Analysts’ Viewpoint

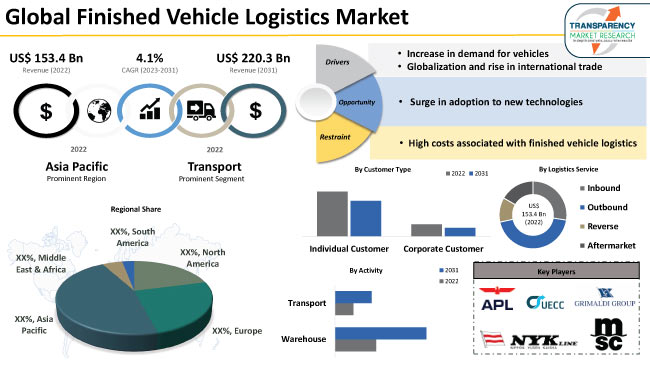

Increase in demand for vehicles, globalization, and rise in international trade are the major factors driving global finished vehicle logistics market statistics. Rise in production of automobiles is expected to fuel market progress during the forecast period. Moreover, surge in adoption of new technologies is contributing to the growth of the global market.

Demand for logistic services to transport newly manufactured vehicles is rising as automotive manufacturers continue to expand their production capacities and introduce new models in the market. Manufacturers are establishing production facilities in different countries to cater to regional demand. This trend has led to rise in international trade of finished vehicles, creating opportunities for logistics providers to facilitate cross-border transportation and distribution. However, high costs associated with finished vehicle logistics are likely to hamper market expansion during the forecast period.

Finished vehicle logistics refers to the management and transportation of completed vehicles from the manufacturing plant to dealerships, distribution centers, or end customers. It involves the coordination of various activities and processes to ensure the efficient and timely delivery of vehicles to their final destinations.

Compliance with customs and regulatory requirements is crucial, particularly for international shipments. Prior to delivery, vehicles may undergo further preparations, such as accessory installation and final inspections, to ensure they are ready for sale.

Effective management of finished vehicle logistics optimizes the supply chain, reduces costs, shortens delivery times, and enhances customer satisfaction through streamlined coordination and collaboration among manufacturers, logistics providers, and transportation companies.

Growth of the finished vehicle logistics business is closely tied to the automotive industry's production levels. Demand for efficient transportation and distribution of finished vehicles is increasing due to the rise in production of vehicles. Passenger vehicles, light commercial vehicles, heavy duty trucks, and buses & coaches are some of the major logistics vehicle types.

Technological advancements play a significant role in shaping the finished vehicle logistics industry. Automation, advanced tracking systems, and real-time data analytics enable logistics providers to optimize their operations, improve vehicle tracking and monitoring, and enhance overall efficiency. These technologies contribute to market growth by providing more reliable and streamlined logistics solutions.

Increase in popularity of electric vehicles is also driving demand for efficient logistics services to transport these vehicles. Several automotive manufacturers are outsourcing their logistics operations to specialized third-party providers. This shift allows manufacturers to focus on their core competencies while leveraging the expertise of logistics companies.

Higher vehicle demand leads to increased production volumes, necessitating a robust logistics network to ensure efficient movement of vehicles from manufacturing facilities to dealerships or export destinations. Vehicle manufacturers require reliable and streamlined logistics services as they strive to meet consumer demand.

Increase in vehicle demand prompts investments in infrastructure development, such as the construction and expansion of manufacturing plants, ports, storage facilities, and distribution centers. These developments provide opportunities for logistics service providers to expand their operations and offer specialized services tailored to the automotive industry's requirements.

Manufacturers and logistics providers focus on optimizing the supply chain to ensure timely and cost-effective delivery of vehicles. This optimization involves implementing advanced logistics technologies, such as real-time tracking systems, route optimization software, and warehouse management systems. These technologies enhance operational efficiency, reduce transit times, and minimize costs.

