The demand for minimally invasive surgical treatments is increasing as a result of benefits such as less discomfort, shorter recovery times, and smaller incisions. An increase in the geriatric population susceptible to chronic conditions including neurovascular disorders, urological disease, and cardiovascular disease is likely to play an important role in the expansion of the global guidewires market.

According to estimates from the World Health Organization (WHO), the global population of people aged 60 years and more is predicted to rise from 12% to 22% by 2050. The healthcare system is burdened by elderly population suffering from cardiovascular illnesses. As per World Bank data, about 27.04% of Japan's overall population was 65 years and older in 2017, up from about 25% in 2015. The prevalence of cardiovascular illnesses rises with age, which is predicted to increase the need for surgical guidewires. As a result, the growing elderly population is one of the major driving forces for the global guidewires market.

In addition to that, the increasing number of adult population is adopting unhealthy lifestyles such as a sedentary work life, lack of physical activity, high alcohol and cigarette intake, and a high diet of saturated fats and sweets. These factors raise the probability of chronic illnesses including heart disease, diabetes, and obesity, and which may necessitate surgical intervention as the condition progresses. As a result, the increased prevalence of chronic diseases is likely to drive the global guidewires market in the years to come.

The National Commission for the Evaluation of Medical Devices and Health Technologies (CNEDiMTS), France, approved Philips Volcano's Verrata and Verrata Plus guidewires for add-on compensation under section V of the List of Reimbursable Products and Services (LPPR) in May 2017. CNEDiMTS also assessed Boston Scientific’s fractional flow reserve guidewire, Comet, in June 2017 for inclusion in the LPPR category based on technical equivalence.

The guidewires market in North America is predicted to develop due to the rising prevalence of cardiovascular illnesses in both men and women in the US. As per the Journal of the American College of Cardiology, cardiovascular disease claims the lives of roughly 17 million people each year, with that figure anticipated to rise to almost 23 million by 2030. The danger of acute coronary syndrome is predicted to encourage the usage of pressure guidewire, fuelling expansion of the global guidewire market.

Due to the increasing demand for minimally invasive coronary operations, the coronary category has been one of the leading segments in the market. A substantial number of atherosclerosis patients are admitted to hospitals, and the incidence of cardiovascular disease is on the rise. In 2017, over 92.1 million American adults suffered from some sort of cardiovascular illness, according to the document Heart Disease and Stroke Statistics 2018.

The development of new technologies is likely to aid the segment's dominance during the forecast period. The availability of favorable reimbursement schemes for cardiovascular procedures is further likely to boosting the global market. Teleflex's Spectre guidewire and Galeo coronary guidewires (Biotronik) are two examples of coronary guidewires that have been introduced in the last four years.

Due to the high frequency of neurovascular illnesses, the neurovascular segment is expected to grow at rapid rate in the global guidewires market throughout the forecast period. The spinal cord and brain vascular system are affected by cavernoma, cerebral hemorrhage, arteriovenous malformations, aneurysms, and stroke. Due to the existence of important blood arteries, treating such illnesses is difficult. The growing use of these devices in extremely difficult neuro-vascular minimally invasive operations, on the other hand, is supporting the market growth.

The use of interventional radiology methods in image-guided diagnosis and treatment of illnesses has grown as guidewire tip technology has improved. Interventional radiology has led to substantial improvement in patient recovery.

As compared to open surgery, this is due to the fact that the technique carries a lower risk, produces less discomfort, and requires a shorter recovery period. pulmonary, hepatobiliary, gastrointestinal, vascular, and genitourinary disorders are all great choices for interventional radiology. The global guidewires market is expected to grow in the future, thanks to an increase in the use of minimally invasive operations and technical developments in surgical techniques.

The global market is likely to dominated by coronary guidewires. Incidences of coronary illnesses are expected to rise, propelling the industry ahead. To reach a lesion or vascular segment, these guidewires are straightforward to move across blood vessels. It serves as a guide for bigger catheters, making delivery to the treatment location easier. Coronary guidewires are expected to account for about half of the overall global market. This is due to the rising frequency of chronic renal disease and the usage of dialysis catheters, which is expected to fuel the expansion of the urology segment in the guidewires market. Furthermore, urology guidewires have an atraumatic hydrophilic tip that makes navigating narrow spaces easier. Urology guidewires are expected to account for a sizeable chunk of the guidewire market.

