Keen players in the global gable top caps and closures market are furthering their market shares through both the organic and inorganic route. Collaborations, acquisitions, and offering a broad range of products are some tried and tested methods used by them.

One of the main growth drivers in the global gable top caps and closures market is the industry friendly innovative design in gable top cartons. This has made it possible to print different product and brand related information on it since it has a comparatively large surface area than other liquid packaging solutions such as bottles and cans. Besides, it is also aesthetically pleasing and hence serves to easily attract consumers. Further, gable top cartons offer ease of stacking during transportation and retailing.

Posing a challenge to the global gable top caps and closure market is the volatile petroleum products prices. Since caps and closures are manufactured from plastics such as PP, PE, etc., which in turn is extracted from petroleum products, price fluctuation of the latter impacts the overall production cost.

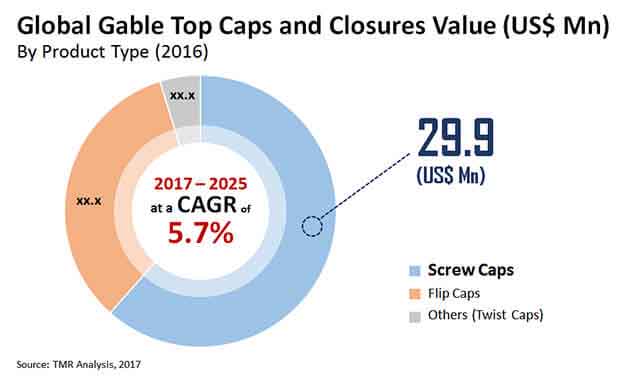

A report by Transparency Market Research predicts the global gable top caps and closures market to rise at a 5.7% CAGR from 2017 to 2025 to reach a value of US$79.1 mn in 2025 from US$48.5 mn in 2016.

Based upon the type of product, the global gable top caps and closures market can be broadly divided into two – screw caps and flip caps. At present, the segment of screw caps leads the market with a significant share. The segment is slated to grow its share further by 2025 by expanding at a 5.9% CAGR between 2017 and 2025. This is because of their convenient features and applicability in different products packaged in gable top cartons. The consumption of screw caps segment is estimated to reach 4,019 million units by the end of 2025.

The consumption of the flip caps segment in the global gable top caps and closures market was around 958 million units by 2016-end. By clocking a CAGR of 5.1% from 2017 to 2025, it is predicted to become 1,428 million units by 2025. The flip caps segment was worth US$17.2 mn in 2016 and is forecasted to be US$26.0 mn by 2025-end.

Geographically, the key segments of the global gable top caps and closures market are North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. Asia Pacific, of them, is a market leader that raked in an overall revenue of US$19.4 mn by the end of 2016. The application segment of beverages is primarily driving the growth in the market in the region. By clocking the maximum CAGR of 6.6% from 2017 to 2025, the segment will grow its share further in the next couple of years.

North America trails Asia Pacific in terms of share in the global gable top caps and closures market. The U.S. leads the market in North America by dint of contributing the most to the revenue. Demand in the overall North America market, however, is slated to increase at a lackluster pace in the upcoming years on account of the market being saturated.

Prominent players in the global gable top caps and closures market are BERICAP GmbH & Co. KG, Evergreen Packaging Inc., UNITED CAPS LUXEMBOURG S.A, Tetra Pak, International S.A., Elopak Inc., Silgan Plastic Closure Solutions, Closure Systems International, Inc., Berry Global, Inc., and O. Berk.

Gable Top Caps and Closure Market to See New Packaging Designs Attracting Businesses

Gable top caps and closure manufacturers have seen exploring new designs. Gable top caps and closures are used extensively in food and beverages and paints and lubricants packaging solutions. In particularly, the growing proposition of consumer convenience of opening the packaging is a key trend propelling new product launches in the gable top caps and closure market. Over the years, increased focus has been on developing closures that meet the visual, audible, and tactile experience for the consumers as well as that offers tamper-resistance properties. In this regard, removable pull ring structure has failed consumers at large, either due to inability of closing and opening of bottles or due to concerns of spill-over effect of the liquid content. There is focus on single-stage opening of caps, spurring the manufacturers to arrive at new packaging designs. Also, beverages brands are increasingly harnessing gable top caps and closures as part of sustainability story, thereby attracting potential consumers. There is a growing demand for gable top caps and closure designs and techniques that help consumer detect that the bottles haven’t been opened before. The sound may be a key differentiating factor in this. Easy resealability is another factor that packaging companies in the gable top caps and closure market is looking forward.

The currently emerging COVID-19 pandemic has led to the many disruption into the retail trade. The changing demographics due to reverse migration from urban to rural areas has also nudged business executives in food and beverages industry to look for new business models to meet the rise in demand, especially for rural consumers. The pandemic-led lockdowns severely constrained the supply chains, opening new avenues for business models that can help players in the gable top caps and closures market focus on expanding their B2B sales. Further, as the economies are gradually opening up in several parts of the world, retail companies are getting into partnerships with beverages retail brands, which will likely spur the growth of the market.

High Bargaining Power of Buyers Restrain Profit Margins of Vendors in Metal Cans and Glass Jars Markets

Metal cans and glass jars are used in food storage application among consumers and commercial establishments. The panoply of design and size is overwhelming. The proliferating of demand for metal cans and glass jars to store wide range of food product such as powders, beverages, and ready-to-cook products among home users has spurred sales in the metal cans and glass jars market. Worldwide inclination to shun plastics for food storage has been an enablers as well as accelerator the demand and sales of metal cans and glass jars. Over the years, the urban consumption driving revenue growth in the metal cans and glass jars has come from two trends: focus on unique product positioning and garnering profits from repeat buyers. The demand has also gathered steam among restaurants and hotels for storing and serving beverages, in part due to the high aesthetic value these have, and environmental-friendliness over plastics bottles. In urban dwelling, the demand for glass jars has proliferated, fueled increasingly by cross-selling efforts by vendors and retailers. Asian economies such as India have seen high demand for metal cans and glass jars of various sizes and thickness. Glass jars are being demanded for meeting the hydration needs, given the increasing shelf-space these products have in multiplex and malls. The growing proclivity of adopting environmentally friendly products among people in such countries has helped spur the use of glass jars and metal cans for food storage.

