Analyst Viewpoint

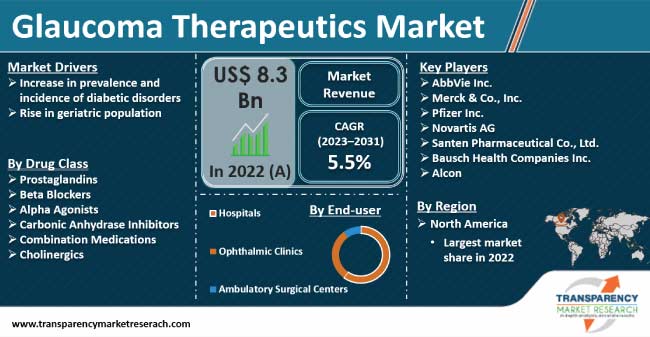

Increase in prevalence and incidence of diabetic disorders and rise in geriatric population are driving the glaucoma therapeutics market size. Serval ophthalmic drugs have pharmacological activities against glaucoma. Some newer class of medications help boost the outflow of aqueous humor and reduce intraocular pressure for the treatment of glaucoma.

Vendors in the global glaucoma therapeutics industry are conducting well-designed and rigorous clinical trials to demonstrate the safety and efficacy of these drugs. They are also launching robust fixed-combination drug therapies to expand their product portfolio. These therapies offer ophthalmologists an attractive option for certain glaucoma patients.

Glaucoma is a disease that damages the optic nerve. Progression of the disease can lead to vision loss and blindness. Topical eye drops that belong to the class of prostaglandins, beta blockers, alpha agonists, combination medication, carbonic anhydrase inhibitors, and cholinergics are recommended for the treatment of glaucoma. These eye drops help reduce the production of fluids inside the eyes, which helps mitigate intraocular pressure.

Prostaglandins analogs are the molecules that bind to the prostaglandin receptor increasing the outflow of the fluid from the eyes and reducing intraocular pressure. Beta-blockers are also commonly utilized topical drugs that act by reducing the production of fluid inside the eyes. Combination medications are eye drops used in patients who require more than one medication.

Cholinergic agents contract the ciliary muscles, tighten the trabecular meshwork, and increase the outflow of fluid. Carbonic anhydrase inhibitors and alpha agonists are employed to boost the outflow of fluid from the eyes, thereby reducing intraocular pressure. Prostaglandins, beta-blockers, and combination medication are the most widely used topical agents.

Glaucoma represents the leading cause of irreversible blindness worldwide. People with diabetes are likely to suffer from glaucoma. Diabetic retinopathy, which is a complication of diabetes and the most common form of diabetic eye disease, can increase the risk of glaucoma. Diabetes affects more than 29 million people in the U.S. Retinopathy damages the tiny blood vessels in the retina. It affects nearly 7.7 million people in the U.S. aged 40 years and older. According to the Centers for Disease Control’s National Diabetes Statistics Report for 2022, the number of diabetes cases reached 37.3 million in the U.S.

New glaucoma medications are effective in lowering intraocular pressure as they increase the outflow of aqueous humor. Netarsudil is a newer class of medication that works by increasing the outflow of aqueous humor and reducing intraocular pressure. In March 2023, Alembic Pharmaceuticals received final approval from the U.S. Food and Drug Administration for its abbreviated new drug application for Brimonidine Tartrate Ophthalmic Solution, 0.15%. The drug is indicated for the reduction of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension.

According to the latest glaucoma therapeutics market analysis, the hospitals end-user segment held largest share in 2022. A large population prefers visiting hospitals first rather than specialty clinics for treatment as the cost of therapy at hospitals is lower. Hospitals offer advanced diagnostic tools and techniques for monitoring intraocular pressure and other parameters relevant to glaucoma. This helps in the effective and targeted treatment of the disease.

According to the latest glaucoma therapeutics market insights, North America accounted for largest share in 2022, followed by Europe. Increase in geriatric population and rise in awareness regarding glaucoma are fueling the market dynamics of the region. According to The Glaucoma Research Foundation, three million people in the U.S. have glaucoma. Older adults are six times more likely to develop glaucoma after age 60. Availability of reimbursements and presence of well-established healthcare infrastructure are also boosting the demand for glaucoma therapeutics in North America.

The market in Asia Pacific is expected to advance at a high CAGR during the forecast period. Surge in prevalence of glaucoma is driving the glaucoma therapeutics market statistics in the region. According to the study ‘The Prevalence of Glaucoma and Its Related Factors in Rural Residents: A Cross-Sectional Study in Jiangxi, China’, the prevalence rate of glaucoma was 1.4% among the 5385 participants.

Major players are investing significantly in R&D activities to expand their product portfolio and increase their glaucoma therapeutics market share. AbbVie Inc., Merck & Co., Inc., Pfizer Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Bausch Health Companies Inc., and Alcon are major glaucoma therapeutics companies.

