In the present times, one of the key concerns in the food & beverages industry is prevention of food wastage. Hence, manufacturers in the functional and barrier coatings for paper market are developing innovative barrier papers that help to reduce food wastage. For instance, Mitsubishi Hitec Paper Europe - a provider of specialty papers has gained expertise in ‘barricote barrier’ that are unique barrier papers extensively used in flexible packaging.

In terms of end use, the food segment of the functional and barrier coatings for paper market is estimated to reach an output of ~482,900 tons by the end of 2027. Thus, it is inevitable for manufacturers in the functional and barrier coatings for paper market to gain increased expertise in sustainable raw materials that prevent food wastage.

Unique barrier papers are gaining popularity for protection against vapor, aroma, and mineral oil migration. Companies in the functional and barrier coatings for paper market are increasing production capacities to produce fully recyclable barrier papers.

Companies in the functional and barrier coatings for paper market are looking beyond linear economy models, and are increasing efforts to fight plastic waste. For instance, Japanese manufacturer of materials, Kuraray, revealed that the company is aiming to fight plastic waste by introducing environment-friendly packaging with barrier coatings, such as EXCEVAL™ to increase the availability of packaging solutions for the paper industry.

Since plastic is causing strain on the environment, manufacturers in the functional and barrier coatings for paper market are introducing innovative packaging materials to address this issue. The aim to achieve reusable and recyclable plastic packaging by 2030 in the European Union is garnering the attention of manufacturers in the functional and barrier coatings for paper market. Thus, to create solutions in the current scenario, manufacturers are leveraging the advantages of specialty papers to contribute toward environment-friendly packaging solutions. Manufacturers in the functional and barrier coatings for paper market are increasing research efforts to develop high-performance barrier coatings using copolymers as a potential alternative to conventional plastic materials.

Repulpable paper packaging is another concern for manufacturers in the functional and barrier coatings for paper market. Renewed focus on paper materials has increased awareness about eco-friendly fiber-based solutions that are replacing plastic straws, disposable cups, bottles, and the likes. Companies in the functional and barrier coatings for paper market are increasing their efficacy in technologies that replace paraffin wax in paper materials and are exploring techniques that replace fluorocarbon for grease barriers in food-service applications.

Companies in the functional and barrier coatings for paper market are introducing novel materials such as barrier biowaxes that are not only used in food and beverages but also in other applications. They are streamlining their production activities to produce final system designs consisting of one to three different coatings that serve different functions, as per the end producers’ requirements. The trend of fiber-based materials is gaining the attention of manufacturers in order to contribute toward the development of repulpable paper materials.

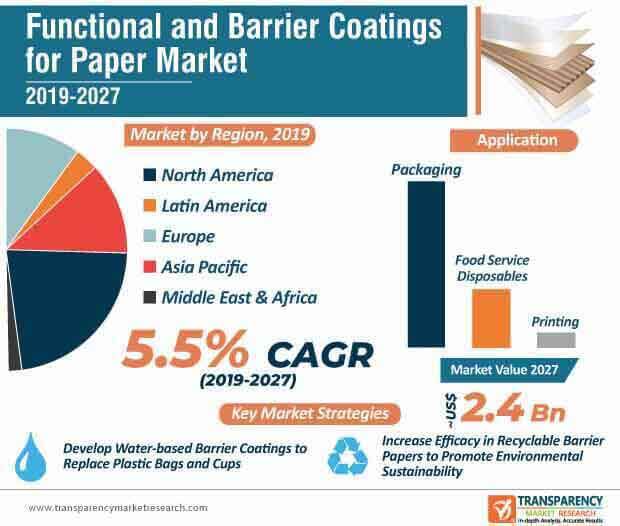

The functional and barrier coatings for paper market is largely fragmented, since tier 2 regional and local companies account for ~70-75% of the market share. Thus, leading players are facing tough competition from emerging players. However, lack of clarity and understanding toward regulations pose as a challenge for market players. For instance, Asia Pacific accounts for the share of the functional and barrier coatings for paper market. India being one of the fastest growing economies in Asia Pacific faces challenges when it comes to compliance with regulations. This phenomenon has stunted the pace of innovation in India functional and barrier coatings for paper market.

In order to increase awareness about regulations in the India functional and barrier coatings for paper market, manufacturers are leading by example and are increasing R&D to develop water-based barrier coatings to promote sustainability. These novel innovations are replacing conventional plastic bags and cups.

Analysts’ Viewpoint

Sustainability, recyclability, and repulpable paper packaging are some of the key focus points for manufacturers in the functional and barrier coatings for paper market. Groundbreaking innovations include the introduction of bio-based barrier coating solutions, predominantly made for paper cups.

However, recycling in developing and developed economies, such as the U.S., only sum up to a fraction of the millions of single-use paper cups that are disposed daily worldwide. Hence, manufacturers should introduce biodegradable paper cups and increase awareness about importance and need for recycling.

