Analysts’ Viewpoint

Surge in production of electronic products, particularly in China and India is expected to fuel the heat pipe industry size during the forecast period. Furthermore, the expanding production of hardware devices, such as laptops and tablets, especially in the U.S., is identified as a crucial driver of the heat pipe market.

High demand from end-use industries such as automotive, consumer electronics, telecommunications, pharmaceuticals, and chemicals is boosting the heat pipe market demand. Increase in usage of heat pipes in desktops and laptops to optimize operational temperatures and enhance overall performance is further driving market progress. Manufacturers of heat pipe are investing significantly in comprehensive R&D activities and focusing on heat pipe industry trends, besides tapping into incremental opportunities to gain a competitive edge in the market.

Heat pipes are sophisticated heat transfer pipes known for their efficiency in transporting heat from one point to another within a closed-loop system. Functioning on the principle of phase transition, heat pipes leverage the evaporation and condensation of a working fluid to effectively manage thermal energy. They find application in various industries, including consumer electronics (laptops, desktops, smartphones), HVAC systems (air conditioners, refrigerators), and industrial machinery (heat exchangers tube, lasers). Their critical role in data centers for cooling servers underscores their versatility in addressing diverse thermal management needs.

The heat pipe's operational cycle involves the absorption of heat at one end, causing the working fluid to vaporize and travel to the cooler end. Condensation at the cooler end releases the absorbed heat, while capillary action in the heat pipe wick structures return the liquid to the hot end, completing the continuous cycle. The need for efficient thermal solutions has intensified with the rise in power density in electronic devices, contributing to the heat pipe market growth.

The escalating demand for smaller and more powerful electronic devices, along with the increasing power density of electronic components, has underscored the critical need for efficient thermal management solutions. Heat pipes, recognized for their effectiveness in dissipating heat, have emerged as a reliable solution for preventing overheating in applications such as consumer electronics and industrial heat pipes for global energy-efficient applications.

As electronic components become densely packed and generate higher levels of heat, the importance of efficient thermal management to maintain device reliability and performance cannot be overstated. Heat pipes excel in this context by efficiently moving heat away from hotspots and distributing it across a larger area, mitigating temperature gradients and preventing thermal pipe issues. All these factors are expected to augment the heat pipe market value during the forecast period.

In data centers, which play a pivotal role in modern digital infrastructure, the substantial heat generated by numerous servers necessitates effective cooling solutions. Heat pipes find application in both air and liquid cooling systems in data centers, contributing to reduced energy consumption and ensuring reliable operations. Overall, the utilization of heat pipes for thermal management not only extends the operational life and reliability of electronic components but also leads to cost savings in maintenance, ultimately enhancing the overall user experience and boosting market development.

Heat pipe manufacturers are increasing R&D to develop high-efficiency in product innovation and developments as the trend in the market is the incorporation of new technologies and product features.

The surge in global electronic product production, particularly in China and India, has been a significant heat pipe market catalyst in recent years. According to the Ministry of Electronics & Information Technology of India, the domestic electronics manufacturing sector in the country has witnessed substantial expansion, with a remarkable 187% increase in production of electronic goods over the past six years, reflecting a compound annual growth rate (CAGR) of approximately 24%. This surge has led to a notable uptick in the incorporation of heat pipes across various electronic applications, including air conditioners, refrigerators, heat exchangers, transistors, and capacitors.

In the United States, the surge in production of hardware devices such as laptops and tablets is anticipated to drive the adoption of heat pipes. These thermal management solutions are commonly used in desktops and laptops to optimize operating temperatures, thereby enhancing overall performance. According to Freedonia Focus Reports, demand for components utilized in electronic goods is expected to experience a 1.6% annual increase in nominal terms through 2024. Additionally, the global manufacturing value added (MVA) for electrical and electronic equipment is forecasted to rise by 3.8% annually in real terms through 2024.

The heat pipe market segmentation based on end-use industry includes automotive, aerospace & defense, medical, telecommunication, consumer electronics, power & energy, food & beverage, and others. The growing demand for consumer electronics, coupled with the expansion of data centers and server farms, is amplifying the need for effective thermal management solutions.

Furthermore, the automotive sector is witnessing increasing integration of electronic components in applications such as Advanced Driver Assistance Systems (ADAS), infotainment systems, and electric vehicles. This trend is propelling the demand for thermal solutions, with heat pipes gaining prominence for their ability to efficiently transfer heat without requiring external power, making them well-suited for electronic cooling in automotive applications.

