Analysts’ Viewpoint

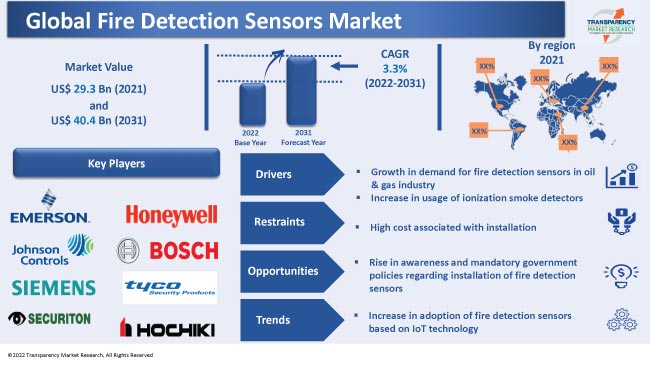

Rise in demand for technologically advanced fire detection systems in residential and industrial sectors is anticipated to drive fire detection sensors market demand during the forecast period. Fire detection sensors are widely used in high-risk industries, such as oil & gas (onshore & offshore), hazardous material handling, petrochemicals, and storage, to protect high-value plants and personnel.

Key market players are focusing on infrared technology to detect fire in minimum time in order to reduce damage. Manufacturers are striving to implement fire early warning technology in fire detection sensors. Advancements in technology for flame, heat, and smoke detectors to decrease false alert and improve sensitivity are further driving market expansion. Penetration of IoT technology in fire detection sensors is creating value-grab opportunities for manufacturers.

Fire hazards have a devastating impact on both life and property. Fast and reliable fire detection has become mandatory for every industrial site. Fire detection sensors give alerts in an emergency situation. These sensors detect fire and activate the siren buzzer at the right time to prevent damage to property or people.

Fire detection sensors play an important role in green buildings, as they help detect fire immediately and provide early warning notifications to limit the emission of toxic products generated by combustion.

Increase in need for secure infrastructure, growth in demand for smart smoke detectors, and surge in adoption of wireless fire detection sensors are some of the key factors augmenting fire detection sensors market development.

According to the fire detection sensors industry analysis, the global market is likely to expand at a steady pace during the forecast period, owing to the rise in demand for these sensors in residential, commercial, and industrial sectors.

The oil & gas sector is plagued by fire risks due to the presence of highly flammable gases and liquids. These calamities can be difficult to manage and pose significant risks to property, human life, and the environment. Therefore, demand for fire detection systems is high in the oil & gas sector.

The National Fire Protection Association (NFPA) and American Petroleum Institute (API) have developed fire codes, especially for petrochemical facilities, to minimize risks and ensure protection against damage in case of a fire.

Fire alarm systems such as flame, gas, and smoke detectors are used in the oil & gas industry, as they provide personnel alerts and help prevent injuries and deaths. Thus, increase in usage of fire detection sensors in the oil & gas sector is projected to drive market progress in the near future.

Several manufacturers are developing wireless gas sensors for plant safety. In July 2019, Emerson launched two new Rosemount 628 universal gas sensors to measure oxygen and carbon monoxide to monitor hydrogen sulfide. These wireless gas sensors are used to monitor hazardous conditions in process plants, pipelines, remote wellheads, and storage terminals. The equipment also helps enhance personnel safety by minimizing the time spent in hazardous locations.

The built-in ionization chambers of ionization smoke detectors facilitate the detection of smoke. Ionization smoke detector is affordable; hence, it is commonly used in various end-use industries. It can detect even lower amount of smoke produced by burning fires.

Ionization smoke detectors respond more quickly to fast-burning fires than photoelectric smoke detectors. They have been proven effective in sounding an early alarm in home fires. Manufacturers are focusing on developing environmentally-friendly products. Ionization smoke detectors do not pose any radiation health risk if handled properly. These factors are likely to boost the demand for ionization smoke detectors in the near future.

In terms of type, the smoke detectors segment held 41.8% share in 2021. It is likely to maintain its dominance and expand at a CAGR of 3.6% during the forecast period. Smoke detectors play an important role in early detection of fire in homes. Thus, they help prevent injuries and deaths. These factors are likely to drive segment growth in the near future.

Manufacturers are focusing on developing a combination version of photoelectric and ionization type detectors, as these respond faster to tiny and large smoke particles. In September 2022, Honeywell International Inc. launched a combined early warning smoke detector with advanced indoor air quality (IAQ) monitoring systems to improve building safety by identifying asset protection, life safety, etc. Combined smoke detectors are ideal for schools, healthcare facilities, commercial buildings, manufacturing plants, and the hospitality industry.

The wireless connectivity segment dominated the global landscape with 56.0% share in 2021. It is expected to register a CAGR of 3.5% during the forecast period.