The Covid-19 pandemic is not just a health crisis, but the prolonged period of lockdowns have also severely impacted the manufacturing industries, including packaging sector. This has brought to the fore the feasibility of new vendor business models and retail trends. These factors have also posed new challenges and new opportunities to the ecosystem in the metal cans and glass jars market. In addition, a high bargaining power of buyers is one of the key propositions that players in the market cannot afford to keep at the arm’s length.

1. Executive Summary

2. Market Introduction

2.1. Gable Top Caps and Closures Market Definition

2.2. Gable Top Caps and Closures Market Taxonomy

2.3. Packaging Market Overview

3. Gable Top Caps and Closures Market Analysis Scenario

3.1. Market Size (US$ Mn) and Forecast

3.1.1. Market Size and Y-o-Y Growth

3.1.2. Absolute $ Opportunity

3.2. Market Overview

3.2.1. Value Chain

3.2.2. Profitability Margins

3.2.3. List of Active Participants

3.2.3.1. Raw Material Suppliers

3.2.3.2. Manufacturers

3.3. Product – Cost Teardown Analysis

4. Market Dynamics

4.1. Macro-economic Factors

4.2. Drivers

4.2.1. Supply Side

4.2.2. Demand Side

4.3. Restraints

4.4. Opportunity

5. Gable Top Caps and Closures Market Analysis and Forecast, By Material Type

5.1. Introduction

5.1.1. Basis Point Share (BPS) Analysis, By Material Type

5.1.2. Y-o-Y Growth Projections, By Material Type

5.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

5.2.1. Plastic

5.2.1.1. PP

5.2.1.2. PE

5.2.1.2.1. LDPE

5.2.1.2.2. HDPE

5.2.1.2.3. LLDPE

5.2.1.3. Others (Bio based polymers etc.)

5.3. Market Attractiveness Analysis, By Material Type

5.4. Prominent Trends

6. Gable Top Caps and Closures Market Analysis and Forecast, By Product Type

6.1. Introduction

6.1.1. Basis Point Share (BPS) Analysis By Product Type

6.1.2. Y-o-Y Growth Projections By Product Type

6.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

6.2.1. Screw caps

6.2.2. Flip caps

6.2.3. Others

6.3. Market Attractiveness Analysis, By Product Type

6.4. Prominent Trends

7. Gable Top Caps and Closures Market Analysis and Forecast, By Application

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis, By Application

7.1.2. Y-o-Y Growth Projections, By Application

7.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

7.2.1. Food

7.2.1.1. Prepared food

7.2.1.2. Dairy Products

7.2.1.3. Ice cream mix

7.2.1.4. Edible Oil

7.2.1.5. Confectionaries

7.2.1.6. Others

7.2.2. Beverage

7.2.2.1. Alcoholic Beverages

7.2.2.1.1. Beer

7.2.2.1.2. Wine

7.2.2.1.3. Other liquors

7.2.2.2. Non-Alcoholic Beverages

7.2.2.2.1. Milk

7.2.2.2.2. Fruit Juices

7.2.2.2.3. Ready to drink beverages

7.2.2.2.4. Others

7.2.3. Laundry & Detergents

7.2.4. Paints & Lubricants

7.2.5. Pet Food

7.3. Market Attractiveness Analysis, By Application

7.4. Prominent Trends

8. Gable Top Caps and Closures Market Analysis and Forecast, By Diameter

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis, By Diameter

8.1.2. Y-o-Y Growth Projections, By Diameter

8.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

8.2.1. 25 mm – 35 mm

8.2.2. 35 mm – 45 mm

8.2.3. 45 mm – 60 mm

8.2.4. Others

8.3. Market Attractiveness Analysis, By Diameter

8.4. Prominent Trends

9. Gable Top Caps and Closures Market Analysis and Forecast, By Region

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis, By Region

9.1.2. Y-o-Y Growth Projections, By Region

9.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East and Africa (MEA)

