Analysts’ Viewpoint on Finishing Lines Market Scenario

Finishing lines are a combination of various equipment used in surface treatment (coating) of products. Coatings are widely used in several end-use sectors, including automotive and vehicle refinish, electronics, aerospace, oil & gas, mining, marine, and power generation. Mass production of products requires equipment that offers speed and flexibility in surface treatment. Rise in need for customized designs and paints, especially in automotive finishing, is likely to boost the global finishing lines market. Companies are increasingly adapting to customers’ facility plans and products to provide solutions such as pretreatment & e-coat and integrated booth/ovens. Quality, cost, and the environment play a key role in determining the usage of finishing lines. Companies operating in the finishing lines market are striving to create innovative products and technologies, such as automatic cutting tape machines, to address end-user requirements.

Finishing line includes features that make it the ideal machine to finish parts of varying sizes with maximum precision. High-quality features of finishing lines mean less rework and less stress in meeting production deadlines. Finishing lines run day in and day out under even the most demanding conditions. They are engineered to deliver almost continuous operation with their heavy-duty frame, making it ideal for three shifts of operation 24/7. This means less downtime with parts and maximum productivity for businesses. Finishing lines are tailor-made for metal fabricators, as they help improve upon operational efficiencies and part consistencies. Thus, finishing lines provide a compact all-in-one solution, utilizing intelligent design and quality components for finishing parts.

Metal finishing plays an important role in sectors such as plating and painting. Rise in environmental concerns is the primary reason for R&D in technology in plating and painting sectors. Demand for cyanide, cadmium, and hexavalent chrome alternatives is high in the plating sector. On the other hand, increase in concerns about VOCs and hazardous air pollutants has resulted in a number of alternative technologies in the painting sector. Powder coating is likely to be an increasingly popular finishing technology in the near future. It has already made major inroads in the liquid coating market. It has also penetrated the traditional decorative plating market. Thus, rise in demand for metal finishing is expected to drive the global finishing lines market. The finishing lines market is a highly fragmented service industry, which is dominated by small enterprises that are typically located near manufacturing bases.

The automotive industry accounts for major share of metal finishes in terms of demand. Automotive finishing is one of the most common methods used to provide a protective layer on metal components of vehicles. Automotive refinish coatings refer to polyurethane, acrylics, or alkyd-based coatings used by vehicle body shops and repair centers. These coatings are applied to new/old passenger and commercial vehicles to cover up the damages on the body caused by extreme temperatures, accidents, and impact from stones. Growth of the global automotive industry is one of the key factors driving the market value of finishing lines. Need for repair and maintenance activities has been increasing due to the rise in number of road accidents and collisions. This is augmenting the expansion of the finishing lines market.

Automotive refining coatings offer improved esthetic appeal, surface protection, and resistance to heat, temperature, and corrosion. Additionally, various product innovations, such as development of environment-friendly refinish coatings, are driving the automotive refining coatings market. Automotive refining coatings are manufactured using organic chemicals. They possess properties such as faster cure time and minimal VOC emissions. Increase in spending capacity of customers and growth in demand for recreational vehicles are anticipated to drive the market share of finishing lines in the near future.

Based on component, the finishing lines market has been classified into pre-treatment plants, ovens, paint booths, conveyor systems, control systems, and others. The ovens segment dominated the global finishing lines market with 34.4% share in 2021. Demand for industrial ovens is high compared to that of other ovens. Industrial ovens are used for heating and drying in industries. They are used in a variety of sectors for heat treatment, curing, drying, and hardening of a wide range of materials. Industrial ovens are also commonly used in the tempering of metals and glass. Depending on end-use application, industrial ovens are available in a number of temperature ranges, sizes, and designs.

Curing, drying, tempering, annealing, or baking of materials, parts, or final products are common industrial applications of industrial ovens. Significant usage of continuous line industrial ovens, which allow numerous activities to take place simultaneously throughout the processing stage, is one of the key trends in the industrial ovens market.

Based on end-use, the finishing lines market has been classified into automotive, building and construction, aerospace and aviation, consumer goods, heavy industries, electronics, and others. The automotive segment dominated the global finishing lines market with 30.7% share in 2021. Metal finishing is used extensively in the automotive industry. It can add value to a car part by protecting it against corrosion and premature wear, as well as by enhancing its appearance. Competitive future of companies in the industry is likely to be largely determined by companies performing ‘high value added’ or ‘low value added’ metal finishing. Demand for metal finishing services in the automotive industry is projected to be determined by the growth of the automotive sector and general economic conditions.

