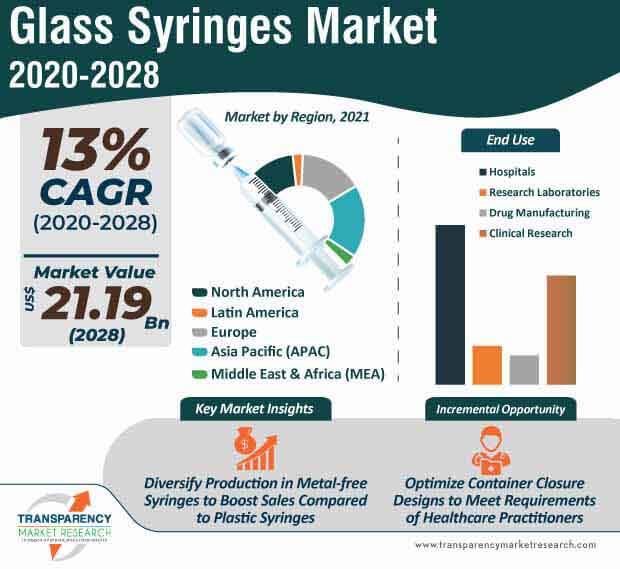

The potential COVID-19 vaccine distribution has led to a huge supply challenge for companies in the glass syringe market. The inoculation of more than 300 million people in the U.S. has created an urgent demand for everything ranging from glass vials, syringes to sophisticated cooling systems. As such, manufacturers in the glass syringe market should increase efforts to boost their production capacities to meet the demand from the U.S. healthcare authorities.

Densely populated India is another hot destination for COVID-19 vaccine distribution. Serum Institute based in Pune, India, has introduced the Covishield vaccine that holds promising potentials to immunize large populations against coronavirus. Thus, companies in the glass syringe market need to increase efforts to maintain robust distribution channels to avoid supply shocks.

Glass prevents oxygen and water vapor from interacting with the product. However, glass is susceptible to breakages, extractables, and leachables. On the other hand, polymer syringes are being made free from heavy metals and tungsten, but are easily scratched and not ideal for oxygen sensitive drugs. Hence, companies in the glass syringe market such as the Gerressheimer Group— a manufacturer of glass and plastic products, are introducing metal-free glass syringes that are compatible with biotechnologically manufacture active ingredients.

Biotechnologically manufacture active ingredients are either high concentrated for viscous in nature and has led to the demand for metal-free glass syringes. Manufacturers need to increase their R&D in patented production technologies to gain a competitive edge in the market landscape.

Though plastic and disposable syringes pose as a threat to the sales of glass syringes, glass has the advantage of being non-reactive and stable. Manufacturers in the glass syringe market are experimenting with Type 1 borosilicate glass to manufacture prefilled syringes. Sterile nature, good visibility, and low reactivity with products are advantages of Type 1 borosilicate glass, which are being highly preferred by users in the healthcare landscape.

Metal-free glass syringes are gaining prominence in the glass syringe market. Companies are gaining a strong research base in the metal-free technology for residue-free cone shaping. Medications based on biotechnologically manufacture active ingredients have triggered the demand for pre-fillable syringes that help to exclude the possibility of contamination with metal.

Contract development and manufacturing organizations (CDMOs) are being mindful about material selection to meet specific requirements of healthcare professionals. AMRI Global— a contract research and manufacturing organization, is increasing efforts to partner with med-tech companies in order to stay mindful about new technologies and materials. The ever-evolving progression-free survival (PFS) landscape is anticipated to spark strategic collaborations between CDMOs and companies in the glass syringe market.

CDMOs are playing a vital role in the glass syringe market who are taking giant strides in offering client support in order to sustain in the ever-changing PFS landscape. They are offering consultation services for product material selection by taking into account various modes of drug administration and end user information.

Manufacturers in the glass syringe market are setting their collaboration wheels in motion by teaming up with CDMOs, since the latter are establishing in-house analytical team of experts that have extensive knowledge about leachables and extractables. These experts are helping med-tech companies to optimize their container closure designs and draw advancements in heavy metal detection.

CDMOs are helping companies in the glass syringe market to comply with Current Good Manufacturing Practices (CGMP) aseptic processing. In order to boost their credibility credentials, med-tech companies are partnering with CDMOs to enable pre-approval inspections for glass syringes. The one size fits all approach has become potentially redundant in PFS manufacturing, CDMOs are helping manufacturers to implement fail-safe compliance processes.