Companies should participate in trade fairs to showcase their innovations in functional and barrier coatings for paper and bolster their credibility credential in the global market landscape.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Market Viewpoint

3.1. Global Economic Outlook

3.2. Global Packaging Industry Outlook

3.3. Porters Five Forces Analysis

3.4. PESTLE Analysis for Key Countries

3.5. Key Trends Elaborating Features of Coated Paper

3.5.1. Food Contact Compliance

3.5.2. Water Resistance

3.5.3. Oil & Grease Resistant

3.5.4. Moisture Resistance

3.5.5. Abrasion Resistance

3.6. Macro-Economic Factors and Co-relation Analysis

3.6.1. Evolution and Advancement in Manufacturing Technology

3.6.2. Evolution and Advancement in Material Capabilities

3.6.3. Exports and Imports Scenario

3.6.4. Manufacturing Sector Value Added

3.7. Forecast Factors – Relevance and Impact

3.8. Value Chain Analysis

3.8.1. Exhaustive List of Active Participants

3.8.1.1. Raw Material Suppliers

3.8.1.2. Manufacturers

3.8.1.3. Distributors/End Users

3.8.2. Profitability Margins

3.9. Cost Teardown Analysis

3.10. Market Dynamics

3.10.1. Drivers

3.10.1.1. Supply Side

3.10.1.2. Demand Side

3.10.2. Restraints

3.10.3. Opportunities

4. Functional and Barrier Coating for Paper Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Value (US$ Mn) and Volume (Tonnes) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Global Functional and Barrier Coating for Paper Analysis and Forecast, By Coating Type

5.1. Section Summary

5.2. Introduction

5.2.1. Market share and Basis Points (BPS) Analysis By Coating Type

5.2.2. Y-o-Y Growth Projections By Coating Type

5.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

5.3.1. Wax Coating

5.3.1.1. Natural Wax

5.3.1.2. Synthetic Wax

5.3.2. Poly Coating

5.3.2.1. Epoxy

5.3.2.2. Vinyl

5.3.2.3. Phenolic

5.3.2.4. Acrylic

5.3.2.5. Others (Polyester, Polyolefin, etc.)

5.3.3. Pigment Coating

5.3.4. UV Coating

5.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

5.4.1. Wax Coating

5.4.1.1. Natural Wax

5.4.1.2. Synthetic Wax

5.4.2. Poly Coating

5.4.2.1. Epoxy

5.4.2.2. Vinyl

5.4.2.3. Phenolic

5.4.2.4. Acrylic

5.4.2.5. Others (Polyester, Polyolefin, etc.)

5.4.3. Pigment Coating

5.4.4. UV Coating

5.5. Market Attractiveness Analysis By Coating Type

6. Global Functional and Barrier Coating for Paper Analysis and Forecast, By Application

6.1. Section Summary

6.2. Introduction

6.2.1. Market share and Basis Points (BPS) Analysis By Application

6.2.2. Y-o-Y Growth Projections By Application

6.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

6.3.1. Printing

6.3.1.1. Banknotes

6.3.1.2. Passport & Visa Paper

6.3.1.3. Lottery & Gaming Paper

6.3.1.4. Stamp Paper

6.3.1.5. Ticket & Voucher Paper

6.3.2. Packaging

6.3.2.1. Corrugated Boxes

6.3.2.2. Folding Cartons

6.3.2.3. Labels & Tags

6.3.3. Food Service Disposables

6.3.3.1. Plates

6.3.3.2. Cups & Glass

6.3.3.3. Trays & Clamshell

6.3.3.4. Bowls & Tubs

6.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

6.4.1. Printing

6.4.1.1. Banknotes

6.4.1.2. Passport & Visa Paper

6.4.1.3. Lottery & Gaming Paper

6.4.1.4. Stamp Paper

6.4.1.5. Ticket & Voucher Paper

6.4.2. Packaging

6.4.2.1. Corrugated Boxes

6.4.2.2. Folding Cartons

6.4.2.3. Labels & Tags

6.4.3. Food Service Disposables

6.4.3.1. Plates

6.4.3.2. Cups & Glass

6.4.3.3. Trays & Clamshell

6.4.3.4. Bowls & Tubs

6.5. Market Attractiveness Analysis By Application

7. Global Functional and Barrier Coating for Paper Analysis and Forecast, By End Use

7.1. Section Summary

7.2. Introduction

7.2.1. Market share and Basis Points (BPS) Analysis By End Use

7.2.2. Y-o-Y Growth Projections By End Use

7.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

7.3.1. Food

7.3.1.1. Meat, Seafood & Poultry

7.3.1.2. Dairy Products

7.3.1.3. Fruits and Vegetables

7.3.1.4. Soups and Sauces

7.3.1.5. Ready to Eat Meals

7.3.1.6. Other Food Products

7.3.2. Beverages

7.3.3. Pharmaceuticals

7.3.4. Homecare & Toiletries

7.3.5. Personal Care & Cosmetics

7.3.6. Banking & Financial Institutions

7.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

7.4.1. Food

7.4.1.1. Meat, Seafood & Poultry

7.4.1.2. Dairy Products

7.4.1.3. Fruits and Vegetables

7.4.1.4. Soups and Sauces

7.4.1.5. Ready to Eat Meals

7.4.1.6. Other Food Products

7.4.2. Beverages

7.4.3. Pharmaceuticals

7.4.4. Homecare & Toiletries

7.4.5. Personal Care & Cosmetics

7.4.6. Banking & Financial Institutions

7.5. Market Attractiveness Analysis By End Use

8. Global Functional and Barrier Coating for Paper Market Analysis and Forecast, By Region

8.1. Section Summary

8.2. Introduction

8.2.1. Market share and Basis Points (BPS) Analysis By Region

8.2.2. Y-o-Y Growth Projections By Region

8.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific (APAC)

