Geospatial Imagery Analytics Market: Snapshot

Geospatial imagery analytics is a comprehensive solution system that provides imagery, both video and image data, of the earth. The data helps companies in different sectors in taking preventive and precautionary measures. With the use of global positioning systems (GPS) and geographical information systems, geospatial imagery analytics providers collect and gather data and then provide these data to end-users. Providers of geospatial imagery analytics are investing in building their own satellites to gather the most effective earth data for end-users. The geospatial imagery analytics market is expected to expand at a CAGR of 7.0% during the forecast period of 2018-2026. In terms of revenue, the market is expected to reach US$ 8.9 Bn in 2026. The major reason for the expansion of the market is development of geographic information system (GIS) technology and convergence of geospatial information with mainstream technologies. Moreover, the rise in requirement for geospatial data from the mining and manufacturing and engineering and construction industries is also making the overall market lucrative.

The geospatial imagery analytics market is experiencing some vital trends. These trends include continuous demand for high resolution satellite images from end-user across all the major regions, as well as increased usage of location based services. Based on analytics type, the geospatial imagery analytics market can be divided into video-based and image-based. Globally, both the video-based and image-based analytics segments are expanding at a rapid pace. The use of video-based and image-based analytics is increasing across various industry verticals including defense and security and construction and manufacturing. In terms of technology, the market can be divided into geographical information systems (GIS), remote sensing, unmanned aerial vehicles (UAVS), and others. The geospatial information system (GIS) is expected to be a lucrative segment during the forecast period. Geospatial information systems (GIS) have the capability to collect and store geospatial data effectively, thereby becoming popular among defense & security, environment monitoring, and mining and manufacturing companies. Based on end-user, the market can be categorized into defense & security, government, environment monitoring, energy, utility & natural resource, engineering & construction, mining & manufacturing, insurance, agriculture, healthcare & life sciences, and others. The others segment of the market includes retail, transportation & logistics sector, etc. The defense & security and the energy, utility, & natural resources segments are prominent revenue contributors to the overall market. However, the use of geospatial imagery analytics in retail and agriculture insurance is also expected to increase in the near future. In agriculture specifically, the use of unmanned aerial vehicles for crop health monitoring and weather monitoring is widespread among farmers and farm owners.

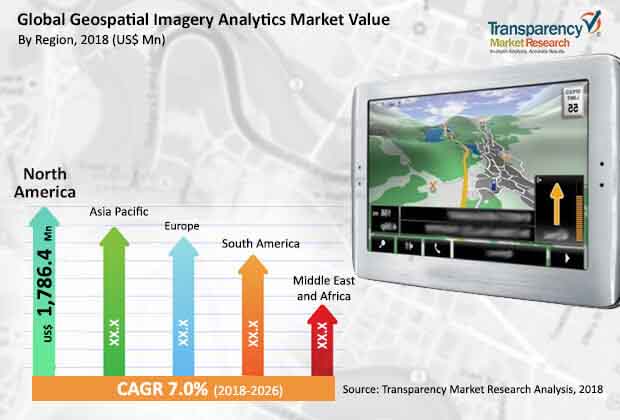

In terms of region, the geospatial imagery analytics market can be segmented into North America, Europe, South America, Middle East & Africa, and Asia Pacific. Asia Pacific, North America, and Europe are the major revenue contributors to the overall market. However, South America and Middle East & Africa are regions with high potential of the geospatial imagery analytics market.

The major strategies adopted by players operating in the market include focus on mergers and acquisitions, enhancing product portfolio, and effectively delivering the required services to end-users. The market is largely dominated by big players such as ESRI, DigitalGlobe Inc., Hexagon AB, and MDA Corporation that have been investing in research and development for a long time and have also been entering into effective mergers and acquisition for stronger penetration in the market.

The global geospatial imagery analytics market comprises a large number of multinational companies that offer a range of comprehensive services and solutions to end-users. These companies include Digital Globe, ESRI, MDA Corporation, Fugro N.V., Harris Corporation, Hexagon AB, General Electric, Planet Labs , RMSI Private Limited, Satellite Imaging Corporation, Satellite Imaging Corporation, TomTom, Trimble Navigation, Ltd. and WS Atkins Plc.

Critical Applications in Economics, Agricultural Sciences fuels Geospatial Imagery Analytics Market

Using the features of global positioning systems (GPS) and geographical information systems underpinned by robust technology, geospatial imagery analytics is an all-inclusive solution system that provides both video and image data of the Earth. The providers of geospatial imagery analytics collect and gather this data and provides it to end users. This data helps end users to take preventive and precautionary measures that could have an adverse effect on life and property.

