Green petroleum coke is obtained by decaying coke from the coker unit. When crude oil is converted into gasoline and jet fuels, green petroleum coke is obtained as a by-product. The quality of green petroleum coke depends on the quality of crude oil. The term ‘green’ refers to the stage of production process. The sulfur content in green petroleum coke decides the application of green petroleum coke. High sulfur content green petroleum coke is mainly used as a fuel in place of coal. Green petroleum coke with low sulfur content is upgraded through calcining and is used as a raw material for the production of aluminum and steel.

The global green petroleum coke market is expected to expand at a significant rate driven by increase in demand from the cement industry. The green petroleum coke market was valued at about US$ 12 Bn in 2016 and is projected to expand at a CAGR of 6.1% during the forecast period. Factors such as strict government laws regarding carbon emissions, rise in demand for fabrication of aluminum smelter anodes, rise in prices of coal, and depletion of coal resources are driving demand for green petroleum coke. Strict government regulations that play a very important role in the green petroleum coke market. The environment is affected by toxins released through industrialization and emissions of harmful gases such as carbon dioxide, hydroxides, sulfur, and nitrogen from factories and vehicles. Green petroleum coke is highly stable and non-reactive to the ambient environment, as it has very low sulfur and ash content. It is an alternative energy source for coal that has high calorific value. Also, it poses less environmental hazards. However, the presence of very few key players in the green petroleum coke market and fragmentation of the market are likely to hamper its expansion. Additionally, the market is so volatile that prices changes on weekly basis sometimes.

Key players in the green petroleum coke market need to focus on the promotion of the benefits of green petroleum coke over coal. The use of green petroleum coke in ceramics and electronics industries can boost the green petroleum coke market. When green petroleum coke is mixed with additives such as binders and sealants, it offers excellent adhesion to the material.

Major players in the market expand their network and share their investments through mergers and acquisitions. Launch of new products and facilities is likely to propel the green petroleum coke market. In May 2015, Asbury Carbons invested US$ 48 Mn in a new facility in Lumberton, North Carolina. The company decided to open the facility in North Carolina due to the state’s favorable access to rails and ports. In July 2014, Oxbow Corporation announced the acquisition of Carbon Resources LLC, a distributor and supplier of activated carbon products made from wood, coconut shells, and coal. Oxbow acquired the company to expand its footprint in the global activated carbon industry. In June 2015, the company initiated a six line expansion project, which is the largest project in the region. This project will enhance the smelter’s production with a capacity of 540,000 metric tons per year and will increase the production capacity up to 1.5 million metric tons per annum. This project will make the company the world largest single site aluminum smelter.

Green petroleum coke is used in the form of sponge coke, shot coke, purge coke, needle coke, and honeycomb coke. Sponge coke is most widely used as a solid fuel to manufacture anodes in the aluminum industry. It is a porous coke produced by adding effective amounts of a carbonaceous material that contains oxygen. Purge coke is produced during the process of producing heat form coking reactions to convert vacuum residual into gasses, distillate liquids, and coke. This process is known as flexi coking. Needle coke is mainly produced from coal tar pitch or FCC decant oil. It is also known as acicular coke. It has high resemblance to the collection of vertical aligned needles. The properties of needle coke include a low puffing tendency, low coefficient of thermal expansion, and high mechanical strength. Needle coke is used for making graphite electrodes for electric arc furnaces. Shot coke has a high density. It is the abnormal form of delayed coke. It is hard, dense, nonporous, vitreous, and sphered shape. Shot coke is used to manufacture titanium dioxide, nuclear graphite, and graphite mold stocks. Honeycomb is an intermediate type of coke. It has elliptical pores that are uniformly distributed amongst each other. It is known as intermediate coke because it is neither as productive as needle coke nor is it like shot or sponge coke.

This coke has lower electric conductivity and lower coefficient of thermal expansion as compared to needle coke .

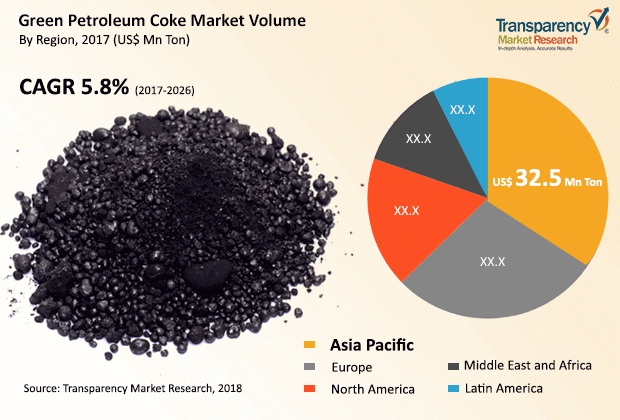

North America and Europe are the key regions of the green petroleum coke market. Asia Pacific holds a major share of the global green petroleum coke market, in terms of consumption, due to high demand in the construction sector, led by a rise in population. Middle East & Africa is an emerging region of the green petroleum coke market, due to high demand and fuel availability.

The green petroleum coke market in India and China is expected to expand at a rapid pace during the forecast period, due to rise in industrialization and expansion in the construction industry in these countries. China is a major supplier of petroleum coke in Asia.

Key players operating in the green petroleum coke market include Oxbow Corporation, AMINCO RESOURCES LLC., Asbury Carbons, Aluminium Bahrain (Alba), Atha Group, Carbograf Industrial S.A. de C.V., Rain Carbon Inc., Minmat Ferro Alloys Private Limited, Shandong KeYu Energy Co., Ltd. Weifang Lianxing New Material Technology Co., Ltd. Linyi Zhenhua Carbon Technology Co., Ltd. COCAN (HUBEI) GRAPHITE MILL INC. Modern Industrial Investment Holding Group. Sinoway Carbon Co., Ltd., and Ningxia Wanboda Carbons & Graphite Co., Ltd.

