Analysts’ Viewpoint

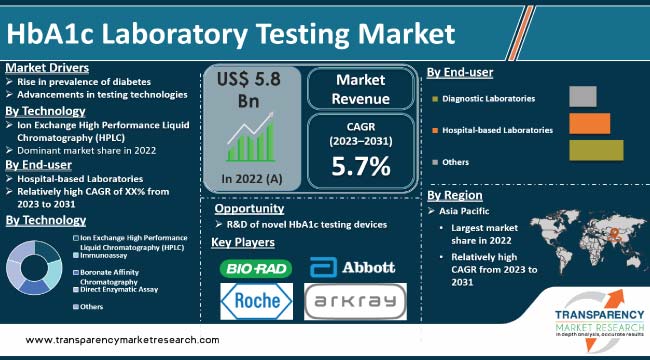

The HbA1c laboratory testing market size is expected to witness steady growth in the near future due to increase in prevalence of diabetes and growth in awareness regarding glycemic control. Advancements in testing technologies and rise in geriatric population are likely to offer lucrative opportunities to vendors in the sector.

Most companies are vying for the HbA1c laboratory testing market share by offering innovative testing methodologies, automation, and improved accuracy. Regulatory changes and reimbursement policies are expected to significantly impact product pricing and market penetration of vendors.

Integration of Electronic Health Records (EHRs) and telehealth solutions is projected to spur the HbA1c laboratory testing market growth in the next few years. These developments are facilitating seamless data sharing between healthcare providers, laboratories, and patients, thereby enhancing the overall quality of care and enabling more personalized treatment approaches. High cost of testing devices and reagents and availability of alternative diabetes management tests are estimated to limit market progress to some extent.

HbA1c laboratory testing, also known as glycated hemoglobin testing, is a common diagnostic tool used in the management of diabetes mellitus. HbA1c stands for Hemoglobin A1c. It is a form of hemoglobin that is chemically linked to glucose (blood sugar) over time. The HbA1c test provides valuable information about a person's average blood sugar levels over approximately 2-3 months, which is the lifespan of a red blood cell.

Unlike traditional blood glucose monitoring, which offers a snapshot of glucose levels at a single point in time, HbA1c reflects glycemic control over an extended period. This allows for better treatment decisions and risk assessment for diabetes-related complications such as cardiovascular disease, retinopathy, and nephropathy.

HbA1c results help tailor treatment plans and assess the effectiveness of current therapies. It enables healthcare providers to make informed decisions regarding medication adjustments and lifestyle modifications. Maintaining a target HbA1c level can reduce the risk of diabetes-related complications. For individuals with diabetes, HbA1c testing offers insights into their overall health and empowers them to take control of their condition. By monitoring HbA1c levels regularly, they can make informed choices about diet, exercise, and medication adherence.

Increase in awareness regarding the importance of regular HbA1c testing for diabetes management, rise in advancements in testing technology, a surge in focus on preventive healthcare, and presence of favorable reimbursement policies and government initiatives to combat diabetes are major factors driving the demand for HbA1c testing.

Increase in prevalence of diabetes worldwide is significantly reshaping the healthcare landscape, particularly in terms of diagnostic testing. Among the pivotal tools in managing diabetes, the HbA1c laboratory test has emerged as a critical tool. Surge in demand for HbA1c tests is predominantly propelled by the escalating prevalence of diabetes, making it a cornerstone in disease management and prevention.

Diabetes has reached epidemic proportions, affecting millions across the world. According to the World Health Organization (WHO), the number of people with diabetes has quadrupled since 1980, with an estimated 422 million adults currently living with the condition. This alarming increase in cases has prompted healthcare systems to focus on early detection and monitoring of diabetes, placing HbA1c tests at the forefront.

