Analysts’ Viewpoint

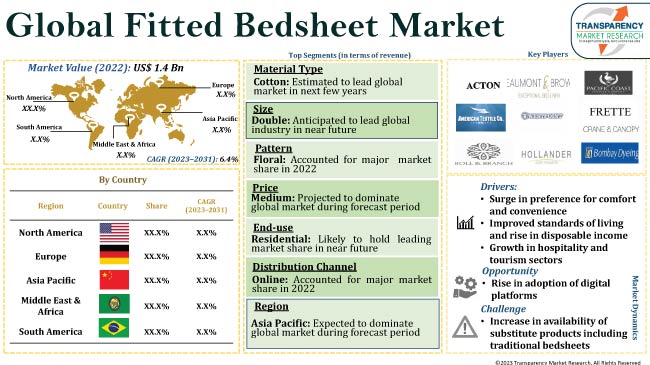

Increase in preference for comfort and convenience and improved standards of living with the rise in disposable income of consumers are significant factors augmenting the fitted bedsheet industry growth. Moreover, growth in hospitality and tourism sectors, increase in demand for visually appealing bedding essentials, and rise in adoption of various digital platforms to purchase these products are expected to fuel the fitted bedsheet market size during the forecast period.

Furthermore, leading manufacturers of fitted bedsheets are focusing on developing innovative products for their consumers. They are primarily using plant-based fabrics such as organic cotton, tencel, and bamboo to make fitted bedsheets as natural materials are better at regulating body temperatures. However, increase in availability of substitute products, including traditional bedsheets, is projected to hamper market expansion in the next few years.

Fitted bedsheets, also known as fitted sheets, are bed linens specifically designed to fit tightly and securely around a mattress. A fitted bedsheet can also be called a mattress protector. Fitted sheets have elasticized corners that stretch and hug the mattress, unlike flat sheets that simply lie on top of the mattress. This elasticized construction allows the sheet to conform to the shape and size of the mattress, providing a snug and taut fit. This feature keeps the sheet in place and prevents it from slipping or coming undone during use.

Moreover, fitted sheets are available in various sizes to match the different dimensions of mattresses. Several fitted bedsheet types are available in the market. Some of these are twin XL sheets and queen size bedsheets. King size bedsheets are also gaining traction among consumers.

Fitted bedsheets come in a range of materials, including cotton, polyester, linen, fleece, and sateen, offering different levels of softness, breathability, and durability. They provide a smooth and comfortable surface for sleeping, while also making it easier to make the bed and maintain a neat appearance.

People, currently, are more likely to opt for bedding essentials that enhance their sleep quality. They give priority to products that are comfortable and convenient to use. Demand for fitted bedsheets is projected to rise in the near future as more consumers prioritize sleep and recognize the benefits of well-fitted bedding products.

Moreover, increase in disposable income of consumers across various regions is contributing to the growth in sale of home decor and bedding essentials. People across the globe are willing to invest in high-quality and esthetically pleasing fitted bedsheets as their spending capacity increases.

Fitted bedsheets are designed to provide a safe and soft surface for sleeping and play a crucial role in providing a comfortable and conducive sleep environment.

Growth in consumer awareness about the value of sleep for a healthy body and mind is motivating market leaders to introduce advanced, comfortable, and versatile fitted bedsheets.

Eco-friendly bedsheets are also gaining popularity among consumers. Manufacturers are focusing on the functional benefits of bedsheets made from plant-based materials such as tencel, bamboo, and organic cotton. These materials absorb moisture and offer breathability.

Moreover, interior design trends greatly influence the demand for bedding products, including fitted bedsheets. Consumers seek bedsheets that match their interior decor, color schemes, and overall esthetics of the house. Manufacturers in the market offer innovative fitted bedsheets in various patterns, colors, and fabrics to cater to the rise in demand of consumers.

Based on material type, the global market segmentation comprises cotton, polyester, fleece, sateen, linen, nylon, rayon, silk, synthetic, velvet, and others (flannel, polycotton, etc.). According to the fitted bedsheet market analysis, the cotton material type segment is estimated to lead the global industry in the near future.

Cotton is a natural fiber known for its softness and breathability. It provides a comfortable sleeping surface, allowing air to circulate and wick away moisture from the body. This helps regulate body temperature and promotes a better night's sleep.

