Analysts’ Viewpoint on Market Scenario

Increase in demand for fresh and high quality food products, need for energy efficiency and time saving solutions, and expansion of the food processing industry are key factors augmenting the food industry vacuum cooling equipment market growth. Vacuum cooling equipment ensures increased shelf life, leading to its increased adoption in the fruits and vegetables segment of the food industry.

Furthermore, technological advancements such as screw vacuum pumps, and autonomous capabilities are expected to fuel the food industry vacuum cooling equipment market size in the next few years.

Vacuum cooling equipment manufacturers are focusing on research & development activities to accelerate the rolling out of products with new features to boost their shares, leading to lucrative opportunities in the market.

Vacuum cooling equipment is a specialized equipment used in the food industry to rapidly cool food products. Vacuum cooling is a method of cooling that exploits the properties of reduced air pressure to lower the temperature of food quickly and efficiently.

The equipment typically consists of a vacuum chamber or vessel where the food products are placed. The chamber is sealed and the air inside is partially or completely removed, creating a vacuum environment. As the air pressure decreases, the boiling point of water decreases as well. This allows the water inside the food to evaporate rapidly, carrying away heat and cooling the product.

Vacuum chilling is commonly used in the food industry to preserve the freshness and quality of perishable products such as fruits, vegetables, and flowers. It can be used to cool down cooked food quickly, reducing the risk of bacterial growth and extending the shelf life of the products.

Consumer preferences are shifting toward fresh, minimally processed, and healthy food options. Vacuum cooling supports these trends by maintaining the nutritional value and visual appeal of fresh produce, thereby meeting consumer expectations and driving the demand for products processed with this technology. It helps to preserve the freshness and quality of food products and minimizes moisture loss, prevents dehydration, and preserves texture, color, and flavor by rapidly cooling the products to low temperatures, thereby inhibiting microbial growth, enzymatic activity, and other deteriorative processes. This extends the shelf life of perishable goods and reduces food waste, which is a significant concern in the food industry. These factors are positively driving food industry vacuum cooling equipment market demand.

Vacuum cooling technology is considered to be an energy-efficient and time saving cooling technology compared to traditional methods such as refrigeration. It requires less energy to achieve rapid cooling, making it as an attractive option for food manufacturers who are looking to reduce their energy consumption and carbon footprint. It also allows for faster production cycles, increasing overall productivity and output, and ensuring food preservation.

The food industry vacuum cooling equipment market share is increasing because it is a versatile equipment and its adaptability makes it a valuable asset across different segments of the food industry such as agriculture, food processing, and catering.

The food industry has started to use new methods of vacuum cooling of food products. Ongoing advancements in vacuum cooling equipment such as improved automation, control systems, and integration with other food processing technologies are further driving product adoption. These advancements enhance efficiency, reliability, and ease of operation, making vacuum cooling methods more accessible to food manufacturers. This is continuously increasing the food industry vacuum cooling equipment market value.

Edwards, a vacuum pump manufacturer based in the UK, developed a line of EDS screw vacuum pumps available in air and water cooled models. EDS screw vacuum pumps are particularly useful in the food business because they enable quick cooling while consuming relatively less power. They can be employed in the food, agriculture, and chemical industries.

Vacuum cooling systems have become more automated and equipped with advanced control systems, allowing for precise monitoring and adjustment of parameters such as pressure, temperature, and cooling time. Automation helps in streamlining the cooling process and ensures consistent results, which is influencing the food industry vacuum cooling equipment industry growth.

The food industry vacuum cooling equipment market segmentation by cooling type includes air cooled vacuum coolers and water cooled vacuum coolers. The air cooled vacuum coolers segment is estimated to lead the global market in the next few years. Air cooled vacuum coolers are the refrigeration systems that utilize vacuum technology and forced air circulation to rapidly cool products. They offer fast and efficient cooling, extended shelf life, and energy savings, making them highly popular in the food industry and in other applications.

Moreover, air cooled vacuum coolers offer several other benefits such as reduced water usage, better product quality, lower maintenance requirements, and they are environment-friendly.

Based on application, the global food industry vacuum cooling equipment market has been bifurcated into baked products, meat products, fruits & vegetables, and others (readymade food, etc.). The baked products segment is likely to lead the global market during the forecast period as consumers shift their focus toward fresh and healthy food products.

