Global Fuel Delivery System Market – An Overview

Performance and delivery of automobiles depends on fuels, which are often judged on the counts of volatility, purity, ignition temperature, and combustibility. Better efficiency is often a result of moderate volatility, high combustibility, and high cetane and octane number. Here, there is another thing that leads to proper automobile functioning – fuel delivery system. This is responsible for taking it to the engine and thus plays a significant role in ensuring uninterrupted supply.

As per Transparency Market Research, over the forecast period of 2016 to 2024, the global fuel delivery system market would see improvements in some of its statistics. A steady growth trajectory will be charted by the market in this period. In the Asia Pacific region, thriving automotive industry will play a key role in its growth. Additionally, it is worth noting that a number of opportunities will emerge for market players.

Some of the most significant factors in the market that have made their presence felt and show promise to impact the market in some way or the other are:

Fuel Delivery System Market: Snapshot

The global market for fuel delivery systems is heading towards overcapacity, a trend that can wreak havoc on the profit margins of large and small players, lead to an increase in the number of loss-making companies, and harm the future growth of human resources in the longer run. Considering the presence of a large number of manufacturers and suppliers in the market, the supply of fuel delivery systems is expected to continue to swell in the next few years. Focus of manufacturers on largescale production to achieve economies of scale is also expected to add to the ever-rising pile of fuel delivery systems and components in the global market.

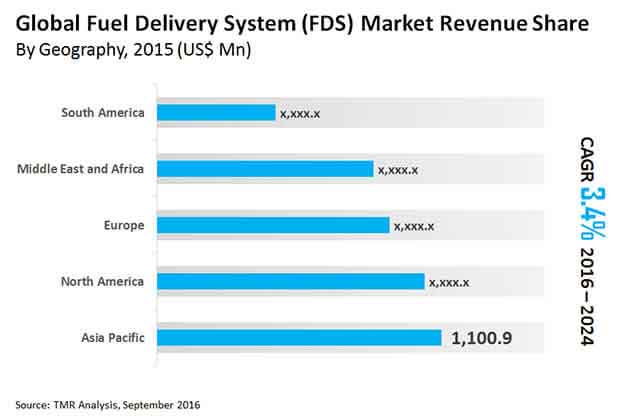

The inevitable supply-demand gap that will arise owing to the situation is expected to hamper growth of the market to a vast extent in the coming years. However, market will be able to gain sustainable growth opportunities owing to the rise in e-commerce activities, which has enabled manufacturers to achieve cross-border sales and reach developing regions that face a scarcity of supply. Transparency Market Research states that the global fuel delivery systems market will exhibit a 3.4% CAGR from 2016 through 2024. As a result, the market, which had a valuation of US$4,330.7 mn in 2015, is expected to rise to US$5,969.1 mn by 2024.

Stop Valves to Continue to Remain Dominant Fuel Delivery System Components

Of the chief components of a typical fuel delivery system, including stop valves, gas regulators, flow and pressure safety switches, sensors, and thermocouples, the segment of stop valves dominates, accounting for a nearly 54% share in the global market in 2015. Although the segment is expected to lose prominence to components such as flow and pressure safety switches and sensors in the next few years, it will continue to dominate the global market, albeit with a lesser share by 2024.

The market for flow and pressure control systems will be driven by high demand across process industries, which utilize these systems for the efficient management of fuel delivery for a variety of industrial applications. In the past few years, the rising emphasis on automation of industrial operations and processes has played a vital role in the development of automated flow control systems.

Emerging Economies in Asia and Africa to Present Lucrative Growth Opportunities

Of the key regional markets for fuel delivery systems, the market in Asia Pacific is presently the most lucrative one. The region held a nearly 25% of the total global fuel delivery systems market in 2015. Presence of a large number of manufacturing units and suppliers and the availability of raw materials aid the fuel delivery systems market’s growth in the region. The market for fuel delivery systems in the region is also driven owing to the vast expansion of energy industries in emerging economies such as India and China. Technological advancements in fuel delivery systems and the rising preference for automated systems in process industries is likely to benefit the market for fuel delivery systems in Asia Pacific in the next few years.

