Analyst Viewpoint

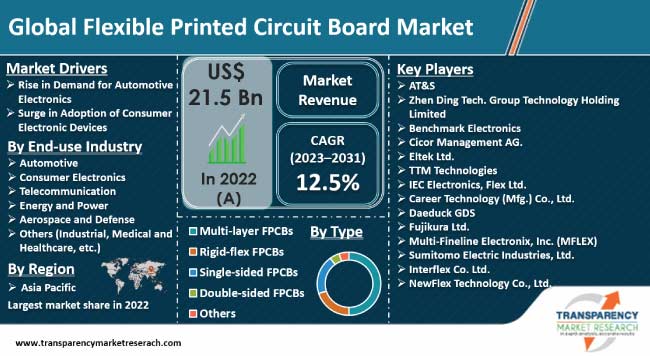

Rise in demand for automotive electronics is one of the key factors that is driving the flexible printed circuit board market size. Electronic systems are used extensively for in-vehicle safety, information, and entertainment purposes in automobiles. Flexible circuitry technology helps resolve issues such as assembly errors and complexities in these systems. Surge in adoption of consumer electronics across the globe is also augmenting market progress.

Companies in the flexible printed circuit board market are investing substantially in the manufacture of high-speed, highly flexible, and dense printed circuit boards to meet the rising demand from industries such as aerospace, telecommunications, and energy & power. They are also introducing cutting-edge flexible circuit board for wearables in order to expand their product portfolio and customer base.

Flexible printed circuit boards (FPCBs) simplify the overall assembly design of a system by limiting the need for wires. Flexible electronics are lightweight, affordable, and employed in any device with a foldable or translating element.

Flexible electronics offer adequate interconnectivity options in limited space and are used as dependable alternatives to traditional wiring methods. Development of green PCBs and miniaturization of PCBs are some of the recent flexible printed circuit board market trends that are molding the flexible electronics landscape.

Flexible printed circuit boards are employed in several electronic devices with complicated networks. Flexible circuitry offers excellent electric induction and controlled performance, leading to a surge in its adoption in the electronics sector.

Integration of electronic systems and devices in automobiles is extremely complex. Electronic systems are used for safety, information, entertainment, and e-mobility purposes in vehicles. Advancements in manufacturing technologies and sustainability concerns are encouraging manufacturers to introduce fuel efficient and high-tech vehicles.

Electronic components account for about one-third of the total cost of a vehicle. According to a report by EVreporter, electrical vehicles constitute nearly 5.0% of total automobile sales in India.

Electronic stability systems and suspensions rely on circuit board networks to maintain automobile balance. The technology plays a vital role in minimizing assembly errors, reducing complexity, lowering costs, and offering reliable communication. Thus, rise in demand for automotive electronics is spurring flexible printed circuit board market growth.

Flexible electronics are known for flexible connection, compactness, and high-density electrical connections. Flexible PCBs are adopted extensively in consumer electronics such as smartphones, tablets, radios, and smart wearables for their smooth functioning.

Consumer electronics, including IoT, wearables, and miniaturizations, can benefit immensely with the usage of flexible printed circuit boards due to their unique ability to connect multiple parts of a circuit or devices.

Flexible printed circuit board market manufacturers are investing significantly in R&D activities to use flexible printed circuit boards in different applications in industries such as telecommunication, energy & power, aerospace & defense, and healthcare.

According to the latest flexible printed circuit board market report, Asia Pacific held the largest share of the global landscape in 2022. Increase in electronics integration in automobiles and enhanced penetration of consumer electronics among the population are augmenting market development in the region.

Growth in popularity of electric vehicles, led by the rise in environmental concerns, is also driving flexible printed circuit board industry statistics in Asia Pacific.

As per the latest flexible printed circuit board market forecast, the industry in North America is projected to grow at a steady pace from 2023 to 2031. Rise in demand for foldable circuit boards in aerospace and automobile sectors is propelling the market dynamics of the region.