The geospatial imagery analytics market is expanding at a rapid pace. The development of geographic information systems (GIS) and integration of geospatial information with mainstream technologies is leading to notable growth in geospatial imagery analytics market. This accounts for continued uptick in demand from the mining, construction, and manufacturing and engineering sectors. Besides this, the rising demand for high resolution satellite images from a number of end users, along with the demand for location based services is creating newer opportunities in the geospatial imagery analytics market.

Key segments of the geospatial imagery analytics market based on analytics type are video-based and image-based, both of which witness significant demand from various end users. Based on technology, unmanned aerial vehicles (UAVs), geographical information systems (GIS), remote sensing, and others are key segments of the geospatial imagery analytics market. Of them, GIS is expected to witness notable growth owing to its capability to collect and store geospatial data effectively. This accounts for the vast use of geospatial information systems in defense & security, mining, manufacturing, and environment monitoring sectors.

The geospatial imagery analytics market features an intensely competitive vendor landscape with the presence of a large number of key players. Improvement of product portfolio, effective delivery of required data, and M&As are some organic and inorganic growth strategies adopted by large players. Large investments in R&D undertaken by a handful of large companies is another ky growth strategy in the geospatial imagery analytics market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Geospatial Imagery Analytics Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Geospatial Imagery Analytics Market Analysis and Forecast, 2016–2026

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Forces Analysis - Global Geospatial Imagery Analytics Market