Over the forecasting horizon, the market for fuel delivery systems in Middle East and Africa (MEA) is likely to present lucrative growth opportunities. The Middle East and Africa fuel delivery systems market is projected to exhibit a 4.7% CAGR from 2016 through 2024. The rapid expansion of the oil and gas and refining industries in the region will be the key factors presenting opportunities for manufacturers and suppliers of fuel delivery systems. Rising investment I n the energy sector in Africa will also generate lucrative growth opportunities for the fuel delivery systems market in the next few years.

Some of the key vendors in the market are Bellofram Group of Companies, Metso, Honeywell International Inc., JANSEN Combustion and Boiler Technologies, Watlow Electric Manufacturing Company, Cashco Inc., Cameron (Schlumberger Ltd.), ARi Industries Inc., and Flowserve Corporation, and Emerson Electric Co.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Fuel Delivery Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Combustion Control Equipment Market Overview

4.3. Key Market Indicators

4.3.1. Automations in Fuel Delivery System Component

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Global Fuel Delivery Systems Market Analysis and Forecasts, 2014 – 2024

4.5.1. Market Revenue and Volume Projections (US$ Mn and Million Units)

4.6. Fuel Delivery Systems Market - Global Supply Demand Scenario

4.7. Porter’s Five Force Analysis

4.8. Value Chain Analysis : Global Fuel Delivery Systems Market (List of Manufacturers, Distributors and System Integrators)

4.9. Market Outlook

5. Global Fuel Delivery Systems Market Analysis and Forecasts, By Components

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size (US$ Mn) Forecast By Components

5.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

5.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

5.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

5.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

5.5. Market Attractiveness, by Components

6. Global Fuel Delivery Systems Market Analysis and Forecasts, By Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn and Million Units) Forecast By Application

6.4.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

6.4.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

6.4.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

6.5. Market Attractiveness, by Application

7. Global Fuel Delivery Systems Market Analysis and Forecasts, By Fuel Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

7.4.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

7.4.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

7.4.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

7.5. Market Attractiveness, by Fuel Type

8. Global Fuel Delivery Systems Market Analysis and Forecasts, By End-Use Industry

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

8.4.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

8.4.2. Power, 2014 – 2024 (US$ Mn and Million Units)

8.4.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

8.4.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

8.4.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

8.4.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

8.4.7. Water, 2014 – 2024 (US$ Mn and Million Units)

8.4.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

8.4.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

8.4.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)

8.4.11. Glass, 2014 – 2024 (US$ Mn and Million Units)

8.4.12. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

8.4.13. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

8.4.14. Automotive, 2014 – 2024 (US$ Mn and Million Units)

8.4.15. Building, 2014 – 2024 (US$ Mn and Million Units)

8.4.16. Others, 2014 – 2024 (US$ Mn and Million Units)

8.5. Market Attractiveness, by End-Use Industry

9. Global Fuel Delivery Systems Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Size (US$ Mn and Million Units) Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East and Africa

9.2.5. South America

9.3. Market Attractiveness, by Country/Region

10. North America Fuel Delivery Systems Market Analysis and Forecast

10.1. Key Findings

10.2. Policies and Regulations

10.3. Key Trends

10.4. Market Size (US$ Mn) Forecast By Components

10.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

10.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

10.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

10.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

10.5. Market Size (US$ Mn and Million Units) Forecast By Application

10.5.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

10.5.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

10.5.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

10.6. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

10.6.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

10.6.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

10.6.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

10.7. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

10.7.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

10.7.2. Power, 2014 – 2024 (US$ Mn and Million Units)

10.7.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

10.7.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

10.7.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

10.7.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

10.7.7. Water, 2014 – 2024 (US$ Mn and Million Units)

10.7.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

10.7.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

10.7.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)