Cotton is commonly used to manufacture fitted bedsheets for several reasons such as comfort, durability, absorbency, and easy maintenance. Cotton fitted bedsheets are hypoallergenic and hence, widely used across residential as well as commercial sectors.

Based on end-use, the residential end-use segment is likely to hold majority of global market share during the forecast period.

Residential consumers are the main buyers of fitted bedsheets. The demand for fitted bedsheets in residential sector is influenced by factors such as rapid urbanization, growth in population, and increase in spending capacity of consumers. Furthermore, high demand for comfortable and esthetically pleasing bedding options is contributing to the fitted bedsheet market development.

According to the fitted bedsheet market forecast, Asia Pacific is likely to dominate the global industry during the forecast period, owing to increase in preference for enhanced home decor and esthetics among consumers in the region. Fitted bedsheets offer a tailored and sophisticated look to the bed, giving it a clean and modern appearance. People in the region are investing significantly in improving the esthetics of their living spaces. This factor is positively impacting the fitted bedsheet market demand in Asia Pacific.

Moreover, changing lifestyles, evolving consumer preferences, convenience factors, and increase in consumer disposable income are some of the factors fueling the fitted bedsheet market growth in the region.

The global landscape is fragmented, with the presence of many local and global players that control majority of the fitted bedsheet market share. As per the latest fitted bedsheet market research analysis, companies are implementing innovative strategies including mergers and new product development to gain incremental opportunities.

Some of the leading companies operating in the global market are Beaumont & Brown Ltd, WestPoint, Boll & Branch LLC, Pacific Coast Feather Company, Crane & Canopy, Acton & Acton Ltd, American Textile Company, Boll & Branch LLC, Hollander, Bombay Dyeing, and Frette. These companies are engaged in following the latest fitted bedsheet market trends to avail lucrative revenue opportunities.

Key players have been profiled in the fitted bedsheet market report based on various parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 1.4 Bn |

|

Market Value in 2031 |

US$ 2.2 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and Brand analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 1.4 Bn in 2022

It is expected to reach US$ 2.2 Bn by 2031

It is estimated to grow at a CAGR of 6.4% by 2031

Rise in preference for comfort and convenience, improved standard of living and growth in disposable income, increased personalization and customization, rapid increase in adoption of digital platforms, and growth in hospitality and tourism sectors

The cotton material type segment held major share in 2022

Asia Pacific is a more attractive region for fitted bedsheets

Acton & Acton Ltd, Beaumont & Brown Ltd, American Textile Company, WestPoint, Boll & Branch LLC, Hollander, Pacific Coast Feather Company, Bombay Dyeing, Crane & Canopy, and Frette

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Material Analysis

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Fitted Bedsheet Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Fitted Bedsheet Market Analysis and Forecast, by Material Type

6.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

6.1.1. Cotton

6.1.2. Polyester

6.1.3. Fleece

6.1.4. Sateen

6.1.5. Linen

6.1.6. Nylon

6.1.7. Rayon

6.1.8. Silk

6.1.9. Synthetic

6.1.10. Velvet

6.1.11. Others

6.2. Incremental Opportunity, by Material Type

7. Global Fitted Bedsheet Market Analysis and Forecast, by Size

7.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

7.1.1. King

7.1.2. Queen

7.1.3. Single

7.1.4. Double

7.2. Incremental Opportunity, by Size

8. Global Fitted Bedsheet Market Analysis and Forecast, by Pattern

8.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

8.1.1. Floral

8.1.2. Abstract

8.1.3. Geometric

8.1.4. Solid

8.1.5. Striped

8.1.6. Others

8.2. Incremental Opportunity, by Pattern

9. Global Fitted Bedsheet Market Analysis and Forecast, by Price

9.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, by Price

10. Global Fitted Bedsheet Market Analysis and Forecast, by End-use

10.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

10.1.1. Residential

10.1.2. Commercial

10.2. Incremental Opportunity, by End-use

11. Global Fitted Bedsheet Market Analysis and Forecast, by Distribution Channel

11.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. Company-owned Websites

11.1.1.2. E-commerce Websites

11.1.2. Offline

11.1.2.1. Specialty Stores

11.1.2.2. Supermarkets & Hypermarkets

11.1.2.3. Multi Branded Stores

11.1.2.4. Other Retail Stores

11.2. Incremental Opportunity, by Distribution Channel

12. Global Fitted Bedsheet Market Analysis and Forecast, by Region

12.1. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Fitted Bedsheet Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

