Since it is suspected that the novel coronavirus may have originated from animals, stakeholders have become more aware about maintaining the safety of meat. There is a high chance of transmission of COVID-19 from food and food packaging. Hence, companies in the fresh meat packaging market are educating their logistics partners and other stakeholders in the value chain to avoid cross contamination while packaging the meat.

Good food safety practices recommended by the World Health Organization (WHO) are being followed by companies in the fresh meat packaging market. Since COVID-19 has led to a dip in meat consumption, companies in the fresh meat packaging market are rethinking their online marketing and sales strategies to boost product uptake via eCommerce. Packaging companies are encouraging consumers to disinfect food packaging surfaces with household sanitizers to ensure safety.

Amid health concerns surrounding the novel coronavirus, companies in the fresh meat packaging market are boosting their output capacities for case-ready packaging solutions. These solutions not only help to maximize protection of raw meat, but are also used to offset supply and demand uncertainties.

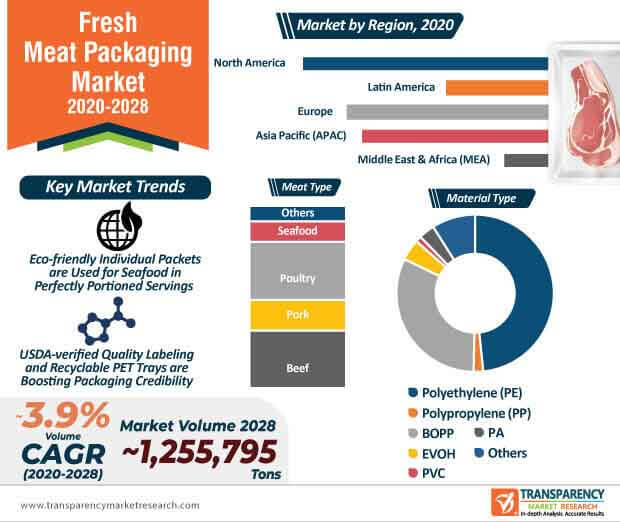

The fresh meat packaging market is predicted to climb a volume growth from ~924,165 tons in 2020 and surpass the volume of ~1,255,795 tons by 2028. High quality barrier technologies, such as vacuum sealing, barrier films, and modified temperatures are being used to ensure the freshness of raw meat. Packaging companies are witnessing a transition from fresh cutting and packaging operations to scaling of eCommerce pickups of perishable items.

A balance between sustainability and performance is being met by companies in the fresh meat packaging market that are becoming aware about consumer concerns for polystyrene foam tray covered with plastic film. Packaging companies are incorporating more recycled materials in their solutions to achieve consumers’ sustainability goals. They are producing bio-plastics and molded fiber materials to meet performance requirements in packaging to keep the meat fresh for consumption.

The fresh meat packaging market is slated to register a volume CAGR of 4.3% during the forecast period. Bio-plastics and molded fibers are offering packaging that is compostable and biodegradable. Manufacturers are establishing continuous research in sustainable materials whilst overcoming challenges to contain moisture and prevent the meat from sticking to packaging.

Companies in the fresh meat packaging market are increasing efforts to draw design innovations in seafood packaging. They are boosting their production capabilities in eco-friendly individual packets that are perfectly portioned servings. In order to make seafood products approachable, companies should improve their design capabilities to ensure food safety and freshness of the product.

Modified atmosphere packaging is a fast growing phenomenon in the poultry industry, since this meat supports growth of microorganisms. Even seafood packaging requires high concentrations of carbon dioxide as compared to poultry.

Lamb packaging is creating new business streams for manufacturers in the fresh meat packaging market who are increasing the availability of corrugated packaging solutions for the same. Stakeholders are increasing focus to deliver premium lamb with standard quality and design in packaging solutions. Manufacturers in the fresh meat packaging market are boosting their production in cardboard-based corrugated boxes with high strength and durability. They are increasing the availability of affordable packaging solutions in cardboard-based and environment-friendly packaging, since plastic and expanded polystyrene are facing a ban across nations.

