Analysts’ Viewpoint on Market Scenario

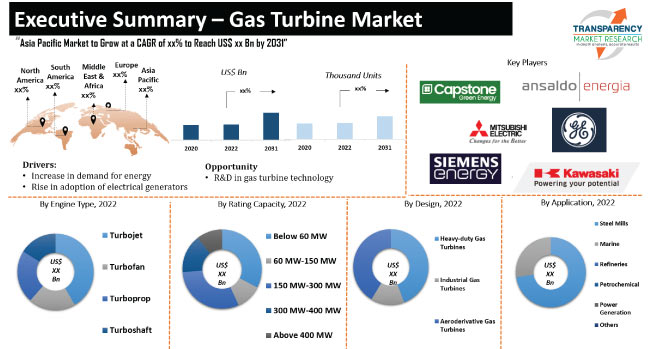

The market for gas turbines is expected to grow at a significant pace in the near future due to rise in energy consumption and surge in need for clean energy sources. Gas turbines are frequently employed in power generation, aviation, and other industrial applications. Growth in the industrial sector is also boosting the gas turbine market size.

Gas turbines are a popular choice for power generation due to their high efficiency and reliability, making them an attractive option for utilities looking to meet the surge in electricity consumption. Increase in demand for efficient turbines has prompted gas turbine manufacturers to invest heavily in R&D activities.

Gas turbine is a type of internal combustion engine that converts the energy from a fuel into mechanical energy, which can be used to generate electricity or to power other machinery. Gas turbines are commonly used in power plants to generate electricity, as well as in aircraft propulsion systems and other industrial applications.

Gas turbines operate by compressing air and mixing it with fuel, which is then ignited in a combustion chamber. The resulting high-pressure, high-temperature gases expand and flow through a turbine, which is connected to a generator to produce electricity. Gas turbines can operate on a variety of fuels, including natural gas, diesel fuel, and aviation fuel.

Rise in energy consumption is expected to boost the demand for gas turbines in the next few years. Gas turbines offer excellent dependability and efficiency for use in electricity production. Countries across the globe are emphasizing the modernization of their outdated electrical infrastructure, which is strengthening the demand for gas turbines.

Expansion in sectors including oil & gas, chemicals, and petrochemicals is also augmenting the gas turbine market progress. Gas turbines are cleaner alternatives to fossil fuel-based power production systems. These turbines are becoming more popular as a means of lowering greenhouse gas emissions.

Electrical generators are used to generate electricity in a wide range of applications, including residential, commercial, and industrial settings. Gas turbines are particularly well-suited for use in electrical generators due to their high efficiency, reliability, and ability to operate on a wide range of fuels. These turbines can provide a reliable source of power for electrical generators in a variety of settings, including emergency backup power for hospitals, data centers, and other critical facilities.

Gas turbines are available in a wide range of configurations to meet a range of power requirements, including those for power production and industrial applications as well as operating tanks, jets, and hellos. These turbines offer several advantages. A gas turbine's starting cost is low for a modestly sized unit. It takes up less room and may be operational in a matter of minutes as opposed to a steam unit, which takes many hours to start up. Consequently, medium-sized ‘peak load’ plants powered by gas turbine engines are frequently employed to run intermittently during brief periods of high power demand on an electric system. Therefore, surge in usage of electrical generators is projected to boost the gas turbine market growth in the near future.

According to the latest gas turbine market analysis, the turbofan engine type segment is expected to hold largest share from 2023 to 2031. Turbofan engines are used to power majority of commercial airliners due to their efficiency, dependability, and minimal noise output.

According to the latest gas turbine market trends, the power generation application segment is projected to dominate the industry during the forecast period. Gas turbines are frequently utilized in electricity generation due to their high efficiency, dependability, and flexibility for baseload and peaking power. These turbines are used in cogeneration, combined cycle, and natural gas-fired power plants. Gas turbines are also employed in the oil & gas sector to power pumps and compressors as well as in the maritime sector to power ships and other vessels.

