Analysts’ Viewpoint

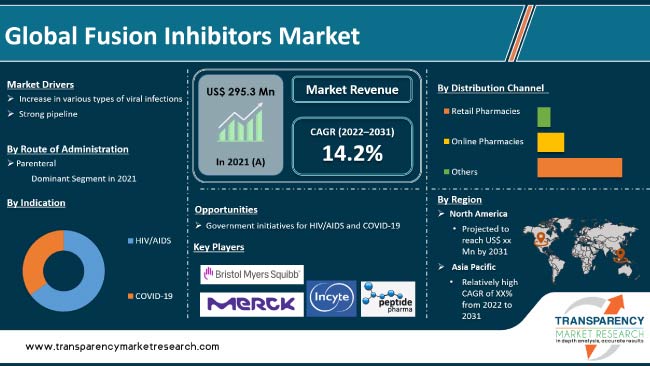

Increase in incidence and prevalence of human immunodeficiency virus (HIV) infections or acquired immunodeficiency syndrome (AIDS) is expected to drive the global fusion inhibitors market growth during the forecast period. The number of people living with HIV/AIDS across the globe has increased rapidly in the past few years. Surge in launch of fusion inhibitors drugs is also expected to propel the industry during the forecast period.

Rise in research & development activities in HIV fusion inhibitors and viral fusion inhibitors is likely to present significant opportunities for the fusion inhibitors market in the next few years. Manufacturers are focusing on developing drugs for the treatment of HIV and pre-exposure prophylaxis (prevention) of COVID-19.

Fusion inhibitors are also known as entry inhibitors. The initial two steps of the viral lifecycle are fusion and binding, which can be inhibited by fusion and entry inhibitors. These inhibitors work by binding to the attachment sites of the HIV virus, thereby inhibiting the fusion of HIV virus to the host cell membranes. These inhibitors disable the de novo virus infection and cell-to-cell transmission of the virus.

The prevalence of viral diseases has increased significantly across the globe in the past few years. Major viral diseases that require lifetime treatment include HIV/AIDS and chronic hepatitis virus. HIV is one of the key public health issues across the globe. An estimated 38.4 million people lived with HIV in 2021. The the global prevalence was projected to be around 1% of the adult population and about 1.5 million people became newly infected with HIV in the year.

According to UNAIDS, AIDS-related illnesses accounted for more than 650,000 deaths in 2021. Majority of the HIV infected people live in low and middle-income countries, with over 70% of them living in sub-Saharan Africa. Rise in prevalence of the disease and increase in awareness among the people have led to a rise in number of people receiving treatment. In 2018, more than 62% of the people living with HIV received treatment and over 53% of them were virally suppressed.

Governments and organizations are focusing on spreading awareness about the treatment for HIV through public education, vaccination, and effective medical support. This is likely to create demand for infusion inhibitor drugs for the effective treatment of HIV, thus accelerating market development.

In terms of route of administration, the global fusion inhibitors market has been bifurcated into parenteral and oral. The oral segment held the largest share in 2021 owing to the availability of drugs such as Maraviroc and Fostemsavir. However, parenteral is expected to be the dominant segment during the forecast period due the launch of drugs such as Evusheld for the treatment of COVID-19. The segment is projected to grow at a higher CAGR during the forecast period.

Based on indication, the global business has been split into HIV/AIDS and COVID-19. The COVID-19 segment is projected to account for dominant market share from 2022 to 2031. The segment is anticipated to expand at a higher CAGR during the forecast period. This is can be ascribed to increase in patient population with various infectious diseases such as COVID-19 infection.

Based on distribution channel, the global fusion inhibitors market has been segregated into retail pharmacies, online pharmacies, and others. The retail pharmacies segment is projected to account for dominant share from 2022 to 2031. This can be ascribed to the increase in sale of antiviral drugs through retail stores in developed countries such as the U.S. and Canada.

