Analysts’ Viewpoint on Gas Meter Market Scenario

Technology trends such as smart infrastructure, IoT ecosystems, Industry 4.0, and digitization; energy-efficient environment; and sustainable development goals are significantly contributing to the growth of the gas meter market. Emphasis on the shift from coal to gas and increase in digitization of gas networks as part of technology roadmap are key factors that are estimated to boost the gas meter market during the forecast period. Emerging technologies such as cellular IoT (NB-IoT) and Low Power Wide Area (LPWA) are expected to overhaul the traditional usage of gas meters, thus driving the gas meter market in the near future.

Gas meter is a device that records gas consumption in households and businesses. This information is relayed to energy retailers. Gas meters are used at residential, commercial, and industrial buildings that consume fuel gas supplied by a gas utility. Introduction of novel technologies and innovations in automation, precision, and electronics industry verticals are boosting the development of gas meter products, thereby creating significant opportunities for manufacturers of gas meters.

Installation of gas meter assists in reducing the loss of gas during transmission and distribution. Smart meters and commercial gas meters are being increasingly deployed in households and commercial areas. Smart gas meters rely on low-voltage battery power to extend operational life and avoid ignition hazards. This is expected to propel the gas meter market. Increase in demand for energy-efficient technologies such as IoT (internet of things) and smart infrastructure is estimated to drive the demand for smart meters. Implementation of IoT has gradually moved from mechanization to informatization. It facilitates the process of meter reading. It also provides web interface between consumers and service providers. Thus, replacement of old conventional meters with new smart meters is likely to drive the market.

Ultrasonic gas meters guarantee long-term stability and accuracy. These meters do not require periodic maintenance. Ultrasonic gas meter and gas meter modules possess several benefits such as lack of pressure drop, no moving parts, ability to measure bidirectional flow, and reliable performance. They are highly accurate, repeatable, and can tolerate extreme temperatures.

Ultrasonic gas meters are also self-diagnosing and can determine measurement shifts once calibrated. The clamp-on model also offers flexibility and easy installation without penetrating the pipe. These features make ultrasonic gas meters highly preferable for industrial applications such as complex piping and oil & gas distribution where magnetic flow meters have limitations. This is expected to boost the demand for ultrasonic gas meter, thereby propelling the gas meter market.

North America is expected to hold prominent share of the global gas meter market during the forecast period. This can be primarily ascribed to the increase in demand for gas meters among industrial as well as residential consumers; and rise in demand and consumption of natural gas in the region. Gas meters and variable area flow meters are gaining popularity in Asia Pacific, especially in China and India, due to the increase in demand for gas and rise in investments by gas utility companies in installation of gas meters in the region. Increase in demand for continuous emission monitoring systems (CEMS) in countries with higher air pollution index is another factor that is driving the gas meter market in Asia Pacific. For instance, in April 2018, Tata Communications, a telecommunication solution and services provider, announced that it would be working with Mahanagar Gas, a domestic gas utility company, to deploy around 5,000 gas meters in Mumbai, India.

Middle East & Africa is witnessing a steady increase in investments in the energy sector, including the oil & gas sector. This is likely to offer lucrative opportunities for manufacturers of gas meters. Thus, deployment of gas meters is expected to increase significantly in industrial and residential sectors in the region. The gas meter market in Asia Pacific and Europe is expected to grow at a significant rate during the forecast period due to the increase in demand for gas meters in oil & gas and food & beverages industries in these regions. China, India, Italy, Spain, Germany, and France are expected to dominate the gas meter market in these regions.

The gas meter market is partially fragmented, with a number of players catering to the global demand. Companies are increasingly investing in research & development activities to introduce new technologies in the market. Prominent players operating in the global gas meter market are ABB Ltd, Itron Inc., EDMI Ltd., Fluenta, Genesis Gas Solutions (P) Ltd., IoT Water Group (Arson Metering), Apator SA., Badger Meter, Inc., Landis+Gyr Corporation, Honeywell International Inc., ZENNER International GmbH & Co. KG, Emerson Electric Co., and Endress+Hauser.

Each of these players has been profiled in the gas meter market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.30 Bn |

|

Market Forecast Value in 2031 |

US$ 6.17 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

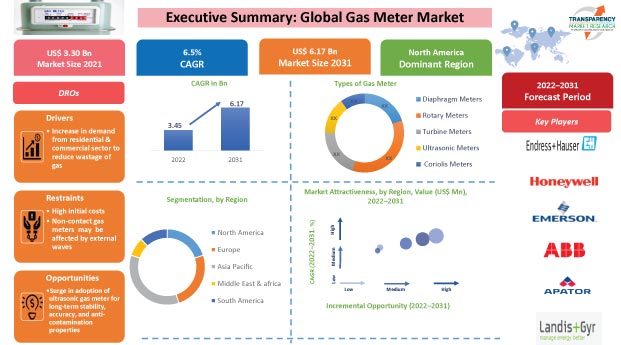

The gas meter market stood at US$ 3.30 Bn in 2021.