As per the latest heat pipe market forecast, Asia Pacific is anticipated to dominate the global landscape. Surge in usage of heat pipes in several industries, such as consumer electronics, aerospace & defense, and telecommunications is driving market dynamics in the region.

Growth in industrial activities and increase in government initiatives related to infrastructure development in India and other countries in Asia Pacific are also contributing to market expansion. Furthermore, rise in environmental concerns and increase in demand for electric vehicles in Asia Pacific are expected to offer lucrative heat pipe market opportunities.

The global heat pipe market is consolidated with a few large-scale vendors controlling majority share. Most firms are undertaking research & development activities, primarily to produce innovative heat pipes. Product portfolio expansion and mergers & acquisitions are major strategies adopted by key players.

ATHERM, CELSIA Inc., DeepCool Industries Co., Ltd., Euro Heat Pipes, Fujikura Ltd., Furukawa Electric Co., Ltd., Noren Thermal Inc., Nidec Corp., Heatwell, Boyd Corporation, Forcecon, ThermAvant Technologies, wtl-heatpipe, and Anthermo GmbH, are the prominent heat pipe making companies in the market.

Each of these players has been profiled in the global heat pipe market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

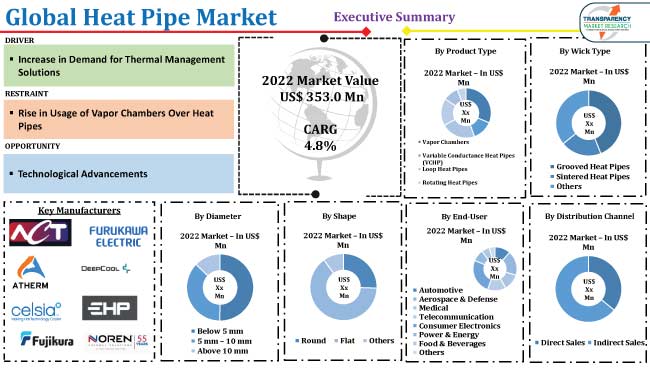

| Market Value in 2022 | US$ 353.0 Mn |

| Market Value in 2031 | US$ 536.0 Mn |

| Growth Rate (CAGR) | 4.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 353.0 Mn in 2022

It is expected to reach US$ 536.0 Mn by the end of 2031

The CAGR is projected to be 4.8% from 2023-2031

Growth in demand from end-use industries

The consumer electronics segment contributed the largest share in 2022

Asia Pacific is a more attractive region for vendors

ATHERM, CELSIA Inc., DeepCool Industries Co., Ltd., Euro Heat Pipes, Fujikura Ltd., Furukawa Electric Co., Ltd., Noren Thermal Inc., Nidec Corp., Heatwell, Boyd Corporation, Forcecon, ThermAvant Technologies, wtl-heatpipe, and Anthermo GmbH

1. Executive Summary: Global Heat Pipe Market

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Key Facts and Figures

1.5. Growth Opportunity Analysis

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Key Market Indicator

2.6. Market Dynamics

2.6.1. Drivers

2.6.2. Restraints

2.6.3. Opportunities

2.7. Global Heat Pipe Market Analysis and Forecasts, 2020-2031

2.7.1. Global Heat Pipe Market Revenue (US$ Mn)

2.7.2. Global Heat Pipe Market Volume (Thousand Units)

2.8. Porter’s Five Forces Analysis

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealers/Distributors

2.9.3. List of Contract Manufacturers

2.9.4. List of Potential Customers

2.10. Industry SWOT Analysis

2.11. Product Specification Analysis, By End-use Industry

2.12. Technology Development Analysis

2.13. Regulatory Landscape

3. Economic Recovery Analysis Post-COVID-19 Impact

4. Price Trend Analysis and Forecast (US$/Thousand Units) by Product Type and Region

5. Global Heat Pipe Market Analysis and Forecast, By Product Type

5.1. Key Findings

5.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, By Product Type,2020 – 2031

