Gastrointestinal diseases are quite common all over the globe, and various treatments are available to tackle these health issues. One such way is the proper administration of a variety of drugs, thereby constituting a distinct gastrointestinal drugs market from a global perspective.

This market is mainly being driven due to rapidly progressing interests in research activities happening in drug development-based activities all over the globe. Moreover, cases of such ailments are quite common in old-aged people, and a rising geriatric population is also increasing the demand of such drugs. In addition, changing lifestyles, unhealthy eating habits, and increasing levels of stress also are key factors driving growth in the global gastrointestinal drugs market. With innovative advancements occurring in the techniques implemented for curing such issues at a steady pace, the global gastrointestinal drugs market is anticipated to register splendid revenue in the years to come.

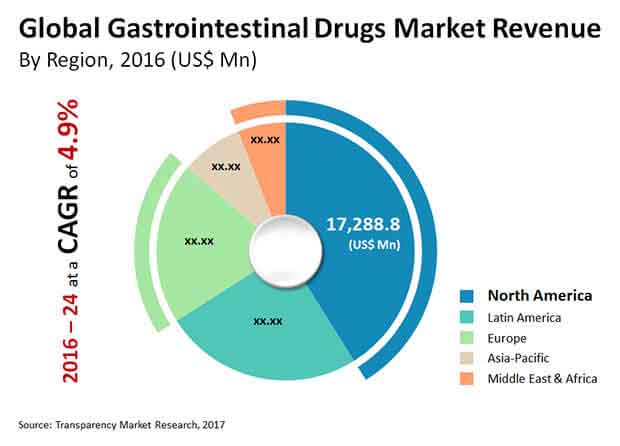

As per expert analysts, the global gastrointestinal drugs market is foretold to clock revenue valuation of US$61.6 bn by 2024, which is a decent increase from an initial valuation of US$45.5 bn clocked in 2015. This growth is prophesized to occur at a healthy CAGR of 4.90% during the forecast period from 2016 to 2024.

Acid Neutralizers Come Out as Winning Segment in the Market

The global gastrointestinal drugs market is segregated into various segments on the basis of various criteria such as drug class, route of administration, disorder type, distribution channel, and regional spread. Under drug class, acid neutralizers, anti-diarrheal and laxatives, antiemetic and anti-nauseants, anti-inflammatory drugs, biologics, and antispasmodic, are key segments. Acid neutralizers are further subdivided into antacids, h2 antagonists, and proton pump inhibitors, in the form of sub-segments. In terms of administration route, oral, parenteral and rectal make up for the gastrointestinal drugs market. Under disorder type, gastro-esophageal reflux disease, inflammatory bowel disease, and irritable bowel syndrome, are prime illness types that require the administration of drugs. Whereas, the drugs are sold through three key distribution channels: hospital pharmacies, retail pharmacies, and online pharmacies.

Among all the drug classes, a rising demand for prevention of gastroesophageal reflux disease (GERD) has led to an increasing use of acid neutralizers. In this way, the acid neutralizers segment holds a dominant position in the global gastrointestinal drugs market. Moreover, the cost efficiency of such neutralizers too has contributed towards the segment’s splendid growth and presence in the market. Even in future, compared to other segments present under the drug class criteria, acid neutralizers are expected to continue gaining extensive revenue for the global gastrointestinal drugs market.

Region-wise, the global gastrointestinal drugs market is spread across North America, Latin America, Asia Pacific, Europe, and the Middle East and Africa. Of these, North America occupies the primary slot in terms of revenue generation in the market. This is mainly due to the presence of favorable reimbursement policies in this region, which are highly beneficial for the welfare of those affected by gastrointestinal issues. Moreover, rapidly increasing instances of various chronic diseases, wherein gastrointestinal problems might exist as a key symptom, also is a prime factor responsible for the market’s progress in North America. To be specific, the region had registered a share of more than 41% in 2016, compared to other regions. With a surge in the number of old-aged people present in North America, the sales of gastrointestinal drugs are prophesized to rapidly increase in the near future.

