Analysts’ Viewpoint on Green Hydrogen Market Scenario

Green hydrogen is hydrogen produced by splitting water by electrolysis. This process uses hydrogen and releases oxygen into the atmosphere with no negative impact. Electricity required for electrolysis is supplied by renewable energy sources, such as solar or wind. This makes green hydrogen the cleanest option of hydrogen without CO2 as a by-product. Renewable energy generation capacity is anticipated to increase in the near future. Moreover, adoption of renewable energy is growing due to an increase in stringency of environment-related regulations and rise in pressure to minimize the energy consumption of hydrocarbons to reduce CO2 emissions. Implementation of stringent regulations to limit GHG emissions from power generation facilities is driving the utilization of renewable resources in electric generation facilities. This, in turn, is projected to propel the global green hydrogen market during the forecast period.

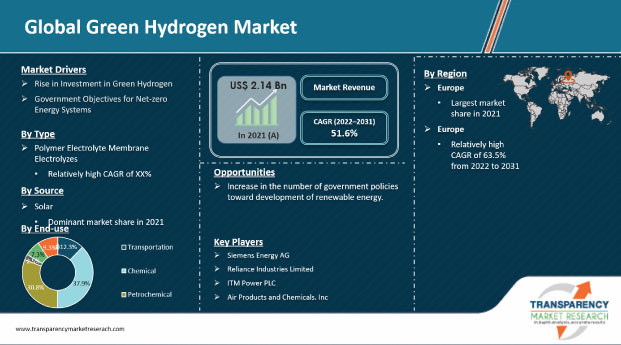

Majority of hydrogen is produced by steam reforming of natural gas and coal, which makes up the bulk of the hydrogen market. Green hydrogen is produced by the electrolysis of water. The global green hydrogen market is projected to advance significantly during the forecast period due to increase in number of government policies focused on the development of renewable energy. With ambitious net-zero targets across the world, policymakers are looking toward green H2 as a solution across several sectors. Green hydrogen has the potential to become a great source of renewable energy. The European Commission has recognized this potential in its recent policy plans. The European Green Deal identifies hydrogen as the key to a clean and circular economy. Furthermore, the European Union (EU) has issued a specific hydrogen strategy in 2020, bundling measures to promote a fast and targeted development of production capacities for green hydrogen. Demand for green hydrogen fuel is increasing across the globe. Green hydrogen manufacturers are gaining lucrative benefits due to increase in demand for green hydrogen in the global market.

The Government of Germany is focused on decarbonizing Europe's biggest economy, in which green hydrogen would play a crucial role. Germany is expected to put 900 million Euros (US$1 Bn) into a funding scheme to support green hydrogen. The H2Global project is designed to boost the global market of green hydrogen by using a double auction. Under the scheme, hydrogen or hydrogen derivatives are bought cheaply on the world market and sold to the highest bidder in the EU. The World Bank Group is working with developing countries to accelerate green hydrogen projects from pilot stage to industrial scale. They are providing technical assistance to short-term policies, regulatory, and fiscal frameworks; integrate risk mitigation and credit enhancement instruments to mobilize private capital, and transfer knowledge to develop local green jobs to support a transition.

The Prime Minister of India, Narendra Modi, announced the National Hydrogen Mission as a step toward environmental security and to make India a global hub for the production and export of green hydrogen. India-based OIL (Oil India Limited) established the country’s first pure green hydrogen plant in Assam. Corporations such as Reliance Group and Adani Group have also announced plans to enter into green hydrogen production. The cost of green hydrogen is higher than blue hydrogen. However, several countries are investing considerably in the adoption of renewable energy sources. This, in turn, is likely to boost the green hydrogen market size across the globe.

