Analyst Viewpoint

Gold nanoparticles are being increasingly utilized in electronic chips, printable inks, and transistors. Rise in integration of chips in critical technologies and electronics is fueling the demand for semiconductors, which in turn driving the gold nanoparticles industry. Moreover, growing innovation and trend of miniaturization in the electronics industry is anticipated to boost the gold nanoparticles market growth in the next few years.

Increase in application of nanotechnology in medical diagnostics, growth in R&D in environmental applications of gold nanoparticles, and rise in demand in specific applications are expected to offer lucrative gold nanoparticles market opportunities in the next few years. However, volatility in prices of gold and stringent regulations and standards for nanomaterials are likely to hamper the gold nanoparticles industry growth in the next few years.

Almost every electronic device we use daily, which includes smartphones, computers, touchscreen tablets, televisions, GPS devices, contains a small amount of gold in it. Accordingly, the global electronics and semiconductor industries consume between 200 and 300 tons of gold each year. The amount of gold used per device is minute; however, when you consider that nearly a billion smartphones are produced each year, the total gold contained in them could be significantly huge.

Gold nanoparticles have a size of less than 10 nanometers and have properties similar to those of platinum or palladium. Gold is an inert metal and does not degrade over time. Moreover, it has a surface chemistry that allows the attachment of molecules. Furthermore, excellent corrosion resistance, electrical and thermal conductivity, and ease of soldering make gold perfectly suited to miniaturization.

Gold nanoparticles have been gaining considerable traction in both the medical and food packaging industries due to the inert and nontoxic nature of gold nanoparticles. Furthermore, unique properties of gold nanoparticles, including their biocompatibility, low cytotoxicity, and optical properties, are driving their applications and consequently, propelling the gold nanomaterials market.

The production of gold nanoparticles can be time-consuming, particularly when using certain synthesis methods. Furthermore, some synthesis methods can result in contamination with toxic chemicals, which can restrict the practical use of gold nanoparticles in biomedical applications. These factors are likely to hamper the gold nanoparticles market scenario in the near future.

Gold nanoparticles have a small size and are ultra-light, which means they have a large surface area relative to their volume. This allows for high reactivity and makes them useful in applications such as catalysis. The minute size of gold nanoparticles is prompting manufacturers of gold nanoparticles to utilize them as electronic connectors, particularly via metallic nanotubes, which are smaller, lighter, and more flexible than conventional metal tubes. Consequently, assembly of gold nanoparticles is anticipated to be widely adopted owing to the rising miniaturization of electronic components. Major manufacturers, such as Sony, Huawei, and Samsung, are already using the technique.

In the electronics industry, nanoscale gold particles are being used to connect resistors, conductors, and other elements of an electronic chip. Inks and nanowires use nanoparticles in assembling compact storage devices and electronic biosensors.

Gold nanoparticles have several unique properties, such as high scattering ability, great absorption with less interference of bone and tissue, and strong optoacoustic signals for its use in the healthcare industry. Gold nanoparticles are used in biosensors due to their interaction with visible light and their unique optoelectronic properties. They are also used in bioimaging applications.

Gold nanoparticles can be conjugated to biomolecules to precisely target cancer cells. They are used for photothermal cancer therapy, where their tunable optical properties cause them to convert laser light into heat and selectively kill cancerous cells. Moreover, gold nanoparticles have been effectively utilized for the delivery of nucleotide therapeutics.

The multivalency of gold nanoparticles helps shield poorly soluble imaging contrast agents or unstable drugs, which enables them to be effectively delivered to those parts of the body that are inaccessible otherwise. Therefore, diagnostic and therapeutic functionalities could be simultaneously executed through gold nanoparticles. These advantages of gold nanoparticles are expected to positively influence the future analysis of gold nanoparticles market.

Asia Pacific dominates the gold nanoparticles market share. This is due to significant growth of nanotechnology industry in China, Taiwan, South Korea, and India. Emergence of high-precision printing industries is also expected to positively impact the global market forecast in the region in the next few years.

Demand for gold nanoparticles is considerably high in North America owing to continuous advancements in the healthcare sector. Researchers are focusing on the development of products that are capable of imitating human body cells and curing antimicrobial diseases.

The gold nanoparticles market revenue in Europe is expected to increase during the forecast period due to growing application of gold nanoparticles in glass tinting, photovoltaic plates, and nanowires.