Another trend is the use of vacuum cooling in plant-based bread, which has 60% protein and 28% nutritional fiber, causing the market to increase at an exponential rate.

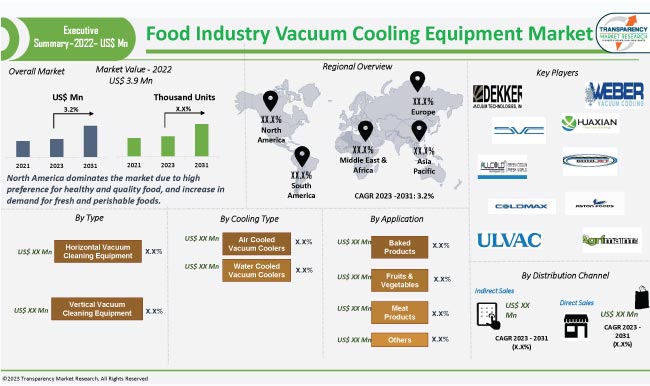

According to the food industry vacuum cooling equipment market forecast, North America is likely to dominate the global landscape during the forecast period. High demand for bakery products in the region is expected to be a major factor driving the demand for food industry vacuum equipment.

Furthermore, surge in demand for fresh and perishable foods, focus on food safety and quality, energy efficiency, expanding food processing equipment and infrastructure, adoption of advanced technologies, improved performance, and auto control features are propelling market progress in North America.

The food industry vacuum cooling equipment market is fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players. Various marketing strategies are being adopted by vacuum cooling equipment suppliers.

Based on the food industry vacuum cooling equipment market trends, suppliers, manufacturers and venders in the sector are focusing on product developments and are striving to meet the evolving demands of customers by introducing more efficient products at reasonable price. Additionally, food industry vacuum cooling equipment market players are focusing on industry research and analyzing the market drivers for further growth.

Prominent players operating in the global food industry vacuum cooling equipment industry include Dekker Vacuum Technologies Inc., Weber Cooling International BV, Southern Vacuum Cooling Inc., Dongguan Huaxian Technology Co.Ltd., Kooljet, SHENZHEN ALLCOLD CO.LTD., Dongguan COLDMAX Ltd., ULVAC Inc., Aston Foods International, and Agrimaint Inc.

Key players have been profiled in the food industry vacuum cooling equipment market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 3.9 Mn |

|

Market Value in 2031 |

US$ 5.3 Mn |

|

Growth Rate (CAGR) |

3.2% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 3.9 Mn in 2022

It is expected to reach US$ 5.3 Mn by 2031

It is estimated to grow at a CAGR of 3.2% from 2023-2031

Expansion of food industries, technological advancements, and rise in need for safe and quality food products

The air cooled vacuum coolers segment holds major share in terms of cooling type

North America is a more attractive region for vendors

Dekker Vacuum Technologies Inc., Weber Cooling International BV, Southern vacuum cooling Inc., Dongguan Huaxian Technology Co. Ltd., Kooljet, SHENZHEN ALLCOLD CO.LTD., Dongguan COLDMAX Ltd., ULVAC Inc., Aston Foods International, and Agrimaint Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, By Type

6.1. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Vertical Vacuum Cleaning Equipment

6.1.2. Horizontal Vacuum Cleaning Equipment

6.2. Incremental Opportunity, By Type

7. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, By Cooling Type

7.1. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

7.1.1. Air Cooled Vacuum Coolers

7.1.2. Water Cooled Vacuum Coolers

7.2. Incremental Opportunity, By Cooling Type

8. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, By Application

8.1. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Baked Products

8.1.2. Meat Products

8.1.3. Fruits & Vegetables

8.1.4. Others

8.2. Incremental Opportunity, By Application

9. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, By Distribution Channel

9.1. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, By Distribution Channel

10. Global Food Industry Vacuum Cooling Equipment Market Analysis and Forecast, By Region

10.1. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Food Industry Vacuum Cooling Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Cooling Type Trend Analysis

11.2.1. Weighted Average Cooling Type

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Key Supplier Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