Wireless fire detection sensors are efficient and reliable. They eliminate the need for long wires. This leads to faster installation and also helps avoid the disruption of property. Furthermore, wireless fire detection sensors offer accurate early fire warnings, with the help of audio and visual alerts when high temperature or smoke is detected. Therefore, these sensors can be widely used in offices, hospitals, and industrial and residential buildings.

In April 2021, Kentec Electronics Ltd launched Ekho wireless fire detection system, which is simple, easy to install, and prevents damage to the fabric of a building. The Ekho wireless fire detection system has a communication range of 1200 meters and battery life of 10 years. It communicates immediately to prevent fire within buildings.

According to the global fire detection sensors market report, North America dominated the global market with 33.3% share in 2021. Fire detection sensors market size in the region is expected to increase during the forecast period, owing to the rise in fire incidents at homes as well as in industrial areas. Increase in focus on infrastructure development and rise in demand for safety devices in hotels, homes, rental properties, and dormitories are augmenting fire detection sensors industry growth in North America.

Asia Pacific accounted for 26.8% share in 2021. Fire detection sensors market share of Asia Pacific is anticipated to increase in the near future, owing to rapid urbanization and industrialization and ongoing smart city projects in the region. Presence of mandatory government policies regarding the installation of fire detection sensors is also likely to spur market statistics.

The global market is fragmented, with the presence of large numbers of players who control majority of the share. Partnerships, collaborations, and expansion of product portfolios are key strategies adopted by leading manufacturers.

Emerson Electric Co., Halma plc, Hochiki Europe, LLC, Honeywell International Inc, Johnson Controls, Protec Fire and Security Group Ltd, Robert Bosch LLC, Securiton AG, Siemens AG, and Tyco Security Products are prominent fire detection sensors market players.

Each of these players has been profiled in the fire detection sensors market report based on parameters such as business strategies, recent developments, business segments, company overview, financial overview, and product portfolio.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 29.3 Bn |

|

Market Forecast Value in 2031 |

US$ 40.4 Bn |

|

Growth Rate (CAGR) |

3.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Billion Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 29.3 Bn in 2021.

It is expected to grow at a CAGR of 3.3% from 2022 to 2031.

Rise in demand for fire detection sensors in oil & gas industry and increase in usage of ionization smoke detectors.

The smoke detector type segment accounted for major share of 41.8% in 2021.

The commercial segment held major share of 42.6% in 2021.

North America is a more attractive region for vendors.

The U.S market was valued at US$ 7.6 Bn in 2021.

Emerson Electric Co, Halma plc, Hochiki Europe, LLC, Honeywell International Inc, Johnson Controls, Protec Fire and Security Group Ltd, Robert Bosch LLC, Securiton AG, Siemens AG, and Tyco Security Products.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Fire Detection Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Fire Detection Sensors Market Analysis By Type

5.1. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

5.1.1. Flame Detector

5.1.2. Heat Detector

5.1.3. Smoke Detector

5.2. Market Attractiveness Analysis, By Type

6. Fire Detection Sensors Market Analysis By Connectivity

6.1. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

6.1.1. Wired

6.1.2. Wireless

6.1.2.1. Wi-Fi

6.1.2.2. ZigBee

6.1.2.3. Others

6.2. Market Attractiveness Analysis, By Connectivity

7. Fire Detection Sensors Market Analysis By Mounting Type

7.1. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

7.1.1. Ceiling-mounted

7.1.2. Wall-mounted

7.2. Market Attractiveness Analysis, By Mounting Type

8. Fire Detection Sensors Market Analysis By End-use Industry

8.1. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

8.1.1. Residential

8.1.2. Commercial

8.1.3. Industrial

8.1.3.1. Chemical

8.1.3.2. Oil & Gas

8.1.3.3. Others

8.2. Market Attractiveness Analysis, By End-use Industry

9. Fire Detection Sensors Market Analysis and Forecast, By Region

9.1. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Fire Detection Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

10.3.1. Flame Detector

10.3.2. Heat Detector

10.3.3. Smoke Detector

10.4. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

10.4.1. Wired

10.4.2. Wireless

10.4.2.1. Wi-Fi

10.4.2.2. ZigBee

10.4.2.3. Others

10.5. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

10.5.1. Ceiling-mounted

10.5.2. Wall-mounted

10.6. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

10.6.1. Residential

10.6.2. Commercial

10.6.3. Industrial

10.6.3.1. Chemical

10.6.3.2. Oil & Gas

10.6.3.3. Others

10.7. Fire Detection Sensors Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Type

10.8.2. By Connectivity

10.8.3. By Mounting Type

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Fire Detection Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