The global gold nanoparticles industry is highly competitive owing to the presence of several players who operate across the globe. Leading players are following the latest gold nanoparticles market trends and investing significantly in research and development activities to grab innovative application opportunities. The market is highly cost-exhaustive and gold nanoparticles have modest yield for specific range of applications. A few prominent players operating in the global market are BBI Solutions, TANAKA, Johnson Matthey Plc, Nanopartz Plc, Nanocomposix Inc., Meliorum Technologies, Inc., Sigma Aldrich, Innova Biosciences, Cline Scientific, and Cytodiagnostics.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.7 Bn |

| Market Forecast Value in 2031 | US$ 11.8 Bn |

| Growth Rate (CAGR) | 10.6% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

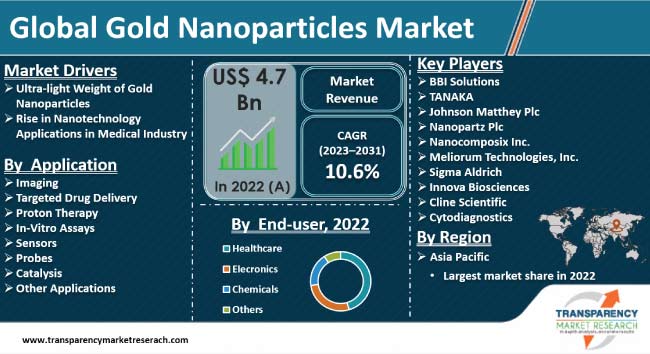

The global market was valued at US$ 4.7 Bn in 2022

It is projected to grow at a CAGR of 10.6% from 2023 to 2031

Ultra-light weight of gold nanoparticles and rise in nanotechnology applications in medical industry

In terms of end-user, the healthcare segment held largest share in 2022

Asia Pacific is estimated to dominate in the next few years

BBI Solutions, TANAKA, Johnson Matthey Plc, Nanopartz Plc, Nanocomposix Inc., Meliorum Technologies, Inc., Sigma Aldrich, Innova Biosciences, Cline Scientific, and Cytodiagnostics

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Gold Nanoparticles Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Gold Nanoparticles Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. Gold Nanoparticles Market Analysis and Forecast, by Application

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Application, 2023–2031

6.3.1. Imaging

6.3.2. Targeted Drug Delivery

6.3.3. Proton Therapy

6.3.4. In-Vitro Assays

6.3.5. Sensors

6.3.6. Probes

6.3.7. Catalysis

6.3.8. Other Applications

6.3.9. 6.4 Market Attractiveness, by Application

7. Gold Nanoparticles Market Analysis and Forecast, by End-user

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2023–2031

7.3.1. Healthcare

7.3.2. Electronics

7.3.3. Chemicals

7.3.4. Others

7.4. Market Attractiveness, by End-user

8. Gold Nanoparticles Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Gold Nanoparticles Market Analysis and Forecast

9.1. Market Value Forecast, by Application, 2023–2031

9.1.1. Imaging

9.1.2. Targeted Drug Delivery

9.1.3. Proton Therapy

9.1.4. In-Vitro Assays

9.1.5. Sensors

9.1.6. Probes

9.1.7. Catalysis

9.1.8. Other Applications

9.2. Market Attractiveness, by Application

9.3. Market Value Forecast, by End-user, 2023–2031

9.3.1. Healthcare

9.3.2. Electronics

9.3.3. Chemicals

9.3.4. Others

9.4. Market Attractiveness, by End-user

9.5. Market Value Forecast, by Country, 2023–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Application

9.6.2. By End-user

9.6.3. By Country

10. Europe Gold Nanoparticles Market Analysis and Forecast

10.1. Market Value Forecast, by Application, 2023–2031

10.1.1. Imaging

10.1.2. Targeted Drug Delivery

10.1.3. Proton Therapy

10.1.4. In-Vitro Assays

10.1.5. Sensors

10.1.6. Probes

10.1.7. Catalysis

10.1.8. Other Applications

10.2. Market Attractiveness, by Application

10.3. Market Value Forecast, by End-user, 2023–2031

10.3.1. Healthcare

10.3.2. Electronics

10.3.3. Chemicals

10.3.4. Others

10.4. Market Attractiveness, by End-user

10.5. Market Value Forecast, by Country/Sub-region, 2023–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Application

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Asia Pacific Gold Nanoparticles Market Analysis and Forecast

11.1. Market Value Forecast, by Application, 2023–2031

11.1.1. Imaging

11.1.2. Targeted Drug Delivery

11.1.3. Proton Therapy

11.1.4. In-Vitro Assays

11.1.5. Sensors

11.1.6. Probes

11.1.7. Catalysis

11.1.8. Other Applications

11.2. Market Attractiveness, by Application

11.3. Market Value Forecast, by End-user, 2023–2031

11.3.1. Healthcare

11.3.2. Electronics

11.3.3. Chemicals

11.3.4. Others

11.4. Market Attractiveness, by End-user

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Application

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. Latin America Gold Nanoparticles Market Analysis and Forecast