10.7.11. Glass, 2014 – 2024 (US$ Mn and Million Units)

10.7.12. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

10.7.13. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

10.7.14. Automotive, 2014 – 2024 (US$ Mn and Million Units)

10.7.15. Building, 2014 – 2024 (US$ Mn and Million Units)

10.7.16. Others, 2014 – 2024 (US$ Mn and Million Units)

10.8. Market Size (US$ Mn and Million Units) Forecast By Country

10.8.1. U.S. Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

10.8.2. Canada Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

10.8.3. Rest of North America Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

10.9. Market Attractiveness Analysis

10.9.1. By Components

10.9.2. By Application

10.9.3. By Fuel Type

10.9.4. By End-Use Industry

10.9.5. By Country

11. Europe Fuel Delivery Systems Market Analysis and Forecast

11.1. Key Findings

11.2. Policies and Regulations

11.3. Key Trends

11.4. Market Size (US$ Mn) Forecast By Components

11.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

11.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

11.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

11.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

11.5. Market Size (US$ Mn and Million Units) Forecast By Application

11.5.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

11.5.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

11.5.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

11.6. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

11.6.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

11.6.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

11.6.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

11.7. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

11.7.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

11.7.2. Power, 2014 – 2024 (US$ Mn and Million Units)

11.7.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

11.7.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

11.7.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

11.7.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

11.7.7. Water, 2014 – 2024 (US$ Mn and Million Units)

11.7.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

11.7.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

11.7.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)

11.7.11. Glass, 2014 – 2024 (US$ Mn and Million Units)

11.7.12. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

11.7.13. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

11.7.14. Automotive, 2014 – 2024 (US$ Mn and Million Units)

11.7.15. Building, 2014 – 2024 (US$ Mn and Million Units)

11.7.16. Others, 2014 – 2024 (US$ Mn and Million Units)

11.8. Market Size (US$ Mn and Million Units) Forecast By Country

11.8.1. Germany Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.8.2. France Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.8.3. UK Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.8.4. Italy Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.8.5. Russia Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.8.6. Rest of Europe Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

11.9. Market Attractiveness Analysis

11.9.1. By Components

11.9.2. By Application

11.9.3. By Fuel Type

11.9.4. By End-Use Industry

11.9.5. By Country

12. Asia Pacific Fuel Delivery Systems Market Analysis and Forecast

12.1. Key Findings

12.2. Policies and Regulations

12.3. Key Trends

12.4. Market Size (US$ Mn) Forecast By Components

12.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

12.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

12.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

12.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

12.5. Market Size (US$ Mn and Million Units) Forecast By Application

12.5.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

12.5.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

12.5.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

12.6. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

12.6.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

12.6.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

12.6.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

12.7. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

12.7.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

12.7.2. Power, 2014 – 2024 (US$ Mn and Million Units)

12.7.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

12.7.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

12.7.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

12.7.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

12.7.7. Water, 2014 – 2024 (US$ Mn and Million Units)

12.7.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

12.7.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

12.7.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)Glass, 2014 – 2024 (US$ Mn and Million Units)

12.7.11. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

12.7.12. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

12.7.13. Automotive, 2014 – 2024 (US$ Mn and Million Units)

12.7.14. Building, 2014 – 2024 (US$ Mn and Million Units)

12.7.15. Others, 2014 – 2024 (US$ Mn and Million Units)

12.8. Market Size (US$ Mn and Million Units) Forecast By Country

12.8.1. India Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

12.8.2. China Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

12.8.3. Japan Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

12.8.4. Australia Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

12.8.5. Rest of APAC Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

12.9. Market Attractiveness Analysis

12.9.1. By Components

12.9.2. By Application

12.9.3. By Fuel Type

12.9.4. By End-Use Industry

12.9.5. By Country

13. Middle East And Africa Fuel Delivery Systems Market Analysis and Forecast

13.1. Key Findings

13.2. Policies and Regulations

13.3. Key Trends

13.4. Market Size (US$ Mn and Million Units) Forecast By Components

13.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

13.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

13.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

13.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

13.5. Market Size (US$ Mn and Million Units) Forecast By Application

13.5.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

13.5.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

13.5.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

13.6. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

13.6.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

13.6.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

13.6.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

13.7. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

13.7.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

13.7.2. Power, 2014 – 2024 (US$ Mn and Million Units)

13.7.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

13.7.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

13.7.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

13.7.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

13.7.7. Water, 2014 – 2024 (US$ Mn and Million Units)

13.7.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

13.7.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

13.7.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)