The gas meter is expected to expand at a CAGR of 6.5% from 2022 to 2031.

Gas meter market is likely to reach US$ 6.17 Bn in 2031.

Use of natural gas in industries across densely populated countries such as India and China; and implementation of regulatory norms for households by governments of various countries to reduce wastage and avoid theft of gas

North America is more lucrative region in gas meter market.

Prominent players in the gas meter market are ABB Ltd, Itron Inc., EDMI Ltd., Fluenta, Genesis Gas Solutions (P) Ltd., IoT Water Group (Arson Metering), Apator SA., Badger Meter, Inc., Landis+Gyr Corporation, Honeywell International Inc., ZENNER International GmbH & Co. KG, Emerson Electric Co., and Endress+Hauser.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Gas Meter Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Process Instrument Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Gas Meter Market Analysis, by Type

5.1. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Diaphragm Meters

5.1.2. Rotary Meters

5.1.3. Turbine Meters

5.1.4. Ultrasonic Meters

5.1.5. Coriolis Meters

5.2. Market Attractiveness Analysis, by Type

6. Global Gas Meter Market Analysis, by Application

6.1. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Residential

6.1.2. Commercial

6.1.3. Industrial

6.2. Market Attractiveness Analysis, by Application

7. Global Gas Meter Market Analysis, by Technology

7.1. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

7.1.1. Standard Meters

7.1.2. Smart Meters

7.2. Market Attractiveness Analysis, by Technology

8. Global Gas Meter Market Analysis and Forecast, by Region

8.1. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Gas Meter Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.3.1. Diaphragm Meters

9.3.2. Rotary Meters

9.3.3. Turbine Meters

9.3.4. Ultrasonic Meters

9.3.5. Coriolis Meters

9.4. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Residential

9.4.2. Commercial

9.4.3. Industrial

9.5. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

9.5.1. Standard Meters

9.5.2. Smart Meters

9.6. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By Technology

9.7.4. By Country and Sub-region

10. Europe Gas Meter Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Diaphragm Meters

10.3.2. Rotary Meters

10.3.3. Turbine Meters

10.3.4. Ultrasonic Meters

10.3.5. Coriolis Meters

10.4. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Residential

10.4.2. Commercial

10.4.3. Industrial

10.5. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

10.5.1. Standard Meters

10.5.2. Smart Meters

10.6. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By Technology

10.7.4. By Country and Sub-region

11. Asia Pacific Gas Meter Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Diaphragm Meters

11.3.2. Rotary Meters

11.3.3. Turbine Meters

11.3.4. Ultrasonic Meters

11.3.5. Coriolis Meters

11.4. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Residential

11.4.2. Commercial

11.4.3. Industrial

11.5. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

11.5.1. Standard Meters

11.5.2. Smart Meters

11.6. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By Technology

11.7.4. By Country and Sub-region

12. Middle East & Africa Gas Meter Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Diaphragm Meters

12.3.2. Rotary Meters

12.3.3. Turbine Meters

12.3.4. Ultrasonic Meters

12.3.5. Coriolis Meters

12.4. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Residential

12.4.2. Commercial

12.4.3. Industrial

12.5. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

12.5.1. Standard Meters

12.5.2. Smart Meters

12.6. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By Technology

12.7.4. By Country and Sub-region

13. South America Gas Meter Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.3.1. Diaphragm Meters

13.3.2. Rotary Meters

13.3.3. Turbine Meters

13.3.4. Ultrasonic Meters

13.3.5. Coriolis Meters

13.4. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Residential

13.4.2. Commercial

13.4.3. Industrial

13.5. Gas Meter Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

13.5.1. Standard Meters

13.5.2. Smart Meters

13.6. Gas Meter Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By Technology

13.8. By Country and Sub-region

14. Competition Assessment

14.1. Global Gas Meter Market Competition Matrix - a Dashboard View

14.1.1. Global Gas Meter Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Itron Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. EDMI Ltd.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Genesis Gas Solutions (P) Ltd.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. IoT Water Group (Arson Metering)

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Apator SA.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Badger Meter, Inc.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Landis+Gyr Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Honeywell International Inc.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. ZENNER International GmbH & Co. KG

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Emerson Electric Co.

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Endress+Hauser

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Fluenta

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Application

16.1.3. By Technology

16.1.4. By Country and Sub-region

List of Tables

Table 01: Global Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 02: Global Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 03: Global Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 04: Global Gas Meter Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 05: Global Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 06: Global Gas Meter Market Size & Forecast, by Technology, Volume (US$ Mn), 2017‒2031

Table 07: Global Gas Meter Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 08: Global Gas Meter Market Size & Forecast, by Region, Volume (Million Units), 2017‒2031

Table 09: North America Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 10: North America Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 11: North America Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 12: North America Gas Meter Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 13: North America Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 14: North America Gas Meter Market Size & Forecast, by Technology, Volume (US$ Mn), 2017‒2031

