There is a growing demand for handheld imaging devices in dentistry and orthopedics. As such, X-ray/fluoroscopic scanners product segment of the handheld imaging devices market is estimated to reach a value of ~US$ 1.2 Bn by the end of 2027. Hence, companies are innovating in advanced X-ray systems that overcome limitations of conventional wall-mount units. For instance, German-based dental products manufacturer KaVo Dental announced the launch of NOMAD™ Pro 2- a unique handheld X-ray system, which is available for routine dental purposes.

Advanced handheld X-ray systems are gradually becoming mainstream in most dentistry clinics. Companies in the handheld imaging devices market are focusing on the needs of clinicians so that dentists gain reliability through these systems during busy dental office needs and appreciates. They are increasing their efficacy in technologies that enhance the safety and portability of these systems. Companies in the handheld imaging devices market are introducing X-ray systems with high-capacity battery technology.

According to Engineering for Change, an online platform that solves global development problems, suggests that oral cancer is among the top three cancers diagnosed in India. High prevalence of oral cancer in India led companies in the handheld imaging devices market to develop innovative equipment. For instance, Sascan Meditech-a Bengaluru-based optical imaging technology company, revealed that the company’s device OralScan built with multi-modal imaging camera is undergoing clinical trials.

Healthcare companies in the market for handheld imaging devices are tapping opportunities in software and data analytics to improve patient outcomes. Medical device startups are participating in innovation trade fairs to bolster their credibility credentials in the global handheld imaging devices market. They are augmenting the advantages of cloud to help circulate the captured data among clinicians. Machine learning is also gaining prominence in the global market landscape, since algorithms provide feed on ratio values to assess differences between the types of cancer in patients.

There is a growing demand for lightweight and portable scanners that perform whole-brain MRI scan for patients with mobility challenges in the handheld imaging devices market. For instance, researchers at the Massachusetts Institute of Technology, Cambridge, developed a cost-effective portable helmet-like scanner that offers promising abilities than conventional MRI systems.

Optical imaging devices product segment of the handheld imaging devices market is projected to reach a value of ~US$ 800 Mn by 2027. Hence, companies in the market for handheld imaging devices are exploring opportunities in optical imaging devices to cater to specific needs of patients.

Innovations in these devices are likely to offer diagnostic-quality images that improve patient quality of life. However, challenges in imaging artefacts during the development of uniform magnetic field for image coding poses as restraint for researchers and manufacturers. Hence, companies in the market for handheld imaging devices should collaborate with researchers to use more flexible image coding approach to generate images with fewer artefacts.

Clinicians operating in the field of dermatology are eyeing alternatives that offer cost-efficiency and enhance the workflow at clinics. With the introduction of new handheld imaging devices, dermatologists are increasingly relying on smarter ways to perform skin examinations. For instance, Barco, a Belgian technology company specializing in digital image projection is increasing awareness about its product Demetra that provides intelligent and augmented insights.

Innovations in handheld imaging devices are serving as affordable and accessible solutions in skin lesion screening. As such, dermatology application segment of the handheld imaging devices market is anticipated to reach a value of ~US$ 600 Mn by 2027. Hence, companies are gaining expertise in multispectral digital imaging technology to improve efficiency in skin examinations.

The uptake of handheld imaging devices in dermatology is soaring, since dermatologists chart lesions on mannequins or through clinical overview photographs. Thus, companies in the handheld imaging devices market are helping dermatologists to boost their professional credibility by increasing the availability of technologically sound devices.

Analysts’ Viewpoint

Ergonomic design innovations are boosting the sales of handheld imaging devices in dentistry, owing to better weight dispersion and stability in the palm. Companies in the handheld imaging devices market are developing equipment with LEDs and monochrome cameras to provide early detection of oral cancer.