13.7.11. Glass, 2014 – 2024 (US$ Mn and Million Units)

13.7.12. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

13.7.13. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

13.7.14. Automotive, 2014 – 2024 (US$ Mn and Million Units)

13.7.15. Building, 2014 – 2024 (US$ Mn and Million Units)

13.7.16. Others, 2014 – 2024 (US$ Mn and Million Units)

13.8. Market Size (US$ Mn and Million Units) Forecast By Country

13.8.1. South Africa Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

13.8.2. UAE Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

13.8.3. Saudi Arabia Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

13.8.4. Rest of Middle East Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

13.9. Market Attractiveness Analysis

13.9.1. By Components

13.9.2. By Application

13.9.3. By Fuel Type

13.9.4. By End-Use Industry

13.9.5. By Country

14. South America Fuel Delivery Systems Market Analysis and Forecast

14.1. Key Findings

14.2. Policies and Regulations

14.3. Key Trends

14.4. Market Size (US$ Mn and Million Units) Forecast By Components

14.4.1. Stop Valves, 2014 – 2024 (US$ Mn)

14.4.2. Flow and Pressure Safety Switches, 2014 – 2024 (US$ Mn)

14.4.3. Gas Regulator, 2014 – 2024 (US$ Mn),

14.4.4. Others (Thermocouple, Flame Sensor etc.), 2014 – 2024 (US$ Mn)

14.5. Market Size (US$ Mn and Million Units) Forecast By Application

14.5.1. Boilers, 2014 – 2024 (US$ Mn and Million Units)

14.5.2. Furnaces, 2014 – 2024 (US$ Mn and Million Units)

14.5.3. Kilns and Ovens, 2014 – 2024 (US$ Mn and Million Units)

14.6. Market Size (US$ Mn and Million Units) Forecast By Fuel Type

14.6.1. Oil, 2014 – 2024 (US$ Mn and Million Units)

14.6.2. Gas, 2014 – 2024 (US$ Mn and Million Units)

14.6.3. Electricity, 2014 – 2024 (US$ Mn and Million Units)

14.7. Market Size (US$ Mn and Million Units) Forecast By End-Use Industry

14.7.1. Oil and Gas, 2014 – 2024 (US$ Mn and Million Units)

14.7.2. Power, 2014 – 2024 (US$ Mn and Million Units)

14.7.3. Mining, Mineral & Metal (MMM), 2014 – 2024 (US$ Mn and Million Units)

14.7.4. Chemicals, 2014 – 2024 (US$ Mn and Million Units)

14.7.5. Refining, 2014 – 2024 (US$ Mn and Million Units)

14.7.6. Printing and Publishing (P2), 2014 – 2024 (US$ Mn and Million Units)

14.7.7. Water, 2014 – 2024 (US$ Mn and Million Units)

14.7.8. Specialty Engineering Chemicals, 2014 – 2024 (US$ Mn and Million Units)

14.7.9. Pharmaceutical, 2014 – 2024 (US$ Mn and Million Units)

14.7.10. Food and Beverage, 2014 – 2024 (US$ Mn and Million Units)

14.7.11. Glass, 2014 – 2024 (US$ Mn and Million Units)

14.7.12. Ceramics, 2014 – 2024 (US$ Mn and Million Units)

14.7.13. Alternate Fuel, 2014 – 2024 (US$ Mn and Million Units)

14.7.14. Automotive, 2014 – 2024 (US$ Mn and Million Units)

14.7.15. Building, 2014 – 2024 (US$ Mn and Million Units)

14.7.16. Others, 2014 – 2024 (US$ Mn and Million Units)

14.8. Market Size (US$ Mn and Million Units) Forecast By Country

14.8.1. Brazil Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

14.8.2. Argentina Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

