Analysts’ Viewpoint on Market Scenario

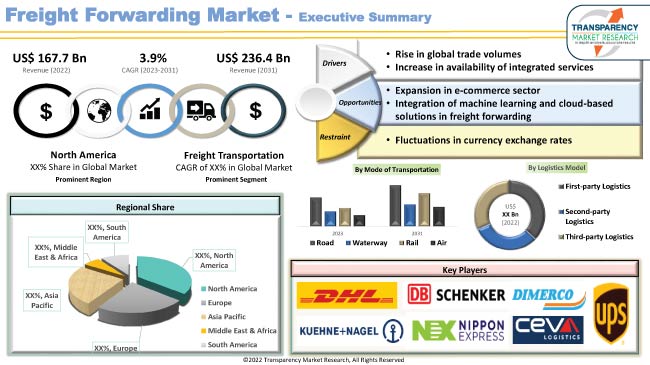

Rise in global trade volumes and increase in availability of integrated services are expected to propel the freight forwarding market size during the forecast period. Expansion in the e-commerce sector and integration of machine learning and cloud-based solutions in freight forwarding are likely to offer lucrative opportunities to vendors in the global freight forwarding industry.

Surge in demand for door-to-door delivery and growth in disposable income are fueling the e-commerce sector, which, in turn, is boosting demand for freight forwarding. Rapid industrialization, urbanization, and rise in import-export activities worldwide are also contributing to the freight forwarding market growth.

Freight forwarding is a business that organizes shipments for people or businesses to get products from the manufacturer to a client or a point of distribution. Freight forwarding companies specialize in reducing costs and streamlining transportation logistics. They are increasingly focusing on environmental sustainability to adhere to various energy and pollution regulations.

Freight forwarding involves various services including warehousing, transportation, and procurement. Freight forwarding service providers are employing data recording systems and offering comprehensive logistics tracking assistance to expand their customer base. They are also offering a variety of value-added services, such as temperature-controlled trucks, air suspension cars, and 24/7 real-time monitoring, to increase their freight forwarding market share.

Freight forwarding is widely utilized in the transportation of oil & gas. It is also employed in energy, mining, chemicals, and other end-use industries. However, lack of effective transportation infrastructure in developing and underdeveloped economies is projected to lead to market limitations.

Increase in the volume of international trade is a major factor driving the freight forwarding market statistics. Rapid industrialization and urbanization along with surge in globalization are boosting global trade. This, in turn, is fueling the number of trade agreements, particularly in emerging economies. Expansion in the e-commerce sector is also augmenting trade operations, thereby propelling the demand for freight forwarding solutions.

Dry van freight forwarding is gaining traction due to growth in the e-commerce sector. Rise in adoption of smartphones and increase in penetration of internet are leading to high demand for doorstep delivery of various products. This, in turn, is fueling the need for freight forwarding worldwide.

Freight forwarders are offering various integrated services, such as packing, insurance, and documentation, in addition to the transportation of cargo. Thus, availability of a wide range of services is driving the freight forwarding market revenue. Freight forwarders are combining various services and employing IoT-based technologies, such as big data, tracking, cloud, and data analysis, to increase their efficiency and transparency.

Recent technical developments in freight forwarding services are boosting operational efficiencies in the sector. Service providers are relying on various IoT technologies to track goods and their condition efficiently. They are also employing machine learning and cloud-based solutions to streamline various freight shipping operations. Thus, Technological Advancements are creating emerging opportunities in the freight forwarding market value.

According to the latest freight forwarding market forecast, North America is anticipated to hold largest share from 2023 to 2031, followed by Europe. Expansion in the trade sector is a major factor fueling market dynamics in the region. North America handles majority of freight movement. Growth in manufacturing, transportation, and warehousing sectors is also boosting market development in the region.

Presence of a robust and highly integrated supply chain network that connects various producers and consumers in several end-use industries is boosting demand for freight forwarding in North America. The U.S. is a major market for freight forwarding in the region due to growth in the logistics sector and presence of several niche firms that provide specialized services such as reverse logistics, IT services, and consultancy, in addition to transportation and distribution.

Rise in adoption of road transportation is augmenting market progress in Europe. According to the International Forwarding Association, more than 75% of freight transported inside the European Union is done so by road. Dry bulk makes up 23.2% of all commodities, followed by containerized cargo at 23.9%.

The industry in Asia Pacific is driven by economic development in countries such as China, India, Japan, and South Korea. Rapid expansion in e-commerce and FMCG sectors and surge in investment in the defense & military industry in China, India, and Pakistan are driving the market trajectory in Asia Pacific.

