Analysts’ Viewpoint on Foundry Chemicals Market Scenario

Players in the foundry chemicals industry are adopting advanced technologies such as cutting-edge printing technologies that can accelerate the production of 3D metal, sand prototype, and other critical components that are used in automotive, aerospace, petrochemical, and construction industries. Foundry chemicals suppliers and manufacturers should focus on expanding their product offerings for foundry chemical binders, foundry chemicals additive agents, and foundry chemicals coatings. Research is being conducted to reinvent the manufacturing landscape in the production of core components by making significant investments to secure the future development of foundry chemicals. Foundries that are able to use data to drive their processes will come out on top of the Industry 4.0 developments. High demand for foundry chemicals binders in casting of aluminum, cast iron, bronze, and steel is expected to drive the market during the forecast period.

Foundry is a factory that produces metal castings from either ferrous or non-ferrous alloys. Chemicals used in the casting process in foundry are known as foundry chemicals. Foundry chemicals include binders, additive agents, coatings, fluxes, and hot topping compounds. Usage of these chemicals enables foundries to enhance the quality of castings and improve productivity. Different types of binders are used in different stages of the casting process and serve distinct purposes. These include core and mold binders, sand additives, parting agents, water-based core or mold coatings used in refractory bases, and solvent-based core or mold coatings used in refractory bases.

Foundry products are widely used in all industries across the globe including automotive, aerospace, power generation, railways, petrochemical, medical, defense, and marine. Nearly all key components of these industries, such as brake disks, medical implants, marine engines, and aircraft turbine blades, are dependent on castings. Cast components are employed in engines, chassis, and vehicle bodies. Foundries are increasingly witnessing technological advancements and high demand for fuel efficiency through lightweight construction and optimization of cast components such as iron and steel casting.

Cast components used in the building & construction industry are pressure and drainage pipes, surface boxes, castings for radiators and boilers, cooker and stove castings, and sanitary castings. Castings are also used in power generation equipment, such as transformers and generators, and in electric motors. Casting components are also widely employed in the medical sector. These include integral parts for computerized tomography and scanners and cast prostheses such as knee joints and hip joints. Castings are also used in the infrastructure of hospitals such as nodes in hospital beds. Castings are employed in several aspects of the energy industry such as for pumps and valves used in the oil & gas sector, cast nodes for offshore and on-shore structures, hubs for wind energy turbines, and wind and wave power applications.

Rise in need to achieve fuel efficiency and implementation of stringent emission regulations are likely to boost the trend of production of automotive components with lightweight materials. In the past, automotive components were primarily made of iron and steel. However, of late, iron and steel have been replaced with aluminum. Aluminum offers comparable strength and durability, and is lightweight. Usage of lightweight materials reduces the overall weight of a vehicle, thus improving the fuel efficiency.

Aluminum has been used in automobiles for more than two decades, primarily in engines, power train castings, wheels, cast parts, and extrusions. Introduction of new aluminum alloys and new production and welding techniques is expected to significantly increase the usage of aluminum sheets in high-selling automobiles. However, electric vehicles account for higher demand for aluminum. Thus, high demand for foundry chemicals in molding of automobile components is driving the size of foundry chemicals market.

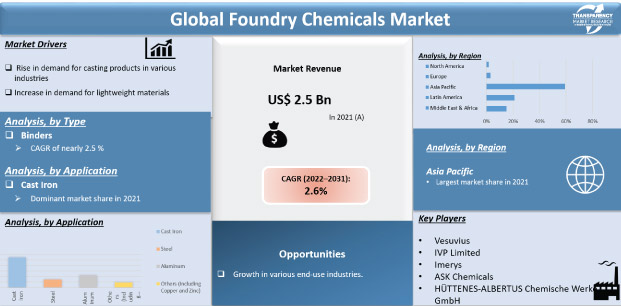

In terms of application, the foundry chemicals market has been divided into cast iron, steel, aluminum, and others. Cast iron was a highly attractive segment of the global foundry chemicals market in 2021. The segment is expected to maintain its attractiveness during the forecast period due to the easy availability and low production cost of these casting components.