According to the latest gas turbine market forecast, Asia Pacific is estimated to account for largest share from 2023 to 2031. Rapid industrialization and urbanization in countries, such as China and India, is driving market statistics in the region. Gas turbines have become a popular choice for power generation due to their efficiency, reliability, and flexibility.

The industry in Europe is anticipated to grow at a significant pace during the forecast period. Presence of a well-developed power sector and rise in adoption of renewable energy are boosting market dynamics in the region. Gas turbines are used extensively in several countries in Europe, particularly as backup power sources for intermittent renewable energy sources such as wind and solar.

The industry in North America is also projected to grow at a significant pace in the near future. The U.S. is one of the largest consumers of gas turbines in the world due to its large and diverse economy, high energy demand, and availability of abundant natural gas resources.

The global industry is consolidated, with a few large-scale and small-scale vendors controlling majority of the gas turbine market share. Ansaldo Energia, GE Power, Kawasaki Heavy Industries, Ltd., Siemens Energy AG, Capstone Green Energy Corporation, Mitsubishi Heavy Industries, Ltd., United Engine Corporation, Harbin Electric Corporation, OPRA Turbines, and Solar Turbines Incorporated are key players operating in the industry. Key vendors are continuously working on catering to consumer demands and launching new products that are energy efficient.

Major players have been profiled in the gas turbine market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 36.6 Bn |

|

Market Forecast Value in 2031 |

US$ 54.8 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, and price trend, brand analysis and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 36.6 Bn in 2022.

It is estimated to grow at a CAGR of 4.8% from 2023 to 2031.

It is projected to reach US$ 54.8 Bn by the end of 2031.

Increase in demand for energy and rise in adoption of electrical generators.

The turbofan engine type segment is expected to dominate during the forecast period.

Asia Pacific is anticipated to record highest CAGR during the forecast period.

Ansaldo Energia, GE Power, Kawasaki Heavy Industries, Ltd., Siemens Energy AG, Capstone Green Energy Corporation, Mitsubishi Heavy Industries, Ltd., United Engine Corporation, Harbin Electric Corporation, OPRA Turbines, and Solar Turbines Incorporated.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Value Chain Analysis

5.6. Technology Overview

5.7. Regulatory Framework Analysis

5.8. Porter’s Five Forces Analysis

5.9. Industry SWOT Analysis

5.10. COVID-19 Impact Analysis

5.11. Global Gas Turbine Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Revenue Projection (US$ Bn)

5.11.2. Market Revenue Projection (Thousand Units)

6. Global Gas Turbine Market Analysis and Forecast, by Engine Type

6.1. Global Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

6.1.1. Turbojet

6.1.2. Turbofan

6.1.3. Turboprop

6.1.4. Turboshaft

6.2. Incremental Opportunity, by Engine Type

7. Global Gas Turbine Market Analysis and Forecast, by Rating Capacity

7.1. Global Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

7.1.1. Below 60 MW

7.1.2. 60 MW-150 MW

7.1.3. 150 MW-300 MW

7.1.4. 300 MW-400 MW

7.1.5. Above 400 MW

7.2. Incremental Opportunity, by Rating Capacity

8. Global Gas Turbine Market Analysis and Forecast, by Design

8.1. Global Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

8.1.1. Heavy-duty Gas Turbines

8.1.2. Industrial Gas Turbines

8.1.3. Aeroderivative Gas Turbines

8.2. Incremental Opportunity, by Design

9. Global Gas Turbine Market Analysis and Forecast, by Application

9.1. Global Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

9.1.1. Steel Mills

9.1.2. Marine

9.1.3. Refineries

9.1.4. Petrochemical

9.1.5. Power Generation

9.1.6. Others (Aircraft, Spacecraft, etc.)

9.2. Incremental Opportunity, by Application

10. Global Gas Turbine Market Analysis and Forecast, by Region

10.1. Global Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. Latin America

10.2. Incremental Opportunity, by Region

11. North America Gas Turbine Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trends Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price ($)