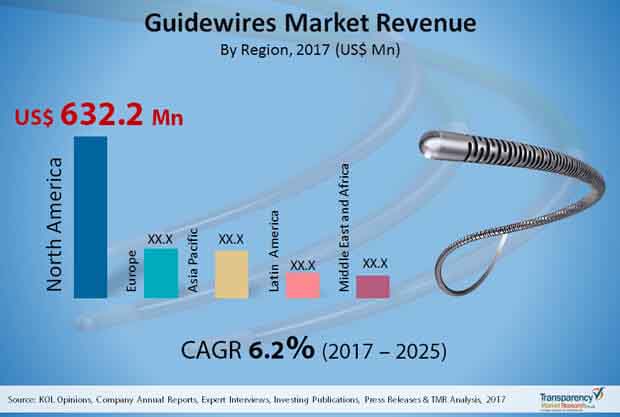

North America is expected to maintain its position as a leader in the global guidewires market. Key growth drivers include the high frequency of urological and cardiovascular disorders, as well as modern healthcare infrastructure and the existence of multiple guidewire producers. The North America guidewires market is expected to grow considerably during the forecast period.

The Asia-Pacific region is expected to develop at the rapid growth rate, with a considerable share of the market during the projection period. The growth of the Asia-Pacific guidewires market is likely to be aided by the growth of the business in developing markets, which is driven by increasing healthcare issues.

The use of high-quality guidewire brands imported from developed parts of the world has increased in these developing countries. Progress in the economy as well as favorable government policies have made it easier for significant market participants in the region to conduct business.

Guidewires market to climb to reach opportunities worth US$2.7 bn by 2025

Guidewires market is expected to garner a CAGR of 6.2% from 2017 to 2025

Guidewires market is driven by growing demand for minimally invasive interventional procedures

North America accounted for a major share of the global guidewires market

The coronary guidewires segment is expected to hold the leading revenue share in the global guidewires market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Guidewires Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1 Increasing prevalence of cardiovascular and renal diseases

4.3.1.2 Rise in number of interventional diagnostic procedures performed

4.3.1.3 Growing demand for minimally invasive surgeries

4.3.1.4 Favorable reimbursement scenario

4.3.2. Restraints

4.3.2.1 High cost minimally invasive surgeries

4.3.2.2 Complications of guidewire use

4.3.3. Opportunity

4.3.3.1 Rising demand for technologically advanced guidewires considering patient comfort

4.3.3.2 Growing economies of emerging markets

4.4. Global Guidewires Market Analysis and Forecasts, 2015–2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Market Outlook

4.7. Guidewire Contract Manufacturing Organizations (CMOs) (CMO Name & Type, Contact/Address, Services/Capabilities)

4.8. Guidewire Accessories Snapshot (Guidewire - Torque & Locking Device, Bowl, Straightener, Dispenser, Introducer Needles, Insertion Tool & Basin)

4.9. Guidewires Technology Trends (Automation of Guidewire Manufacturing Process, Coating & Use of Radiopaque Markers)

4.10. Key Metrics of New Generation Guidewires

4.11. Guidewires Core Material Snapshot (Nitinol & Stainless Steel)

5. Global Guidewires Market Analysis and Forecasts, By Product Type

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Value Forecast by Product Type, 2015–2025

5.3.1. Coronary Guidewires

5.3.2. Peripheral Guidewires

5.3.3. Neurovascular Guidewires

5.3.4. Urology Guidewires

5.3.5. Radiology Guidewires

5.3.6. Gastroenterology Guidewires

5.3.7. Other Guidewires (Otolaryngology & Oncology)

5.4. Market Attractiveness by Product Type

6. Global Guidewires Market Analysis and Forecasts, By End-user

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast by End-user, 2015–2025

6.3.1. Hospitals

6.3.2. Clinics

6.3.3. Ambulatory Surgical Centers

6.3.4. Diagnostic Centers

6.4. Market Attractiveness by End-user

7. Global Guidewires Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Market Value Forecast by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness by Country/Region