According to International Diabetes Federation (IDF) data, the number of adults living with diabetes globally is projected to reach 643 million by 2030. This surge is driven by several factors, including population growth, aging, and urbanization. As per the Centers for Disease Control and Prevention (CDC), in 2022, an estimated 37.3 million people in the U.S. had diabetes, accounting for 11.3% of the population. Among them, 28.7 million people had diagnosed diabetes, and 8.5 million people had undiagnosed diabetes. The prevalence of diabetes has increased in the U.S. in the past few decades. In 2002, an estimated 8.3% of the population had diabetes, a figure that had increased to 11.3% by 2022.

HbA1c tests have gained popularity due to several advantages they offer. Unlike traditional blood glucose tests, HbA1c provides a long-term view of blood sugar control by averaging levels over three months. This provides a more comprehensive understanding of a patient's glycemic status, enabling healthcare providers to make informed decisions about treatment regimens. Furthermore, the convenience of HbA1c tests, which do not require fasting and can be carried out at any time of day, makes them more accessible and patient-friendly.

In the past few years, advancements in testing technology have revolutionized the field of healthcare diagnostics, particularly in the realm of diabetes management. One of the key beneficiaries of these technological leaps is the HbA1c laboratory testing business. Hemoglobin A1c testing plays a pivotal role in monitoring long-term blood sugar control in individuals with diabetes. The traditional method of measuring HbA1c involved time-consuming and cumbersome processes but the landscape is rapidly changing due to the integration of cutting-edge technologies.

Introduction of High Performance Liquid Chromatography (HPLC) and capillary electrophoresis methods is fueling the HbA1c laboratory testing market revenue. These technologies offer greater precision and speed in HbA1c measurements, enabling healthcare providers to make quicker and more accurate clinical decisions. Moreover, these techniques require smaller sample volumes, reducing patient discomfort, and the risk of complications associated with blood collection.

In 2023, the American Diabetes Association (ADA) and the American Association of Clinical Chemistry (AACC) released new guidance regarding the use of laboratory analysis in the diagnosis and management of diabetes. The ADA's guidance recommends HbA1c as the primary test employed for diagnosing diabetes and monitoring glycemic control. This is a significant change from previous guidance, which recommended using a combination of HbA1c and fasting plasma glucose testing.

Integration of data analytics and machine learning algorithms has enabled healthcare providers to extract valuable insights from HbA1c test results. This data-driven approach helps identify various diagnosis trends and predict future glycemic control, which is leading to more personalized and effective treatment strategies. It also facilitates remote monitoring, allowing healthcare professionals to remotely track patients' progress and intervene when necessary.

According to the latest HbA1c laboratory testing market trends, the ion exchange high performance liquid chromatography (HPLC) technology segment is projected to dominate the global sector during the forecast period. FDA approval for HPLC-based devices in the past few years, launch of new products, and increase in adoption of HbA1c testing in the diagnosis & monitoring of diabetes are boosting the segment.

HPLC is considered the gold standard method for HbA1c testing as it is highly accurate and precise. It is also very sensitive, which means that it can detect even small amounts of HbA1c in the blood. This is important for identifying patients with early-stage diabetes or prediabetes, as well as for monitoring patients with diabetes who are at risk of complications. A study published in the journal "Diabetes Research and Clinical Practice" found that HPLC was the most widely used method for HbA1c testing in Asia Pacific, accounting for over 70% of all tests performed.

According to the latest HbA1c laboratory testing market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Increase in diabetes population in countries, such as India and China, is fueling the market dynamics of the region. According to the International Diabetes Federation, in 2021, China recorded about 141 million diabetic patients aged from 20 to 79 years, which was the highest number in any country. This figure is projected to reach 174 million by 2045.

Rise in prevalence of diabetes is augmenting the HbA1c laboratory testing market expansion during the forecast period. Diabetes management requires regular monitoring of blood glucose levels. HbA1c testing is a crucial tool for assessing long-term glycemic control.

There is a strong emphasis on diabetes management and prevention in North America, driven by public health initiatives, healthcare policies, and awareness campaigns. HbA1c testing plays a vital role in monitoring and managing diabetes, helping healthcare providers assess the effectiveness of treatment plans and make necessary adjustments. This focus on diabetes management contributes to the demand for HbA1c testing.