Green Petroleum Coke Market to Attract High Revenues with Increasing Expansion of Road and Rail Transport Sector

Green oil coke is gotten by rotting coke from the coker unit. At the point when unrefined petroleum is changed over into gas and fly fills, green petrol coke is acquired as a result. The nature of green petrol coke relies upon the nature of unrefined petroleum. The term 'green' alludes to the phase of creation measure. The sulfur content in green petrol coke chooses the utilization of green oil coke. High sulfur content green oil coke is for the most part utilized as a fuel instead of coal. Green oil coke having low sulfur content is overhauled through calcining and is utilized as a crude material for the creation of aluminum and steel.

The development in rail, vehicle and transport improvement is prompting expanded interest for steel, and petroleum coke has additionally requested the extension of the market for green petroleum coke. There is generally little debris substance of green petroleum coke and subsequently negligible poisonousness in a wide scope of ventures. The development of the Green petroleum coke market is supplemented by lower cargo costs joined with better preservation of assets.

North America and Europe are the vital districts of this market earning the highest revenues. Besides this, Asia Pacific is also holding a significant portion of the worldwide green petroleum coke market, as far as utilization, because of appeal in the development area, driven by an ascent in populace. Center East and Africa is an arising locale of the green petroleum coke market, because of popularity and fuel accessibility.

The market for green petroleum coke is controlled by the power area, power plants, constructing, and expanding request in the aluminum and steel areas. Expanded creation of aluminum and expanded utilization of petroleum coke in the Asia-Pacific force and concrete ventures are factors that fundamentally drive development in the oil coke market. Furthermore, green petroleum coke emits less carbon, provided there is low sulfur content, thereby augmenting the growth of the global market in the coming years.

In 2016, Green Petroleum Coke Market was valued at US$ 12 billion

Green Petroleum Coke Market is estimated to rise at a CAGR of 6.1 % during forecast period

The global green petroleum coke market is expected to expand at a significant rate driven by increase in demand from the cement industry

North America and Europe is more attractive for vendors in the Green Petroleum Coke Market

Key players of Green Petroleum Coke Market are Oxbow Corporation, AMINCO RESOURCES LLC., Asbury Carbons, Aluminium Bahrain (Alba), Atha Group, Carbograf Industrial S.A. de C.V., Rain Carbon Inc., Minmat Ferro Alloys Private Limited, Shandong KeYu Energy Co., Ltd. Weifang Lianxing New Material Technology Co., Ltd. Linyi Zhenhua Carbon Technology Co., Ltd. COCAN (HUBEI) GRAPHITE MILL INC. Modern Industrial Investment Holding Group. Sinoway Carbon Co., Ltd., and Ningxia Wanboda Carbons & Graphite C

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

1.4. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: Global Green Petroleum Coke Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Key Industry Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Porter's Five Analysis

