Analysts’ Viewpoint

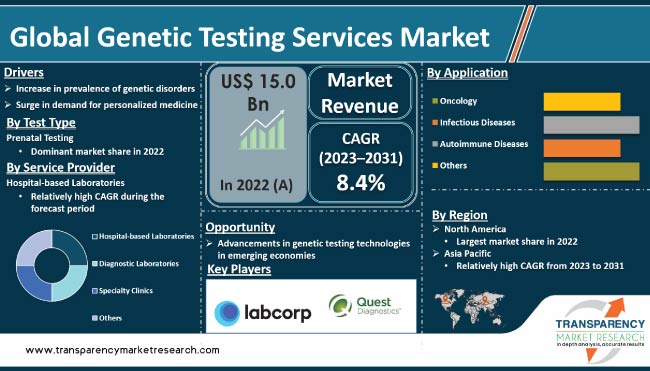

Increase in prevalence of genetic disorders and rise in awareness about personalized medicine is driving the genetic testing services market size. Advancements in technology, such as next-generation sequencing and gene editing techniques, have improved the accuracy, efficiency, and affordability of genetic testing, further fueling market expansion.

Increase in adoption of direct-to-consumer gene testing kits has made genetic testing more accessible to individuals. These kits allow consumers to obtain genetic information from the comfort of their homes, enabling personalized health management and ancestry exploration, thereby boosting the genetic testing services industry.

Market players are adopting partnership and collaboration strategies to increase revenue. They are also focusing of product portfolio expansion to broaden customer base.

Genetic testing services refer to the analysis of an individual's genetic material, such as DNA testing, to identify genetic disorders, predict disease risks, and guide personalized treatment plans. These services have gained significant importance in the field of healthcare due to their potential to provide valuable insights into an individual's genetic makeup and help making informed medical decisions.

DNA analysis services encompass a wide range of applications, including carrier testing, prenatal testing, diagnostic testing, predictive testing, and pharmacogenomic testing. Carrier testing helps identify individuals who carry a gene for a specific genetic disorder and may pass it on to their offspring.

Prenatal testing involves examining fetal DNA to detect genetic abnormalities or conditions before birth. Diagnostic testing is used to confirm or rule out a suspected genetic disorder based on symptoms or family history.

Increase in prevalence of genetic disorders across the globe is fueling the global genetic testing services market. Genetic testing plays a crucial role in diagnosing and managing these disorders, enabling early intervention and personalized treatment plans.

Genetic testing helps healthcare providers make informed decisions about patient care, leading to improved outcomes, by identifying specific genetic variations and mutations. Continuous rise in incidence of genetic diseases is expected to lead to the genetic testing services market growth, resulting in innovation in the field.

Rise in demand for personalized medicine offers lucrative genetic testing services market opportunities to market players. Personalized medicine aims to customize healthcare based on an individual's unique genetic information. Genetic testing plays a critical role in this approach by providing insights into an individual's genetic makeup, disease risks, and treatment responses.

Healthcare providers can make more informed decisions about disease prevention, diagnosis, and treatment, by utilizing genetic testing results, leading to improved patient outcomes. Surge in adoption of personalized medicine practices is driving the genetic testing services market demand and shaping the future of healthcare.

Technological advancements in genetic testing includes next-generation gene sequencing services, microarray analysis, and PCR. These advancements have significantly improved the accuracy, speed, and affordability of genetic testing. They have made genetic testing more accessible to healthcare providers and patients, driving market progress.

The enhanced capabilities of these technologies have facilitated high adoption of genetic testing services and expanded their applications in various healthcare settings, contributing to the genetic testing services market development.

According to the latest genetic testing services market trends, the prenatal testing product segment is estimated to dominate the industry during the forecast period. Prenatal testing experiences high demand during pregnancy due to several factors.

Expectant parents seek prenatal testing to assess the health and development of the fetus, identify potential genetic disorders or chromosomal abnormalities, and make informed decisions about the pregnancy. This is expected to influence the genetic testing services market statistics.

According to the latest genetic testing services market forecast, North America is expected to hold the largest market share during 2022-2031. This can be ascribed to factors such as advanced healthcare infrastructure, increased adoption of genetic testing, favorable reimbursement policies, and high prevalence of genetic disorders in the region.

