Analysts’ Viewpoint

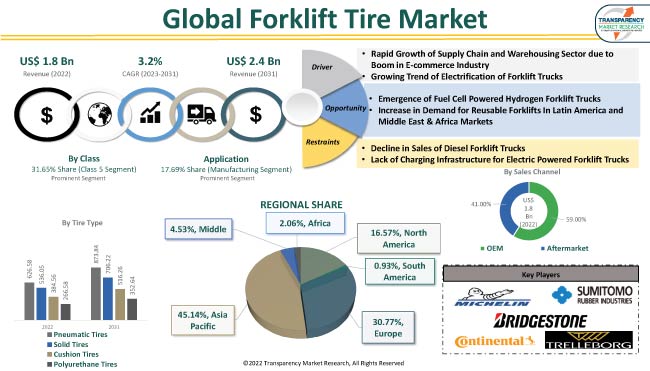

Expansion of e-commerce and logistics industries is driving the global demand for forklift tires. Increase in demand for online shopping has propelled the demand for warehouses and dark stores across the globe, which in turn has driven the demand for material handling equipment. Additionally, the demand for electric forklifts is rising due to stringent carbon emission laws implemented by various governments. This is estimated to offer significant forklift tire market opportunities for key manufacturers in the near future.

Furthermore, major players, such as Bridgestone, MICHELIN, Continental AG, Sumitomo Rubber Industries, Ltd. and Trelleborg AB, are focusing on diversifying their product portfolio and offering cutting-edge benefits in order to enhance their revenue streams. Additionally, tire manufacturers are emphasizing on the development of tires that are not affected by different road and weather conditions in order to ensure safety and reduce the chances of accidents. Advancements in forklift technologies, such as hydrogen fuel cell powered forklifts, are projected to fuel the forklift tires market growth in the next few years.

Forklift wheels and tires are an integral part of forklift trucks, as they are the intermediate between path and vehicle body. Main constituents of tires are natural rubber, synthetic rubber, carbon black, wire, fabric, and other chemical compounds. Forklift truck tires are designed as per their material handling and high load carrying capacities for usage on paved and indoor surfaces. Forklift truck tires used on smooth surfaces have thin, and smooth treads, while forklifts used in outdoor applications and in harsh environments have larger, well-defined treads.

According to analysis of the latest global forklift tire market report, the global forklift tire industry growth is projected to grow at a decent growth rate in the next few years due to the boom in the e-commerce sector as well as rapid growth of global supply chain, which is augmenting the demand for forklifts in warehouses, ports etc. Furthermore, increase in buying power of an individuals as well as high demand for material handling equipment from the manufacturing sector is estimated to positively impact the forklift tire market demand in the near future.

The e-commerce sector has been growing exponentially for the last decade, enabling industries to diversify and upgrade their operations. A vast majority of the global population is choosing online shopping for fast doorstep deliveries of required commodities. According to International Trade Organization, the global e-commerce market is expected to account reach a value of US$ 6.3 Trn in 2023 and expected to reach US$ 8.1 Trn by the end of 2026. Asia Pacific accounts for a leading share with China holding 50% share of the global retail sales, followed by the U.S., U.K., India, and other major economies across the globe. Consequently, logistics companies are expanding their operations and recalibrating their warehousing facilities.

Increased forklift usage worldwide is being driven by an increase in the number of warehouses, which is also propelling the forklift tire market statistics. Moreover, the popularity of online shopping has raised the demand for cutting-edge material handling equipment in warehouses. E-commerce and third-party logistics companies are increasingly using forklifts in warehouses and distribution centers to ensure quick product delivery to clients. This is expected to fuel the forklift tire market revenue during the forecast period.

Electric forklift trucks are gaining traction, which can be attributed to lower operating costs than diesel forklift trucks, the rising price of oil, government incentives for electric vehicles, and the adoption of more stringent automotive emission standards. Additionally, the quiet operation of electric forklift trucks helps to lower decibel levels in loud manufacturing areas, improving worker safety and health, and resulting in healthy productivity improvements.