Prominent manufacturers operating across the globe landscape are investing significantly in the development of highly-dense and high-speed flexible PCBs. They are also seeking to establish partnerships with leading industry players to enhance their knowledge transfer and expand their product portfolio. Key flexible printed circuit board market manufacturers are also striving to achieve higher efficiency in material and design aspects of FPCBs.

Leading companies operating in the global flexible printed circuit board market are AT&S, Zhen Ding Tech. Group Technology Holding Limited, Benchmark Electronics, Cicor Management AG., Eltek Ltd., TTM Technologies, IEC Electronics, Flex Ltd, Career Technology (Mfg.) Co., Ltd., Daeduck GDS, Flexcom Inc., Fujikura Ltd., Multi-Fineline Electronix, Inc. (MFLEX), Sumitomo Electric Industries, Ltd., Interflex Co. Ltd., NewFlex Technology Co., Ltd., Nitto Denko Corporation, and NOK Corporation.

The flexible printed circuit board market report highlights these players in terms of various parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 21.5 Bn |

| Market Forecast Value in 2031 | US$ 37.9 Bn |

| Growth Rate (CAGR) | 12.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 21.5 Bn in 2022

It is projected to advance at a CAGR of 12.5% from 2023 to 2031

Rise in demand for automotive electronics and surge in adoption of consumer electronic devices

The multi-layer FPCBs segment held significant share in 2022

Asia Pacific dominated the global landscape in 2022

AT&S, Zhen Ding Tech. Group Technology Holding Limited, Benchmark Electronics, Cicor Management AG., Eltek Ltd., TTM Technologies, IEC Electronics, Flex Ltd, Career Technology (Mfg.) Co., Ltd., Daeduck GDS., Flexcom Inc., Fujikura Ltd., Multi-Fineline Electronix, Inc. (MFLEX), Sumitomo Electric Industries, Ltd., Interflex Co. Ltd., NewFlex Technology Co., Ltd., Nitto Denko Corporation, and NOK Corporation

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Flexible Printed Circuit Board Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Flexible Printed Circuit Board Market Analysis, by Type

5.1. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Multi-layer FPCBs

5.1.2. Rigid-flex FPCBs

5.1.3. Single-sided FPCBs

5.1.4. Double-sided FPCBs

5.1.5. Others

5.2. Market Attractiveness Analysis, by Type

6. Global Flexible Printed Circuit Board Market Analysis, by End-use Industry

6.1. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

6.1.1. Automotive

6.1.2. Consumer Electronics

6.1.3. Telecommunication

6.1.4. Energy and Power

6.1.5. Aerospace and Defense

6.1.6. Others (Industrial, Medical and Healthcare, etc.)

6.2. Market Attractiveness Analysis, by End-use Industry

7. Global Flexible Printed Circuit Board Market Analysis and Forecast, by Region

7.1. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Flexible Printed Circuit Board Market Analysis and Forecast

8.1. Market Snapshot

8.2. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

8.2.1. Multi-layer FPCBs

8.2.2. Rigid-flex FPCBs

8.2.3. Single-sided FPCBs

8.2.4. Double-sided FPCBs

8.2.5. Others

8.3. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

8.3.1. Automotive

8.3.2. Consumer Electronics

8.3.3. Telecommunication

8.3.4. Energy and Power

8.3.5. Aerospace and Defense

8.3.6. Others (Industrial, Medical and Healthcare, etc.)

8.4. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country, 2017–2031

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Type

8.5.2. By End-use Industry

8.5.3. By Country/Sub-region

9. Europe Flexible Printed Circuit Board Market Analysis and Forecast

9.1. Market Snapshot

9.2. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.2.1. Multi-layer FPCBs

9.2.2. Rigid-flex FPCBs

9.2.3. Single-sided FPCBs

9.2.4. Double-sided FPCBs

9.2.5. Others

9.3. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.3.1. Automotive

9.3.2. Consumer Electronics

9.3.3. Telecommunication

9.3.4. Energy and Power

9.3.5. Aerospace and Defense

9.3.6. Others (Industrial, Medical and Healthcare, etc.)

9.4. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.4.1. U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-use Industry