Key players in the global freight forwarding business are forming strategic alliances with other companies to offer international freight forwarding services. DHL Supply Chain, Kuehne + Nagel Inc., DB Schenker, Sinotrans India Private Limited., DSV A/S, Expeditors International of Washington, Inc., Nippon Express Co., Ltd., United Parcel Service of America, Inc., Bolloré Logistics, CEVA Logistics, Dimerco, Transporteca, MGF, and Uber Freight LLC are key players in the freight forwarding market.

Each of these players has been profiled in the freight forwarding market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 167.7 Bn |

|

Market Forecast Value in 2031 |

US$ 236.4 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 167.7 Bn in 2022

It is projected to grow at a CAGR of 3.9% from 2023 to 2031

It is estimated to reach US$ 236.4 Bn by the end of 2031

Rise in global trade volumes and increase in availability of integrated services

The retail application segment is anticipated to account for largest share during the forecast period

North America is estimated to record the highest demand during the forecast period

DHL Supply Chain, Kuehne + Nagel Inc., DB Schenker, Sinotrans India Private Limited., DSV A/S, Expeditors International of Washington, Inc., Nippon Express Co., Ltd., United Parcel Service of America, Inc., Bolloré Logistics, CEVA Logistics, Dimerco, Transporteca, MGF, and Uber Freight LLC

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. Gap Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding Buying Process of Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

4. Global Freight Forwarding Market, By Service Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

4.2.1. Freight Transportation

4.2.2. Warehousing

4.2.3. Documentation

4.2.4. Packaging

4.2.5. Insurance

4.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

5. Global Freight Forwarding Market, By Mode of Transportation

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

5.2.1. Road

5.2.2. Waterway

5.2.3. Rail

5.2.4. Air

6. Global Freight Forwarding Market, By Logistics Model

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

6.2.1. First-party Logistics

6.2.2. Second-party Logistics

6.2.3. Third-party Logistics

7. Global Freight Forwarding Market, By Customer Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

7.2.1. B2C

7.2.2. B2B

8. Global Freight Forwarding Market, By Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Application

8.2.1. Industrial and Manufacturing

8.2.2. Retail

8.2.3. Healthcare

8.2.4. Media & Entertainment

8.2.5. Military

8.2.6. Oil & Gas

8.2.7. Food & Beverage

8.2.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

9. Global Freight Forwarding Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Freight Forwarding Market Size & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Freight Forwarding Market

10.1. Market Snapshot

10.2. Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

10.2.1. Freight Transportation

10.2.2. Warehousing

10.2.3. Documentation

10.2.4. Packaging

10.2.5. Insurance

10.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

10.3. Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

10.3.1. Road

10.3.2. Waterway

10.3.3. Rail

10.3.4. Air

10.4. Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

10.4.1. First-party Logistics

10.4.2. Second-party Logistics

10.4.3. Third-party Logistics

10.5. Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

10.5.1. B2C

10.5.2. B2B

10.6. Freight Forwarding Market Size & Forecast, 2017-2031, By Application

10.6.1. Industrial and Manufacturing

10.6.2. Retail

10.6.3. Healthcare

10.6.4. Media & Entertainment

10.6.5. Military

10.6.6. Oil & Gas

10.6.7. Food & Beverage

10.6.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

10.7. Key Country Analysis - North America Freight Forwarding Market Size & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Freight Forwarding Market

11.1. Market Snapshot

11.2. Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

11.2.1. Freight Transportation

11.2.2. Warehousing

11.2.3. Documentation

11.2.4. Packaging

11.2.5. Insurance

11.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

11.3. Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

11.3.1. Road

11.3.2. Waterway

11.3.3. Rail

11.3.4. Air

11.4. Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

11.4.1. First-party Logistics

11.4.2. Second-party Logistics

11.4.3. Third-party Logistics

11.5. Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

11.5.1. B2C

11.5.2. B2B

11.6. Freight Forwarding Market Size & Forecast, 2017-2031, By Application

11.6.1. Industrial and Manufacturing

11.6.2. Retail

11.6.3. Healthcare

11.6.4. Media & Entertainment

11.6.5. Military

11.6.6. Oil & Gas

11.6.7. Food & Beverage

11.6.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

11.7. Key Country Analysis - Europe Freight Forwarding Market Size & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Freight Forwarding Market

12.1. Market Snapshot

12.2. Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

12.2.1. Freight Transportation

12.2.2. Warehousing

12.2.3. Documentation

12.2.4. Packaging

12.2.5. Insurance

12.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

12.3. Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

12.3.1. Road

12.3.2. Waterway

12.3.3. Rail

12.3.4. Air

12.4. Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

12.4.1. First-party Logistics

12.4.2. Second-party Logistics

12.4.3. Third-party Logistics

12.5. Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

12.5.1. B2C

12.5.2. B2B

12.6. Freight Forwarding Market Size & Forecast, 2017-2031, By Application

12.6.1. Industrial and Manufacturing

12.6.2. Retail

12.6.3. Healthcare

12.6.4. Media & Entertainment

12.6.5. Military

12.6.6. Oil & Gas

12.6.7. Food & Beverage

12.6.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

12.7. Key Country Analysis - Asia Pacific Freight Forwarding Market Size & Forecast, 2017-2031, By Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Freight Forwarding Market