According to World Economy Forum, in total, more than 120 countries have announced net-zero emissions goals. Among them is the People’s Republic of China, the largest GHG emitter, which recently pledged to reduce its net carbon emissions to zero within 40 years. These net-zero commitments have still to be transformed into practical actions; however, they would require reduction in emissions in the industrial sector where green hydrogen energy could play an important role. The environmental impact and energy-efficiency of hydrogen depend on its production chain. Innovative technologies are focused on a large-scale transition to green hydrogen. Hydrogen from low and zero-carbon renewable energy sources, such as solar and wind, is encouraging the adoption of clean hydrogen, leading to a green economy.

According to the International Energy Agency (IEA), the number of low-carbon hydrogen projects is increasing. In July 2020, the European Commission published a hydrogen strategy to boost hydrogen production toward the goal of being climate neutral by 2050. The U.S. and Australia have signed the “Australia-United States Net Zero Source Acceleration Partnership”. This partnership is expected to work on the development and deployment of zero-emission sources and cooperate on advancement in long-duration storage, grid integration, and clean hydrogen, which would provide an essential opportunity to export the innovations that are projected to accelerate clean energy transmission across the globe.

In terms of type, the global green hydrogen market has been segregated into polymer electrolyte membrane electrolyzes, alkaline electrolyzes, and solid oxide electrolyzes. The polymer electrolyte membrane electrolyzes segment held a major share of 72.02% of the global market in 2021. It is estimated to dominate the market during the forecast period because polymer electrolyte membrane electrolyzes possess high proton conductivity and low fuel permeability. Polymer electrolyte membrane electrolyzes also offer good thermal stability and better film forming ability, which drives the demand for green hydrogen.

In terms of source, the global green hydrogen market has been segregated into solar and wind. The solar segment held a major share of 61.9% of the global market in 2021. It is estimated to dominate the market during the forecast period. Solar energy produces green hydrogen by electrolysis, which converts water into hydrogen. The wind segment accounted for 38.1% share of the market in 2021. The wind segment is estimated to grow at a steady pace during the forecast period.

In terms of end-use, the global green hydrogen market has been segregated into transportation, chemical, petrochemical, steel, domestic, and others. The chemical segment held a major share of 37.9% of the global market in 2021. Development of innovative solutions that enable a shift toward a sustainable and circular economy is contributing to rise in applications of green hydrogen in the chemical industry. Moreover, rise in R&D in manufacturing of hydrogen green steel is creating opportunities for market players.

Europe accounted for a prominent share of 58.7% of the global market in 2021. The market in the region is projected to grow at a significant pace during the forecast period. Germany is a major market for green hydrogen in Europe, holding more than 29.7% share of the green hydrogen market in the region. This is due to rise in investments in the development of clean technologies, such as solar and wind, for power generation in Germany. Asia Pacific is also a key market for green hydrogen, and the region held 20.12% share of the global market in 2021.

The global green hydrogen market is consolidated with a small number of large-scale vendors that control majority of the share. Several organizations are spending a significant amount on a global market study on green hydrogen. Research and development activities also help augment the market significantly. Key players operating in global green hydrogen market are Siemens Energy AG, Reliance Industries Limited, ITM Power PLC, Air Products and Chemicals. Inc, Ballard Power Systems, Linde plc, Air Liquide, SRI Energy, Inc, Nel ASA, Green Hydrogen Systems, Iberdrola, S.A, Plug Power Inc, and SGH2 Energy.

Each of these players has been profiled in global green hydrogen market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.14 Bn |

|

Market Forecast Value in 2031 |

US$ 135.73 Bn |

|

Growth Rate (CAGR) |

51.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The green hydrogen market stood at US$ 2.14 Bn in 2021

The green hydrogen market is expected to advance at a CAGR of 51.6% from 2022 to 2031

Rise in investment in green hydrogen and government objectives for net-zero emissions

The polymer electrolyte membrane electrolyzes segment accounted for a 72.2% share of the green hydrogen market in 2021