13.6.1. Cotton

13.6.2. Polyester

13.6.3. Fleece

13.6.4. Sateen

13.6.5. Linen

13.6.6. Nylon

13.6.7. Rayon

13.6.8. Silk

13.6.9. Synthetic

13.6.10. Velvet

13.6.11. Others

13.7. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

13.7.1. King

13.7.2. Queen

13.7.3. Single

13.7.4. Double

13.8. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

13.8.1. Floral

13.8.2. Abstract

13.8.3. Geometric

13.8.4. Solid

13.8.5. Striped

13.8.6. Others

13.9. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

13.9.1. Low

13.9.2. Medium

13.9.3. High

13.10. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

13.10.1. Residential

13.10.2. Commercial

13.11. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.1.1. Company-owned Websites

13.11.1.2. E-commerce Websites

13.11.2. Offline

13.11.2.1. Specialty Stores

13.11.2.2. Supermarkets & Hypermarkets

13.11.2.3. Multi-branded Stores

13.11.2.4. Other Retail Stores

13.12. Fitted Bedsheet Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2027

13.12.1. The U.S.

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Fitted Bedsheet Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

14.6.1. Cotton

14.6.2. Polyester

14.6.3. Fleece

14.6.4. Sateen

14.6.5. Linen

14.6.6. Nylon

14.6.7. Rayon

14.6.8. Silk

14.6.9. Synthetic

14.6.10. Velvet

14.6.11. Others

14.7. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

14.7.1. King

14.7.2. Queen

14.7.3. Single

14.7.4. Double

14.8. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

14.8.1. Floral

14.8.2. Abstract

14.8.3. Geometric

14.8.4. Solid

14.8.5. Striped

14.8.6. Others

14.9. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

14.9.1. Low

14.9.2. Medium

14.9.3. High

14.10. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

14.10.1. Residential

14.10.2. Commercial

14.11. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.11.1. Online

14.11.1.1. Company-owned Websites

14.11.1.2. E-commerce Websites

14.11.2. Offline

14.11.2.1. Specialty Stores

14.11.2.2. Supermarkets & Hypermarkets

14.11.2.3. Multi-branded Stores

14.11.2.4. Other Retail Stores

14.12. Fitted Bedsheet Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.12.1. U.K.

14.12.2. Germany

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Fitted Bedsheet Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

15.6.1. Cotton

15.6.2. Polyester

15.6.3. Fleece

15.6.4. Sateen

15.6.5. Linen

15.6.6. Nylon

15.6.7. Rayon

15.6.8. Silk

15.6.9. Synthetic

15.6.10. Velvet

15.6.11. Others

15.7. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

15.7.1. King

15.7.2. Queen

15.7.3. Single

15.7.4. Double

15.8. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

15.8.1. Floral

15.8.2. Abstract

15.8.3. Geometric

15.8.4. Solid

15.8.5. Striped

15.8.6. Others

15.9. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

15.9.1. Low

15.9.2. Medium

15.9.3. High

15.10. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

15.10.1. Residential

15.10.2. Commercial

15.11. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.1.1. Company-owned Websites

15.11.1.2. E-commerce Websites

15.11.2. Offline

15.11.2.1. Specialty Stores

15.11.2.2. Supermarkets & Hypermarkets

15.11.2.3. Multi-branded Stores

15.11.2.4. Other Retail Stores

15.12. Fitted Bedsheet Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

15.12.1. China

15.12.2. India

15.12.3. Japan

15.12.4. Rest of Asia Pacific

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Fitted Bedsheet Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

16.6.1. Cotton

16.6.2. Polyester

16.6.3. Fleece

16.6.4. Sateen

16.6.5. Linen

16.6.6. Nylon

16.6.7. Rayon

16.6.8. Silk

16.6.9. Synthetic

16.6.10. Velvet

16.6.11. Others

16.7. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

16.7.1. King

16.7.2. Queen

16.7.3. Single

16.7.4. Double

16.8. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

16.8.1. Floral

16.8.2. Abstract

16.8.3. Geometric

16.8.4. Solid

16.8.5. Striped

16.8.6. Others

16.9. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

16.9.1. Low

16.9.2. Medium

16.9.3. High

16.10. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

16.10.1. Residential

16.10.2. Commercial

16.11. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.1.1. Company-owned Websites