Surge in prevalence of diabetes, rise in adoption of advanced tools, and increase in disposable income are driving the HbA1c laboratory testing market trajectory in Europe. The region has one of the highest rates of diabetes in the world, with over 50 million people living with the condition. European laboratories are increasingly adopting advanced HbA1c testing technologies, which offer faster and more accurate results.

Major HbA1c laboratory testing companies are investing significantly in research & development and engaging in partnerships & agreements to expand their HbA1c Laboratory Testing Industry presence. Abbott Laboratories, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Danaher Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc., Ortho Clinical Diagnostics, ARKRAY, Inc., EKF Diagnostics Holdings plc., and Meril Life Science Pvt. Ltd. are key entities operating in this industry.

The HbA1c laboratory testing market report profiles the top players based on various factors including company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 5.8 Bn |

| Forecast Value in 2031 | More than US$ 9.5 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.8 Bn in 2022

It is projected to reach more than US$ 9.5 Bn by the end of 2031

It is anticipated to be 5.7% from 2023 to 2031

Rise in prevalence of diabetes and advancements in testing technologies

The ion exchange high performance liquid chromatography (HPLC) segment accounted for the largest share in 2022

Asia Pacific is expected to record the highest demand during the forecast period

Abbott Laboratories, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Danaher Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc., Ortho Clinical Diagnostics, ARKRAY, Inc., EKF Diagnostics Holdings plc., and Meril Life Science Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global HbA1c Laboratory Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global HbA1c Laboratory Testing Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projection (US$ Bn)

5. Key Insights

5.1. Disease Prevalence and Incidence Rate

5.2. Regulatory Scenario

5.3. Quantitative Analysis of HbA1c Test in Laboratory and POC Settings, By Region

5.4. COVID-19 Pandemic Impact on Industry

6. Global HbA1c Laboratory Testing Market Analysis and Forecast, By Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Technology, 2017-2031

6.3.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

6.3.2. Immunoassay

6.3.3. Boronate Affinity Chromatography

6.3.4. Direct Enzymatic Assay

6.3.5. Others

6.4. Market Attractiveness By Technology

7. Global HbA1c Laboratory Testing Market Analysis and Forecast, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By End-user, 2017-2031

7.3.1. Diagnostic Laboratories

7.3.2. Hospital-based Laboratories

7.3.3. Others (Research Laboratories, etc.)

7.4. Market Attractiveness By End-user

8. Global HbA1c Laboratory Testing Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness By Country/Region

9. North America HbA1c Laboratory Testing Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Technology, 2017-2031

9.2.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

9.2.2. Immunoassay

9.2.3. Boronate Affinity Chromatography

9.2.4. Direct Enzymatic Assay

9.2.5. Others

9.3. Market Value Forecast By End-user, 2017-2031

9.3.1. Diagnostic Laboratories

9.3.2. Hospital-based Laboratories

9.3.3. Others (Research Laboratories, etc.)

9.4. Market Value Forecast By Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Technology

9.5.2. By End-user

9.5.3. By Country

10. Europe HbA1c Laboratory Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Technology, 2017-2031

10.2.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

10.2.2. Immunoassay

10.2.3. Boronate Affinity Chromatography

10.2.4. Direct Enzymatic Assay

10.2.5. Others

10.3. Market Value Forecast By End-user, 2017-2031

10.3.1. Diagnostic Laboratories

10.3.2. Hospital-based Laboratories

10.3.3. Others (Research Laboratories, etc.)

10.4. Market Value Forecast By Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Technology

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific HbA1c Laboratory Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Technology, 2017-2031

11.2.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

11.2.2. Immunoassay

11.2.3. Boronate Affinity Chromatography

11.2.4. Direct Enzymatic Assay

11.2.5. Others

11.3. Market Value Forecast By End-user, 2017-2031

11.3.1. Diagnostic Laboratories

11.3.2. Hospital-based Laboratories

11.3.3. Others (Research Laboratories, etc.)

11.4. Market Value Forecast By Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Technology

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America HbA1c Laboratory Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Technology, 2017-2031