North America's strong market presence reflects its significant contribution in the growth and development of genetic testing services.

Asia Pacific is expected to register a substantial genetic testing services market CAGR during the forecast period. Large population base, increase in disposable income, rise in awareness about genetic disorders, and improvements in healthcare infrastructure contribute to the regional market expansion. Rise in healthcare expenditure and focus on personalized medicine in countries such as China, India, and Japan are also augmenting market statistics.

Advancements in technology and availability of cost-effective genetic testing solutions are propelling market demand in the region. Collaborations between international and local players are also fostering market development. Overall, these factors are likely to provide significant growth opportunities to the industry players during the forecast period.

Small number of dominant players hold substantial market share, indicating a consolidated industry. These companies prioritize research and development by making significant investments in this area.

Players in the market focus on expanding their product portfolios and adopting mergers and acquisitions strategies. This allows them to enhance their offerings and gain a competitive edge.

Companies profiled in the global genetic testing services market include Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Genomic Health, Inc., NeoGenomics Laboratories, Inc., Eurofins Scientific, Ambry Genetics, Illumina, Inc., and 23andMe, Inc.

Key players have been profiled in the genetic testing services market report based on parameters such as product portfolio, recent developments, financial overview, company overview, business strategies, and business segments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 15.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 31.5 Bn |

|

Growth Rate (CAGR) |

8.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 15.0 Bn in 2022

It is projected to reach more than US$ 31.5 Bn by 2031

It is anticipated grow at a CAGR of 8.4% from 2023 to 2031

The prenatal testing segment held the largest share in 2022

North America is expected to be an attractive region

Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Genomic Health, Inc., NeoGenomics Laboratories, Inc., Eurofins Scientific, Ambry Genetics, Illumina, Inc., and 23andMe, Inc. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Genetic Testing Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Genetic Testing Services Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Regulatory Scenario by Region/Globally

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. Technological Advancements

5.4. COVID-19 Impact Analysis

6. Global Genetic Testing Services Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Test Type, 2017 - 2031

6.3.1. Prenatal Testing

6.3.2. New Born Screening

6.3.3. Predictive & Presymptomatic Testing

6.3.4. Pharmacogenomic Testing

6.3.5. Others

6.4. Market Attractiveness Analysis, by Test Type

7. Global Genetic Testing Services Market Analysis and Forecast, by Service Provider

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Provider, 2017-2031

7.3.1. Hospital-based Laboratories

7.3.2. Diagnostic Laboratories

7.3.3. Specialty Clinics

7.3.4. Others

7.4. Market Attractiveness Analysis, by Service Provider

8. Global Genetic Testing Services Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Oncology

8.3.2. Infectious Diseases

8.3.3. Autoimmune Diseases

8.3.4. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Genetic Testing Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Genetic Testing Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Test Type, 2017-2031

10.2.1. Prenatal Testing

10.2.2. New Born Screening

10.2.3. Predictive & Presymptomatic Testing

10.2.4. Pharmacogenomic Testing

10.2.5. Others

10.3. Market Value Forecast, by Service Provider, 2017-2031

10.3.1. Hospital-based Laboratories

10.3.2. Diagnostic Laboratories

10.3.3. Specialty Clinics

10.3.4. Others

10.4. Market Value Forecast, by Application, 2017-2031

10.4.1. Oncology

10.4.2. Infectious Diseases

10.4.3. Autoimmune Diseases

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Test Type

10.6.2. By Service Provider

10.6.3. By Application

10.6.4. By Country

11. Europe Genetic Testing Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Test Type, 2017-2031

11.2.1. Prenatal Testing

11.2.2. New Born Screening

11.2.3. Predictive & Presymptomatic Testing

11.2.4. Pharmacogenomic Testing

11.2.5. Others

11.3. Market Value Forecast, by Service Provider, 2017-2031

11.3.1. Hospital-based Laboratories

11.3.2. Diagnostic Laboratories

11.3.3. Specialty Clinics

11.3.4. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Oncology

11.4.2. Infectious Diseases

11.4.3. Autoimmune Diseases

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Test Type

11.6.2. By Service Provider

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Genetic Testing Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017-2031