Pitfalls of handheld devices involve heavy weight of these devices that affect the productivity of clinicians. Hence, companies should gain knowledge about ergonomics to design devices that reduce fatigue among users. They should develop devices that alleviate the hassle of switching between cameras or lenses during close-up or clinical overview pictures taken at the time of skin examinations.

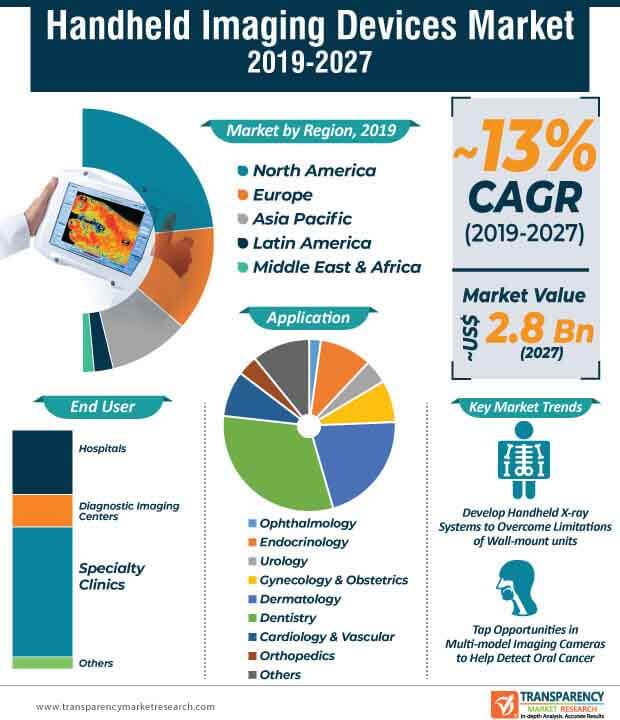

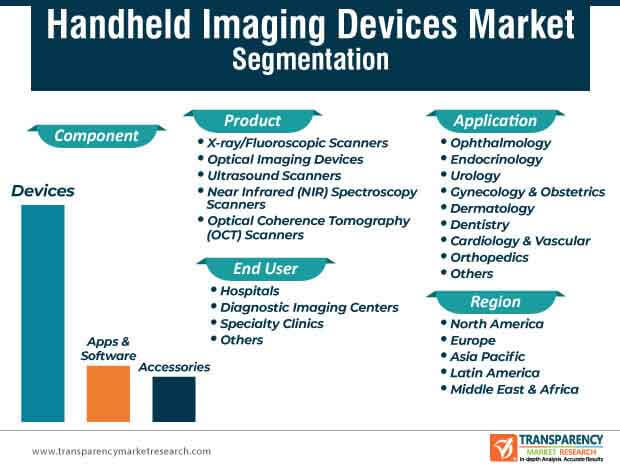

Handheld imaging devices market to reach a valuation of ~US$ 2.8 Bn by 2027

Handheld imaging devices market is expected to expand at a CAGR of ~13% from 2019 to 2027

Handheld imaging devices market is driven by rise in number of approved handheld imaging devices by different regulatory authorities across the world

The end-use segments in handheld imaging devices market are hospitals, diagnostic imaging centers, specialty clinics, and others

Key players analyzed in this report include GE Healthcare (GE Electric Company), Koninklijke Philips N.V., Siemens Healthineers, FUJIFILM Corporation, Micro C.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Handheld Imaging Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Handheld Imaging Devices Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Key Industry Events (Acquisitions, Mergers, Collaborations, Product Launches, etc.)