Europe is more attractive for vendors in the green hydrogen market

Siemens Energy AG, Reliance Industries Limited, ITM Power PLC, Air Products and Chemicals. Inc, Ballard Power Systems, Linde plc, Air Liquide, SRI Energy, Inc, Nel ASA, Green Hydrogen Systems, Iberdrola, S.A, Plug Power Inc, and SGH2 Energy

1. Executive Summary

1.1. Green Hydrogen Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Suppliers/ Distributors

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2020

5. Price Trend Analysis

6. Global Green Hydrogen Market Analysis and Forecast, by Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

6.2.1. Polymer Electrolyte Membrane Electrolyzes

6.2.2. Alkaline Electrolyzes

6.2.3. Solid Oxide Electrolyzes

6.3. Global Green Hydrogen Market Attractiveness, by Type

7. Global Green Hydrogen Market Analysis and Forecast, by Source, 2020–2031

7.1. Introduction and Definitions

7.2. Global Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

7.2.1. Solar

7.2.2. Wind

8. Global Green Hydrogen Market Attractiveness, by Source

9. Global Green Hydrogen Market Analysis and Forecast, by End-use, 2020–2031

9.1. Introduction and Definitions

9.2. Global Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.2.1. Transportation

9.2.2. Chemical

9.2.3. Petrochemical

9.2.4. Steel

9.2.5. Domestic

9.2.6. Others

9.3. Global Green Hydrogen Market Attractiveness, by End-use

10. Global Green Hydrogen Market Analysis and Forecast, by Region, 2020–2031

10.1. Key Findings

10.2. Global Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2020–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. Latin America

10.3. Global Green Hydrogen Market Attractiveness, by Region

11. North America Green Hydrogen Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. North America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

11.3. North America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4. North America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5. North America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2020–2031

11.5.1. U.S. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

11.5.2. U.S. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.5.3. U.S. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5.4. Canada Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

11.5.5. Canada Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.5.6. Canada Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.6. North America Green Hydrogen Market Attractiveness Analysis

12. Europe Green Hydrogen Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.3. Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.4. Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5. Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. Germany Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.2. Germany Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.3. Germany Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.4. France Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.5. France Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.6. France Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.7. U.K. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.8. U.K. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.9. U.K. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.10. Italy Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.11. Italy. Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.12. Italy Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.13. Russia & CIS Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.14. Russia & CIS Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.15. Russia & CIS Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.16. Rest of Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.17. Rest of Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.5.18. Rest of Europe Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.6. Europe Green Hydrogen Market Attractiveness Analysis

13. Asia Pacific Green Hydrogen Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type

13.3. Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.4. Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5. Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. China Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

13.5.2. China Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.5.3. China Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5.4. Japan Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

13.5.5. Japan Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.5.6. Japan Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5.7. India Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

13.5.8. India Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.5.9. India Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5.10. ASEAN Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

13.5.11. ASEAN Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.5.12. ASEAN Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5.13. Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

13.5.14. Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.5.15. Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.6. Asia Pacific Green Hydrogen Market Attractiveness Analysis

14. Latin America Green Hydrogen Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

14.3. Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

14.4. Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

14.5. Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. Brazil Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