Analysts’ Viewpoint

Based on input from research institutes, manufacturers are boosting their output capacities for potential COVID-19 vaccines to meet the demand in global inoculation campaigns. Current good manufacturing practices are being adopted by med-tech companies to enable pre-approval inspections for new glass syringe products. The success for commercial products relies in product characterization, processing, and improved understanding of device range in the evolving PFS manufacturing landscape. However, plastic and disposable syringes are emerging as a threat to the sales of glass syringes. Hence, manufacturers should introduce metal-free syringes with the help of innovative patented production technologies to gain a competitive advantage in the glass syringe market landscape.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Glass Syringes Market Overview

3.1. Introduction

3.2. Global Glass Syringes Market Overview

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. Glass Syringes Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors/Retailers

3.5.1.3. End Users

3.5.2. Profitability Margins

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Current Economic Projection – GDP/GVA and Probable Impact

4.3. Comparison of SAARs and Market Recovery, for Key Countries

4.4. Comparison to 2008 Financial Crisis and Market Recovery, for Key Countries

4.5. Impact of COVID-19 on Glass Syringes Market

5. Glass Syringes Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Glass Syringes Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

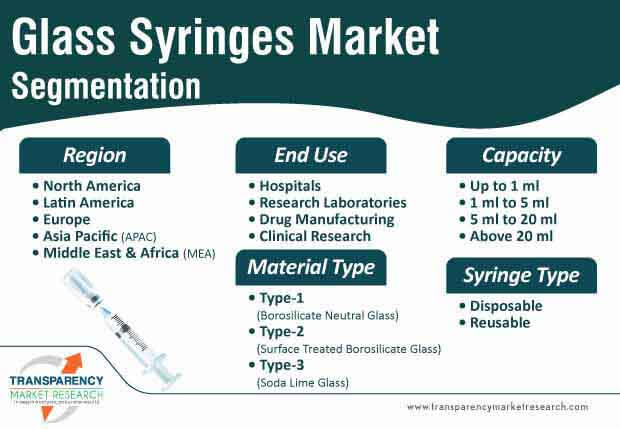

7. Global Glass Syringes Market Analysis and Forecast, By Syringe Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Syringe Type