Globalization has led to the expansion of automotive manufacturing and sales across different countries and regions. Several automobile manufacturers have established production facilities in multiple countries to take advantage of lower production costs, access to new markets, and to be closer to their customers. This has resulted in a higher volume of vehicles being produced and traded internationally. This is fueling demand for finished vehicle logistics services.

The transportation of vehicles from manufacturing plants to overseas destinations requires specialized logistics services, including shipping, handling, customs clearance, and inland distribution. Logistics providers play a crucial role in managing complex supply chains and ensuring that vehicles are delivered efficiently and on time.

Expansion of global supply chains and the complexity of international trade have also led to the development of advanced technologies and digital solutions in the finished vehicle logistics sector. These technologies help optimize logistics operations, track shipments, manage inventory, and provide real-time visibility to all stakeholders involved.

In terms of activity, the transport activity segment accounted for major share of the global market in 2022. According to the latest finished vehicle logistics market forecast, this segment is likely to lead the global industry in the near future.

Growth of the transportation sector is driving demand for vehicles. Increase in vehicle production across the globe is fueling demand for finished vehicles that need to be transported and distributed efficiently. This is likely to augment finished vehicle logistics market size in the near future.

The automotive industry has become highly globalized, with vehicles being manufactured in one country and sold in multiple regions across the world. This requires efficient transportation networks and logistics services to move vehicles across different countries and continents. This creates emerging opportunities in the finished vehicle logistics market for participants.

Rise of e-commerce and direct-to-consumer sales channels in the automotive industry has increased the need for specialized logistics services. Customers now expect timely delivery of their vehicles, and logistics companies play a crucial role in ensuring efficient transportation and last-mile delivery.

According to the finished vehicle logistics market research analysis, Asia Pacific is anticipated to dominate the global industry during the forecast period. The region has become a major hub for automobile manufacturing. Increase in production of vehicles in countries such as China, Japan, South Korea, and India is contributing to the finished vehicle logistics market growth. These countries have witnessed significant increase in the production of finished vehicles to cater to both domestic and international markets.

Surge in disposable income of consumers in Asia Pacific is fueling demand for automobiles. This augments the demand for efficient and reliable finished vehicle logistics to transport vehicles from manufacturing plants to dealerships or end customers.

The global landscape is highly competitive, with the presence of several players that control majority of the finished vehicle logistics market share. Moreover, key players in the finished vehicle logistics market have adopted various strategies such as mergers, acquisitions, and partnerships to gain a competitive edge.

Leading finished vehicle logistics companies operating across the globe are APL (American President Lines), ARC (American Roll-On Roll-Off Carrier), CMA CGM, Crowley Maritime Corporation, CSAV (Compnia Sud Americana de Vapores), Glovis, Grimaldi Group, Hoegh Autoliners, K Line, Mitsui O.S.K. Lines (MOL), MSC (Mediterranean Shipping Company), Nippon Yusen Kabushiki Kaisha (NYK Line), NYK Group, UECC (United European Car Carriers), and Wilhelmsen.

Key players have been profiled in the finished vehicle logistics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Value in 2022 |

US$ 153.4 Bn |

|

Forecast (Value) in 2031 |

US$ 220.3 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 153.4 Bn in 2022

It is expected to grow at a CAGR of 4.1% by 2031

It is likely to reach US$ 220.3 Bn in 2031

Rise in number of vehicle registrations and organized transportation & warehousing activities

The transport activity segment held major share in 2022

Asia Pacific is anticipated to be a highly lucrative region in the next few years

APL (American President Lines), ARC (American Roll-On Roll-Off Carrier), CMA CGM, Crowley Maritime Corporation, CSAV (Compnia Sud Americana de Vapores), Glovis, Grimaldi Group, Hoegh Autoliners, K Line, Mitsui O.S.K. Lines (MOL), MSC (Mediterranean Shipping Company), Nippon Yusen Kabushiki Kaisha (NYK Line), NYK Group, UECC (United European Car Carriers), and Wilhelmsen

