Analysts’ Viewpoint on Market Scenario

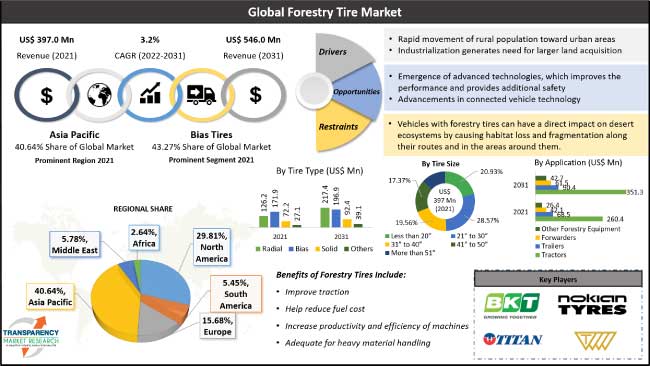

Key players, such as NORTEC, Yokohama Rubber Co. Ltd., Deere & Company, Nokian Tires Plc, Balkrishna Industries Ltd., Maxxis International, and Trelleborg AB, operating in the global forestry tire industry are focusing on the upgrade of performance of forestry tires to offer their customers with a product portfolio, which is innovative, and offers cutting-edge benefits that are cost-effective and diverse. Consequently, the market growth is likely to be at decent pace during the forecast period. Forestry tires are designed to improve the efficiency of forestry vehicles by enhancing their safety features. Furthermore, manufacturers are emphasizing on the development of forestry tires that perform well on different terrain and in diverse weather conditions to ensure safety and reduce the chances of failure or accidents. Rise in demand for larger land area, which we can be fulfilled by converting forests into even land, is a key factor driving market expansion.

Forestry tires use a unique tread composition and feature extremely thick sidewalls and under tread. The strengthened bead of these tires provide exceptional improvement in performance. Moreover, the lower lug angle of the tire demonstrates self-cleaning properties and offers great grip due to its broad inter-lug gap, which is essential in logging applications. Forestry tires have a reinforced structure to cope with terrain that is majorly rough and uneven, this structure provides additional resisting capacity. The diagonal belted construction offers higher rigidity to the forestry tires.

Furthermore, the forestry tire market prospects appear fairly promising due to an increase in movement of population from villages and small towns to urban areas, which is creating a gap between demand and supply of land area.

Rise in public and private sector investments in infrastructure development projects is a key factor boosting the demand for forestry tires globally. This, together with growing urbanization, is contributing to market expansion. Furthermore, rise in disposable income among the general public and increase in global population are also contributing to the global demand for forestry tires.

Ongoing improvements in the forestry sector; a significant population shift from rural to urban areas; the rapid adoption of technological innovation in the forest sector, which necessitates the most advanced tires; and the introduction of new generation tires that can operate in various terrains are also driving market development.

The market for forestry vehicles is constantly expanding owing to rapid expansion of plants and factories. Forestry work is repetitive, precise, and time-sensitive, which makes it a perfect application for advanced machines. Autonomous forestry equipment is being developed by manufacturers that can communicate wirelessly by interfering with the radio signals of other machinery, asking for guidance, and reporting its status. It ensures increased output, a reduction in unplanned maintenance, and improved safety.

Increased demand for increased work efficiency of forestry vehicles is encouraging the use of forestry material handling equipment and other forestry vehicles that help minimize the overall cost of the operation by minimizing human errors.

Forestry tire manufacturers are incorporating technical advancements into their tyres, such as radialization, tire pressure monitoring systems, cut and chip resistance, etc., to cater to the demand from equipment manufacturers. High abrasion resistance and fuel and energy-efficient characteristics are being included in modern forestry tires. The newest technological developments in forestry tires are likely to focus on achieving larger weight bearing capacities, faster speeds, and low rolling resistance.

One of the top features of bias tires is that they offer maximum stability for all types of operations performed in sparse or dense forest areas. Their precise tread design and features ensure maximum adhesion at any time, even while operating on the toughest surfaces. This makes loading and moving operations efficient and smooth and ensures highest resistance to accidental damages, including cuts and ruptures.

