3.1. Business Overview

16.3.2. Sales Area/ Geographical Presence

16.3.3. Key Competitors

16.3.4. Revenue

16.3.5. Strategy

16.4. Panduit

16.4.1. Business Overview

16.4.2. Sales Area/ Geographical Presence

16.4.3. Key Competitors

16.4.4. Revenue

16.4.5. Strategy

16.5. Pexco LLC

16.5.1. Business Overview

16.5.2. Sales Area/ Geographical Presence

16.5.3. Key Competitors

16.5.4. Revenue

16.5.5. Strategy

16.6. SHAWCOR

16.6.1. Business Overview

16.6.2. Sales Area/ Geographical Presence

16.6.3. Key Competitors

16.6.4. Revenue

16.6.5. Strategy

16.7. Sumitomo Electric Industries, Ltd.

16.7.1. Business Overview

16.7.2. Sales Area/ Geographical Presence

16.7.3. Key Competitors

16.7.4. Revenue

16.7.5. Strategy

16.8. Taiwan Yun Lin Electronic Co., Ltd

16.8.1. Business Overview

16.8.2. Sales Area/ Geographical Presence

16.8.3. Key Competitors

16.8.4. Revenue

16.8.5. Strategy

16.9. TE Connectivity Ltd.

16.9.1. Business Overview

16.9.2. Sales Area/ Geographical Presence

16.9.3. Key Competitors

16.9.4. Revenue

16.9.5. Strategy

16.10. Techflex, Inc

16.10.1. Business Overview

16.10.2. Sales Area/ Geographical Presence

16.10.3. Key Competitors

16.10.4. Revenue

16.10.5. Strategy

16.11. Zeus Industrial Products, Inc.

16.11.1. Business Overview

16.11.2. Sales Area/ Geographical Presence

16.11.3. Key Competitors

16.11.4. Revenue

16.11.5. Strategy

17. Key Takeaways

List of Tables

Table No 1: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 2: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 3: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 4a: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 4b: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 5: Global Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table No 6: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 7: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 8: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 9a: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 9b: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 10: North America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table No 11: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 12: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 13: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 14a: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 14b: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 15: Europe Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table No 16: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 17: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 18: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 19a: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 19b: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 20: Asia Pacific Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table No 21: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 22: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 23: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 24a: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 24b: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 25: MEA Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table No 26: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Type, 2017 - 2027

Table No 27: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Material, 2017 - 2027

Table No 28: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Shrink Ratio, 2017 - 2027

Table No 29a: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 29b: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table No 30: South America Heat Shrink Tubing Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

List of Figures

Figure No 1: Global Heat Shrink Tubing Market Size (US$ Mn) Forecast, 2017 – 2027

Figure No 2: Global Heat Shrink Tubing Market Revenue Opportunity Share (%), 2019 – 2027

Figure No 3: Global Heat Shrink Tubing Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure No 4: Global Heat Shrink Tubing Market Value (US$ Mn) Opportunity Assessment, by Region, 2027F

Figure No 5: Top Segment Analysis - Heat Shrink Tubing Market

Figure No 6: Country Abstract -Heat Shrink Tubing Market

Figure No 7: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure No 8: Top Economies GDP Landscape, 2018

Figure No 9: Major Countries Average GDP Contribution, by Industry, 2018

Figure No 10: Macro-Economic Factors Analysis

Figure No 11: Global Heat Shrink Tubing Market Revenue (US$ Mn) and Y-o-Y Growth (Value %) Forecast, 2013 - 2027

Figure No 12: Global Heat Shrink Tubing Market Revenue Opportunity (US$ Mn) Forecast, 2017 - 2027

Figure No 13: Attractiveness Rating- by Type

Figure No 14: Opportunity Assessment- by Type

Figure No 15: Attractiveness Rating- by Material

Figure No 16: Opportunity Assessment- by Material

Figure No 17: Attractiveness Rating- by Material

Figure No 18: Opportunity Assessment- by Material

Figure No 19: Attractiveness Rating- By Region

Figure No 20: Opportunity Assessment- By Region

Figure No 21: Global Heat Shrink Tubing Market, Component CAGR (%) (2019-2027)