8. North America Guidewires Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast by Product Type, 2015–2025

8.2.1. Coronary Guidewires

8.2.2. Peripheral Guidewires

8.2.3. Neurovascular Guidewires

8.2.4. Urology Guidewires

8.2.5. Radiology Guidewires

8.2.6. Gastroenterology Guidewires

8.2.7. Other Guidewires (Otolaryngology & Oncology)

8.3. Market Value Forecast by End-user, 2015–2025

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgical Centers

8.3.4. Diagnostic Centers

8.4. Market Value Forecast by Country, 2015–2025

8.4.1. U.S.

8.4.2. Canada

8.5. Market Attractiveness Analysis

8.5.1. By Product Type

8.5.2. By End-user

8.5.3. By Country

9. Europe Guidewires Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Product Type, 2015–2025

9.2.1. Coronary Guidewires

9.2.2. Peripheral Guidewires

9.2.3. Neurovascular Guidewires

9.2.4. Urology Guidewires

9.2.5. Radiology Guidewires

9.2.6. Gastroenterology Guidewires

9.2.7. Other Guidewires (Otolaryngology & Oncology)

9.3. Market Value Forecast By End-user, 2015–2025

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Ambulatory Surgical Centers

9.3.4. Diagnostic Centers

9.4. Market Value Forecast By Country/Sub-Region, 2015–2025

9.4.1. Germany

9.4.2. U.K.

9.4.3. France

9.4.4. Spain

9.4.5. Italy

9.4.6. Russia

9.4.6. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country/Sub-Region

10. Asia Pacific Guidewires Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast by Product Type, 2015–2025

10.2.1. Coronary Guidewires

10.2.2. Peripheral Guidewires

10.2.3. Neurovascular Guidewires

10.2.4. Urology Guidewires

10.2.5. Radiology Guidewires

10.2.6. Gastroenterology Guidewires

10.2.7. Other Guidewires (Otolaryngology & Oncology)

10.3. Market Value Forecast by End-user, 2015–2025

10.3.1. Hospitals

10.3.2. Clinics

10.3.3. Ambulatory Surgical Centers

10.3.4. Diagnostic Centers

10.4. Market Value Forecast by Country/Sub-Region, 2015–2025

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Australia & New Zealand

10.4.5. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-Region

11. Latin America Guidewires Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast by Product Type, 2015–2025

11.2.1. Coronary Guidewires

11.2.2. Peripheral Guidewires

11.2.3. Neurovascular Guidewires

11.2.4. Urology Guidewires

11.2.5. Radiology Guidewires

11.2.6. Gastroenterology Guidewires

11.2.7. Other Guidewires (Otolaryngology & Oncology)

11.3. Market Value Forecast by End-user, 2015–2025

11.3.1. Hospitals

11.3.2. Clinics

11.3.3. Ambulatory Surgical Centers

11.3.4. Diagnostic Centers

11.4. Market Value Forecast by Country/Sub-Region, 2015–2025

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Rest of Latin America

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-Region

12. Middle East & Africa Guidewires Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast by Product Type, 2015–2025

12.2.1. Coronary Guidewires

12.2.2. Peripheral Guidewires

12.2.3. Neurovascular Guidewires

12.2.4. Urology Guidewires

12.2.5. Radiology Guidewires

12.2.6. Gastroenterology Guidewires

12.2.7. Other Guidewires (Otolaryngology & Oncology)

12.3. Market Value Forecast by End-user, 2015–2025

12.3.1. Hospitals

12.3.2. Clinics

12.3.3. Ambulatory Surgical Centers

12.3.4. Diagnostic Centers

12.4. Market Value Forecast by Country/Sub-Region, 2015–2025

12.4.1. GCC Countries

12.4.2. South Africa

12.4.3. Israel

12.4.4. Rest of Middle East & Africa

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End User

12.5.3. By Country/Sub-Region

13. Competition Landscape*

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis by Company (2016)

13.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.3.1. Abbott

13.3.1.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.1.2 Financial Overview

13.3.1.3 Product Portfolio

13.3.1.4 SWOT Analysis

13.3.1.5 Strategic Overview

13.3.2. Terumo Medical Corporation

13.3.2.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.2.2 Financial Overview

13.3.2.3 Product Portfolio

13.3.2.4 SWOT Analysis

13.3.2.5 Strategic Overview

13.3.3. Integer Holdings Corporation

13.3.3.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.3.2 Financial Overview

13.3.3.3 Product Portfolio

13.3.3.4 SWOT Analysis

13.3.3.5 Strategic Overview

13.3.4. B. Braun Melsungen AG

13.3.4.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.4.2 Financial Overview