11.3.1. Flame Detector

11.3.2. Heat Detector

11.3.3. Smoke Detector

11.4. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

11.4.1. Wired

11.4.2. Wireless

11.4.2.1. Wi-Fi

11.4.2.2. ZigBee

11.4.2.3. Others

11.5. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

11.5.1. Ceiling-mounted

11.5.2. Wall-mounted

11.6. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

11.6.1. Residential

11.6.2. Commercial

11.6.3. Industrial

11.6.3.1. Chemical

11.6.3.2. Oil & Gas

11.6.3.3. Others

11.7. Fire Detection Sensors Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Connectivity

11.8.3. By Mounting Type

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Fire Detection Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

12.3.1. Flame Detector

12.3.2. Heat Detector

12.3.3. Smoke Detector

12.4. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

12.4.1. Wired

12.4.2. Wireless

12.4.2.1. Wi-Fi

12.4.2.2. ZigBee

12.4.2.3. Others

12.5. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

12.5.1. Ceiling-mounted

12.5.2. Wall-mounted

12.6. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

12.6.1. Residential

12.6.2. Commercial

12.6.3. Industrial

12.6.3.1. Chemical

12.6.3.2. Oil & Gas

12.6.3.3. Others

12.7. Fire Detection Sensors Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Connectivity

12.8.3. By Mounting Type

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East and Africa Fire Detection Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

13.3.1. Flame Detector

13.3.2. Heat Detector

13.3.3. Smoke Detector

13.4. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

13.4.1. Wired

13.4.2. Wireless

13.4.2.1. Wi-Fi

13.4.2.2. ZigBee

13.4.2.3. Others

13.5. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

13.5.1. Ceiling-mounted

13.5.2. Wall-mounted

13.6. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

13.6.1. Residential

13.6.2. Commercial

13.6.3. Industrial

13.6.3.1. Chemical

13.6.3.2. Oil & Gas

13.6.3.3. Others

13.7. Fire Detection Sensors Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of the Middle East and Africa

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Connectivity

13.8.3. By Mounting Type

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Fire Detection Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Type, 2017–2031

14.3.1. Flame Detector

14.3.2. Heat Detector

14.3.3. Smoke Detector

14.4. Fire Detection Sensors Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Connectivity, 2017–2031

14.4.1. Wired

14.4.2. Wireless

14.4.2.1. Wi-Fi

14.4.2.2. ZigBee

14.4.2.3. Others

14.5. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By Mounting Type, 2017–2031

14.5.1. Ceiling-mounted

14.5.2. Wall-mounted

14.6. Fire Detection Sensors Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

14.6.1. Residential

14.6.2. Commercial

14.6.3. Industrial

14.6.3.1. Chemical

14.6.3.2. Oil & Gas

14.6.3.3. Others

14.7. Fire Detection Sensors Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Connectivity

14.8.3. By Mounting Type

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Fire Detection Sensors Market Competition Matrix - a Dashboard View

15.1.1. Global Fire Detection Sensors Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Emerson Electric Co.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Halma plc

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Hochiki Europe, LLC.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Honeywell International Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Johnson Controls

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Protec Fire and Security Group Ltd

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Robert Bosch LLC

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Securiton AG

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Siemens AG

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Tyco Security Products

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Type

17.1.2. By Connectivity

17.1.3. By Mounting Type

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 1: Global Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 2: Global Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 1: Global Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 2: Global Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 1: Global Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 3: Global Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 4: Global Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 5: North America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 6: North America Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 7: North America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 8: North America Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 7: North America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 9: North America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 10: North America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 11: Europe Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 12: Europe Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 13: Europe Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 14: Europe Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 13: Europe Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 15: Europe Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 16: Europe Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Asia Pacific Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 18: Asia Pacific Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 19: Asia Pacific Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 20: Asia Pacific Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 19: Asia Pacific Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 21: Asia Pacific Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 22: Asia Pacific Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 23: Middle East and Africa Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 24: Middle East and Africa Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 25: Middle East and Africa Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 26: Middle East and Africa Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 25: Middle East and Africa Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 27: Middle East and Africa Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 28: Middle East and Africa Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 29: South America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 30: South America Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Type, 2017‒2031

Table 31: South America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Connectivity, 2017‒2031

Table 32: South America Fire Detection Sensors Market Volume (Billion Units) & Forecast, by Connectivity, 2017‒2031

Table 31: South America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Mounting Type, 2017‒2031

Table 33: South America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 34: South America Fire Detection Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Fire Detection Sensors

Figure 02: Global Fire Detection Sensors Price Trend Analysis (Average Price, US$)

Figure 03: Porter Five Forces Analysis - Global Fire Detection Sensors

Figure 04: Technology Road Map - Global Fire Detection Sensors

Figure 05: Global Fire Detection Sensors Market, Value (US$ Bn), 2017-2031

Figure 06: Global Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 07: Global Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 08: Global Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 09: Global Fire Detection Sensors Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 10: Global Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 11: Global Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 12: Global Fire Detection Sensors Market Projections by Connectivity, Value (US$ Bn), 2017‒2031

