Analysts’ Viewpoint on Market Scenario

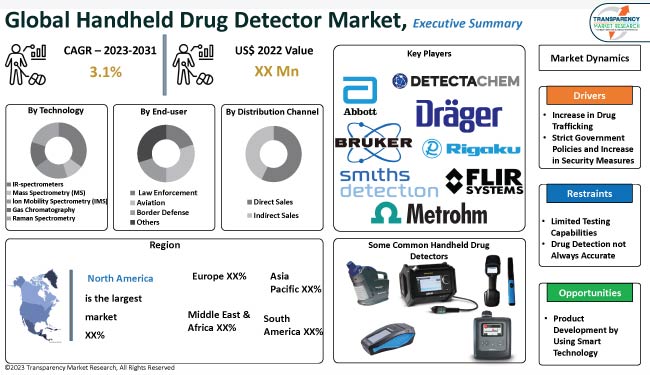

Increase in drug trafficking and strict government policies are the primary factors expected to drive the handheld drug detector market growth in the near future. Drug screening devices are highly sensitive and accurate and are a reliable tool for drug screening and identification.

The future of the global handheld drug detector industry is expected to be determined by product diversity and significant investments in research and development. Companies in the handheld drug detector market are launching lightweight handheld detectors, smartphone technologies, and highly intuitive devices, which allow fast operations and detection.

The devices that use spectroscopic methods and other technologies of detection to identify a variety of illegal drugs are known as handheld drug detectors. Drug detection devices have sensors that can quickly detect chemicals, making it easier for security and law enforcement personnel to rapidly identify illegal substances.

A handheld drug detector is capable of detecting a wide range of drugs, including amphetamines, narcotics, and hallucinogens. Portable drug testing devices can detect street drugs such as cocaine, MDMA (ecstasy), and LSD as well. Some drug detectors are better suited for detecting a wider range of drugs than others and some others have the option to identify numerous pharmaceuticals drugs within one scan.

Trace detection is a challenge, not only because there are many varieties of synthetic opioids similar to fentanyl, but also because particles may be lodged in the surrounding areas, increasing the chances of exposure. A single whiff of fentanyl-laced drugs may lead to hospitalization. Governments are therefore demanding handheld synthetic drug detectors in order to reduce exposure risk to potent chemicals.

Airports use handheld drug detectors to find drugs, explosives, and other illegal substances. The rise in drug trafficking is anticipated to propel handheld drug detector industry growth because airports are frequently used as transit points.

More than 14,000 suspects were detained across Central and South America, according to latest Interpol drug statistics, and an unprecedented US$ 5.7 Bn in illegal drugs were discovered and seized. In 2021, the Narcotics Control Bureau estimates that 4,386 kilograms of opium and 6,75,631 kilograms of cannabis was seized in India. 77,000 suspects were arrested, 27 tons of drugs were seized, and 326,000 people were identified using a drug detector as being related to drugs, according to China's narcotics control authorities.

At checkpoints, security personnel use drug testing kits to check on passengers entering the area, or luggage that has been checked into a baggage carousel. In some cases, handheld drug detectors are deployed to help police on watch when suspicious behavior is seen close to an air terminal.

The handheld drug detector market demand is likely to be propelled by regulatory rules and government policies to use drug detectors for public security measures.

The law nowadays mandates and defines permissible drug-detecting programs in the U.S. All drug detecting/distinguishing by public bodies and some drug detecting by legal authorities is done according to lawful power or order. To address the security and health implications of drug use and trafficking, the European Union and its member states have implemented both strategic and operational measures on how to perform drug detecting and screening, utilizing handheld drug detection devices.

Majority of nations already have laws in place to deal with illegal drugs and many have passed laws on mandatory use of drug detectors, specifically targeting drug driving. Methods for screening and detecting specific substances have become more accurate as a result of advancements in drug detection equipment.