13.3.4.3 Product Portfolio

13.3.4.4 SWOT Analysis

13.3.4.5 Strategic Overview

13.3.5. Olympus Corporation

13.3.5.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.5.2 Financial Overview

13.3.5.3 Product Portfolio

13.3.5.4 SWOT Analysis

13.3.5.5 Strategic Overview

13.3.6. Stryker

13.3.6.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.6.2 Financial Overview

13.3.6.3 Product Portfolio

13.3.6.4 SWOT Analysis

13.3.6.5 Strategic Overview

13.3.7. Cardinal Health, Inc.

13.3.7.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.7.2 Financial Overview

13.3.7.3 Product Portfolio

13.3.7.4 SWOT Analysis

13.3.7.5 Strategic Overview

13.3.8. CONMED Corporation

13.3.8.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.8.2 Financial Overview

13.3.8.3 Product Portfolio

13.3.8.4 SWOT Analysis

13.3.8.5 Strategic Overview

13.3.9. Cook

13.3.9.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.9.2 Financial Overview

13.3.9.3 Product Portfolio

13.3.9.4 SWOT Analysis

13.3.9.5 Strategic Overview

13.3.10. Merit Medical Systems, Inc.

13.3.10.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.10.2 Financial Overview

13.3.10.3 Product Portfolio

13.3.10.4 SWOT Analysis

13.3.10.5 Strategic Overview

13.3.11. Boston Scientific Corporation

13.3.11.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.11.2 Financial Overview

13.3.11.3 Product Portfolio

13.3.11.4 SWOT Analysis

13.3.11.5 Strategic Overview

13.3.12. Medtronic

13.3.12.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.12.2 Financial Overview

13.3.12.3 Product Portfolio

13.3.12.4 SWOT Analysis

13.3.12.5 Strategic Overview

13.3.13. Entellus Medical, Inc.

13.3.13.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.13.2 Financial Overview

13.3.13.3 Product Portfolio

13.3.13.4 SWOT Analysis

13.3.13.5 Strategic Overview

13.3.14. SP Medical A/S.

13.3.14.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.14.2 Financial Overview

13.3.14.3 Product Portfolio

13.3.14.4 SWOT Analysis

13.3.14.5 Strategic Overview

13.3.15. EPflex Feinwerktechnik GmbH

13.3.15.1 Company Overview (HQ, Business Segments, Employee Strengths)

13.3.15.2 Financial Overview

13.3.15.3 Product Portfolio

13.3.15.4 SWOT Analysis

13.3.15.5 Strategic Overview

14. Key Take Aways

List of Tables

Table 01 Guidewire Contract Manufacturing Organizations (CMOs)

Table 02 Guidewire Contract Manufacturing Organizations (CMOs)

Table 03 Guidewire Contract Manufacturing Organizations (CMOs)

Table 04 Guidewire Contract Manufacturing Organizations (CMOs)

Table 05 Global Guidewires Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 06 Global Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 07 Global Guidewires Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 08 North America Guidewires Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 09 North America Guidewires Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 10 North America Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 11 Europe Guidewires Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 12 Europe Guidewires Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 13 Europe Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 14 Asia Pacific Guidewires Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 15 Asia Pacific Guidewires Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 16 Asia Pacific Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 17 Latin America Guidewires Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 18 Latin America Guidewires Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 19 Latin America Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 20 Middle East & Africa Guidewires Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 21 Middle East & Africa Guidewires Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 22 Middle East & Africa Guidewires Market Size (US$ Mn) Forecast, by End-user, 2015–2025

List of Figures

Figure 01 Global Guidewires Market Size (US$ Mn) Forecast, 2015–2025

Figure 02 Market Value Share (%), by Product (2016)

Figure 03 Market Value Share (%), by End-user (2016)

Figure 04 Market Value Share (%), by Region (2016)

Figure 05 Global Guidewires Market Value Share (%), by Product, 2017 and 2025

Figure 06 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Coronary Guidewires, 2015–2025

Figure 07 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Peripheral Guidewires, 2015–2025

Figure 08 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Neurovascular Guidewires, 2015–2025

Figure 09 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Urology Guidewires, 2015–2025

Figure 10 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Radiology Guidewires, 2015–2025

