Analysts’ Viewpoint

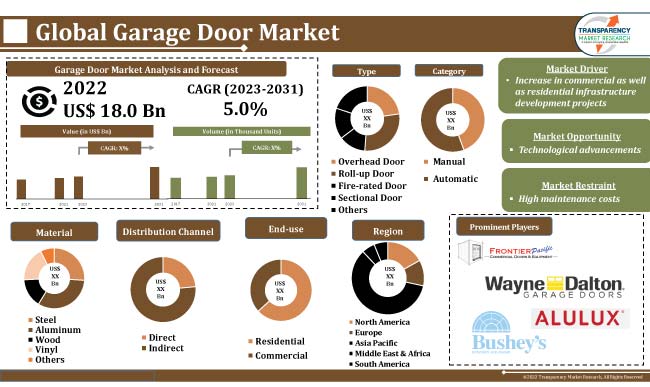

Increase in construction activities across the globe along with rise in popularity of smart homes is significantly driving the global garage door market. Moreover, rise in number of infrastructure development projects and increase in awareness about safety and security of homes and commercial buildings are fueling the garage door market demand. Demand for garage doors is increasing in residential as well as commercial spaces.

Furthermore, key suppliers are increasing their R&D spending and focusing on the development of technologically upgraded garage doors with sustainable materials in order to supply high-value products to end-users. Surge in demand for sustainable and eco-friendly products is further creating value-grab business opportunities in garage door market. However, high cost of maintenance is a key factor that is projected to hamper the garage door market development in the next few years.

Garage doors are used in both residential and commercial spaces to provide protection from theft, climatic conditions, fire, etc. Garage doors are available in different types, such as overhead doors, roll-up doors, sectional doors, and sliding doors, and are also constructed using different materials, depending on end-users.

Some of the common materials used in the construction of garage doors are wood, steel, and aluminum. Garage doors can be manual or automatic. Increase in residential and commercial construction activities across the globe is augmenting market statistics.

Increase in investment in modern home improvement projects and rise in number of commercial infrastructure development projects are fueling market progress. In commercial space, garage doors can be used in hospitals and clinics, warehouses and distribution centers, etc.

Construction activities are increasing due to the rapid growth in population and industrialization in several regions. The idea of smart homes is gaining immense popularity in the global market. This has led to a rise in demand for garage doors, specifically automated garage doors. Automated garage doors are convenient to use and consumers can operate them from a distance or by simple buttons instead of doing it manually.

High-income consumer groups in developed countries, such as the U.K. and the U.S., are more likely to opt for installation of automatic garage doors in the near future.

Rise in environmental issues is fueling the demand for eco-friendly products in order to reduce the carbon footprint. This is likely to create new growth opportunities for market participants.

Furthermore, key manufacturers in the global market have started to adopt sustainable materials to manufacture garage doors. This is anticipated to propel the garage door industry growth during the forecast period.

Based on end-use, the global market has been classified into residential and commercial. According to the latest garage door market forecast, the residential end-use segment is projected to account for major share of the global industry in the near future. This can be ascribed to the rise in residential construction activities in several regions.

Residential construction projects are increasing in the U.S., thereby fueling the demand for garage doors. Furthermore, demand for garage doors is estimated to increase in the commercial sector during the forecast period.

North America is anticipated to dominate the global market during the forecast period. Demand for garage doors in North America is expected to rise in the near future.

The U.S. and Canada are the prominent markets for garage doors. Moreover, key players in North America are working toward product innovation and development, which is likely to fuel garage door market growth in the next few years.

The garage door market size in Asia Pacific is likely to increase during the forecast period, owing to growth in commercial as well as residential infrastructure development projects in the region.

The global industry is fragmented, with the presence of several local and international players that control majority of the garage door market share.

Manufacturers are continuously launching new products to maximize their revenues. Leading players in the garage door industry are including more modern design features, such as flexibility, ease of installation, and transportation options in order to stay competitive and fulfill the needs of customers.