5.2. Regulatory Scenario by Region/globally

5.3. Disease Prevalence & Incidence Rate globally with key countries

6. Global Handheld Imaging Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

6.3.1. X-ray/Fluoroscopic Scanners

6.3.2. Optical Imaging Devices

6.3.3. Ultrasound Scanners

6.3.4. Near Infrared(NIR) Spectroscopy Scanners

6.3.5. Optical Coherence Tomography(OCT) Scanners

6.4. Global Handheld Imaging Devices Market Attractiveness, by Product, 2019?2027

7. Global Handheld Imaging Devices Market Analysis and Forecast, by Component

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

7.3.1. Devices

7.3.2. Apps & Software

7.3.3. Accessories

7.4. Global Handheld Imaging Devices Market Attractiveness, by Component, 2019?2027

8. Global Handheld Imaging Devices Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

8.3.1. Ophthalmology

8.3.2. Endocrinology

8.3.3. Urology

8.3.4. Gynecology & Obstetrics

8.3.5. Dermatology

8.3.6. Dentistry

8.3.7. Cardiology and Vascular

8.3.8. Orthopedics

8.3.9. Others

8.4. Global Handheld Imaging Devices Market Attractiveness, by Application, 2019?2027

9. Global Handheld Imaging Devices Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Global Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Diagnostic Imaging Centers

9.3.3. Specialty Clinics

9.3.4. Others

9.4. Global Handheld Imaging Devices Market Attractiveness, by End-user, 2019?2027

10. Global Handheld Imaging Devices Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Handheld Imaging Devices Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Handheld Imaging Devices Market Attractiveness, by Country/Region, 2019?2027

11. North America Handheld Imaging Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

11.2.1. X-ray/Fluoroscopic Scanners

11.2.2. Optical Imaging Devices

11.2.3. Ultrasound Scanners

11.2.4. Near Infrared (NIR) Spectroscopy Scanners

11.2.5. Optical Coherence Tomography (OCT) Scanners

11.3. North America Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

11.3.1. Devices

11.3.2. Apps & Software

11.3.3. Accessories

11.4. North America Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

11.4.1. Ophthalmology

11.4.2. Endocrinology

11.4.3. Urology

11.4.4. Gynecology & Obstetrics

11.4.5. Dermatology

11.4.6. Dentistry

11.4.7. Cardiology and Vascular

11.4.8. Orthopedics

11.4.9. Others

11.5. North America Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

11.5.1. Hospitals

11.5.2. Diagnostic Imaging Centers

11.5.3. Specialty Clinics

11.5.4. Others

11.6. North America Handheld Imaging Devices Market Value Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. North America Handheld Imaging Devices Market Attractiveness Analysis, 2019?2027

11.7.1. By Product

11.7.2. By Component

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Handheld Imaging Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Europe Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

12.2.1. X-ray/Fluoroscopic Scanners

12.2.2. Optical Imaging Devices

12.2.3. Ultrasound Scanners

12.2.4. Near Infrared (NIR) Spectroscopy Scanners

12.2.5. Optical Coherence Tomography (OCT) Scanners

12.3. Europe Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

12.3.1. Devices

12.3.2. Apps & Software

12.3.3. Accessories

12.4. Europe Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

12.4.1. Ophthalmology

12.4.2. Endocrinology

12.4.3. Urology

12.4.4. Gynecology & Obstetrics

12.4.5. Dermatology

12.4.6. Dentistry

12.4.7. Cardiology and Vascular

12.4.8. Orthopedics

12.4.9. Others

12.5. Europe Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

12.5.1. Hospitals

12.5.2. Diagnostic Imaging Centers

12.5.3. Specialty Clinics

12.5.4. Others

12.6. Europe Handheld Imaging Devices Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Handheld Imaging Devices Market Attractiveness Analysis, 2019?2027

12.7.1. By Product

12.7.2. By Component

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Handheld Imaging Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Asia Pacific Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