North America held more than 35% share in 2021. Well-established pharmaceutical & biopharmaceutical research industry and presence of the world’s leading companies engaged in research activities are the major factors driving market expansion in the region during the forecast period.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period. This can be ascribed to the increase in patient population living with HIV in the region. The market in Middle East & Africa is expected to grow at a moderate pace during the forecast period. According to a study published in a news article, currently, about 8.5 million people in South Africa are living with HIV as compared to 3.68 million in 2002. According to the study, South Africa has the most number of people enrolled on antiretroviral medications in the world.

The global fusion inhibitors market is consolidated, with the presence of international as well as local players. Top five or six players account for significant share of the industry. Leading companies are striving to increase their presence across the globe and establish strong distribution network through mergers & acquisitions, collaborations, and partnerships.

Key players operating in the global fusion inhibitors market are Bristol-Myers Squibb Company, PeptidePharma, Incyte, AstraZeneca, ViiV Healthcare Limited, Frontier Bio Corporation, Trimeris, Inc., Progenics Pharmaceuticals, Schering-Plough (Merck & Co.), Biogen, Vanderbilt University, and Genentech.

Leading players have been profiled in the fusion inhibitors market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 295.3 Mn |

|

Forecast (Value) in 2031 |

More than US$ 7.2 Bn |

|

Growth Rate (CAGR) |

14.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 295.3 Mn in 2021

It is projected to reach more than US$ 7.2 Bn by 2031

The CAGR was 18.7% from 2017 to 2031

The CAGR is anticipated to be 14.2% from 2022 to 2031

Increase in various types of viral infection and strong pipeline

North America is expected to account for the largest share during the forecast period.

Bristol-Myers Squibb Company, PeptidePharma, Incyte, AstraZeneca, ViiV Healthcare Limited, Frontier Bio Corporation, Trimeris, Inc., Progenics Pharmaceuticals, Schering-Plough (Merck & Co.), Biogen, Vanderbilt University, and Genentech

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Fusion Inhibitors Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Fusion Inhibitors Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. Drug Pricing Analysis

5.4. Pipeline Analysis

5.5. Covid-19 Pandemic Impact on the Industry

6. Global Fusion Inhibitors Market Analysis and Forecast, by Route of Administration

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Route of Administration, 2017–2031

6.3.1. Oral

6.3.2. Parenteral

6.4. Market Attractiveness Analysis, by Route of Administration

7. Global Fusion Inhibitors Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. HIV/AIDS

7.3.2. COVID-19

7.4. Market Attractiveness Analysis, by Indication

8. Global Fusion Inhibitors Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Retail Pharmacies

8.3.2. Online Pharmacies

8.3.3. Others

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Fusion Inhibitors Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Fusion Inhibitors Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Route of Administration, 2017–2031

10.2.1. Oral

10.2.2. Parenteral

10.3. Market Value Forecast, by Indication, 2017–2031

10.3.1. HIV/AIDS

10.3.2. COVID-19

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Retail Pharmacies

10.4.2. Online Pharmacies

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Route of Administration

10.6.2. By Indication

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Fusion Inhibitors Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Route of Administration, 2017–2031

11.2.1. Oral

11.2.2. Parenteral

11.3. Market Value Forecast, by Indication, 2017–2031

11.3.1. HIV/AIDS

11.3.2. COVID-19

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Retail Pharmacies

11.4.2. Online Pharmacies

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Route of Administration

11.6.2. By Indication

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Fusion Inhibitors Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Route of Administration, 2017–2031

12.2.1. Oral

12.2.2. Parenteral

12.3. Market Value Forecast, by Indication, 2017–2031

12.3.1. HIV/AIDS

12.3.2. COVID-19

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Retail Pharmacies

12.4.2. Online Pharmacies

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Route of Administration

12.6.2. By Indication

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Fusion Inhibitors Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Route of Administration, 2017–2031