Frontier Pacific, Integrity Overhead Doors, Wayne Dalton, Raynor, Safe-Way Door, Martin Door, Windsor Door, Alulux GmbH, First United Door Technologies, Novoferm GmbH, General Doors Corporation, and DoorHan Group Of Companies are some of the prominent players in the global market.

Key players have been profiled in the global garage door market research report based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 (Base Year) |

US$ 18.0 Bn |

|

Market Forecast Value in 2031 |

US$ 27.6 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 18.0 Bn in 2022

It is estimated to expand at a CAGR of 5.0% during 2023-2031

Rise in number of infrastructure development projects and increase in sale of vehicles

The overhead doors type segment is likely to account for major share during the forecast period

North America is likely to be the most lucrative region in the next few years

Frontier Pacific, Integrity Overhead Doors, Wayne Dalton, Raynor, Safe-Way Door, Martin Door, Windsor Door, Alulux GmbH, First United Door Technologies, Novoferm GmbH, DoorHan Group Of Companies, and General Doors Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overview of Doors Market

5.4.2. Overview of Warehouse Industry

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Raw Material Analysis

5.9. Standards and Regulations

5.10. Global Garage Door Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Garage Door Market Analysis and Forecast, by Type

6.1. Global Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Overhead Door

6.1.2. Roll-up Door

6.1.3. Fire-rated Door

6.1.4. Sectional Door

6.1.5. Others

6.2. Incremental Opportunity, by Type

7. Global Garage Door Market Analysis and Forecast, by Category

7.1. Global Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

7.1.1. Automatic

7.1.2. Manual

8. Global Garage Door Market Analysis and Forecast, by Material

8.1. Global Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

8.1.1. Steel

8.1.2. Aluminum

8.1.3. Wood

8.1.4. Vinyl

8.1.5. Others

8.2. Incremental Opportunity, by Material

9. Global Garage Door Market Analysis and Forecast, by End-use

9.1. Global Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

9.1.1. Residential

9.1.2. Commercial

9.1.2.1. Warehouse and Distribution Center

9.1.2.2. Hypermarket and Mall

9.1.2.3. School and College

9.1.2.4. Hotel & Restaurant

9.1.2.5. Auto Dealer and Service Center

9.1.2.6. Hospital and Clinic

9.1.2.7. Office and Commercial Complex

9.1.2.8. Others

9.2. Incremental Opportunity, by End-use

10. Global Garage Door Market Analysis and Forecast, by Distribution Channel

10.1. Global Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

10.1.1. Direct

10.1.2. Indirect

10.2. Incremental Opportunity, by Distribution Channel

11. Global Garage Door Market Analysis and Forecast, by Region

11.1. Global Garage Door Market Size (US$ Bn & Thousand Units), by Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East and Africa

11.1.5. South America

11.2. Global Incremental Opportunity, by Region

12. North America Garage Door Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Type

12.1.2. By Material

12.1.3. By Category

12.1.4. By End-use

12.1.5. By Distribution Channel

12.1.6. By Country

12.2. COVID-19 Impact Analysis

12.3. Key Trend Impact Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price ($)

12.5. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

12.5.1. Overhead Door

12.5.2. Roll-up Door

12.5.3. Fire-rated Door

12.5.4. Sectional Door

12.5.5. Others

12.6. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

12.6.1. Automatic

12.6.2. Manual

12.7. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

12.7.1. Steel

12.7.2. Aluminum

12.7.3. Wood

12.7.4. Vinyl

12.7.5. Others

12.8. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

12.8.1. Residential

12.8.2. Commercial

12.8.2.1. Warehouse and Distribution Center

12.8.2.2. Hypermarket and Mall

12.8.2.3. School and College

12.8.2.4. Hotel & Restaurant

12.8.2.5. Auto Dealer and Service Center

12.8.2.6. Hospital and Clinic

12.8.2.7. Office and Commercial Complex

12.8.2.8. Others

12.9. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Direct

12.9.2. Indirect

12.10. Garage Door Market Size (US$ Bn & Thousand Units), by Country, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Garage Door Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Type