8.3.5. Middle East and Africa (MEA)

8.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027 By Region

8.4.1. North America

8.4.2. Latin America

8.4.3. Europe

8.4.4. Asia Pacific (APAC)

8.4.5. Middle East and Africa (MEA)

8.5. Market Attractiveness Analysis By Region

9. North America Functional and Barrier Coating for Paper Market Analysis and Forecast

9.1. Section Summary

9.2. Introduction

9.2.1. Market share and Basis Points (BPS) Analysis By Country

9.2.2. Y-o-Y Growth Projections By Country

9.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Country

9.3.1. U.S.

9.3.2. Canada

9.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027 By Country

9.4.1. U.S.

9.4.2. Canada

9.5. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

9.5.1. Wax Coating

9.5.1.1. Natural Wax

9.5.1.2. Synthetic Wax

9.5.2. Poly Coating

9.5.2.1. Epoxy

9.5.2.2. Vinyl

9.5.2.3. Phenolic

9.5.2.4. Acrylic

9.5.2.5. Others (Polyester, Polyolefin, etc.)

9.5.3. Pigment Coating

9.5.4. UV Coating

9.6. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

9.6.1. Wax Coating

9.6.1.1. Natural Wax

9.6.1.2. Synthetic Wax

9.6.2. Poly Coating

9.6.2.1. Epoxy

9.6.2.2. Vinyl

9.6.2.3. Phenolic

9.6.2.4. Acrylic

9.6.2.5. Others (Polyester, Polyolefin, etc.)

9.6.3. Pigment Coating

9.6.4. UV Coating

9.7. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

9.7.1. Printing

9.7.1.1. Banknotes

9.7.1.2. Passport & Visa Paper

9.7.1.3. Lottery & Gaming Paper

9.7.1.4. Stamp Paper

9.7.1.5. Ticket & Voucher Paper

9.7.2. Packaging

9.7.2.1. Corrugated Boxes

9.7.2.2. Folding Cartons

9.7.2.3. Labels & Tags

9.7.3. Food Service Disposables

9.7.3.1. Plates

9.7.3.2. Cups & Glass

9.7.3.3. Trays & Clamshell

9.7.3.4. Bowls & Tubs

9.8. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

9.8.1. Printing

9.8.1.1. Banknotes

9.8.1.2. Passport & Visa Paper

9.8.1.3. Lottery & Gaming Paper

9.8.1.4. Stamp Paper

9.8.1.5. Ticket & Voucher Paper

9.8.2. Packaging

9.8.2.1. Corrugated Boxes

9.8.2.2. Folding Cartons

9.8.2.3. Labels & Tags

9.8.3. Food Service Disposables

9.8.3.1. Plates

9.8.3.2. Cups & Glass

9.8.3.3. Trays & Clamshell

9.8.3.4. Bowls & Tubs

9.9. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

9.9.1. Food

9.9.1.1. Meat, Seafood & Poultry

9.9.1.2. Dairy Products

9.9.1.3. Fruits and Vegetables

9.9.1.4. Soups and Sauces

9.9.1.5. Ready to Eat Meals

9.9.1.6. Other Food Products

9.9.2. Beverages

9.9.3. Pharmaceuticals

9.9.4. Homecare & Toiletries

9.9.5. Personal Care & Cosmetics

9.9.6. Banking & Financial Institutions

9.10. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

9.10.1. Food

9.10.1.1. Meat, Seafood & Poultry

9.10.1.2. Dairy Products

9.10.1.3. Fruits and Vegetables

9.10.1.4. Soups and Sauces

9.10.1.5. Ready to Eat Meals

9.10.1.6. Other Food Products

9.10.2. Beverages

9.10.3. Pharmaceuticals

9.10.4. Homecare & Toiletries

9.10.5. Personal Care & Cosmetics

9.10.6. Banking & Financial Institutions

9.11. Key Market Participants – Intensity Mapping

10. Latin America Functional and Barrier Coating for Paper Market Analysis and Forecast

10.1. Section Summary

10.2. Introduction

10.2.1. Market share and Basis Points (BPS) Analysis By Country

10.2.2. Y-o-Y Growth Projections By Country

10.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Country

10.3.1. Brazil

10.3.2. Mexico

10.3.3. Argentina

10.3.4. Rest of Latin America

10.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027By Country

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Argentina

10.4.4. Rest of Latin America

10.5. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

10.5.1. Wax Coating

10.5.1.1. Natural Wax

10.5.1.2. Synthetic Wax

10.5.2. Poly Coating

10.5.2.1. Epoxy

10.5.2.2. Vinyl

10.5.2.3. Phenolic

10.5.2.4. Acrylic

10.5.2.5. Others (Polyester, Polyolefin, etc.)

10.5.3. Pigment Coating

10.5.4. UV Coating

10.6. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

10.6.1. Wax Coating

10.6.1.1. Natural Wax

10.6.1.2. Synthetic Wax

10.6.2. Poly Coating

10.6.2.1. Epoxy

10.6.2.2. Vinyl

10.6.2.3. Phenolic

10.6.2.4. Acrylic

10.6.2.5. Others (Polyester, Polyolefin, etc.)

10.6.3. Pigment Coating

10.6.4. UV Coating

10.7. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

