During the peak of the coronavirus outbreak amid the second wave in India, there had been an unprecedented demand for Remdesivir - an antiviral medication for the treatment of patients. Due to shortage in the supply of Remdesivir, companies in the generic injectables market such as Hetero Drugs, an Indian pharmaceutical company and one of world’s largest producer of anti-retroviral drugs, released its generic form of Remdesivir called Covifor.

Manufacturers in the generic injectables market are becoming future-ready by maintaining adequate supply chains to prevent vulnerabilities caused by potential COVID-19-like situations. Drug firms including Zydus Cadila are observed to significantly reduce the price of its generic version of Remdesivir namely Remdac. Companies are taking the advantage of government programs and financial schemes offered by the BFSI sector to streamline their business activities as per the volatile market sentiments.

Syringes are among the most difficult containers to inspect. With the largest vaccination effort in human history, challenges posed by syringe inspection become especially relevant while considering the ever-growing adoption of injectable drugs. These findings have led to the need of sophisticated inspection systems to help manufacturers address not only the coronavirus pandemic but also various other maladies.

While other containers such as cartridges, vials, and ampoules largely stand still and can enter the inspection process independently, syringes are typically carried via conveyor and then turned upside down. This has resulted in the need for robust inspection systems so that any hidden particles in the funnel can sink down into the liquid for increased inspection detectability.

The global generic injectables market is projected to clock a CAGR of 12.3% during the forecast period. Biological E Limited - an Indian biotechnology and biopharmaceutical company based in Hyderabad, Telangana, is gaining recognition for broadening its portfolio in 20 routine and complex injectable products. In order to establish stable revenue streams, companies are tapping into regulated markets and exploring other markets to generate income sources.

There is a growing demand for specialty generic injectables packaged in glass vials. Express Pharma in associated with West Pharma recently conducted a webinar to understand why emerging generic injectable manufacturers need flexibility and simplicity when dealing with drug delivery and containment.

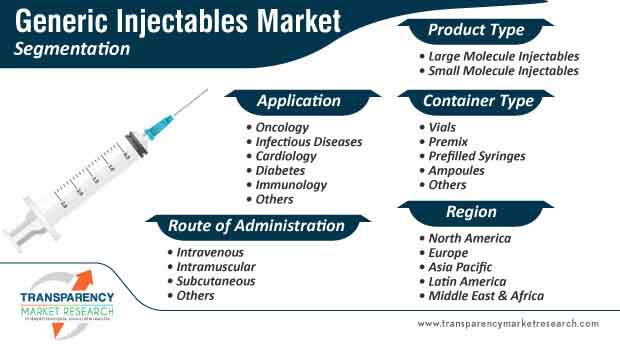

The generic injectables market is expected to cross US$ 307.7 Bn by 2031. The U.S. FDA (Food and Drug Administration) has approved the first generic of glucagon for injection USP for the treatment of severe hypoglycemia, which may occur in patients with diabetes mellitus. The drug has potentials as a diagnostic aid in the radiologic examination of the stomach, duodenum, small bowel, and colon in cases when diminished intestinal motility would be advantageous.

Companies in the generic injectables market are increasing their research to develop products meant for oncology and cardiology in order to expand their income sources.

Analysts’ Viewpoint

Apart from drug launches and price cuts, stakeholders in the generic injectables market are conducting webinars to understand how manufacturers are combating COVID-19 with the help of flexibility and simplicity during drug containment and delivery. Sun Pharmaceutical Industries Limited— an Indian multinational pharmaceutical company headquartered in Mumbai, India, is being publicized for its high quality generic and branded injectables available at affordable costs worldwide. However, syringes are among the most difficult containers to inspect and require handling protocols that are different from other primary packaging types. Stakeholders in the generic injectables market should adopt sophisticated inspection systems for gentle handling of syringes and avoiding glass-to-glass contact, which mitigates the likelihood of cracks or breakage.