The steel segment held about 13% share of the global foundry chemicals market in 2021. Market share of the segment is expected to continue to increase during the forecast period. Aluminum cast parts are light in weight and have the strength of steel. Appearance and esthetic value of aluminum-made parts is also superior to that of other metal alloys. Furthermore, aluminum cast parts are cheaper. Therefore, end-users can get high quality metal products at affordable prices. Castings made from aluminum are versatile, corrosion resistant, and can be used for different purposes. These qualities allow manufacturers to produce multiple products using aluminum parts.

Based on type, binders was a highly attractive segment of the global foundry chemicals market in 2021. This trend is likely to continue during the forecast period owing to the high demand for binders in casting of aluminum, cast iron, bronze, and steel. Organic and inorganic are the two types of foundry chemicals binders. Organic foundry chemical binders include clay, oil, acrylic, and phenol. Demand for organic alkyd, furan, and phenolic binders is expected to be high in the near future. However, oil binders are anticipated to be phased out, as oil requires high baking temperature compared to other binders.

The fluxes segment is expected to become attractive toward the end of the forecast period. This can be largely ascribed to the increase in demand for casting components across the globe. Foundry chemicals fluxes are highly exothermic and recommended for cleaning furnaces including melting and holding furnaces.

In terms of value, Asia Pacific dominated the global foundry chemicals market with around 40% value share in 2021. The region is expected to remain highly lucrative during the forecast period, due to rapid industrialization and rise in foundry chemicals uses in automotive and aerospace industries in the region. China is a key country of the foundry chemicals market in Asia Pacific, led by the expansion of industries such as power transmission and railways in the country. China is a major hub for automotive products, where aluminum casting products are used, due to their superior properties such as light weight and low cost over other metals.

Europe constituted 29.9% share of the global foundry chemicals market in 2021. The market in the region is expected to grow at a CAGR of 1.79% during the forecast period. Europe is an attractive region of the global foundry chemicals market, led by the rise in industrial automation and technological reforms in the region.

Middle East & Africa offers immense potential for investors operating in the foundry industry. The market size is small in the region; however, there exists vast potential for casting products due to the growth in the automotive industry.

A few large-sized players and numerous small scale manufacturers from the unorganized segment operate in the global foundry chemicals market. The unorganized segment holds larger share of the market. Companies are investing in comprehensive research and development activities, primarily to create innovative technologies and products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by major players. Key players operating in the global foundry chemicals market are Vesuvius, IVP Limited, Imerys, ASK Chemicals, and HÜTTENES-ALBERTUS Chemische Werke GmbH.

Each of these players has been profiled in the foundry chemicals market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

2.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 2.5 Bn in 2021

The market is expected to grow at a CAGR of 2.6% from 2022 to 2031

Rise in demand for casting products in various industries and increase in demand for lightweight materials are key drivers of the foundry chemicals market

Binders was the largest type segment that held 50% value share in 2021

Asia Pacific was the most lucrative region with value share of around 40% of the foundry chemicals market in 2021

Vesuvius, IVP Limited, Imerys, ASK Chemicals, and HÜTTENES-ALBERTUS Chemische Werke GmbH

1. Executive Summary

1.1. Foundry Chemicals Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Foundry Chemicals Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customer

3. COVID-19 Impact Analysis

4. Foundry Chemicals Market Analysis and Forecast, by Type, 2022–2031

4.1. Introduction and Definitions

4.2. Global Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

4.2.1. Binders

4.2.2. Additive Agents

4.2.3. Coatings

4.2.4. Fluxes

4.2.5. Hot Topping Compounds

4.2.6. Others (Parting Agents, Slaghold Allied Products)

4.3. Global Foundry Chemicals Market Attractiveness, by Type

5. Global Foundry Chemicals Market Analysis and Forecast, Application, 2022–2031

5.1. Introduction and Definitions

5.2. Global Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

5.2.1. Iron

5.2.2. Steel

5.2.3. Aluminum

5.2.4. Others (including Copper, Zinc, and Magnesium)

5.3. Global Foundry Chemicals Market Attractiveness, by Application

6. Global Foundry Chemicals Market Analysis and Forecast, by Region, 2022–2031

6.1. Key Findings

6.2. Global Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Foundry Chemicals Market Attractiveness, by Region

7. North America Foundry Chemicals Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. North America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.3. North America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.4. North America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2022–2031

7.4.1. U.S. Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.4.2. U.S. Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

7.4.3. Canada Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.4.4. Canada Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