10.7.1. Printing

10.7.1.1. Banknotes

10.7.1.2. Passport & Visa Paper

10.7.1.3. Lottery & Gaming Paper

10.7.1.4. Stamp Paper

10.7.1.5. Ticket & Voucher Paper

10.7.2. Packaging

10.7.2.1. Corrugated Boxes

10.7.2.2. Folding Cartons

10.7.2.3. Labels & Tags

10.7.3. Food Service Disposables

10.7.3.1. Plates

10.7.3.2. Cups & Glass

10.7.3.3. Trays & Clamshell

10.7.3.4. Bowls & Tubs

10.8. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

10.8.1. Printing

10.8.1.1. Banknotes

10.8.1.2. Passport & Visa Paper

10.8.1.3. Lottery & Gaming Paper

10.8.1.4. Stamp Paper

10.8.1.5. Ticket & Voucher Paper

10.8.2. Packaging

10.8.2.1. Corrugated Boxes

10.8.2.2. Folding Cartons

10.8.2.3. Labels & Tags

10.8.3. Food Service Disposables

10.8.3.1. Plates

10.8.3.2. Cups & Glass

10.8.3.3. Trays & Clamshell

10.8.3.4. Bowls & Tubs

10.9. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

10.9.1. Food

10.9.1.1. Meat, Seafood & Poultry

10.9.1.2. Dairy Products

10.9.1.3. Fruits and Vegetables

10.9.1.4. Soups and Sauces

10.9.1.5. Ready to Eat Meals

10.9.1.6. Other Food Products

10.9.2. Beverages

10.9.3. Pharmaceuticals

10.9.4. Homecare & Toiletries

10.9.5. Personal Care & Cosmetics

10.9.6. Banking & Financial Institutions

10.10. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

10.10.1. Food

10.10.1.1. Meat, Seafood & Poultry

10.10.1.2. Dairy Products

10.10.1.3. Fruits and Vegetables

10.10.1.4. Soups and Sauces

10.10.1.5. Ready to Eat Meals

10.10.1.6. Other Food Products

10.10.2. Beverages

10.10.3. Pharmaceuticals

10.10.4. Homecare & Toiletries

10.10.5. Personal Care & Cosmetics

10.10.6. Banking & Financial Institutions

10.11. Key Market Participants – Intensity Mapping

11. Europe Functional and Barrier Coating for Paper Market Analysis and Forecast

11.1. Section Summary

11.2. Introduction

11.2.1. Market share and Basis Points (BPS) Analysis By Country

11.2.2. Y-o-Y Growth Projections By Country

11.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Country

11.3.1. Germany

11.3.2. Spain

11.3.3. Italy

11.3.4. France

11.3.5. U.K.

11.3.6. BENELUX

11.3.7. NORDIC

11.3.8. Russia

11.3.9. Poland

11.3.10. Rest of Europe

11.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027By Country

11.4.1. Germany

11.4.2. Spain

11.4.3. Italy

11.4.4. France

11.4.5. U.K.

11.4.6. BENELUX

11.4.7. NORDIC

11.4.8. Russia

11.4.9. Poland

11.4.10. Rest of Europe

11.5. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

11.5.1. Wax Coating

11.5.1.1. Natural Wax

11.5.1.2. Synthetic Wax

11.5.2. Poly Coating

11.5.2.1. Epoxy

11.5.2.2. Vinyl

11.5.2.3. Phenolic

11.5.2.4. Acrylic

11.5.2.5. Others (Polyester, Polyolefin, etc.)

11.5.3. Pigment Coating

11.5.4. UV Coating

11.6. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

11.6.1. Wax Coating

11.6.1.1. Natural Wax

11.6.1.2. Synthetic Wax

11.6.2. Poly Coating

11.6.2.1. Epoxy

11.6.2.2. Vinyl

11.6.2.3. Phenolic

11.6.2.4. Acrylic

11.6.2.5. Others (Polyester, Polyolefin, etc.)

11.6.3. Pigment Coating

11.6.4. UV Coating

11.7. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

11.7.1. Printing

11.7.1.1. Banknotes

11.7.1.2. Passport & Visa Paper

11.7.1.3. Lottery & Gaming Paper

11.7.1.4. Stamp Paper

11.7.1.5. Ticket & Voucher Paper

11.7.2. Packaging

11.7.2.1. Corrugated Boxes

11.7.2.2. Folding Cartons

11.7.2.3. Labels & Tags

11.7.3. Food Service Disposables

11.7.3.1. Plates

11.7.3.2. Cups & Glass

11.7.3.3. Trays & Clamshell

11.7.3.4. Bowls & Tubs

11.8. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

11.8.1. Printing

11.8.1.1. Banknotes

11.8.1.2. Passport & Visa Paper

11.8.1.3. Lottery & Gaming Paper

11.8.1.4. Stamp Paper

11.8.1.5. Ticket & Voucher Paper

11.8.2. Packaging

11.8.2.1. Corrugated Boxes

11.8.2.2. Folding Cartons

11.8.2.3. Labels & Tags

11.8.3. Food Service Disposables

11.8.3.1. Plates

11.8.3.2. Cups & Glass

11.8.3.3. Trays & Clamshell

11.8.3.4. Bowls & Tubs

11.9. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

11.9.1. Food

11.9.1.1. Meat, Seafood & Poultry

11.9.1.2. Dairy Products

11.9.1.3. Fruits and Vegetables

11.9.1.4. Soups and Sauces

11.9.1.5. Ready to Eat Meals

11.9.1.6. Other Food Products

11.9.2. Beverages

11.9.3. Pharmaceuticals