Generic injectables market is expected to cross US$ 307.7 Bn by 2031

Generic injectables market is projected to clock a CAGR of 12.3% during 2021-2031

Generic injectables market is driven by rise in prevalence of various diseases and increase in demand for generic injectables

The large molecule injectables segment held major share of the global generic injectables market in 2020, and the trend is anticipated to continue during the forecast period

Key players in the market are Sanofi, Lupin Ltd., Biocon, Hikma Pharmaceuticals, Mylan N.V., Fresenius SE & Co

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Generic Injectables Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Generic Injectables Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.2. COVID-19 Pandemic Impact on Industry (value chain and short / mid /long term impact)

5.3. Regulatory Scenario, by Region/globally

5.4. Pipeline Analysis

5.5. Disease Prevalence & Incidence Rate globally with key countries

6. Global Generic Injectables Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Large Molecule Injectables

6.3.1.1. Monoclonal Antibodies (mAbs)

6.3.1.2. Insulin

6.3.1.3. Others

6.3.2. Small Molecule Injectables

6.4. Market Attractiveness Analysis, by Product Type

7. Global Generic Injectables Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Oncology

7.3.2. Infectious diseases

7.3.3. Cardiology

7.3.4. Diabetes

7.3.5. Immunology

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Generic Injectables Market Analysis and Forecast, by Container Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Container Type, 2017–2031

8.3.1. Vials

8.3.2. Premix

8.3.3. Prefilled Syringes

8.3.4. Ampoules

8.3.5. Others

8.4. Market Attractiveness Analysis, by Container Type

9. Global Generic Injectables Market Analysis and Forecast, by Route of Administration

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Route of Administration, 2017–2031

9.3.1. Intravenous

9.3.2. Intramuscular

9.3.3. Subcutaneous

9.3.4. Others

9.4. Market Attractiveness Analysis, by Route of Administration

10. Global Generic Injectables Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Generic Injectables Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Large Molecule Injectables