5.2.1. Vapor Chamber

5.2.2. Variable Conductance Heat Pipe

5.2.3. Loop Heat Pipe

5.2.4. Rotating Heat Pipe

5.2.5. Thermosiphon Heat Pipe

5.2.6. Others

5.3. Incremental Opportunity, By Product Type

6. Global Heat Pipe Market Analysis and Forecast, By Wick Type

6.1. Key Findings

6.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Wick Type, 2020 - 2031

6.2.1. Grooved Heat Pipe

6.2.2. Sintered Heat Pipe

6.2.3. Others

6.3. Incremental Opportunity, By Wick Type

7. Global Heat Pipe Market Analysis and Forecast, By Diameter

7.1. Key Findings

7.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Diameter, 2020 - 2031

7.2.1. Below 5 mm

7.2.2. 5 mm-10 mm

7.2.3. Above 10 mm

7.3. Incremental Opportunity, By Diameter

8. Global Heat Pipe Market Analysis and Forecast, By Shape

8.1. Key Findings

8.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Shape, 2020 - 2031

8.2.1. Round

8.2.2. Square

8.2.3. Others

8.3. Incremental Opportunity, By Shape

9. Global Heat Pipe Market Analysis and Forecast, By End-use Industry

9.1. Key Findings

9.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2020 - 2031

9.2.1. Automotive

9.2.2. Aerospace & Defense

9.2.3. Medical

9.2.4. Telecommunication

9.2.5. Consumer Electronics

9.2.6. Power & Energy

9.2.7. Food & Beverage

9.2.8. Others

9.3. Incremental Opportunity, By End-use Industry

10. Global Heat Pipe Market Analysis and Forecast, By Distribution Channel

10.1. Key Findings

10.2. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Distribution Channel, 2020 - 2031

10.2.1. Direct Sales

10.2.2. Indirect Sales

10.3. Incremental Opportunity, By Distribution Channel

11. Global Heat Pipe Market Analysis and Forecasts, by Region

11.1. Key Findings

11.2. Market Size and Forecast (US$ Mn and Thousand Units) by Region, 2020-2031

11.2.1. North America

11.2.1.1. U.S.

11.2.1.2. Canada

11.2.1.3. Rest of North America

11.2.2. Europe

11.2.2.1. Germany

11.2.2.2. France

11.2.2.3. U.K.

11.2.2.4. Italy

11.2.2.5. Russia & CIS

11.2.2.6. Rest of Europe

11.2.3. Asia Pacific

11.2.3.1. China

11.2.3.2. Japan

11.2.3.3. India

11.2.3.4. ASEAN

11.2.3.5. Rest of Asia Pacific

11.2.4. South America

11.2.4.1. Brazil

11.2.4.2. Rest of South America

11.2.5. Middle East & Africa

11.2.5.1. GCC

11.2.5.2. South Africa

11.2.5.3. Rest of Middle East & Africa

11.3. Incremental Opportunity Analysis

12. North America Heat Pipe Market Analysis and Forecasts

12.1. Regional Snapshot

12.2. Heat Pipes Market (US$ Mn and Thousand Units) Forecast, By Product Type, 2020 - 2031

12.2.1. Vapor Chamber

12.2.2. Variable Conductance Heat Pipe

12.2.3. Loop Heat Pipe

12.2.4. Rotating Heat Pipe

12.2.5. Thermosiphon Heat Pipe

12.2.6. Others

12.3. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Wick Type, 2020 - 2031

12.3.1. Grooved Heat Pipe

12.3.2. Sintered Heat Pipe

12.3.3. Others

12.4. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Diameter, 2020 - 2031

12.4.1. Below 5 mm

12.4.2. 5 mm-10 mm

12.4.3. Above 10 mm

12.5. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Shape, 2020 - 2031

12.5.1. Round

12.5.2. Square

12.5.3. Others

12.6. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2020 - 2031

12.6.1. Automotive

12.6.2. Aerospace & Defense

12.6.3. Medical

12.6.4. Telecommunication

12.6.5. Consumer Electronics

12.6.6. Power & Energy

12.6.7. Food & Beverage

12.6.8. Others

12.7. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Distribution Channel, 2020 - 2031