In terms of the vendor landscape, Abbott Laboratories, Allergan Plc, AstraZeneca, Bayer AG, Boehringer Ingelheim GmbH, GlaxoSmithKline Plc., Janssen Biotech Inc., Sanofi, Takeda Pharmaceutical, and Valeant Pharmaceuticals Inc. are chief players operating in the global gastrointestinal drugs market.

Augmented Research and Development Activities to Boost Gastrointestinal Drugs Market

Gastrointestinal disorders are quite prevalent all over the world and there are a variety of medications and treatment methods available to address these health problems. One such method is proper drug administration, which has resulted in the development of a distinct gastrointestinal drugs industry on a global scale. This factor is likely to favour development of the global gastrointestinal drugs market in the years to come.

This demand is primarily motivated by the increasingly growing interest in drug development-related research activities taking place all over the world. Furthermore, such diseases are very prevalent in the elderly, and the need for such medicines is growing as the geriatric population grows. In addition, evolving diets, unhealthy dietary patterns, and the stress levels are all contributing to the expansion of the global gastrointestinal drugs market. With constant developments in the procedures used to treat such problems, the global gastrointestinal drugs market is expected to grow significantly in the coming years.

High Prevalence of GI Problems in the Geriatric Population to Spur Market Growth

The rising prevalence of gastrointestinal diseases around the world is a major factor in the gastrointestinal drugs market's growth. On the other hand, heavy funding, especially in scientific research for the expansion and advancement of these medicines, as well as increasing awareness about the efficacy of the therapies as well as the healing process, are significantly contributing to the growth of the market. In addition, technical advancements in the treatment process are expected to propel this market forward significantly in the coming years. The demand for these drugs is expected to rise due to an increase in the number of patients struggling with GI disorders as a result of dietary changes.

North America is expected to become the world's most active geographic market for gastrointestinal medicines. It is expected to gain a sizable chunk of the gastrointestinal drugs market in the coming years as a result of customer-friendly payment programmes for the treatment of chronic syndromes or diseases. Because of the increasing number of elderly people who are vulnerable to gastrointestinal diseases, North America is expected to maintain its dominance in the gastrointestinal drugs market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Gastrointestinal Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Gastrointestinal Drugs Market Overview

5. Market Dynamics

5.1. Drivers

5.1.1. Restraints

5.1.2. Opportunity

5.1.3. Trends

5.2. Porter’s Five Force Analysis

5.3. FDA Approved Biologics Products

5.4. Overview of Clinical Trials

5.5. Epidemiology of Gastrointestinal Disease: Global Scenario

5.6. Global prevalence of Inflammatory Bowel Disease in 2015

6. Global Gastrointestinal Drugs Market Analysis and Forecasts, By Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn) Forecast By Drug Class

6.4.1. Acid Neutralizers

6.4.1.1. Antacids

6.4.1.2. H2 antagonists

6.4.1.3. Proton pump inhibitors

6.4.1.4. Helicobacter pylori eradication

6.4.2. Antidiarrheal and Laxatives

6.4.3. Antiemetic and Antinauseants

6.4.4. Anti-inflammatory drugs

6.4.5. Biologics

6.4.6. Others (Antispasmodic etc.)

6.5. Market Attractiveness By Drug Class

7. Global Gastrointestinal Drugs Market Analysis and Forecasts, By Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Size (US$ Mn) Forecast By Route of Administration

7.4.1. Oral

7.4.2. Intravenous

7.4.3. Rectal

7.5. Market Attractiveness By Route of Administration

8. Global Gastrointestinal Drugs Market Analysis and Forecasts, By Disorder Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Size (US$ Mn) Forecast By Disorder Type

8.4.1. Gastroesophageal Reflux Disease

8.4.2. Inflammatory Bowel Disease

8.4.3. Irritable Bowel Syndrome

8.5. Market Attractiveness By Disorder Type

9. Global Gastrointestinal Drugs Market Analysis and Forecasts, By Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Key Trends