11.2.1.1. Monoclonal Antibodies (mAbs)

11.2.1.2. Insulin

11.2.1.3. Others

11.2.2. Small Molecule Injectables

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Oncology

11.3.2. Infectious diseases

11.3.3. Cardiology

11.3.4. Diabetes

11.3.5. Immunology

11.3.6. Others

11.4. Market Value Forecast, by Container Type, 2017–2031

11.4.1. Vials

11.4.2. Premix

11.4.3. Prefilled Syringes

11.4.4. Ampoules

11.4.5. Others

11.5. Market Value Forecast, by Route of Administration, 2017–2031

11.5.1. Intravenous

11.5.2. Intramuscular

11.5.3. Subcutaneous

11.5.4. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Application

11.7.3. By Container Type

11.7.4. By Route of Administration

11.7.5. By Country

12. Europe Generic Injectables Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Large Molecule Injectables

12.2.1.1. Monoclonal Antibodies (mAbs)

12.2.1.2. Insulin

12.2.1.3. Others

12.2.2. Small Molecule Injectables

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Oncology

12.3.2. Infectious diseases

12.3.3. Cardiology

12.3.4. Diabetes

12.3.5. Immunology

12.3.6. Others

12.4. Market Value Forecast, by Container Type, 2017–2031

12.4.1. Vials

12.4.2. Premix

12.4.3. Prefilled Syringes

12.4.4. Ampoules

12.4.5. Others

12.5. Market Value Forecast, by Route of Administration, 2017–2031

12.5.1. Intravenous

12.5.2. Intramuscular

12.5.3. Subcutaneous

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Application

12.7.3. By Container Type

12.7.4. By Route of Administration

12.7.5. By Country/Sub-region

13. Asia Pacific Generic Injectables Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Large Molecule Injectables

13.2.1.1. Monoclonal Antibodies (mAbs)

13.2.1.2. Insulin

13.2.1.3. Others

13.2.2. Small Molecule Injectables

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Oncology

13.3.2. Infectious diseases

13.3.3. Cardiology

13.3.4. Diabetes

13.3.5. Immunology

13.3.6. Others

13.4. Market Value Forecast, by Container Type, 2017–2031

13.4.1. Vials

13.4.2. Premix

13.4.3. Prefilled Syringes

13.4.4. Ampoules

13.4.5. Others

13.5. Market Value Forecast, by Route of Administration, 2017–2031

13.5.1. Intravenous

13.5.2. Intramuscular

13.5.3. Subcutaneous

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. Australia & New Zealand

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Application

13.7.3. By Container Type

13.7.4. By Route of Administration

13.7.5. By Country/Sub-region

14. Latin America Generic Injectables Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Large Molecule Injectables

14.2.1.1. Monoclonal Antibodies (mAbs)

14.2.1.2. Insulin

14.2.1.3. Others

14.2.2. Small Molecule Injectables

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Oncology

14.3.2. Infectious diseases

14.3.3. Cardiology

14.3.4. Diabetes

14.3.5. Immunology

14.3.6. Others

14.4. Market Value Forecast, by Container Type, 2017–2031

14.4.1. Vials

14.4.2. Premix

14.4.3. Prefilled Syringes

14.4.4. Ampoules

14.4.5. Others

14.5. Market Value Forecast, by Route of Administration, 2017–2031

14.5.1. Intravenous

14.5.2. Intramuscular

14.5.3. Subcutaneous

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Application

14.7.3. By Container Type

14.7.4. By Route of Administration

14.7.5. By Country/Sub-region

15. Middle East & Africa Generic Injectables Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. Large Molecule Injectables