13.1. Market Snapshot

13.2. Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

13.2.1. Freight Transportation

13.2.2. Warehousing

13.2.3. Documentation

13.2.4. Packaging

13.2.5. Insurance

13.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

13.3. Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

13.3.1. Road

13.3.2. Waterway

13.3.3. Rail

13.3.4. Air

13.4. Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

13.4.1. First-party Logistics

13.4.2. Second-party Logistics

13.4.3. Third-party Logistics

13.5. Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

13.5.1. B2C

13.5.2. B2B

13.6. Freight Forwarding Market Size & Forecast, 2017-2031, By Application

13.6.1. Industrial and Manufacturing

13.6.2. Retail

13.6.3. Healthcare

13.6.4. Media & Entertainment

13.6.5. Military

13.6.6. Oil & Gas

13.6.7. Food & Beverage

13.6.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

13.7. Key Country Analysis - Middle East & Africa Freight Forwarding Market Size & Forecast, 2017-2031, By Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Freight Forwarding Market

14.1. Market Snapshot

14.2. Freight Forwarding Market Size & Forecast, 2017-2031, By Service Type

14.2.1. Freight Transportation

14.2.2. Warehousing

14.2.3. Documentation

14.2.4. Packaging

14.2.5. Insurance

14.2.6. Others (Value Added Services - Custom Clearance, Inventory Management, etc.)

14.3. Freight Forwarding Market Size & Forecast, 2017-2031, By Mode of Transportation

14.3.1. Road

14.3.2. Waterway

14.3.3. Rail

14.3.4. Air

14.4. Freight Forwarding Market Size & Forecast, 2017-2031, By Logistics Model

14.4.1. First-party Logistics

14.4.2. Second-party Logistics

14.4.3. Third-party Logistics

14.5. Freight Forwarding Market Size & Forecast, 2017-2031, By Customer Type

14.5.1. B2C

14.5.2. B2B

14.6. Freight Forwarding Market Size & Forecast, 2017-2031, By Application

14.6.1. Industrial and Manufacturing

14.6.2. Retail

14.6.3. Healthcare

14.6.4. Media & Entertainment

14.6.5. Military

14.6.6. Oil & Gas

14.6.7. Food & Beverage

14.6.8. Others (Agro Commodities & Fertilizers, Government & Public Utilities, Jewelry, etc.)

14.7. Key Country Analysis - South America Freight Forwarding Market Size & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Key Strategy Analysis

15.2.1. Strategic Overview - Expansion, M&A, Partnership

15.2.2. Product & Marketing Strategy

15.3. Pricing Comparison Among Key Players

15.4. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profiles/ Key Players

16.1. DHL Supply Chain

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Kuehne + Nagel Inc.

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. DB Schenker

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Sinotrans India Private Limited.

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. DSV A/S

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Expeditors International of Washington, Inc.

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Nippon Express Co., Ltd.

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. United Parcel Service of America, Inc.

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Bolloré Logistics

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. CEVA Logistics

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Dimerco

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Transporteca

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. MGF

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Uber Freight LLC

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Others

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

List of Tables

Table 1: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 2: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 3: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 4: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 5: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 6: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 8: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 9: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 10: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 11: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 12: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 14: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 15: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 16: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 17: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 18: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 20: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 21: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 22: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 23: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 24: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 26: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 27: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 28: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 29: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 30: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 32: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Table 33: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Table 34: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 35: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 36: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 2: Global Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 3: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 4: Global Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 5: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 6: Global Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 7: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 8: Global Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 9: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 10: Global Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 11: Global Freight Forwarding Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Freight Forwarding Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 14: North America Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 15: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 16: North America Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 17: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 18: North America Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 19: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 20: North America Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 21: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 22: North America Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 23: North America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Freight Forwarding Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 26: Europe Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 27: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 28: Europe Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 29: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 30: Europe Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 31: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 32: Europe Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 33: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 34: Europe Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 35: Europe Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Freight Forwarding Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 38: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 40: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 42: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 44: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 46: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Freight Forwarding Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 50: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 52: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 54: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 56: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 58: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Freight Forwarding Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 62: South America Freight Forwarding Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 63: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Mode of Transportation, 2017-2031

Figure 64: South America Freight Forwarding Market, Incremental Opportunity, by Mode of Transportation, Value (US$ Bn), 2023-2031

Figure 65: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Logistics Model, 2017-2031

Figure 66: South America Freight Forwarding Market, Incremental Opportunity, by Logistics Model, Value (US$ Bn), 2023-2031

Figure 67: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 68: South America Freight Forwarding Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 69: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 70: South America Freight Forwarding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 71: South America Freight Forwarding Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Freight Forwarding Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031