9.4. Market Size (US$ Mn) Forecast By Distribution Channel

9.4.1. Hospital Pharmacies

9.4.2. Retail Pharmacies

9.4.3. Online Pharmacies

9.5. Market Attractiveness By Distribution Channel

10. Global Gastrointestinal Drugs Market Analysis and Forecasts, By Region

10.1. Key Findings

10.2. Policies and Regulations

10.3. Market Size (US$ Mn) Forecast By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa

10.4. Market Attractiveness By Country/Region

11. North America Gastrointestinal Drugs Market Analysis and Forecast

11.1. Key Findings

11.2. Policies and Regulations

11.3. Key Trends

11.4. Market Value Forecast By Country

11.4.1. US

11.4.2. Canada

11.5. Market Size (US$ Mn) Forecast By Drug Class

11.5.1. Acid Neutralizers

11.5.1.1. Antacids

11.5.1.2. H2 antagonists

11.5.1.3. Proton pump inhibitors

11.5.1.4. Helicobacter pylori eradication

11.5.2. Antidiarrheal and Laxatives

11.5.3. Antiemetic and Antinauseants

11.5.4. Anti-inflammatory drugs

11.5.5. Biologics

11.5.6. Others (Antispasmodic etc.)

11.6. Market Size (US$ Mn) Forecast By Route of Administration

11.6.1. Oral

11.6.2. Intravenous

11.6.3. Rectal

11.7. Market Size (US$ Mn) Forecast By Disorder Type

11.7.1. Gastroesophageal Reflux Disease

11.7.2. Inflammatory Bowel Disease

11.7.3. Irritable Bowel Syndrome

11.8. Market Size (US$ Mn) Forecast By Distribution Channel

11.8.1. Hospital Pharmacies

11.8.2. Retail Pharmacies

11.8.3. Online Pharmacies

11.9. Market Attractiveness Analysis

11.9.1. By Country

11.9.2. By Drug Class

11.9.3. By Route of Administration

11.9.4. By Disorder Type

11.9.5. By Distribution Channel

12. Europe Gastrointestinal Drugs Market Analysis and Forecast

12.1. Key Findings

12.2. Policies and Regulations

12.3. Key Trends

12.4. Market Value Forecast By Country

12.4.1. Germany

12.4.2. France

12.4.3. U.K.

12.4.4. Italy

12.4.5. Russia

12.4.6. Spain

12.4.7. Rest of Europe

12.5. Market Size (US$ Mn) Forecast By Drug Class

12.5.1. Acid Neutralizers

12.5.1.1. Antacids

12.5.1.2. H2 antagonists

12.5.1.3. Proton pump inhibitors

12.5.1.4. Helicobacter pylori eradication

12.5.2. Antidiarrheal and Laxatives

12.5.3. Antiemetic and Antinauseants

12.5.4. Anti-inflammatory drugs

12.5.5. Biologics

12.5.6. Others (Antispasmodic etc.)

12.6. Market Size (US$ Mn) Forecast By Route of Administration

12.6.1. Oral

12.6.2. Intravenous

12.6.3. Rectal

12.7. Market Size (US$ Mn) Forecast By Disorder Type

12.7.1. Gastroesophageal Reflux Disease

12.7.2. Inflammatory Bowel Disease

12.7.3. Irritable Bowel Syndrome

12.8. Market Size (US$ Mn) Forecast By Distribution Channel

12.8.1. Hospital Pharmacies

12.8.2. Retail Pharmacies

12.8.3. Online Pharmacies

12.9. Market Attractiveness Analysis

12.9.1. By Country

12.9.2. By Drug Class

12.9.3. By Route of Administration

12.9.4. By Disorder Type

12.9.5. By Distribution Channel

13. Asia Pacific Gastrointestinal Drugs Market Analysis and Forecast

13.1. Key Findings

13.2. Policies and Regulations

13.3. Key Trends

13.4. Market Value Forecast By Country

13.4.1. China

13.4.2. Japan

13.4.3. India

13.4.4. Australia & New Zealand

13.4.5. India

13.4.6. Rest of Asia Pacific

13.5. Market Size (US$ Mn) Forecast By Drug Class

13.5.1. Acid Neutralizers

13.5.1.1. Antacids

13.5.1.2. H2 antagonists

13.5.1.3. Proton pump inhibitors

13.5.1.4. Helicobacter pylori eradication

13.5.2. Antidiarrheal and Laxatives

13.5.3. Antiemetic and Antinauseants

13.5.4. Anti-inflammatory drugs

13.5.5. Biologics

13.5.6. Others (Antispasmodic etc.)

13.6. Market Size (US$ Mn) Forecast By Route of Administration

13.6.1. Oral

13.6.2. Intravenous

13.6.3. Rectal

13.7. Market Size (US$ Mn) Forecast By Disorder Type

13.7.1. Gastroesophageal Reflux Disease

13.7.2. Inflammatory Bowel Disease

13.7.3. Irritable Bowel Syndrome

13.8. Market Size (US$ Mn) Forecast By Distribution Channel