14.8.3. Rest of South America Fuel Delivery Systems Market Analysis and Forecast, 2014 – 2024 (US$ Mn and Million Units)

14.9. Market Attractiveness Analysis

14.9.1. By Components

14.9.2. By Application

14.9.3. By Fuel Type

14.9.4. By End-Use Industry

14.9.5. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Share Analysis By Company (2015)

15.3. Company Profiles

15.3.1. Global Market Players

15.3.1.1. Metso

15.3.1.1.1. Company Highlights

15.3.1.1.2. Products/Brand Offerings

15.3.1.1.3. Key Developments

15.3.1.1.4. Geographical Share

15.3.1.1.5. Company Financials

15.3.1.2. Honeywell International, Inc.

15.3.1.2.1. Company Highlights

15.3.1.2.2. Products/Brand Offerings

15.3.1.2.3. Key Developments

15.3.1.2.4. Geographical Share

15.3.1.2.5. Company Financials

15.3.1.3. Bellofram Group of Companies

15.3.1.3.1. Company Highlights

15.3.1.3.2. Products/Brand Offerings

15.3.1.3.3. Key Developments

15.3.1.4. Cashco, Inc.

15.3.1.4.1. Company Highlights

15.3.1.4.2. Products/Brand Offerings

15.3.1.4.3. Key Developments

15.3.1.5. Cameron (Schlumberger Limited)

15.3.1.5.1. Company Highlights

15.3.1.5.2. Products/Brand Offerings

15.3.1.5.3. Key Developments

15.3.1.5.4. Geographical Share

15.3.1.5.5. Company Financials

15.3.1.6. JANSEN Combustion And Boiler Technologies, Inc.

15.3.1.6.1. Company Highlights

15.3.1.6.2. Products/Brand Offerings

15.3.1.6.3. Key Developments

15.3.1.7. Watlow Electric Manufacturing Company

15.3.1.7.1. Company Highlights

15.3.1.7.2. Products/Brand Offerings

15.3.1.7.3. Key Developments

15.3.1.8. Flowserve Corporation

15.3.1.8.1. Company Highlights

15.3.1.8.2. Products/Brand Offerings

15.3.1.8.3. Key Developments

15.3.1.8.4. Geographical Share

15.3.1.8.5. Company Financials

15.3.1.9. Emerson Electric Co.

15.3.1.9.1. Company Highlights

15.3.1.9.2. Products/Brand Offerings

15.3.1.9.3. Key Developments

15.3.1.9.4. Geographical Share

15.3.1.9.5. Company Financials

15.3.1.10. ARi Industries, Inc.

15.3.1.10.1. Company Highlights

15.3.1.10.2. Products/Brand Offerings

15.3.1.10.3. Key Developments

15.3.1.10.4. Geographical Share

15.3.1.11. ABB Ltd.

15.3.1.11.1. Company Highlights

15.3.1.11.2. Products/Brand Offerings

15.3.1.11.3. Key Developments

15.3.1.11.4. Geographical Share

15.3.1.11.5. Company Financials

16. Key Take Away

List of Tables

Table 1: Global Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 2: Global Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 3: Global Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 4: Global Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 5: Global Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 6: Global Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 7: Global Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 8: Global Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 9: Global Fuel Delivery System Market Size Forecast, By Region Type, 2014–2024 (US$ Mn)

Table 10: Global Fuel Delivery System Market Volume Forecast, By Region Type, 2014–2024 (Thousand Units)