Each of these players has been profiled in the glaucoma therapeutics market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 8.3 Bn |

| Market Forecast Value in 2031 | US$ 13.5 Bn |

| Growth Rate (CAGR) | 5.5% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 8.3 Bn in 2022

It is projected to grow at a CAGR of 5.5% from 2023 to 2031

Increase in prevalence and incidence of diabetic disorders and rise in geriatric population

The hospitals end-user segment held the largest share in 2022

North America held largest share in 2022

AbbVie Inc., Merck & Co., Inc., Pfizer Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Bausch Health Companies Inc., and Alcon

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Glaucoma Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Glaucoma Therapeutics Market Analysis and Forecast, 2023–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Glaucoma Therapeutics Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2023–2031

6.3.1. Prostaglandins

6.3.2. Beta Blockers

6.3.3. Alpha Agonists

6.3.4. Combination Medications

6.3.5. Cholinergics

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Glaucoma Therapeutics Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2023–2031

7.3.1. Hospitals

7.3.2. Ophthalmic Clinics

7.3.3. Ambulatory Surgical Centers

7.4. Market Attractiveness Analysis, by End-user

8. Global Glaucoma Therapeutics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Glaucoma Therapeutics Market Analysis and Forecast

9.1. Introduction

9.2. Key Findings

9.3. Market Value Forecast, by Drug Class, 2023–2031

9.3.1. Prostaglandins

9.3.2. Beta Blockers

9.3.3. Alpha Agonists

9.3.4. Combination Medications

9.3.5. Cholinergics

9.4. Market Value Forecast, by End-user, 2023–2031

9.4.1. Hospitals

9.4.2. Ophthalmic Clinics

9.4.3. Ambulatory Surgical Centers

9.5. Market Value Forecast, by Country, 2023–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Drug Class

9.6.2. By End-user

9.6.3. By Country

10. Europe Glaucoma Therapeutics Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Drug Class, 2023–2031

10.3.1. Prostaglandins

10.3.2. Beta Blockers

10.3.3. Alpha Agonists

10.3.4. Combination Medications

10.3.5. Cholinergics

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Hospitals

10.4.2. Ophthalmic Clinics

10.4.3. Ambulatory Surgical Centers

10.5. Market Value Forecast, by Country/Sub-region, 2023–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Asia Pacific Glaucoma Therapeutics Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Drug Class, 2023–2031

11.3.1. Prostaglandins

11.3.2. Beta Blockers

11.3.3. Alpha Agonists

11.3.4. Combination Medications

11.3.5. Cholinergics

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Hospitals

11.4.2. Ophthalmic Clinics

11.4.3. Ambulatory Surgical Centers

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. Latin America Glaucoma Therapeutics Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Drug Class, 2023–2031

12.3.1. Prostaglandins

12.3.2. Beta Blockers

12.3.3. Alpha Agonists

12.3.4. Combination Medications

12.3.5. Cholinergics

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Hospitals

12.4.2. Ophthalmic Clinics

12.4.3. Ambulatory Surgical Centers

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Middle East & Africa Glaucoma Therapeutics Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Drug Class, 2023–2031

13.3.1. Prostaglandins

13.3.2. Beta Blockers

13.3.3. Alpha Agonists

13.3.4. Combination Medications

13.3.5. Cholinergics

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Hospitals

13.4.2. Ophthalmic Clinics

13.4.3. Ambulatory Surgical Centers

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By End-user

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. AbbVie Inc.

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. Merck & Co., Inc.

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. Pfizer Inc.

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. Novartis AG

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Santen Pharmaceutical Co., Ltd.

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Bausch Health Companies Inc.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Overview

14.3.6.5. Strategic Overview

14.3.7. Alcon

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Overview

14.3.7.5. Strategic Overview

List of Tables

Table 01: Global Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 02: Global Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 03: Global Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Region, 2023–2031

Table 04: North America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Country, 2023–2031

Table 05: North America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 06: North America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 07: Europe Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 08: Europe Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 9: Europe Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 10: Asia Pacific Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 11: Asia Pacific Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 12: Asia Pacific Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Latin America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Latin America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 15: Latin America Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Middle East & Africa Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Middle East & Africa Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2023–2031

Table 18: Middle East & Africa Glaucoma Therapeutics Market Size (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Glaucoma Therapeutics Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Glaucoma Therapeutics Market Revenue (US$ Mn), by Drug Class, 2022

Figure 03: Global Glaucoma Therapeutics Market Value Share, by Drug Class, 2022

Figure 04: Global Glaucoma Therapeutics Market Revenue (US$ Mn), by End-user, 2022

Figure 05: Global Glaucoma Therapeutics Market Value Share, by End-user, 2022

Figure 06: Global Glaucoma Therapeutics Market Value Share, by Region, 2022

Figure 07: Global Glaucoma Therapeutics Market Value (US$ Mn) Forecast, 2023–2031

Figure 8: Global Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 9: Global Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 10: Global Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 11: Global Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Glaucoma Therapeutics Market Value Share Analysis, by Region, 2023 and 2031

Figure 13: Global Glaucoma Therapeutics Market Attractiveness Analysis, by Region, 2023-2031

Figure 14: North America Glaucoma Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 15: North America Glaucoma Therapeutics Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Glaucoma Therapeutics Market Value Share Analysis, by Country, 2023 and 2031

Figure 17: North America Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 18: North America Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 19: North America Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 20: North America Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 21: Europe Glaucoma Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 22: Europe Glaucoma Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 23: Europe Glaucoma Therapeutics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 24: Europe Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 25: Europe Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 26: Europe Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 27: Europe Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 28: Asia Pacific Glaucoma Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 29: Asia Pacific Glaucoma Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Asia Pacific Glaucoma Therapeutics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 31: Asia Pacific Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 32: Asia Pacific Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 33: Asia Pacific Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 34: Asia Pacific Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 35: Latin America Glaucoma Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 36: Latin America Glaucoma Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Glaucoma Therapeutics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 38: Latin America Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 39: Latin America Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 40: Latin America Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 41: Latin America Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 42: Middle East & Africa Glaucoma Therapeutics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 43: Middle East & Africa Glaucoma Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Middle East & Africa Glaucoma Therapeutics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 45: Middle East & Africa Glaucoma Therapeutics Market Value Share Analysis, by Drug Class, 2023 and 2031

Figure 46: Middle East & Africa Glaucoma Therapeutics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 47: Middle East & Africa Glaucoma Therapeutics Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 48: Middle East & Africa Glaucoma Therapeutics Market Attractiveness Analysis, by End-user, 2023–2031