Packaging companies are improving their design and material exposure capabilities for lamb meat to offset incidence of contamination.

Analysts’ Viewpoint

Case-ready packaging and improvements in material exposure in packaging for fresh meat are offsetting the incidence of contamination of COVID-19. In-store overwrap trays are being associated with unverified quality labeling and non-recyclable polystyrene foam trays. Hence, companies in the fresh meat packaging market should increase the availability of USDA-verified quality labeling, and recyclable PET and paperboard trays. Bio-plastics and modified fibers are gaining prominence in poultry packaging. Transparent packaging is being preferred for lamb meat and seafood to earn the trust of consumers. New packaging designs include food safety guidelines, nutritional values, and manufacturing date, among other details.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Fresh Meat Packaging Market Overview

3.1. Introduction

3.2. Global Packaging Market Overview

3.3. Global Flexible Packaging Market Overview

3.4. Macro-economic Factors – Correlation Analysis

3.5. Forecast Factors – Relevance & Impact

3.6. Value Chain Analysis

3.6.1. Exhaustive List of Active Participants

3.6.1.1. Manufacturers

3.6.1.2. Distributors/Retailers

3.6.1.3. End Users

3.6.2. Profitability Margins

3.7. Current Statistics and Probable Future Impact

3.8. Impact of COVID-19 on Fresh Meat Packaging Market

3.9. Drivers

3.10. Restraints

3.11. Opportunity Analysis

3.12. Trends

4. Fresh Meat Packaging Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Fresh Meat Packaging Market Analysis and Forecast, By Packaging Type

5.1. Introduction

5.1.1. Market share and Basis Points (BPS) Analysis, By Packaging Type

5.1.2. Y-o-Y Growth Projections, By Packaging Type

5.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

5.2.1. Modified Atmosphere Packaging

5.2.2. Vacuum Skin Packaging Stand up Pouches

5.2.3. Vacuum Thermoformed Packaging

5.2.4. Others

5.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

5.3.1. Modified Atmosphere Packaging

5.3.2. Vacuum Skin Packaging Stand up Pouches

5.3.3. Vacuum Thermoformed Packaging

5.3.4. Others

5.4. Market Attractiveness Analysis, By Packaging Type

6. Global Fresh Meat Packaging Market Analysis and Forecast, By Material

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Material

6.1.2. Y-o-Y Growth Projections, By Material

6.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

6.2.1. Polyethylene (PE)

6.2.2. Polypropylene (PP)

6.2.3. BOPP

6.2.4. EVOH

6.2.5. PVC

6.2.6. PA

6.2.7. Others

6.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

6.3.1. Polyethylene (PE)

6.3.2. Polypropylene (PP)

6.3.3. BOPP

6.3.4. EVOH

6.3.5. PVC

6.3.6. PA

6.3.7. Others

6.4. Market Attractiveness Analysis, By Material

7. Global Fresh Meat Packaging Market Analysis and Forecast, By Meat Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Meat Type

7.1.2. Y-o-Y Growth Projections, By Meat Type

7.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

7.2.1. Beef

7.2.2. Pork

7.2.3. Poultry

7.2.4. Seafood

7.2.5. Others

7.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

7.3.1. Beef

7.3.2. Pork

7.3.3. Poultry

7.3.4. Seafood

7.3.5. Others

7.4. Market Attractiveness Analysis, By Meat Type

8. Global Fresh Meat Packaging Market Analysis and Forecast, By Region

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis By Region

8.1.2. Y-o-Y Growth Projections By Region

8.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Region

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa (MEA)

8.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028 By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific

8.3.5. Middle East & Africa (MEA)

8.4. Market Attractiveness Analysis By Region

8.5. Prominent Trends

9. North America Fresh Meat Packaging Market Analysis and Forecast

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Country

9.1.2. Y-o-Y Growth Projections, By Country

9.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Country

9.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Country

9.3.1. U.S.

9.3.2. Canada

9.4. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

9.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

9.5.1. Modified Atmosphere Packaging

9.5.2. Vacuum Skin Packaging Stand up Pouches

9.5.3. Vacuum Thermoformed Packaging

9.5.4. Others

9.6. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

9.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

9.7.1. Polyethylene (PE)

9.7.2. Polypropylene (PP)

9.7.3. BOPP

9.7.4. EVOH

9.7.5. PVC

9.7.6. PA

9.7.7. Others

9.8. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

9.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

9.9.1. Beef

9.9.2. Pork

9.9.3. Poultry

9.9.4. Seafood

9.9.5. Others

9.10. Market Attractiveness Analysis

9.10.1. By Country

9.10.2. By Packaging Type

9.10.3. By Material Type

9.10.4. By Meat Type

10. Latin America Fresh Meat Packaging Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Country

10.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028 By Country

10.3.1. Brazil

10.3.2. Mexico

10.3.3. Argentina

10.3.4. Rest of Latin America

10.4. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

10.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

10.5.1. Modified Atmosphere Packaging

10.5.2. Vacuum Skin Packaging Stand up Pouches

10.5.3. Vacuum Thermoformed Packaging

10.5.4. Others

10.6. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

10.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

10.7.1. Polyethylene (PE)

10.7.2. Polypropylene (PP)

10.7.3. BOPP

10.7.4. EVOH

10.7.5. PVC

10.7.6. PA

10.7.7. Others

10.8. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

10.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

10.9.1. Beef

10.9.2. Pork

10.9.3. Poultry

10.9.4. Seafood

10.9.5. Others

10.10. Market Attractiveness Analysis

10.10.1. By Country

10.10.2. By Packaging Type

10.10.3. By Material Type

10.10.4. By Meat Type

11. Europe Fresh Meat Packaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Country

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028 By Country

11.3.1. Germany

11.3.2. Spain

11.3.3. Italy

11.3.4. France

11.3.5. U.K.

11.3.6. BENELUX

11.3.7. Nordic

11.3.8. Russia

11.3.9. Poland

11.3.10. Rest of Europe

11.4. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

11.5.1. Modified Atmosphere Packaging

11.5.2. Vacuum Skin Packaging Stand up Pouches

11.5.3. Vacuum Thermoformed Packaging

11.5.4. Others

11.6. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

11.7.1. Polyethylene (PE)

11.7.2. Polypropylene (PP)

11.7.3. BOPP

11.7.4. EVOH

11.7.5. PVC

11.7.6. PA

11.7.7. Others

11.8. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

11.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

11.9.1. Beef

11.9.2. Pork

11.9.3. Poultry

11.9.4. Seafood

11.9.5. Others

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Packaging Type

11.10.3. By Material Type

11.10.4. By Meat Type

12. Asia Pacific Fresh Meat Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Country

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028 By Country

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Australia and New Zealand

12.3.6. Rest of APAC

12.4. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

12.5.1. Modified Atmosphere Packaging

12.5.2. Vacuum Skin Packaging Stand up Pouches

12.5.3. Vacuum Thermoformed Packaging

12.5.4. Others

12.6. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

12.7.1. Polyethylene (PE)

12.7.2. Polypropylene (PP)

12.7.3. BOPP

12.7.4. EVOH

12.7.5. PVC

12.7.6. PA

12.7.7. Others

12.8. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

12.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

12.9.1. Beef

12.9.2. Pork

12.9.3. Poultry

12.9.4. Seafood

12.9.5. Others

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Packaging Type

12.10.3. By Material Type

12.10.4. By Meat Type

13. Middle East and Africa Fresh Meat Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Country

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Country

13.3.1. North Africa