11.4. Key Supplier Analysis

11.5. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

11.5.1. Turbojet

11.5.2. Turbofan

11.5.3. Turboprop

11.5.4. Turboshaft

11.6. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

11.6.1. Below 60 MW

11.6.2. 60 MW-150 MW

11.6.3. 150 MW-300 MW

11.6.4. 300 MW-400 MW

11.6.5. Above 400 MW

11.7. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

11.7.1. Heavy-duty Gas Turbines

11.7.2. Industrial Gas Turbines

11.7.3. Aeroderivative Gas Turbines

11.8. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

11.8.1. Steel Mills

11.8.2. Marine

11.8.3. Refineries

11.8.4. Petrochemical

11.8.5. Power Generation

11.8.6. Others (Aircraft, Spacecraft, etc.)

11.9. Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Country, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Gas Turbine Market Analysis and Forecast

12.1. Key Trends Analysis

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price ($)

12.3. Key Supplier Analysis

12.4. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

12.4.1. Turbojet

12.4.2. Turbofan

12.4.3. Turboprop

12.4.4. Turboshaft

12.5. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

12.5.1. Below 60 MW

12.5.2. 60 MW-150 MW

12.5.3. 150 MW-300 MW

12.5.4. 300 MW-400 MW

12.5.5. Above 400 MW

12.6. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

12.6.1. Heavy-duty Gas Turbines

12.6.2. Industrial Gas Turbines

12.6.3. Aeroderivative Gas Turbines

12.7. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

12.7.1. Steel Mills

12.7.2. Marine

12.7.3. Refineries

12.7.4. Petrochemical

12.7.5. Power Generation

12.7.6. Others (Aircraft, Spacecraft, etc.)

12.8. Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Country, 2017 - 2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Asia Pacific Gas Turbine Market Analysis and Forecast

13.1. Key Trends Analysis

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price ($)

13.3. Key Supplier Analysis

13.4. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

13.4.1. Turbojet

13.4.2. Turbofan

13.4.3. Turboprop

13.4.4. Turboshaft

13.5. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

13.5.1. Below 60 MW

13.5.2. 60 MW-150 MW

13.5.3. 150 MW-300 MW

13.5.4. 300 MW-400 MW

13.5.5. Above 400 MW

13.6. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

13.6.1. Heavy-duty Gas Turbines

13.6.2. Industrial Gas Turbines

13.6.3. Aeroderivative Gas Turbines

13.7. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

13.7.1. Steel Mills

13.7.2. Marine

13.7.3. Refineries

13.7.4. Petrochemical

13.7.5. Power Generation

13.7.6. Others (Aircraft, Spacecraft, etc.)

13.8. Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Country, 2017 - 2031

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & Africa Gas Turbine Market Analysis and Forecast

14.1. Key Trends Analysis

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price ($)

14.3. Key Supplier Analysis

14.4. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

14.4.1. Turbojet

14.4.2. Turbofan

14.4.3. Turboprop

14.4.4. Turboshaft

14.5. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

14.5.1. Below 60 MW

14.5.2. 60 MW-150 MW

14.5.3. 150 MW-300 MW

14.5.4. 300 MW-400 MW

14.5.5. Above 400 MW

14.6. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

14.6.1. Heavy-duty Gas Turbines

14.6.2. Industrial Gas Turbines

14.6.3. Aeroderivative Gas Turbines

14.7. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

14.7.1. Steel Mills

14.7.2. Marine

14.7.3. Refineries

14.7.4. Petrochemical

14.7.5. Power Generation

14.7.6. Others (Aircraft, Spacecraft, etc.)

14.8. Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Country, 2017 - 2031

14.8.1. South Africa

14.8.2. Rest of Middle East & Africa

14.9. Incremental Opportunity Analysis

15. South America Gas Turbine Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price ($)

15.4. Key Supplier Analysis

15.5. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Engine Type, 2017 - 2031