11.6.1. Vertical Vacuum Cleaning Equipment

11.6.2. Horizontal Vacuum Cleaning Equipment

11.7. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

11.7.1. Air Cooled Vacuum Coolers

11.7.2. Water Cooled Vacuum Coolers

11.8. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

11.8.1. Baked Products

11.8.2. Meat Products

11.8.3. Fruits & Vegetables

11.8.4. Others

11.9. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2027

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Food Industry Vacuum Cooling Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Cooling Type Trend Analysis

12.2.1. Weighted Average Cooling Type

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Key Supplier Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

12.6.1. Vertical Vacuum Cleaning Equipment

12.6.2. Horizontal Vacuum Cleaning Equipment

12.7. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

12.7.1. Air Cooled Vacuum Coolers

12.7.2. Water Cooled Vacuum Coolers

12.8. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

12.8.1. Baked Products

12.8.2. Meat Products

12.8.3. Fruits & Vegetables

12.8.4. Others

12.9. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Food Industry Vacuum Cooling Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Cooling Type Trend Analysis

13.2.1. Weighted Average Cooling Type

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

13.6.1. Vertical Vacuum Cleaning Equipment

13.6.2. Horizontal Vacuum Cleaning Equipment

13.7. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

13.7.1. Air Cooled Vacuum Coolers

13.7.2. Water Cooled Vacuum Coolers

13.8. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

13.8.1. Baked Products

13.8.2. Meat Products

13.8.3. Fruits & Vegetables

13.8.4. Others

13.9. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Food Industry Vacuum Cooling Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Cooling Type Trend Analysis

14.2.1. Weighted Average Cooling Type

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

14.6.1. Vertical Vacuum Cleaning Equipment

14.6.2. Horizontal Vacuum Cleaning Equipment

14.7. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

14.7.1. Air Cooled Vacuum Coolers

14.7.2. Water Cooled Vacuum Coolers

14.8. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

14.8.1. Baked Products

14.8.2. Meat Products

14.8.3. Fruits & Vegetables

14.8.4. Others

14.9. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Food Industry Vacuum Cooling Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Cooling Type Trend Analysis

15.2.1. Weighted Average Cooling Type

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

15.6.1. Vertical Vacuum Cleaning Equipment

15.6.2. Horizontal Vacuum Cleaning Equipment

15.7. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Cooling Type, 2017 - 2031

15.7.1. Air Cooled Vacuum Coolers

15.7.2. Water Cooled Vacuum Coolers

15.8. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

15.8.1. Baked Products

15.8.2. Meat Products

15.8.3. Fruits & Vegetables

15.8.4. Others

15.9. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Food Industry Vacuum Cooling Equipment Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis - 2022 (%)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Dekker Vacuum Technologies Inc.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Weber Cooling International Bv

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Southern Vacuum Cooling Inc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Dongguan Huaxian Technology Co. Ltd.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Kooljet

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Shenzhenallcols Co. Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Dongguan Coldmax Ltd.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Ulvac Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Aston Foods International

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Agrimaint Inc.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Cooling Type

17.1.3. Application

17.1.4. Distribution channel

17.1.5. Region

17.2. Understanding the Procurement Process of End-Users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 2: Global Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 3: Global Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 4: Global Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 5: Global Food Industry Vacuum Cooling Equipment Market by Application, Thousand Units, 2017-2031

Table 6: Global Food Industry Vacuum Cooling Equipment Market by Application, US$ Mn 2017-2031

Table 7: Global Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

Table 9: Global Food Industry Vacuum Cooling Equipment Market by Region, Thousand Units, 2017-2031

Table 10: Global Food Industry Vacuum Cooling Equipment Market by Region, US$ Mn 2017-2031

Table 11: North America Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 12: North America Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 13: North America Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 14: North America Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 15: North America Food Industry Vacuum Cooling Equipment Market by Application , Thousand Units, 2017-2031

Table 16: North America Food Industry Vacuum Cooling Equipment Market by Application , US$ Mn 2017-2031

Table 17: North America Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

Table 19: Europe Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 20: Europe Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 21: Europe Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 22: Europe Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 23: Europe Food Industry Vacuum Cooling Equipment Market by Application, Thousand Units, 2017-2031