11.9.4. Homecare & Toiletries

11.9.5. Personal Care & Cosmetics

11.9.6. Banking & Financial Institutions

11.10. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

11.10.1. Food

11.10.1.1. Meat, Seafood & Poultry

11.10.1.2. Dairy Products

11.10.1.3. Fruits and Vegetables

11.10.1.4. Soups and Sauces

11.10.1.5. Ready to Eat Meals

11.10.1.6. Other Food Products

11.10.2. Beverages

11.10.3. Pharmaceuticals

11.10.4. Homecare & Toiletries

11.10.5. Personal Care & Cosmetics

11.10.6. Banking & Financial Institutions

11.11. Key Market Participants – Intensity Mapping

12. Asia Pacific Functional and Barrier Coating for Paper Market Analysis and Forecast

12.1. Section Summary

12.2. Introduction

12.2.1. Market share and Basis Points (BPS) Analysis By Country

12.2.2. Y-o-Y Growth Projections By Country

12.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Country

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN Countries

12.3.5. Australia and New Zealand

12.3.6. Rest of APAC

12.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027 By Country

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. ASEAN Countries

12.4.5. Australia and New Zealand

12.4.6. Rest of APAC

12.5. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

12.5.1. Wax Coating

12.5.1.1. Natural Wax

12.5.1.2. Synthetic Wax

12.5.2. Poly Coating

12.5.2.1. Epoxy

12.5.2.2. Vinyl

12.5.2.3. Phenolic

12.5.2.4. Acrylic

12.5.2.5. Others (Polyester, Polyolefin, etc.)

12.5.3. Pigment Coating

12.5.4. UV Coating

12.6. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

12.6.1. Wax Coating

12.6.1.1. Natural Wax

12.6.1.2. Synthetic Wax

12.6.2. Poly Coating

12.6.2.1. Epoxy

12.6.2.2. Vinyl

12.6.2.3. Phenolic

12.6.2.4. Acrylic

12.6.2.5. Others (Polyester, Polyolefin, etc.)

12.6.3. Pigment Coating

12.6.4. UV Coating

12.7. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

12.7.1. Printing

12.7.1.1. Banknotes

12.7.1.2. Passport & Visa Paper

12.7.1.3. Lottery & Gaming Paper

12.7.1.4. Stamp Paper

12.7.1.5. Ticket & Voucher Paper

12.7.2. Packaging

12.7.2.1. Corrugated Boxes

12.7.2.2. Folding Cartons

12.7.2.3. Labels & Tags

12.7.3. Food Service Disposables

12.7.3.1. Plates

12.7.3.2. Cups & Glass

12.7.3.3. Trays & Clamshell

12.7.3.4. Bowls & Tubs

12.8. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

12.8.1. Printing

12.8.1.1. Banknotes

12.8.1.2. Passport & Visa Paper

12.8.1.3. Lottery & Gaming Paper

12.8.1.4. Stamp Paper

12.8.1.5. Ticket & Voucher Paper

12.8.2. Packaging

12.8.2.1. Corrugated Boxes

12.8.2.2. Folding Cartons

12.8.2.3. Labels & Tags

12.8.3. Food Service Disposables

12.8.3.1. Plates

12.8.3.2. Cups & Glass

12.8.3.3. Trays & Clamshell

12.8.3.4. Bowls & Tubs

12.9. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

12.9.1. Food

12.9.1.1. Meat, Seafood & Poultry

12.9.1.2. Dairy Products

12.9.1.3. Fruits and Vegetables

12.9.1.4. Soups and Sauces

12.9.1.5. Ready to Eat Meals

12.9.1.6. Other Food Products

12.9.2. Beverages

12.9.3. Pharmaceuticals

12.9.4. Homecare & Toiletries

12.9.5. Personal Care & Cosmetics

12.9.6. Banking & Financial Institutions

12.10. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

12.10.1. Food

12.10.1.1. Meat, Seafood & Poultry

12.10.1.2. Dairy Products

12.10.1.3. Fruits and Vegetables

12.10.1.4. Soups and Sauces

12.10.1.5. Ready to Eat Meals

12.10.1.6. Other Food Products

12.10.2. Beverages

12.10.3. Pharmaceuticals

12.10.4. Homecare & Toiletries

12.10.5. Personal Care & Cosmetics

12.10.6. Banking & Financial Institutions

12.11. Key Market Participants – Intensity Mapping

13. Middle East and Africa Functional and Barrier Coating for Paper Market Analysis and Forecast

13.1. Section Summary

13.2. Introduction

13.2.1. Market share and Basis Points (BPS) Analysis By Country

13.2.2. Y-o-Y Growth Projections By Country

13.3. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Country

13.3.1. GCC countries

13.3.2. Northern Africa

13.3.3. South Africa

13.3.4. Turkey

13.3.5. Rest of MEA

13.4. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027 By Country

13.4.1. GCC countries

13.4.2. Northern Africa

13.4.3. South Africa

13.4.4. Turkey

13.4.5. Rest of MEA

13.5. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Coating Type