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Finished Vehicle Logistics Market, By Activity

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

3.2.1. Warehouse

3.2.2. Transport

3.2.2.1. Roadway

3.2.2.2. Railway

3.2.2.3. Maritime

3.2.2.4. Airway

4. Global Finished Vehicle Logistics Market, By Logistics Service

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

4.2.1. Inbound

4.2.2. Outbound

4.2.3. Reverse

4.2.4. Aftermarket

5. Global Finished Vehicle Logistics Market, By Customer Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

5.2.1. Individual Customer

5.2.2. Corporate Customer

6. Global Finished Vehicle Logistics Market, By Geography

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

6.2.1. Domestic

6.2.2. International

7. Global Finished Vehicle Logistics Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

7.2.1. Passenger Vehicle

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicle

7.2.2. Light Commercial Vehicle

7.2.3. Heavy Duty Truck

7.2.4. Bus & Coach

8. Global Finished Vehicle Logistics Market, By Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Finished Vehicle Logistics Market

9.1. Market Snapshot

9.2. North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

9.2.1. Warehouse

9.2.2. Transport

9.2.2.1. Roadway

9.2.2.2. Railway

9.2.2.3. Maritime

9.2.2.4. Airway

9.3. North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

9.3.1. Inbound

9.3.2. Outbound

9.3.3. Reverse

9.3.4. Aftermarket

9.4. North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

9.4.1. Individual Customer

9.4.2. Corporate Customer

9.5. North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

9.5.1. Domestic

9.5.2. International

9.6. North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.6.1. Passenger Vehicle

9.6.1.1. Hatchback

9.6.1.2. Sedan

9.6.1.3. Utility Vehicle

9.6.2. Light Commercial Vehicle

9.6.3. Heavy Duty Truck

9.6.4. Bus & Coach

9.7. Key Country Analysis - North America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Finished Vehicle Logistics Market

10.1. Market Snapshot

10.2. Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

10.2.1. Warehouse

10.2.2. Transport

10.2.2.1. Roadway

10.2.2.2. Railway

10.2.2.3. Maritime

10.2.2.4. Airway

10.3. Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

10.3.1. Inbound

10.3.2. Outbound

10.3.3. Reverse

10.3.4. Aftermarket

10.4. Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

10.4.1. Individual Customer

10.4.2. Corporate Customer

10.5. Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

10.5.1. Domestic

10.5.2. International

10.6. Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.6.1. Passenger Vehicle

10.6.1.1. Hatchback

10.6.1.2. Sedan

10.6.1.3. Utility Vehicle

10.6.2. Light Commercial Vehicle

10.6.3. Heavy Duty Truck

10.6.4. Bus & Coach

10.7. Key Country Analysis - Europe Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031

10.7.1. Germany

10.7.2. U.K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Finished Vehicle Logistics Market

11.1. Market Snapshot

11.2. Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

11.2.1. Warehouse

11.2.2. Transport

11.2.2.1. Roadway

11.2.2.2. Railway

11.2.2.3. Maritime

11.2.2.4. Airway

11.3. Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

11.3.1. Inbound

11.3.2. Outbound

11.3.3. Reverse

11.3.4. Aftermarket

11.4. Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

11.4.1. Individual Customer

11.4.2. Corporate Customer

11.5. Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

11.5.1. Domestic

11.5.2. International

11.6. Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.6.1. Passenger Vehicle

11.6.1.1. Hatchback

11.6.1.2. Sedan

11.6.1.3. Utility Vehicle

11.6.2. Light Commercial Vehicle

11.6.3. Heavy Duty Truck

11.6.4. Bus & Coach

11.7. Key Country Analysis - Asia Pacific Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Finished Vehicle Logistics Market