13.3.2. GCC countries

13.3.3. South Africa

13.3.4. Turkey

13.3.5. Rest of MEA

13.4. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Packaging Type

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Packaging Type

13.5.1. Modified Atmosphere Packaging

13.5.2. Vacuum Skin Packaging Stand up Pouches

13.5.3. Vacuum Thermoformed Packaging

13.5.4. Others

13.6. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Material

13.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Material

13.7.1. Polyethylene (PE)

13.7.2. Polypropylene (PP)

13.7.3. BOPP

13.7.4. EVOH

13.7.5. PVC

13.7.6. PA

13.7.7. Others

13.8. Historical Market Value(US$ Mn) and Volume (Tons), 2015-2019, By Meat Type

13.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2020-2028, By Meat Type

13.9.1. Beef

13.9.2. Pork

13.9.3. Poultry

13.9.4. Seafood

13.9.5. Others

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Packaging Type

13.10.3. By Material Type

13.10.4. By Meat Type

14. Competitive Landscape

14.1. Market Structure

14.2. Competition Dashboard

14.3. Company Market Share Analysis

14.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

14.5. Competition Deep Dive

(Global Players)

14.5.1. Mondi Plc

14.5.1.1. Overview

14.5.1.2. Financials

14.5.1.3. Strategy

14.5.1.4. Recent Developments

14.5.1.5. SWOT Analysis

(The same will be provided for all the companies)

14.5.2. Amcor Plc

14.5.2.1. Overview

14.5.2.2. Financials

14.5.2.3. Strategy

14.5.2.4. Recent Developments

14.5.2.5. SWOT Analysis

14.5.3. Berry Global Group Inc.

14.5.3.1. Overview

14.5.3.2. Financials

14.5.3.3. Strategy

14.5.3.4. Recent Developments

14.5.3.5. SWOT Analysis

14.5.4. Coveris Holdings SA

14.5.4.1. Overview

14.5.4.2. Financials

14.5.4.3. Strategy

14.5.4.4. Recent Developments

14.5.4.5. SWOT Analysis

14.5.5. Winpak Ltd.

14.5.5.1. Overview

14.5.5.2. Financials

14.5.5.3. Strategy

14.5.5.4. Recent Developments

14.5.5.5. SWOT Analysis

14.5.6. Sealed Air Corporation

14.5.6.1. Overview

14.5.6.2. Financials

14.5.6.3. Strategy

14.5.6.4. Recent Developments

14.5.6.5. SWOT Analysis

14.5.7. Bolloré Group

14.5.7.1. Overview

14.5.7.2. Financials

14.5.7.3. Strategy

14.5.7.4. Recent Developments

14.5.7.5. SWOT Analysis

14.5.8. Cascades Inc.

14.5.8.1. Overview

14.5.8.2. Financials

14.5.8.3. Strategy

14.5.8.4. Recent Developments

14.5.8.5. SWOT Analysis

14.5.9. Amerplast Ltd.

14.5.9.1. Overview

14.5.9.2. Financials

14.5.9.3. Strategy

14.5.9.4. Recent Developments

14.5.9.5. SWOT Analysis

14.5.10. R. Faerch Plast A/S

14.5.10.1. Overview

14.5.10.2. Financials

14.5.10.3. Strategy

14.5.10.4. Recent Developments

14.5.10.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 1: Global Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 2: Global Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 3: Global Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 4: Global Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 5: Global Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Region, 2015(H)-2028(F)

Table 6: Global Fresh Meat Packaging Market Volume (Tons) Analysis, by Region, 2015(H)-2028(F)

Table 7: North America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 8: North America Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 9: North America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 10: North America Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 11: North America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Country, 2015(H)-2028(F)

Table 12: North America Fresh Meat Packaging Market Volume (Tons) Analysis, by Country, 2015(H)-2028(F)

Table 13: Latin America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 14: Latin America Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 15: Latin America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 16: Latin America Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 17: Latin America Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Country, 2015(H)-2028(F)

Table 18: Latin America Fresh Meat Packaging Market Volume (Tons) Analysis, by Country, 2015(H)-2028(F)

Table 19: Europe Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 20: Europe Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 21: Europe Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 22: Europe Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 23: Europe Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Country, 2015(H)-2028(F)