Electric forklift trucks are estimated to contribute to 15% to 20% lower operating costs than diesel powered forklift trucks. Electric trucks are more suitable for light duty applications, hence they are rapidly replacing diesel trucks in light to medium duty operations, worldwide. Electric trucks don’t have any tailpipe emissions, which enables them to meet stringent emission norms more easily. Therefore, rapid increase in adoption of electric forklifts is anticipated to positively impact the forklift tire market forecast in the next few years.

In terms of tire type, the pneumatic tire segment held a major forklift tire market share in 2022. Growth in the segment can be attributed to the various qualities offered by pneumatic tires, such as better shock absorption, optimal heat distribution, ability to use in on-road and off-road application, and enhanced maneuverability. Forklift operators, especially for outdoor work on rough terrains, usually experience a much smoother ride resulting in less fatigue and very less chances of accidents. Moreover, the resilience of pneumatic tires also make them highly preferable for rough terrain, as the forklifts experience considerable damage due to increased wear and tear.

In terms of class, the forklift tire market segmentation comprises class 1: electric motor rider trucks, class 2: electric motor narrow aisle trucks, class 3: electric motor hand trucks or hand/rider trucks, class 4: internal combustion engine trucks (solid/cushion tires), and class 5: internal combustion engine trucks (pneumatic tires). The class 5: internal combustion engine trucks (pneumatic tires) segment dominated the global market in 2022.

The class 5: internal combustion engine trucks (pneumatic tires) are ideal for all weather conditions, both indoor and outdoor. These forklifts offer better load bearing capacity as compared to other class of forklifts. Moreover, these forklifts are 15% less expensive than electric forklifts, offering fast refilling of fuel; it only take 5 minutes to refuel. Therefore, class 5: internal combustion engine trucks (pneumatic tires) are preferred by various industries including manufacturing and logistics.

In terms of revenue, Asia Pacific dominated the global forklift tire market due to rapid expansion of the automotive industry in countries such as China, India, South Korea, and Japan. Additionally, stringent government regulations for safe and secure workstations are prompting the rapid deployment of such trucks at industrial sites, ports, warehouses and other workstations.

In terms of share of global market, Asia Pacific is followed by Europe and North America. The forklift tire market size in these regions is anticipated to increase at a decent pace due to the adoption of forklift trucks, increasing demand for material handling equipment due to rapid industrialization, and widespread use of solid tires in these regions. Furthermore, rising concern about carbon emission is propelling the demand for the electric forklifts in Europe and North America.

The global forklift tire market is fairly consolidated with the largest players controlling a majority of the market share. Prominent players are following the latest forklift tire market trends and spending significantly on comprehensive research and development, primarily to develop highly adequate services. Expansion of product portfolios and mergers & acquisitions are notable strategies adopted by major players. Yokohama Off-Highway Tires, Balkrishna Industries Limited, Bridgestone, Camso, China National Tire & Rubber Co., Ltd., Continental AG, Hankook Tire & Technology, IRC Tyre Industrial Rubber Company, Magna Tyres Group, Maxam Tires, Michelin, Nokian Tyres plc, Sumitomo Rubber Industries, Ltd., The Advance Tire Inc., Trelleborg AB, and TVH are a few of the prominent entities operating in the forklift tire business.

Key players in the forklift tire market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 1.8 Bn |

| Market Forecast Value in 2031 | US$ 2.4 Bn |

| Growth Rate (CAGR) | 3.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | Thousand Units for Volume US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, electric scooter industry analysis, electric scooter market size, electric motorcycle market growth etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 1.8 Bn in 2022

It is expected to expand at a CAGR of 3.2% by 2031

The global business is estimated to be reach a value of US$ 2.4 Bn in 2031

Yokohama Off-Highway Tires, Balkrishna Industries Limited, Bridgestone, Camso, China National Tire & Rubber Co., Ltd., Continental AG, Hankook Tire & Technology, IRC Tyre Industrial Rubber Company, Magna Tyres Group, Maxam Tires, Michelin, Nokian Tyres plc, Sumitomo Rubber Industries, Ltd., The Advance Tire Inc., Trelleborg AB, and TVH.

China is a prominent market for forklift tire due to the presence of dominant manufacturing industry players and large sea ports, which drives the need of material handling equipment to ensure the international trading of goods.