4.4. Regulatory Landscape

4.5. Value Chain Analysis

4.6. Traders/Distributors

4.7. List of Potential Customers

4.8. Green Petroleum Coke Specifications

4.9. Global Green Petroleum Coke Market Forecast, 2012–2026

5. Global Green Petroleum Coke Market Analysis and Forecast, by Source

5.1. Key Trends

5.2. Definitions & Introduction

5.3. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

5.3.1. Anode

5.3.2. Fuel

6. Global Green Petroleum Coke Market Analysis and Forecast, by Form

6.1. Key Trends

6.2. Definitions & Introduction

6.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

6.3.1. Sponge coke

6.3.2. Purge coke

6.3.3. Needle coke

6.3.4. Shot coke

6.3.5. Honeycomb coke

7. Global Green Petroleum Coke Market Analysis and Forecast, by Application

7.1. Key Trends

7.2. Definitions & Introduction

7.3. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

7.3.1. Aluminum

7.3.2. Calcined coke

7.3.3. Cement

7.3.4. Power Stations

7.3.5. Graphite Electrode

7.3.5.1. Regular Power Graphite Electrode

7.3.5.2. Others

7.3.6. Others

7.4. Global Green Petroleum Coke Market Attractiveness Analysis, by Source, Form and Application

8. Global Green Petroleum Cokes Market Analysis and Forecast, by Region, 2012-2026

8.1. Key Trends

8.2. Definitions & Introduction

8.3. Market Size (Mn Tons) (US$ Mn), by Region, 2012-2026

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. Latin America

8.4. Global Green Petroleum Coke Market Attractiveness Analysis, by Region

9. North America Green Petroleum Coke Market Analysis & Forecasts

9.1. Key Findings

9.2. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

9.2.1. Anode

9.2.2. Fuel

9.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

9.3.1. Sponge coke

9.3.2. Purge coke

9.3.3. Needle coke

9.3.4. Shot coke

9.3.5. Honeycomb coke

9.4. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

9.4.1. Aluminum

9.4.2. Calcined coke

9.4.3. Cement

9.4.4. Power Stations

9.4.5. Graphite Electrode

9.4.5.1. Regular Power Graphite Electrode

9.4.5.2. Others

9.4.6. Others

9.5. U.S. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

9.5.1. Anode

9.5.2. Fuel

9.6. U.S. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

9.6.1. Sponge coke

9.6.2. Purge coke

9.6.3. Needle coke

9.6.4. Shot coke

9.6.5. Honeycomb coke

9.7. U.S. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

9.7.1. Aluminum

9.7.2. Calcined coke

9.7.3. Cement

9.7.4. Power Stations

9.7.5. Graphite Electrode

9.7.5.1. Regular Power Graphite Electrode

9.7.5.2. Others

9.7.6. Others

9.8. Canada Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

9.8.1. Anode

9.8.2. Fuel

9.9. Canada Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

9.9.1. Sponge coke

9.9.2. Purge coke

9.9.3. Needle coke

9.9.4. Shot coke

9.9.5. Honeycomb coke

9.10. Canada Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

9.10.1. Aluminum

9.10.2. Calcined coke

9.10.3. Cement

9.10.4. Power Stations

9.10.5. Graphite Electrode

9.10.5.1. Regular Power Graphite Electrode

9.10.5.2. Others

9.10.6. Others

9.11. North America Market Attractiveness

10. Europe Green Petroleum Coke Market Analysis & Forecasts

10.1. Key Findings

10.2. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.2.1. Anode

10.2.2. Fuel

10.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.3.1. Sponge coke

10.3.2. Purge coke

10.3.3. Needle coke

10.3.4. Shot coke

10.3.5. Honeycomb coke

10.4. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.4.1. Aluminum

10.4.2. Calcined coke

10.4.3. Cement

10.4.4. Power Stations

10.4.5. Graphite Electrode

10.4.5.1. Regular Power Graphite Electrode

10.4.5.2. Others

10.4.6. Others

10.5. Germany Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.5.1. Anode

10.5.2. Fuel

10.6. Germany Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.6.1. Sponge coke

10.6.2. Purge coke

10.6.3. Needle coke

10.6.4. Shot coke

10.6.5. Honeycomb coke

10.7. Germany Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.7.1. Aluminum

10.7.2. Calcined coke

10.7.3. Cement

10.7.4. Power Stations

10.7.5. Graphite Electrode

10.7.5.1. Regular Power Graphite Electrode

10.7.5.2. Others

10.7.6. Others

10.8. U.K. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.8.1. Anode

10.8.2. Fuel

10.9. U.K. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.9.1. Sponge coke

10.9.2. Purge coke

10.9.3. Needle coke

10.9.4. Shot coke

10.9.5. Honeycomb coke

10.10. U.K. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.10.1. Aluminum

10.10.2. Calcined coke

10.10.3. Cement

10.10.4. Power Stations

10.10.5. Graphite Electrode

10.10.5.1. Regular Power Graphite Electrode

10.10.5.2. Others

10.10.6. Others

10.11. France Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.11.1. Anode

10.11.2. Fuel

10.12. France Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.12.1. Sponge coke

10.12.2. Purge coke

10.12.3. Needle coke

10.12.4. Shot coke

10.12.5. Honeycomb coke

10.13. France Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.13.1. Aluminum

10.13.2. Calcined coke

10.13.3. Cement

10.13.4. Power Stations

10.13.5. Graphite Electrode

10.13.5.1. Regular Power Graphite Electrode

10.13.5.2. Others

10.13.6. Others

10.14. Spain Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.14.1. Anode

10.14.2. Fuel

10.15. Spain Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.15.1. Sponge coke

10.15.2. Purge coke

10.15.3. Needle coke

10.15.4. Shot coke

10.15.5. Honeycomb coke

10.16. Spain Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.16.1. Aluminum

10.16.2. Calcined coke

10.16.3. Cement

10.16.4. Power Stations

10.16.5. Graphite Electrode

10.16.5.1. Regular Power Graphite Electrode

10.16.5.2. Others

10.16.6. Others

10.17. Italy Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.17.1. Anode

10.17.2. Fuel

10.18. Italy Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.18.1. Sponge coke

10.18.2. Purge coke

10.18.3. Needle coke

10.18.4. Shot coke

10.18.5. Honeycomb coke

10.19. Italy Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.19.1. Aluminum

10.19.2. Calcined coke

10.19.3. Cement

10.19.4. Power Stations

10.19.5. Graphite Electrode

10.19.5.1. Regular Power Graphite Electrode

10.19.5.2. Others

