Analysts’ Viewpoint

Currently available gastric electric stimulators are used in the treatment of refractory gastroparesis and obesity. However, these stimulators are bigger and powered by a non-rechargeable battery. Hence, these devices require surgical implantation and subsequent replacement surgical procedure. Companies have developed a prototype miniature gastric electric stimulator, which can be wirelessly recharged and is small enough for endoscopic implantation. Thus, introduction of smaller and wireless rechargeable gastric electric stimulation systems presents significant opportunities for existing and new entrants in the gastric electrical stimulation systems market.

Post the peak of the COVID-19 pandemic, companies in the business are taking data-driven decisions before investing in new device technologies. They are investing significantly in research & development of technologically advanced gastric electric stimulators for gastroparesis and obesity treatment.

Gastric electrical stimulation (GES), also referred to as gastric pacing or implantable gastric stimulation (IGS), is the usage of specific devices to provide electrical stimulation to the stomach in order to treat gastroparesis. It is also used to treat overweight and obese individuals. GES is currently used as an alternative treatment for medically refractory gastroparesis.

Gastric electrical stimulator is a small, battery-operated gastric neurostimulator, which is implanted beneath the skin in the lower abdominal area for the treatment of gastroparesis. The device consists of two insulated wires called leads, which are implanted in the stomach wall muscle and connected to the neurostimulator. The leads deliver mild, controlled electrical pulses to the antrum portion of the stomach muscle wall.

The two types of gastric electrical stimulation systems are low-frequency gastric electrical stimulators and high-frequency gastric electrical stimulators. Low-frequency gastric electrical stimulation mitigates the symptoms caused by gastrointestinal motility disorders, whereas high-frequency gastric electrical stimulation is used for the treatment of gastroparesis.

Gastric electrical stimulation surgery or gastric electrical stimulation procedure involves implantation of a neurostimulator into the right side of abdomen, followed by two insulated wires (leads) into the muscle wall of stomach. A surgeon turns on the device and the wires start transmitting low-energy electrical pulses to stomach. Using a hand-held programmer, the surgeon customizes the frequency and strength of the pulses to meet patient’s needs.

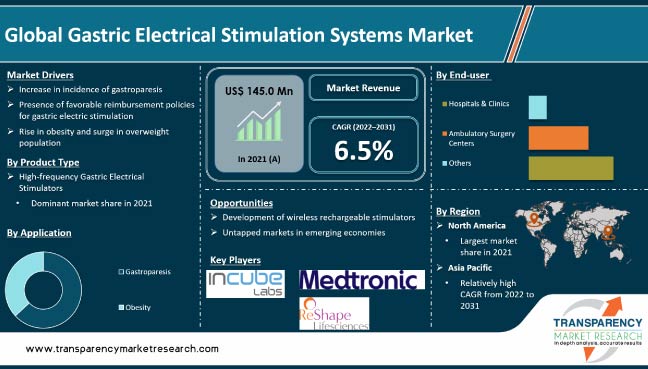

Increase in incidence of gastroparesis, presence of favorable reimbursement policies for gastric electric stimulation, and rise in obesity & surge in overweight population are likely to drive gastric electrical stimulation systems market progress in the next few years.

Incidence of gastroparesis is rising across the world. According to an article published in the United European Gastroenterology Journal (UEG Journal) in October 2022, gastroparesis-like symptoms (GPLS) are common globally, especially in diabetic patients. The global prevalence of GPLS stood at 0.9% overall and 1.3% among diabetic individuals.

Gastric electrical stimulation is an emerging weight loss treatment. According to statistics provided by the World Health Organization (WHO), obesity has nearly tripled between 1975 and 2016 across the globe. More than 1.9 billion adults, 18 years and older, were overweight in 2016. Of these, over 650 million were obese. Furthermore, 39% of adults aged 18 years and over were overweight in 2016, and 13% were obese. Type 2 diabetes mellitus is most common among patients with gastroparesis.