The pneumatic tire segment accounted for the largest share (34.5%) in 2022

Rapid growth in supply chain and warehousing sector due to boom in e-commerce industry and growing trend of electrification of forklift trucks.

Asia Pacific was the most lucrative region in 2022

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Mn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

3.9. COVID-19 Impact Analysis – Forklift Tire Market

4. Impact Factor

4.1. Emergence of electric forklift trucks

5. Global Forklift Tire Market

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

5.2.1. Pneumatic Tires

5.2.2. Solid Tires

5.2.3. Cushion Tires

5.2.4. Polyurethane Tires

5.3. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

5.3.1. OEM

5.3.2. Aftermarket

5.4. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

5.4.1. Less than 4”

5.4.2. 6”

5.4.3. 8”

5.4.4. 9”

5.4.5. 10”

5.4.6. 12”

5.4.7. 13”

5.4.8. 15”

5.4.9. 20”

5.4.10. More than 21”

5.5. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

5.5.1. Class 1: Electric motor rider trucks.

5.5.2. Class 2: Electric motor narrow aisle trucks.

5.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

5.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

5.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

5.6. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

5.6.1. Retail/ Wholesale

5.6.2. Food/ Pharma

5.6.3. Transport/ Logistics

5.6.4. Manufacturing

5.6.5. Automotive

5.6.6. Ports/ Terminals

5.6.7. Mining & Construction

5.6.8. Chemical/ Energy

5.6.9. Forestry/ Wood

5.6.10. Others

5.7. Global Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Region

5.7.1. North America

5.7.2. Europe

5.7.3. Asia Pacific

5.7.4. South America

5.7.5. Middle East

5.7.6. Africa

6. North America Forklift Tire Market

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

6.2.1. Pneumatic Tires

6.2.2. Solid Tires

6.2.3. Cushion Tires

6.2.4. Polyurethane Tires

6.3. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

6.3.1. OEM

6.3.2. Aftermarket

6.4. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

6.4.1. Less than 4”

6.4.2. 6”

6.4.3. 8”

6.4.4. 9”

6.4.5. 10”

6.4.6. 12”

6.4.7. 13”

6.4.8. 15”

6.4.9. 20”

6.4.10. More than 21”

6.5. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

6.5.1. Class 1: Electric motor rider trucks.

6.5.2. Class 2: Electric motor narrow aisle trucks.

6.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

6.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

6.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

6.6. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

6.6.1. Retail/ Wholesale

6.6.2. Food/ Pharma

6.6.3. Transport/ Logistics

6.6.4. Manufacturing

6.6.5. Automotive

6.6.6. Ports/ Terminals

6.6.7. Mining & Construction

6.6.8. Chemical/ Energy

6.6.9. Forestry/ Wood

6.6.10. Others

6.7. North America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

6.7.1. U. S.

6.7.2. Canada

6.7.3. Mexico

7. Europe Forklift Tire Market

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

7.2.1. Pneumatic Tires

7.2.2. Solid Tires

7.2.3. Cushion Tires

7.2.4. Polyurethane Tires

7.3. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

7.3.1. OEM

7.3.2. Aftermarket

7.4. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

7.4.1. Less than 4”

7.4.2. 6”

7.4.3. 8”

7.4.4. 9”

7.4.5. 10”

7.4.6. 12”

7.4.7. 13”

7.4.8. 15”

7.4.9. 20”

7.4.10. More than 21”

7.5. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

7.5.1. Class 1: Electric motor rider trucks.

7.5.2. Class 2: Electric motor narrow aisle trucks.

7.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

7.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

7.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

7.6. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

7.6.1. Retail/ Wholesale

7.6.2. Food/ Pharma

7.6.3. Transport/ Logistics

7.6.4. Manufacturing

7.6.5. Automotive

7.6.6. Ports/ Terminals

7.6.7. Mining & Construction

7.6.8. Chemical/ Energy

7.6.9. Forestry/ Wood

7.6.10. Others

7.7. Europe Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

7.7.1. Germany

7.7.2. U. K.

7.7.3. France

7.7.4. Italy

7.7.5. Spain

7.7.6. Nordic Countries

7.7.7. Russia & CIS

7.7.8. Rest of Europe

8. Asia Pacific Forklift Tire Market

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

8.2.1. Pneumatic Tires

8.2.2. Solid Tires

8.2.3. Cushion Tires

8.2.4. Polyurethane Tires

8.3. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

8.3.1. OEM

8.3.2. Aftermarket

8.4. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

8.4.1. Less than 4”

8.4.2. 6”