7.5. North America Foundry Chemicals Market Attractiveness Analysis

8. Europe Foundry Chemicals Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Europe Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.3. Europe Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.4. Europe Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

8.4.1. Germany Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.2. Germany Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.3. France Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.4. France Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.5. U.K. Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.6. U.K. Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.7. Italy Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.8. Italy Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.9. Russia & CIS Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.10. Russia & CIS Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.11. Rest of Europe Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.12. Rest of Europe Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.5. Europe Foundry Chemicals Market Attractiveness Analysis

9. Asia Pacific Foundry Chemicals Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type

9.3. Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.4. Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

9.4.1. China Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.2. China Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.3. Japan Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.4. Japan Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.5. India Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.6. India Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.7. ASEAN Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.8. ASEAN Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.9. Rest of Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.10. Rest of Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.5. Asia Pacific Foundry Chemicals Market Attractiveness Analysis

10. Latin America Foundry Chemicals Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Latin America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.3. Latin America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.4. Latin America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

10.4.1. Brazil Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.2. Brazil Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.4.3. Mexico Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.4. Mexico Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.4.5. Rest of Latin America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.6. Rest of Latin America Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.5. Latin America Foundry Chemicals Market Attractiveness Analysis

11. Middle East & Africa Foundry Chemicals Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.3. Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

11.4. Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. GCC Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.2. GCC Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.3. South Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.4. South Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.5. Rest of Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.6. Rest of Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.5. Middle East & Africa Foundry Chemicals Market Attractiveness Analysis

