Global Flight Data Monitoring and Analysis Market: Snapshot

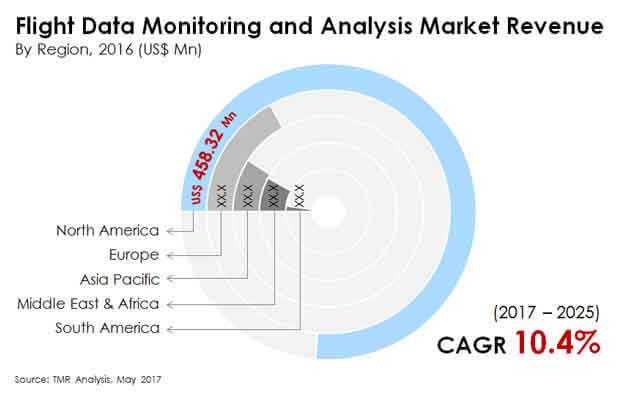

Flight Data Monitoring and Analysis (FDMA) is used to enhance flight crew performance and air traffic control procedures. Thus, flaws in the aircraft operations can be detected before they lead to major accidents thus developing a preventive and corrective action. For this reason, they are integrated with the aircraft operator’s safety management system. In different regions of the world, the concept of FDMA is addressed differently. International Aviation Civil Organization (ICAO) has made FDMA mandatory for aircrafts above a specified maximum certificated take-off mass. This is expected to be the major driver for the Flight data monitoring and analysis market during the forecast period. According to the research report, the global flight data monitoring and analysis market is expected to be worth US$1,623.16 mn by the end of 2025 from US$677.6 mn in 2016. During the forecast years of 2017 and 2025, the global market for flight data monitoring and analysis market is estimated to progress at a CAGR of 10.4%.

Fixed Wing Aircraft Segment to Assume Lead due to Maximum Take-offs

On the basis of aircraft type, the global market is segmented into fixed wing and rotary wing. The fixed wing segment involves the aircrafts that are lifted by their immovable wings and generally have larger seating capacity and weight than the rotary wings aircraft. Therefore, the fixed wing aircrafts have comparatively higher number of applications and carry large volumes than the rotary wing aircrafts. Since the FDMA solutions are mandatory for aircrafts with maximum certificated take-off mass of 27,000 Kg, the fixed wing aircrafts segment is estimated to dominate the FDMA market. By the end of the forecast period, this segment is likely to hold 90% of the market share.

On the basis of end use, the global FDMA market is divided into civil, which includes commercial and general, and military. The civil segment includes all the non-military aviation activities, which comprises both commercial and general aviation aircrafts. The commercial sub segment includes aircrafts that are used for transportation of passengers and cargo loads while general sub segment includes aircrafts for business meetings, flight training, personal travel, recreational flying, medical transport, search and rescue, agriculture aviation, aerial firefighting, pipeline patrol, and many more applications. Due to larger number of activities the civil segment is estimated to the lead the global market over the coming few years.

Asia Pacific to Exhibit Robust Growth Rate

On the basis of geography, the global FDMA market is likely to be driven by the Asia Pacific and the Middle East region. Emerging economies in these regions that are focusing on increasing the safety standards in the aviation industry is expected to support the market. Furthermore, the growing general aviation in Asia Pacific and Middle East are expected to be the possible reasons for its growth in the forecast period. However, North America held a major share in the overall market in 2016, which was closely followed by Europe. North America is estimated to register a CAGR of 8.8% in the global market between 2017 and 2025.

The key players profiled in the global Flight Data Monitoring and Analysis market include Curtiss-Wright Corporation, Teledyne Controls LLC, and Safran Electronics & Defense. Other players included are Hi-Fly Marketing, NeST Aerospace Pvt. Ltd, Guardian Mobility Corporation, French Flight Safety, Helinalysis Ltd, FlightDataPeople, Flight Data Services Ltd, Scaled Analytics Inc., and Aerobytes Ltd.