Asia Pacific accounted for prominent share of 59.6% of the global finishing lines market in 2021. The finishing lines market in Asia Pacific is estimated to grow at a rapid pace in the near future due to the rise in manufacture of electrical and electronics products, and surging demand for heavy equipment in the region. China is one of the prominent markets for finishing lines in Asia Pacific.

Europe is also a key market for finishing lines. The region held 18.03% share of the global market in 2021. Technological advancements are expected to propel the finishing lines market in the region in the near future. Ongoing technological developments to improve energy efficiency is driving the demand for finish line accessories in Europe. Middle East & Africa and Latin America are relatively minor markets for finishing lines.

The global finishing lines market comprises several small and large-scale service providers that control a majority of share. Most of the firms are adopting new technologies and strategies with comprehensive research and development activities, primarily to develop and prioritize sustainable finishing lines. Insights on the finishing lines market suggest that expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. Graco Inc., J. Wagner GmbH, and Nordson Corporation are the prominent entities operating in the market.

Key players have been profiled in the finishing lines market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.1 Bn |

|

Market Forecast Value in 2031 |

US$ 11.0 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, drivers, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

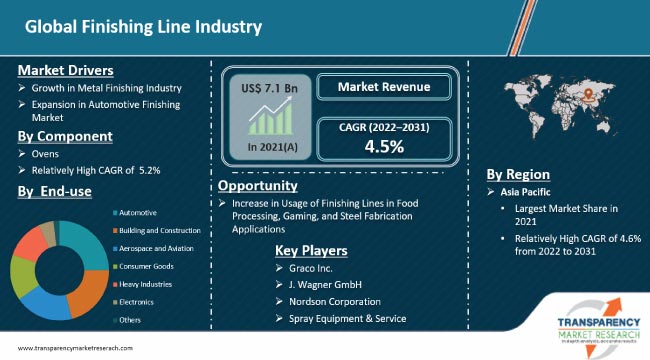

The market stood at US$ 7.1 Bn in 2021.

The market is expected to grow at a CAGR of 4.5% from 2022 to 2031.

Growth of metal finishing industry and expansion of automotive finishing market.

Automotive was the largest end-use segment that held 30.7% share in 2021.

Asia Pacific was the most lucrative region of the finishing line market in 2021.

Graco Inc., J. Wagner GmbH, Nordson Corporation, Spray Equipment & Service, and Global Finishing Solutions.

1. Executive Summary

1.1. Finishing Lines Industry Snapshot

1.2. Demand Side Trends

1.3. Key Facts and Figure

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments/Product Timeline

2.3. Market Trends

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Drivers

2.5. Porter’s Five Forces Analysis

2.6. Regulatory Analysis

2.7. Value Chain Analysis

2.7.1. List of Equipment Suppliers

2.7.2. List of Finishing Lines Manufacturers

2.7.3. List of Dealers/Distributors

2.7.4. List of Potential Customers

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Finishing Lines

3.2. Impact on the Demand of Finishing Lines – Pre & Post Crisis

4. Global Finishing Lines Market Analysis and Forecast, by Component, 2022–2031

4.1. Key Findings

4.2. Market Size and Forecast (US$ Mn) by Component, 2020-2031

4.2.1. Pre-treatment Plants

4.2.2. Ovens

4.2.3. Paint Booths

4.2.4. Conveyor Systems

4.2.5. Control Systems

4.2.6. Others

4.3. Global Market Attractiveness, by Component

5. Global Finishing Lines Market Analysis and Forecast, by Application, 2022–2031

5.1. Key Findings

5.2. Market Size and Forecast (US$ Mn) by Application, 2020-2031

5.2.1. Automotive Parts

5.2.1.1. Interior Parts

5.2.1.2. Exterior Parts

5.2.1.3. Others

5.2.2. Engine and Motors

5.2.3. Electronics and Control Panels

5.2.4. Furniture

5.2.5. Machinery

5.2.6. Household Appliances

5.2.7. Others

6. Global Market Attractiveness, by Application

7. Global Finishing Lines Market Analysis and Forecast, by End-use, 2022–2031

7.1. Key Findings

7.2. Market Size and Forecast (US$ Mn) by End-use, 2020-2031

7.2.1. Automotive

7.2.2. Building and Construction

7.2.3. Aerospace and Aviation

7.2.4. Consumer Goods

7.2.5. Heavy Industries

7.2.6. Electronics

7.2.7. Others

7.3. Global Market Attractiveness, by End-use

8. Global Finishing Lines Market Analysis and Forecast, by Region, 2022–2031

8.1. Key Findings

8.2. Market Size and Forecast (US$ Mn) by Region, 2020-2031

8.2.1. North America

8.2.2. U.S.

8.2.3. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Russia & CIS

8.3.7. Rest of Europe

8.4. Asia Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. ASEAN

8.4.5. Rest of Asia Pacific

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America

8.6. Middle East & Africa

8.6.1. GCC

8.6.2. South Africa

8.6.3. Rest of Middle East & Africa

8.7. Global Market Attractiveness Analysis, by Region

9. North America Finishing Lines Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. North America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