10.19.6. Others

10.20. Greece Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.20.1. Anode

10.20.2. Fuel

10.21. Greece Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.21.1. Sponge coke

10.21.2. Purge coke

10.21.3. Needle coke

10.21.4. Shot coke

10.21.5. Honeycomb coke

10.22. Greece Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.22.1. Aluminum

10.22.2. Calcined coke

10.22.3. Cement

10.22.4. Power Stations

10.22.5. Graphite Electrode

10.22.5.1. Regular Power Graphite Electrode

10.22.5.2. Others

10.22.6. Others

10.23. Turkey Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.23.1. Anode

10.23.2. Fuel

10.24. Turkey Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.24.1. Sponge coke

10.24.2. Purge coke

10.24.3. Needle coke

10.24.4. Shot coke

10.24.5. Honeycomb coke

10.25. Turkey Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.25.1. Aluminum

10.25.2. Calcined coke

10.25.3. Cement

10.25.4. Power Stations

10.25.5. Graphite Electrode

10.25.5.1. Regular Power Graphite Electrode

10.25.5.2. Others

10.25.6. Others

10.26. Russia & CIS Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.26.1. Anode

10.26.2. Fuel

10.27. Russia &CIS Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.27.1. Sponge coke

10.27.2. Purge coke

10.27.3. Needle coke

10.27.4. Shot coke

10.27.5. Honeycomb coke

10.28. Russia & CIS Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.28.1. Aluminum

10.28.2. Calcined coke

10.28.3. Cement

10.28.4. Power Stations

10.28.5. Graphite Electrode

10.28.5.1. Regular Power Graphite Electrode

10.28.5.2. Others

10.28.6. Others

10.29. Rest of Europe Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

10.29.1. Anode

10.29.2. Fuel

10.30. Rest of Europe Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

10.30.1. Sponge coke

10.30.2. Purge coke

10.30.3. Needle coke

10.30.4. Shot coke

10.30.5. Honeycomb coke

10.31. Rest of Europe Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

10.31.1. Aluminum

10.31.2. Calcined coke

10.31.3. Cement

10.31.4. Power Stations

10.31.5. Graphite Electrode

10.31.5.1. Regular Power Graphite Electrode

10.31.5.2. Others

10.31.6. Others

10.32. Europe Market Attractiveness

11. Asia Pacific Green Petroleum Coke Market Analysis & Forecasts

11.1. Key Findings

11.2. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.2.1. Anode

11.2.2. Fuel

11.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.3.1. Sponge coke

11.3.2. Purge coke

11.3.3. Needle coke

11.3.4. Shot coke

11.3.5. Honeycomb coke

11.4. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.4.1. Aluminum

11.4.2. Calcined coke

11.4.3. Cement

11.4.4. Power Stations

11.4.5. Graphite Electrode

11.4.5.1. Regular Power Graphite Electrode

11.4.5.2. Others

11.4.6. Others

11.5. China Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.5.1. Anode

11.5.2. Fuel

11.6. China Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.6.1. Sponge coke

11.6.2. Purge coke

11.6.3. Needle coke

11.6.4. Shot coke

11.6.5. Honeycomb coke

11.7. China Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.7.1. Aluminum

11.7.2. Calcined coke

11.7.3. Cement

11.7.4. Power Stations

11.7.5. Graphite Electrode

11.7.5.1. Regular Power Graphite Electrode

11.7.5.2. Others

11.7.6. Others

11.8. Japan Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.8.1. Anode

11.8.2. Fuel

11.9. Japan Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.9.1. Sponge coke

11.9.2. Purge coke

11.9.3. Needle coke

11.9.4. Shot coke

11.9.5. Honeycomb coke

11.10. Japan Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.10.1. Aluminum

11.10.2. Calcined coke

11.10.3. Cement

11.10.4. Power Stations

11.10.5. Graphite Electrode

11.10.5.1. Regular Power Graphite Electrode

11.10.5.2. Others

11.10.6. Others

11.11. India Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.11.1. Anode

11.11.2. Fuel

11.12. India Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.12.1. Sponge coke

11.12.2. Purge coke

11.12.3. Needle coke

11.12.4. Shot coke

11.12.5. Honeycomb coke

11.13. India Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.13.1. Aluminum

11.13.2. Calcined coke

11.13.3. Cement

11.13.4. Power Stations

11.13.5. Graphite Electrode

11.13.5.1. Regular Power Graphite Electrode

11.13.5.2. Others

11.13.6. Others

11.14. Australia Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.14.1. Anode

11.14.2. Fuel

11.15. Australia Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.15.1. Sponge coke

11.15.2. Purge coke

11.15.3. Needle coke

11.15.4. Shot coke

11.15.5. Honeycomb coke

11.16. Australia Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.16.1. Aluminum

11.16.2. Calcined coke

11.16.3. Cement

11.16.4. Power Stations

11.16.5. Graphite Electrode

11.16.5.1. Regular Power Graphite Electrode

11.16.5.2. Others

11.16.6. Others

11.17. ASEAN Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.17.1. Anode

11.17.2. Fuel

11.18. ASEAN Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.18.1. Sponge coke

11.18.2. Purge coke

11.18.3. Needle coke

11.18.4. Shot coke

11.18.5. Honeycomb coke

11.19. ASEAN Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.19.1. Aluminum

11.19.2. Calcined coke

11.19.3. Cement

11.19.4. Power Stations

11.19.5. Graphite Electrode

11.19.5.1. Regular Power Graphite Electrode

11.19.5.2. Others

11.19.6. Others

11.20. Rest of Asia Pacific Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

11.20.1. Anode

11.20.2. Fuel

11.21. Rest of Asia Pacific Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

11.21.1. Sponge coke

11.21.2. Purge coke

11.21.3. Needle coke

11.21.4. Shot coke

11.21.5. Honeycomb coke

11.22. Rest of Asia Pacific Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

11.22.1. Aluminum

11.22.2. Calcined coke

11.22.3. Cement

11.22.4. Power Stations

11.22.5. Graphite Electrode

11.22.5.1. Regular Power Graphite Electrode

11.22.5.2. Others

11.22.6. Others

11.23. Asia Pacific Market Attractiveness

12. Latin America Green Petroleum Coke Market Analysis & Forecasts

12.1. Key Findings

12.2. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

12.2.1. Anode

12.2.2. Fuel

12.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

12.3.1. Sponge coke