13.5.1. Wax Coating

13.5.1.1. Natural Wax

13.5.1.2. Synthetic Wax

13.5.2. Poly Coating

13.5.2.1. Epoxy

13.5.2.2. Vinyl

13.5.2.3. Phenolic

13.5.2.4. Acrylic

13.5.2.5. Others (Polyester, Polyolefin, etc.)

13.5.3. Pigment Coating

13.5.4. UV Coating

13.6. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Coating Type

13.6.1. Wax Coating

13.6.1.1. Natural Wax

13.6.1.2. Synthetic Wax

13.6.2. Poly Coating

13.6.2.1. Epoxy

13.6.2.2. Vinyl

13.6.2.3. Phenolic

13.6.2.4. Acrylic

13.6.2.5. Others (Polyester, Polyolefin, etc.)

13.6.3. Pigment Coating

13.6.4. UV Coating

13.7. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By Application

13.7.1. Printing

13.7.1.1. Banknotes

13.7.1.2. Passport & Visa Paper

13.7.1.3. Lottery & Gaming Paper

13.7.1.4. Stamp Paper

13.7.1.5. Ticket & Voucher Paper

13.7.2. Packaging

13.7.2.1. Corrugated Boxes

13.7.2.2. Folding Cartons

13.7.2.3. Labels & Tags

13.7.3. Food Service Disposables

13.7.3.1. Plates

13.7.3.2. Cups & Glass

13.7.3.3. Trays & Clamshell

13.7.3.4. Bowls & Tubs

13.8. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By Application

13.8.1. Printing

13.8.1.1. Banknotes

13.8.1.2. Passport & Visa Paper

13.8.1.3. Lottery & Gaming Paper

13.8.1.4. Stamp Paper

13.8.1.5. Ticket & Voucher Paper

13.8.2. Packaging

13.8.2.1. Corrugated Boxes

13.8.2.2. Folding Cartons

13.8.2.3. Labels & Tags

13.8.3. Food Service Disposables

13.8.3.1. Plates

13.8.3.2. Cups & Glass

13.8.3.3. Trays & Clamshell

13.8.3.4. Bowls & Tubs

13.9. Historical Market Size (US$ Mn) and Volume (Tonnes) Analysis 2014-2018 By End Use

13.9.1. Food

13.9.1.1. Meat, Seafood & Poultry

13.9.1.2. Dairy Products

13.9.1.3. Fruits and Vegetables

13.9.1.4. Soups and Sauces

13.9.1.5. Ready to Eat Meals

13.9.1.6. Other Food Products

13.9.2. Beverages

13.9.3. Pharmaceuticals

13.9.4. Homecare & Toiletries

13.9.5. Personal Care & Cosmetics

13.9.6. Banking & Financial Institutions

13.10. Market Size (US$ Mn) and Volume (Tonnes) Forecast 2019-2027, By End Use

13.10.1. Food

13.10.1.1. Meat, Seafood & Poultry

13.10.1.2. Dairy Products

13.10.1.3. Fruits and Vegetables

13.10.1.4. Soups and Sauces

13.10.1.5. Ready to Eat Meals

13.10.1.6. Other Food Products

13.10.2. Beverages

13.10.3. Pharmaceuticals

13.10.4. Homecare & Toiletries

13.10.5. Personal Care & Cosmetics

13.10.6. Banking & Financial Institutions

13.11. Key Market Participants – Intensity Mapping

14. Market Structure Analysis

14.1. Market Analysis, by Tier of Companies

14.2. Production Capacity Share Analysis

14.3. Market Presence Analysis

14.3.1. By Regional footprint of Players

14.3.2. Channel footprint by Players

15. Competitive Landscape

15.1. Competition Dashboard

15.2. Company Market Share Analysis

15.3. Market Tier Structure Analysis

15.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

15.5. Competition Deep Dive

15.5.1. Paramelt B.V

15.5.1.1. Overview

15.5.1.2. Product Portfolio

15.5.1.3. Profitability

15.5.1.4. Production Footprint

15.5.1.5. Sales Footprint

15.5.1.6. Channel Footprint

15.5.1.7. Competition Benchmarking

15.5.1.8. Strategy

15.5.1.8.1. Marketing Strategy

15.5.1.8.2. Product Strategy

15.5.1.8.3. Channel Strategy

15.5.2. Cortec Corporation

15.5.2.1. Overview

15.5.2.2. Product Portfolio

15.5.2.3. Profitability

15.5.2.4. Production Footprint

15.5.2.5. Sales Footprint

15.5.2.6. Channel Footprint

15.5.2.7. Competition Benchmarking

15.5.2.8. Strategy

15.5.2.8.1. Marketing Strategy

15.5.2.8.2. Product Strategy

15.5.2.8.3. Channel Strategy

15.5.3. Sierra Coating Technologies LLC Overview

15.5.3.1. Product Portfolio

15.5.3.2. Profitability

15.5.3.3. Production Footprint

15.5.3.4. Sales Footprint

15.5.3.5. Channel Footprint

15.5.3.6. Competition Benchmarking

15.5.3.7. Strategy

15.5.3.7.1. Marketing Strategy

15.5.3.7.2. Product Strategy

15.5.3.7.3. Channel Strategy

15.5.3. Stora Enso Oyj

15.5.3.1. Overview

15.5.3.2. Product Portfolio

15.5.3.3. Profitability

15.5.3.4. Production Footprint

15.5.3.5. Sales Footprint

15.5.3.6. Channel Footprint

15.5.3.7. Competition Benchmarking

15.5.3.8. Strategy

15.5.3.8.1. Marketing Strategy

15.5.3.8.2. Product Strategy

15.5.3.8.3. Channel Strategy

15.5.4. Michelman, Inc.

15.5.4.1. Overview