9.3. Market Attractiveness Analysis, By Region

10. North America Gable Top Caps and Closures Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.1.3. Key Regulations

10.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

10.2.1. U.S.

10.2.2. Canada

10.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

10.3.1. Plastic

10.3.1.1. PP

10.3.1.2. PE

10.3.1.2.1. LDPE

10.3.1.2.2. HDPE

10.3.1.2.3. LLDPE

10.3.1.3. Others (Bio based polymers etc.)

10.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

10.4.1. Screw caps

10.4.2. Flip caps

10.4.3. Others

10.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

10.5.1. Food

10.5.1.1. Prepared food

10.5.1.2. Dairy Products

10.5.1.3. Ice cream mix

10.5.1.4. Edible Oil

10.5.1.5. Confectionaries

10.5.1.7. Others

10.5.2. Beverage

10.5.2.1. Alcoholic Beverages

10.5.2.1.1. Beer

10.5.2.1.2. Wine

10.5.2.1.3. Other liquors

10.5.2.2. Non-Alcoholic Beverages

10.5.2.2.1. Milk

10.5.2.2.2. Fruit Juices

10.5.2.2.3. Ready to drink beverages

10.5.2.2.4. Others

10.5.3. Laundry & Detergents

10.5.4. Paints & Lubricants

10.5.5. Pet Food

10.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

10.6.1. 25 mm – 35 mm

10.6.2. 35 mm – 45 mm

10.6.3. 45 mm – 60 mm

10.6.4. Others

10.7. Market Attractiveness Analysis

10.7.1. By Country

10.7.2. By Material Type

10.7.3. By Product Type

10.7.4. By Application

10.7.5. By Diameter

10.8. Prominent Trends

10.9. Drivers and Restraints: Impact Analysis

11. Latin America Gable Top Caps and Closures Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.1.3. Key Regulations

11.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Country

11.2.1. Brazil

11.2.2. Mexico

11.2.3. Rest of Latin America

11.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

11.3.1. Plastic

11.3.1.1. PP

11.3.1.2. PE

11.3.1.2.1. LDPE

11.3.1.2.2. HDPE

11.3.1.2.3. LLDPE

11.3.1.3. Others (Bio based polymers etc.)

11.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

11.4.1. Screw caps

11.4.2. Flip caps

11.4.3. Others

11.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

11.5.1. Food

11.5.1.2. Prepared food

11.5.1.3. Dairy Products

11.5.1.4. Ice cream mix

11.5.1.5. Edible Oil

11.5.1.6. Confectionaries

11.5.1.7. Others

11.5.2. Beverage

11.5.2.1. Alcoholic Beverages

11.5.2.1.1. Beer

11.5.2.1.2. Wine

11.5.2.1.3. Other liquors

11.5.2.2. Non-Alcoholic Beverages

11.5.2.2.1. Milk

11.5.2.2.2. Fruit Juices

11.5.2.2.3. Ready to drink beverages

11.5.2.2.4. Others

11.5.3. Laundry & Detergents

11.5.4. Paints & Lubricants

11.5.5. Pet Food

11.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

11.6.1. 25 mm – 35 mm

11.6.2. 35 mm – 45 mm

11.6.3. 45 mm – 60 mm

11.6.4. Others

11.7. Market Attractiveness Analysis

11.7.1. By Country

11.7.2. By Material Type

11.7.3. By Product Type

11.7.4. By Application

11.7.5. By Diameter

11.8. Prominent Trends

11.9. Drivers and Restraints: Impact Analysis

12. Europe Gable Top Caps and Closures Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.1.3. Key Regulations

12.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Country

12.2.1. Germany

12.2.2. Italy

12.2.3. France

12.2.4. U.K.

12.2.5. Spain

12.2.6. Benelux

12.2.7. Nordic

12.2.8. Rest of Europe

12.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

12.3.1. Plastic

12.3.1.1. PP

12.3.1.2. PE

12.3.1.2.1. LDPE

12.3.1.2.2. HDPE

12.3.1.2.3. LLDPE

12.3.1.2. Others (Bio based polymers etc.)

12.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

12.4.1. Screw caps

12.4.2. Flip caps

12.4.3. Others

12.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

12.5.1. Food

12.5.1.1. Prepared food

12.5.1.2. Dairy Products

12.5.1.3. Ice cream mix

12.5.1.4. Edible Oil

12.5.1.5. Confectionaries

12.5.1.6. Others

12.5.2. Beverage

12.5.2.1. Alcoholic Beverages

12.5.2.1.1. Beer

12.5.2.1.2. Wine

12.5.2.1.3. Other liquors

12.5.2.2. Non-Alcoholic Beverages

12.5.2.2.1. Milk

12.5.2.2.2. Fruit Juices

12.5.2.2.3. Ready to drink beverages

12.5.2.2.4. Others

12.5.3. Laundry & Detergents

12.5.4. Paints & Lubricants

12.5.5. Pet Food

12.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

12.6.1. 25 mm – 35 mm

12.6.2. 35 mm – 45 mm

12.6.3. 45 mm – 60 mm

12.6.4. Others

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Material Type

12.7.3. By Product Type

12.7.4. By Application

12.7.5. By Diameter

12.8. Prominent Trends

12.9. Drivers and Restraints: Impact Analysis

13. Asia Pacific (APAC) Gable Top Caps and Closures Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.1.3. Key Regulations

13.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Country

13.2.1. China

13.2.2. India

13.2.3. ASEAN

13.2.4. Japan

13.2.5. Australia and New Zealand

13.2.6. Rest of APAC

13.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

13.3.1. Plastic

13.3.1.1. PP

13.3.1.2. PE

13.3.1.2.1. LDPE

13.3.1.2.2. HDPE

13.3.1.2.3. LLDPE

13.3.1.3. Others (Bio based polymers etc.)

13.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

13.4.1. Screw caps

13.4.2. Flip caps

13.4.3. Others

13.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

13.5.1. Food

13.5.1.1. Prepared food

13.5.1.2. Dairy Products

13.5.1.3. Ice cream mix

13.5.1.4. Edible Oil

13.5.1.5. Confectionaries

13.5.1.6. Others

13.5.2. Beverage

13.5.2.1. Alcoholic Beverages

13.5.2.1.1. Beer

13.5.2.1.2. Wine

13.5.2.1.3. Other liquors

13.5.2.2. Non-Alcoholic Beverages

13.5.2.2.1. Milk

13.5.2.2.2. Fruit Juices

13.5.2.2.3. Ready to drink beverages

13.5.2.2.4. Others

13.5.3. Laundry & Detergents

13.5.4. Paints & Lubricants

13.5.5. Pet Food

13.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

13.6.1. 25 mm – 35 mm

13.6.2. 35 mm – 45 mm

13.6.3. 45 mm – 60 mm

13.6.4. Others

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Material Type

13.7.3. By Product Type

13.7.4. By Application

13.7.5. By Diameter

13.8. Prominent Trends

13.9. Drivers and Restraints: Impact Analysis

14. Middle East & Africa (MEA) Gable Top Caps and Closures Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.1.3. Key Regulations