13.1.2. By Material

13.1.3. By Category

13.1.4. By End-use

13.1.5. By Distribution Channel

13.1.6. By Country

13.2. COVID-19 Impact Analysis

13.3. Key Trend Impact Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price ($)

13.5. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

13.5.1. Overhead Door

13.5.2. Roll-up Door

13.5.3. Fire-rated Door

13.5.4. Sectional Door

13.5.5. Others

13.6. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

13.6.1. Automatic

13.6.2. Manual

13.7. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

13.7.1. Steel

13.7.2. Aluminum

13.7.3. Wood

13.7.4. Vinyl

13.7.5. Others

13.8. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

13.8.1. Residential

13.8.2. Commercial

13.8.2.1. Warehouse and Distribution Center

13.8.2.2. Hypermarket and Mall

13.8.2.3. School and College

13.8.2.4. Hotel & Restaurant

13.8.2.5. Auto Dealer and Service Center

13.8.2.6. Hospital and Clinic

13.8.2.7. Office and Commercial Complex

13.8.2.8. Others

13.9. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Direct

13.9.2. Indirect

13.10. Garage Door Market Size (US$ Bn & Thousand Units), by Country, 2017 - 2031

13.10.1. Germany

13.10.2. U.K.

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Garage Door Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Type

14.1.2. By Material

14.1.3. By Category

14.1.4. By End-use

14.1.5. By Distribution Channel

14.1.6. By Country

14.2. COVID-19 Impact Analysis

14.3. Key Trend Impact Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price ($)

14.5. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

14.5.1. Overhead Door

14.5.2. Roll-up Door

14.5.3. Fire-rated Door

14.5.4. Sectional Door

14.5.5. Others

14.6. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

14.6.1. Automatic

14.6.2. Manual

14.7. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

14.7.1. Steel

14.7.2. Aluminum

14.7.3. Wood

14.7.4. Vinyl

14.7.5. Others

14.8. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

14.8.1. Residential

14.8.2. Commercial

14.8.2.1. Warehouse and Distribution Center

14.8.2.2. Hypermarket and Mall

14.8.2.3. School and College

14.8.2.4. Hotel & Restaurant

14.8.2.5. Auto Dealer and Service Center

14.8.2.6. Hospital and Clinic

14.8.2.7. Office and Commercial Complex

14.8.2.8. Others

14.9. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.9.1. Direct

14.9.2. Indirect

14.10. Garage Door Market Size (US$ Bn & Thousand Units), by Country, 2017 - 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Garage Door Market Analysis and Forecast

15.1. Regional Snapshot

15.1.1. By Type

15.1.2. By Material

15.1.3. By Category

15.1.4. By End-use

15.1.5. By Distribution Channel

15.1.6. By Country

15.2. COVID-19 Impact Analysis

15.3. Key Trend Impact Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price ($)

15.5. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

15.5.1. Overhead Door

15.5.2. Roll-up Door

15.5.3. Fire-rated Door

15.5.4. Sectional Door

15.5.5. Others

15.6. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

15.6.1. Automatic

15.6.2. Manual

15.7. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

15.7.1. Steel

15.7.2. Aluminum

15.7.3. Wood

15.7.4. Vinyl

15.7.5. Others

15.8. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

15.8.1. Residential

15.8.2. Commercial

15.8.2.1. Warehouse and Distribution Center

15.8.2.2. Hypermarket and Mall

15.8.2.3. School and College

15.8.2.4. Hotel & Restaurant

15.8.2.5. Auto Dealer and Service Center

15.8.2.6. Hospital and Clinic

15.8.2.7. Office and Commercial Complex

15.8.2.8. Others

15.9. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.9.1. Direct

15.9.2. Indirect

15.10. Garage Door Market Size (US$ Bn & Thousand Units), by Country, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Garage Door Market Analysis and Forecast