Table 24: Europe Fresh Meat Packaging Market Volume (Tons) Analysis, by Country, 2015(H)-2028(F)

Table 25: APAC Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 26: APAC Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 27: APAC Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 28: APAC Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 29: APAC Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Country, 2015(H)-2028(F)

Table 30: APAC Fresh Meat Packaging Market Volume (Tons) Analysis, by Country, 2015(H)-2028(F)

Table 31: MEA Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 32: MEA Fresh Meat Packaging Market Volume (Tons) Analysis, by Packaging Type, 2015(H)-2028(F)

Table 33: MEA Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Material, 2015(H)-2028(F)

Table 34: MEA Fresh Meat Packaging Market Volume (Tons) Analysis, by Material, 2015(H)-2028(F)

Table 35: MEA Fresh Meat Packaging Market Value (US$ Mn) Analysis, by Country, 2015(H)-2028(F)

Table 36: MEA Fresh Meat Packaging Market Volume (Tons) Analysis, by Country, 2015(H)-2028(F)

List of Figures

Figure 1: Global Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 2: Global Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 3: Global Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 4: Global Fresh Meat Packaging Market Y-o-Y Analysis, By Packaging Type, 2020E - 2028F

Figure 5: Global Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 6: Global Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 7: Global Fresh Meat Packaging Market Y-o-Y Analysis, By Material, 2020E - 2028F

Figure 8: Global Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 9: Global Fresh Meat Packaging Market Share Analysis, By Region, 2020E & 2028F

Figure 10: Global Fresh Meat Packaging Market Y-o-Y Analysis, By Region, 2020E - 2028F

Figure 11: Global Fresh Meat Packaging Market Attractiveness Analysis, By Region, 2020E - 2028F

Figure 12: North America Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 13: North America Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 14: North America Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 15: North America Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 16: North America Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 17: North America Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 18: North America Fresh Meat Packaging Market Share Analysis, By Country, 2020E & 2028F

Figure 19: North America Fresh Meat Packaging Market Attractiveness Analysis, By Country, 2020E - 2028F

Figure 20: Latin America Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 21: Latin America Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 22: Latin America Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 23: Latin America Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 24: Latin America Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 25: Latin America Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 26: Latin America Fresh Meat Packaging Market Share Analysis, By Country, 2020E & 2028F

Figure 27: Latin America Fresh Meat Packaging Market Attractiveness Analysis, By Country, 2020E - 2028F

Figure 28: Europe Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 29: Europe Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 30: Europe Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 31: Europe Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 32: Europe Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 33: Europe Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 34: Europe Fresh Meat Packaging Market Share Analysis, By Country, 2020E & 2028F

Figure 35: Europe Fresh Meat Packaging Market Attractiveness Analysis, By Country, 2020E - 2028F

Figure 36: APAC Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 37: APAC Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 38: APAC Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 39: APAC Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 40: APAC Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 41: APAC Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 42: APAC Fresh Meat Packaging Market Share Analysis, By Country, 2020E & 2028F

Figure 43: APAC Fresh Meat Packaging Market Attractiveness Analysis, By Country, 2020E - 2028F

Figure 44: MEA Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2015H-2019A

Figure 45: MEA Fresh Meat Packaging Market Value (US$ Mn) and Volume (Tons) Analysis, 2020E-2028F

Figure 46: MEA Fresh Meat Packaging Market Share Analysis, By Packaging Type, 2020E & 2028F

Figure 47: MEA Fresh Meat Packaging Market Attractiveness Analysis, By Packaging Type 2020E - 2028F

Figure 48: MEA Fresh Meat Packaging Market Share Analysis, By Material, 2020E & 2028F

Figure 49: MEA Fresh Meat Packaging Market Attractiveness Analysis, By Material, 2020E - 2028F

Figure 50: MEA Fresh Meat Packaging Market Share Analysis, By Country, 2020E & 2028F

Figure 51: MEA Fresh Meat Packaging Market Attractiveness Analysis, By Country, 2020E - 2028F