14.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Country

14.2.1. North Africa

14.2.2. South Africa

14.2.3. GCC countries

14.2.4. Rest of MEA

14.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Material Type

14.3.1. Plastic

14.3.1.1. PP

14.3.1.2. PE

14.3.1.2.1. LDPE

14.3.1.2.2. HDPE

14.3.1.2.3. LLDPE

14.3.1.3. Others (Bio based polymers, etc.)

14.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Product Type

14.4.1. Screw caps

14.4.2. Flip caps

14.4.3. Others

14.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Application

14.5.1. Food

14.5.1.1. Prepared food

14.5.1.2. Dairy Products

14.5.1.3. Ice cream mix

14.5.1.4. Edible Oil

14.5.1.5. Confectionaries

14.5.1.6. Others

14.5.2. Beverage

14.5.2.1. Alcoholic Beverages

14.5.2.1.1. Beer

14.5.2.1.2. Wine

14.5.2.1.3. Other liquors

14.5.2.2. Non-Alcoholic Beverages

14.5.2.2.1. Milk

14.5.2.2.2. Fruit Juices

14.5.2.2.3. Ready to drink beverages

14.5.2.2.4. Others

14.5.3. Laundry & Detergents

14.5.4. Paints & Lubricants

14.5.5. Pet Food

14.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Diameter

14.6.1. 25 mm – 35 mm

14.6.2. 35 mm – 45 mm

14.6.3. 45 mm – 60 mm

14.6.4. Others

14.7. Market Attractiveness Analysis

14.7.1. By Country

14.7.2. By Material Type

14.7.3. By Product Type

14.7.4. By Application

14.7.5. By Diameter

14.8. Prominent Trends

14.9. Drivers and Restraints: Impact Analysis

15. Competitive Landscape

15.1. Competition Dashboard

15.2. Company Market Share Analysis

15.3. Company Profiles

15.3.1. Bericap GmbH & Co. KG

15.3.1.1. Overview

15.3.1.2. Financials

15.3.1.3. Strategy

15.3.1.4. Recent Developments

15.3.1.5. SWOT Analysis

15.3.2. Evergreen Packaging Inc.

15.3.2.1. Overview

15.3.2.2. Financials

15.3.2.3. Strategy

15.3.2.4. Recent Developments

15.3.2.5. SWOT Analysis

15.3.3. United Caps Luxembourg S.A.

15.3.3.1. Overview

15.3.3.2. Financials

15.3.3.3. Strategy

15.3.3.4. Recent Developments

15.3.3.5. SWOT Analysis

15.3.4. Tetra Pak, International S.A.

15.3.4.1. Overview

15.3.4.2. Financials

15.3.4.3. Strategy

15.3.4.4. Recent Developments

15.3.4.5. SWOT Analysis

15.3.5. Elopak Inc.

15.3.5.1. Overview

15.3.5.2. Financials

15.3.5.3. Strategy

15.3.5.4. Recent Developments

15.3.5.5. SWOT Analysis

15.3.6. Silgan Plastic Closure Solutions

15.3.6.1. Overview

15.3.6.2. Financials

15.3.6.3. Strategy

15.3.6.4. Recent Developments

15.3.6.5. SWOT Analysis

15.3.7. Closure Systems International, Inc.

15.3.7.1. Overview

15.3.7.2. Financials

15.3.7.3. Strategy

15.3.7.4. Recent Developments

15.3.7.5. SWOT Analysis

15.3.8. Berry Global Inc.

15.3.8.1. Overview

15.3.8.2. Financials

15.3.8.3. Strategy

15.3.8.4. Recent Developments

15.3.8.5. SWOT Analysis

15.3.9. O.Berk

15.3.9.1. Overview

15.3.9.2. Financials

15.3.9.3. Strategy

15.3.9.4. Recent Developments

15.3.9.5. SWOT Analysis

15.3.10. Amcor Limited

15.3.10.1. Overview

15.3.10.2. Financials

15.3.10.3. Strategy

15.3.10.4. Recent Developments

15.3.10.5. SWOT Analysis

16. Assumptions and Acronyms Used

17. Research Methodology

List of Table

Table 01: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) Forecast, by Material Type, 2015–2025

Table 02: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Product Type, 2015–2025

Table 03: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 04: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 05: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Diameter, 2015–2025

Table 06: Global Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Region, 2015–2025

Table 07: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Material Type, 2015–2025

Table 08: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Product Type, 2015–2025

Table 09: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 10: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 11: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Diameter, 2015–2025

Table 12: North America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Country, 2015–2025

Table 13: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Material Type, 2015–2025

Table 14: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Product Type, 2015–2025

Table 15: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 16: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 17: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Diameter, 2015–2025

Table 18: Latin America Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Country, 2015–2025

Table 19: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Material Type, 2015–2025

Table 20: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Product Type, 2015–2025

Table 21: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Application, 2015–2025

Table 22: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Application Type, 2015–2025

Table 23: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Diameter, 2015–2025

Table 24: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Country, 2015–2025

Table 25: Europe Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Country, 2015–2025

Table 26: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Material Type, 2015–2025

Table 27: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units) by Product Type, 2015–2025

Table 28: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 29: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Application, 2015–2025

Table 30: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Diameter, 2015–2025

Table 31: APAC Gable Top Caps & Closures Market Size (US$ Mn) and Volume (Million Units), by Country, 2015–2025

Table 32: MEA Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Material Type, 2015–2025

Table 33: MEA Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Product Type, 2015–2025

Table 34: MEA Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Application, 2015–2025

Table 35: MEA Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Application Type, 2015–2025

Table 36: MEA Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Diameter, 2015–2025

Table 37: Middle East & Africa (MEA) Gable Top Caps & Closures Market Size (US$ Thousand) and Volume (Million Units) by Country, 2015–2025

List of Figure

Figure 01: Global Gable Top Caps & Closures Market Value Share and BPS Analysis, by Material Type, 2016 & 2025

Figure 02: Global Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Material Type, 2016–2025

Figure 03: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) Forecast, by Material Type,

Figure 04: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) Forecast, by Material Type, 2016–2025