13.2.1. Oral

13.2.2. Parenteral

13.3. Market Value Forecast, by Indication, 2017–2031

13.3.1. HIV/AIDS

13.3.2. COVID-19

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Retail Pharmacies

13.4.2. Online Pharmacies

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Route of Administration

13.6.2. By Indication

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Fusion Inhibitors Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Route of Administration, 2017–2031

14.2.1. Oral

14.2.2. Parenteral

14.3. Market Value Forecast, by Indication, 2017–2031

14.3.1. HIV/AIDS

14.3.2. COVID-19

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Retail Pharmacies

14.4.2. Online Pharmacies

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Route of Administration

14.6.2. By Indication

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share/Ranking Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Bristol-Myers Squibb Company

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. PeptidePharma

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Incyte

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Astrazeneca

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. ViiV Healthcare Limited

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Frontier Bio Corporation

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Trimeris, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Progenics Pharmaceuticals

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Schering-Plough (Merck & Co.)

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Biogen

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Vanderbilt University

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. Genentech

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

List of Tables

Table 01: Global Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 02: Global Fusion Inhibitors Market Value (US$ Mn) Forecast, by 2017‒2031, by Indication

Table 03: Global Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Fusion Inhibitors Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 07: North America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 08: North America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Fusion Inhibitors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 11: Europe Fusion Inhibitors Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 12: Europe Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Fusion Inhibitors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 15: Asia Pacific Fusion Inhibitors Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 16: Asia Pacific Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 19: Latin America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 20: Latin America Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Fusion Inhibitors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Fusion Inhibitors Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 23: Middle East & Africa Fusion Inhibitors Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 24: Middle East & Africa Fusion Inhibitors Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Fusion Inhibitors Market Value Share, by Route of Administration, 2021

Figure 03: Global Fusion Inhibitors Market Value Share, by Indication, 2021

Figure 04: Global Fusion Inhibitors Market Value Share, by Distribution Channel, 2021

Figure 05: Global Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 06: Global Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 09: Global Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 10: Global Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 11: Global Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 12: Global Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 13: Global Fusion Inhibitors Market Value Share Analysis, by Region, 2021 and 2031

Figure 14: Global Fusion Inhibitors Market Attractiveness Analysis, by Region, 2022–2031

Figure 15: North America Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: North America Fusion Inhibitors Market Value Share Analysis, by Country, 2021 and 2031

Figure 17: North America Fusion Inhibitors Market Attractiveness Analysis, by Country, 2022–2031

Figure 18: North America Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 19: North America Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 20: North America Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 21: North America Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 22: North America Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 23: North America Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 24: Europe Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Europe Fusion Inhibitors Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 26: Europe Fusion Inhibitors Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: Europe Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 28: Europe Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 29: Europe Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 30: Europe Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 31: Europe Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 32: Europe Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 33: Asia Pacific Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: Asia Pacific Fusion Inhibitors Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Asia Pacific Fusion Inhibitors Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Asia Pacific Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 37: Asia Pacific Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 38: Asia Pacific Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 39: Asia Pacific Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 40: Asia Pacific Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 41: Asia Pacific Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 42: Latin America Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Latin America Fusion Inhibitors Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Latin America Fusion Inhibitors Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 45: Latin America Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 46: Latin America Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 47: Latin America Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 48: Latin America Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 49: Latin America Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 50: Latin America Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 51: Middle East & Africa Fusion Inhibitors Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: Middle East & Africa Fusion Inhibitors Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 53: Middle East & Africa Fusion Inhibitors Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 54: Middle East & Africa Fusion Inhibitors Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 55: Middle East & Africa Fusion Inhibitors Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 56: Middle East & Africa Fusion Inhibitors Market Value Share Analysis, by Indication, 2021 and 2031

Figure 57: Middle East & Africa Fusion Inhibitors Market Attractiveness Analysis, by Indication, 2022–2031

Figure 58: Middle East & Africa Fusion Inhibitors Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 59: Middle East & Africa Fusion Inhibitors Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 60: Company Share Analysis, 2021