4.6. Ecosystem Analysis - Global Geospatial Imagery Analytics Market

4.7. Market Outlook

5. Global Geospatial Imagery Analytics Market Analysis and Forecast, By Technology

5.1. Overview and Definitions

5.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

5.2.1. Global Positioning Systems (GPS)

5.2.2. Geographical Information Systems (GIS)

5.2.3. Remote Sensing

5.2.4. Unmanned Aerial Vehicles (UAVS)

5.2.5. Others

5.3. Market Attractiveness, by Technology

6. Global Geospatial Imagery Analytics Market Analysis and Forecast, By Analytics Type

6.1. Overview and Definitions

6.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

6.2.1. Video-based

6.2.2. Image-based

6.3. Market Attractiveness, by Analytics Type

7. Global Geospatial Imagery Analytics Market Analysis and Forecast, By Deployment

7.1. Overview and Definitions

7.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

7.2.1. On-premise

7.2.2. Cloud

7.3. Market Attractiveness, by Deployment

8. Global Geospatial Imagery Analytics Market Analysis and Forecast, By Application

8.1. Overview and Definitions

8.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

8.2.1. Defense & Security

8.2.2. Government

8.2.3. Environment Monitoring

8.2.4. Energy, Utility & Natural Resources

8.2.5. Engineering & Construction

8.2.6. Mining & Manufacturing

8.2.7. Insurance

8.2.8. Agriculture

8.2.9. Healthcare & Life Sciences

8.2.10. Others

8.3. Market Attractiveness, by Application

9. Global Geospatial Imagery Analytics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Region, 2016–2026

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East and Africa

9.2.5. South America

9.3. Market Attractiveness, by Region

10. North America Geospatial Imagery Analytics Market Analysis and Forecast

10.1. Overview

10.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

10.2.1. Global Positioning Systems (GPS)

10.2.2. Geographical Information Systems (GIS)

10.2.3. Remote Sensing

10.2.4. Unmanned Aerial Vehicles (UAVS)

10.2.5. Others

10.3. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

10.3.1. Video-based

10.3.2. Image-based

10.4. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

10.4.1. On-premise

10.4.2. Cloud

10.5. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

10.5.1. Defense & Security

10.5.2. Government

10.5.3. Environment Monitoring

10.5.4. Energy, Utility & Natural Resources

10.5.5. Engineering & Construction

10.5.6. Mining & Manufacturing

10.5.7. Insurance

10.5.8. Agriculture

10.5.9. Healthcare & Life Sciences

10.5.10. Others

10.6. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Country, 2016–2026

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Technology

10.7.2. By Analytics Type

10.7.3. By Deployment

10.7.4. By Application

10.7.5. By Country

11. Europe Geospatial Imagery Analytics Market Analysis and Forecast

11.1. Overview

11.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

11.2.1. Global Positioning Systems (GPS)

11.2.2. Geographical Information Systems (GIS)

11.2.3. Remote Sensing

11.2.4. Unmanned Aerial Vehicles (UAVS)

11.2.5. Others

11.3. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

11.3.1. Video-based

11.3.2. Image-based

11.4. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

11.4.1. On-premise

11.4.2. Cloud

11.5. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

11.5.1. Defense & Security

11.5.2. Government

11.5.3. Environment Monitoring

11.5.4. Energy, Utility & Natural Resources

11.5.5. Engineering & Construction

11.5.6. Mining & Manufacturing

11.5.7. Insurance

11.5.8. Agriculture

11.5.9. Healthcare & Life Sciences

11.5.10. Others

11.6. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Country, 2016–2026

11.6.1. Germany

11.6.2. France

11.6.3. U.K.

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Analytics Type

11.7.3. By Deployment

11.7.4. By Application

11.7.5. By Country

12. Asia Pacific Geospatial Imagery Analytics Market Analysis and Forecast

12.1. Overview

12.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

12.2.1. Global Positioning Systems (GPS)

12.2.2. Geographical Information Systems (GIS)

12.2.3. Remote Sensing

12.2.4. Unmanned Aerial Vehicles (UAVS)

12.2.5. Others

12.3. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

12.3.1. Video-based

12.3.2. Image-based

12.4. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

12.4.1. On-premise

12.4.2. Cloud

12.5. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

12.5.1. Defense & Security

12.5.2. Government

12.5.3. Environment Monitoring

12.5.4. Energy, Utility & Natural Resources

12.5.5. Engineering & Construction

12.5.6. Mining & Manufacturing

12.5.7. Insurance

12.5.8. Agriculture

12.5.9. Healthcare & Life Sciences

12.5.10. Others

12.6. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Country, 2016–2026

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Analytics Type

12.7.3. By Deployment

12.7.4. By Application

12.7.5. By Country

13. Middle East and Africa (MEA) Geospatial Imagery Analytics Market Analysis and Forecast

13.1. Overview

13.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

13.2.1. Global Positioning Systems (GPS)

13.2.2. Geographical Information Systems (GIS)

13.2.3. Remote Sensing

13.2.4. Unmanned Aerial Vehicles (UAVS)

13.2.5. Others

13.3. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

13.3.1. Video-based

13.3.2. Image-based

13.4. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

13.4.1. On-premise

13.4.2. Cloud

13.5. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

13.5.1. Defense & Security

13.5.2. Government

13.5.3. Environment Monitoring

13.5.4. Energy, Utility & Natural Resources

13.5.5. Engineering & Construction

13.5.6. Mining & Manufacturing

13.5.7. Insurance

13.5.8. Agriculture

13.5.9. Healthcare & Life Sciences

13.5.10. Others

13.6. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Country, 2016–2026

13.6.1. GCC Countries

13.6.2. South Africa

13.6.3. Rest of MEA

13.7. Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Analytics Type

13.7.3. By Deployment

13.7.4. By Application

13.7.5. By Country

14. South America Geospatial Imagery Analytics Market Analysis and Forecast

14.1. Overview

14.2. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Technology, 2016–2026

14.2.1. Global Positioning Systems (GPS)

14.2.2. Geographical Information Systems (GIS)

14.2.3. Remote Sensing

14.2.4. Unmanned Aerial Vehicles (UAVS)

14.2.5. Others

14.3. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Analytics Type, 2016–2026

14.3.1. Video-based

14.3.2. Image-based

14.4. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Deployment, 2016–2026

14.4.1. On-premise

14.4.2. Cloud

14.5. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Application, 2016–2026

14.5.1. Defense & Security

14.5.2. Government

14.5.3. Environment Monitoring

14.5.4. Energy, Utility & Natural Resources

14.5.5. Engineering & Construction

14.5.6. Mining & Manufacturing

14.5.7. Insurance

14.5.8. Agriculture

14.5.9. Healthcare & Life Sciences

14.5.10. Others

14.6. Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, by Country, 2016–2026