13.2.1. X-ray/Fluoroscopic Scanners

13.2.2. Optical Imaging Devices

13.2.3. Ultrasound Scanners

13.2.4. Near Infrared (NIR) Spectroscopy Scanners

13.2.5. Optical Coherence Tomography (OCT) Scanners

13.3. Asia Pacific Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

13.3.1. Devices

13.3.2. Apps & Software

13.3.3. Accessories

13.4. Asia Pacific Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

13.4.1. Ophthalmology

13.4.2. Endocrinology

13.4.3. Urology

13.4.4. Gynecology & Obstetrics

13.4.5. Dermatology

13.4.6. Dentistry

13.4.7. Cardiology and Vascular

13.4.8. Orthopedics

13.4.9. Others

13.5. Asia Pacific Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

13.5.1. Hospitals

13.5.2. Diagnostic Imaging Centers

13.5.3. Specialty Clinics

13.5.4. Others

13.6. Asia Pacific Handheld Imaging Devices Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Handheld Imaging Devices Market Attractiveness Analysis, 2019?2027

13.7.1. By Product

13.7.2. By Component

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Handheld Imaging Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Latin America Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

14.2.1. X-ray/Fluoroscopic Scanners

14.2.2. Optical Imaging Devices

14.2.3. Ultrasound Scanners

14.2.4. Near Infrared (NIR) Spectroscopy Scanners

14.2.5. Optical Coherence Tomography (OCT) Scanners

14.3. Latin America Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

14.3.1. Devices

14.3.2. Apps & Software

14.3.3. Accessories

14.4. Latin America Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

14.4.1. Ophthalmology

14.4.2. Endocrinology

14.4.3. Urology

14.4.4. Gynecology & Obstetrics

14.4.5. Dermatology

14.4.6. Dentistry

14.4.7. Cardiology and Vascular

14.4.8. Orthopedics

14.4.9. Others

14.5. Latin America Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

14.5.1. Hospitals

14.5.2. Diagnostic Imaging Centers

14.5.3. Specialty Clinics

14.5.4. Others

14.6. Latin America Handheld Imaging Devices Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Latin America Handheld Imaging Devices Market Attractiveness Analysis, 2019?2027

14.7.1. By Product

14.7.2. By Component

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Handheld Imaging Devices Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Middle East & Africa Handheld Imaging Devices Market Value Forecast, by Product, 2017–2027

15.2.1. X-ray/Fluoroscopic Scanners

15.2.2. Optical Imaging Devices

15.2.3. Ultrasound Scanners

15.2.4. Near Infrared (NIR) Spectroscopy Scanners

15.2.5. Optical Coherence Tomography (OCT) Scanners

15.3. Middle East & Africa Handheld Imaging Devices Market Value Forecast, by Component, 2017–2027

15.3.1. Devices

15.3.2. Apps & Software

15.3.3. Accessories

15.4. Middle East & Africa Handheld Imaging Devices Market Value Forecast, by Application, 2017–2027

15.4.1. Ophthalmology

15.4.2. Endocrinology

15.4.3. Urology

15.4.4. Gynecology & Obstetrics

15.4.5. Dermatology

15.4.6. Dentistry

15.4.7. Cardiology and Vascular

15.4.8. Orthopedics

15.4.9. Others

15.5. Middle East & Africa Handheld Imaging Devices Market Value Forecast, by End-user, 2017–2027

15.5.1. Hospitals

15.5.2. Diagnostic Imaging Centers

15.5.3. Specialty Clinics

15.5.4. Others

15.6. Middle East & Africa Handheld Imaging Devices Market Value Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Handheld Imaging Devices Market Attractiveness Analysis, 2019?2027

15.7.1. By Product

15.7.2. By Component

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share/Position Analysis, by Company (2018)

16.3. Company Profiles

16.3.1. GE Healthcare (GE Electric Company)

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Koninklijke Philips N.V.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. Siemens Healthineers

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. FUJIFILM Corporation

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Micro C, LLC

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. Butterfly Network, Inc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Clarius Mobile Health

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. InfraScan, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. KaVo Dental

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. MolecuLight, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 03: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 04: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 05: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 08: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 09: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 10: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 11: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 13: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 14: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 15: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 18: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 19: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 20: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 23: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 24: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 25: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 26: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 27: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 28: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Component, 2017–2027