9.3. North America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. North America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

9.5. North America Finishing Lines Market Value (US$ Mn) Forecast, by Country, 2022–2031

9.5.1. U.S. Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

9.5.2. U.S. Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.5.3. U.S. Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

9.5.4. Canada Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

9.5.5. Canada Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.5.6. Canada Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

9.6. North America Finishing Lines Market Attractiveness Analysis

10. Europe Finishing Lines Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Europe Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.3. Europe Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Europe Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5. Europe Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.5.1. Germany Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.2. Germany Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.3. Germany Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5.4. France Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.5. France Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.6. France Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5.7. U.K. Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.8. U.K. Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.9. U.K. Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5.10. Italy Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.11. Italy. Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.12. Italy Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5.13. Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.14. Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.15. Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.5.16. Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

10.5.17. Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5.18. Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

10.6. Europe Finishing Lines Market Attractiveness Analysis

11. Asia Pacific Finishing Lines Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Component

11.3. Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.4. Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.5. Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. China Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

11.5.2. China Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5.3. China Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.5.4. Japan Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

11.5.5. Japan Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5.6. Japan Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.5.7. India Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

11.5.8. India Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5.9. India Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.5.10. ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

11.5.11. ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5.12. ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.5.13. Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

11.5.14. Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5.15. Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

11.6. Asia Pacific Finishing Lines Market Attractiveness Analysis

12. Latin America Finishing Lines Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

12.3. Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4. Latin America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

12.5. Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. Brazil Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

12.5.2. Brazil Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.3. Brazil Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

12.5.4. Mexico Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

12.5.5. Mexico Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.6. Mexico Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

12.5.7. Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

12.5.8. Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.9. Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

12.6. Latin America Finishing Lines Market Attractiveness Analysis

13. Middle East & Africa Finishing Lines Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

13.3. Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

13.4. Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5. Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. GCC Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

13.5.2. GCC Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.3. GCC Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.4. South Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

13.5.5. South Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.6. South Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.7. Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

13.5.8. Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.9. Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

13.6. Middle East & Africa Finishing Lines Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Players - Competition Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, 2021

14.3. Market Footprint Analysis

14.3.1. By Component

14.3.2. By Application

14.4. Company Profiles

14.4.1. Wewin Finishing Equipments Pvt. Ltd

14.4.1.1. Company Revenue

14.4.1.2. Business Overview

14.4.1.3. Product Segments

14.4.1.4. Geographic Footprint

14.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.2. Graco Inc.

14.4.2.1. Company Revenue

14.4.2.2. Business Overview

14.4.2.3. Product Segments

14.4.2.4. Geographic Footprint

14.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.3. Nordson Corporation

14.4.3.1. Company Revenue

14.4.3.2. Business Overview

14.4.3.3. Product Segments

14.4.3.4. Geographic Footprint

14.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.4. Wagner GmbH

14.4.4.1. Company Revenue

14.4.4.2. Business Overview

14.4.4.3. Product Segments

14.4.4.4. Geographic Footprint

14.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.5. HeatTek Inc.

14.4.5.1. Company Revenue

14.4.5.2. Business Overview

14.4.5.3. Product Segments

14.4.5.4. Geographic Footprint

14.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.6. Global Finishing Solutions

14.4.6.1. Company Revenue

14.4.6.2. Business Overview

14.4.6.3. Product Segments

14.4.6.4. Geographic Footprint

14.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.7. Spray Equipment & Service Center

14.4.7.1. Company Revenue

14.4.7.2. Business Overview

14.4.7.3. Product Segments

14.4.7.4. Geographic Footprint

14.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.8. Blasdel Enterprises

14.4.8.1. Business Revenue

14.4.8.2. Business Overview

14.4.8.3. Product Segments

14.4.8.4. Geographic Footprint

14.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.9. Crescent Technologies Pvt. Ltd

14.4.9.1. Business Revenue

14.4.9.2. Business Overview

14.4.9.3. Product Segments

14.4.9.4. Geographic Footprint

14.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.10. Crescent Technologies Pvt. Ltd

14.4.10.1. Business Revenue

14.4.10.2. Business Overview

14.4.10.3. Product Segments

14.4.10.4. Geographic Footprint

14.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.11. Smart Engineering & Coating Equipments Trading LLC

14.4.11.1. Business Revenue

14.4.11.2. Business Overview

14.4.11.3. Product Segments

14.4.11.4. Geographic Footprint

14.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.12. KSW India Private Limited