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Technology

14.7.2. By Analytics Type

14.7.3. By Deployment

14.7.4. By Application

14.7.5. By Country

15. Competition Landscape

15.1. Market Share Analysis, by Company (2017)

15.2. Company Profiles (Details – Overview, Financials, Recent Developments and Strategy)

15.2.1. Digital Globe

15.2.1.1. Company Details

15.2.1.2. Company Description

15.2.1.3. SWOT

15.2.1.4. Strategy

15.2.2. ESRI, MDA Corporation

15.2.2.1. Company Details

15.2.2.2. Company Description

15.2.2.3. SWOT

15.2.2.4. Strategy

15.2.3. Fugro N.V.

15.2.3.1. Company Details

15.2.3.2. Company Description

15.2.3.3. SWOT

15.2.3.4. Strategy

15.2.4. Harris Corporation

15.2.4.1. Company Details

15.2.4.2. Company Description

15.2.4.3. SWOT

15.2.4.4. Strategy

15.2.5. Hexagon AB

15.2.5.1. Company Details

15.2.5.2. Company Description

15.2.5.3. SWOT

15.2.5.4. Strategy

15.2.6. General Electric

15.2.6.1. Company Details

15.2.6.2. Company Description

15.2.6.3. SWOT

15.2.6.4. Strategy

15.2.7. Planet Labs

15.2.7.1. Company Details

15.2.7.2. Company Description

15.2.7.3. SWOT

15.2.7.4. Strategy

15.2.8. RMSI Private Limited

15.2.8.1. Company Details

15.2.8.2. Company Description

15.2.8.3. SWOT

15.2.8.4. Strategy

15.2.9. Satellite Imaging Corporation

15.2.9.1. Company Details

15.2.9.2. Company Description

15.2.9.3. SWOT

15.2.9.4. Strategy

15.2.10. TomTom

15.2.10.1. Company Details

15.2.10.2. Company Description

15.2.10.3. SWOT

15.2.10.4.Strategy

15.2.11. Trimble Navigation, Ltd.

15.2.11.1.Company Details

15.2.11.2. Company Description

15.2.11.3. SWOT

15.2.11.4. Strategy

15.2.12. WS Atkins Plc.

15.2.12.1.Company Details

15.2.12.2. Company Description

15.2.12.3. SWOT

15.2.12.4. Strategy

16. Key Takeaways

List of Table

Table 1: Global Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 2: Global Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 3: Global Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 4: Global Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 5: Global Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Region, 2016–2026

Table 6: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 7: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 8: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 9: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 10: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 11: Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 12: Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 13: Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 14: Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 15: Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 16: Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 17: Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 18: Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 19: Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 20: Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 21: MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 22: MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 23: MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 24: MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 25: MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 26 : South America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Analytics Type, 2016–2026

Table 27: South America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Technology, 2016–2026

Table 28: South America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 29: South America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by End-use, 2016–2026

Table 30: South America Geospatial Imagery Analytics Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

List of Figures

Figure 1: The Global Geospatial Imagery Analytics Market Overview

Figure 2: Geospatial Imagery Analytics Market Size (US$ Mn) Forecast, 2016 – 2026

Figure 3: Global Geospatial Imagery Analytics Market Y-o-Y Growth (Value %) Forecast, 2017 – 2026

Figure 4: Global Geospatial Imagery Analytics Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 5: Porters Five Forces Analysis

Figure 6: Ecosystem analysis

Figure 7: Market Outlook, by Analytics Type

Figure 8: Market Outlook, by Deployment Type

Figure 8: Market Outlook, by Technology

Figure 8: Market Outlook, By technology

Figure 9: Global Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 10: Global Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 11: Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 12: Global Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 13: Global Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 14 : Global Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 15 : Global Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 16 : Global Geospatial Imagery Analytics Market Share Analysis, by Deployment (2026)

Figure 17 : Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 18 : Global Geospatial Imagery Analytics Market Share Analysis, by End–use (2018)

Figure 19 : Global Geospatial Imagery Analytics Market Share Analysis, by End-use (2026)

Figure 20 : Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 21 : Global Geospatial Imagery Analytics Market Share Analysis, by Region (2018)

Figure 22 : Global Geospatial Imagery Analytics Market Share Analysis, by Region (2026)

Figure 23 : Global Geospatial Imagery Analytics Market Attractiveness Analysis, by Region, 2018

Figure 24: North America Geospatial Imagery Analytics Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 25: North America Geospatial Imagery Analytics Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 26: North America Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 27 : North America Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 28: North America Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 29 : North America Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 30: North America Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 31 : North America Geospatial Imagery Analytics Market Share Analysis, by Deployment (2026)

Figure 32 : North America Geospatial Imagery Analytics Market Share Analysis, by End–use (2018)

Figure 33 : North America Geospatial Imagery Analytics Market Share Analysis, by End-use (2026)

Figure 34: North America Geospatial Imagery Analytics Market Share Analysis, by Country (2018)

Figure 35: North America Geospatial Imagery Analytics Market Share Analysis, by Country (2026)