13.8.1. Hospital Pharmacies

13.8.2. Retail Pharmacies

13.8.3. Online Pharmacies

13.9. Market Attractiveness Analysis

13.9.1. By Country

13.9.2. By Drug Class

13.9.3. By Route of Administration

13.9.4. By Disorder Type

13.9.5. By Distribution Channel

14. Latin America Gastrointestinal Drugs Market Analysis and Forecast

14.1. Key Findings

14.2. Policies and Regulations

14.3. Key Trends

14.4. Market Value Forecast By Country

14.4.1. Brazil

14.4.2. Mexico

14.4.3. Rest of Latin America

14.5. Market Size (US$ Mn) Forecast By Drug Class

14.5.1. Acid Neutralizers

14.5.1.1. Antacids

14.5.1.2. H2 antagonists

14.5.1.3. Proton pump inhibitors

14.5.1.4. Helicobacter pylori eradication

14.5.2. Antidiarrheal and Laxatives

14.5.3. Antiemetic and Antinauseants

14.5.4. Anti-inflammatory drugs

14.5.5. Biologics

14.5.6. Others (Antispasmodic etc.)

14.6. Market Size (US$ Mn) Forecast By Route of Administration

14.6.1. Oral

14.6.2. Intravenous

14.6.3. Rectal

14.7. Market Size (US$ Mn) Forecast By Disorder Type

14.7.1. Gastroesophageal Reflux Disease

14.7.2. Inflammatory Bowel Disease

14.7.3. Irritable Bowel Syndrome

14.8. Market Size (US$ Mn) Forecast By Distribution Channel

14.8.1. Hospital Pharmacies

14.8.2. Retail Pharmacies

14.8.3. Online Pharmacies

14.9. Market Attractiveness Analysis

14.9.1. By Country

14.9.2. By Drug Class

14.9.3. By Route of Administration

14.9.4. By Disorder Type

14.9.5. By Distribution Channel

15. Middle East & Africa Gastrointestinal Drugs Market Analysis and Forecast

15.1. Key Findings

15.2. Policies and Regulations

15.3. Key Trends

15.4. Market Value Forecast By Country

15.4.1. GCC countries

15.4.2. South Africa

15.4.3. Rest of Middle East & Africa

15.5. Market Size (US$ Mn) Forecast By Drug Class

15.5.1. Acid Neutralizers

15.5.1.1. Antacids

15.5.1.2. H2 antagonists

15.5.1.3. Proton pump inhibitors

15.5.1.4. Helicobacter pylori eradication

15.5.2. Antidiarrheal and Laxatives

15.5.3. Antiemetic and Antinauseants

15.5.4. Anti-inflammatory drugs

15.5.5. Biologics

15.5.6. Others (Antispasmodic etc.)

15.6. Market Size (US$ Mn) Forecast By Route of Administration

15.6.1. Oral

15.6.2. Intravenous

15.6.3. Rectal

15.7. Market Size (US$ Mn) Forecast By Disorder Type

15.7.1. Gastroesophageal Reflux Disease

15.7.2. Inflammatory Bowel Disease

15.7.3. Irritable Bowel Syndrome

15.8. Market Size (US$ Mn) Forecast By Distribution Channel

15.8.1. Hospital Pharmacies

15.8.2. Retail Pharmacies

15.8.3. Online Pharmacies

15.9. Market Attractiveness Analysis

15.9.1. By Country

15.9.2. By Drug Class

15.9.3. By Route of Administration

15.9.4. By Disorder Type

15.9.5. By Distribution Channel

16. Competition Landscape

16.1. Market Player

16.2. Company Share Analysis (2016)

16.3. Company Profiles

16.3.1. Abbott Laboratories

16.3.1.1. Overview

16.3.1.2. Financials

16.3.1.3. Recent Developments

16.3.1.4. Strategy

16.3.2. Allergan Plc

16.3.2.1. Overview

16.3.2.2. Financials

16.3.2.3. Recent Developments

16.3.2.4. Strategy

16.3.3. AstraZeneca

16.3.3.1. Overview

16.3.3.2. Financials

16.3.3.3. Recent Developments

16.3.3.4. Strategy

16.3.4. Bayer AG

16.3.4.1. Overview

16.3.4.2. Financials

16.3.4.3. Recent Developments

16.3.4.4. Strategy

16.3.5. Boehringer Ingelheim GmbH

16.3.5.1. Overview

16.3.5.2. Financials

16.3.5.3. Recent Developments

16.3.5.4. Strategy

16.3.6. GlaxoSmithKline plc

16.3.6.1. Overview

16.3.6.2. Financials

16.3.6.3. Recent Developments

16.3.6.4. Strategy

16.3.7. Janssen Biotech, Inc.

16.3.7.1. Overview

16.3.7.2. Financials

16.3.7.3. Recent Developments

16.3.7.4. Strategy

16.3.8. Sanofi

16.3.8.1. Overview

16.3.8.2. Financials

16.3.8.3. Recent Developments

16.3.8.4. Strategy

16.3.9. Takeda Pharmaceutical

16.3.9.1. Overview

16.3.9.2. Financials

16.3.9.3. Recent Developments