16.1. Regional Snapshot

16.1.1. By Type

16.1.2. By Material

16.1.3. By Category

16.1.4. By End-use

16.1.5. By Distribution Channel

16.1.6. By Country

16.2. COVID-19 Impact Analysis

16.3. Key Trend Impact Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price ($)

16.5. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Type, 2017 - 2031

16.5.1. Overhead Door

16.5.2. Roll-up Door

16.5.3. Fire-rated Door

16.5.4. Sectional Door

16.5.5. Others

16.6. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Category, 2017 - 2031

16.6.1. Automatic

16.6.2. Manuals

16.7. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Material, 2017 - 2031

16.7.1. Steel

16.7.2. Aluminum

16.7.3. Wood

16.7.4. Vinyl

16.7.5. Others

16.8. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by End-use, 2017 - 2031

16.8.1. Residential

16.8.2. Commercial

16.8.2.1. Warehouse and Distribution Center

16.8.2.2. Hypermarket and Mall

16.8.2.3. School and College

16.8.2.4. Hotel & Restaurant

16.8.2.5. Auto Dealer and Service Center

16.8.2.6. Hospital and Clinic

16.8.2.7. Office and Commercial Complex

16.8.2.8. Others

16.9. Garage Door Market Size (US$ Bn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.9.1. Direct

16.9.2. Indirect

16.10. Garage Door Market Size (US$ Bn & Thousand Units), by Country, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player– Competition Dashboard and Market Share (%) Analysis, 2020

17.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Type Portfolio, Revenue, Strategy & Business Overview)

17.2.1. Frontier Pacific

17.2.1.1. Company Overview

17.2.1.2. Sales Area/Geographical Presence

17.2.1.3. Type Portfolio

17.2.1.4. Revenue

17.2.1.5. Strategy & Business Overview

17.2.2. Integrity Overhead Door

17.2.2.1. Company Overview

17.2.2.2. Sales Area/Geographical Presence

17.2.2.3. Type Portfolio

17.2.2.4. Revenue

17.2.2.5. Strategy & Business Overview

17.2.3. Wayne Dalton

17.2.3.1. Company Overview

17.2.3.2. Sales Area/Geographical Presence

17.2.3.3. Type Portfolio

17.2.3.4. Revenue

17.2.3.5. Strategy & Business Overview

17.2.4. Raynor

17.2.4.1. Company Overview

17.2.4.2. Sales Area/Geographical Presence

17.2.4.3. Type Portfolio

17.2.4.4. Revenue

17.2.4.5. Strategy & Business Overview

17.2.5. Safe-Way Door

17.2.5.1. Company Overview

17.2.5.2. Sales Area/Geographical Presence

17.2.5.3. Type Portfolio

17.2.5.4. Revenue

17.2.5.5. Strategy & Business Overview

17.2.6. Martin Door

17.2.6.1. Company Overview

17.2.6.2. Sales Area/Geographical Presence

17.2.6.3. Type Portfolio

17.2.6.4. Revenue

17.2.6.5. Strategy & Business Overview

17.2.7. Windsor Door

17.2.7.1. Company Overview

17.2.7.2. Sales Area/Geographical Presence

17.2.7.3. Type Portfolio

17.2.7.4. Revenue

17.2.7.5. Strategy & Business Overview

17.2.8. Alulux GmbH

17.2.8.1. Company Overview

17.2.8.2. Sales Area/Geographical Presence

17.2.8.3. Type Portfolio

17.2.8.4. Revenue

17.2.8.5. Strategy & Business Overview

17.2.9. First United Door Technologies

17.2.9.1. Company Overview

17.2.9.2. Sales Area/Geographical Presence

17.2.9.3. Type Portfolio

17.2.9.4. Revenue

17.2.9.5. Strategy & Business Overview

17.2.10. General Doors Corporation

17.2.10.1. Company Overview

17.2.10.2. Sales Area/Geographical Presence

17.2.10.3. Type Portfolio

17.2.10.4. Revenue

17.2.10.5. Strategy & Business Overview

17.2.11. Novoferm GmbH

17.2.11.1. Company Overview

17.2.11.2. Sales Area/Geographical Presence

17.2.11.3. Type Portfolio

17.2.11.4. Revenue

17.2.11.5. Strategy & Business Overview

17.2.12. DoorHan Group Of Companies

17.2.12.1. Company Overview

17.2.12.2. Sales Area/Geographical Presence

17.2.12.3. Type Portfolio

17.2.12.4. Revenue

17.2.12.5. Strategy & Business Overview

18. Go To Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Prevailing Market Risks

List of Tables

Table 1: Global Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 2: Global Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 3: Global Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 4: Global Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 5: Global Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 6: Global Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 7: Global Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 8: Global Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 9: Global Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 10: Global Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 11: Global Garage Door Market Volume (Thousand Units) Share, by Region, 2017-2031