Table 15: North America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 16: North America Gas Meter Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 17: Europe Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 18: Europe Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 19: Europe Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 20: Europe Gas Meter Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 21: Europe Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 22: Europe Gas Meter Market Size & Forecast, by Technology, Volume (US$ Mn), 2017‒2031

Table 23: Europe Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 24: Europe Gas Meter Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 25: Asia Pacific Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 26: Asia Pacific Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 27: Asia Pacific Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 28: Asia Pacific Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 29: Asia Pacific Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 30: Asia Pacific Gas Meter Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 31: Middle East & Africa Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 32: Middle East & Africa Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 33: Middle East & Africa Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 34: Middle East & Africa Gas Meter Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 35: Middle East & Africa Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 36: Middle East & Africa Gas Meter Market Size & Forecast, by Technology, Volume (US$ Mn), 2017‒2031

Table 37: Middle East & Africa Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 38: Middle East & Africa Gas Meter Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 39: South America Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 40: South America Gas Meter Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 41: South America Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 42: South America Gas Meter Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 43: South America Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Table 44: South America Gas Meter Market Size & Forecast, by Technology, Volume (US$ Mn), 2017‒2031

Table 45: South America Gas Meter Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 46: South America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 47: South America Gas Meter Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

List of Figures

Figure 01: Global Gas Meter Price Trend Analysis (Average Price, US$)

Figure 02: Global Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 03: Global Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 04: Global Gas Meter Market Volume (Million Units), 2017‒2031

Figure 05: Global Gas Meter Market Volume (Million Units), 2017‒2031

Figure 06: Global Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 08: Global Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 09: Global Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 10: Global Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 11: Global Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 12: Global Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 13: Global Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 14: Global Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 15: Global Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 16: Global Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 17: Global Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 18: North America Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 19: North America Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 20: North America Gas Meter Market Volume (Million Units), 2017‒2031

Figure 21: North America Gas Meter Market Volume (Million Units), 2017‒2031

Figure 22: North America Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 23: North America Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 24: North America Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 25: North America Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 26: North America Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 27: North America Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 28: North America Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 29: North America Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 30: North America Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 31: North America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 32: North America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 33: North America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 34: Europe Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 35: Europe Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 36: Europe Gas Meter Market Volume (Million Units), 2017‒2031

Figure 37: Europe Gas Meter Market Volume (Million Units), 2017‒2031

Figure 38: Europe Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 39: Europe Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 40: Europe Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 41: Europe Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 42: Europe Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 43: Europe Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 44: Europe Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 45: Europe Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 46: Europe Gas Meter Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 47: Europe Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 48: Europe Gas Meter Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 49: Europe Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 50: Europe Gas Meter Market Share Analysis, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 51: Europe Gas Meter Market Share Analysis, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 52: Asia Pacific Gas Meter Market Share Analysis, by Country & Region, Value (US$ Bn), 2021‒2031

Figure 53: Asia Pacific Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 54: Asia Pacific Gas Meter Market Volume (Million Units), 2017‒2031

Figure 55: Asia Pacific Gas Meter Market Volume (Million Units), 2017‒2031

Figure 56: Asia Pacific Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 57: Asia Pacific Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 59: Asia Pacific Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 60: Asia Pacific Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 61: Asia Pacific Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 62: Asia Pacific Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 63: Asia Pacific Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 64: Asia Pacific Gas Meter Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 65: Asia Pacific Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 66: Asia Pacific Gas Meter Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 67: Asia Pacific Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 68: Middle East & Africa Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 69: Middle East & Africa Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 70: Middle East & Africa Gas Meter Market Volume (Million Units), 2017‒2031

Figure 71: Middle East & Africa Gas Meter Market Volume (Million Units), 2017‒2031

Figure 72: Middle East & Africa Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 73: Middle East & Africa Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 74: Middle East & Africa Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 75: Middle East & Africa Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 76: Middle East & Africa Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 77: Middle East & Africa Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 78: Middle East & Africa Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 79: Middle East & Africa Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 80: Middle East & Africa Gas Meter Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 81: Middle East & Africa Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 82: Middle East & Africa Gas Meter Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 83: Middle East & Africa Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 84: South America Gas Meter Market Share Analysis, by Region, Value (US$ Bn), 2021‒2031

Figure 85: South America Gas Meter Market Value (US$ Bn), 2017‒2031

Figure 86: South America Gas Meter Market Volume (Million Units), 2017‒2031

Figure 87: South America Gas Meter Market Volume (Million Units), 2017‒2031

Figure 88: South America Gas Meter Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 89: South America Gas Meter Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 90: South America Gas Meter Market Share Analysis, by Type, Value (US$ Bn), 2021‒2031

Figure 91: South America Gas Meter Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 92: South America Gas Meter Market Attractiveness, by Application, Value (US$ Bn), 2021‒2031

Figure 93: South America Gas Meter Market Share Analysis, by Application, Value (US$ Bn), 2021‒2031

Figure 94: South America Gas Meter Market Share Analysis, by Technology, Value (US$ Bn), 2021‒2031

Figure 95: South America Gas Meter Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 96: South America Gas Meter Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 97: South America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 98: South America Gas Meter Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 99: South America Gas Meter Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 100: Global Gas Meter Market Share Analysis, by Company