14.4.12.1. Business Revenue

14.4.12.2. Business Overview

14.4.12.3. Product Segments

14.4.12.4. Geographic Footprint

14.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.5. Key Primary Research Insights

14.6. Analyst Recommendations

15. Appendix

15.1. Assumptions and Acronyms

15.2. Research Methodology

List of Tables

Table 1: Global Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 2: Global Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 3: Global Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 4: Global Finishing Lines Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 5: North America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 6: North America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 7: North America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 8: North America Finishing Lines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 9: U.S. Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 10: U.S. Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: U.S. Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 12: Canada Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 13: Canada Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 14: Canada Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 15: Europe Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 16: Europe Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 17: Europe Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 18: Europe Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 19: Germany Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 20: Germany Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: Germany Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 22: France Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 23: France Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 24: France Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 25: U.K. Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 26: U.K. Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 27: U.K. Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 28: Italy Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 29: Italy Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 30: Italy Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 31: Spain Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 32: Spain Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 33: Spain Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 34: Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 35: Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 36: Russia & CIS Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 37: Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 38: Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: Rest of Europe Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 40: Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 41: Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 42: Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 43: Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 44: China Finishing Lines Market Value (US$ Mn) Forecast, by Component 2022–2031

Table 45: China Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 46: China Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 47: Japan Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 48: Japan Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 49: Japan Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 50: India Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 51: India Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 52: India Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 53: India Finishing Lines Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 54: ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 55: ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 56: ASEAN Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 57: Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 58: Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 59: Rest of Asia Pacific Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 60: Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 61: Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 62: Latin America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 63: Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 64: Brazil Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 65: Brazil Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 66: Brazil Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 67: Mexico Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 68: Mexico Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 69: Mexico Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 70: Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 71: Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 72: Rest of Latin America Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 73: Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 74: Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 75: Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 76: Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 77: GCC Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 78: GCC Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 79: GCC Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 80: South Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 81: South Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 82: South Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 83: Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Component, 2022–2031

Table 84: Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 85: Rest of Middle East & Africa Finishing Lines Market Value (US$ Mn) Forecast, by End-use, 2022–2031

List of Figures

Figure 1: Global Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 2: Global Finishing Lines Market Attractiveness, by Component

Figure 3: Global Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Global Finishing Lines Market Attractiveness, by Application

Figure 5: Global Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 6: Global Finishing Lines Market Attractiveness, by End-use

Figure 7: Global Finishing Lines Market Share Analysis, by Region, 2021, 2025, and 2031

Figure 8: Global Finishing Lines Market Attractiveness, by Region

Figure 9: North America Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 10: North America Finishing Lines Market Attractiveness, by Component

Figure 11: North America Finishing Lines Market Attractiveness, by Component

Figure 12: North America Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 13: North America Finishing Lines Market Attractiveness, by Application

Figure 14: North America Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 15: North America Finishing Lines Market Attractiveness, by End-use

Figure 16: North America Finishing Lines Market Attractiveness, by Country

Figure 17: Europe Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 18: Europe Finishing Lines Market Attractiveness, by Component

Figure 19: Europe Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 20: Europe Finishing Lines Market Attractiveness, by Application

Figure 21: Europe Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 22: Europe Finishing Lines Market Attractiveness, by End-use

Figure 23: Europe Finishing Lines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Europe Finishing Lines Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 26: Asia Pacific Finishing Lines Market Attractiveness, by Component

Figure 27: Asia Pacific Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 28: Asia Pacific Finishing Lines Market Attractiveness, by Application

Figure 29: Asia Pacific Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 30: Asia Pacific Finishing Lines Market Attractiveness, by End-use

Figure 31: Asia Pacific Finishing Lines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 32: Asia Pacific Finishing Lines Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 34: Latin America Finishing Lines Market Attractiveness, by Component

Figure 35: Latin America Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 36: Latin America Finishing Lines Market Attractiveness, by Application

Figure 37: Latin America Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 38: Latin America Finishing Lines Market Attractiveness, by End-use

Figure 39: Latin America Finishing Lines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 40: Latin America Finishing Lines Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Finishing Lines Market Share Analysis, by Component, 2021, 2025, and 2031

Figure 42: Middle East & Africa Finishing Lines Market Attractiveness, by Component

Figure 43: Middle East & Africa Finishing Lines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 44: Middle East & Africa Finishing Lines Market Attractiveness, by Application

Figure 45: Middle East & Africa Finishing Lines Market Share Analysis, by End-use, 2021, 2025, and 2031

Figure 46: Middle East & Africa Finishing Lines Market Attractiveness, by End-use

Figure 47: Middle East & Africa Finishing Lines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 48: Middle East & Africa Finishing Lines Market Attractiveness, by Country and Sub-region