Analyst Viewpoint

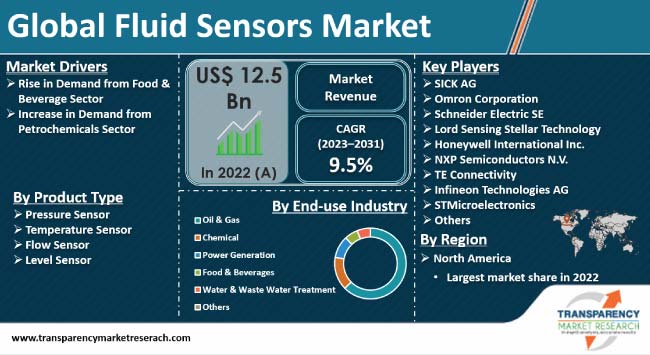

Increase in applications of fluid sensors in the food & beverages sector to ensure efficient, safe, and sustainable production of foodstuff and beverages is driving the fluid sensors market growth. These sensors perform optimally even in extreme process temperatures, which helps save energy and ensures safer production. Furthermore, need for hygienic processing with proper temperature and fluid control is expected to boost the fluid sensors industry during the forecast period.

Fluid sensors are extensively used in petrochemical plants to detect highly corrosive and acidic elements. These sensors also help reduce spillage and wastage, which ensures that processes are carried out efficiently. Regulations laid down by governments across the globe regarding safe operations of petrochemicals plants are also prompting key players to opt for fluid sensors, as detection of any lethal substances could invite preventive/precautionary measures accordingly.

Rise in demand for real-time precise fluid monitoring, detection, and analysis in oil & gas, chemical, power generation, food & beverages, water & wastewater treatment industries is driving the industrial applications of high-precision fluid sensors. In the chemical sector, aqueous substance sensors are used to determine the presence of chemical substances by detecting change in color of chemical triggered by the substance’s chemical bonding.

Flow monitoring sensors, as the name suggests, monitor flow velocity/flow rate of liquid or gaseous media. Deviations from the individual threshold values could thus be detected at an earlier stage, thereby prompting the adoption of preventive measures by end-users. Extensive applications of high-precision fluid sensors in diverse industries are likely to drive the fluid sensors market during the forecast period.

Fluid sensors measure temperature, flow rate and pressure of hydraulic fluid, which assists in taking corrective/preventive measures for optimization of hydraulic systems. These fluid sensors are termed as hydraulic sensor systems as well. Innovative uses of fluid sensors in medical devices include air flow sensors that are used on an extensive note to monitor as well as control gas flow. Mass flow or volumetric flow can be measured using these sensors so that the patient’s line of treatment could be determined based on these readings.

Reliable fluid sensors for aerospace engineering constitute using sensors in conjunction with pressure transducers that offer a precise and reliable solution for aerospace applications that need pressure management. SOI pressure sensing technology used by these transducers provides higher stability and accuracy.

One of the latest fluid sensor market trends is the combining of microfluidic technology with microelectromechanical systems (MEMSs) in various small-scale devices for biosensing and accurately detecting particles at a higher rate. This technology is being adopted by car makers such as BMW and Audi for estimating fluid in stopping mechanism and also for determining the water cooling temperature for maintaining a strategic distance from risks of mishaps.

Liquid level detectors are used for in-line control and measurement of food processing operation. They monitor fluid levels and temperature, acid/alkali inputs, and gas flow. For instance, a level sensor is used to determine specific volumes of the liquid dispensed during cooking. It states that too little or too much of liquid may imply spoilage of product. Other applications of liquid property sensors include storage vessels, food processing monitoring systems, alerts and alarms, water purification, liquid level sensing for industrial food processing operations, cryogenic fast freeze technologies, food test laboratories, liquid gas storage, transport, liquid dispensing, and solvent and chemical control.

Growing interest in locating spillages of fluid in water and gas supplies and assembling offices is expected to positively influence the fluid sensors market outlook in the next few years. Spillage results in critical loss of assets and capital, and application of fluid sensors helps minimize these losses. They also aid in early identification of oil in ground or submerged vehicles that are deployed for investigating ocean lines. Governments across the globe are also enacting stringent regulations regarding climate wellbeing of oceans, which is anticipated to further drive the demand for fluidic sensing technology during the forecast period.

Extended applications of fluid sensors in the petrochemicals sector include monitoring the fluid level in storage tanks, chemical injections, tote level monitoring, monitoring reservoirs of hydraulic and lubricating fluids, and monitoring drilling fluid, i.e. mud tanks. Increase in investments in oil & gas exploration activities is projected to boost the demand for customizable fluid sensor solutions in the oil & gas sector during the forecast period.