16.3.9.4. Strategy

16.3.10. Valeant Pharmaceuticals, Inc.

16.3.10.1. Overview

16.3.10.2. Financials

16.3.10.3. Recent Developments

16.3.10.4. Strategy

List of Tables

Table 01: Biologics Products, Manufacturers & Trade Names

Table 02: Biologics Products, Manufacturers & Trade Names

Table 03: Overview of major clinical trials for Inflammatory Bowel Disease

Table 04: Overview of major clinical trials for Inflammatory Bowel Disease

Table 05: Overview of major clinical trials for Inflammatory Bowel Disease

Table 06: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 07: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizer (Drug Class), 2014–2024

Table 08: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 09: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 10: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 11: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 12: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 13: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 14: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizers (Drug Class), 2014–2024

Table 15: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 16: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 17: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 18: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 19: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 20: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizers (Drug Class), 2014–2024

Table 21: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 22: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 23: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 24: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 25: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 26: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizers (Drug Class),

Table 27: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 28: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 29: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 30: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 31: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 32: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizers (Drug Class), 2014-2024

Table 33: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 34: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 35: Latin America Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

Table 36: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 37: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2014–2024

Table 38: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Acid Neutralizers, 2014–2024

Table 39: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 40: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Disorder Type, 2014–2024

Table 41: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2014–2024

List of Figures

Figure 01: Market Value Share, by Drug Class (2015)

Figure 02: Market Value Share, by Route of Administration (2015)

Figure 03: Market Value Share, by Disorder Type (2015)

Figure 04: Market Value Share, by Distribution Channel (2015)

Figure 05: Market Value Share, by Region (2015)

Figure 06: Global Gastrointestinal Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 07: Global Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 08: Global Acid Neutralizers Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 09: Global Antidiarrheal and Laxatives Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 10: Global Antiemetic and Antinauseants Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 11: Global Anti-inflammatory drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 12: Global Biologics Market Revenue (US$ Mn) and

Figure 13: Global Others (Antispasmodic etc.)Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 14: Global Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class