Global Flight Data Monitoring Analysis Market to Expand with Advancements in Aviation Planning

The demand within the global flight data monitoring analysis market is slated to rise at a formidable pace in the times to follow. Advancements in the aviation industry have created formidable avenues for growth within this market. The focus of this industry on fetching key data related to positioning and control of flights is an important consideration for decision makers. Decision makers in the aviation industry are under tremendous pressure to provide enhanced security to the masses. This has compelled them to induct new safety nodes and technologies. Therefore, the global flight data monitoring analysis market is projected to grow at a stellar pace.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.2. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Flight Data Monitoring and Analysis Market

4. Market Overview

4.1. Introduction

4.1.1. Definitions

4.1.2. Government Policies and Regulations

4.2. Global Flight Data Monitoring and Analysis Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Key Trends

4.5. Global Flight Data Monitoring and Analysis Market Analysis and Forecasts, 2015 – 2025

4.5.1. Market Revenue Projections (US$ Mn)

4.6. Porter’s Five Force Analysis

4.7. Ecosystem Analysis

4.8. Market Outlook

5. Global Flight Data Monitoring and Analysis Market Analysis and Forecast, by Aircraft Type

5.1. Introduction & Definition

5.2. Key Findings

5.3. Market Size (US$ Mn) and Forecast, by Aircraft Type, 2015 – 2025

5.3.1. Fixed Wing

5.3.2. Rotary Wing

5.4. Aircraft Type Comparison Matrix

5.5. Market Attractiveness, by Aircraft Type

6. Global Flight Data Monitoring and Analysis Market Analysis and Forecast, by End-use Vertical

6.1. Introduction & Definition

6.2. Key Findings

6.3. Market Size (US$ Mn) and Forecast, by End-use Vertical, 2015 – 2025

6.3.1. Civil

6.3.1.1. Commercial

6.3.1.2. General

6.3.2. Military

6.4. End-use Vertical Comparison Matrix

6.5. Market Attractiveness, by End-use Vertical

7. Global Flight Data Monitoring and Analysis Market Analysis and Forecast by Region

7.1. Key Findings

7.2. Market Size (US$ Mn) and Forecast by Region, 2015 – 2025

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East and Africa

7.2.5. South America

7.3. Market Attractiveness by Region

8. North America Flight Data Monitoring and Analysis Market Analysis and Forecast

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast By Aircraft Type, 2015 – 2025

8.2.1. Fixed Wing

8.2.2. Rotary Wing

8.3. Market Size (US$ Mn) Forecast By End-use Vertical, 2015 – 2025

8.3.1. Civil

8.3.1.1. Commercial

8.3.1.2. General

8.3.2. Military

8.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

8.4.1. The U.S.

8.4.2. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Aircraft Type

8.5.2. By End-use Vertical

8.5.3. By Country

9. Europe Flight Data Monitoring and Analysis Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast By Aircraft Type, 2015 – 2025

9.2.1. Fixed Wing

9.2.2. Rotary Wing

9.3. Market Size (US$ Mn) Forecast By End-use Vertical, 2015 – 2025

9.3.1. Civil

9.3.1.1. Commercial

9.3.1.2. General

9.3.2. Military

9.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

9.4.1. UK

9.4.2. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Aircraft Type

9.5.2. By End-use Vertical

9.5.3. By Country

10. Asia Pacific (APAC) Flight Data Monitoring and Analysis Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast By Aircraft Type, 2015 – 2025

10.2.1. Fixed Wing

10.2.2. Rotary Wing

10.3. Market Size (US$ Mn) Forecast By End-use Vertical, 2015 – 2025

10.3.1. Civil

10.3.1.1 Commercial

10.3.1.2. General

10.3.2. Military

10.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

10.4.1. China

10.4.2. Japan

10.4.3. Rest of APAC

10.5. Market Attractiveness Analysis

10.5.1. By Aircraft Type

10.5.2. By End-use Vertical

10.5.3. By Country

11. Middle-East and Africa (MEA) Flight Data Monitoring and Analysis Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast By Aircraft Type, 2015 – 2025