Table 29: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 30: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Handheld Imaging Devices Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Handheld Imaging Devices Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Handheld Imaging Devices Market Value Share, by Product (2018)

Figure 04: Global Handheld Imaging Devices Market Value Share, by Component (2018)

Figure 05: Global Handheld Imaging Devices Market Value Share, by Component (2018)

Figure 06: Global Handheld Imaging Devices Market Value Share, by End-user (2018)

Figure 07: U.S. Handheld Imaging Devices Market Value Share, by End-user (2018)

Figure 08: U.S. Medical Device Approval Process

Figure 09: Global Diabetes Prevalence in Adults (20-79 years)

Figure 10: Global Handheld Imaging Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 11: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by X-ray/Fluoroscopy Scanners, 2017-2027

Figure 12: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Optical Imaging Devices, 2017-2027

Figure 13: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Ultrasound Scanners, 2017-2027

Figure 14: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Near Infrared (NIR) Spectroscopy Scanners, 2017-2027

Figure 15: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Optical Coherence Tomography (OCT) Scanners, 2017-2027

Figure 16: Global Handheld Imaging Devices Market Attractiveness Analysis, by Product 2019?2027

Figure 17: Global Handheld Imaging Devices Market Value Share Analysis, by Component, 2018 and 2027

Figure 18: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Devices, 2017–2027

Figure 19: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Apps & Software, 2017–2027

Figure 20: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Accessories, 2017–2027

Figure 21: Global Handheld Imaging Devices Market Attractiveness, by Component, 2019–2027

Figure 22: Global Handheld Imaging Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 23: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Ophthalmology, 2017–2027

Figure 24: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Endocrinology, 2017–2027

Figure 25: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Urology, 2017–2027

Figure 26: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Gynecology & Obstetrics, 2017–2027

Figure 27: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Dermatology, 2017–2027

Figure 28: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Dentistry, 2017–2027

Figure 29: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Cardiology and Vascular, 2017–2027

Figure 30: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Orthopedics, 2017–2027

Figure 31: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2016-2026

Figure 32: Global Handheld Imaging Devices Market Attractiveness Analysis, by Application, 2019–2027

Figure 33: Global Handheld Imaging Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 34: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 35: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Diagnostic Imaging Centers, 2017–2027

Figure 36: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2027

Figure 37: Global Handheld Imaging Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 38: Global Handheld Imaging Devices Market Attractiveness Analysis, by End-user, 2019–2027

Figure 39: Global Handheld Imaging Devices Market Value Share, by Region, 2018 and 2027

Figure 40: Global Handheld Imaging Devices Market Attractiveness Analysis, by Region, 2019–2027

Figure 41: North America Handheld Imaging Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 42: North America Handheld Imaging Devices Market Value Share, by Country, 2018 and 2027

Figure 43: North America Handheld Imaging Devices Market Attractiveness, by Country, 2019–2027

Figure 44: North America Handheld Imaging Devices Market Value Share, by Product, 2018 and 2027

Figure 45: North America Handheld Imaging Devices Market Attractiveness, by Product, 2019–2027

Figure 46: North America Home Blood Pressure Monitoring Market Value Share, by Component, 2018 and 2027

Figure 47: North America Home Blood Pressure Monitoring Market Attractiveness, by Component, 2019–2027

Figure 48: North America Handheld Imaging Devices Market Value Share, by Application, 2018 and 2027

Figure 49: North America Handheld Imaging Devices Market Attractiveness, by Application, 2019–2027

Figure 50: North America Handheld Imaging Devices Market Value Share, by End-user, 2018 and 2027

Figure 51: North America Handheld Imaging Devices Market Attractiveness, by End-user, 2019–2027

Figure 52: Europe Handheld Imaging Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 53: Europe Handheld Imaging Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 54: Europe Handheld Imaging Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 55: Europe Handheld Imaging Devices Market Value Share, by Product, 2018 and 2027