12.2.1. Prenatal Testing

12.2.2. New Born Screening

12.2.3. Predictive & Presymptomatic Testing

12.2.4. Pharmacogenomic Testing

12.2.5. Others

12.3. Market Value Forecast, by Service Provider, 2017-2031

12.3.1. Hospital-based Laboratories

12.3.2. Diagnostic Laboratories

12.3.3. Specialty Clinics

12.3.4. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Oncology

12.4.2. Infectious Diseases

12.4.3. Autoimmune Diseases

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Test Type

12.6.2. By Service Provider

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Genetic Testing Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017-2031

13.2.1. Prenatal Testing

13.2.2. New Born Screening

13.2.3. Predictive & Presymptomatic Testing

13.2.4. Pharmacogenomic Testing

13.2.5. Others

13.3. Market Value Forecast, by Service Provider, 2017-2031

13.3.1. Hospital-based Laboratories

13.3.2. Diagnostic Laboratories

13.3.3. Specialty Clinics

13.3.4. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Oncology

13.4.2. Infectious Diseases

13.4.3. Autoimmune Diseases

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Test Type

13.6.2. By Service Provider

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Genetic Testing Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Test Type, 2017-2031

14.2.1. Prenatal Testing

14.2.2. New Born Screening

14.2.3. Predictive & Presymptomatic Testing

14.2.4. Pharmacogenomic Testing

14.2.5. Others

14.3. Market Value Forecast, by Service Provider, 2017-2031

14.3.1. Hospital-based Laboratories

14.3.2. Diagnostic Laboratories

14.3.3. Specialty Clinics

14.3.4. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Oncology

14.4.2. Infectious Diseases

14.4.3. Autoimmune Diseases

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Test Type

14.6.2. By Service Provider

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Laboratory Corporation of America Holdings

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Service Provider Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Quest Diagnostics Incorporated

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Service Provider Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Genomic Health, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Service Provider Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. NeoGenomics Laboratories, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Service Provider Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Eurofins Scientific

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Service Provider Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Ambry Genetics

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Service Provider Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Illumina, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Service Provider Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. 23andMe, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Service Provider Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

List of Tables

Table 01: Global Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 02: Global Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 03: Global Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 04: Global Genetic Testing Services Market Value (US$ Mn) Forecast, by Region, 2017-2032

Table 05: North America Genetic Testing Services Market Value (US$ Mn) Forecast, by Country, 2017-2032

Table 06: North America Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 07: North America Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 08: North America Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 09: Europe Genetic Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 10: Europe Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 11: Europe Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 12: Europe Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 13: Asia Pacific Genetic Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 14: Asia Pacific Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 15: Asia Pacific Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 16: Asia Pacific Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 17: Latin America Genetic Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 18: Latin America Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 19: Latin America Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 20: Latin America Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 21: Middle East & Africa Genetic Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 22: Middle East & Africa Genetic Testing Services Market Value (US$ Mn) Forecast, by Test Type, 2017-2032

Table 23: Middle East & Africa Genetic Testing Services Market Value (US$ Mn) Forecast, by Service Provider, 2017-2032

Table 24: Middle East & Africa Genetic Testing Services Market Value (US$ Mn) Forecast, by Application, 2017-2032

List of Figures

Figure 01: Global Genetic Testing Services Market Value (US$ Mn) Forecast, 2017-2032

Figure 02: Genetic Testing Services Market Value Share, by Test Type, 2022

Figure 03: Genetic Testing Services Market Value Share, by Service Provider, 2022

Figure 04: Genetic Testing Services Market Value Share, by Application, 2022

Figure 05: Global Genetic Testing Services Market Value Share Analysis, by Test Type, 2022 and 2032

Figure 06: Global Genetic Testing Services Market Revenue (US$ Mn), by Prenatal Testing, 2017-2032

Figure 07: Global Genetic Testing Services Market Revenue (US$ Mn), by New Born Screening, 2017-2032

Figure 08: Global Genetic Testing Services Market Revenue (US$ Mn), by Predictive & Presymptomatic Testing, 2017-2032

Figure 09: Global Genetic Testing Services Market Revenue (US$ Mn), by Pharmacogenomic Testing, 2017-2032

Figure 10: Global Genetic Testing Services Market Revenue (US$ Mn), by Others, 2017-2032

Figure 11: Global Genetic Testing Services Market Attractiveness Analysis, by Test Type, 2023-2032