Figure 36 : North America Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 37 : North America Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 38: North America Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 39 : North America Geospatial Imagery Analytics Market Attractiveness Analysis, by Country, 2018

Figure 40 : Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 41 : Europe Geospatial Imagery Analytics Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 42 : Europe Geospatial Imagery Analytics Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 43 : Europe Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 44 : Europe Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 45 : Europe Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 46: Europe Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 47: Europe Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 48 : Europe Geospatial Imagery Analytics Market Share Analysis, by Deployment (2026)

Figure 49: Europe Geospatial Imagery Analytics Market Share Analysis, by End – use (2018)

Figure 50 : Europe Geospatial Imagery Analytics Market Share Analysis, by End - use (2026)

Figure 51 : Europe Geospatial Imagery Analytics Market Share Analysis, by Country (2018)

Figure 52 : Europe Geospatial Imagery Analytics Market Share Analysis, by Country (2026)

Figure 53 : Europe Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 54 : Europe Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 55 : Europe Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 56 : Europe Geospatial Imagery Analytics Market Attractiveness Analysis, by Country, 2018

Figure 57: Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 58 : Asia Pacific Geospatial Imagery Analytics Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 59 : Asia Pacific Geospatial Imagery Analytics Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 60 : Asia Pacific Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 61 : Asia Pacific Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 62 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 63 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 64 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 65 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, By Deployment (2026)

Figure 66 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by End-use (2018)

Figure 67 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by End-use (2026)

Figure 68 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by Country (2018)

Figure 69 : Asia Pacific Geospatial Imagery Analytics Market Share Analysis, by Country (2026)

Figure 70 : Asia Pacific Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 71 : Asia Pacific Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 72 : Asia Pacific Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 73 : Asia Pacific Geospatial Imagery Analytics Market Attractiveness Analysis, by Country, 2018

Figure 74: Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 75 : MEA Geospatial Imagery Analytics Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2026

Figure 76 : MEA Geospatial Imagery Analytics Opportunity Growth Analysis (US$ Mn) Forecast, 2017 – 2026

Figure77 : MEA Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 78 : MEA Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 79 : MEA Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 80 : MEA Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 81 : MEA Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 82 : MEA Geospatial Imagery Analytics Market Share Analysis, by Deployment (2026)

Figure 83: MEA Geospatial Imagery Analytics Market Share Analysis, by End–use (2018)

Figure 84 : MEA Geospatial Imagery Analytics Market Share Analysis, by End-use (2026)

Figure 85 : MEA Geospatial Imagery Analytics Market Share Analysis, by Country (2018)

Figure 86 : MEA Geospatial Imagery Analytics Market Share Analysis, by Country (2026)

Figure 87 : MEA Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 88 : MEA Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 89 : MEA Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 90 : MEA Geospatial Imagery Analytics Market Attractiveness Analysis, by Country, 2018

Figure 91 : Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 92 : South America Geospatial Imagery Analytics Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 93 : South America Geospatial Imagery Analytics Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 94 : South America Geospatial Imagery Analytics Market Value Share, by Analytics Type (2018)

Figure 95 : South America Geospatial Imagery Analytics Market Value Share, by Analytics Type (2026)

Figure 96 : South America Geospatial Imagery Analytics Market Share Analysis, by Technology (2018)

Figure 97 : South America Geospatial Imagery Analytics Market Share Analysis, by Technology (2026)

Figure 98 : South America Geospatial Imagery Analytics Market Share Analysis, by Deployment (2018)

Figure 99 : South America Geospatial Imagery Analytics Market Share Analysis, by Deployment (2026)

Figure 100 : South America Geospatial Imagery Analytics Market Share Analysis, by End–use (2018)

Figure 101 : South America Geospatial Imagery Analytics Market Share Analysis, by End-use (2026)

Figure 102 : South America Geospatial Imagery Analytics Market Share Analysis, by Country (2018)

Figure 103 : South America Geospatial Imagery Analytics Market Share Analysis, by Country (2026)

Figure 104 : South America Geospatial Imagery Analytics Market Attractiveness Analysis, by Analytics Type, 2018

Figure 105 : South America Geospatial Imagery Analytics Market Attractiveness Analysis, by Technology, 2018

Figure 106 : South America Geospatial Imagery Analytics Market Attractiveness Analysis, by Deployment, 2018

Figure 107 : South America Geospatial Imagery Analytics Market Attractiveness Analysis, by Country, 2018

Figure 108 : Geospatial Imagery Analytics Market Attractiveness Analysis, by End-use, 2018

Figure 109 : Market Share Analysis, 2017 (Value %)