Analysts’ Viewpoint on Market Scenario

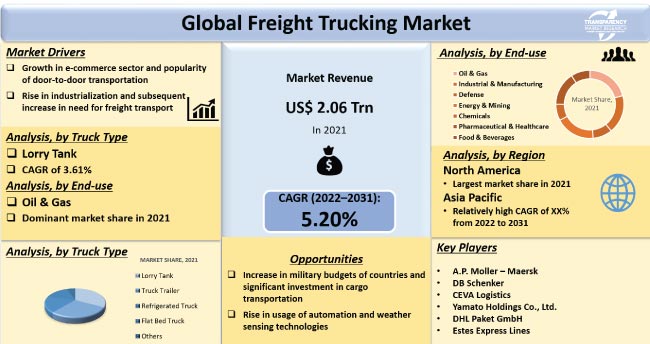

Significant growth in the e-commerce sector is driving the demand for door-to-door transportation of goods. This, in turn, is augmenting the global freight trucking market. Rise in need for transportation in oil & gas, energy, mining, and chemicals sectors is also boosting the demand for fright trucking. However, lack of efficient transport infrastructure in developing and underdeveloped economies is hampering the market.

Importance of freight transportation in tackling weather challenges has encouraged companies to incorporate environmental considerations in various areas of operations, from warehousing to transportation and procurement. Companies are increasingly adopting electric truck transportation, especially in developed regions such as Europe and North America.

They are also providing complete logistics tracking support, with a wide range of value added services such as GPS tracking, 24/7 real-time monitoring, and temperature-controlled trucks. Key freight and logistic trucking companies are actively carrying out mergers and acquisitions to expand their global footprint.

Freight trucks are large, powerful vehicles used to move cargo, merchandise, and other items from one location to another. These trucks are equipped with powerful engines and sturdy chassis, which allow them to carry bigger loads with ease. Typically, these trucks transport freight between factories, warehouses, wholesalers, and retailers. Fright transportation types of trucks include lorry tanks, truck trailers, refrigerated trucks, and flatbed trucks.

Growth of the freight trucking market can be ascribed to the rise in demand for house-to-house transport owing to the highly developing e-commerce sector. Increase in middle-class population and rise in disposable income level of the people are propelling the e-commerce industry. This, in turn, is leading to an increase in demand for freight trucking, thereby augmenting the revenue of freight trucking companies. Surge in industrialization, urbanization, and import-export activities is anticipated to offer lucrative opportunities to the market.

The e-commerce sector has created lucrative opportunities for dry van trucking. Getting things at fingertips has become a key trend owing to the ever evolving technologies, smartphones, and internet. This has resulted in significant growth in the door-to-door transportation industry. Increase in demand for consumer goods is also key factor propelling the demand for fright trucking transportation. Rise in demand for food and food-related products due to the growth in population has led to a significant increase in demand for refrigerated trucking.

Rapid growth in industries across the globe has led to a rise in demand for heavy haul trucking and flatbed trucking. Flatbed trucking is used for heavy machineries, irregular or complex shaped equipment, and other heavy industrial goods. Surge in urbanization and industrialization has prompted significant investments in construction and infrastructure. This, in turn, is boosting the demand for heavy haul trucking. Demand for lorry freight has also increased substantially across the globe due to the growth of the consumer goods industry.

Rise in cross-border tensions in Europe and Asia Pacific has led to an increase in demand for military cargo transport. For instance, Russia plans to invest US$ 600 Bn in national defense, security, and transportation during the on-going Russia-Ukraine war. Thus, growth in demand for cargo transportation is offering lucrative opportunities for heavy haul trucking.

In Asia, China, India, and Pakistan are investing substantially in military infrastructure amid border disputes. North Korea and South Korea are also engaged in cross-border tensions. These countries are investing significantly in the military sector. This is driving the transportation management system market in the region.

In terms of truck type, the lorry tank segment is expected to hold major share of the global freight trucking market during the forecast period. Crude oil is one of most transported commodities across the world. Transportation of crude oil is continuously increasing in developed and developing countries. This is boosting the demand for lorry tank freight trucking. Demand for lorry tank fright trucking is expected to be followed by the demand for truck trailer and refrigerated truck freight. Increase in need for food products hauling is likely to bolster the truck trailer and refrigerated truck segments.