8.4.3. 8”

8.4.4. 9”

8.4.5. 10”

8.4.6. 12”

8.4.7. 13”

8.4.8. 15”

8.4.9. 20”

8.4.10. More than 21”

8.5. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

8.5.1. Class 1: Electric motor rider trucks.

8.5.2. Class 2: Electric motor narrow aisle trucks.

8.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

8.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

8.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

8.6. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

8.6.1. Retail/ Wholesale

8.6.2. Food/ Pharma

8.6.3. Transport/ Logistics

8.6.4. Manufacturing

8.6.5. Automotive

8.6.6. Ports/ Terminals

8.6.7. Mining & Construction

8.6.8. Chemical/ Energy

8.6.9. Forestry/ Wood

8.6.10. Others

8.7. Asia Pacific Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

8.7.1. China

8.7.2. India

8.7.3. Japan

8.7.4. ASEAN Countries

8.7.5. South Korea

8.7.6. ANZ

8.7.7. Rest of Asia Pacific

9. South America Forklift Tire Market

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

9.2.1. Pneumatic Tires

9.2.2. Solid Tires

9.2.3. Cushion Tires

9.2.4. Polyurethane Tires

9.3. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

9.3.1. OEM

9.3.2. Aftermarket

9.4. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

9.4.1. Less than 4”

9.4.2. 6”

9.4.3. 8”

9.4.4. 9”

9.4.5. 10”

9.4.6. 12”

9.4.7. 13”

9.4.8. 15”

9.4.9. 20”

9.4.10. More than 21”

9.5. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

9.5.1. Class 1: Electric motor rider trucks.

9.5.2. Class 2: Electric motor narrow aisle trucks.

9.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

9.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

9.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

9.6. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

9.6.1. Retail/ Wholesale

9.6.2. Food/ Pharma

9.6.3. Transport/ Logistics

9.6.4. Manufacturing

9.6.5. Automotive

9.6.6. Ports/ Terminals

9.6.7. Mining & Construction

9.6.8. Chemical/ Energy

9.6.9. Forestry/ Wood

9.6.10. Others

9.7. South America Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

9.7.1. Brazil

9.7.2. Argentina

9.7.3. Rest of South America

10. Middle East Forklift Tire Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

10.2.1. Pneumatic Tires

10.2.2. Solid Tires

10.2.3. Cushion Tires

10.2.4. Polyurethane Tires

10.3. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

10.3.1. OEM

10.3.2. Aftermarket

10.4. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

10.4.1. Less than 4”

10.4.2. 6”

10.4.3. 8”

10.4.4. 9”

10.4.5. 10”

10.4.6. 12”

10.4.7. 13”

10.4.8. 15”

10.4.9. 20”

10.4.10. More than 21”

10.5. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

10.5.1. Class 1: Electric motor rider trucks.

10.5.2. Class 2: Electric motor narrow aisle trucks.

10.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

10.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

10.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

10.6. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

10.6.1. Retail/ Wholesale

10.6.2. Food/ Pharma

10.6.3. Transport/ Logistics

10.6.4. Manufacturing

10.6.5. Automotive

10.6.6. Ports/ Terminals

10.6.7. Mining & Construction

10.6.8. Chemical/ Energy

10.6.9. Forestry/ Wood

10.6.10. Others

10.7. Middle East Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

10.7.1. Saudi Arabia

10.7.2. Turkey

10.7.3. Iran

10.7.4. UAE

10.7.5. Israel

10.7.6. Egypt

10.7.7. Qatar

10.7.8. Rest of Middle East

11. Africa Forklift Tire Market

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Type

11.2.1. Pneumatic Tires

11.2.2. Solid Tires

11.2.3. Cushion Tires

11.2.4. Polyurethane Tires

11.3. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

11.3.1. OEM

11.3.2. Aftermarket

11.4. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Tire Size

11.4.1. Less than 4”

11.4.2. 6”