9.5.3. By Country/Sub-region

10. Asia Pacific Flexible Printed Circuit Board Market Analysis and Forecast

10.1. Market Snapshot

10.2. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.2.1. Multi-layer FPCBs

10.2.2. Rigid-flex FPCBs

10.2.3. Single-sided FPCBs

10.2.4. Double-sided FPCBs

10.2.5. Others

10.3. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.3.1. Automotive

10.3.2. Consumer Electronics

10.3.3. Telecommunication

10.3.4. Energy and Power

10.3.5. Aerospace and Defense

10.3.6. Others (Industrial, Medical and Healthcare, etc.)

10.4. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. ASEAN

10.4.6. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By End-use Industry

10.5.3. By Country/Sub-region

11. Middle East & Africa Flexible Printed Circuit Board Market Analysis and Forecast

11.1. Market Snapshot

11.2. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.2.1. Multi-layer FPCBs

11.2.2. Rigid-flex FPCBs

11.2.3. Single-sided FPCBs

11.2.4. Double-sided FPCBs

11.2.5. Others

11.3. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.3.1. Automotive

11.3.2. Consumer Electronics

11.3.3. Telecommunication

11.3.4. Energy and Power

11.3.5. Aerospace and Defense

11.3.6. Others (Industrial, Medical and Healthcare, etc.)

11.4. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of Middle East & Africa

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-use Industry

11.5.3. By Country/Sub-region

12. South America Flexible Printed Circuit Board Market Analysis and Forecast

12.1. Market Snapshot

12.2. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.2.1. Multi-layer FPCBs

12.2.2. Rigid-flex FPCBs

12.2.3. Single-sided FPCBs

12.2.4. Double-sided FPCBs

12.2.5. Others

12.3. Flexible Printed Circuit Board Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.3.1. Automotive

12.3.2. Consumer Electronics

12.3.3. Telecommunication

12.3.4. Energy and Power

12.3.5. Aerospace and Defense

12.3.6. Others (Industrial, Medical and Healthcare, etc.)

12.4. Flexible Printed Circuit Board Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-use Industry

12.5.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Flexible Printed Circuit Board Market Competition Matrix - a Dashboard View

13.1.1. Global Flexible Printed Circuit Board Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. AT&S

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Zhen Ding Tech. Group Technology Holding Limited

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Benchmark Electronics

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Cicor Management AG.

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Eltek Ltd.

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. TTM Technologies

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. IEC Electronics, Flex Ltd.

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Career Technology (Mfg.) Co., Ltd.

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Daeduck GDS.

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Flexcom Inc.

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Fujikura Ltd.

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Multi-Fineline Electronix, Inc. (MFLEX)

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. Sumitomo Electric Industries, Ltd.

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

14.14. Interflex Co. Ltd.

14.14.1. Overview

14.14.2. Product Portfolio

14.14.3. Sales Footprint

14.14.4. Key Subsidiaries or Distributors

14.14.5. Strategy and Recent Developments

14.14.6. Key Financials

14.15. NewFlex Technology Co., Ltd.

14.15.1. Overview

14.15.2. Product Portfolio

14.15.3. Sales Footprint

14.15.4. Key Subsidiaries or Distributors

14.15.5. Strategy and Recent Developments

14.15.6. Key Financials

14.16. Nitto Denko Corporation

14.16.1. Overview

14.16.2. Product Portfolio

14.16.3. Sales Footprint

14.16.4. Key Subsidiaries or Distributors

14.16.5. Strategy and Recent Developments

14.16.6. Key Financials

14.17. NOK Corporation

14.17.1. Overview

14.17.2. Product Portfolio

14.17.3. Sales Footprint

14.17.4. Key Subsidiaries or Distributors

14.17.5. Strategy and Recent Developments

14.17.6. Key Financials

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 2: Global Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 3: Global Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 4: Global Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 5: Global Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 6: North America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 7: North America Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 8: North America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 9: North America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 10: North America Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 11: Europe Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 12: Europe Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 13: Europe Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 14: Europe Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 15: Europe Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 17: Asia Pacific Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 18: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 19: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: Asia Pacific Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Middle East & Africa Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 22: Middle East & Africa Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 23: Middle East & Africa Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 24: Middle East & Africa Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 25: Middle East & Africa Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 26: South America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 27: South America Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 28: South America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 29: South America Flexible Printed Circuit Board Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: South America Flexible Printed Circuit Board Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Flexible Printed Circuit Board Market