Table 11: North America Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 12: North America Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 13: North America Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 14: North America Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 15: North America Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 16: North America Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 17: North America Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 18: North America Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 19: The U.S. Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 20: The U.S. Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 21: The U.S. Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 22: The U.S. Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 23: The U.S. Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 24: The U.S. Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 25: The U.S. Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 26: The U.S. Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 27: Canada Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 28: Canada Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 29: Canada Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 30: Canada Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 31: Canada Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 32: Canada Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 33: Canada Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 34: Canada Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 35: Rest of North America Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 36: Rest of North America Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 37: Rest of North America Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 38: Rest of North America Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 39: Rest of North America Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 40: Rest of North America Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 41: Rest of North America Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 42: Rest of North America Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 43: Europe Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 44: Europe Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 45: Europe Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 46: Europe Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 47: Europe Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 48: Europe Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 49: Europe Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 50: Europe Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 51: Germany Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 52: Germany Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 53: Germany Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 54: Germany Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 55: Germany Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 56: Germany Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 57: Germany Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 58: Germany Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 59: France Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 60: France Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 61: France Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 62: France Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 63: France Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 64: France Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 65: France Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 66: France Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 67: UK Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 68: UK Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 69: UK Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 70: UK Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 71: UK Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 72: UK Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 73: UK Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 74: UK Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 75: Italy Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 76: Italy Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 77: Italy Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 78: Italy Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 79: Italy Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 80: Italy Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 81: Italy Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 82: Italy Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 83: Russia Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 84: Russia Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 85: Russia Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 86: Russia Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 87: Russia Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 88: Russia Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 89: Russia Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 90: Russia Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 91: Rest of Europe Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 92: Rest of Europe Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 93: Rest of Europe Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 94: Rest of Europe Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 95: Rest of Europe Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 96: Rest of Europe Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 97: Rest of Europe Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 98: Rest of Europe Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 99: Asia Pacific Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 100: Asia Pacific Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 101: Asia Pacific Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 102: Asia Pacific Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 103: Asia Pacific Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 104: Asia Pacific Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 105: Asia Pacific Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 106: Asia Pacific Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 107: India Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 108: India Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 109: India Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 110: India Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 111: India Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 112: India Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 113: India Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 114: India Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 115: China Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 116: China Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 117: China Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 118: China Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 119: China Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 120: China Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 121: China Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 122: China Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 123: Japan Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 124: Japan Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 125: Japan Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 126: Japan Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 127: Japan Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 128: Japan Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 129: Japan Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 130: Japan Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 131: South Korea Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 132: South Korea Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 133: South Korea Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 134: South Korea Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 135: South Korea Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 136: South Korea Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 137: South Korea Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 138: South Korea Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 139: South East Asia Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 140: South East Asia Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 141: South East Asia Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 142: South East Asia Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 143: South East Asia Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 144: South East Asia Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 145: South East Asia Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 146: South East Asia Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 147: Rest of Asia Pacific Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 148: Rest of Asia Pacific Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 149: Rest of Asia Pacific Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 150: Rest of Asia Pacific Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 151: Rest of Asia Pacific Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 152: Rest of Asia Pacific Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 153: Rest of Asia Pacific Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 154: Rest of Asia Pacific Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 155: MEA Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 156: MEA Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 157: MEA Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 158: MEA Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 159: MEA Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 160: MEA Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 161: MEA Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 162: MEA Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 163: South Africa Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 164: South Africa Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 165: South Africa Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 166: South Africa Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 167: South Africa Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 168: South Africa Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 169: South Africa Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 170: South Africa Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 171: UAE Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 172: UAE Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 173: UAE Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 174: UAE Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 175: UAE Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 176: UAE Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 177: UAE Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 178: UAE Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 179: Saudi Arabia Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 180: Saudi Arabia Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 181: Saudi Arabia Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 182: Saudi Arabia Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 183: Saudi Arabia Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 184: Saudi Arabia Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 185: Saudi Arabia Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 186: Saudi Arabia Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 187: Rest of MEA Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 188: Rest of MEA Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 189: Rest of MEA Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 190: Rest of MEA Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 191: Rest of MEA Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 192: Rest of MEA Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 193: Rest of MEA Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 194: Rest of MEA Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 195: South America Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 196: South America Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 197: South America Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 198: South America Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 199: South America Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 200: South America Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 201: South America Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 202: South America Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 203: Brazil Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 204: Brazil Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 205: Brazil Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 206: Brazil Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 207: Brazil Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 208: Brazil Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 209: Brazil Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 210: Brazil Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 211: Argentina Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 212: Argentina Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 213: Argentina Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 214: Argentina Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 215: Argentina Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 216: Argentina Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 217: Argentina Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 218: Argentina Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