15.5.1. Turbojet

15.5.2. Turbofan

15.5.3. Turboprop

15.5.4. Turboshaft

15.6. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Rating Capacity, 2017 - 2031

15.6.1. Below 60 MW

15.6.2. 60 MW-150 MW

15.6.3. 150 MW-300 MW

15.6.4. 300 MW-400 MW

15.6.5. Above 400 MW

15.7. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Design, 2017 - 2031

15.7.1. Heavy-duty Gas Turbines

15.7.2. Industrial Gas Turbines

15.7.3. Aeroderivative Gas Turbines

15.8. Gas Turbine Market Size (US$ Bn & Thousand Units) Forecast, by Application, 2017 - 2031

15.8.1. Steel Mills

15.8.2. Marine

15.8.3. Refineries

15.8.4. Petrochemical

15.8.5. Power Generation

15.8.6. Others (Aircraft, Spacecraft, etc.)

15.9. Gas Turbine Market Size (Thousand Units & US$ Bn) Forecast, by Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%) - 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Ansaldo Energia

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. GE Power

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Kawasaki Heavy Industries, Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Siemens Energy AG

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Capstone Green Energy Corporation

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Mitsubishi Heavy Industries, Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. United Engine Corporation

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Harbin Electric

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. OPRA Turbines

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Solar Turbines Incorporated

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Engine Type

17.1.2. By Rating Capacity

17.1.3. By Design

17.1.4. By Application

17.1.5. By Region

17.2. Market Risks

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 2: Global Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 3: Global Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 4: Global Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 5: Global Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 6: Global Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 7: Global Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 8: Global Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 9: Global Gas Turbine Market Value, by Region, US$ Bn, 2017-2031

Table 10: Global Gas Turbine Market Volume, by Region, Thousand Units, 2017-2031

Table 11: North America Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 12: North America Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 13: North America Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 14: North America Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 15: North America Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 16: North America Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 17: North America Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 18: North America Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 19: North America Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Table 20: North America Gas Turbine Market Volume, by Country, Thousand Units, 2017-2031

Table 21: Europe Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 22: Europe Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 23: Europe Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 24: Europe Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 25: Europe Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 26: Europe Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 27: Europe Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 28: Europe Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 29: Europe Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Table 30: Europe Gas Turbine Market Volume, by Country, Thousand Units, 2017-2031

Table 31: Asia Pacific Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 32: Asia Pacific Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 33: Asia Pacific Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 34: Asia Pacific Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 35: Asia Pacific Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 36: Asia Pacific Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 37: Asia Pacific Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 38: Asia Pacific Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 39: Asia Pacific Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Table 40: Asia Pacific Gas Turbine Market Volume, by Country, Thousand Units, 2017-2031

Table 41: Middle East & Africa Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 42: Middle East & Africa Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 43: Middle East & Africa Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 44: Middle East & Africa Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 45: Middle East & Africa Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 46: Middle East & Africa Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 47: Middle East & Africa Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 48: Middle East & Africa Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 49: Middle East & Africa Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Table 50: Middle East & Africa Gas Turbine Market Volume, by Country, Thousand Units, 2017-2031

Table 51: South America Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Table 52: South America Gas Turbine Market Volume, by Engine Type, Thousand Units, 2017-2031

Table 53: South America Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Table 54: South America Gas Turbine Market Volume, by Rating Capacity, Thousand Units, 2017-2031

Table 55: South America Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Table 56: South America Gas Turbine Market Volume, by Design, Thousand Units, 2017-2031

Table 57: South America Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Table 58: South America Gas Turbine Market Volume, by Application, Thousand Units, 2017-2031

Table 59: South America Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Table 60: South America Gas Turbine Market Volume, by Country, Thousand Units, 2017-2031