COVID-19 had a positive effect on the industry in 2020 due to the increase in demand for gastric electrical stimulators. For instance, a case study published in the Journal of Medicine (Baltimore) in April 2021 reported that COVID-19 could present with exacerbated symptoms of an underlying disorder, such as a severe gastroparesis flare in a patient with underlying gastroparesis. A number of patients tested positive for COVID-19 after developing gastrointestinal (GI) symptoms, either solely or in conjunction with respiratory symptoms.

In terms of product type, the high-frequency gastric electrical stimulators segment held largest global gastric electrical stimulation systems market share in 2021. The trend is expected to continue during the forecast period due to advantages of high-frequency stimulators over low-frequency stimulators such as long battery life.

High-frequency gastric electric stimulators are gaining traction, as these are less invasive and more patient-friendly in terms of insertion. Furthermore, surge in availability of high-frequency gastric electrical stimulators and rise in focus on the treatment of gastroparesis are expected to propel the segment in the near future.

Based on application, the gastroparesis segment dominated the gastric electrical stimulation systems market in 2021. This can be ascribed to the increase in usage of gastric electrical stimulation for gastroparesis. GES for gastroparesis has been in use for decades. It is safe, effective and currently used as an alternative treatment for medically refractory gastroparesis.

In terms of end-user, the hospitals & clinics segment held significant share in 2021. This can be ascribed to the increase in number of hospitals and clinics and rise in number of gastroparesis treatments performed in these settings. According to the American Hospital Association (AHA), the number of hospitals in the U.S. increased from 5,564 in 2017 to 6,093 in 2022. Growth in number of hospitals in the region has led to a surge in number of MIS procedures performed.

North America accounted for significant share of the global market in 2021. This can be ascribed to the rise in prevalence of lifestyle-related and chronic diseases, technological advancements in gastric electrical stimulators, increase in healthcare expenditure, regulatory support, and growth in awareness about gastroparesis among medical professionals. Organizations such as The American College of Gastroenterology and the National Institute for Health and Care Excellence (NICE) have enacted guidelines listing gastric electrical stimulators as a safe and reliable therapeutic approach for gastroparesis. This is likely to augment market expansion in North America.

Asia Pacific is expected to record significant market development during the forecast period. This can be ascribed to the increase in geriatric population, developing healthcare infrastructure, rise in awareness about gastric electrical stimulation systems, and higher incidence of chronic diseases such as obesity, diabetes, and gastrointestinal disorders in developing countries in the region.

The gastric electrical stimulation systems market report concludes with the company profiles section that comprises key information about the major players. Companies are focusing on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace. Companies in gastric electrical stimulation systems market are Changzhou Rishena Medical Device Co., Ltd., Intrapace, Inc. (InCube Labs), Medtronic plc, and ReShape Lifesciences, Inc. (EnteroMedics Inc.).

Prominent players have been profiled in the gastric electrical stimulation systems market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size Value in 2021 |

US$ 145.0 Mn |

|

Forecast (Value) in 2031 |

More than US$ 273.7 Mn |

|

Compound Annual Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 145.0 Mn in 2021

It is projected to reach more than US$ 273.7 Mn by 2031

The market is anticipated to grow at a CAGR of 6.5% from 2022 to 2031.

Increase in incidence of gastroparesis, presence of favorable reimbursement policies for gastric electric stimulation, and rise in obese and overweight population

The high-frequency gastric electrical stimulators segment accounted for more than 60% share in 2021

North America is expected to account for the largest share from 2022 to 2031.