Table 219: Rest of South America Fuel Delivery System Market Size Forecast, by Component, 2014–2024 (US$ Mn)

Table 220: Rest of South America Fuel Delivery System Market Volume Forecast, by Component, 2014–2024 (Thousand Units)

Table 221: Rest of South America Fuel Delivery System Market Size Forecast, by Fuel Type, 2014–2024 (US$ Mn)

Table 222: Rest of South America Fuel Delivery System Market Volume Forecast, by Fuel Type, 2014–2024 (Thousand Units)

Table 223: Rest of South America Fuel Delivery System Market Size Forecast, by Application, 2014–2024 (US$ Mn)

Table 224: Rest of South America Fuel Delivery System Market Volume Forecast, by Application, 2014–2024 (Thousand Units)

Table 225: Rest of South America Fuel Delivery System Market Size Forecast, by End-use, 2014–2024 (US$ Mn)

Table 226: Rest of South America Fuel Delivery System Market Volume Forecast, by End-use, 2014–2024 (Thousand Units)

List of Figures

Figure 1: Global Fuel Delivery Systems Market Revenue and Forecasts, 2014 – 2024 (US$ Mn)

Figure 2: Global Fuel Delivery Systems Market Volume and Forecasts, 2014 – 2024 (Thousand Units)

Figure 3: Fuel Delivery Systems Market Value Chain Analysis

Figure 4: Market Value Share, by Component (2015)

Figure 5: Market Value Share, by Application (2015)

Figure 6: Market Value Share, by Fuel Type (2015)

Figure 7: Market Value Share, by Region (2015)

Figure 8: Market Value Share, by End-Use (2015)

Figure 9: Global Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 10: Global Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 11: Global Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 12: Global Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 13: Global Fuel Delivery System Market Value Share Analysis, By Region, 2015 and 2024

Figure 14: Global Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 15: Global Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 16: Global Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 17: Global Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 18: Global Fuel Delivery Systems Market: Market Attractiveness, By Region

Figure 19: North America Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 20: North America Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 21: North America Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 22: North America Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 23: North America Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 24: North America Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 25: North America Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 26: North America Fuel Delivery Systems Market: Market Attractiveness, By Country

Figure 27: North America Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 28: Europe Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 29: Europe Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 30: Europe Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 31: Europe Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 32: Europe Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 33: Europe Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 34: Europe Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 35: Europe Fuel Delivery Systems Market: Market Attractiveness, By Country

Figure 36: Europe Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 37: Asia Pacific Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 38: Asia Pacific Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 39: Asia Pacific Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 40: Asia Pacific Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 41: Asia Pacific Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 42: Asia Pacific Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 43: Asia Pacific Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 44: Asia Pacific Fuel Delivery Systems Market: Market Attractiveness, By Country

Figure 45: Asia Pacific Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 46: MEA Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 47: MEA Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 48: MEA Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 49: MEA Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 50: Middle East and Africa Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 51: Middle East and Africa Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 52: Middle East and Africa Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 53: Middle East and Africa Fuel Delivery Systems Market: Market Attractiveness, By Country

Figure 54: Middle East and Africa Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 55: South America Fuel Delivery System Market Value Share Analysis, by Component, 2015 and 2024

Figure 56: South America Fuel Delivery System Market Value Share Analysis, by Fuel Type, 2015 and 2024

Figure 57: South America Fuel Delivery System Market Value Share Analysis, by Application, 2015 and 2024

Figure 58: South America Fuel Delivery System Market Value Share Analysis, by End-use, 2015 and 2024

Figure 59: South America Fuel Delivery Systems Market: Market Attractiveness, By Component

Figure 60: South America Fuel Delivery Systems Market: Market Attractiveness, By Fuel Type

Figure 61: South America Fuel Delivery Systems Market: Market Attractiveness, By Application

Figure 62: South America Fuel Delivery Systems Market: Market Attractiveness, By Country

Figure 63: South America Fuel Delivery Systems Market: Market Attractiveness, By End-use

Figure 64: Global Fuel Delivery Systems Market Share Analysis, by Company (2015)