12.1. Market Snapshot

12.2. Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

12.2.1. Warehouse

12.2.2. Transport

12.2.2.1. Roadway

12.2.2.2. Railway

12.2.2.3. Maritime

12.2.2.4. Airway

12.3. Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

12.3.1. Inbound

12.3.2. Outbound

12.3.3. Reverse

12.3.4. Aftermarket

12.4. Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

12.4.1. Individual Customer

12.4.2. Corporate Customer

12.5. Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

12.5.1. Domestic

12.5.2. International

12.6. Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.6.1. Passenger Vehicle

12.6.1.1. Hatchback

12.6.1.2. Sedan

12.6.1.3. Utility Vehicle

12.6.2. Light Commercial Vehicle

12.6.3. Heavy Duty Truck

12.6.4. Bus & Coach

12.7. Key Country Analysis - Middle East & Africa Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Finished Vehicle Logistics Market

13.1. Market Snapshot

13.2. South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Activity

13.2.1. Warehouse

13.2.2. Transport

13.2.2.1. Roadway

13.2.2.2. Railway

13.2.2.3. Maritime

13.2.2.4. Airway

13.3. South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Logistics Service

13.3.1. Inbound

13.3.2. Outbound

13.3.3. Reverse

13.3.4. Aftermarket

13.4. South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Customer Type

13.4.1. Individual Customer

13.4.2. Corporate Customer

13.5. South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Geography

13.5.1. Domestic

13.5.2. International

13.6. South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.6.1. Passenger Vehicle

13.6.1.1. Hatchback

13.6.1.2. Sedan

13.6.1.3. Utility Vehicle

13.6.2. Light Commercial Vehicle

13.6.3. Heavy Duty Truck

13.6.4. Bus & Coach

13.7. Key Country Analysis - South America Finished Vehicle Logistics Market Size Analysis & Forecast, 2017-2031

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. APL (American President Lines)

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. ARC (American Roll-On Roll-Off Carrier)

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. CMA CGM

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Crowley Maritime Corporation

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. CSAV (Compnia Sud Americana de Vapores)

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Glovis

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Grimaldi Group

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Hoegh Autoliners

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. K Line

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Mitsui O.S.K. Lines (MOL)

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. MOL (Mitsui O.S.K. Lines)

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. MSC (Mediterranean Shipping Company)

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Nippon Yusen Kabushiki Kaisha (NYK Line)

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. NYK Group

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. UECC (United European Car Carriers)

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Wilhelmsen

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

List of Tables

Table 1: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 2: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 3: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 4: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 5: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 8: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 9: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 10: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 11: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 12: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 14: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 15: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 16: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 17: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 18: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 20: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 21: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 22: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 23: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 24: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 26: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 27: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 28: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 29: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 30: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Table 32: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Table 33: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Table 34: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Table 35: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 36: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 2: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 3: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 4: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 5: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 6: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 7: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 8: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 9: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 10: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 11: Global Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Finished Vehicle Logistics Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 14: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 15: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 16: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 17: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 18: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 19: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 20: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 21: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 22: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 23: North America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Finished Vehicle Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 26: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 27: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 28: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 29: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 30: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 32: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 33: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 34: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 35: Europe Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Finished Vehicle Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 38: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 40: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 42: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 44: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 46: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Finished Vehicle Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 50: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 52: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 54: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 56: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 58: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Finished Vehicle Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Activity, 2017-2031

Figure 62: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Activity, Value (US$ Bn), 2023-2031

Figure 63: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Logistics Service, 2017-2031

Figure 64: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Logistics Service, Value (US$ Bn), 2023-2031

Figure 65: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Customer Type, 2017-2031

Figure 66: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Customer Type, Value (US$ Bn), 2023-2031

Figure 67: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Geography, 2017-2031

Figure 68: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Geography, Value (US$ Bn), 2023-2031

Figure 69: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 70: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 71: South America Finished Vehicle Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Finished Vehicle Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031