Figure 05: Global Gable Caps & Closures Market Absolute $ Opportunity, by PP, 2016–2025

Figure 06: Global Gable Caps & Closures Market Absolute $ Opportunity, by PE, 2016–2025

Figure 07: Global Gable Caps & Closures Market Absolute $ Opportunity, by HDPE, 2016–2025

Figure 08: Global Gable Caps & Closures Market Absolute $ Opportunity, by LDPE, 2016–2025

Figure 09: Global Gable Caps & Closures Market Absolute $ Opportunity, by LLDPE, 2016–2025

Figure 10: Global Gable Caps & Closures Market Absolute $ Opportunity, by Others, 2016–2025

Figure 11: Global Gable Top Caps & Closures Market Attractiveness, by Material Type, 2017–2025

Figure 12: Global Gable Top Caps & Closures Market Share and BPS Analysis, by Product Type, 2016 & 2025

Figure 13: Global Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Product Type, 2016–2025

Figure 14: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) Forecast, by Screw Caps, 2016–2025

Figure 15: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Screw Caps, 2016–2025

Figure 16: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) Forecast, by Flip Caps,

Figure 17: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Flip Caps, 2016–2025

Figure 18: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) Forecast, by Others, 2016–2025

Figure 19: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Others, 2016–2025

Figure 20: Global Gable Top Caps & Closures Market Attractiveness, by Product Type, 2017–2025

Figure 21: Global Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 22: Global Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Application, 2016–2025

Figure 23: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Food, 2016–2025

Figure 24: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Food, 2016–2025

Figure 25: Global Gable Caps & Closures Market Absolute $ Opportunity, by Prepared Food Sub-segment, 2016–2025

Figure 26: Global Gable Caps & Closures Market Absolute $ Opportunity, by Dairy Products Sub-segment, 2016–2025

Figure 27: Global Gable Caps & Closures Market Absolute $ Opportunity, by Ice Cream Mix Sub-segment, 2016–2025

Figure 28: Global Gable Caps & Closures Market Absolute $ Opportunity, by Edible Oil Sub-segment, 2016–2025

Figure 29: Global Gable Caps & Closures Market Absolute $ Opportunity, by Confectionaries Sub-segment, 2016–2025

Figure 30: Global Gable Caps & Closures Market Absolute $ Opportunity, by Others Sub-segment, 2016–2025

Figure 31: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Beverages, 2016–2025

Figure 32: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Beverages, 2016–2025

Figure 33: U.S. Global Gable Caps & Closures Market Absolute $ Opportunity, by Beer Sub-segment, 2016–2025

Figure 34: Global Gable Caps & Closures Market Absolute $ Opportunity, by Wine Sub-segment, 2016–2025

Figure 35: Global Gable Caps & Closures Market Absolute $ Opportunity, by Others Sub-segment, 2016–2025

Figure 36: Global Gable Caps & Closures Market Absolute $ Opportunity, by Milk Sub-segment, 2016–2025

Figure 37: Global Gable Caps & Closures Market Absolute $ Opportunity, by Fruit Juices Sub-segment, 2016–2025

Figure 38: Global Gable Caps & Closures Market Absolute $ Opportunity, by Ready-to-drink Beverages Sub-segment, 2016–2025

Figure 39: Global Gable Caps & Closures Market Absolute $ Opportunity, by Others Sub-segment, 2016–2025

Figure 40: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) by Laundry & Detergents, 2016–2025

Figure 41: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Laundry & Detergents, 2016–2025

Figure 42: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) by Paints & Lubricants, 2016–2025

Figure 43: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Paints & Lubricants, 2016–2025

Figure 44: Global Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units) by Pet Food, 2016–2025

Figure 45: Global Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Pet Food, 2016–2025

Figure 46: Global Gable Top Caps & Closures Market Attractiveness, by Application, 2017–2025

Figure 47: Global Gable Top Caps & Closures Market Share and BPS Analysis, by Diameter, 2016 and 2025

Figure 48: Global Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Diameter, 2016–2025

Figure 49: Global Gable Caps & Closures Market Absolute $ Opportunity, by Diameter, 2016–2025

Figure 50: Global Gable Caps & Closures Market Absolute $ Opportunity, by diameter, 2016–2025

Figure 51: Global Gable Caps & Closures Market Absolute $ Opportunity, by Diameter, 2016–2025

Figure 52: Global Gable Caps & Closures Market Absolute $ Opportunity, by Diameter, 2016–2025

Figure 53: Global Gable Top Caps & Closures Market Attractiveness, by Diameter, 2017–2025

Figure 54: Global Gable Top Caps & Closures Market Share and BPS Analysis, by Region, 2016 and 2025

Figure 55: Global Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Region, 2016–2025

Figure 56: Global Gable Top Caps & Closures Market Attractiveness, by Region, 2017–2025

Figure 57: North America Gable Top Caps & Closures Market Value (US$ Mn) and Market Volume (Million Units), 2016–2025

Figure 58: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), 2016?2025

Figure 59: North America Gable Top Caps & Closures Market Share & BPS Analysis, by Material Type, 2016 & 2025

Figure 60: North America Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Material Type, 2016–2025

Figure 61: North America Gable Top Caps & Closures Market Absolute $ Opportunity, by PP, 2016–2025

Figure 62: North America Gable Top Caps & Closures Market Absolute $ Opportunity by PE, 2016–2025

Figure 63: North America Gable Top Caps & Closures Market Absolute $ Opportunity by HDPE, 2016–2025

Figure 64: North America Gable Top Caps & Closures Market Absolute $ Opportunity by LDPE, 2016–2025

Figure 65: North America Gable Top Caps & Closures Market Absolute $ Opportunity, by LLDPE, 2016–2025

Figure 66: North America Gable Top Caps & Closures Market Absolute $ Opportunity Others, 2016–2025

Figure 67: North America Gable Top Caps & Closures Market Share & BPS Analysis by Product Type, 2016 & 2025