12.3.2. Purge coke

12.3.3. Needle coke

12.3.4. Shot coke

12.3.5. Honeycomb coke

12.4. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

12.4.1. Aluminum

12.4.2. Calcined coke

12.4.3. Cement

12.4.4. Power Stations

12.4.5. Graphite Electrode

12.4.5.1. Regular Power Graphite Electrode

12.4.5.2. Others

12.4.6. Others

12.5. Brazil Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

12.5.1. Anode

12.5.2. Fuel

12.6. Brazil Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

12.6.1. Sponge coke

12.6.2. Purge coke

12.6.3. Needle coke

12.6.4. Shot coke

12.6.5. Honeycomb coke

12.7. Brazil Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

12.7.1. Aluminum

12.7.2. Calcined coke

12.7.3. Cement

12.7.4. Power Stations

12.7.5. Graphite Electrode

12.7.5.1. Regular Power Graphite Electrode

12.7.5.2. Others

12.7.6. Others

12.8. Mexico Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

12.8.1. Anode

12.8.2. Fuel

12.9. Mexico Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

12.9.1. Sponge coke

12.9.2. Purge coke

12.9.3. Needle coke

12.9.4. Shot coke

12.9.5. Honeycomb coke

12.10. Mexico Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

12.10.1. Aluminum

12.10.2. Calcined coke

12.10.3. Cement

12.10.4. Power Stations

12.10.5. Graphite Electrode

12.10.5.1. Regular Power Graphite Electrode

12.10.5.2. Others

12.10.6. Others

12.11. Rest of Latin America Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

12.11.1. Anode

12.11.2. Fuel

12.12. Rest of Latin America Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

12.12.1. Sponge coke

12.12.2. Purge coke

12.12.3. Needle coke

12.12.4. Shot coke

12.12.5. Honeycomb coke

12.13. Rest of Latin America Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

12.13.1. Aluminum

12.13.2. Calcined coke

12.13.3. Cement

12.13.4. Power Stations

12.13.5. Graphite Electrode

12.13.5.1. Regular Power Graphite Electrode

12.13.5.2. Others

12.13.6. Others

12.14. Latin America Market Attractiveness

13. Middle East & Africa Green Petroleum Coke Market Analysis & Forecasts

13.1. Key Findings

13.2. Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

13.2.1. Anode

13.2.2. Fuel

13.3. Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

13.3.1. Sponge coke

13.3.2. Purge coke

13.3.3. Needle coke

13.3.4. Shot coke

13.3.5. Honeycomb coke

13.4. Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

13.4.1. Aluminum

13.4.2. Calcined coke

13.4.3. Cement

13.4.4. Power Stations

13.4.5. Graphite Electrode

13.4.5.1. Regular Power Graphite Electrode

13.4.5.2. Others

13.4.6. Others

13.5. GCC Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

13.5.1. Anode

13.5.2. Fuel

13.6. GCC Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

13.6.1. Sponge coke

13.6.2. Purge coke

13.6.3. Needle coke

13.6.4. Shot coke

13.6.5. Honeycomb coke

13.7. GCC Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

13.7.1. Aluminum

13.7.2. Calcined coke

13.7.3. Cement

13.7.4. Power Stations

13.7.5. Graphite Electrode

13.7.5.1. Regular Power Graphite Electrode

13.7.5.2. Others

13.7.6. Others

13.8. Mexico Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

13.8.1. Anode

13.8.2. Fuel

13.9. South Africa Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

13.9.1. Sponge coke

13.9.2. Purge coke

13.9.3. Needle coke

13.9.4. Shot coke

13.9.5. Honeycomb coke

13.10. South Africa Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

13.10.1. Aluminum

13.10.2. Calcined coke

13.10.3. Cement

13.10.4. Power Stations

13.10.5. Graphite Electrode

13.10.5.1. Regular Power Graphite Electrode

13.10.5.2. Others

13.10.6. Others

13.11. Rest of Middle East & Africa Market Size (Mn Tons) (US$ Mn), by Source, 2012–2026

13.11.1. Anode

13.11.2. Fuel

13.12. Rest of Middle East & Africa Market Size (Mn Tons) (US$ Mn), by Form, 2012-2026

13.12.1. Sponge coke

13.12.2. Purge coke

13.12.3. Needle coke

13.12.4. Shot coke

13.12.5. Honeycomb coke

13.13. Rest of Middle East & Africa Market Size (Mn Tons) (US$ Mn), by Application, 2012–2026

13.13.1. Aluminum

13.13.2. Calcined coke

13.13.3. Cement

13.13.4. Power Stations

13.13.5. Graphite Electrode

13.13.5.1. Regular Power Graphite Electrode

13.13.5.2. Others

13.13.6. Others

13.14. Middle East & Africa Market Attractiveness

14. Competition Landscape

14.1. Competition Matrix

14.2. Green Petroleum Coke Market Share Analysis, by Company (2017)

14.3. Market Footprint Analysis, by Region

14.4. Market Footprint Analysis, by Application

14.5. Competitive Business Strategies

14.5.1. Oxbow Corporation

14.5.1.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.1.1.1. Business Segments

14.5.1.1.2. Application Segments

14.5.1.1.3. Product Segments

14.5.1.1.4. Strategic Overview, Acquisitions

14.5.2. AMINCO RESOURCES LLC.

14.5.2.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.2.1.1. Business Segments

14.5.2.1.2. Application Segments

14.5.2.1.3. Product Segments

14.5.2.1.4. Strategic Overview, Agreement

14.5.3. Asbury Carbons

14.5.3.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.3.1.1. Business Segments

14.5.3.1.2. Application Segments

14.5.3.1.3. Product Segments

14.5.3.1.4. Strategic Overview, New Facility

14.5.4. Aluminium Bahrain (Alba)

14.5.4.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.4.1.1. Business Segments

14.5.4.1.2. Application Segments

14.5.4.1.3. Product Segments

14.5.4.1.4. Revenue (US$ Bn) and Y-o-Y Growth (%), 2012–2017

14.5.4.1.5. Total Net Sales (US$ Mn), by Product Segment, 2017

14.5.4.1.6. Strategic Overview, Awards and Expansion

14.5.5. Atha Group

14.5.5.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.5.1.1. Business Segments

14.5.5.1.2. Application Segments

14.5.5.1.3. Product Segments

14.5.6. Carbograf Industrial S.A. de C.V.

14.5.6.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.6.1.1. Business Segments

14.5.6.1.2. Application Segments

14.5.6.1.3. Product Segments

14.5.7. Rain Carbon Inc.

14.5.7.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.7.2. Business Segments

14.5.7.3. Application Segments

14.5.7.4. Product Segments

14.5.8. Minmat Ferro Alloys Private Limited

14.5.8.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.8.1.1. Business Segments