Figure 13: Global Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 14: Global Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 15: Global Fire Detection Sensors Market Projections by Mounting Type, Value (US$ Bn), 2017‒2031

Figure 16: Global Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 17: Global Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 18: Global Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 19: Global Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 20: Global Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 21: Global Fire Detection Sensors Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 22: Global Fire Detection Sensors Market, Incremental Opportunity, by Region, 2021‒2031

Figure 23: Global Fire Detection Sensors Market Share Analysis, by Region, 2021 and 2031

Figure 24: North America Fire Detection Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 25: North America Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 26: North America Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 27: North America Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 28: North America Fire Detection Sensors Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 29: North America Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 30: North America Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 31: North America Fire Detection Sensors Market Projections by Connectivity Value (US$ Bn), 2017‒2031

Figure 32: North America Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 33: North America Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 34: North America Fire Detection Sensors Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 35: North America Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 36: North America Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 37: North America Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 38: North America Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 39: North America Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 40: North America Fire Detection Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 41: North America Fire Detection Sensors Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 42: North America Fire Detection Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 43: Europe Fire Detection Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 44: Europe Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 45: Europe Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 46: Europe Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 47: Europe Fire Detection Sensors Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 48: Europe Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 49: Europe Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 50: Europe Fire Detection Sensors Market Projections by Connectivity Value (US$ Bn), 2017‒2031

Figure 51: Europe Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 52: Europe Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 53: Europe Fire Detection Sensors Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 54: Europe Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 55: Europe Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 56: Europe Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 57: Europe Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 58: Europe Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 59: Europe Fire Detection Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 60: Europe Fire Detection Sensors Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 61: Europe Fire Detection Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 62: Asia Pacific Fire Detection Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 63: Asia Pacific Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 64: Asia Pacific Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 65: Asia Pacific Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 66: Asia Pacific Fire Detection Sensors Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 67: Asia Pacific Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 68: Asia Pacific Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 69: Asia Pacific Fire Detection Sensors Market Projections by Connectivity Value (US$ Bn), 2017‒2031

Figure 70: Asia Pacific Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 71: Asia Pacific Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 72: Asia Pacific Fire Detection Sensors Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 73: Asia Pacific Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 74: Asia Pacific Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 75: Asia Pacific Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 76: Asia Pacific Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 77: Asia Pacific Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 78: Asia Pacific Fire Detection Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 79: Asia Pacific Fire Detection Sensors Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 80: Asia Pacific Fire Detection Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 81: Middle East & Africa Fire Detection Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 82: Middle East & Africa Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 83: Middle East & Africa Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 84: Middle East & Africa Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 85: Middle East & Africa Fire Detection Sensors Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 86: Middle East & Africa Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 87: Middle East & Africa Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 88: Middle East & Africa Fire Detection Sensors Market Projections by Connectivity Value (US$ Bn), 2017‒2031

Figure 89: Middle East & Africa Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 90: Middle East & Africa Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 91: Middle East & Africa Fire Detection Sensors Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 92: Middle East & Africa Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 93: Middle East & Africa Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 94: Middle East & Africa Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 95: Middle East & Africa Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 96: Middle East & Africa Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 97: Middle East & Africa Fire Detection Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 98: Middle East & Africa Fire Detection Sensors Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 99: Middle East & Africa Fire Detection Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 100: South America Fire Detection Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 101: South America Fire Detection Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 102: South America Fire Detection Sensors Market, Volume (Billion Units), 2017-2031

Figure 103: South America Fire Detection Sensors Market Size & Forecast, Y-O-Y, Volume (Billion Units), 2017‒2031

Figure 104: South America Fire Detection Sensors Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 105: South America Fire Detection Sensors Market, Incremental Opportunity, by Type, 2022‒2031

Figure 106: South America Fire Detection Sensors Market Share Analysis, by Type, 2021 and 2031

Figure 107: South America Fire Detection Sensors Market Projections by Connectivity Value (US$ Bn), 2017‒2031

Figure 108: South America Fire Detection Sensors Market, Incremental Opportunity, by Connectivity, 2022‒2031

Figure 109: South America Fire Detection Sensors Market Share Analysis, by Connectivity, 2021 and 2031

Figure 110: South America Fire Detection Sensors Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 111: South America Fire Detection Sensors Market, Incremental Opportunity, by Mounting Type, 2022‒2031

Figure 112: South America Fire Detection Sensors Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 113: South America Fire Detection Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 114: South America Fire Detection Sensors Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 115: South America Fire Detection Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 116: South America Fire Detection Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 117: South America Fire Detection Sensors Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 118: South America Fire Detection Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 119: Global Fire Detection Sensors Market Competition

Figure 120: Global Fire Detection Sensors Market Company Share Analysis