North America accounted for the largest share of the market for fluid sensors in 2022 due to increase in demand for high-quality and reliable sensors owing to enactment of safety regulations by governments to guard against harsh conditions in the oil & gas sector.

Integration of AI and IoT in liquid detection devices in Asia Pacific, especially in Singapore, China, and India, is fueling the fluid sensors market share held by the region. Fluid sensors are used in the large water reservoirs in wastewater treatment plants to monitor and control water levels in order to ascertain optimal efficiency of various purification processes.

As per the latest fluid sensors market analysis, key players are engaging in development of flexible sensor materials, innovative sensing mechanisms and their applications in health monitoring and soft robotic applications. Furthermore, leading sensor manufacturers are emphasizing on the integration of Internet of Things (IoT) to enable the control of fluid sensors from remote places.

A few prominent entities operating in the global market are SICK AG, Omron Corporation, Schneider Electric SE, Lord Sensing Stellar Technology, Honeywell International Inc., NXP Semiconductors N.V., Bosch Sensortec, TE Connectivity, Infineon Technologies AG, Gems Sensors, Inc., Sensata Technologies Holding N.V., STMicroelectronics, Futek Advance Sensor Technologies, Sensirion AG, Yokogawa Electric Corporation, and General Electric Company.

Key players in the fluid sensors market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 12.5 Bn |

| Forecast (Value) in 2031 | US$ 19.4 Bn |

| Growth Rate (CAGR) | 9.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Fluid Sensors Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 12.5 Bn in 2022

It is projected to advance at a CAGR of 9.5% from 2023 to 2031

Rise in demand from food & beverages and petrochemicals sectors

In terms of end-use industry, the oil & gas segment held largest share in 2022

North America is estimated to dominate in the next few years

SICK AG, Omron Corporation, Schneider Electric SE, Lord Sensing Stellar Technology, Honeywell International Inc., NXP Semiconductors N.V., Bosch Sensortec, TE Connectivity, Infineon Technologies AG, Gems Sensors, Inc., Sensata Technologies Holding N.V., STMicroelectronics, Futek Advance Sensor Technologies, Sensirion AG, Yokogawa Electric Corporation, and General Electric Company

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Fluid Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. End-use Industry Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Fluid Sensors Market Analysis, by Product Type

5.1. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

5.1.1. Pressure Sensor

5.1.2. Temperature Sensor

5.1.3. Flow Sensor

5.1.4. Level Sensor

5.2. Market Attractiveness Analysis, by Product Type

6. Global Fluid Sensors Market Analysis, by Detection Medium

6.1. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

6.1.1. Liquid

6.1.2. Gas

6.1.3. Plasma

6.2. Market Attractiveness Analysis, by Detection Medium

7. Global Fluid Sensors Market Analysis, by Measurement Type

7.1. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

7.1.1. Contact

7.1.2. Non-contact

7.2. Market Attractiveness Analysis, by Measurement Type

8. Global Fluid Sensors Market Analysis, by End-use Industry

8.1. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

8.1.1. Oil & Gas

8.1.2. Chemical

8.1.3. Power Generation

8.1.4. Food & Beverages

8.1.5. Water & Waste Water Treatment

8.1.6. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Fluid Sensors Market Analysis and Forecast, by Region

9.1. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Region, 2023–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Fluid Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

10.2.1. Pressure Sensor

10.2.2. Temperature Sensor

10.2.3. Flow Sensor

10.2.4. Level Sensor

10.3. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

10.3.1. Liquid

10.3.2. Gas

10.3.3. Plasma

10.4. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

10.4.1. Contact

10.4.2. Non-contact

10.5. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

10.5.1. Oil & Gas

10.5.2. Chemical

10.5.3. Power Generation

10.5.4. Food & Beverages

10.5.5. Water & Waste Water Treatment

10.5.6. Others

10.6. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Country, 2023–2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Detection Medium

10.7.3. By Measurement Type

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe Fluid Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

11.2.1. Pressure Sensor

11.2.2. Temperature Sensor

11.2.3. Flow Sensor

11.2.4. Level Sensor

11.3. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

11.3.1. Liquid

11.3.2. Gas

11.3.3. Plasma

11.4. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

11.4.1. Contact

11.4.2. Non-contact

11.5. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

11.5.1. Oil & Gas

11.5.2. Chemical

11.5.3. Power Generation

11.5.4. Food & Beverages

11.5.5. Water & Waste Water Treatment

11.5.6. Others

11.6. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Detection Medium

11.7.3. By Measurement Type

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific Fluid Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