Rise in volume of transportation of oil and gas across the globe is fueling the demand for freight trucks. Increase in export of oil, gasoline, and diesel also propelling the freight trucking market. The need for transportation of oil and gas has increased significantly owing to the rise in number of on-road vehicles, and surge in industrialization and urbanization.

North America is expected to dominate the global freight trucking market during the forecast period. Currently, the U.S. is one of the key markets for truck logistics in the region, with a highly integrated supply chain network that links producers and consumers. Besides transportation and distribution services, many niche players offer specialized services such as reverse logistics, IT services, and consulting in the country.

Asia Pacific is anticipated to be one of the fastest growing markets for freight trucking. Growth of the market in the region can be ascribed to the presence of developing economies such as China, India, Japan, and South Korea. Robust industrial development in China and India, and rapid growth of the e-commerce sector are likely to boost the freight trucking market in Asia Pacific. Transportation of FMCG goods is quite high in the region. Additionally, rise in military cargo transportation owing to the increase in military budgets in China, India, and Pakistan is driving the freight trucking industry in Asia Pacific.

In terms of revenue, Europe is also estimated to hold key share of the global market during the forecast period. As per the International Forwarding Association, road transport accounts for more than 75% share of freight transport in the European Union. Containerized cargo constitutes 23.9% share of all commodities, followed by dry bulk (23.2%).

The global freight trucking market is fragmented, with a large number of service providers controlling the majority of the share. Expansion of product portfolios and mergers and acquisitions are key strategies adopted by the leading players. Prominent players operating in the global market are A.P. Moller Maersk, Canadian National, CEVA Logistics, CMA CGM, DB SCHENKER, Deutsche Post, DHL Paket GmbH, Estes Express Lines, FedEx Corporation, Kuehne + Nagel, Nippon Express Co., Ltd., R+L Carriers, Saia Motor Freight Line, SNCF Geodis, Swift Transportation, TNT Holding B.V., UPS Freight, XPO Logistics, Yamato Holdings Co., Ltd., and YRC Worldwide Inc.

Each of these players has been profiled in the freight trucking market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.06 Trn |

|

Market Forecast Value in 2031 |

US$ 3.43 Trn |

|

Growth Rate (CAGR) |

5.20% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Trn for Value and Million Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 2.06 Trn in 2021

The market is expected to grow at a CAGR of 5.20% by 2031

The industr is likely to be valued at US$ 3.43 Trn in 2031

Increase in demand for door-to-door transportation due to growth in e-commerce platforms, and rise in military cargo transportation

Based on end-use, the oil & gas segment accounts for the major share of the market

North America is anticipated to be a highly lucrative region of the global freight trucking market

A.P. Moller Maersk, Canadian National, CEVA Logistics, CMA CGM, DB SCHENKER, Deutsche Post, DHL Paket GmbH, Estes Express Lines, FedEx Corporation, Kuehne + Nagel, Nippon Express Co., Ltd., R+L Carriers, Saia Motor Freight Line, SNCF Geodis, Swift Transportation, TNT Holding B.V., UPS Freight, XPO Logistics, Yamato Holdings Co., Ltd., and YRC Worldwide Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Million Tons, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Market Factor Analysis