16.11.1.2. E-commerce Websites

16.11.2. Offline

16.11.2.1. Specialty Stores

16.11.2.2. Supermarkets & Hypermarkets

16.11.2.3. Multi-branded Stores

16.11.2.4. Other Retail Stores

16.12. Fitted Bedsheet Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Incremental Opportunity Analysis

17. South America Fitted Bedsheet Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Price

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Material Type, 2017 - 2031

17.6.1. Cotton

17.6.2. Polyester

17.6.3. Fleece

17.6.4. Sateen

17.6.5. Linen

17.6.6. Nylon

17.6.7. Rayon

17.6.8. Silk

17.6.9. Synthetic

17.6.10. Velvet

17.6.11. Others

17.7. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Size, 2017 - 2031

17.7.1. King

17.7.2. Queen

17.7.3. Single

17.7.4. Double

17.8. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Pattern, 2017 - 2031

17.8.1. Floral

17.8.2. Abstract

17.8.3. Geometric

17.8.4. Solid

17.8.5. Striped

17.8.6. Others

17.9. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Price, 2017 - 2031

17.9.1. Low

17.9.2. Medium

17.9.3. High

17.10. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

17.10.1. Residential

17.10.2. Commercial

17.11. Fitted Bedsheet Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

17.11.1. Online

17.11.1.1. Company-owned Websites

17.11.1.2. E-commerce Websites

17.11.2. Offline

17.11.2.1. Specialty Stores

17.11.2.2. Supermarkets & Hypermarkets

17.11.2.3. Multi-branded Stores

17.11.2.4. Other Retail Stores

17.12. Fitted Bedsheet Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

17.12.1. Brazil

17.12.2. Rest of South America

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis - 2022 (%)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Acton & Acton Ltd

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Beaumont & Brown Ltd

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. American Textile Company

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. WestPoint

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Boll & Branch LLC

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Hollander

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Pacific Coast Feather Company

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Bombay Dyeing

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. Crane & Canopy

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Frette

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Other Key Players

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.1.1. Material Type

19.1.2. Size

19.1.3. Pattern

19.1.4. Price

19.1.5. End-use

19.1.6. Distribution channel

19.1.7. Region

19.2. Understanding the Procurement Process of the End-Users

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 2: Global Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 3: Global Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 4: Global Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 5: Global Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 6: Global Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 7: Global Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 8: Global Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 9: Global Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 10: Global Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 11: Global Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 12: Global Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

Table 13: Global Fitted Bedsheet Market by Region, Thousand Units, 2017-2031

Table 14: Global Fitted Bedsheet Market by Region, US$ Bn, 2017-2031

Table 15: North America Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 16: North America Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 17: North America Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 18: North America Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 19: North America Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 20: North America Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 21: North America Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 22: North America Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 23: North America Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 24: North America Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 25: North America Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: North America Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

Table 27: Europe Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 28: Europe Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 29: Europe Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 30: Europe Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 31: Europe Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 32: Europe Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 33: Europe Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 34: Europe Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 35: Europe Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 36: Europe Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 37: Europe Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 38: Europe Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

Table 39: Asia Pacific Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 40: Asia Pacific Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 41: Asia Pacific Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 42: Asia Pacific Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 43: Asia Pacific Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 44: Asia Pacific Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 45: Asia Pacific Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 46: Asia Pacific Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 47: Asia Pacific Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 48: Asia Pacific Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 49: Asia Pacific Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: Asia Pacific Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

Table 51: Middle East & Africa Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 52: Middle East & Africa Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 53: Middle East & Africa Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 54: Middle East & Africa Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 55: Middle East & Africa Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 56: Middle East & Africa Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 57: Middle East & Africa Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 58: Middle East & Africa Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 59: Middle East & Africa Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 60: Middle East & Africa Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 61: Middle East & Africa Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 62: Middle East & Africa Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

Table 63: South America Fitted Bedsheet Market by Material Type, Thousand Units 2017-2031

Table 64: South America Fitted Bedsheet Market by Material Type, US$ Bn, 2017-2031

Table 65: South America Fitted Bedsheet Market by Size, Thousand Units 2017-2031

Table 66: South America Fitted Bedsheet Market by Size, US$ Bn, 2017-2031

Table 67: South America Fitted Bedsheet Market by Pattern, Thousand Units 2017-2031