12.2.1. Pressure Sensor

12.2.2. Temperature Sensor

12.2.3. Flow Sensor

12.2.4. Level Sensor

12.3. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

12.3.1. Liquid

12.3.2. Gas

12.3.3. Plasma

12.4. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

12.4.1. Contact

12.4.2. Non-contact

12.5. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

12.5.1. Oil & Gas

12.5.2. Chemical

12.5.3. Power Generation

12.5.4. Food & Beverages

12.5.5. Water & Waste Water Treatment

12.5.6. Others

12.6. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Detection Medium

12.7.3. By Measurement Type

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East & Africa Fluid Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

13.2.1. Pressure Sensor

13.2.2. Temperature Sensor

13.2.3. Flow Sensor

13.2.4. Level Sensor

13.3. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

13.3.1. Liquid

13.3.2. Gas

13.3.3. Plasma

13.4. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

13.4.1. Contact

13.4.2. Non-contact

13.5. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

13.5.1. Oil & Gas

13.5.2. Chemical

13.5.3. Power Generation

13.5.4. Food & Beverages

13.5.5. Water & Waste Water Treatment

13.5.6. Others

13.6. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Detection Medium

13.7.3. By Measurement Type

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America Fluid Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2023–2031

14.2.1. Pressure Sensor

14.2.2. Temperature Sensor

14.2.3. Flow Sensor

14.2.4. Level Sensor

14.3. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Detection Medium, 2023–2031

14.3.1. Liquid

14.3.2. Gas

14.3.3. Plasma

14.4. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Measurement Type, 2023–2031

14.4.1. Contact

14.4.2. Non-contact

14.5. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

14.5.1. Oil & Gas

14.5.2. Chemical

14.5.3. Power Generation

14.5.4. Food & Beverages

14.5.5. Water & Waste Water Treatment

14.5.6. Others

14.6. Fluid Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Detection Medium

14.7.3. By Measurement Type

14.7.4. By End-use Industry

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Fluid Sensors Market Competition Matrix - a Dashboard View

15.1.1. Global Fluid Sensors Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. SICK AG

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Omron Corporation

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Schneider Electric SE

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Lord Sensing Stellar Technology

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Honeywell International Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. NXP Semiconductors N.V.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Bosch Sensortec

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. TE Connectivity

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Infineon Technologies AG

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Gems Sensors, Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Sensata Technologies Holding N.V.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. STMicroelectronics

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Futek Advance Sensor Technologies

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Sensirion AG

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Yokogawa Electric Corporation

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. General Electric Company

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 2: Global Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 3: Global Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 3: Global Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 4: Global Fluid Sensors Market Value (US$ Mn) & Forecast, by Region, 2023‒2031

Table 5: North America Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 6: North America Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 7: North America Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 8: North America Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 9: North America Fluid Sensors Market Value (US$ Mn) & Forecast, by Country, 2023‒2031

Table 10: Europe Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 11: Europe Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 12: Europe Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 13: Europe Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 14: Europe Fluid Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 15: Asia Pacific Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 16: Asia Pacific Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 17: Asia Pacific Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 18: Asia Pacific Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 19: Asia Pacific Fluid Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 20: Middle East & Africa Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 21: Middle East & Africa Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 22: Middle East & Africa Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 23: Middle East & Africa Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 24: Middle East & Africa Fluid Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 25: South America Fluid Sensors Market Value (US$ Mn) & Forecast, by Product Type, 2023‒2031

Table 26: South America Fluid Sensors Market Value (US$ Mn) & Forecast, by Detection Medium, 2023‒2031

Table 27: South America Fluid Sensors Market Value (US$ Mn) & Forecast, by Measurement Type, 2023‒2031

Table 28: South America Fluid Sensors Market Value (US$ Mn) & Forecast, by End-use Industry, 2023‒2031

Table 29: South America Fluid Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Fluid Sensors Market

Figure 02: Porter Five Forces Analysis – Global Fluid Sensors Market

Figure 03: End-use Industry Road Map - Global Fluid Sensors Market

Figure 04: Global Fluid Sensors Market, Value (US$ Mn), 2023-2031

Figure 05: Global Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 06: Global Fluid Sensors Market Projections, by Product Type, Value (US$ Mn), 2023‒2031

Figure 07: Global Fluid Sensors Market Projections, by Detection Medium, Value (US$ Mn), 2023‒2031

Figure 08: Global Fluid Sensors Market Projections, by Measurement Type, Value (US$ Mn), 2023‒2031

Figure 09: Global Fluid Sensors Market Projections, by End-use Industry, Value (US$ Mn), 2023‒2031

Figure 10: Global Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 11: Global Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 12: Global Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 13: Global Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 14: Global Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 15: Global Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 16: Global Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 17: Global Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global Fluid Sensors Market Projections, by Region, Value (US$ Mn), 2023‒2031

Figure 19: Global Fluid Sensors Market, Incremental Opportunity, by Region, 2023‒2031

Figure 20: Global Fluid Sensors Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Fluid Sensors Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 22: North America Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 23: North America Fluid Sensors Market Projections, by Product Type (US$ Mn), 2023‒2031