Figure 68: North America Gable Top Caps & Closures Market Y-o-Y Growth Rate by Product Type, 2016–2025

Figure 69: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Screw caps

Figure 70: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Flip caps

Figure 71: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other product segment

Figure 72: North America Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 73: North America Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Application, 2016–2025

Figure 74: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Prepared food, 2016–2025

Figure 75: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Dairy products, 2016–2025

Figure 76: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ice cream mix, 2016–2025

Figure 77: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Edible oil, 2016–2025

Figure 78: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Confectionaries, 2016–2025

Figure 79: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Others, 2016–2025

Figure 80: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Beverages, 2016–2025

Figure 81: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Beverages, 2016–2025

Figure 82: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Alcoholic Beverages, 2016–2025

Figure 83: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Alcoholic Beverages, 2016–2025

Figure 84: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Beer, 2016–2025

Figure 85: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Wine, 2016–2025

Figure 86: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Other Liquors, 2016–2025

Figure 87: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Non-alcoholic Beverages, 2016–2025

Figure 88: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Non-alcoholic Beverages, 2016–2025

Figure 89: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Milk, 2016–2025

Figure 90: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Fruit Juices, 2016–2025

Figure 91: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ready-to-Drink Beverages, 2016–2025

Figure 92: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other segment 2016–2025

Figure 93: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Laundry and Detergents, 2016–2025

Figure 94: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Laundry and Detergents, 2016–2025

Figure 95: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Paints and Lubricants, 2016–2025

Figure 96: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Paints and Lubricants, 2016–2025

Figure 97: North America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Pet Food, 2016–2025

Figure 98: North America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Pet Food, 2016–2025

Figure 99: North America Gable Top Caps & Closures Market Share & BPS Analysis, by Diameter, 2016 & 2025

Figure 100: North America Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Diameter, 2016–2025

Figure 101: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 102: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 103: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 104: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 105: North America Gable Top Caps & Closures Market Share & BPS Analysis, by Country, 2016 & 2025

Figure 106: North America Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 107: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by U.S.

Figure 108: North America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Canada

Figure 109: North America Gable Top Caps & Closures Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 110: North America Gable Top Caps & Closures Market Attractiveness Analysis, by Material Type, 2017–2025

Figure 111: North America Gable Top Caps & Closures Market Attractiveness Analysis, by Application, 2017–2025

Figure 112: North America Gable Top Caps & Closures Market Attractiveness Analysis, by Diameter, 2017–2025

Figure 113: North America Gable Top Caps & Closures Market Attractiveness Analysis, by Country, 2017–2025

Figure 114: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Market Volume (Million Units), 2016–2025

Figure 115: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), 2016?2025

Figure 116: Latin America Gable Top Caps & Closures Market Share & BPS Analysis, by Material Type, 2016 & 2025

Figure 117: Latin America Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Material Type, 2016–2025

Figure 118: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity, by PP, 2016–2025

Figure 119: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity by PE, 2016–2025

Figure 120: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity by HDPE, 2016–2025

Figure 121: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity by LDPE, 2016–2025

Figure 122: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity, by LLDPE, 2016–2025

Figure 123: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Others, 2016–2025

Figure 124: Latin America Gable Top Caps & Closures Market Share & BPS Analysis by Product Type, 2016 & 2025

Figure 125: Latin America Gable Top Caps & Closures Market Y-o-Y Growth Rate by Product Type, 2016–2025

Figure 126: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Screw caps

Figure 127: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Flip caps

Figure 128: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other product segment

Figure 129: Latin America Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 130: Latin America Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Application, 2016–2025

Figure 131: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Prepared food, 2016–2025

Figure 132: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Dairy products, 2016–2025

Figure 133: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ice cream mix, 2016–2025

Figure 134: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Edible oil, 2016–2025

Figure 135: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Confectionaries, 2016–2025

Figure 136: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Others, 2016–2025

Figure 137: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Beverages, 2016–2025

Figure 138: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Beverages, 2016–2025

Figure 139: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Alcoholic Beverages, 2016–2025

Figure 140: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Alcoholic Beverages, 2016–2025

Figure 141: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Beer, 2016–2025

Figure 142: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Wine, 2016–2025

Figure 143: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Other Liquors, 2016–2025

Figure 144: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Non-alcoholic Beverages, 2016–2025

Figure 145: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Non-alcoholic Beverages, 2016–2025

Figure 146: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Milk, 2016–2025

Figure 147: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Fruit Juices, 2016–2025

Figure 148: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ready-to-Drink Beverages, 2016–2025

Figure 149: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other segment 2016–2025

Figure 150: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Laundry and Detergents, 2016–2025

Figure 151: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Laundry and Detergents, 2016–2025

Figure 152: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Paints and Lubricants, 2016–2025

Figure 153: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Paints and Lubricants, 2016–2025

Figure 154: Latin America Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Pet Food, 2016–2025

Figure 155: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Pet Food, 2016–2025

Figure 156: Latin America Gable Top Caps & Closures Market Share & BPS Analysis, by Diameter, 2016 & 2025

Figure 157: Latin America Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Diameter, 2016–2025

Figure 158: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 159: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 160: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 161: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 162: Latin America Gable Top Caps & Closures Market Share & BPS Analysis, by Country, 2016 & 2025

Figure 163: Latin America Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 164: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Brazil

Figure 165: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Mexico

Figure 166: Latin America Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Rest of LA

Figure 167: Latin America Gable Top Caps & Closures Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 168: Latin America Gable Top Caps & Closures Market Attractiveness Analysis, by Material Type, 2017–2025

Figure 169: Latin America Gable Top Caps & Closures Market Attractiveness Analysis, by Application, 2017–2025

Figure 170: Latin America Gable Top Caps & Closures Market Attractiveness Analysis, by Diameter, 2017–2025