Bias tires are the most common type of tires used worldwide. A key market trend likely to be witnessed during the forecast period is the switch from bias to radial tires. The preference for radial tyres is expected to change rather rapidly in North America and Europe. However, in South America and Asia Pacific, bias tires are still commonly utilized.

In terms of tire size, the 21" to 30" segment led the global industry demand, in terms of volume and revenue, in 2021. The segment and is anticipated to maintain its dominance during the forecast period. This is due to the existence of medium- to large-sized forestry vehicles in various nations. Various equipment are used in forestry areas, including tractors, trailers, and forwarders, to ensure easy material handling and transportation. These equipment are equipped with mid-sized forestry tires; however, but it becomes necessary to replace them with new ones because of continuous use on rough terrain, which drives the price of these tires.

In terms of region, the global market analysis reveals that, Asia Pacific dominates the global industry owing to the presence of two of the highest populated countries China and India, which are also the second- and fifth-largest economies in the world, respectively. China is one of the top manufacturers of forestry tires in Asia Pacific. The region is expected to account for a prominent share of the global market demand for forest tires by the end of the forecast period, followed by North America and Europe, in terms of volume and revenue, respectively.

North America was also a prominent market for forestry tire in 2021. The crash of the construction market in the U.S. has played a huge role in the forestry products industry in North America in the last few years. The global economic downturn has also impacted exports of lumber from the region.

The global forestry tire business is fairly consolidated with the largest players controlling a majority of the global market share. A majority of the firms are focusing on introduction of high performance tires through extensive R&D activities. Major business strategies adopted by key forest tire manufacturers include acquisitions, mergers, and expansion of product portfolios. Yokohama Rubber Co. Ltd., Apollo Tyres Ltd., JK Tire & Industries Ltd, Continental AG, Deere & Company, Trelleborg AB, Nokian Tires Plc, NORTEC, Maxxis International, Sumitomo Rubber Industries Ltd., Nexen Tire Corporation, Titan International Inc., Balkrishna Industries Ltd. are a few of the prominent market players.

Key players in the market research report have been analyzed in terms of financial overview, business strategies, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 397.0 Mn |

|

Market Forecast Value in 2031 |

US$ 546.0 Mn |

|

Growth Rate (CAGR) |

3.2% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

Thousand Units for Volume US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, Forestry Tire industry analysis, Forestry Tire market size, Forestry Tire market growth etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market was valued at US$ 397.0 Mn in 2021

It is expected to grow at a CAGR of 3.22% by 2031

It is estimated to reach a value of US$ 546.0 Mn in 2031

NORTEC, Yokohama Rubber Co. Ltd., Deere & Company, Nokian Tires Plc, Balkrishna Industries Ltd., Maxxis International, Trelleborg AB, Interco Tire Corporation, Apollo Tyres Ltd., Sumitomo Rubber Industries Ltd., and Nexen Tire Corporation.

China is a prominent market for forestry tires due to the presence of notable manufacturing industry players and large forests in the region, which drives the need of material handling equipment to ensure the ease in transportation of forestry goods.

The bias tire segment accounted for the largest share (43.27%) in 2021.

Ply rating is the major parameter determining the efficiency and durability of the any forestry tire because an equipment consistently deals with higher weighted materials.

Asia Pacific is the most lucrative region for the forestry tire and holds the dominant market share.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. COVID-19 Impact Analysis – Forestry Tire Market

5. Pricing Analysis

6. Global Forestry Tire Market, by Material Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

6.2.1. Synthetic Rubber

6.2.2. Natural Rubber

6.2.3. Carbon Black

6.2.4. Fabrics & Wire

7. Global Forestry Tire Market, by Tire Size

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

7.2.1. Less than 20”

7.2.2. 21” to 30”

7.2.3. 31” to 40”

7.2.4. 41” to 50”