12.7.1. Direct Sales

12.7.2. Indirect Sales

12.8. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2020 - 2031

12.8.1. U.S

12.8.2. Canada

12.8.3. Rest of North America

13. U.S. Heat Pipe Market Analysis and Forecasts

13.1. Country Snapshot

13.2. Macroeconomic Scenario

13.3. Key Trend Analysis

13.4. Key Supplier Analysis

13.5. Heat Pipes Market (US$ Mn and Thousand Units) Forecast, By Product Type, 2020 - 2031

13.5.1. Vapor Chamber

13.5.2. Variable Conductance Heat Pipe

13.5.3. Loop Heat Pipe

13.5.4. Rotating Heat Pipe

13.5.5. Thermosiphon Heat Pipe

13.5.6. Others

13.6. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Wick Type, 2020 - 2031

13.6.1. Grooved Heat Pipe

13.6.2. Sintered Heat Pipe

13.6.3. Others

13.7. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Diameter, 2020 - 2031

13.7.1. Below 5 mm

13.7.2. 5 mm-10 mm

13.7.3. Above 10 mm

13.8. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Shape, 2020 - 2031

13.8.1. Round

13.8.2. Square

13.8.3. Others

13.9. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2020 - 2031

13.9.1. Automotive

13.9.2. Aerospace & Defense

13.9.3. Medical

13.9.4. Telecommunication

13.9.5. Consumer Electronics

13.9.6. Power & Energy

13.9.7. Food & Beverage

13.9.8. Others

13.10. Heat Pipe Market Size (US$ Mn and Thousand Units) Forecast, Distribution Channel, 2020 - 2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

13.11. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Players - Competition Dashboard

14.2. Market Share Analysis, 2022

14.3. Company Profiles

14.3.1. Advanced Cooling Technologies Inc.

14.3.1.1. Company Revenue

14.3.1.2. Business Overview

14.3.1.3. Product Segments

14.3.1.4. Geographic Footprint

14.3.1.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.2. ATHERM

14.3.2.1. Company Revenue

14.3.2.2. Business Overview

14.3.2.3. Product Segments

14.3.2.4. Geographic Footprint

14.3.2.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.3. CELSIA Inc.

14.3.3.1. Company Revenue

14.3.3.2. Business Overview

14.3.3.3. Product Segments

14.3.3.4. Geographic Footprint

14.3.3.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.4. DeepCool Industries Co., Ltd.

14.3.4.1. Company Revenue

14.3.4.2. Business Overview

14.3.4.3. Product Segments

14.3.4.4. Geographic Footprint

14.3.4.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.5. Euro Heat Pipes

14.3.5.1. Company Revenue

14.3.5.2. Business Overview

14.3.5.3. Product Segments

14.3.5.4. Geographic Footprint

14.3.5.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.6. Fujikura Ltd.

14.3.6.1. Company Revenue

14.3.6.2. Business Overview

14.3.6.3. Product Segments

14.3.6.4. Geographic Footprint

14.3.6.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.7. Furukawa Electric Co., Ltd.

14.3.7.1. Company Revenue

14.3.7.2. Business Overview

14.3.7.3. Product Segments

14.3.7.4. Geographic Footprint

14.3.7.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.8. Noren Thermal Inc.

14.3.8.1. Company Revenue

14.3.8.2. Business Overview

14.3.8.3. Product Segments

14.3.8.4. Geographic Footprint

14.3.8.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.9. Nidec Corp.

14.3.9.1. Company Revenue

14.3.9.2. Business Overview

14.3.9.3. Product Segments

14.3.9.4. Geographic Footprint

14.3.9.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.10. Heatwell

14.3.10.1. Company Revenue

14.3.10.2. Business Overview

14.3.10.3. Product Segments

14.3.10.4. Geographic Footprint

14.3.10.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.11. Boyd Corporation

14.3.11.1. Company Revenue

14.3.11.2. Business Overview

14.3.11.3. Product Segments

14.3.11.4. Geographic Footprint

14.3.11.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.12. Forcecon

14.3.12.1. Company Revenue

14.3.12.2. Business Overview

14.3.12.3. Product Segments

14.3.12.4. Geographic Footprint

14.3.12.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.13. ThermAvant Technologies

14.3.13.1. Company Revenue

14.3.13.2. Business Overview

14.3.13.3. Product Segments

14.3.13.4. Geographic Footprint

14.3.13.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.14. wtl-heatpipe

14.3.14.1. Company Revenue

14.3.14.2. Business Overview

14.3.14.3. Product Segments

14.3.14.4. Geographic Footprint

14.3.14.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.15. Anthermo GmbH

14.3.15.1. Company Revenue

14.3.15.2. Business Overview

14.3.15.3. Product Segments

14.3.15.4. Geographic Footprint

14.3.15.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.16. Other Key Players

14.3.16.1. Company Revenue

14.3.16.2. Business Overview

14.3.16.3. Product Segments

14.3.16.4. Geographic Footprint

14.3.16.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4. List of Players in the Market