List of Figures

Figure 1: Global Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 2: Global Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 3: Global Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 4: Global Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 5: Global Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 6: Global Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 7: Global Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 8: Global Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 9: Global Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 10: Global Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 11: Global Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 12: Global Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 13: Global Gas Turbine Market Value, by Region, US$ Bn, 2017-2031

Figure 14: Global Gas Turbine Market Volume, by Region, Thousand Units,2017-2031

Figure 15: Global Gas Turbine Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 17: North America Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 18: North America Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 19: North America Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 20: North America Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 21: North America Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 22: North America Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 23: North America Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 24: North America Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 25: North America Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 26: North America Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 27: North America Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 28: North America Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Figure 29: North America Gas Turbine Market Volume, by Country, Thousand Units,2017-2031

Figure 30: North America Gas Turbine Market Incremental Opportunity, by Country,2021-2031

Figure 31: Europe Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 32: Europe Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 33: Europe Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 34: Europe Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 35: Europe Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 36: Europe Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 37: Europe Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 38: Europe Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 39: Europe Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 40: Europe Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 41: Europe Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 42: Europe Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 43: Europe Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Figure 44: Europe Gas Turbine Market Volume, by Country, Thousand Units,2017-2031

Figure 45: Europe Gas Turbine Market Incremental Opportunity, by Country,2021-2031

Figure 46: Asia Pacific Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 47: Asia Pacific Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 48: Asia Pacific Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 49: Asia Pacific Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 50: Asia Pacific Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 51: Asia Pacific Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 52: Asia Pacific Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 53: Asia Pacific Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 54: Asia Pacific Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 55: Asia Pacific Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 56: Asia Pacific Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 57: Asia Pacific Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 58: Asia Pacific Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Figure 59: Asia Pacific Gas Turbine Market Volume, by Country, Thousand Units,2017-2031

Figure 60: Asia Pacific Gas Turbine Market Incremental Opportunity, by Country,2021-2031

Figure 61: Middle East & Africa Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 62: Middle East & Africa Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 63: Middle East & Africa Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 64: Middle East & Africa Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 65: Middle East & Africa Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 66: Middle East & Africa Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 67: Middle East & Africa Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 68: Middle East & Africa Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 69: Middle East & Africa Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 70: Middle East & Africa Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 71: Middle East & Africa Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 72: Middle East & Africa Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 73: Middle East & Africa Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Figure 74: Middle East & Africa Gas Turbine Market Volume, by Country, Thousand Units,2017-2031

Figure 75: Middle East & Africa Gas Turbine Market Incremental Opportunity, by Country,2021-2031

Figure 76: South America Gas Turbine Market Value, by Engine Type, US$ Bn, 2017-2031

Figure 77: South America Gas Turbine Market Volume, by Engine Type, Thousand Units,2017-2031

Figure 78: South America Gas Turbine Market Incremental Opportunity, by Engine Type, 2021-2031

Figure 79: South America Gas Turbine Market Value, by Rating Capacity, US$ Bn, 2017-2031

Figure 80: South America Gas Turbine Market Volume, by Rating Capacity, Thousand Units,2017-2031

Figure 81: South America Gas Turbine Market Incremental Opportunity, by Rating Capacity, 2021-2031

Figure 82: South America Gas Turbine Market Value, by Design, US$ Bn, 2017-2031

Figure 83: South America Gas Turbine Market Volume, by Design, Thousand Units,2017-2031

Figure 84: South America Gas Turbine Market Incremental Opportunity, by Design, 2021-2031

Figure 85: South America Gas Turbine Market Value, by Application, US$ Bn, 2017-2031

Figure 86: South America Gas Turbine Market Volume, by Application, Thousand Units,2017-2031

Figure 87: South America Gas Turbine Market Incremental Opportunity, by Application, 2021-2031

Figure 88: South America Gas Turbine Market Value, by Country, US$ Bn, 2017-2031

Figure 89: South America Gas Turbine Market Volume, by Country, Thousand Units,2017-2031

Figure 90: South America Gas Turbine Market Incremental Opportunity, by Country,2021-2031