Changzhou Rishena Medical Device Co., Ltd., Intrapace, Inc. (InCube Labs), Medtronic plc, and ReShape Lifesciences, Inc. (EnteroMedics, Inc.)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Gastric Electrical Stimulation Systems Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Gastric Electrical Stimulation Systems Market Value Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Gastric Electrical Stimulation Systems Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Low-frequency Gastric Electrical Stimulators

6.3.2. High-frequency Gastric Electrical Stimulators

6.4. Market Attractiveness Analysis, by Product Type

7. Global Gastric Electrical Stimulation Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Gastroparesis

7.3.2. Obesity

7.4. Market Attractiveness Analysis, by Application

8. Global Gastric Electrical Stimulation Systems Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Clinics

8.3.2. Ambulatory Surgery Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Gastric Electrical Stimulation Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Gastric Electrical Stimulation Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Low-frequency Gastric Electrical Stimulators

10.2.2. High-frequency Gastric Electrical Stimulators

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Gastroparesis

10.3.2. Obesity

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Clinics

10.4.2. Ambulatory Surgery Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Gastric Electrical Stimulation Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Low-frequency Gastric Electrical Stimulators

11.2.2. High-frequency Gastric Electrical Stimulators

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Gastroparesis

11.3.2. Obesity

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Clinics

11.4.2. Ambulatory Surgery Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Gastric Electrical Stimulation Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Low-frequency Gastric Electrical Stimulators

12.2.2. High-frequency Gastric Electrical Stimulators

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Gastroparesis

12.3.2. Obesity

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Clinics

12.4.2. Ambulatory Surgery Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Gastric Electrical Stimulation Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Low-frequency Gastric Electrical Stimulators

13.2.2. High-frequency Gastric Electrical Stimulators

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Gastroparesis

13.3.2. Obesity

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Clinics

13.4.2. Ambulatory Surgery Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Gastric Electrical Stimulation Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Low-frequency Gastric Electrical Stimulators

14.2.2. High-frequency Gastric Electrical Stimulators

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Gastroparesis

14.3.2. Obesity

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals & Clinics

14.4.2. Ambulatory Surgery Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. Changzhou Rishena Medical Device Co., Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Intrapace, Inc. (InCube Labs)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Medtronic plc

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. ReShape Lifesciences, Inc. (EnteroMedics, Inc.)

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

List of Tables

Table 01: Global Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 06: North America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: Europe Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Asia Pacific Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Latin America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Middle East & Africa Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East & Africa Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 03: Global Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 04: Global Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application 2021 and 2031

Figure 05: Global Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 06: Global Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 07: Global Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 08: Global Gastric Electrical Stimulation Systems Market Value Share Analysis, by Region, 2021 and 2031

Figure 09: Global Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Region, 2022–2031

Figure 10: North America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 12: North America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 13: North America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application, 2021 and 2031

Figure 14: North America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 15: North America Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: North America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: North America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Country, 2021 and 2031

Figure 18: North America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: Europe Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 21: Europe Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 22: Europe Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application, 2021 and 2031

Figure 23: Europe Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 24: Europe Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 25: Europe Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 26: Europe Gastric Electrical Stimulation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Asia Pacific Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 30: Asia Pacific Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 31: Asia Pacific Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application 2021 and 2031

Figure 32: Asia Pacific Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 33: Asia Pacific Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Asia Pacific Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Gastric Electrical Stimulation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 39: Latin America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 40: Latin America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application, 2021 and 2031

Figure 41: Latin America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 42: Latin America Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Latin America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Latin America Gastric Electrical Stimulation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Middle East & Africa Gastric Electrical Stimulation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Gastric Electrical Stimulation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 48: Middle East & Africa Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 49: Middle East & Africa Gastric Electrical Stimulation Systems Market Value Share Analysis, by Application, 2021 and 2031

Figure 50: Middle East & Africa Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Application, 2022–2031

Figure 51: Middle East & Africa Gastric Electrical Stimulation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Middle East & Africa Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Middle East & Africa Gastric Electrical Stimulation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Gastric Electrical Stimulation Systems Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Global Gastric Electrical Stimulation Systems Market Share Analysis, by Company, 2021