11.4.3. 8”

11.4.4. 9”

11.4.5. 10”

11.4.6. 12”

11.4.7. 13”

11.4.8. 15”

11.4.9. 20”

11.4.10. More than 21”

11.5. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Class

11.5.1. Class 1: Electric motor rider trucks.

11.5.2. Class 2: Electric motor narrow aisle trucks.

11.5.3. Class 3: Electric motor hand trucks or hand/rider trucks.

11.5.4. Class 4: Internal combustion engine trucks (solid/cushion tires)

11.5.5. Class 5: Internal combustion engine trucks (pneumatic tires)

11.6. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

11.6.1. Retail/ Wholesale

11.6.2. Food/ Pharma

11.6.3. Transport/ Logistics

11.6.4. Manufacturing

11.6.5. Automotive

11.6.6. Ports/ Terminals

11.6.7. Mining & Construction

11.6.8. Chemical/ Energy

11.6.9. Forestry/ Wood

11.6.10. Others

11.7. Africa Forklift Tire Market Value (US$ Mn) Analysis & Forecast, 2017-2031, by Country

11.7.1. Nigeria

11.7.2. South Africa

11.7.3. Algeria

11.7.4. Morocco

11.7.5. Kenya

11.7.6. Ethiopia

11.7.7. Ghana

11.7.8. Rest of Africa

12. Competitive Landscape

12.1. Company Share Analysis/ Brand Share Analysis, 2022

12.2. Company Analysis for each player

Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization,

Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios

13. Company Profile/ Key Players – Forklift Tires Market

13.1. Yokohama Off-Highway Tires

13.1.1. Company Overview,

13.1.2. Company Footprints,

13.1.3. Production Locations,

13.1.4. Product Portfolio,

13.1.5. Competitors & Customers,

13.1.6. Subsidiaries & Parent Organization,

13.1.7. Recent Developments,

13.1.8. Financial Analysis,

13.1.9. Profitability,

13.1.10. Revenue Share,

13.1.11. Executive Bios

13.2. Balkrishna Industries Limited

13.2.1. Company Overview,

13.2.2. Company Footprints,

13.2.3. Production Locations,

13.2.4. Product Portfolio,

13.2.5. Competitors & Customers,

13.2.6. Subsidiaries & Parent Organization,

13.2.7. Recent Developments,

13.2.8. Financial Analysis,

13.2.9. Profitability,

13.2.10. Revenue Share,

13.2.11. Executive Bios

13.3. Bridgestone

13.3.1. Company Overview,

13.3.2. Company Footprints,

13.3.3. Production Locations,

13.3.4. Product Portfolio,

13.3.5. Competitors & Customers,

13.3.6. Subsidiaries & Parent Organization,

13.3.7. Recent Developments,

13.3.8. Financial Analysis,

13.3.9. Profitability,

13.3.10. Revenue Share,

13.3.11. Executive Bios

13.4. Camso

13.4.1. Company Overview,

13.4.2. Company Footprints,

13.4.3. Production Locations,

13.4.4. Product Portfolio,

13.4.5. Competitors & Customers,

13.4.6. Subsidiaries & Parent Organization,

13.4.7. Recent Developments,

13.4.8. Financial Analysis,

13.4.9. Profitability,

13.4.10. Revenue Share,

13.4.11. Executive Bios

13.5. China National Tire & Rubber Co., Ltd.

13.5.1. Company Overview,

13.5.2. Company Footprints,

13.5.3. Production Locations,

13.5.4. Product Portfolio,

13.5.5. Competitors & Customers,

13.5.6. Subsidiaries & Parent Organization,

13.5.7. Recent Developments,

13.5.8. Financial Analysis,

13.5.9. Profitability,

13.5.10. Revenue Share,

13.5.11. Executive Bios

13.6. Continental AG

13.6.1. Company Overview,

13.6.2. Company Footprints,

13.6.3. Production Locations,

13.6.4. Product Portfolio,

13.6.5. Competitors & Customers,

13.6.6. Subsidiaries & Parent Organization,

13.6.7. Recent Developments,

13.6.8. Financial Analysis,

13.6.9. Profitability,

13.6.10. Revenue Share,

13.6.11. Executive Bios

13.7. Hankook Tire & Technology

13.7.1. Company Overview,

13.7.2. Company Footprints,

13.7.3. Production Locations,

13.7.4. Product Portfolio,

13.7.5. Competitors & Customers,

13.7.6. Subsidiaries & Parent Organization,

13.7.7. Recent Developments,

13.7.8. Financial Analysis,

13.7.9. Profitability,

13.7.10. Revenue Share,

13.7.11. Executive Bios

13.8. IRC TYRE INDUSTRIAL RUBBER COMPANY

13.8.1. Company Overview,

13.8.2. Company Footprints,

13.8.3. Production Locations,

13.8.4. Product Portfolio,

13.8.5. Competitors & Customers,

13.8.6. Subsidiaries & Parent Organization,

13.8.7. Recent Developments,

13.8.8. Financial Analysis,

13.8.9. Profitability,

13.8.10. Revenue Share,

13.8.11. Executive Bios

13.9. Magna Tyres

13.9.1. Company Overview,

13.9.2. Company Footprints,

13.9.3. Production Locations,

13.9.4. Product Portfolio,

13.9.5. Competitors & Customers,

13.9.6. Subsidiaries & Parent Organization,

13.9.7. Recent Developments,

13.9.8. Financial Analysis,

13.9.9. Profitability,

13.9.10. Revenue Share,

13.9.11. Executive Bios

13.10. Maxam Tires

13.10.1. Company Overview,

13.10.2. Company Footprints,

13.10.3. Production Locations,

13.10.4. Product Portfolio,

13.10.5. Competitors & Customers,

13.10.6. Subsidiaries & Parent Organization,

13.10.7. Recent Developments,

13.10.8. Financial Analysis,

13.10.9. Profitability,

13.10.10. Revenue Share,

13.10.11. Executive Bios

13.11. MICHELIN

13.11.1. Company Overview,

13.11.2. Company Footprints,

13.11.3. Production Locations,

13.11.4. Product Portfolio,

13.11.5. Competitors & Customers,

13.11.6. Subsidiaries & Parent Organization,

13.11.7. Recent Developments,

13.11.8. Financial Analysis,

13.11.9. Profitability,

13.11.10. Revenue Share,

13.11.11. Executive Bios

13.12. Nokian Tyres plc

13.12.1. Company Overview,

13.12.2. Company Footprints,

13.12.3. Production Locations,

13.12.4. Product Portfolio,

13.12.5. Competitors & Customers,

13.12.6. Subsidiaries & Parent Organization,

13.12.7. Recent Developments,

13.12.8. Financial Analysis,

13.12.9. Profitability,

13.12.10. Revenue Share,

13.12.11. Executive Bios

13.13. Sumitomo Rubber Industries, Ltd.

13.13.1. Company Overview,

13.13.2. Company Footprints,

13.13.3. Production Locations,

13.13.4. Product Portfolio,

13.13.5. Competitors & Customers,

13.13.6. Subsidiaries & Parent Organization,

13.13.7. Recent Developments,

13.13.8. Financial Analysis,

13.13.9. Profitability,

13.13.10. Revenue Share,

13.13.11. Executive Bios

13.14. The Advance Tire Inc.

13.14.1. Company Overview,

13.14.2. Company Footprints,

13.14.3. Production Locations,

13.14.4. Product Portfolio,

13.14.5. Competitors & Customers,

13.14.6. Subsidiaries & Parent Organization,

13.14.7. Recent Developments,

13.14.8. Financial Analysis,

13.14.9. Profitability,

13.14.10. Revenue Share,

13.14.11. Executive Bios

13.15. Trelleborg AB

13.15.1. Company Overview,

13.15.2. Company Footprints,

13.15.3. Production Locations,

13.15.4. Product Portfolio,

13.15.5. Competitors & Customers,

13.15.6. Subsidiaries & Parent Organization,

13.15.7. Recent Developments,

13.15.8. Financial Analysis,

13.15.9. Profitability,

13.15.10. Revenue Share,

13.15.11. Executive Bios

13.16. TVH

13.16.1. Company Overview,

13.16.2. Company Footprints,

13.16.3. Production Locations,