Figure 24: North America Fluid Sensors Market Projections, by Detection Medium (US$ Mn), 2023‒2031

Figure 25: North America Fluid Sensors Market Projections, by Measurement Type (US$ Mn), 2023‒2031

Figure 26: North America Fluid Sensors Market Projections, by End-use Industry (US$ Mn), 2023‒2031

Figure 27: North America Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 28: North America Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 29: North America Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 30: North America Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 31: North America Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 32: North America Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 33: North America Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 34: North America Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 35: North America Fluid Sensors Market Projections, by Country, Value (US$ Mn), 2023‒2031

Figure 36: North America Fluid Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 37: North America Fluid Sensors Market Share Analysis, by Country, 2023 and 2031

Figure 38: Europe Fluid Sensors Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 39: Europe Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 40: Europe Fluid Sensors Market Projections, by Product Type, Value (US$ Mn), 2023‒2031

Figure 41: Europe Fluid Sensors Market Projections, by Detection Medium, Value (US$ Mn), 2023‒2031

Figure 42: Europe Fluid Sensors Market Projections, by Measurement Type, Value (US$ Mn), 2023‒2031

Figure 43: Europe Fluid Sensors Market Projections, by End-use Industry, Value (US$ Mn), 2023‒2031

Figure 44: Europe Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 45: Europe Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 46: Europe Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 47: Europe Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 48: Europe Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 49: Europe Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 50: Europe Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 51: Europe Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 52: Europe Fluid Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 53: Europe Fluid Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 54: Europe Fluid Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 55: Asia Pacific Fluid Sensors Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 56: Asia Pacific Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 57: Asia Pacific Fluid Sensors Market Projections, by Product Type, Value (US$ Mn), 2023‒2031

Figure 58: Asia Pacific Fluid Sensors Market Projections, by Detection Medium, Value (US$ Mn), 2023‒2031

Figure 59: Asia Pacific Fluid Sensors Market Projections, by Measurement Type, Value (US$ Mn), 2023‒2031

Figure 60: Asia Pacific Fluid Sensors Market Projections, by End-use Industry, Value (US$ Mn), 2023‒2031

Figure 61: Asia Pacific Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 62: Asia Pacific Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 63: Asia Pacific Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 64: Asia Pacific Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 65: Asia Pacific Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 66: Asia Pacific Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 67: Asia Pacific Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 68: Asia Pacific Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Asia Pacific Fluid Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 70: Asia Pacific Fluid Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 71: Asia Pacific Fluid Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 72: Middle East & Africa Fluid Sensors Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 73: Middle East & Africa Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 74: Middle East & Africa Fluid Sensors Market Projections, by Product Type, Value (US$ Mn), 2023‒2031

Figure 75: Middle East & Africa Fluid Sensors Market Projections, by Detection Medium, Value (US$ Mn), 2023‒2031

Figure 76: Middle East & Africa Fluid Sensors Market Projections, by Measurement Type, Value (US$ Mn), 2023‒2031

Figure 77: Middle East & Africa Fluid Sensors Market Projections, by End-use Industry, Value (US$ Mn), 2023‒2031

Figure 78: Middle East & Africa Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 79: Middle East & Africa Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 80: Middle East & Africa Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 81: Middle East & Africa Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 82: Middle East & Africa Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 83: Middle East & Africa Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 84: Middle East & Africa Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 85: Middle East & Africa Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 86: Middle East & Africa Fluid Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 87: Middle East & Africa Fluid Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 88: Middle East & Africa Fluid Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 89: South America Fluid Sensors Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 90: South America Fluid Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 91: South America Fluid Sensors Market Projections, by Product Type, Value (US$ Mn), 2023‒2031

Figure 92: South America Fluid Sensors Market Projections, by Detection Medium, Value (US$ Mn), 2023‒2031

Figure 93: South America Fluid Sensors Market Projections, by Measurement Type, Value (US$ Mn), 2023‒2031

Figure 94: South America Fluid Sensors Market Projections, by End-use Industry, Value (US$ Mn), 2023‒2031

Figure 95: South America Fluid Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 96: South America Fluid Sensors Market, Incremental Opportunity, by Detection Medium, 2023‒2031

Figure 97: South America Fluid Sensors Market, Incremental Opportunity, by Measurement Type, 2023‒2031

Figure 98: South America Fluid Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 99: South America Fluid Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 100: South America Fluid Sensors Market Share Analysis, by Detection Medium, 2023 and 2031

Figure 101: South America Fluid Sensors Market Share Analysis, by Measurement Type, 2023 and 2031

Figure 102: South America Fluid Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 103: South America Fluid Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 104: South America Fluid Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 105: South America Fluid Sensors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 106: Global Fluid Sensors Market Competition

Figure 107: Global Fluid Sensors Market Company Share Analysis