15.5.4.2. Product Portfolio

15.5.4.3. Profitability

15.5.4.4. Production Footprint

15.5.4.5. Sales Footprint

15.5.4.6. Channel Footprint

15.5.4.7. Competition Benchmarking

15.5.4.8. Strategy

15.5.4.8.1. Marketing Strategy

15.5.4.8.2. Product Strategy

15.5.4.8.3. Channel Strategy

15.5.5. Coatings & Adhesives Corp

15.5.5.1. Overview

15.5.5.2. Product Portfolio

15.5.5.3. Profitability

15.5.5.4. Production Footprint

15.5.5.5. Sales Footprint

15.5.5.6. Channel Footprint

15.5.5.7. Competition Benchmarking

15.5.5.8. Strategy

15.5.5.8.1. Marketing Strategy

15.5.5.8.2. Product Strategy

15.5.5.8.3. Channel Strategy

15.5.6. Omnova Solutions Inc.

15.5.6.1. Overview

15.5.6.2. Product Portfolio

15.5.6.3. Profitability

15.5.6.4. Production Footprint

15.5.6.5. Sales Footprint

15.5.6.6. Channel Footprint

15.5.6.7. Competition Benchmarking

15.5.6.8. Strategy

15.5.6.8.1. Marketing Strategy

15.5.6.8.2. Product Strategy

15.5.6.8.3. Channel Strategy

15.5.7. Cattie Adhesive Solutions Llc

15.5.7.1. Overview

15.5.7.2. Product Portfolio

15.5.7.3. Profitability

15.5.7.4. Production Footprint

15.5.7.5. Sales Footprint

15.5.7.6. Channel Footprint

15.5.7.7. Competition Benchmarking

15.5.7.8. Strategy

15.5.7.8.1. Marketing Strategy

15.5.7.8.2. Product Strategy

15.5.7.8.3. Channel Strategy

15.5.8. SNP, Inc.

15.5.8.1. Overview

15.5.8.2. Product Portfolio

15.5.8.3. Profitability

15.5.8.4. Production Footprint

15.5.8.5. Sales Footprint

15.5.8.6. Channel Footprint

15.5.8.7. Competition Benchmarking

15.5.8.8. Strategy

15.5.8.8.1. Marketing Strategy

15.5.8.8.2. Product Strategy

15.5.8.8.3. Channel Strategy

15.5.9. ALTANA Group

15.5.9.1. Overview

15.5.9.2. Product Portfolio

15.5.9.3. Profitability

15.5.9.4. Production Footprint

15.5.9.5. Sales Footprint

15.5.9.6. Channel Footprint

15.5.9.7. Competition Benchmarking

15.5.9.8. Strategy

15.5.9.8.1. Marketing Strategy

15.5.9.8.2. Product Strategy

15.5.9.8.3. Channel Strategy

15.5.10. CH-Polymers Oy

15.5.10.1. Overview

15.5.10.2. Product Portfolio

15.5.10.3. Profitability

15.5.10.4. Production Footprint

15.5.10.5. Sales Footprint

15.5.10.6. Channel Footprint

15.5.10.7. Competition Benchmarking

15.5.10.8. Strategy

15.5.10.8.1. Marketing Strategy

15.5.10.8.2. Product Strategy

15.5.10.8.3. Channel Strategy

15.5.11. Sonoco Products Company

15.5.11.1. Overview

15.5.11.2. Product Portfolio

15.5.11.3. Profitability

15.5.11.4. Production Footprint

15.5.11.5. Sales Footprint

15.5.11.6. Channel Footprint

15.5.11.7. Competition Benchmarking

15.5.11.8. Strategy

15.5.11.8.1. Marketing Strategy

15.5.11.8.2. Product Strategy

15.5.11.8.3. Channel Strategy

15.5.12. Koninklijke DSM NV

15.5.12.1. Overview

15.5.12.2. Product Portfolio

15.5.12.3. Profitability

15.5.12.4. Production Footprint

15.5.12.5. Sales Footprint

15.5.12.6. Channel Footprint

15.5.12.7. Competition Benchmarking

15.5.12.8. Strategy

15.5.12.8.1. Marketing Strategy

15.5.12.8.2. Product Strategy

15.5.12.8.3. Channel Strategy

15.5.13. BASF S.E.

15.5.13.1. Overview

15.5.13.2. Product Portfolio

15.5.13.3. Profitability

15.5.13.4. Production Footprint

15.5.13.5. Sales Footprint

15.5.13.6. Channel Footprint

15.5.13.7. Competition Benchmarking

15.5.13.8. Strategy

15.5.13.8.1. Marketing Strategy

15.5.13.8.2. Product Strategy

15.5.13.8.3. Channel Strategy

15.5.14. Dow Chemical Company

15.5.14.1. Overview

15.5.14.2. Product Portfolio

15.5.14.3. Profitability

15.5.14.4. Production Footprint

15.5.14.5. Sales Footprint

15.5.14.6. Channel Footprint

15.5.14.7. Competition Benchmarking

15.5.14.8. Strategy

15.5.14.8.1. Marketing Strategy

15.5.14.8.2. Product Strategy

15.5.14.8.3. Channel Strategy

16. Assumptions and Acronyms

17. Research Methodology

List of Table

Table 01: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 02: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 03: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 04: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 05: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 06: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 07: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 08: Global Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Region