Figure 12: Global Genetic Testing Services Market Revenue (US$ Mn), by Service Provider, 2017-2032

Figure 13: Global Genetic Testing Services Market Attractiveness Analysis, by Service Provider, 2017-2032

Figure 14: Global Genetic Testing Services Market Value Share Analysis, by Application, 2022 and 2032

Figure 15: Global Genetic Testing Services Market Attractiveness Analysis, by Application, 2023-2032

Figure 16: Global Genetic Testing Services Market Value Share Analysis, by Region, 2022 and 2032

Figure 17: Global Genetic Testing Services Market Attractiveness Analysis, by Region, 2023-2032

Figure 18: North America Genetic Testing Services Market Value (US$ Mn) Forecast, 2017-2032

Figure 19: North America Genetic Testing Services Market Value Share Analysis, by Country, 2022 and 2032

Figure 20: North America Genetic Testing Services Market Attractiveness Analysis, by Country, 2023-2032

Figure 21: North America Genetic Testing Services Market Value Share Analysis, by Test Type, 2022 and 2032

Figure 22: North America Genetic Testing Services Market Attractiveness Analysis, by Test Type, 2023-2032

Figure 23: North America Genetic Testing Services Market Value Share Analysis, by Service Provider, 2022 and 2032

Figure 24: North America Genetic Testing Services Market Attractiveness Analysis, by Service Provider, 2023-2032

Figure 25: North America Genetic Testing Services Market Value Share Analysis, by Application, 2022 and 2032

Figure 26: North America Genetic Testing Services Market Attractiveness Analysis, by Application, 2023-2032

Figure 27: Europe Genetic Testing Services Market Value (US$ Mn) Forecast, 2017-2032

Figure 28: Europe Genetic Testing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 29: Europe Genetic Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 30: Europe Genetic Testing Services Market Value Share Analysis, by Test Type, 2022 and 2032

Figure 31: Europe Genetic Testing Services Market Attractiveness Analysis, by Test Type, 2023-2032

Figure 32: Europe Genetic Testing Services Market Value Share Analysis, by Service Provider, 2022 and 2032

Figure 33: Europe Genetic Testing Services Market Attractiveness Analysis, by Service Provider, 2023-2032

Figure 34: Europe Genetic Testing Services Market Value Share Analysis, by Application, 2022 and 2032

Figure 35: Europe Genetic Testing Services Market Attractiveness Analysis, by Application, 2023-2032

Figure 36: Asia Pacific Genetic Testing Services Market Value (US$ Mn) Forecast, 2017-2032

Figure 37: Asia Pacific Genetic Testing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 38: Asia Pacific Genetic Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 39: Asia Pacific Genetic Testing Services Market Value Share Analysis, by Test Type, 2022 and 2032

Figure 40: Asia Pacific Genetic Testing Services Market Attractiveness Analysis, by Test Type, 2023-2032

Figure 41: Asia Pacific Genetic Testing Services Market Value Share Analysis, by Service Provider, 2022 and 2032

Figure 42: Asia Pacific Genetic Testing Services Market Attractiveness Analysis, by Service Provider, 2023-2032

Figure 43: Latin America Genetic Testing Services Market Value Share Analysis, by Indication, 2022 and 2032

Figure 44: Latin America Genetic Testing Services Market Attractiveness Analysis, Indication, 2023-2032

Figure 45: Middle East & Africa Genetic Testing Services Market Value (US$ Mn) Forecast, 2017-2032

Figure 46: Middle East & Africa Genetic Testing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 47: Middle East & Africa Genetic Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 48: Middle East & Africa Genetic Testing Services Market Value Share Analysis, by Test Type, 2022 and 2032

Figure 49: Middle East & Africa Genetic Testing Services Market Attractiveness Analysis, by Test Type, 2023-2032

Figure 50: Middle East & Africa Genetic Testing Services Market Value Share Analysis, by Service Provider, 2022 and 2032

Figure 51: Middle East & Africa Genetic Testing Services Market Attractiveness Analysis, by Service Provider, 2023-2032

Figure 52: Middle East & Africa Genetic Testing Services Market Value Share Analysis, by Application, 2022 and 2032

Figure 53: Middle East & Africa Genetic Testing Services Market Attractiveness Analysis, by Application, 2023-2032