Figure 15: Global Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 16: Global Oral Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 17: Global Parenteral Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 18: Global Rectal Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 19: Global Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 20: Global Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 21: Global Gastroesophageal Reflux Disease Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 22: Global Inflammatory Bowel Disease Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 23: Global Irritable Bowel Syndrome Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 24: Global Gastrointestinal Drugs Market Attractiveness Analysis, by Disorder Type, 2016–2024

Figure 25: Global Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 26: Global Hospital Pharmacies Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 27: Global Retail Pharmacies Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 28: Global Online Pharmacies Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 29: Global Gastrointestinal Drugs Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 30: Global Gastrointestinal Drugs Market Value Share Analysis, by Region, 2016 and 2024

Figure 31: Global Gastrointestinal Drugs Market Attractiveness Analysis, by Region

Figure 32: North America Gastrointestinal Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 33: North America Gastrointestinal Drugs Market Attractiveness Analysis, by Country, 2016–2024

Figure 34: North America Gastrointestinal Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 35: North America Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 36: North America Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 37: North America Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 38: North America Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 39: North America Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class, 2016–2024

Figure 40: North America Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 41: North America Gastrointestinal Drugs Market Attractiveness Analysis, by Disorder Type, 2016–2024

Figure 42: North America Gastrointestinal Drugs Market Attractiveness Analysis, by distribution channel, 2016–2024

Figure 43: Europe Gastrointestinal Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 44: Europe Gastrointestinal Drugs Market Attractiveness Analysis, by Country, 2015

Figure 45: Europe Gastrointestinal Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 46: Europe Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 47: Europe Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 48: Europe Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 49: Europe Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 50: Europe Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class, 2016–2024

Figure 51: Europe Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 52: Europe Gastrointestinal Drugs Market Attractiveness Analysis, by disorder type, 2016–2024

Figure 53: Europe Gastrointestinal Drugs Market Attractiveness Analysis, by distribution channel, 2016–2024

Figure 54: Asia Pacific Gastrointestinal Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 55: Asia Pacific Gastrointestinal Drugs Market Attractiveness Analysis, by Country, 2016–2024

Figure 56: Asia Pacific Gastrointestinal Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 57: Asia Pacific Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 58: Asia Pacific Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 59: Asia Pacific Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 60: Asia Pacific Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 61: Asia Pacific Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class, 2016–2024

Figure 62: Asia Pacific Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 63: Asia Pacific Gastrointestinal Drugs Market Attractiveness Analysis, by disorder type, 2016–2024

Figure 64: Asia Pacific Gastrointestinal Drugs Market Attractiveness Analysis, by distribution channel, 2016–2024

Figure 66: Latin America Gastrointestinal Drugs Market Attractiveness Analysis, by Country, 2016–2024

Figure 67: Latin America Gastrointestinal Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 68: Latin America Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 69: Latin America Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 70: Latin America Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 71: Latin America Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 72: Latin America Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class, 2016–2024

Figure 73: Latin America Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 74: Latin America Gastrointestinal Drugs Market Attractiveness Analysis, by disorder type, 2016–2024

Figure 75: Latin America Gastrointestinal Drugs Market Attractiveness Analysis, by distribution channel, 2016–2024

Figure 76: Middle East & Africa Gastrointestinal Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 77: Middle East & Africa Gastrointestinal Drugs Market Attractiveness Analysis, by Country, 2016–2024

Figure 78: Middle East & Africa Gastrointestinal Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 79: Middle East & Africa Gastrointestinal Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 80: Middle East & Africa Gastrointestinal Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2024

Figure 81: Middle East & Africa Gastrointestinal Drugs Market Value Share Analysis, by Disorder Type, 2016 and 2024

Figure 82: Middle East & Africa Gastrointestinal Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2024

Figure 83: Middle East & Africa Gastrointestinal Drugs Market Attractiveness Analysis, by Drug Class, 2016–2024

Figure 84: Middle East & Africa Gastrointestinal Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 85: Middle East & Africa Gastrointestinal Drugs Market Attractiveness Analysis, by disorder type, 2016–2024

Figure 86: Middle East & Africa Gastrointestinal Drugs Market Attractiveness Analysis, by distribution channel, 2016–2024

Figure 87: Global Gastrointestinal Drugs Market Share Analysis, by Company, 2016 (Estimated)