7.1.2. Y-o-Y Growth Projections, By Syringe Type

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

7.2.1. Disposable

7.2.2. Reusable

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

7.3.1. Disposable

7.3.2. Reusable

7.4. Market Attractiveness Analysis, By Syringe Type

8. Global Glass Syringes Market Analysis and Forecast, By Material Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

8.1.2. Y-o-Y Growth Projections, By Material Type

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

8.2.1. Type-1 (Borosilicate Neutral Glass)

8.2.2. Type-2 (Surface Treated Borosilicate Glass)

8.2.3. Type-3 (Soda Lime Glass)

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

8.3.1. Type-1 (Borosilicate Neutral Glass)

8.3.2. Type-2 (Surface Treated Borosilicate Glass)

8.3.3. Type-3 (Soda Lime Glass)

8.4. Market Attractiveness Analysis, By Material Type

9. Global Glass Syringes Market Analysis and Forecast, By Capacity

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

9.1.2. Y-o-Y Growth Projections, By Capacity

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

9.2.1. Up to 1 ml

9.2.2. 1 ml to 5 ml

9.2.3. 5 ml to 20 ml

9.2.4. Above 20 ml

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

9.3.1. Up to 1 ml

9.3.2. 1 ml to 5 ml

9.3.3. 5 ml to 20 ml

9.3.4. Above 20 ml

9.4. Market Attractiveness Analysis, By Capacity

10. Global Glass Syringes Market Analysis and Forecast, By End Use

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By End Use

10.1.2. Y-o-Y Growth Projections, By End Use

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

10.2.1. Hospitals

10.2.2. Research Laboratories

10.2.3. Drug Manufacturing

10.2.4. Clinical Research

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

10.3.1. Hospitals

10.3.2. Research Laboratories

10.3.3. Drug Manufacturing

10.3.4. Clinical Research

10.4. Market Attractiveness Analysis, By End Use

11. Global Glass Syringes Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific

11.2.5. Middle East & Africa (MEA)

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028 By Region

11.3.1. North America

11.3.2. Latin America

11.3.3. Europe

11.3.4. Asia Pacific

11.3.5. Middle East & Africa (MEA)

11.4. Market Attractiveness Analysis By Region

12. North America Glass Syringes Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Country

12.3.1. U.S.

12.3.2. Canada

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

12.5.1. Disposable

12.5.2. Reusable

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

12.7.1. Type-1 (Borosilicate Neutral Glass)

12.7.2. Type-2 (Surface Treated Borosilicate Glass)

12.7.3. Type-3 (Soda Lime Glass)

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

12.9.1. Up to 1 ml

12.9.2. 1 ml to 5 ml

12.9.3. 5 ml to 20 ml

12.9.4. Above 20 ml

12.10. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

12.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

12.11.1. Hospitals

12.11.2. Research Laboratories

12.11.3. Drug Manufacturing

12.11.4. Clinical Research

12.12. Market Attractiveness Analysis

12.12.1. By Country

12.12.2. By Syringe Type

12.12.3. By Material Type

12.12.4. By Capacity

12.12.5. By End Use

12.13. Prominent Trends

12.14. Drivers and Restraints: Impact Analysis

13. Latin America Glass Syringes Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028 By Country

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Argentina

13.3.4. Rest of Latin America

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

13.5.1. Disposable

13.5.2. Reusable

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

13.7.1. Type-1 (Borosilicate Neutral Glass)

13.7.2. Type-2 (Surface Treated Borosilicate Glass)

13.7.3. Type-3 (Soda Lime Glass)

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

13.9.1. Up to 1 ml

13.9.2. 1 ml to 5 ml

13.9.3. 5 ml to 20 ml

13.9.4. Above 20 ml

13.10. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

13.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

13.11.1. Hospitals

13.11.2. Research Laboratories

13.11.3. Drug Manufacturing

13.11.4. Clinical Research

13.12. Market Attractiveness Analysis

13.12.1. By Country

13.12.2. By Syringe Type

13.12.3. By Material Type

13.12.4. By Capacity

13.12.5. By End Use

13.13. Prominent Trends

13.14. Drivers and Restraints: Impact Analysis

14. Europe Glass Syringes Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028 By Country

14.3.1. Germany

14.3.2. Spain

14.3.3. Italy

14.3.4. France

14.3.5. U.K.

14.3.6. BENELUX

14.3.7. Nordic

14.3.8. Russia

14.3.9. Poland

14.3.10. Rest of Europe

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

14.5.1. Disposable

14.5.2. Reusable

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

14.7.1. Type-1 (Borosilicate Neutral Glass)

14.7.2. Type-2 (Surface Treated Borosilicate Glass)

14.7.3. Type-3 (Soda Lime Glass)

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

14.9.1. Up to 1 ml

14.9.2. 1 ml to 5 ml

14.9.3. 5 ml to 20 ml

14.9.4. Above 20 ml

14.10. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

14.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

14.11.1. Hospitals

14.11.2. Research Laboratories

14.11.3. Drug Manufacturing

14.11.4. Clinical Research

14.12. Market Attractiveness Analysis

14.12.1. By Country

14.12.2. By Syringe Type

14.12.3. By Material Type

14.12.4. By Capacity

14.12.5. By End Use

14.13. Prominent Trends

14.14. Drivers and Restraints: Impact Analysis

15. Asia Pacific Glass Syringes Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Country

15.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028 By Country

15.3.1. China