15.2.1.1. Monoclonal Antibodies (mAbs)

15.2.1.2. Insulin

15.2.1.3. Others

15.2.2. Small Molecule Injectables

15.3. Market Value Forecast, by Application, 2017–2031

15.3.1. Oncology

15.3.2. Infectious diseases

15.3.3. Cardiology

15.3.4. Diabetes

15.3.5. Immunology

15.3.6. Others

15.4. Market Value Forecast, by Container Type, 2017–2031

15.4.1. Vials

15.4.2. Premix

15.4.3. Prefilled Syringes

15.4.4. Ampoules

15.4.5. Others

15.5. Market Value Forecast, by Route of Administration, 2017–2031

15.5.1. Intravenous

15.5.2. Intramuscular

15.5.3. Subcutaneous

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Application

15.7.3. By Container Type

15.7.4. By Route of Administration

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix

16.2. Market Share Analysis, by Company, 2020

16.3. Competitive Business Strategies

16.4. Company Profiles

16.4.1. AstraZeneca

16.4.1.1. Company Overview

16.4.1.2. Company Financials

16.4.1.3. Growth Strategies

16.4.1.4. SWOT Analysis

16.4.2. Baxter International, Inc.

16.4.2.1. Company Overview

16.4.2.2. Company Financials

16.4.2.3. Growth Strategies

16.4.2.4. SWOT Analysis

16.4.3. Biocon

16.4.3.1. Company Overview

16.4.3.2. Company Financials

16.4.3.3. Growth Strategies

16.4.3.4. SWOT Analysis

16.4.4. Fresenius SE & Co. KGaA

16.4.4.1. Company Overview

16.4.4.2. Company Financials

16.4.4.3. Growth Strategies

16.4.4.4. SWOT Analysis

16.4.5. GlaxoSmithKline plc

16.4.5.1. Company Overview

16.4.5.2. Company Financials

16.4.5.3. Growth Strategies

16.4.5.4. SWOT Analysis

16.4.6. Hikma Pharmaceuticals plc

16.4.6.1. Company Overview

16.4.6.2. Company Financials

16.4.6.3. Growth Strategies

16.4.6.4. SWOT Analysis

16.4.7. Johnson & Johnson Services, Inc.

16.4.7.1. Company Overview

16.4.7.2. Company Financials

16.4.7.3. Growth Strategies

16.4.7.4. SWOT Analysis

16.4.8. Lupin Ltd.

16.4.8.1. Company Overview

16.4.8.2. Company Financials

16.4.8.3. Growth Strategies

16.4.8.4. SWOT Analysis

16.4.9. Merck KGaA

16.4.9.1. Company Overview

16.4.9.2. Company Financials

16.4.9.3. Growth Strategies

16.4.9.4. SWOT Analysis

16.4.10. Mylan N.V.

16.4.10.1. Company Overview

16.4.10.2. Company Financials

16.4.10.3. Growth Strategies

16.4.10.4. SWOT Analysis

16.4.11. Novartis AG (Sandoz International GmbH)

16.4.11.1. Company Overview

16.4.11.2. Company Financials

16.4.11.3. Growth Strategies

16.4.11.4. SWOT Analysis

16.4.12. Pfizer, Inc.

16.4.12.1. Company Overview

16.4.12.2. Company Financials

16.4.12.3. Growth Strategies

16.4.12.4. SWOT Analysis

16.4.13. Piramal Pharma Solutions

16.4.13.1. Company Overview

16.4.13.2. Company Financials

16.4.13.3. Growth Strategies

16.4.13.4. SWOT Analysis

16.4.14. Sanofi

16.4.14.1. Company Overview

16.4.14.2. Company Financials

16.4.14.3. Growth Strategies

16.4.14.4. SWOT Analysis

16.4.15. Sun Pharmaceutical Industries Ltd.

16.4.15.1. Company Overview

16.4.15.2. Company Financials

16.4.15.3. Growth Strategies

16.4.15.4. SWOT Analysis

16.4.16. Teva Pharmaceutical Industries Ltd.

16.4.16.1. Company Overview

16.4.16.2. Company Financials

16.4.16.3. Growth Strategies

16.4.16.4. SWOT Analysis

List of Tables

Table 01: Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Generic Injectables Market Value (US$ Mn) Forecast, by Large Molecule Injectables, 2017–2031

Table 03: Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 05: Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 06: Global Generic Injectables Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 09: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 12: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration , 2017–2031

Table 13: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 16: North America Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 18: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration , 2017–2031

Table 19: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 21: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 24: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration , 2017–2031

Table 25: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 27: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 28: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 29: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 30: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration , 2017–2031

Table 31: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 33: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 34: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 35: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Container Type, 2017–2031

Table 36: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

List of Figures

Figure 01: Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Generic Injectables Market Value Share, by Product Type, 2020

Figure 03: Global Generic Injectables Market Value Share, by Application, 2020

Figure 04: Global Generic Injectables Market Value Share, by Container Type, 2020

Figure 05: Global Generic Injectables Market Value Share, by Rout of Administration, 2020

Figure 06: Global Generic Injectables Market Value Share, by Region, 2020

Figure 07: Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 08: Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 09: Global Generic Injectables Market Revenue (US$ Mn), by Large Molecule Injectables, 2017–2031

Figure 10: Global Generic Injectables Market Revenue (US$ Mn), by Small Molecule Injectables, 2017–2031

Figure 11: Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 12: Global Generic Injectables Market Attractiveness Analysis, by Application, 2021–2031

Figure 13: Global Generic Injectables Market Revenue (US$ Mn), by Oncology, 2017–2031

Figure 14: Global Generic Injectables Market Revenue (US$ Mn), by Infectious Disease, 2017–2031

Figure 15: Global Generic Injectables Market Revenue (US$ Mn), by Cardiology, 2017–2031

Figure 16: Global Generic Injectables Market Revenue (US$ Mn), by Diabetes, 2017–2031

Figure 17: Global Generic Injectables Market Revenue (US$ Mn), by Immunology, 2017–2031