During the forecast period, North America is expected to hold majority of the handheld drug detector market share owing to the increase in risks from substandard and falsified drugs and stringent regulatory frameworks by governments. Moreover, government demand for handheld synthetic drug detectors is further creating lucrative opportunities in the global handheld drug detector market.

The handheld drug detector market size in Asia Pacific is anticipated to grow at a fast rate in the near future. This is due to favorable government policies for drug detecting and rise in drug trafficking, further boosting handheld drug detector market development in the region.

The business model of prominent manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Product development is a major marketing strategy for top handheld drug detector market players. The market is highly competitive, with the presence of various global and regional players.

Abbott, Bruker, DetectaChem, Drägerwerk AG & Co. KGaA, Flir Systems, Metrohm, Rapiscan Systems, Rigaku, Smith’s Detection, and Thermo Fisher are the prominent entities profiled in the handheld drug detector market report.

Key players have been profiled in the handheld drug detector market research based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 210.8 Mn |

|

Market Forecast Value in 2031 |

US$ 423.1 Mn |

|

Growth Rate (CAGR) |

3.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 210.8 Mn in 2022

It is projected to grow at a CAGR of 3.1% from 2023 to 2031

Increase in drug trafficking, strict government policies, and increasing security measures

The aviation end-user segment accounted for significant share in 2022

Asia Pacific is likely to be one of the lucrative markets in the next few years

Abbott, Bruker, DetectaChem, Drägerwerk AG & Co. KGaA, Flir Systems, Metrohm, Rapiscan Systems, Rigaku, Smith’s Detection, and Thermo Fisher Scientific

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. Technological Overview Analysis

5.9. Global Handheld Drug Detector Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Handheld Drug Detector Market Analysis and Forecast, by Technology

6.1. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

6.1.1. IR-spectrometers

6.1.2. Mass Spectrometry (MS)

6.1.3. lon Mobility Spectrometry (IMS)

6.1.4. Gas Chromatography

6.1.5. Raman Spectrometry

6.2. Incremental Opportunity, by Technology

7. Global Handheld Drug Detector Market Analysis and Forecast, by End-user

7.1. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

7.1.1. Law Enforcement

7.1.2. Aviation

7.1.3. Border Defense

7.1.4. Others

7.2. Incremental Opportunity, by End-user

8. Global Handheld Drug Detector Market Analysis and Forecast, by Distribution Channel

8.1. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

8.1.1. Direct Sales

8.1.2. Indirect Sales

8.2. Incremental Opportunity, by Distribution Channel

9. Global Handheld Drug Detector Market Analysis and Forecast, by Region

9.1. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East and Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Handheld Drug Detector Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Brand Analysis

10.5. Consumer Buying Behavior Analysis

10.6. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

10.6.1. IR-spectrometers

10.6.2. Mass Spectrometry (MS)

10.6.3. lon Mobility Spectrometry (IMS)

10.6.4. Gas Chromatography

10.6.5. Raman Spectrometry

10.7. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

10.7.1. Law Enforcement

10.7.2. Aviation

10.7.3. Border Defense

10.7.4. Others

10.8. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

10.8.1. Direct Sales

10.8.2. Indirect Sales

10.9. Handheld Drug Detector Market (US$ Mn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Handheld Drug Detector Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

11.6.1. IR-spectrometers

11.6.2. Mass Spectrometry (MS)

11.6.3. lon Mobility Spectrometry (IMS)

11.6.4. Gas Chromatography

11.6.5. Raman Spectrometry

11.7. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

11.7.1. Law Enforcement

11.7.2. Aviation

11.7.3. Border Defense

11.7.4. Others

11.8. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Handheld Drug Detector Market (US$ Mn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.9.1. UK

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Handheld Drug Detector Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

12.6.1. IR-spectrometers

12.6.2. Mass Spectrometry (MS)

12.6.3. lon Mobility Spectrometry (IMS)

12.6.4. Gas Chromatography

12.6.5. Raman Spectrometry

12.7. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

12.7.1. Law Enforcement

12.7.2. Aviation

12.7.3. Border Defense

12.7.4. Others

12.8. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Handheld Drug Detector Market (US$ Mn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Handheld Drug Detector Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