7.2.5. More than 51”

8. Global Forestry Tire Market, by Tire Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

8.2.1. Radial

8.2.2. Bias

8.2.3. Solid

8.2.4. Others

9. Global Forestry Tire Market, by Application

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

9.2.1. Tractors

9.2.2. Trailers

9.2.3. Forwarders

9.2.4. Other Forestry Equipment

10. Global Forestry Tire Market, by Sales Channel

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

10.2.1. OEM

10.2.2. Aftermarket

11. Global Forestry Tire Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Forestry Tire Market

12.1. Market Snapshot

12.2. North America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

12.2.1. Synthetic Rubber

12.2.2. Natural Rubber

12.2.3. Carbon Black

12.2.4. Fabrics & Wire

12.3. North America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

12.3.1. Less than 20”

12.3.2. 21” to 30”

12.3.3. 31” to 40”

12.3.4. 41” to 50”

12.3.5. More than 51”

12.4. North America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

12.4.1. Radial

12.4.2. Bias

12.4.3. Solid

12.4.4. Others

12.5. North America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

12.5.1. Tractors

12.5.2. Trailers

12.5.3. Forwarders

12.5.4. Other Forestry Equipment

12.6. North America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis – North America Forestry Tire Market Size Analysis & Forecast, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.7.3. Mexico

13. Europe Forestry Tire Market

13.1. Market Snapshot

13.2. Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

13.2.1. Synthetic Rubber

13.2.2. Natural Rubber

13.2.3. Carbon Black

13.2.4. Fabrics & Wire

13.3. Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

13.3.1. Less than 20”

13.3.2. 21” to 30”

13.3.3. 31” to 40”

13.3.4. 41” to 50”

13.3.5. More than 51”

13.4. Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

13.4.1. Radial

13.4.2. Bias

13.4.3. Solid

13.4.4. Others

13.5. Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

13.5.1. Tractors

13.5.2. Trailers

13.5.3. Forwarders

13.5.4. Other Forestry Equipment

13.6. Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – Europe Forestry Tire Market Size Analysis & Forecast, 2017-2031

13.7.1. Germany

13.7.2. U. K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Nordic Countries

13.7.7. Russia & CIS

13.7.8. Rest of Europe

14. Asia Pacific Forestry Tire Market

14.1. Market Snapshot

14.2. Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

14.2.1. Synthetic Rubber

14.2.2. Natural Rubber

14.2.3. Carbon Black

14.2.4. Fabrics & Wire

14.3. Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

14.3.1. Less than 20”

14.3.2. 21” to 30”

14.3.3. 31” to 40”

14.3.4. 41” to 50”

14.3.5. More than 51”

14.4. Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

14.4.1. Radial

14.4.2. Bias

14.4.3. Solid

14.4.4. Others

14.5. Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

14.5.1. Tractors

14.5.2. Trailers

14.5.3. Forwarders

14.5.4. Other Forestry Equipment

14.6. Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – Asia Pacific Forestry Tire Market Size Analysis & Forecast, 2017-2031

14.7.1. China

14.7.2. India

14.7.3. Japan

14.7.4. ASEAN Countries

14.7.5. South Korea

14.7.6. ANZ

14.7.7. Rest of Asia Pacific

15. Middle East & Africa Forestry Tire Market

15.1. Market Snapshot

15.2. Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

15.2.1. Synthetic Rubber

15.2.2. Natural Rubber

15.2.3. Carbon Black

15.2.4. Fabrics & Wire

15.3. Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

15.3.1. Less than 20”

15.3.2. 21” to 30”

15.3.3. 31” to 40”

15.3.4. 41” to 50”

15.3.5. More than 51”

15.4. Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

15.4.1. Radial

15.4.2. Bias

15.4.3. Solid

15.4.4. Others

15.5. Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

15.5.1. Tractors

15.5.2. Trailers

15.5.3. Forwarders

15.5.4. Other Forestry Equipment

15.6. Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. Key Country Analysis – Middle East & Africa Forestry Tire Market Size Analysis & Forecast, 2017-2031

15.7.1. GCC

15.7.2. South Africa

15.7.3. Turkey

15.7.4. Rest of Middle East & Africa

16. South America Forestry Tire Market

16.1. Market Snapshot

16.2. South America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Material Type

16.2.1. Synthetic Rubber

16.2.2. Natural Rubber

16.2.3. Carbon Black

16.2.4. Fabrics & Wire

16.3. South America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Size

16.3.1. Less than 20”

16.3.2. 21” to 30”