11.2.1. Fixed Wing

11.2.2. Rotary Wing

11.3. Market Size (US$ Mn) Forecast By End-use Vertical, 2015 – 2025

11.3.1. Civil

11.3.1.1. Commercial

11.3.1.2. General

11.3.2. Military

11.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

11.4.1. GCC

11.4.2. Rest of MEA

11.5. Market Attractiveness Analysis

11.5.1. By Aircraft Type

11.5.2. By End-use Vertical

11.5.3. By Country

12. South America Flight Data Monitoring and Analysis Market Analysis and Forecast

12.1. Key Findings

12.2. Market Size (US$ Mn) Forecast By Aircraft Type, 2015 – 2025

12.2.1. Fixed Wing

12.2.2. Rotary Wing

12.3. Market Size (US$ Mn) Forecast By End-use Vertical, 2015 – 2025

12.3.1. Civil

12.3.1.1. Commercial

12.3.1.2. General

12.3.2. Military

12.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Aircraft Type

12.5.2. By End-use Vertical

12.5.3. By Country

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis by Company (2016)

13.3. Company Profiles

13.3.1. Flight Data Services Ltd.

13.3.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.1.2. Company Description

13.3.1.3. SWOT Analysis

13.3.1.4. Strategic Overview

13.3.2. Scaled Analytics Inc.

13.3.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.2.2. Company Description

13.3.2.3. SWOT Analysis

13.3.2.4. Strategic Overview

13.3.3. Aerobytes Ltd

13.3.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.3.2. Company Description

13.3.3.3. SWOT Analysis

13.3.3.4. Strategic Overview

13.3.4. Curtiss-Wright Corporation

13.3.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.4.3. Company Description

13.3.4.3. SWOT Analysis

13.3.4.4. Strategic Overview

13.3.5. Teledyne Controls LLC.

13.3.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.5.2. Company Description

13.3.5.3. SWOT Analysis

13.3.5.4. Strategic Overview

13.3.6. Hi-fly Marketing

13.3.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.6.2. Company Description

13.3.6.3. SWOT Analysis

13.3.6.4. Strategic Overview

13.3.7. NeST Aerospace Pvt Ltd.

13.3.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.7.2. Company Description

13.3.7.3. SWOT Analysis

13.3.7.4. Strategic Overview

13.3.8. Guardian Mobility Corporation

13.3.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.8.2. Company Description

13.3.8.3. SWOT Analysis

13.3.8.4. Strategic Overview

13.3.9. French Flight Safety

13.3.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.9.2. Company Description

13.3.9.3. SWOT Analysis

13.3.9.4. Strategic Overview

13.3.10. Helinalysis Ltd

13.3.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.10.2. Company Description

13.3.10.3. SWOT Analysis

13.3.10.4. Strategic Overview

13.3.9. FlightDataPeople

13.3.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.9.2. Company Description

13.3.9.3. SWOT Analysis

13.3.9.4. Strategic Overview

13.3.10. Safran Electronics & Defense

13.3.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.3.10.2. Company Description

13.3.10.3. SWOT Analysis

13.3.10.4. Strategic Overview

14. Key Takeaways

List of Tables

Table 1: Global Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 2: Global Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 3: Global Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 4: Global Flight Data Monitoring and Analysis Market Forecast, By Region, 2015–2025 (US$ Mn)

Table 5: North America Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 6: North America Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 7: North America Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 8: North America Flight Data Monitoring and Analysis Market Forecast, By Country, 2015–2025 (US$ Mn)

Table 9: Europe Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 10: Europe Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 11: Europe Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 12: Europe Flight Data Monitoring and Analysis Market Forecast, By Country, 2015–2025 (US$ Mn)

Table 13: APAC Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 14: APAC Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 15: APAC Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 16: APAC Flight Data Monitoring and Analysis Market Forecast, By Country, 2015–2025 (US$ Mn)