2.4.1. Porter’s Five Forces Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Freight Trucking Market

4. Global Freight Trucking Market, By Truck Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

4.2.1. Lorry Tank

4.2.2. Truck Trailer

4.2.3. Refrigerated Truck

4.2.4. Flat Bed Truck

4.2.5. Others

5. Global Freight Trucking Market, By Distance

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

5.2.1. 50 Miles or Less

5.2.2. 51 to 100 Miles

5.2.3. 101-200 Miles

5.2.4. 201-500 Miles

5.2.5. Above 500 Miles

6. Global Freight Trucking Market, By Cargo Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

6.2.1. Dry Bulk Goods

6.2.2. Oil & Diesel

6.2.3. Postal

6.2.4. Others

7. Global Freight Trucking Market, By End-use

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

7.2.1. Oil & Gas

7.2.2. Industrial & Manufacturing

7.2.3. Defense

7.2.4. Energy and Mining

7.2.5. Chemicals

7.2.6. Pharmaceutical & Healthcare

7.2.7. Food & Beverages

8. Global Freight Trucking Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Freight Trucking Market

9.1. Market Snapshot

9.2. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

9.2.1. Lorry Tank

9.2.2. Truck Trailer

9.2.3. Refrigerated Truck

9.2.4. Flat Bed Truck

9.2.5. Others

9.3. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

9.3.1. 50 Miles or Less

9.3.2. 51 to 100 Miles

9.3.3. 101-200 Miles

9.3.4. 201-500 Miles

9.3.5. Above 500 Miles

9.4. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

9.4.1. Dry Bulk Goods

9.4.2. Oil & Diesel

9.4.3. Postal

9.4.4. Others

9.5. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

9.5.1. Oil & Gas

9.5.2. Industrial & Manufacturing

9.5.3. Defense

9.5.4. Energy and Mining

9.5.5. Chemicals

9.5.6. Pharmaceutical & Healthcare

9.5.7. Food & Beverages

9.6. Key Country Analysis – North America Freight Trucking Market Size Volume Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Freight Trucking Market

10.1. Market Snapshot

10.2. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

10.2.1. Lorry Tank

10.2.2. Truck Trailer

10.2.3. Refrigerated Truck

10.2.4. Flat Bed Truck

10.2.5. Others

10.3. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

10.3.1. 50 Miles or Less

10.3.2. 51 to 100 Miles

10.3.3. 101-200 Miles

10.3.4. 201-500 Miles

10.3.5. Above 500 Miles

10.4. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

10.4.1. Dry Bulk Goods

10.4.2. Oil & Diesel

10.4.3. Postal

10.4.4. Others

10.5. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

10.5.1. Oil & Gas

10.5.2. Industrial & Manufacturing

10.5.3. Defense

10.5.4. Energy and Mining

10.5.5. Chemicals

10.5.6. Pharmaceutical & Healthcare

10.5.7. Food & Beverages

10.6. Key Country Analysis – Europe Freight Trucking Market Size Volume Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. France

10.6.3. U.K.

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Region

10.6.7. Rest of Europe

11. Asia-Pacific Freight Trucking Market

11.1. Market Snapshot

11.2. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

11.2.1. Lorry Tank

11.2.2. Truck Trailer

11.2.3. Refrigerated Truck

11.2.4. Flat Bed Truck

11.2.5. Others

11.3. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

11.3.1. 50 Miles or Less

11.3.2. 51 to 100 Miles

11.3.3. 101-200 Miles

11.3.4. 201-500 Miles

11.3.5. Above 500 Miles

11.4. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

11.4.1. Dry Bulk Goods

11.4.2. Oil & Diesel

11.4.3. Postal

11.4.4. Others

11.5. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

11.5.1. Oil & Gas

11.5.2. Industrial & Manufacturing

11.5.3. Defense

11.5.4. Energy and Mining

11.5.5. Chemicals

11.5.6. Pharmaceutical & Healthcare

11.5.7. Food & Beverages

11.6. Key Country Analysis – Asia-Pacific Freight Trucking Market Size Volume Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Freight Trucking Market

12.1. Market Snapshot

12.2. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

12.2.1. Lorry Tank

12.2.2. Truck Trailer

12.2.3. Refrigerated Truck

12.2.4. Flat Bed Truck

12.2.5. Others

12.3. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

12.3.1. 50 Miles or Less

12.3.2. 51 to 100 Miles

12.3.3. 101-200 Miles

12.3.4. 201-500 Miles

12.3.5. Above 500 Miles

12.4. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

12.4.1. Dry Bulk Goods

12.4.2. Oil & Diesel

12.4.3. Postal

12.4.4. Others

12.5. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

12.5.1. Oil & Gas

12.5.2. Industrial & Manufacturing

12.5.3. Defense

12.5.4. Energy and Mining

12.5.5. Chemicals

12.5.6. Pharmaceutical & Healthcare

12.5.7. Food & Beverages

12.6. Key Country Analysis – Middle East & Africa Freight Trucking Market Size Volume Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Freight Trucking Market