13.6.1. IR-spectrometers

13.6.2. Mass Spectrometry (MS)

13.6.3. lon Mobility Spectrometry (IMS)

13.6.4. Gas Chromatography

13.6.5. Raman Spectrometry

13.7. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

13.7.1. Law Enforcement

13.7.2. Aviation

13.7.3. Border Defense

13.7.4. Others

13.8. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Handheld Drug Detector Market (US$ Mn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Handheld Drug Detector Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Technology, 2017 - 2031

14.6.1. IR-spectrometers

14.6.2. Mass Spectrometry (MS)

14.6.3. lon Mobility Spectrometry (IMS)

14.6.4. Gas Chromatography

14.6.5. Raman Spectrometry

14.7. Handheld Drug Detector Market (US$ Mn and Thousand Units), by End-user, 2017 - 2031

14.7.1. Law Enforcement

14.7.2. Aviation

14.7.3. Border Defense

14.7.4. Others

14.8. Handheld Drug Detector Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Handheld Drug Detector Market (US$ Mn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2022)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Bruker

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. DetectaChem

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. Drägerwerk AG & Co. KGaA

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Flir Systems

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Metrohm

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Rapiscan Systems

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Rigaku

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Smith’s Detection

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Thermo Fisher

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

15.3.11. Other Key Players

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Revenue

15.3.11.4. Strategy & Business Overview

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. By Technology

16.1.2. By End-user

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 2: Global Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 3: Global Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 4: Global Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 5: Global Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 6: Global Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 8: Global Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 10: North America Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 11: North America Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 12: North America Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 13: North America Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 14: North America Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 16: North America Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Table 17: Europe Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 18: Europe Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 19: Europe Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 20: Europe Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 21: Europe Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 22: Europe Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 24: Europe Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Table 25: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 26: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 27: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 28: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 29: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 32: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Table 33: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 34: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 35: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 36: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 37: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 40: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Table 41: South America Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Table 42: South America Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Table 43: South America Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Table 44: South America Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Table 45: South America Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 46: South America Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South America Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Table 48: South America Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 2: Global Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 3: Global Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 4: Global Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 5: Global Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 6: Global Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End-user , 2023-2031

Figure 7: Global Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 8: Global Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 10: Global Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 11: Global Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 13: North America Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 14: North America Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 15: North America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 16: North America Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 17: North America Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 18: North America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End-user , 2023-2031

Figure 19: North America Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 20: North America Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 22: North America Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 23: North America Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 24: North America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 25: Europe Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 26: Europe Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 27: Europe Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 28: Europe Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 29: Europe Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 30: Europe Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 31: Europe Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 32: Europe Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 34: Europe Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 35: Europe Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Europe Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 37: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 38: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 39: Asia Pacific Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 40: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 41: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 42: Asia Pacific Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 43: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 44: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 46: Asia Pacific Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 47: Asia Pacific Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 48: Asia Pacific Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 49: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 50: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 51: Middle East & Africa Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 52: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 53: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 54: Middle East & Africa Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End User, 2023-2031

Figure 55: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 56: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Middle East & Africa Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 59: Middle East & Africa Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Middle East & Africa Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 61: South America Handheld Drug Detector Market Value (US$ Mn), by Technology, 2017-2031

Figure 62: South America Handheld Drug Detector Market Volume (Thousand Units), by Technology 2017-2031

Figure 63: South America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2023-2031

Figure 64: South America Handheld Drug Detector Market Value (US$ Mn), by End-user , 2017-2031

Figure 65: South America Handheld Drug Detector Market Volume (Thousand Units), by End-user 2017-2031

Figure 66: South America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by End-user , 2023-2031

Figure 67: South America Handheld Drug Detector Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 68: South America Handheld Drug Detector Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by

Distribution Channel, 2023-2031

Figure 70: South America Handheld Drug Detector Market Value (US$ Mn), by Region, 2017-2031

Figure 71: South America Handheld Drug Detector Market Volume (Thousand Units), by Region 2017-2031

Figure 72: South America Handheld Drug Detector Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031