14.5.8.1.2. Application Segments

14.5.8.1.3. Product Segments

14.5.9. Shandong KeYu Energy Co., Ltd.

14.5.9.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.9.1.1. Business Segments

14.5.9.1.2. Application Segments

14.5.9.1.3. Product Segments

14.5.10. Weifang Lianxing New Material Technology Co., Ltd.

14.5.10.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.10.1.1. Business Segments

14.5.10.1.2. Application Segments

14.5.10.1.3. Product Segments

14.5.11. Linyi Zhenhua Carbon Technology Co., Ltd.

14.5.11.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.11.1.1. Business Segments

14.5.11.1.2. Application Segments

14.5.11.1.3. Product Segments

14.5.12. COCAN (HUBEI) GRAPHITE MILL INC.

14.5.12.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.12.1.1. Business Segments

14.5.12.1.2. Application Segments

14.5.12.1.3. Product Segments

14.5.13. Modern Industrial Investment Holding Group.

14.5.13.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.13.1.1. Business Segments

14.5.13.1.2. Application Segments

14.5.13.1.3. Product Segments

14.5.14. Sinoway Carbon Co., Ltd.

14.5.14.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.14.1.1. Business Segments

14.5.14.1.2. Application Segments

14.5.14.1.3. Product Segments

14.5.14.1.4. Strategic Overview

14.5.15. Ningxia Wanboda Carbons & Graphite Co., Ltd.

14.5.15.1. Head Quarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.15.1.1. Business Segments

14.5.15.1.2. Application Segments

List of Tables

Table 1 Global Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 2 Global Green Petroleum Coke Market Volume (Million Tons) Historical, by Source, 2012–2016

Table 3 Global Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 4 Global Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 5 Global Green Petroleum Coke Market Size (US$ Mn) Historical, by Form, 2012–2026

Table 6 Global Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2026

Table 7 Global Green Petroleum Coke Market Size (US$ Mn) Forecast, by Form, 2017–2026

Table 8 Global Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 9 Global Green Petroleum Coke Market Value (US$ Mn) Historical, by Application, 2012–2016

Table 10 Global Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 11 Global Green Petroleum Coke Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 12 Global Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 13 Global Green Petroleum Coke Market Size (US$ Mn) Historical, by Region, 2012–2016

Table 14 Global Green Petroleum Coke Market Volume (Million Tons) Historical, by Region, 2012–2016

Table 15 Global Green Petroleum Coke Market Value (US$ Mn) Forecast, by Region, 2017–2026

Table 16 Global Green Petroleum Coke Market Volume (Million Tons) Forecast, by Region, 2017–2026

Table 17 North America Green Petroleum Coke Market Revenue (US$ Mn) (Historical) by Source, 2012–2016

Table 18 North America Green Petroleum Coke Market Volume (Million Tons) (Historical) by Source, 2012–2016

Table 19 North America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 20 North America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 21 North America Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 22 North America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 23 North America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 24 North America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form , 2017–2026

Table 25 North America Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 26 North America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 27 North America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 28 North America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 29 North America Green Petroleum Coke Market Revenue (US$ Mn) (Historical) by Country, 2012–2016

Table 30 North America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Country, 2012–2016

Table 31 North America Green Petroleum Coke Market Revenue (US$ Mn) Forecast,S by Country, 2017–2026

Table 32 North America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Country, 2017–2026

Table 33 U.S. Green Petroleum Coke Market Revenue (US$ Mn) (Historical) by Source, 2012–2016

Table 34 U.S. Green Petroleum Coke Market Volume (Million Tons) (Historical) by Source, 2012–2016

Table 35 U.S. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 36 U.S. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 37 U.S. Green Petroleum Coke Market Revenue (US$ Mn) historic, by Form, 2012–2016

Table 38 U.S. Green Petroleum Coke Market Volume (Million Tons) historic, by Form, 2012–2016

Table 39 U.S. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 40 U.S. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 41 U.S. Green Petroleum Coke Market Revenue (US$ Mn) historic, by Application, 2012–2016

Table 42 U.S. Green Petroleum Coke Market Volume (Million Tons) historic, by Application, 2012–2016

Table 43 U.S. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 44 U.S. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 45 Canada Green Petroleum Coke Market Revenue (US$ Mn) (Historical) by Source, 2012–2016

Table 46 Canada Green Petroleum Coke Market Volume (Million Tons) (Historical) by Source, 2012–2016

Table 47 Canada Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 48 Canada Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 49 Canada Green Petroleum Coke Market Revenue (US$ Mn) historic, by Form, 2012–2016

Table 50 Canada Green Petroleum Coke Market Volume (Million Tons) historic, by Form, 2012–2016

Table 51 Canada Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 52 Canada Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 53 Canada Green Petroleum Coke Market Revenue (US$ Mn) historic, by Application, 2012–2016

Table 54 Canada Green Petroleum Coke Market Volume (Million Tons) historic, by Application, 2012–2016

Table 55 Canada Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 56 Canada Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 57 Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical) by Source, 2012–2016

Table 58 Europe Green Petroleum Coke Market Volume (Million Tons) (Historical) by Source, 2012–2016

Table 59 Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 60 Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 61 Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 62 Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 63 Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 64 Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 65 Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 66 Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 67 Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 68 Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 69 Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Country, 2012–2016

Table 70 Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Country , 2012–2016