14.5.2. Brazil Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

14.5.3. Brazil Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

14.5.4. Mexico Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

14.5.5. Mexico Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

14.5.6. Mexico Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

14.5.7. Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

14.5.8. Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

14.5.9. Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

14.6. Latin America Green Hydrogen Market Attractiveness Analysis

15. Middle East & Africa Green Hydrogen Market Analysis and Forecast, 2020–2031

15.1. Key Findings

15.2. Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

15.3. Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

15.4. Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

15.5. Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

15.5.1. GCC Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

15.5.2. GCC Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

15.5.3. GCC Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

15.5.4. South Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

15.5.5. South Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

15.5.6. South Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

15.5.7. Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020–2031

15.5.8. Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

15.5.9. Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

15.6. Middle East & Africa Green Hydrogen Market Attractiveness Analysis

16. Competition Landscape

16.1. Global Green Hydrogen Company Market Share Analysis, 2020

16.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

16.2.1. Siemens Energy AG

16.2.1.1. Company Description

16.2.1.2. Business Overview

16.2.1.3. Financial Overview

16.2.1.4. Strategic Overview

16.2.2. Reliance Industries Limited

16.2.2.1. Company Description

16.2.2.2. Business Overview

16.2.2.3. Financial Overview

16.2.2.4. Strategic Overview

16.2.3. ITM Power PLC

16.2.3.1. Company Description

16.2.3.2. Business Overview

16.2.3.3. Financial Overview

16.2.3.4. Strategic Overview

16.2.4. Air Products and Chemicals. Inc,

16.2.4.1. Company Description

16.2.4.2. Business Overview

16.2.4.3. Financial Overview

16.2.4.4. Strategic Overview

16.2.5. Linde plc

16.2.5.1. Company Description

16.2.5.2. Business Overview

16.2.5.3. Financial Overview

16.2.5.4. Strategic Overview

16.2.6. Air Liquide

16.2.6.1. Company Description

16.2.6.2. Business Overview

16.2.6.3. Financial Overview

16.2.6.4. Strategic Overview

16.2.7. SRI Energy, Inc,

16.2.7.1. Company Description

16.2.7.2. Business Overview

16.2.7.3. Financial Overview

16.2.7.4. Strategic Overview

16.2.8. Nel ASA

16.2.8.1. Company Description

16.2.8.2. Business Overview

16.2.8.3. Financial Overview

16.2.8.4. Strategic Overview

16.2.9. Green Hydrogen Systems

16.2.9.1. Company Description

16.2.9.2. Business Overview

16.2.9.3. Financial Overview

16.2.9.4. Strategic Overview

16.2.10. Iberdrola, S.A

16.2.10.1. Company Description

16.2.10.2. Business Overview

16.2.10.3. Financial Overview

16.2.10.4. Strategic Overview

16.2.11. Plug Power Inc

16.2.11.1. Company Description

16.2.11.2. Business Overview

16.2.11.3. Financial Overview

16.2.11.4. Strategic Overview

16.2.12. SGH2 Energy

16.2.12.1. Company Description

16.2.12.2. Business Overview

16.2.12.3. Financial Overview

16.2.12.4. Strategic Overview

17. Primary Research: Key Insights

18. Appendix

List of Tables

Table 1: Global Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 2: Global Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 3: Global Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 4: Global Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 5: Global Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 6: Global Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 7: Global Green Hydrogen Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 8: Global Green Hydrogen Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 9: North America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 10: North America Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 11: North America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 12: North America Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 13: North America Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 14: North America Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 15: North America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 16: North America Green Hydrogen Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 17: U.S. Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 18: U.S. Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 19: U.S. Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 20: U.S. Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 21: U.S. Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 22: U.S. Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 23: Canada Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 24: Canada Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 25: Canada Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 26: Canada Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 27: Canada Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 28: Canada Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 29: Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 30: Europe Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 31: Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 32: Europe Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 33: Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 34: Europe Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 35: Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Green Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 38: Germany Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 39: Germany Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 40: Germany Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 41: Germany Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 42: Germany Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 43: France Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 44: France Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 45: France Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 46: France Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 47: France Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 48: France Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 49: U.K. Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 50: U.K. Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 51: U.K. Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 52: U.K. Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 53: U.K. Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 54: U.K. Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 55: Italy Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 56: Italy Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 57: Italy Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 58: Italy Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 59: Italy Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 60: Italy Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 61: Spain Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 62: Spain Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 63: Spain Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 64: Spain Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 65: Spain Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 66: Spain Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 67: Russia & CIS Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 68: Russia & CIS Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 69: Russia & CIS Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 70: Russia & CIS Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 71: Russia & CIS Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 72: Russia & CIS Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 73: Rest of Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 74: Rest of Europe Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 75: Rest of Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 76: Rest of Europe Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 77: Rest of Europe Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 78: Rest of Europe Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 79: Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 80: Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 81: Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 82: Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 83: Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 84: Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 85: Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 88: China Green Hydrogen Market Value (US$ Bn) Forecast, by Type 2020–2031