13.1. Market Snapshot

13.2. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Truck Type

13.2.1. Lorry Tank

13.2.2. Truck Trailer

13.2.3. Refrigerated Truck

13.2.4. Flat Bed Truck

13.2.5. Others

13.3. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Distance

13.3.1. 50 Miles or Less

13.3.2. 51 to 100 Miles

13.3.3. 101-200 Miles

13.3.4. 201-500 Miles

13.3.5. Above 500 Miles

13.4. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

13.4.1. Dry Bulk Goods

13.4.2. Oil & Diesel

13.4.3. Postal

13.4.4. Others

13.5. Freight Trucking Market Size Volume (Million Tons), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use

13.5.1. Oil & Gas

13.5.2. Industrial & Manufacturing

13.5.3. Defense

13.5.4. Energy and Mining

13.5.5. Chemicals

13.5.6. Pharmaceutical & Healthcare

13.5.7. Food & Beverages

13.6. Key Country Analysis – South America Freight Trucking Market Size Volume Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14.3. Company Profile/ Key Players

14.3.1. A.P.Moller Maersk

14.3.1.1. Company Overview

14.3.1.2. Company Footprints

14.3.1.3. Production Locations

14.3.1.4. Product Portfolio

14.3.1.5. Competitors & Customers

14.3.1.6. Subsidiaries & Parent Organization

14.3.1.7. Recent Developments

14.3.1.8. Financial Analysis

14.3.1.9. Profitability

14.3.1.10. Revenue Share

14.3.2. Canadian National

14.3.2.1. Company Overview

14.3.2.2. Company Footprints

14.3.2.3. Production Locations

14.3.2.4. Product Portfolio

14.3.2.5. Competitors & Customers

14.3.2.6. Subsidiaries & Parent Organization

14.3.2.7. Recent Developments

14.3.2.8. Financial Analysis

14.3.2.9. Profitability

14.3.2.10. Revenue Share

14.3.3. CEVA Logistics

14.3.3.1. Company Overview

14.3.3.2. Company Footprints

14.3.3.3. Production Locations

14.3.3.4. Product Portfolio

14.3.3.5. Competitors & Customers

14.3.3.6. Subsidiaries & Parent Organization

14.3.3.7. Recent Developments

14.3.3.8. Financial Analysis

14.3.3.9. Profitability

14.3.3.10. Revenue Share

14.3.4. CMA CGM

14.3.4.1. Company Overview

14.3.4.2. Company Footprints

14.3.4.3. Production Locations

14.3.4.4. Product Portfolio

14.3.4.5. Competitors & Customers

14.3.4.6. Subsidiaries & Parent Organization

14.3.4.7. Recent Developments

14.3.4.8. Financial Analysis

14.3.4.9. Profitability

14.3.4.10. Revenue Share

14.3.5. DB SCHENKER

14.3.5.1. Company Overview

14.3.5.2. Company Footprints

14.3.5.3. Production Locations

14.3.5.4. Product Portfolio

14.3.5.5. Competitors & Customers

14.3.5.6. Subsidiaries & Parent Organization

14.3.5.7. Recent Developments

14.3.5.8. Financial Analysis

14.3.5.9. Profitability

14.3.5.10. Revenue Share

14.3.6. DHL Paket GmbH

14.3.6.1. Company Overview

14.3.6.2. Company Footprints

14.3.6.3. Production Locations

14.3.6.4. Product Portfolio

14.3.6.5. Competitors & Customers

14.3.6.6. Subsidiaries & Parent Organization

14.3.6.7. Recent Developments

14.3.6.8. Financial Analysis

14.3.6.9. Profitability

14.3.6.10. Revenue Share

14.3.7. Estes Express Lines

14.3.7.1. Company Overview

14.3.7.2. Company Footprints

14.3.7.3. Production Locations

14.3.7.4. Product Portfolio

14.3.7.5. Competitors & Customers

14.3.7.6. Subsidiaries & Parent Organization

14.3.7.7. Recent Developments

14.3.7.8. Financial Analysis

14.3.7.9. Profitability

14.3.7.10. Revenue Share

14.3.8. FedEx Corporation

14.3.8.1. Company Overview

14.3.8.2. Company Footprints

14.3.8.3. Production Locations

14.3.8.4. Product Portfolio

14.3.8.5. Competitors & Customers

14.3.8.6. Subsidiaries & Parent Organization

14.3.8.7. Recent Developments

14.3.8.8. Financial Analysis

14.3.8.9. Profitability

14.3.8.10. Revenue Share

14.3.9. Kuehne + Nagel

14.3.9.1. Company Overview

14.3.9.2. Company Footprints

14.3.9.3. Production Locations

14.3.9.4. Product Portfolio

14.3.9.5. Competitors & Customers

14.3.9.6. Subsidiaries & Parent Organization

14.3.9.7. Recent Developments

14.3.9.8. Financial Analysis

14.3.9.9. Profitability

14.3.9.10. Revenue Share

14.3.10. Nippon Express Co., Ltd.

14.3.10.1. Company Overview

14.3.10.2. Company Footprints

14.3.10.3. Production Locations

14.3.10.4. Product Portfolio

14.3.10.5. Competitors & Customers

14.3.10.6. Subsidiaries & Parent Organization

14.3.10.7. Recent Developments

14.3.10.8. Financial Analysis

14.3.10.9. Profitability

14.3.10.10. Revenue Share

14.3.11. R+L Carriers

14.3.11.1. Company Overview

14.3.11.2. Company Footprints

14.3.11.3. Production Locations

14.3.11.4. Product Portfolio

14.3.11.5. Competitors & Customers

14.3.11.6. Subsidiaries & Parent Organization

14.3.11.7. Recent Developments

14.3.11.8. Financial Analysis

14.3.11.9. Profitability

14.3.11.10. Revenue Share

14.3.12. Saia Motor Freight Line

14.3.12.1. Company Overview

14.3.12.2. Company Footprints

14.3.12.3. Production Locations

14.3.12.4. Product Portfolio

14.3.12.5. Competitors & Customers

14.3.12.6. Subsidiaries & Parent Organization

14.3.12.7. Recent Developments

14.3.12.8. Financial Analysis

14.3.12.9. Profitability

14.3.12.10. Revenue Share

14.3.13. SNCF Geodis

14.3.13.1. Company Overview

14.3.13.2. Company Footprints

14.3.13.3. Production Locations

14.3.13.4. Product Portfolio

14.3.13.5. Competitors & Customers

14.3.13.6. Subsidiaries & Parent Organization

14.3.13.7. Recent Developments

14.3.13.8. Financial Analysis

14.3.13.9. Profitability

14.3.13.10. Revenue Share

14.3.14. Swift Transportation

14.3.14.1. Company Overview

14.3.14.2. Company Footprints

14.3.14.3. Production Locations

14.3.14.4. Product Portfolio

14.3.14.5. Competitors & Customers

14.3.14.6. Subsidiaries & Parent Organization