15.3.2. India

15.3.3. Japan

15.3.4. ASEAN

15.3.5. Australia and New Zealand

15.3.6. Rest of APAC

15.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

15.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

15.5.1. Disposable

15.5.2. Reusable

15.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

15.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

15.7.1. Type-1 (Borosilicate Neutral Glass)

15.7.2. Type-2 (Surface Treated Borosilicate Glass)

15.7.3. Type-3 (Soda Lime Glass)

15.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

15.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

15.9.1. Up to 1 ml

15.9.2. 1 ml to 5 ml

15.9.3. 5 ml to 20 ml

15.9.4. Above 20 ml

15.10. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

15.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

15.11.1. Hospitals

15.11.2. Research Laboratories

15.11.3. Drug Manufacturing

15.11.4. Clinical Research

15.12. Market Attractiveness Analysis

15.12.1. By Country

15.12.2. By Syringe Type

15.12.3. By Material Type

15.12.4. By Capacity

15.12.5. By End Use

15.13. Prominent Trends

15.14. Drivers and Restraints: Impact Analysis

16. Middle East and Africa Glass Syringes Market Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Country

16.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Country

16.3.1. North Africa

16.3.2. GCC countries

16.3.3. South Africa

16.3.4. Turkey

16.3.5. Rest of MEA

16.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Syringe Type

16.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Syringe Type

16.5.1. Disposable

16.5.2. Reusable

16.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Material Type

16.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Material Type

16.7.1. Type-1 (Borosilicate Neutral Glass)

16.7.2. Type-2 (Surface Treated Borosilicate Glass)

16.7.3. Type-3 (Soda Lime Glass)

16.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By Capacity

16.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By Capacity

16.9.1. Up to 1 ml

16.9.2. 1 ml to 5 ml

16.9.3. 5 ml to 20 ml

16.9.4. Above 20 ml

16.10. Historical Market Value (US$ Mn) and Volume (Units), 2015-2019, By End Use

16.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2020-2028, By End Use

16.11.1. Hospitals

16.11.2. Research Laboratories

16.11.3. Drug Manufacturing

16.11.4. Clinical Research

16.12. Market Attractiveness Analysis

16.12.1. By Country

16.12.2. By Syringe Type

16.12.3. By Material Type

16.12.4. By Capacity

16.12.5. By End Use

16.13. Prominent Trends

16.14. Drivers and Restraints: Impact Analysis

17. Competitive Landscape

17.1. Market Structure

17.2. Competition Dashboard

17.3. Company Market Share Analysis

17.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.5. Competition Deep Dive

(Global Players)

17.5.1. Hamilton Company

17.5.1.1. Overview

17.5.1.2. Financials

17.5.1.3. Strategy

17.5.1.4. Recent Developments

17.5.1.5. SWOT Analysis

17.5.2. Gerresheimer AG

17.5.2.1. Overview

17.5.2.2. Financials

17.5.2.3. Strategy

17.5.2.4. Recent Developments

17.5.2.5. SWOT Analysis

17.5.3. Merck KGaA

17.5.3.1. Overview

17.5.3.2. Financials

17.5.3.3. Strategy

17.5.3.4. Recent Developments

17.5.3.5. SWOT Analysis

17.5.4. KD Scientific Inc.

17.5.4.1. Overview

17.5.4.2. Financials

17.5.4.3. Strategy

17.5.4.4. Recent Developments

17.5.4.5. SWOT Analysis

17.5.5. SCHOTT AG

17.5.5.1. Overview

17.5.5.2. Financials

17.5.5.3. Strategy

17.5.5.4. Recent Developments

17.5.5.5. SWOT Analysis

17.5.6. DWK Life Sciences

17.5.6.1. Overview

17.5.6.2. Financials

17.5.6.3. Strategy

17.5.6.4. Recent Developments

17.5.6.5. SWOT Analysis

17.5.7. Cadence Science

17.5.7.1. Overview

17.5.7.2. Financials

17.5.7.3. Strategy

17.5.7.4. Recent Developments

17.5.7.5. SWOT Analysis

17.5.8. Becton, Dickinson and Company

17.5.8.1. Overview

17.5.8.2. Financials

17.5.8.3. Strategy

17.5.8.4. Recent Developments

17.5.8.5. SWOT Analysis

17.5.9. Socorex Isba S.A.

17.5.9.1. Overview

17.5.9.2. Financials

17.5.9.3. Strategy

17.5.9.4. Recent Developments

17.5.9.5. SWOT Analysis

17.5.10. Top Syringe Mfg Co (P) Ltd.

17.5.10.1. Overview

17.5.10.2. Financials

17.5.10.3. Strategy

17.5.10.4. Recent Developments

17.5.10.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 1: Global Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 2: Global Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 3: Global Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 4: Global Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 5: Global Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 6: Global Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 7: Global Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 8: Global Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 9: Global Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 10: Global Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

Table 11: North America Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 12: North America Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 13: North America Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 14: North America Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 15: North America Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 16: North America Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 17: North America Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 18: North America Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 19: North America Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 20: North America Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