Table 71 Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Country, 2017–2026

Table 72 Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Country, 2017–2026

Table 73 Germany Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 74 Germany Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 75 Germany Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 76 Germany Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 77 Germany Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 78 Germany Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 79 Germany Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 80 Germany Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 81 Germany Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 82 Germany Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 83 Germany Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 84 Germany Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 85 France Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 86 France Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 87 France Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 88 France Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 89 France Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 90 France Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 91 France Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 92 France Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 93 France Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 94 France Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 95 France Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 96 France Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 97 U.K. Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 98 U.K. Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 99 U.K. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 100 U.K. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 101 U.K. Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 102 U.K. Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 103 U.K. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 104 U.K. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 105 U.K. Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 106 U.K. Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 107 U.K. Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 108 U.K. Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 109 Italy Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 110 Italy Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 111 Italy Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 112 Italy Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 113 Italy Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 114 Italy Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 115 Italy Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 116 Italy Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 117 Italy Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 118 Italy Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 119 Italy Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 120 Italy Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 121 Spain Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 122 Spain Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 123 Spain Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 124 Spain Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 125 Spain Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 126 Spain Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 127 Spain Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 128 Spain Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 129 Spain Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 130 Spain Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 131 Spain Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 132 Spain Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 133 Greece Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 134 Greece Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 135 Greece Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 136 Greece Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 137 Greece Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 138 Greece Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 139 Greece Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 140 Greece Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 141 Greece Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 142 Greece Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 143 Greece Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 144 Greece Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 145 Turkey Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 146 Turkey Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 147 Turkey Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 148 Turkey Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 149 Turkey Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 150 Turkey Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 151 Turkey Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 152 Turkey Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 153 Turkey Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 154 Turkey Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 155 Turkey Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 156 Turkey Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 157 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 158 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 159 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 160 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 161 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 162 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 163 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 164 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 165 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 166 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 167 Russia & CIS Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 168 Russia & CIS Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 169 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 170 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 171 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 172 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 173 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Form, 2012–2016

Table 174 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Form, 2012–2016

Table 175 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 176 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 177 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Application, 2012–2016

Table 178 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) (Historical), by Application, 2012–2016

Table 179 Rest of Europe Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 180 Rest of Europe Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 181 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 182 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 183 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 184 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 185 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 186 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 187 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 188 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 189 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 190 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 191 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 192 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 193 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Country/Sub-region, 2012–2016

Table 194 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Historical, by Country/Sub-region, 2012–2016

Table 195 Asia Pacific Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 196 Asia Pacific Green Petroleum Coke Market Volume (Million Tons) Forecast, by Country/Sub-region, 2017–2026

Table 197 China Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 198 China Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 199 China Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 200 China Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 201 China Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 202 China Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 203 China Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 204 China Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 205 China Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 206 China Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 207 China Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 208 China Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 209 India Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 210 India Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 211 India Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 212 India Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 213 India Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 214 India Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 215 India Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 216 India Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 217 India Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 218 India Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 219 India Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 220 India Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 221 Japan Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 222 Japan Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 223 Japan Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 224 Japan Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 225 Japan Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 226 Japan Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 227 India Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 228 Japan Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 229 Japan Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 230 Japan Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 231 Japan Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 232 Japan Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 233 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 234 ASEAN Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 235 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 236 ASEAN Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 237 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 238 ASEAN Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 239 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 240 ASEAN Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 241 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 242 ASEAN Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 243 ASEAN Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 244 ASEAN Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 245 Australia Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 246 Australia Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 247 Australia Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 248 Australia Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 249 Australia Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 250 Australia Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 251 Australia Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 252 Australia Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 253 Australia Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 254 Australia Green Petroleum Coke Market Volume (Million Tons) Historical, by Application, 2012–2016

Table 255 Australia Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 256 Australia Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 257 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Source, 2012–2016

Table 258 Rest of APAC Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 259 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2017–2026

Table 260 Rest of APAC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2017–2026

Table 261 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 262 Rest of APAC Green Petroleum Coke Market Volume (Million Tons) Historical, by Form, 2012–2016

Table 263 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 264 Rest of APAC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 265 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 266 Rest of APAC Green Petroleum Coke Market Volume (US$ Mn) Historical, by Application, 2012–2016

Table 267 Rest of APAC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 268 Rest of APAC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 269 Latin America Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 270 Latin America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 271 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 272 Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 273 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 274 Latin America Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 275 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 276 Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 277 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 278 Latin America Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 279 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 280 Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 281 Latin America Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Country/Sub-region, 2012–2016

Table 282 Latin America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Country , 2012–2016

Table 283 Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 284 Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Country/Sub-region, 2017–2026

Table 285 Brazil Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 286 Brazil Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 287 Brazil Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 288 Brazil Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 289 Brazil Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 290 Brazil Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 291 Brazil Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 292 Brazil Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 293 Brazil Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 294 Brazil Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 295 Brazil Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 296 Brazil Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 297 Mexico Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 298 Mexico Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 299 Mexico Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 300 Mexico Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 301 Mexico Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 302 Mexico Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 303 Mexico Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 304 Mexico Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 305 Mexico Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 306 Mexico Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 307 Mexico Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 308 Mexico Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 309 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 310 Rest of Latin America Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 311 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 312 Rest of Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 313 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 314 Rest of Latin America Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 315 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 316 Rest of Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 317 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 318 Rest of Latin America Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 319 Rest of Latin America Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 320 Rest of Latin America Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 321 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 322 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 323 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 324 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 325 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 326 Middle East & Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 327 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 328 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 329 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 330 Middle East & Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 331 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 332 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 333 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Country/Sub-region, 2012–2016

Table 334 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) (Historical), by Country , 2012–2016

Table 335 Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Country, 2017–2026

Table 336 Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Country, 2017–2026

Table 337 GCC Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 338 GCC Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 339 GCC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 340 GCC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 341 GCC Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 342 GCC Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 343 GCC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 344 GCC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 345 GCC Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 346 GCC Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 347 GCC Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 348 GCC Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 349 South Africa Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 350 South Africa Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 351 South Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 352 South Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 353 South Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 354 South Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 355 South Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 356 South Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 357 South Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 358 South Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 359 South Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 360 South Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

Table 361 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) (Historical), by Source, 2012–2016

Table 362 Rest of Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) (Historical), by Source, 2012–2016

Table 363 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Source, 2016–2026

Table 364 Rest of Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Source, 2016–2026