Table 89: China Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 90: China Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 91: China Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 92: China Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 93: Japan Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 94: Japan Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 95: Japan Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 96: Japan Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 97: Japan Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 98: Japan Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 99: India Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 100: India Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 101: India Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 102: India Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 103: India Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 104: India Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 105: India Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 106: India Green Hydrogen Market Value (US$ Bn) Forecast, by End-use 2020–2031

Table 107: ASEAN Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 108: ASEAN Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 109: ASEAN Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 110: ASEAN Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 111: ASEAN Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 112: ASEAN Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 113: Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 114: Rest of Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 115: Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 116: Rest of Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 117: Rest of Asia Pacific Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 118: Rest of Asia Pacific Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 119: Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 120: Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 121: Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 122: Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 123: Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 124: Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 125: Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 128: Brazil Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 129: Brazil Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 130: Brazil Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 131: Brazil Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 132: Brazil Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 133: Mexico Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 134: Mexico Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 135: Mexico Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 136: Mexico Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 137: Mexico Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 138: Mexico Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 139: Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 140: Rest of Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 141: Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 142: Rest of Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 143: Rest of Latin America Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 144: Rest of Latin America Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 145: Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 146: Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 147: Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 148: Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 149: Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 150: Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 151: Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 154: GCC Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 155: GCC Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 156: GCC Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 157: GCC Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 158: GCC Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 159: South Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 160: South Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 161: South Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 162: South Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 163: South Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 164: South Africa Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 165: Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 166: Rest of Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 167: Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by Source, 2020–2031

Table 168: Rest of Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 169: Rest of Middle East & Africa Green Hydrogen Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 170: Rest of Middle East & Africa Green Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020–2031

List of Figures

Figure 1: Global Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 2: Global Green Hydrogen Market Attractiveness, by Type

Figure 3: Global Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 4: Global Green Hydrogen Market Attractiveness, by Source

Figure 5: Global Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 6: Global Green Hydrogen Market Attractiveness, by End-use

Figure 7: Global Green Hydrogen Market Volume Share Analysis, by Region, 2020, 2025, and 2031

Figure 8: Global Green Hydrogen Market Attractiveness, by Region

Figure 9: North America Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 10: North America Green Hydrogen Market Attractiveness, by Type

Figure 11: North America Green Hydrogen Market Attractiveness, by Type

Figure 12: North America Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 13: North America Green Hydrogen Market Attractiveness, by Source

Figure 14: North America Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 15: North America Green Hydrogen Market Attractiveness, by End-use

Figure 16: North America Green Hydrogen Market Attractiveness, by Country

Figure 17: Europe Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 18: Europe Green Hydrogen Market Attractiveness, by Type

Figure 19: Europe Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 20: Europe Green Hydrogen Market Attractiveness, by Source

Figure 21: Europe Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 22: Europe Green Hydrogen Market Attractiveness, by End-use

Figure 23: Europe Green Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 24: Europe Green Hydrogen Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 26: Asia Pacific Green Hydrogen Market Attractiveness, by Type

Figure 27: Asia Pacific Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 28: Asia Pacific Green Hydrogen Market Attractiveness, by Source

Figure 29: Asia Pacific Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 30: Asia Pacific Green Hydrogen Market Attractiveness, by End-use

Figure 31: Asia Pacific Green Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 32: Asia Pacific Green Hydrogen Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 34: Latin America Green Hydrogen Market Attractiveness, by Type

Figure 35: Latin America Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 36: Latin America Green Hydrogen Market Attractiveness, by Source

Figure 37: Latin America Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 38: Latin America Green Hydrogen Market Attractiveness, by End-use

Figure 39: Latin America Green Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 40: Latin America Green Hydrogen Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Green Hydrogen Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 42: Middle East & Africa Green Hydrogen Market Attractiveness, by Type

Figure 43: Middle East & Africa Green Hydrogen Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 44: Middle East & Africa Green Hydrogen Market Attractiveness, by Source

Figure 45: Middle East & Africa Green Hydrogen Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 46: Middle East & Africa Green Hydrogen Market Attractiveness, by End-use

Figure 47: Middle East & Africa Green Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 48: Middle East & Africa Green Hydrogen Market Attractiveness, by Country and Sub-region