Figure 171: Latin America Gable Top Caps & Closures Market Attractiveness Analysis, by Country, 2017–2025

Figure 172: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 173: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 174: Europe Gable Top Caps & Closures Market Share & BPS Analysis, by Material Type, 2016 & 2025

Figure 175: Europe Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Material Type, 2016–2025

Figure 176: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by PP, 2017–2025

Figure 177: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by PE, 2017–2025

Figure 178: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by HDPE 2017 - 2025

Figure 179: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by LDPE, 2017 - 2025

Figure 180: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by LLDPE, 2017 - 2025

Figure 181: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Other, 2017 - 2025

Figure 182: Europe Gable Top Caps & Closures Market Share & BPS Analysis by Product Type, 2016 & 2025

Figure 183: Europe Gable Top Caps & Closures Market Y-o-Y Growth Rate by Product Type, 2016–2025

Figure 184: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Screw caps

Figure 185: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Flip caps

Figure 186: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by other segment

Figure 187: Europe Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 188: Europe Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Application, 2016–2025

Figure 189: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Prepared food, 2017 - 2025

Figure 190: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Dairy product, 2017 - 2025

Figure 191: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Ice cream mix, 2017 - 2025

Figure 192: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Edible Oil, 2017 - 2025

Figure 193: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by confectionaries, 2017 - 2025

Figure 194: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other segment, 2017 - 2025

Figure 195: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 196: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 197: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 198: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 199: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Beer, 2017 - 2025

Figure 200: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Wine, 2017 - 2025

Figure 201: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Other Liquors, 2017 - 2025

Figure 202: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 203: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 204: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Milk, 2017 - 2025

Figure 205: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Fruit juices, 2017 - 2025

Figure 206: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Ready to drink beverage, 2017 - 2025

Figure 207: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other segment, 2017 - 2025

Figure 208: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Laundry and Detergent 2016–2025

Figure 209: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Laundry and Detergent 2016?2025

Figure 210: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Paint and Lubricants, 2016–2025

Figure 211: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Paint and Lubricants, 2016?2025

Figure 212: Europe Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Pet food, 2016–2025

Figure 213: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Pet food, 2016?2025

Figure 214: Europe Gable Top Caps & Closures Market Share & BPS Analysis, by Diameter, 2016 & 2025

Figure 215: Europe Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Diameter, 2016–2025

Figure 216: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 25 mm – 35 mm, 2017 - 2025

Figure 217: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 35 mm – 45 mm, 2017 - 2025

Figure 218: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 45 mm – 60 mm, 2017 - 2025

Figure 219: Europe Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other diameter segment, 2017 - 2025

Figure 220: Europe Gable Top Caps & Closures Market Share & BPS Analysis by Country, 2016 & 2025

Figure 221: Europe Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 222: M Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Germany

Figure 223: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Italy

Figure 224: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by France

Figure 225: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by UK

Figure 226: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Spain

Figure 227: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by BENELUX

Figure 228: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Nordic

Figure 229: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Poland

Figure 230: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Russia

Figure 231: Europe Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Rest of Europe

Figure 232: Europe Gable Top Caps & Closures Market Attractiveness Analysis by Material Type, 2017 - 2025

Figure 233: Europe Gable Top Caps & Closures Market Attractiveness Analysis by Product Type, 2017 - 2025

Figure 234: Europe Gable Top Caps & Closures Market Attractiveness Analysis by Application, 2017 - 2025

Figure 235: Europe Gable Top Caps & Closures Market Attractiveness Analysis by Diameter, 2017 - 2025

Figure 236: Europe Gable Top Caps & Closures Market Attractiveness Analysis by Country, 2017 - 2025

Figure 237: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Market Volume (Million Units), 2016–2025

Figure 238: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), 2016?2025

Figure 239: APAC Gable Top Caps & Closures Market Share & BPS Analysis, by Material Type, 2016 & 2025

Figure 240: APAC Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Material Type, 2016–2025

Figure 241: APAC Gable Top Caps & Closures Market Absolute $ Opportunity, by PP, 2016–2025

Figure 242: APAC Gable Top Caps & Closures Market Absolute $ Opportunity by PE, 2016–2025

Figure 243: APAC Gable Top Caps & Closures Market Absolute $ Opportunity by HDPE, 2016–2025

Figure 244: APAC Gable Top Caps & Closures Market Absolute $ Opportunity by LDPE, 2016–2025

Figure 245: APAC Gable Top Caps & Closures Market Absolute $ Opportunity, by LLDPE, 2016–2025

Figure 246: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Others, 2016–2025

Figure 247: APAC Gable Top Caps & Closures Market Share & BPS Analysis by Product Type, 2016 & 2025

Figure 248: APAC Gable Top Caps & Closures Market Y-o-Y Growth Rate by Product Type, 2016–2025

Figure 249: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Screw caps

Figure 250: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Flip caps

Figure 251: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other product segment

Figure 252: APAC Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 253: APAC Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Application, 2016–2025

Figure 254: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Prepared food, 2016–2025

Figure 255: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Dairy products, 2016–2025

Figure 256: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ice cream mix, 2016–2025

Figure 257: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Edible oil, 2016–2025

Figure 258: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Confectionaries, 2016–2025

Figure 259: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Others, 2016–2025

Figure 260: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Beverages, 2016–2025

Figure 261: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Beverages, 2016–2025

Figure 262: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Alcoholic Beverages, 2016–2025

Figure 263: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Alcoholic Beverages, 2016–2025

Figure 264: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Beer, 2016–2025

Figure 265: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Wine, 2016–2025

Figure 266: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Other Liquors, 2016–2025

Figure 267: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Non-alcoholic Beverages, 2016–2025

Figure 268: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Non-alcoholic Beverages, 2016–2025

Figure 269: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Milk, 2016–2025

Figure 270: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Fruit Juices, 2016–2025

Figure 271: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Ready-to-Drink Beverages, 2016–2025