14.3.14.7. Recent Developments

14.3.14.8. Financial Analysis

14.3.14.9. Profitability

14.3.14.10. Revenue Share

14.3.15. TNT Holding B.V.

14.3.15.1. Company Overview

14.3.15.2. Company Footprints

14.3.15.3. Production Locations

14.3.15.4. Product Portfolio

14.3.15.5. Competitors & Customers

14.3.15.6. Subsidiaries & Parent Organization

14.3.15.7. Recent Developments

14.3.15.8. Financial Analysis

14.3.15.9. Profitability

14.3.15.10. Revenue Share

14.3.16. UPS Freight

14.3.16.1. Company Overview

14.3.16.2. Company Footprints

14.3.16.3. Production Locations

14.3.16.4. Product Portfolio

14.3.16.5. Competitors & Customers

14.3.16.6. Subsidiaries & Parent Organization

14.3.16.7. Recent Developments

14.3.16.8. Financial Analysis

14.3.16.9. Profitability

14.3.16.10. Revenue Share

14.3.17. XPO Logistics

14.3.17.1. Company Overview

14.3.17.2. Company Footprints

14.3.17.3. Production Locations

14.3.17.4. Product Portfolio

14.3.17.5. Competitors & Customers

14.3.17.6. Subsidiaries & Parent Organization

14.3.17.7. Recent Developments

14.3.17.8. Financial Analysis

14.3.17.9. Profitability

14.3.17.10. Revenue Share

14.3.18. Yamato Holdings Co., Ltd.

14.3.18.1. Company Overview

14.3.18.2. Company Footprints

14.3.18.3. Production Locations

14.3.18.4. Product Portfolio

14.3.18.5. Competitors & Customers

14.3.18.6. Subsidiaries & Parent Organization

14.3.18.7. Recent Developments

14.3.18.8. Financial Analysis

14.3.18.9. Profitability

14.3.18.10. Revenue Share

14.3.19. YRC Worldwide Inc.

14.3.19.1. Company Overview

14.3.19.2. Company Footprints

14.3.19.3. Production Locations

14.3.19.4. Product Portfolio

14.3.19.5. Competitors & Customers

14.3.19.6. Subsidiaries & Parent Organization

14.3.19.7. Recent Developments

14.3.19.8. Financial Analysis

14.3.19.9. Profitability

14.3.19.10. Revenue Share

14.3.20. Deutsche Post

14.3.20.1. Company Overview

14.3.20.2. Company Footprints

14.3.20.3. Production Locations

14.3.20.4. Product Portfolio

14.3.20.5. Competitors & Customers

14.3.20.6. Subsidiaries & Parent Organization

14.3.20.7. Recent Developments

14.3.20.8. Financial Analysis

14.3.20.9. Profitability

14.3.20.10. Revenue Share

List of Tables

Table 1: Global Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 2: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 3: Global Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 4: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 5: Global Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 6: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 7: Global Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 8: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 9: Global Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Table 10: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 12: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 13: North America Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 14: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 15: North America Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 16: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 17: North America Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 18: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 19: North America Freight Trucking Market Volume (Million Tons) Forecast, by Country 2017-2031

Table 20: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Country 2017-2031

Table 21: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 22: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 23: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 24: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 25: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 26: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 27: Europe Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 28: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 29: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 30: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 32: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 33: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 34: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 35: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 36: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 37: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 38: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 39: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 42: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 43: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 44: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 45: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 46: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 47: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 48: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 49: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Table 52: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 53: South America Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Table 54: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Table 55: South America Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Table 56: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 57: South America Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Table 58: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 59: South America Freight Trucking Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 60: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 2: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 3: Global Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 4: Global Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 5: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 6: Global Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 7: Global Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 8: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 9: Global Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 10: Global Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 11: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 12: Global Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 13: Global Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 14: Global Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 16: North America Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 17: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 18: North America Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 19: North America Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 20: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 21: North America Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 22: North America Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 23: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 24: North America Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 25: North America Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 26: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 27: North America Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 28: North America Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 29: North America Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 30: North America Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 31: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 32: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 33: Europe Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 34: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 35: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 36: Europe Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 37: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 38: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 39: Europe Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 41: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 42: Europe Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 43: Europe Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 44: Europe Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 45: Europe Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 47: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 48: Asia Pacific Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 49: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 50: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 51: Asia Pacific Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 52: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 53: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 54: Asia Pacific Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 56: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 57: Asia Pacific Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 59: Asia Pacific Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 60: Asia Pacific Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 61: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 62: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 63: Middle East & Africa Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 64: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 65: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 66: Middle East & Africa Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 67: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 68: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 69: Middle East & Africa Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 70: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 71: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 72: Middle East & Africa Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 74: Middle East & Africa Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 75: Middle East & Africa Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 76: South America Freight Trucking Market Volume (Million Tons) Forecast, by Truck Type, 2017-2031

Figure 77: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 78: South America Freight Trucking Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2022-2031

Figure 79: South America Freight Trucking Market Volume (Million Tons) Forecast, by Distance, 2017-2031

Figure 80: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Distance, 2017-2031

Figure 81: South America Freight Trucking Market, Incremental Opportunity, by Distance, Value (US$ Bn), 2022-2031

Figure 82: South America Freight Trucking Market Volume (Million Tons) Forecast, by Cargo Type, 2017-2031

Figure 83: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 84: South America Freight Trucking Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2022-2031

Figure 85: South America Freight Trucking Market Volume (Million Tons) Forecast, by End-use, 2017-2031

Figure 86: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 87: South America Freight Trucking Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2022-2031

Figure 88: South America Freight Trucking Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 89: South America Freight Trucking Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 90: South America Freight Trucking Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031