13.16.4. Product Portfolio,

13.16.5. Competitors & Customers,

13.16.6. Subsidiaries & Parent Organization,

13.16.7. Recent Developments,

13.16.8. Financial Analysis,

13.16.9. Profitability,

13.16.10. Revenue Share,

13.16.11. Executive Bios

13.17. Other Key Players

13.17.1. Company Overview,

13.17.2. Company Footprints,

13.17.3. Production Locations,

13.17.4. Product Portfolio,

13.17.5. Competitors & Customers,

13.17.6. Subsidiaries & Parent Organization,

13.17.7. Recent Developments,

13.17.8. Financial Analysis,

13.17.9. Profitability,

13.17.10. Revenue Share,

13.17.11. Executive Bios

List of Tables

Table 1: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 2: Global Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 3: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 4: Global Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 5: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 6: Global Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 7: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 8: Global Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 9: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 10: Global Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 11: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 12: Global Forklift Tire Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 13: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 14: North America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 15: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 16: North America Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 17: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 18: North America Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 19: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 20: North America Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 21: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 22: North America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 23: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 24: North America Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 25: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 26: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 27: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 28: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 29: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 30: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 31: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 32: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 33: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 34: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 35: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 36: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 38: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 39: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 40: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 41: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 42: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 43: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 44: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 45: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 46: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 47: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 48: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 49: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 50: South America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 51: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 52: South America Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 53: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 54: South America Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 55: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 56: South America Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 57: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 58: South America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 59: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 60: South America Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 61: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 62: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 63: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 64: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 65: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 66: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 67: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 68: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 69: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 70: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 71: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 72: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 73: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 74: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 75: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 76: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 77: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Table 78: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Table 79: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 80: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 81: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 82: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 83: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 84: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 2: Global Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 3: Global Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 4: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 5: Global Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 6: Global Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 7: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 8: Global Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 9: Global Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 10: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 11: Global Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 12: Global Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 13: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 14: Global Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 15: Global Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 16: Global Forklift Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 17: Global Forklift Tire Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 18: Global Forklift Tire Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023‒2031