12. Competition Landscape

12.1. Global Foundry Chemicals Company Market Share Analysis, 2021

12.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.2.1. Vesuvius

12.2.1.1. Company Description

12.2.1.2. Business Overview

12.2.1.3. Financial Overview

12.2.1.4. Strategic Overview

12.2.2. ASK Chemicals

12.2.2.1. Company Description

12.2.2.2. Business Overview

12.2.2.3. Financial Overview

12.2.2.4. Strategic Overview

12.2.3. HÜTTENES-ALBERTUS Chemische Werke GmbH

12.2.3.1. Company Description

12.2.3.2. Business Overview

12.2.3.3. Financial Overview

12.2.3.4. Strategic Overview

12.2.4. Imerys

12.2.4.1. Company Description

12.2.4.2. Business Overview

12.2.4.3. Financial Overview

12.2.4.4. Strategic Overview

12.2.5. IVP Limited

12.2.5.1. Company Description

12.2.5.2. Business Overview

12.2.5.3. Financial Overview

12.2.5.4. Strategic Overview

12.2.6. General Chemical Corp.

12.2.6.1. Company Description

12.2.6.2. Business Overview

12.2.6.3. Financial Overview

12.2.6.4. Strategic Overview

12.2.7. Affcil Industries

12.2.7.1. Company Description

12.2.7.2. Business Overview

12.2.7.3. Financial Overview

12.2.7.4. Strategic Overview

12.2.8. Ultraseal India Pvt. Ltd.

12.2.8.1. Company Description

12.2.8.2. Business Overview

12.2.8.3. Financial Overview

12.2.8.4. Strategic Overview

12.2.9. John Winter

12.2.9.1. Company Description

12.2.9.2. Business Overview

12.2.9.3. Financial Overview

12.2.9.4. Strategic Overview

12.2.10. Yash Chemicals

12.2.10.1. Company Description

12.2.10.2. Business Overview

12.2.10.3. Financial Overview

12.2.10.4. Strategic Overview

12.2.11. Fincast Foundry Flux

12.2.11.1. Company Description

12.2.11.2. Business Overview

12.2.11.3. Financial Overview

12.2.11.4. Strategic Overview

12.2.12. Mancuso Chemicals Limited

12.2.12.1. Company Description

12.2.12.2. Business Overview

12.2.12.3. Financial Overview

12.2.12.4. Strategic Overview

12.2.13. Forace Polymers (P) Ltd.

12.2.13.1. Company Description

12.2.13.2. Business Overview

12.2.13.3. Financial Overview

12.2.13.4. Strategic Overview

12.2.14. Shamlax Metachem Pvt. Ltd.

12.2.14.1. Company Description

12.2.14.2. Business Overview

12.2.14.3. Financial Overview

12.2.14.4. Strategic Overview

12.2.15. CERAFLUX INDIA PVT LTD.

12.2.15.1. Company Description

12.2.15.2. Business Overview

12.2.15.3. Financial Overview

12.2.15.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 2: Global Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 3: Global Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 4: Global Foundry Chemicals Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 5: Global Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 6: Global Foundry Chemicals Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 7: North America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 8: North America Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 9: North America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 10: North America Foundry Chemicals Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 11: North America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 12: North America Foundry Chemicals Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 13: U.S. Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 14: U.S. Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 15: U.S. Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 16: U.S. Foundry Chemicals Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 17: Canada Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 18: Canada Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 19: Canada Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 20: Canada Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 21: Europe Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 22: Europe Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 23: Europe Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 24: Europe Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 25: Europe Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Foundry Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 28: Germany Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 29: Germany Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 30: Germany Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 31: France Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 32: France Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 33: France Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 34: France Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 35: U.K. Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 36: U.K. Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 37: U.K. Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 38: U.K. Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 39: Italy Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 40: Italy Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 41: Italy Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 42: Italy Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 43: Spain Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 44: Spain Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 45: Spain Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 46: Spain Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 47: Russia & CIS Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 48: Russia & CIS Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 49: Russia & CIS Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 50: Russia & CIS Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 51: Rest of Europe Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 52: Rest of Europe Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 53: Rest of Europe Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Europe Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 55: Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 56: Asia Pacific Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 57: Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 58: Asia Pacific Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 59: Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Foundry Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 62: China Foundry Chemicals Market Value (US$ Bn) Forecast, by Type 2022–2031

Table 63: China Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 64: China Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 65: Japan Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 66: Japan Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 67: Japan Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 68: Japan Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 69: India Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 70: India Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 71: India Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 72: India Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 73: ASEAN Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 74: ASEAN Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 75: ASEAN Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 76: ASEAN Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 77: Rest of Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 78: Rest of Asia Pacific Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 79: Rest of Asia Pacific Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 80: Rest of Asia Pacific Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 81: Latin America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 82: Latin America Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 83: Latin America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 84: Latin America Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 85: Latin America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Foundry Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 88: Brazil Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 89: Brazil Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 90: Brazil Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 91: Mexico Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 92: Mexico Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 93: Mexico Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 94: Mexico Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 95: Rest of Latin America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 96: Rest of Latin America Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 97: Rest of Latin America Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 98: Rest of Latin America Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 99: Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 100: Middle East & Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 101: Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 102: Middle East & Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 103: Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 106: GCC Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 107: GCC Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 108: GCC Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 109: South Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 110: South Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 111: South Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 112: South Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 113: Rest of Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2022–2031

Table 114: Rest of Middle East & Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 115: Rest of Middle East & Africa Foundry Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 116: Rest of Middle East & Africa Foundry Chemicals Market Value (US$ Bn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 2: Global Foundry Chemicals Market Attractiveness, by Type

Figure 3: Global Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Global Foundry Chemicals Market Attractiveness, by Application

Figure 5: Global Foundry Chemicals Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 6: Global Foundry Chemicals Market Attractiveness, by Region

Figure 7: North America Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 8: North America Foundry Chemicals Market Attractiveness, by Type

Figure 9: North America Foundry Chemicals Market Attractiveness, by Type

Figure 10: North America Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 11: North America Foundry Chemicals Market Attractiveness, by Application

Figure 12: North America Foundry Chemicals Market Attractiveness, by Country

Figure 13: Europe Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 14: Europe Foundry Chemicals Market Attractiveness, by Type

Figure 15: Europe Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 16: Europe Foundry Chemicals Market Attractiveness, by Application

Figure 17: Europe Foundry Chemicals Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 18: Europe Foundry Chemicals Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 20: Asia Pacific Foundry Chemicals Market Attractiveness, by Type

Figure 21: Asia Pacific Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Asia Pacific Foundry Chemicals Market Attractiveness, by Application

Figure 23: Asia Pacific Foundry Chemicals Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Asia Pacific Foundry Chemicals Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 26: Latin America Foundry Chemicals Market Attractiveness, by Type

Figure 27: Latin America Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 28: Latin America Foundry Chemicals Market Attractiveness, by Application

Figure 29: Latin America Foundry Chemicals Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 30: Latin America Foundry Chemicals Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Foundry Chemicals Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 32: Middle East & Africa Foundry Chemicals Market Attractiveness, by Type

Figure 33: Middle East & Africa Foundry Chemicals Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 34: Middle East & Africa Foundry Chemicals Market Attractiveness, by Application

Figure 35: Middle East & Africa Foundry Chemicals Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 36: Middle East & Africa Foundry Chemicals Market Attractiveness, by Country and Sub-region