12.1. Market Value Forecast, by Application, 2023–2031

12.1.1. Imaging

12.1.2. Targeted Drug Delivery

12.1.3. Proton Therapy

12.1.4. In-Vitro Assays

12.1.5. Sensors

12.1.6. Probes

12.1.7. Catalysis

12.1.8. Other Applications

12.2. Market Attractiveness, by Application

12.3. Market Value Forecast, by End-user, 2023–2031

12.3.1. Healthcare

12.3.2. Electronics

12.3.3. Chemicals

12.3.4. Others

12.4. Market Attractiveness, by End-user

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Application

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Middle East & Africa Gold Nanoparticles Market Analysis and Forecast

13.1. Market Value Forecast, by Application, 2023–2031

13.1.1. Imaging

13.1.2. Targeted Drug Delivery

13.1.3. Proton Therapy

13.1.4. In-Vitro Assays

13.1.5. Sensors

13.1.6. Probes

13.1.7. Catalysis

13.1.8. Other Applications

13.2. Market Attractiveness, by Application

13.3. Market Value Forecast, by End-user, 2023–2031

13.3.1. Healthcare

13.3.2. Electronics

13.3.3. Chemicals

13.3.4. Others

13.4. Market Attractiveness, by End-user

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Application

13.6.2. By End-user

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. BBI Solutions

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. TANAKA

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Johnson Matthey Plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Nanopartz Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Nanocomposix Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Meliorum Technologies, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Sigma Aldrich

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Innova Biosicences

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Cline Scientific

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Cytodiagnostics

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 1: Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 2: Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 3: Gold Nanoparticles Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 4: North America Gold Nanoparticles Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 5: North America Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 6: North America Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 7: Europe Gold Nanoparticles Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 8: Europe Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 9: Europe Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user 2023–2031

Table 10: Asia Pacific Gold Nanoparticles Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 11: Asia Pacific Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 12: Asia Pacific Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Latin America Gold Nanoparticles Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Latin America Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Latin America Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user 2023–2031

Table 16: Middle East & Africa Gold Nanoparticles Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Middle East & Africa Gold Nanoparticles Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 18: Middle East & Africa Gold Nanoparticles Market Value (US$ Mn) Forecast, by End-user 2023–2031

List of Figures

Figure 1: Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 2: Gold Nanoparticles Market Value Share, by Application, 2022

Figure 3: Gold Nanoparticles Market Value Share, by End-user, 2022

Figure 4: Gold Nanoparticles Market Value Share Analysis, by Application, 2022 and 2031

Figure 5: Gold Nanoparticles Market Attractiveness Analysis, by Application, 2023–2031

Figure 6: Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 7: Gold Nanoparticles Market Attractiveness Analysis, by End-user 2023–2031

Figure 8: Gold Nanoparticles Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Gold Nanoparticles Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 11: North America Gold Nanoparticles Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Gold Nanoparticles Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America Gold Nanoparticles Market Value Share Analysis, by Application, 2022 and 2031

Figure 14: North America Gold Nanoparticles Market Attractiveness Analysis, by Application, 2023–2031

Figure 15: North America Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: North America Gold Nanoparticles Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: Europe Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 18: Europe Gold Nanoparticles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Gold Nanoparticles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe Gold Nanoparticles Market Value Share Analysis, by Application, 2022 and 2031

Figure 21: Europe Gold Nanoparticles Market Attractiveness Analysis, by Application, 2023–2031

Figure 22: Europe Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: Europe Gold Nanoparticles Market Attractiveness Analysis, by End-user 2023–2031

Figure 24: Asia Pacific Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 25: Asia Pacific Gold Nanoparticles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Gold Nanoparticles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Gold Nanoparticles Market Value Share Analysis, by Application, 2022 and 2031

Figure 28: Asia Pacific Gold Nanoparticles Market Attractiveness Analysis, by Application, 2023–2031

Figure 29: Asia Pacific Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Asia Pacific Gold Nanoparticles Market Attractiveness Analysis, by End-user 2023–2031

Figure 31: Latin America Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 32: Latin America Gold Nanoparticles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Gold Nanoparticles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America Gold Nanoparticles Market Value Share Analysis, by Application, 2022 and 2031

Figure 35: Latin America Gold Nanoparticles Market Attractiveness Analysis, by Application, 2023–2031

Figure 36: Latin America Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 37: Latin America Gold Nanoparticles Market Attractiveness Analysis, by End-user, 2023–2031

Figure 38: Middle East & Africa Gold Nanoparticles Market Value (US$ Mn) Forecast, 2023–2031

Figure 39: Middle East & Africa Gold Nanoparticles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 40: Middle East & Africa Gold Nanoparticles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 41: Middle East & Africa Gold Nanoparticles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Middle East & Africa Gold Nanoparticles Market Attractiveness Analysis, by End-user 2023–2031

Figure 43: Gold Nanoparticles Market Share Analysis, by Company (2022)