14.5. Key Primary Research Insights

15. Go To Market Strategy

16. Appendix

16.1. Assumptions and Acronyms

16.2. Research Methodology

List of Tables

Table 1: Global Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 2: Global Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 3: Global Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 4: Global Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 5: Global Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 6: Global Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 7: Global Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 8: Global Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 9: Global Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 10: Global Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 11: Global Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 12: Global Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 13: Global Heat Pipe Market Value (US$ Mn), by Region, 2020-2031

Table 14: Global Heat Pipe Market Volume (Thousand Units), by Region 2020-2031

Table 15: North America Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 16: North America Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 17: North America Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 18: North America Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 19: North America Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 20: North America Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 21: North America Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 22: North America Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 23: North America Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 24: North America Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 25: North America Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 26: North America Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 27: North America Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 28: North America Heat Pipe Market Volume (Thousand Units), by Country 2020-2031

Table 29: Europe Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 30: Europe Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 31: Europe Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 32: Europe Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 33: Europe Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 34: Europe Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 35: Europe Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 36: Europe Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 37: Europe Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 38: Europe Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 39: Europe Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 40: Europe Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 41: Europe Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 42: Europe Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 43: Asia Pacific Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 44: Asia Pacific Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 45: Asia Pacific Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 46: Asia Pacific Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 47: Asia Pacific Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 48: Asia Pacific Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 49: Asia Pacific Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 50: Asia Pacific Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 51: Asia Pacific Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 52: Asia Pacific Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 53: Asia Pacific Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 54: Asia Pacific Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 55: Asia Pacific Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 56: Asia Pacific Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 57: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 58: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 59: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 60: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 61: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 62: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 63: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 64: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 65: Middle East & Africa Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 66: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 67: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 68: Middle East & Africa Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 69: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 70: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 71: South America Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Table 72: South America Heat Pipe Market Volume (Thousand Units), by Product Type 2020-2031

Table 73: South America Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Table 74: South America Heat Pipe Market Volume (Thousand Units), by Wick Type 2020-2031

Table 75: South America Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Table 76: South America Heat Pipe Market Volume (Thousand Units), by Diameter 2020-2031

Table 77: South America Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Table 78: South America Heat Pipe Market Volume (Thousand Units), by Shape 2020-2031

Table 79: South America Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Table 80: South America Heat Pipe Market Volume (Thousand Units), by End Use Industry 2020-2031

Table 81: South America Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 82: South America Heat Pipe Market Volume (Thousand Units), by Distribution Channel 2020-2031

Table 83: South America Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Table 84: South America Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

List of Figures

Figure 1: Global Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 2: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 3: Global Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 4: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 5: Global Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 6: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 7: Global Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 8: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 9: Global Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 10: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 11: Global Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 12: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Heat Pipe Market Value (US$ Mn), by Region, 2020-2031

Figure 14: Global Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Region, 2023-2031

Figure 15: North America Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 16: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 17: North America Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 18: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 19: North America Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 20: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 21: North America Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 22: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 23: North America Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 24: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 25: North America Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 26: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 27: North America Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Figure 28: North America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Country, 2023-2031

Figure 29: Europe Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 30: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 31: Europe Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 32: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 33: Europe Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 34: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 35: Europe Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 36: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 37: Europe Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 38: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 39: Europe Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 40: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 41: Europe Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Figure 42: Europe Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Country, 2023-2031

Figure 43: Asia Pacific Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 44: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 45: Asia Pacific Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 46: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 47: Asia Pacific Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 48: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 49: Asia Pacific Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 50: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 51: Asia Pacific Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 52: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 53: Asia Pacific Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 54: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 55: Asia Pacific Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Figure 56: Asia Pacific Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Country, 2023-2031

Figure 57: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 58: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 59: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 60: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 61: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 62: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 63: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 64: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 65: Middle East & Africa Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 66: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 67: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 68: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 69: Middle East & Africa Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Figure 70: Middle East & Africa Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Country, 2023-2031

Figure 71: South America Heat Pipe Market Value (US$ Mn), by Product Type, 2020-2031

Figure 72: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 73: South America Heat Pipe Market Value (US$ Mn), by Wick Type, 2020-2031

Figure 74: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Wick Type, 2023-2031

Figure 75: South America Heat Pipe Market Value (US$ Mn), by Diameter, 2020-2031

Figure 76: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Diameter, 2023-2031

Figure 77: South America Heat Pipe Market Value (US$ Mn), by Shape, 2020-2031

Figure 78: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Shape, 2023-2031

Figure 79: South America Heat Pipe Market Value (US$ Mn), by End Use Industry, 2020-2031

Figure 80: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 81: South America Heat Pipe Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 82: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 83: South America Heat Pipe Market Value (US$ Mn), by Country, 2020-2031

Figure 84: South America Heat Pipe Market Attractiveness (US$ Mn), Forecast, by Country, 2023-2031