Table 68: South America Fitted Bedsheet Market by Pattern, US$ Bn, 2017-2031

Table 69: South America Fitted Bedsheet Market by Price, Thousand Units 2017-2031

Table 70: South America Fitted Bedsheet Market by Price, US$ Bn, 2017-2031

Table 71: South America Fitted Bedsheet Market by End-use, Thousand Units, 2017-2031

Table 72: South America Fitted Bedsheet Market by End-use, US$ Bn, 2017-2031

Table 73: South America Fitted Bedsheet Market by Distribution Channel, Thousand Units, 2017-2031

Table 74: South America Fitted Bedsheet Market by Distribution Channel, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 2: Global Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 3: Global Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 4: Global Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 5: Global Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 6: Global Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 7: Global Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 8: Global Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 9: Global Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 10: Global Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 11: Global Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 12: Global Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 13: Global Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 14: Global Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 15: Global Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 16: Global Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 17: Global Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 18: Global Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 19: Global Fitted Bedsheet Market Projections, by Region, Thousand Units, 2017-2031

Figure 20: Global Fitted Bedsheet Market Projections, by Region, US$ Bn, 2017-2031

Figure 21: Global Fitted Bedsheet Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 22: North America Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 23: North America Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 24: North America Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 25: North America Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 26: North America Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 27: North America Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 28: North America Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 29: North America Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 30: North America Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 31: North America Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 32: North America Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 33: North America Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 34: North America Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 35: North America Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 36: North America Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 37: North America Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: North America Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 39: North America Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 40: Europe Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 41: Europe Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 42: Europe Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 43: Europe Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 44: Europe Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 45: Europe Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 46: Europe Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 47: Europe Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 48: Europe Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 49: Europe Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 50: Europe Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 51: Europe Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 52: Europe Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 53: Europe Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 54: Europe Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 55: Europe Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Europe Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 57: Europe Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 58: Asia Pacific Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 59: Asia Pacific Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 60: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 61: Asia Pacific Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 62: Asia Pacific Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 63: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 64: Asia Pacific Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 65: Asia Pacific Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 66: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 67: Asia Pacific Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 68: Asia Pacific Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 69: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 70: Asia Pacific Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 71: Asia Pacific Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 72: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 73: Asia Pacific Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 74: Asia Pacific Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 75: Asia Pacific Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 76: Middle East & Africa Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 77: Middle East & Africa Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 78: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 79: Middle East & Africa Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 80: Middle East & Africa Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 81: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 82: Middle East & Africa Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 83: Middle East & Africa Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 84: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 85: Middle East & Africa Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 86: Middle East & Africa Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 87: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 88: Middle East & Africa Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 89: Middle East & Africa Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 90: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 91: Middle East & Africa Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 92: Middle East & Africa Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 93: Middle East & Africa Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 94: South America Fitted Bedsheet Market Projections, by Material Type, Thousand Units 2017-2031

Figure 95: South America Fitted Bedsheet Market Projections, by Material Type, US$ Bn, 2017-2031

Figure 96: South America Fitted Bedsheet Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 97: South America Fitted Bedsheet Market Projections, by Size, Thousand Units 2017-2031

Figure 98: South America Fitted Bedsheet Market Projections, by Size, US$ Bn, 2017-2031

Figure 99: South America Fitted Bedsheet Market, Incremental Opportunity, by Size, US$ Bn 2023-2031

Figure 100: South America Fitted Bedsheet Market Projections, by Pattern, Thousand Units 2017-2031

Figure 101: South America Fitted Bedsheet Market Projections, by Pattern, US$ Bn, 2017-2031

Figure 102: South America Fitted Bedsheet Market, Incremental Opportunity, by Pattern, US$ Bn 2023-2031

Figure 103: South America Fitted Bedsheet Market Projections, by Price, Thousand Units 2017-2031

Figure 104: South America Fitted Bedsheet Market Projections, by Price, US$ Bn, 2017-2031

Figure 105: South America Fitted Bedsheet Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 106: South America Fitted Bedsheet Market Projections, by End-use, Thousand Units, 2017-2031

Figure 107: South America Fitted Bedsheet Market Projections, by End-use, US$ Bn, 2017-2031

Figure 108: South America Fitted Bedsheet Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 109: South America Fitted Bedsheet Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 110: South America Fitted Bedsheet Market Projections, by Distribution Channel, US$ Bn, 2017-2031

Figure 111: South America Fitted Bedsheet Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031