Table 12: Global Garage Door Market Value (US$ Bn) Share, by Region, 2017-2031

Table 13: North America Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 14: North America Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 15: North America Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 16: North America Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 17: North America Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 18: North America Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 19: North America Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 20: North America Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 21: North America Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 22: North America Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 23: North America Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 24: North America Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Table 25: Europe Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 26: Europe Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 27: Europe Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 28: Europe Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 29: Europe Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 30: Europe Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 31: Europe Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 32: Europe Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 33: Europe Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 34: Europe Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 35: Europe Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 36: Europe Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Table 37: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 38: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 39: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 40: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 41: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 42: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 43: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 44: Asia Pacific Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 45: Asia Pacific Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 46: Asia Pacific Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 47: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 48: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Table 49: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 50: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 51: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 52: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 53: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 54: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 55: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 56: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 57: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 58: Middle East & Africa Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 59: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 60: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Table 61: South America Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 62: South America Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Table 63: South America Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Table 64: South America Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Table 65: South America Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 66: South America Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Table 67: South America Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 68: South America Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 69: South America Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Table 70: South America Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Table 71: South America Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 72: South America Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

List of Figures

Figure 1: Global Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 2: Global Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 3: Global Garage Door Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 4: Global Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Figure 5: Global Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Figure 6: Global Garage Door Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 7: Global Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 8: Global Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 9: Global Garage Door Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 10: Global Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 11: Global Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 12: Global Garage Door Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 13: Global Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Figure 14: Global Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Figure 15: Global Garage Door Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 16: Global Garage Door Market Volume (Thousand Units) Share, by Region, 2017-2031

Figure 17: Global Garage Door Market Value (US$ Bn) Share, by Region, 2017-2031

Figure 18: Global Garage Door Market Incremental Opportunity (US$ Bn), by Region, 2017-2031

Figure 19: North America Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 20: North America Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 21: North America Garage Door Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 22: North America Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Figure 23: North America Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Figure 24: North America Garage Door Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 25: North America Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 26: North America Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 27: North America Garage Door Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 28: North America Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 29: North America Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 30: North America Garage Door Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 31: North America Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Figure 32: North America Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Figure 33: North America Garage Door Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 34: North America Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 35: North America Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 36: North America Garage Door Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 37: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 38: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 39: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 40: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Figure 41: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Figure 42: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 43: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 44: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 45: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 46: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 47: Asia Pacific Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 48: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 49: Asia Pacific Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Figure 50: Asia Pacific Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Figure 51: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 52: Asia Pacific Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 53: Asia Pacific Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 54: Asia Pacific Garage Door Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 55: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 56: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 57: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 58: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Figure 59: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Figure 60: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 61: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 62: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 63: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 64: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 65: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 66: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 67: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Figure 68: Middle East & Africa Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Figure 69: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 70: Middle East & Africa Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 71: Middle East & Africa Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 72: Middle East & Africa Garage Door Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 73: South America Garage Door Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 74: South America Garage Door Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 75: South America Garage Door Market Volume (Thousand Units) Share, by Category, 2017-2031

Figure 76: South America Garage Door Market Value (US$ Bn) Share, by Category, 2017-2031

Figure 77: South America Garage Door Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 78: South America Garage Door Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 79: South America Garage Door Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 80: South America Garage Door Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 81: South America Garage Door Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 82: South America Garage Door Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 83: South America Garage Door Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 84: South America Garage Door Market Volume (Thousand Units) Share, By Distribution Channel, 2017-2031

Figure 85: South America Garage Door Market Value (US$ Bn) Share, By Distribution Channel, 2017-2031

Figure 86: South America Garage Door Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 87: South America Garage Door Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 88: South America Garage Door Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 89: South America Garage Door Market Incremental Opportunity (US$ Bn), by Country, 2017-2031