Table 365 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Form, 2012–2016

Table 366 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Form, 2012–2016

Table 367 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Form, 2017–2026

Table 368 Rest of Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Form, 2017–2026

Table 369 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Historical, by Application, 2012–2016

Table 370 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (Million Tons) Historical, by Application, 2012–2016

Table 371 Rest of Middle East & Africa Green Petroleum Coke Market Revenue (US$ Mn) Forecast, by Application, 2017–2026

Table 372 Rest of Middle East & Africa Green Petroleum Coke Market Volume (Million Tons) Forecast, by Application, 2017–2026

List of Figures

Figure 1 Market Share, by Application, 2017

Figure 2 Top 3 trends

Figure 3 Market size, by region

Figure 4 Executive Summary

Figure 5 Global Green Petroleum Coke Market Size (US$ Mn) and Volume (Million Tons) Forecast, 2017–2026

Figure 6 Global Green Petroleum Coke Market Volume Share, by Source, 2017 and 2026

Figure 7 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Anode/Pitch, 2017–2026

Figure 8 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Fuel/Crude, 2017–2026

Figure 9 Global Green Petroleum Coke Market Volume Share, by Form, 2017 and 2026

Figure 10 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Sponge Coke, 2017–2026

Figure 11 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Purge Coke, 2017–2026

Figure 12 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Needle Coke, 2017–2026

Figure 13 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Shot Coke, 2017–2026

Figure 14 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Honeycomb Coke, 2017–2026

Figure 15 Global Green Petroleum Coke Market Volume Share, by Application, 2017 and 2026

Figure 16 Global Green Petroleum Coke Market Volume Share, by Graphite Electrode, 2017 and 2026

Figure 17 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Aluminum, 2017–2026

Figure 18 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Calcined Coke, 2017–2026

Figure 19 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Cement, 2017–2026

Figure 20 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Power Station, 2017–2026

Figure 21 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Graphite Electrode, 2017- 2026

Figure 22 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Regular Power Graphite, 2017-2026

Figure 23 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Others, 2017-2026

Figure 24 Global Green Petroleum Coke Market Revenue (US$ Mn) and Volume (Million Tons), by Others, 2017-2026

Figure 25 Global Green Petroleum Coke Market Attractiveness, by Source

Figure 26 Global Green Petroleum Coke Market Attractiveness, by Application

Figure 27 Global Green Petroleum Coke Market Attractiveness, by Form

Figure 28 Global Green Petroleum Coke Market Volume Share, by Region, 2017–2026

Figure 29 Global Green Petroleum Coke Market Attractiveness, by Region

Figure 30 North America Green Petroleum Coke Market Size (US$ Mn) and Volume (Million Tons) Forecast, 2018–2026

Figure 31 North America Market Attractiveness Analysis, by Country

Figure 32 North America Market Volume Share Analysis, by Source, 2017 and 2026

Figure 33 North America Market Volume Share Analysis, by Form, 2017 and 2026

Figure 34 North America Market Volume Share Analysis, by Application, 2017 and 2026

Figure 35 North America Market Volume Share Analysis, by Graphite Electrode Application, 2017 and 2026

Figure 36 North America Market Volume Share Analysis, by Country, 2017 and 2026

Figure 37 North America Green Petroleum Coke Market Attractiveness Analysis, by Source

Figure 38 North America Green Petroleum Coke Market Attractiveness Analysis, by Form

Figure 39 North America Green Petroleum Coke Market Attractiveness Analysis, by Application

Figure 40 Europe Green Petroleum Coke Market Size (US$ Mn) and Volume (Million Tons) Forecast, 2018–2026

Figure 41 Europe Market Attractiveness Analysis, by Country

Figure 42 Europe Market Volume Share Analysis, by Source, 2017 and 2026

Figure 43 Europe Market Volume Share Analysis, by Form, 2017 and 2026

Figure 44 Europe Market Volume Share Analysis, by Application, 2017 and 2026

Figure 45 Europe Market Volume Share Analysis, by Graphite Electrode Application, 2017 and 2026

Figure 46 Europe Market Volume Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 47 Europe Green Petroleum Coke Market Attractiveness Analysis, by Source

Figure 48 Europe Green Petroleum Coke Market Attractiveness Analysis, by Form

Figure 49 Europe Green Petroleum Coke Market Attractiveness Analysis, by Application

Figure 50 Asia Pacific Green Petroleum Coke Market Size (US$ Mn) and Volume (Million Tons) Forecast, 2018–2026

Figure 51 Asia Pacific Market Attractiveness Analysis, by Country

Figure 52 Asia Pacific Market Volume Share Analysis, by Source, 2017 and 2026

Figure 53 Asia Pacific Market Volume Share Analysis, by Form, 2017 and 2026

Figure 54 Asia Pacific Market Volume Share Analysis, by Application, 2017 and 2026

Figure 55 Asia Pacific Market Volume Share Analysis, by Application, 2017 and 2026

Figure 56 Asia Pacific Market Volume Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 57 Asia Pacific Green Petroleum Coke Market Attractiveness Analysis, by Source

Figure 58 Asia Pacific Green Petroleum Coke Market Attractiveness Analysis, by Form

Figure 59 Asia Pacific Green Petroleum Coke Market Attractiveness Analysis, by Application

Figure 60 Latin America Green Petroleum Coke Market Size (US$ Mn) and Volume (Million Tons) Forecast, 2018–2026

Figure 61 Latin America Market Attractiveness Analysis, by Country

Figure 62 Latin America Market Volume Share Analysis, by Source, 2017 and 2026

Figure 63 Latin America Market Volume Share Analysis, by Form, 2017 and 2026