Figure 02: Porter Five Forces Analysis – Global Flexible Printed Circuit Board Market

Figure 03: Technology Road Map - Global Flexible Printed Circuit Board Market

Figure 04: Global Flexible Printed Circuit Board Market, Value (US$ Mn), 2017-2031

Figure 05: Global Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Flexible Printed Circuit Board Market Projections, by Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 08: Global Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 09: Global Flexible Printed Circuit Board Market Projections, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 10: Global Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 11: Global Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 12: Global Flexible Printed Circuit Board Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 13: Global Flexible Printed Circuit Board Market, Incremental Opportunity, by Region, 2023‒2031

Figure 14: Global Flexible Printed Circuit Board Market Share Analysis, by Region, 2022 and 2031

Figure 15: North America Flexible Printed Circuit Board Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 16: North America Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 17: North America Flexible Printed Circuit Board Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 18: North America Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 19: North America Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 20: North America Flexible Printed Circuit Board Market Projections, by End-use Industry (US$ Mn), 2017‒2031

Figure 21: North America Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 22: North America Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2017 and 2031

Figure 23: North America Flexible Printed Circuit Board Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 24: North America Flexible Printed Circuit Board Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 25: North America Flexible Printed Circuit Board Market Share Analysis, by Country, 2022 and 2031

Figure 26: Europe Flexible Printed Circuit Board Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 27: Europe Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 28: Europe Flexible Printed Circuit Board Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 29: Europe Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 30: Europe Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 31: Europe Flexible Printed Circuit Board Market Projections, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 32: Europe Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 33: Europe Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 34: Europe Flexible Printed Circuit Board Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 35: Europe Flexible Printed Circuit Board Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 36: Europe Flexible Printed Circuit Board Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 37: Asia Pacific Flexible Printed Circuit Board Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 38: Asia Pacific Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 39: Asia Pacific Flexible Printed Circuit Board Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 40: Asia Pacific Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 41: Asia Pacific Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 42: Asia Pacific Flexible Printed Circuit Board Market Projections, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 43: Asia Pacific Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 44: Asia Pacific Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 45: Asia Pacific Flexible Printed Circuit Board Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 46: Asia Pacific Flexible Printed Circuit Board Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 47: Asia Pacific Flexible Printed Circuit Board Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 48: Middle East & Africa Flexible Printed Circuit Board Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 49: Middle East & Africa Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 50: Middle East & Africa Flexible Printed Circuit Board Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 51: Middle East & Africa Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 52: Middle East & Africa Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 53: Middle East & Africa Flexible Printed Circuit Board Market Projections, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 54: Middle East & Africa Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 55: Middle East & Africa Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 56: Middle East & Africa Flexible Printed Circuit Board Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 57: Middle East & Africa Flexible Printed Circuit Board Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 58: Middle East & Africa Flexible Printed Circuit Board Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 59: South America Flexible Printed Circuit Board Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 60: South America Flexible Printed Circuit Board Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 61: South America Flexible Printed Circuit Board Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 62: South America Flexible Printed Circuit Board Market, Incremental Opportunity, by Type, 2023‒2031

Figure 63: South America Flexible Printed Circuit Board Market Share Analysis, by Type, 2022 and 2031

Figure 64: South America Flexible Printed Circuit Board Market Projections, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 65: South America Flexible Printed Circuit Board Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 66: South America Flexible Printed Circuit Board Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 67: South America Flexible Printed Circuit Board Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 68: South America Flexible Printed Circuit Board Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 69: South America Flexible Printed Circuit Board Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 70: Global Flexible Printed Circuit Board Market Competition

Figure 71: Global Flexible Printed Circuit Board Market Company Share Analysis