16.3.3. 31” to 40”

16.3.4. 41” to 50”

16.3.5. More than 51”

16.4. South America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Tire Type

16.4.1. Radial

16.4.2. Bias

16.4.3. Solid

16.4.4. Others

16.5. South America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Application

16.5.1. Tractors

16.5.2. Trailers

16.5.3. Forwarders

16.5.4. Other Forestry Equipment

16.6. South America Forestry Tire Market Size Analysis & Forecast, 2017-2031, by Sales Channel

16.6.1. OEM

16.6.2. Aftermarket

16.7. Key Country Analysis – South America Forestry Tire Market Size Analysis & Forecast, 2017-2031

16.7.1. Brazil

16.7.2. Argentina

16.7.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2021

17.2. Pricing comparison among key players

17.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. NORTEC

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Interco Tire Corporation

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Yokohama Rubber Co. Ltd.

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Apollo Tyres Ltd.

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. JK Tire & Industries Ltd

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Bridgestone Corporation

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Continental AG

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Michelin

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. Deere & Company

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. Trelleborg AB

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Nokian Tires Plc

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Maxxis International

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Sumitomo Rubber Industries Ltd.

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. Nexen Tire Corporation

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Titan International Inc.

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Balkrishna Industries Ltd

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

18.17. Other Key Players

List of Tables

Table 1: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 2: Global Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 3: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 4: Global Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 5: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 6: Global Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 7: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 8: Global Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 9: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 10: Global Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 12: Global Forestry Tire Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 13: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 14: North America Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 15: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 16: North America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 17: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 18: North America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 19: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 20: North America Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 21: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 22: North America Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 24: North America Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 25: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 26: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 27: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 28: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 29: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 30: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 31: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 32: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 33: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 34: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 36: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 38: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 39: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 40: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 41: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 42: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 43: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 44: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 45: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 46: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 48: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 50: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 51: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 52: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 53: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 54: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 55: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 56: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 57: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 58: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 60: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 61: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 62: South America Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 63: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 64: South America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Table 65: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 66: South America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Table 67: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 68: South America Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 69: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 70: South America Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 72: South America Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 2: Global Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 3: Global Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 4: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 5: Global Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 6: Global Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 7: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 8: Global Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 9: Global Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 10: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 11: Global Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 12: Global Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 13: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 14: Global Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 15: Global Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 16: Global Forestry Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 17: Global Forestry Tire Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 18: Global Forestry Tire Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022‒2031

Figure 19: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 20: North America Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 21: North America Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 22: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 23: North America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 24: North America Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 25: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 26: North America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 27: North America Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 28: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 29: North America Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 30: North America Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 31: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 32: North America Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 33: North America Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 34: North America Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 35: North America Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 36: North America Forestry Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 37: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 38: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 39: Europe Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 40: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 41: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 42: Europe Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 43: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 44: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 45: Europe Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 46: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 47: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 48: Europe Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 49: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 50: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 51: Europe Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 52: Europe Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 53: Europe Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 54: Europe Forestry Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 55: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 56: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 57: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 58: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 59: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 60: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 61: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 62: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 63: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 64: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 65: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 66: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 67: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 68: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 69: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 70: Asia Pacific Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 71: Asia Pacific Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 72: Asia Pacific Forestry Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 73: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 74: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 75: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 76: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 77: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 78: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 79: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 80: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 81: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 82: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 83: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 84: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 85: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 86: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 87: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 88: Middle East & Africa Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 89: Middle East & Africa Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 90: Middle East & Africa Forestry Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 91: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 92: South America Forestry Tire Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Figure 93: South America Forestry Tire Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022‒2031

Figure 94: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 95: South America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Size, 2017‒2031

Figure 96: South America Forestry Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Mn), 2022‒2031

Figure 97: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 98: South America Forestry Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017‒2031

Figure 99: South America Forestry Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2022‒2031

Figure 100: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 101: South America Forestry Tire Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 102: South America Forestry Tire Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 103: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 104: South America Forestry Tire Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 105: South America Forestry Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 106: South America Forestry Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 107: South America Forestry Tire Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 108: South America Forestry Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031