12.2.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

12.2.2. Immunoassay

12.2.3. Boronate Affinity Chromatography

12.2.4. Direct Enzymatic Assay

12.2.5. Others

12.3. Market Value Forecast By End-user, 2017-2031

12.3.1. Diagnostic Laboratories

12.3.2. Hospital-based Laboratories

12.3.3. Others (Research Laboratories, etc.)

12.4. Market Value Forecast By Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Technology

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa HbA1c Laboratory Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Technology, 2017-2031

13.2.1. Ion Exchange High Performance Liquid Chromatography (HPLC)

13.2.2. Immunoassay

13.2.3. Boronate Affinity Chromatography

13.2.4. Direct Enzymatic Assay

13.2.5. Others

13.3. Market Value Forecast By End-user, 2017-2031

13.3.1. Diagnostic Laboratories

13.3.2. Hospital-based Laboratories

13.3.3. Others (Research Laboratories, etc.)

13.4. Market Value Forecast By Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Technology

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of companies)

14.2. Global HbA1c Laboratory Testing Market Position Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Abbott Laboratories

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Bio-Rad Laboratories, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. F. Hoffmann-La Roche Ltd.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Danaher Corporation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Siemens Healthcare GmbH

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Thermo Fisher Scientific, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Ortho Clinical Diagnostics

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. ARKRAY, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. EKF Diagnostics Holdings plc

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Meril Life Science Pvt. Ltd.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by Technology, 2017-2031

Table 02: Global HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 03: Global HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by Region, 2017-2031

Table 04: North America HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by Technology, 2017-2031

Table 05: North America HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 06: North America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 07: Europe HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by Technology, 2017-2031

Table 08: Europe HbA1c Laboratory Testing Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 09: Europe HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Asia Pacific HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 11: Asia Pacific HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 12: Asia Pacific HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Latin America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 14: Latin America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 15: Latin America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Middle East & Africa HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 17: Middle East & Africa HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 18: Middle East & Africa HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global HbA1c Laboratory Testing Market Value Share, by Technology, 2022

Figure 03: Global HbA1c Laboratory Testing Market Value Share, by End-user, 2022

Figure 04: Global HbA1c Laboratory Testing Market Value Share, by Region, 2022

Figure 05: Global HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 06: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Ion Exchange High Performance Liquid Chromatography (HPLC), 2017-2031

Figure 07: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Immunoassay, 2017-2031

Figure 08: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Boronate Affinity Chromatography, 2017-2031

Figure 09: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Direct Enzymatic Assay, 2017-2031

Figure 10: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Others, 2017-2031

Figure 11: Global HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 12: Global HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 13: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Diagnostic Laboratories, 2017-2031

Figure 14: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Hospital-based Laboratories, 2017-2031

Figure 15: Global HbA1c Laboratory Testing Market Revenue (US$ Bn), by Others (Research Laboratories, etc.) , 2017-2031

Figure 16: Global HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 17: Global HbA1c Laboratory Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 18: North America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 19: North America HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 20: North America HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 21: North America HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 22: North America HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 23: North America HbA1c Laboratory Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 24: North America HbA1c Laboratory Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 25: Europe HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 26: Europe HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 27: Europe HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 28: Europe HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: Europe HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 30: Europe HbA1c Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Europe HbA1c Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 32: Asia Pacific HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 33: Asia Pacific HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 34: Asia Pacific HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 35: Asia Pacific HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 36: Asia Pacific HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 37: Asia Pacific HbA1c Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Asia Pacific HbA1c Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 39: Latin America HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 40: Latin America HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 41: Latin America HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 42: Latin America HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Latin America HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 44: Latin America HbA1c Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Latin America HbA1c Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 46: Middle East & Africa HbA1c Laboratory Testing Market Value (US$ Bn) Forecast, 2017-2031

Figure 47: Middle East & Africa HbA1c Laboratory Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 48: Middle East & Africa HbA1c Laboratory Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 49: Middle East & Africa HbA1c Laboratory Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 50: Middle East & Africa HbA1c Laboratory Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 51: Middle East & Africa HbA1c Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 52: Middle East & Africa HbA1c Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031