Table 09: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 10: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 11: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 12: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 13: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 14: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 15: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 16: North America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 17: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 18: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 19: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 20: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 21: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 22: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 23: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 24: Latin America Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 25: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 26: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 27: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 28: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 29: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 30: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 31: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 32: Europe Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 33: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 34: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 35: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 36: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 37: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 38: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 39: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 40: Asia Pacific Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 41: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 42: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 43: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Coating Type

Table 44: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 45: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 46: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application

Table 47: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

Table 48: Middle East & Africa Functional and Barrier Coatings for Paper Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By End Use

List of Figure

Figure 01: Global Functional and Barrier Coatings for Paper Market Value Share, by Coating Type, 2019(E)

Figure 02: Global Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type 2019(E)-2027(F)

Figure 04: Global Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 03: Global Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Application, 2019(E) & 2027(F)

Figure 05: Global Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 06: Global Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)

Figure 08: Global Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Region 2019(E)-2027(F)

Figure 07: Global Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Region 2019(E)-2027(F)

Figure 09: North America Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 10: North America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 11: North America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 12: North America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Coating Type 2019(E)-2027(F)

Figure 13: North America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type, 2019(E)-2027(F)

Figure 14: North America Functional and Barrier Coatings for Paper Market Value Share Analysis, By Coating Type, 2019(E)

Figure 16: North America Functional and Barrier Coatings for Paper Market Value Share Analysis, By Application, 2019(E)

Figure 15: North America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 17: North America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application 2019(E)-2027(F)

Figure 18: North America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by End Use 2019(E)-2027(F)

Figure 19: North America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 20: North America Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)

Figure 21: Latin America Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 22: Latin America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 23: Latin America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 24: Latin America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Coating Type 2019(E)-2027(F)

Figure 25: Latin America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type, 2019(E)-2027(F)

Figure 26: Latin America Functional and Barrier Coatings for Paper Market Value Share Analysis, By Coating Type, 2019(E)

Figure 28: Latin America Functional and Barrier Coatings for Paper Market Value Share Analysis, By Application, 2019(E)

Figure 27: Latin America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 29: Latin America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application 2019(E)-2027(F)

Figure 30: Latin America Functional and Barrier Coatings for Paper Market Y-o-Y growth, by End Use 2019(E)-2027(F)

Figure 31: Latin America Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 32: Latin America Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)

Figure 33: Europe Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 34: Europe Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 35: Europe Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 36: Europe Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Coating Type 2019(E)-2027(F)

Figure 37: Europe Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type, 2019(E)-2027(F)

Figure 38: Europe Functional and Barrier Coatings for Paper Market Value Share Analysis, By Coating Type, 2019(E)

Figure 40: Europe Functional and Barrier Coatings for Paper Market Value Share Analysis, By Application, 2019(E)

Figure 39: Europe Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 41: Europe Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application 2019(E)-2027(F)

Figure 42: Europe Functional and Barrier Coatings for Paper Market Y-o-Y growth, by End Use 2019(E)-2027(F)

Figure 43: Europe Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 44: Europe Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)

Figure 45: Asia Pacific Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 46: Asia Pacific Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 47: Asia Pacific Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 48: Asia Pacific Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Coating Type 2019(E)-2027(F)

Figure 49: Asia Pacific Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type, 2019(E)-2027(F)

Figure 50: Asia Pacific Functional and Barrier Coatings for Paper Market Value Share Analysis, By Coating Type, 2019(E)

Figure 52: Asia Pacific Functional and Barrier Coatings for Paper Market Value Share Analysis, By Application, 2019(E)

Figure 51: Asia Pacific Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 53: Asia Pacific Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application 2019(E)-2027(F)

Figure 54: Asia Pacific Functional and Barrier Coatings for Paper Market Y-o-Y growth, by End Use 2019(E)-2027(F)

Figure 55: Asia Pacific Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 56: Asia Pacific Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)

Figure 57: Middle East & Africa Functional and Barrier Coatings for Paper Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 58: Middle East & Africa Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 59: Middle East & Africa Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 60: Middle East & Africa Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Coating Type 2019(E)-2027(F)

Figure 61: Middle East & Africa Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Coating Type, 2019(E)-2027(F)

Figure 62: Middle East & Africa Functional and Barrier Coatings for Paper Market Value Share Analysis, By Coating Type, 2019(E)

Figure 64: Middle East & Africa Functional and Barrier Coatings for Paper Market Value Share Analysis, By Application, 2019(E)

Figure 63: Middle East & Africa Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 65: Middle East & Africa Functional and Barrier Coatings for Paper Market Y-o-Y growth, by Application 2019(E)-2027(F)

Figure 66: Middle East & Africa Functional and Barrier Coatings for Paper Market Y-o-Y growth, by End Use 2019(E)-2027(F)

Figure 67: Middle East & Africa Functional and Barrier Coatings for Paper Market Attractiveness Analysis, by End Use, 2019(E)-2027(F)

Figure 68: Middle East & Africa Functional and Barrier Coatings for Paper Market Value Share Analysis, By End Use, 2019(E)