Figure 19: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 20: North America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 21: North America Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 22: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 23: North America Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 24: North America Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 25: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 26: North America Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 27: North America Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 28: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 29: North America Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 30: North America Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 31: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 32: North America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 33: North America Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 34: North America Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 35: North America Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 36: North America Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 37: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 38: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 39: Europe Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 40: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 41: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 42: Europe Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 43: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 44: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 45: Europe Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 46: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 47: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 48: Europe Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 49: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 50: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 51: Europe Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 52: Europe Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 53: Europe Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 54: Europe Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 55: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 56: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 57: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 58: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 59: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 60: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 61: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 62: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 63: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 64: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 65: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 66: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 67: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 68: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 69: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 70: Asia Pacific Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 71: Asia Pacific Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 72: Asia Pacific Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 73: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 74: South America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 75: South America Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 76: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 77: South America Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 78: South America Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 79: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 80: South America Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 81: South America Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 82: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 83: South America Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 84: South America Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 85: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 86: South America Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 87: South America Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 88: South America Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 89: South America Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 90: South America Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 91: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 92: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 93: Middle East Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 94: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 95: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 96: Middle East Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 97: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 98: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 99: Middle East Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 100: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 101: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 102: Middle East Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 103: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 104: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 105: Middle East Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 106: Middle East Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 107: Middle East Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 108: Middle East Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 109: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 110: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 111: Africa Forklift Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2023‒2031

Figure 112: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 113: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 114: Africa Forklift Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 115: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Class, 2017‒2031

Figure 116: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Class, 2017‒2031

Figure 117: Africa Forklift Tire Market, Incremental Opportunity, by Class, Value (US$ Mn), 2023‒2031

Figure 118: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 119: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 120: Africa Forklift Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 121: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 122: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 123: Africa Forklift Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2023‒2031

Figure 124: Africa Forklift Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 125: Africa Forklift Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 126: Africa Forklift Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031