Figure 11 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Gastroenterology Guidewires, 2015–2025

Figure 12 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Other Guidewires, 2015–2025

Figure 13 Global Guidewires Market Attractiveness, by Product, 2017–2025

Figure 14 Global Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 15 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2017–2025

Figure 16 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Clinics, 2017–2025

Figure 17 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ambulatory Surgical Centers, 2017–2025

Figure 18 Global Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, Diagnostic Centers, 2017–2025

Figure 19 Global Guidewires Market Attractiveness, by End-user, 2017–2025

Figure 20 Global Guidewires Market Value Share (%), by Region, 2017 and 2025

Figure 21 Global Guidewires Market Attractiveness, by Region, 2017–2025

Figure 22 North America Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2025

Figure 23 North America Market Attractiveness, by Country, 2017–2025

Figure 24 North America Guidewires Market Value Share (%), by Country, 2017 and 2025

Figure 25 North America Guidewires Market Value (%) Share, by Product, 2017 and 2025

Figure 26 North America Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 27 North America Market Attractiveness, by Product, 2017–2025

Figure 28 North America Market Attractiveness, by End-user, 2017–2025

Figure 29 Europe Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2025

Figure 30 Europe Market Attractiveness, by Country, 2017–2025

Figure 31 Europe Guidewires Market Value Share (%), by Country, 2017 and 2025

Figure 32 Europe Guidewires Market Value Share (%), by Product, 2017 and 2025

Figure 33 Europe Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 34 Europe Market Attractiveness, by Product, 2017–2025

Figure 35 Europe Market Attractiveness, by End-user, 2017–2025

Figure 36 Asia Pacific Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 37 Asia Pacific Guidewires Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 38 Asia Pacific Guidewires Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 39 Asia Pacific Guidewires Market Value Share (%), by Product type, 2017 and 2025

Figure 40 Asia Pacific Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 41 Asia Pacific Guidewires Market Attractiveness, by Product, 2017–2025

Figure 42 Asia Pacific Guidewires Market Attractiveness, by End-user, 2017–2025

Figure 43 Latin America Guidewires Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 44 Latin America Guidewires Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 45 Latin America Guidewires Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 46 Latin America Guidewires Market Value Share, by Product, 2017 and 2025

Figure 47 Latin America Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 48 Latin America Guidewires Market Attractiveness, by Product, 2017–2025

Figure 49 Latin America Guidewires Market Attractiveness, by End-user, 2017–2025

Figure 50 Middle East & Africa Guidewires Market Size (US$ Mn) Forecast, 2015–2025

Figure 51 Middle East & Africa Guidewires Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 52 Middle East & Africa Guidewires Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 53 Middle East & Africa Guidewires Market Value Share (%), by Product, 2017 and 2025

Figure 54 Middle East & Africa Guidewires Market Value Share (%), by End-user, 2017 and 2025

Figure 55 Middle East & Africa Guidewires Market Attractiveness, by Product, 2017–2025

Figure 56 Middle East & Africa Guidewires Market Attractiveness, by End-user, 2017–2025

Figure 57 Global Heart Valve Devices Market Share, by Company, 2016

Figure 58 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 59 R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 60 Breakdown of Net Sales (%), by Region, 2016

Figure 61 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 62 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 63 R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 64 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 65 Breakdown of Net Sales (%), by Country, 2016

Figure 66 Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure 67 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 68 Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure 69 R&D Intensity and Sales & Marketing Intensity (%), 2015–2016

Figure 70 (SP Group A/S) Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure 71 (SP Group A/S) Breakdown of Net Sales (%), by Business Segment, 2016

Figure 72 Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure 73 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 74 Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure 75 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 76 Breakdown of Net Sales (%), by Region, 2016

Figure 77 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 78 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 79 Breakdown of Net Sales (%), by Region, 2016

Figure 80 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 81 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 82 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 83 "Breakdown of Net Sales (%), by Business Segment, 2016

Figure 84 Breakdown of Net Sales (%), by Region, 2016

Figure 85 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 86 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 87 Breakdown of Net Sales (%), by Medical Business Segment, 2016

Figure 88 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 89 Breakdown of Net Sales (%), by Business Segment, 2016

Figure 90 Breakdown of Net Sales (%), by Neurotechnology & Spine Business Segment, 2016

Figure 91 Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Figure 92 Breakdown of Net Sales (%), by Region, 2016