Table 24: Europe Food Industry Vacuum Cooling Equipment Market by Application, US$ Mn 2017-2031

Table 25: Europe Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: Europe Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

Table 27: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 28: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 29: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 30: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 31: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Application, Thousand Units, 2017-2031

Table 32: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Application, US$ Mn 2017-2031

Table 33: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 34: Asia Pacific Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

Table 35: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 36: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 37: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 38: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 39: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Application, Thousand Units, 2017-2031

Table 40: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Application, US$ Mn 2017-2031

Table 41: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 42: Middle East & Africa Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

Table 43: South America Food Industry Vacuum Cooling Equipment Market by Type, Thousand Units 2017-2031

Table 44: South America Food Industry Vacuum Cooling Equipment Market by Type, US$ Mn 2017-2031

Table 45: South America Food Industry Vacuum Cooling Equipment Market by Cooling Type, Thousand Units 2017-2031

Table 46: South America Food Industry Vacuum Cooling Equipment Market by Cooling Type, US$ Mn 2017-2031

Table 47: South America Food Industry Vacuum Cooling Equipment Market by Application , Thousand Units, 2017-2031

Table 48: South America Food Industry Vacuum Cooling Equipment Market by Application, US$ Mn 2017-2031

Table 49: South America Food Industry Vacuum Cooling Equipment Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: South America Food Industry Vacuum Cooling Equipment Market by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Global Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 2: Global Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 3: Global Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 4: Global Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 5: Global Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 6: Global Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 7: Global Food Industry Vacuum Cooling Equipment Market Projections, by Application , Thousand Units , 2017-2031

Figure 8: Global Food Industry Vacuum Cooling Equipment Market Projections, by Application , US$ Mn 2017-2031

Figure 9: Global Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 10: Global Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 11: Global Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 12: Global Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 13: Global Food Industry Vacuum Cooling Equipment Market Projections, by Region, Thousand Units , 2017-2031

Figure 14: Global Food Industry Vacuum Cooling Equipment Market Projections, by Region, US$ Mn 2017-2031

Figure 15: Global Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Region, US$ Mn 2023-2031

Figure 16: North America Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 17: North America Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 18: North America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 19: North America Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 20: North America Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 21: North America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 22: North America Food Industry Vacuum Cooling Equipment Market Projections, by Application , Thousand Units , 2017-2031

Figure 23: North America Food Industry Vacuum Cooling Equipment Market Projections, by Application , US$ Mn 2017-2031

Figure 24: North America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 25: North America Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 26: North America Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 27: North America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 28: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 29: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 30: Europe Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 31: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 32: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 33: Europe Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 34: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Application, Thousand Units , 2017-2031

Figure 35: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Application, US$ Mn 2017-2031

Figure 36: Europe Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 37: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 38: Europe Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 39: Europe Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 40: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 41: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 42: Asia Pacific Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 43: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 44: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 45: Asia Pacific Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 46: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Application, Thousand Units , 2017-2031

Figure 47: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Application, US$ Mn 2017-2031

Figure 48: Asia Pacific Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 49: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 50: Asia Pacific Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 51: Asia Pacific Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 52: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 53: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 54: Middle East & Africa Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 55: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 56: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 57: Middle East & Africa Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 58: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Application , Thousand Units , 2017-2031

Figure 59: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Application , US$ Mn 2017-2031

Figure 60: Middle East & Africa Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 61: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 62: Middle East & Africa Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 63: Middle East & Africa Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 64: South America Food Industry Vacuum Cooling Equipment Market Projections, by Type, Thousand Units 2017-2031

Figure 65: South America Food Industry Vacuum Cooling Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 66: South America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 67: South America Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, Thousand Units 2017-2031

Figure 68: South America Food Industry Vacuum Cooling Equipment Market Projections, by Cooling Type, US$ Mn 2017-2031

Figure 69: South America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Cooling Type, US$ Mn 2023-2031

Figure 70: South America Food Industry Vacuum Cooling Equipment Market Projections, by Application, Thousand Units , 2017-2031

Figure 71: South America Food Industry Vacuum Cooling Equipment Market Projections, by Application , US$ Mn 2017-2031

Figure 72: South America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Application , US$ Mn 2023-2031

Figure 73: South America Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 74: South America Food Industry Vacuum Cooling Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 75: South America Food Industry Vacuum Cooling Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031