Table 21: Latin America Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 22: Latin America Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 23: Latin America Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 24: Latin America Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 25: Latin America Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 26: Latin America Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 27: Latin America Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 28: Latin America Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 29: Latin America Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 30: Latin America Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

Table 31: Europe Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 32: Europe Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 33: Europe Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 34: Europe Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 35: Europe Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 36: Europe Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 37: Europe Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 38: Europe Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 39: Europe Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 40: Europe Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

Table 41: Asia Pacific Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 42: Asia Pacific Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 43: Asia Pacific Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 44: Asia Pacific Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 45: Asia Pacific Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 46: Asia Pacific Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 47: Asia Pacific Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 48: Asia Pacific Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 49: Asia Pacific Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 50: Asia Pacific Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

Table 51: MEA Glass Syringes Market Value (US$ Mn) Analysis, by Syringe Type, 2015-2028

Table 52: MEA Glass Syringes Market Volume (Mn Units) Analysis, by Syringe Type, 2015-2028

Table 53: MEA Glass Syringes Market Value (US$ Mn) Analysis, by Material Type, 2015-2028

Table 54: MEA Glass Syringes Market Volume (Mn Units) Analysis, by Material Type, 2015-2028

Table 55: MEA Glass Syringes Market Value (US$ Mn) Analysis, by Capacity, 2015-2028

Table 56: MEA Glass Syringes Market Volume (Mn Units) Analysis, by Capacity, 2015-2028

Table 57: MEA Glass Syringes Market Value (US$ Mn) Analysis, by End Use, 2015-2028

Table 58: MEA Glass Syringes Market Volume (Mn Units) Analysis, by End Use, 2015-2028

Table 59: MEA Glass Syringes Market Value (US$ Mn) Analysis, by Region, 2015-2028

Table 60: MEA Glass Syringes Market Volume (Mn Units) Analysis, by Region, 2015-2028

List of Figure

Figure 1: Global Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 2: Global Glass Syringes Market Y-o-Y Analysis, by Syringe Type, 2020-2028

Figure 3: Global Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 4: Global Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 5: Global Glass Syringes Market Y-o-Y Analysis, by Material Type, 2020-2028

Figure 6: Global Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 7: Global Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 8: Global Glass Syringes Market Y-o-Y Analysis, by Capacity, 2020-2028

Figure 9: Global Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 10: Global Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 11: Global Glass Syringes Market Y-o-Y Analysis, by End Use, 2020-2028

Figure 12: Global Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 13: Global Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 14: Global Glass Syringes Market Y-o-Y Analysis, by Region, 2020-2028

Figure 15: Global Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028

Figure 16: North America Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 17: North America Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 18: North America Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 19: North America Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 20: North America Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 21: North America Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 22: North America Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 23: North America Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 24: North America Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 25: North America Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028

Figure 26: Latin America Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 27: Latin America Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 28: Latin America Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 29: Latin America Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 30: Latin America Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 31: Latin America Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 32: Latin America Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 33: Latin America Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 34: Latin America Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 35: Latin America Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028

Figure 36: Europe Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 37: Europe Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 38: Europe Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 39: Europe Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 40: Europe Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 41: Europe Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 42: Europe Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 43: Europe Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 44: Europe Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 45: Europe Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028

Figure 46: Asia Pacific Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 47: Asia Pacific Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 48: Asia Pacific Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 49: Asia Pacific Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 50: Asia Pacific Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 51: Asia Pacific Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 52: Asia Pacific Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 53: Asia Pacific Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 54: Asia Pacific Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 55: Asia Pacific Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028

Figure 56: MEA Glass Syringes Market Value Share Analysis, by Syringe Type, 2021

Figure 57: MEA Glass Syringes Market Attractiveness Analysis, by Syringe Type, 2020-2028

Figure 58: MEA Glass Syringes Market Value Share Analysis, by Material Type, 2021

Figure 59: MEA Glass Syringes Market Attractiveness Analysis, by Material Type, 2020-2028

Figure 60: MEA Glass Syringes Market Value Share Analysis, by Capacity, 2021

Figure 61: MEA Glass Syringes Market Attractiveness Analysis, by Capacity, 2020-2028

Figure 62: MEA Glass Syringes Market Value Share Analysis, by End Use, 2021

Figure 63: MEA Glass Syringes Market Attractiveness Analysis, by End Use, 2020-2028

Figure 64: MEA Glass Syringes Market Value Share Analysis, by Region, 2021

Figure 65: MEA Glass Syringes Market Attractiveness Analysis, by Region, 2020-2028