Figure 56: Europe Handheld Imaging Devices Market Attractiveness, by Product, 2019–2027

Figure 57: Europe Handheld Imaging Devices Market Value Share, by Component, 2018 and 2027

Figure 58: Europe Handheld Imaging Devices Market Attractiveness, by Component, 2019–2027

Figure 59: Europe Handheld Imaging Devices Market Value Share, by Application, 2018 and 2027

Figure 60: Europe Handheld Imaging Devices Market Attractiveness, by Application, 2019–2027

Figure 61: Europe Handheld Imaging Devices Market Value Share, by End-user, 2018 and 2027

Figure 62: Europe Handheld Imaging Devices Market Attractiveness, by End-user, 2019–2027

Figure 63: Asia Pacific Handheld Imaging Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 64: Asia Pacific Handheld Imaging Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 65: Asia Pacific Handheld Imaging Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 66: Asia Pacific Handheld Imaging Devices Market Value Share, by Product, 2018 and 2027

Figure 67: Asia Pacific Handheld Imaging Devices Market Attractiveness, by Product, 2019–2027

Figure 68: Asia Pacific Handheld Imaging Devices Market Value Share, by Component, 2018 and 2027

Figure 69: Asia Pacific Handheld Imaging Devices Market Attractiveness, by Component, 2019–2027

Figure 70: Asia Pacific Handheld Imaging Devices Market Value Share, by Application, 2018 and 2027

Figure 71: Asia Pacific Handheld Imaging Devices Market Attractiveness, by Application, 2019–2027

Figure 72: Asia Pacific Handheld Imaging Devices Market Value Share, by End-user, 2018 and 2027

Figure 73: Asia Pacific Handheld Imaging Devices Market Attractiveness, by End-user, 2019–2027

Figure 74: Latin America Handheld Imaging Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 75: Latin America Handheld Imaging Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 76: Latin America Handheld Imaging Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 77: Latin America Handheld Imaging Devices Market Value Share, by Product, 2018 and 2027

Figure 78: Latin America Handheld Imaging Devices Market Attractiveness, by Product, 2019–2027

Figure 79: Latin America Handheld Imaging Devices Market Value Share, by Component, 2018 and 2027

Figure 80: Latin America Handheld Imaging Devices Market Attractiveness, by Component, 2019–2027

Figure 81: Latin America Handheld Imaging Devices Market Value Share, by Application, 2018 and 2027

Figure 82: Latin America Handheld Imaging Devices Market Attractiveness, by Application, 2019–2027

Figure 83: Latin America Handheld Imaging Devices Market Value Share, by End-user, 2018 and 2027

Figure 84: Latin America Handheld Imaging Devices Market Attractiveness, by End-user, 2019–2027

Figure 85: Middle East & Africa Handheld Imaging Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 86: Middle East & Africa Handheld Imaging Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 87: Middle East & Africa Handheld Imaging Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 88: Middle East & Africa Handheld Imaging Devices Market Value Share, by Product, 2018 and 2027

Figure 89: Middle East & Africa Handheld Imaging Devices Market Attractiveness, by Product, 2019–2027

Figure 90: Middle East & Africa Handheld Imaging Devices Market Value Share, by Component, 2018 and 2027

Figure 91: Middle East & Africa Handheld Imaging Devices Market Attractiveness, by Component, 2019–2027

Figure 92: Middle East & Africa Handheld Imaging Devices Market Value Share, by Application, 2018 and 2027

Figure 93: Middle East & Africa Handheld Imaging Devices Market Attractiveness, by Application, 2019–2027

Figure 94: Middle East & Africa Handheld Imaging Devices Market Value Share, by End-user, 2018 and 2027

Figure 95: Middle East & Africa Handheld Imaging Devices Market Attractiveness, by End-user, 2019–2027

Figure 96: Market Position/Ranking Analysis, 2018, by Tier and Size of the Company