Figure 18: Global Generic Injectables Market Revenue (US$ Mn), by Others, 2017–2031

Figure 19: Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 20: Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 21: Global Generic Injectables Market Value (US$ Mn), by Vials, 2017–2031

Figure 22: Global Generic Injectables Market Value (US$ Mn), by Premix, 2017–2031

Figure 23: Global Generic Injectables Market Value (US$ Mn), by Prefilled Syringes, 2017–2031

Figure 24: Global Generic Injectables Market Value (US$ Mn), by Ampoules, 2017–2031

Figure 25: Global Generic Injectables Market Value (US$ Mn), by Others, 2017–2031

Figure 26: Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 27: Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031

Figure 28: Global Generic Injectables Market Value (US$ Mn), by Intravenous, 2017–2031

Figure 29: Global Generic Injectables Market Value (US$ Mn), by Intramuscular, 2017–2031

Figure 30: Global Generic Injectables Market Value (US$ Mn), by Subcutaneous, 2017–2031

Figure 31: Global Generic Injectables Market Value (US$ Mn), by Others, 2017–2031

Figure 32: Global Generic Injectables Market Value Share Analysis, by Region, 2020 and 2031

Figure 33: Global Generic Injectables Market Attractiveness Analysis, by Region, 2021–2031

Figure 34: North America Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: North America Global Generic Injectables Market Value Share Analysis, by Country, 2020 and 2031

Figure 36: North America Global Generic Injectables Market Attractiveness Analysis, by Country, 2021–2031

Figure 37: North America Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 38: North America Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 39: North America Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 40: North America Global Generic Injectables Market Attractiveness Analysis, by Material, 2021–2031

Figure 41: North America Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 42: North America Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 43: North America Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 44: North America Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031

Figure 45: Europe Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Europe America Global Generic Injectables Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 47: Europe Global Generic Injectables Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 48: Europe Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 49: Europe Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 50: Europe Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 51: Europe Global Generic Injectables Market Attractiveness Analysis, by Material, 2021–2031

Figure 52: Europe Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 53: Europe Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 54: Europe Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 55: Europe Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031

Figure 56: Asia Pacific Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Asia Pacific Global Generic Injectables Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 58: Asia Pacific Global Generic Injectables Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 59: Asia Pacific Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 60: Asia Pacific Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 61: Asia Pacific Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 62: Asia Pacific Global Generic Injectables Market Attractiveness Analysis, by Material, 2021–2031

Figure 63: Asia Pacific Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 64: Asia Pacific Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 65: Asia Pacific Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 66: Asia Pacific Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031

Figure 67: Latin America Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 68: Latin America Global Generic Injectables Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 69: Latin America Global Generic Injectables Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 70: Latin America Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 71: Latin America Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 72: Latin America Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 73: Latin America Global Generic Injectables Market Attractiveness Analysis, by Material, 2021–2031

Figure 74: Latin America Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 75: Latin America Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 76: Latin America Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 77: Latin America Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031

Figure 78: Middle East & Africa Global Generic Injectables Market Value (US$ Mn) Forecast, 2017–2031

Figure 79: Middle East & Africa Global Generic Injectables Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 80: Middle East & Africa Global Generic Injectables Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 81: Middle East & Africa Global Generic Injectables Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 82: Middle East & Africa Global Generic Injectables Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 83: Middle East & Africa Global Generic Injectables Market Value Share Analysis, by Application, 2020 and 2031

Figure 84: Middle East & Africa Global Generic Injectables Market Attractiveness Analysis, by Material, 2021–2031

Figure 85: Middle East & Africa Global Generic Injectables Market Value Share Analysis, by Container Type, 2020 and 2031

Figure 86: Middle East & Africa Global Generic Injectables Market Attractiveness Analysis, by Container Type, 2021–2031

Figure 87: Middle East & Africa Global Generic Injectables Market Value Share Analysis, by Route of Administration, 2020 and 2031

Figure 88: Middle East & Africa Global Generic Injectables Market Attractiveness Analysis, by Route of Administration, 2021–2031