Figure 272: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by other segment 2016–2025

Figure 273: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Laundry and Detergents, 2016–2025

Figure 274: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Laundry and Detergents, 2016–2025

Figure 275: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Paints and Lubricants, 2016–2025

Figure 276: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn), by Paints and Lubricants, 2016–2025

Figure 277: APAC Gable Top Caps & Closures Market Value (US$ Mn) and Volume (Million Units), by Pet Food, 2016–2025

Figure 278: APAC Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Mn) by Pet Food, 2016–2025

Figure 279: APAC Gable Top Caps & Closures Market Share & BPS Analysis, by Diameter, 2016 & 2025

Figure 280: APAC Gable Top Caps & Closures Market Revenue Y-o-Y Growth, by Diameter, 2016–2025

Figure 281: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 282: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 283: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 284: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Diameter, 2016–2025

Figure 285: APAC Gable Top Caps & Closures Market Share & BPS Analysis, by Country, 2016 & 2025

Figure 286: APAC Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 287: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by China

Figure 288: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by India

Figure 289: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by ASEAN

Figure 290: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Japan

Figure 291: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by ANZ

Figure 292: APAC Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Rest of APAC

Figure 293: APAC Gable Top Caps & Closures Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 294: APAC Gable Top Caps & Closures Market Attractiveness Analysis, by Material Type, 2017–2025

Figure 295: APAC Gable Top Caps & Closures Market Attractiveness Analysis, by Application, 2017–2025

Figure 296: APAC Gable Top Caps & Closures Market Attractiveness Analysis, by Diameter, 2017–2025

Figure 297: APAC Gable Top Caps & Closures Market Attractiveness Analysis, by Country, 2017–2025

Figure 298: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 299: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 300: MEA Gable Top Caps & Closures Market Share & BPS Analysis, by Material Type, 2016 & 2025

Figure 301: MEA Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Material Type, 2016–2025

Figure 302: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by PP, 2017–2025

Figure 303: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by LDPE, 2017–2025

Figure 304: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by HDPE 2016-2025

Figure 305: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by LDPE, 2016-2025

Figure 306: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by LLDPE, 2016-2025

Figure 307: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Other, 2016-2025

Figure 308: MEA Gable Top Caps & Closures Market Share & BPS Analysis by Product Type, 2016 & 2025

Figure 309: MEA Gable Top Caps & Closures Market Y-o-Y Growth Rate by Product Type, 2016–2025

Figure 310: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Screw caps

Figure 311: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by Flip caps

Figure 312: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by other segment

Figure 313: MEA Gable Top Caps & Closures Market Share & BPS Analysis, by Application, 2016 & 2025

Figure 314: MEA Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Application, 2016–2025

Figure 315: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Prepared food, 2016-2025

Figure 316: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Dairy product, 2016-2025

Figure 317: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Ice cream mix, 2016-2025

Figure 318: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Edible Oil, 2016-2025

Figure 319: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by confectionaries, 2016-2025

Figure 320: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other segment, 2016-2025

Figure 321: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 322: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 323: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 324: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 325: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Beer, 2016-2025

Figure 326: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Wine, 2016-2025

Figure 327: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Other Liquors, 2016-2025

Figure 328: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), 2016–2025

Figure 329: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), 2016?2025

Figure 330: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Milk, 2016-2025

Figure 331: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Fruit juices, 2016-2025

Figure 332: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Ready to drink beverage, 2016-2025

Figure 333: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other segment, 2016-2025

Figure 334: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Laundry and Detergent 2016–2025

Figure 335: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Laundry and Detergent 2016?2025

Figure 336: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Paint and Lubricants, 2016–2025

Figure 337: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Paint and Lubricants, 2016?2025

Figure 338: MEA Gable Top Caps & Closures Market Value (US$ Thousand) and Market Volume (Million Units), by Pet food, 2016–2025

Figure 339: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by Pet food, 2016?2025

Figure 340: MEA Gable Top Caps & Closures Market Share & BPS Analysis, by Diameter, 2016 & 2025

Figure 341: MEA Gable Top Caps & Closures Market Y-o-Y Growth Rate, by Diameter, 2016–2025

Figure 342: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 25 mm – 35 mm, 2016-2025

Figure 343: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 35 mm – 45 mm, 2016-2025

Figure 344: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by 45 mm – 60 mm, 2016-2025

Figure 345: MEA Gable Top Caps & Closures Market Absolute $ Opportunity (US$ Thousand), by other diameter segment, 2016-2025

Figure 346: Middle East & Africa (MEA) Gable Top Caps & Closures Market Share & BPS Analysis by Country, 2016 & 2025

Figure 347: Middle East & Africa (MEA) Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 348: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by GCC

Figure 349: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by South Africa

Figure 350: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by North Africa

Figure 351: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Rest of MEA

Figure 352: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Material Type, 2017-2025

Figure 353: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Product Type, 2017-2025

Figure 354: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Application, 2017-2025

Figure 355: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Diameter, 2017 - 2025

Figure 356: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Country, 2017 - 2025

Figure 346: Middle East & Africa (MEA) Gable Top Caps & Closures Market Share & BPS Analysis by Country, 2016 & 2025

Figure 347: Middle East & Africa (MEA) Gable Top Caps & Closures Market Y-o-Y Growth Rate by Country, 2016–2025

Figure 348: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by GCC

Figure 349: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis (US$ Thousand), by South Africa

Figure 350: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by North Africa

Figure 351: MEA Gable Top Caps & Closures Market Absolute $ Opportunity Analysis, by Rest of MEA

Figure 352: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Material Type, 2017-2025

Figure 353: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Product Type, 2017-2025

Figure 354: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Application, 2017-2025

Figure 355: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Diameter, 2017 - 2025

Figure 356: MEA Gable Top Caps & Closures Market Attractiveness Analysis by Country, 2017 - 2025