Figure No 22: Global Heat Shrink Tubing Market, Institution Type CAGR (%) (2019-2027)

Figure No 23: Global Heat Shrink Tubing Market, Region CAGR (%) (2019-2027)

Figure No 24: Global Heat Shrink Tubing Market Share Analysis, by Type (2019)

Figure No 25: Global Heat Shrink Tubing Market Share Analysis, by Type (2027)

Figure No 26: Global Heat Shrink Tubing Market Share Analysis, by Material (2019)

Figure No 27: Global Heat Shrink Tubing Market Share Analysis, by Material (2027)

Figure No 28: Global Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2019)

Figure No 29: Global Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2027)

Figure No 30: Global Heat Shrink Tubing Market Share Analysis, by Industry (2019)

Figure No 31: Global Heat Shrink Tubing Market Share Analysis, by Industry (2027)

Figure No 32: Global Heat Shrink Tubing Market Share Analysis, by Region, 2019 and 2027

Figure No 33: North America Heat Shrink Tubing Market Share Analysis, by Type (2019)

Figure No 34: North America Heat Shrink Tubing Market Share Analysis, by Type (2027)

Figure No 35: North America Heat Shrink Tubing Market Share Analysis, by Material (2019)

Figure No 36: North America Heat Shrink Tubing Market Share Analysis, by Material (2027)

Figure No 37: North America Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2019)

Figure No 38: North America Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2027)

Figure No 39: North America Heat Shrink Tubing Market Share Analysis, by Industry (2019)

Figure No 40: North America Heat Shrink Tubing Market Share Analysis, by Industry (2027)

Figure No 41: North America Heat Shrink Tubing Market Share Analysis, by Country (2019)

Figure No 42: North America Heat Shrink Tubing Market Share Analysis, by Country (2027)

Figure No 43: Europe Heat Shrink Tubing Market Share Analysis, by Type (2019)

Figure No 44: Europe Heat Shrink Tubing Market Share Analysis, by Type (2027)

Figure No 45: Europe Heat Shrink Tubing Market Share Analysis, by Material (2019)

Figure No 46: Europe Heat Shrink Tubing Market Share Analysis, by Material (2027)

Figure No 47: Europe Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2019)

Figure No 48: Europe Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2027)

Figure No 49: Europe Heat Shrink Tubing Market Share Analysis, by Industry (2019)

Figure No 50: Europe Heat Shrink Tubing Market Share Analysis, by Industry (2027)

Figure No 51: Europe Heat Shrink Tubing Market Share Analysis, by Country (2019)

Figure No 52: Europe Heat Shrink Tubing Market Share Analysis, by Country (2027)

Figure No 53: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Type (2019)

Figure No 54: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Type (2027)

Figure No 55: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Material (2019)

Figure No 56: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Material (2027)

Figure No 57: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2019)

Figure No 58: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2027)

Figure No 59: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Industry (2019)

Figure No 60: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Industry (2027)

Figure No 61: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Country (2019)

Figure No 62: Asia Pacific Heat Shrink Tubing Market Share Analysis, by Country (2027)

Figure No 63: MEA Heat Shrink Tubing Market Share Analysis, by Type (2019)

Figure No 64: MEA Heat Shrink Tubing Market Share Analysis, by Type (2027)

Figure No 65: MEA Heat Shrink Tubing Market Share Analysis, by Material (2019)

Figure No 66: MEA Heat Shrink Tubing Market Share Analysis, by Material (2027)

Figure No 67: MEA Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2019)

Figure No 68: MEA Heat Shrink Tubing Market Share Analysis, by Shrink Ratio (2027)

Figure No 69: Market Player – Competition Matrix

Figure No 70: Market Positioning of Key Players (2018)

Figure No 71: Regional Presence (Intensity Map)