Table 17: MEA Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 18: MEA Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 19: MEA Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 20: MEA Flight Data Monitoring and Analysis Market Forecast, By Country, 2015–2025 (US$ Mn)

Table 21: South America Flight Data Monitoring and Analysis Market Forecast, By Aircraft Type, 2015–2025 (US$ Mn)

Table 22: South America Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical, 2015–2025 (US$ Mn)

Table 23: South America Flight Data Monitoring and Analysis Market Forecast, By Civil, 2015–2025 (US$ Mn)

Table 24: South America Flight Data Monitoring and Analysis Market Forecast, By Country, 2015–2025 (US$ Mn)

List of Figures

Figure 1: Market Revenue Projections, 2015 – 2025 (US$ Mn)

Figure 2: Market Value Share, By Aircraft Type (2017)

Figure 3: Market Value Share, By End-use Vertical (2017)

Figure 4: Market Value Share, By Civil (2017)

Figure 5: Market Value Share, By Geography (2017)

Figure 6: Global Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 7: Fixed Wing Graph

Figure 8: Rotary Wing Graph

Figure 9: Aircraft Type Comparison Matrix

Figure 10: Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 11: Global Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 12: Civil Graph

Figure 13: Military Graph

Figure 14: Global Flight Data Monitoring and Analysis Market Value Share Analysis, By Civil, 2017 and 2025

Figure 15: End-use Vertical Comparison Matrix

Figure 16: Global Flight Data Monitoring and Analysis Market Forecast, By End-use Vertical

Figure 17: Flight Data Monitoring and Analysis Market CAGR (2017 – 2025) Analysis, By Country

Figure 18: Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Region

Figure 19: North America Flight Data Monitoring and Analysis Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2025

Figure 20: North America Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 21: North America Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 22: North America Flight Data Monitoring and Analysis Market Value Share Analysis, By Country, 2017 and 2025

Figure 23: North America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 24: North America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By End-use Vertical

Figure 25: North America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Country

Figure 26: Europe Flight Data Monitoring and Analysis Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2025

Figure 27: Europe Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 28: Europe Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 29: Europe Flight Data Monitoring and Analysis Market Value Share Analysis, By Country, 2017 and 2025

Figure 30: Europe Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 31: Europe Flight Data Monitoring and Analysis Market Attractiveness Analysis, By End-use Vertical

Figure 32: Europe Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Country

Figure 33: APAC Flight Data Monitoring and Analysis Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2025

Figure 34: APAC Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 35: APAC Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 36: APAC Flight Data Monitoring and Analysis Market Value Share Analysis, By Country, 2017 and 2025

Figure 37: APAC Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 38: APAC Flight Data Monitoring and Analysis Market Attractiveness Analysis, By End-use Vertical

Figure 39: Asia Pacific Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Country

Figure 40: MEA Flight Data Monitoring and Analysis Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2025

Figure 41: MEA Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 42: MEA Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 43: MEA Flight Data Monitoring and Analysis Market Value Share Analysis, By Country, 2017 and 2025

Figure 44: MEA Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 45: MEA Flight Data Monitoring and Analysis Market Attractiveness Analysis, By End-use Vertical

Figure 46: MEA Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Country

Figure 47: South America Flight Data Monitoring and Analysis Market Revenue (US$ Mn) and Y-o-Y Forecast, 2017 – 2025

Figure 48: South America Flight Data Monitoring and Analysis Market Value Share Analysis, By Aircraft Type, 2017 and 2025

Figure 49: South America Flight Data Monitoring and Analysis Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 50: South America Flight Data Monitoring and Analysis Market Value Share Analysis, By Country, 2017 and 2025

Figure 51: South America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Aircraft Type

Figure 52: South America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By End-use Vertical

Figure 53: South America Flight Data Monitoring and Analysis Market Attractiveness Analysis, By Country

Figure 54: Global Flight Data Monitoring and Analysis Market Share Analysis (2016)